Digital Hearts Holdings (Price Discovery)

Wait and See

Profile

The core business is console and mobile game software debugging in the Entertainment business. The non-gaming Enterprise business is growing.

| Securities Code |

| TYO:3676 |

| Market Capitalization |

| 22,577 million yen |

| Industry |

| Information / Communication |

Stock Hunter’s View

Re-emerging through global business expansion

Digital Hearts HD offers a wide range of entertainment-related services, centred on game debugging services to detect game defects, translation, LQA and other localisation, customer support and marketing support. It is currently preparing for a share-distribution spin-off and listing of AGEST, the core subsidiary of its Enterprise Business.

Operating profit in the second quarter (Apr-Sep) of the current financial year ending 31 March (YoY: -46.8%) was a difficult performance in the short term, with an operating profit of 729 million yen. This was due to the absence of significant domestic debugging in the previous year, which saw a series of major titles, and the lingering aftermath of the impact of COVID-19 and game debugging restrictions in the Chinese market. As a result, the company revised its full-year forecasts downwards at the time of the result announcement.

On the other hand, the company shows confidence in returning to higher sales and profits in the second half of the year, expecting to achieve record-high sales and operating profit on a half-year basis. In its mainstay Entertainment Business, the company is actively pursuing new alliances to expand its global business. It includes a business alliance with a Spanish localisation company to grow in Europe and develop a game translation engine using generative AI with Rosetta.

Investor’s View

The company is a good business. Wait and see if returns on capital rise.

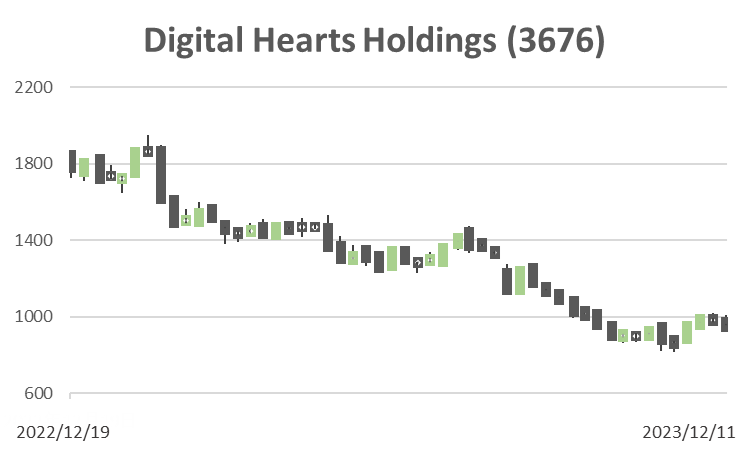

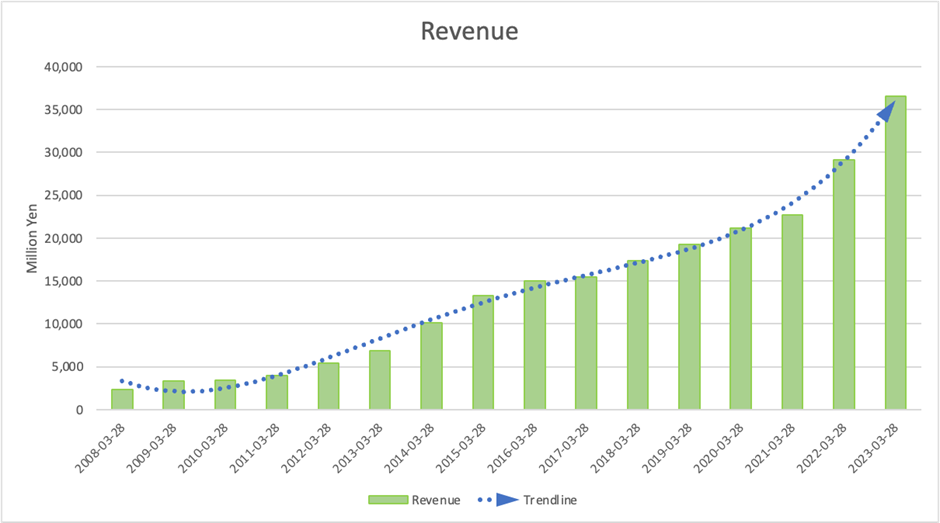

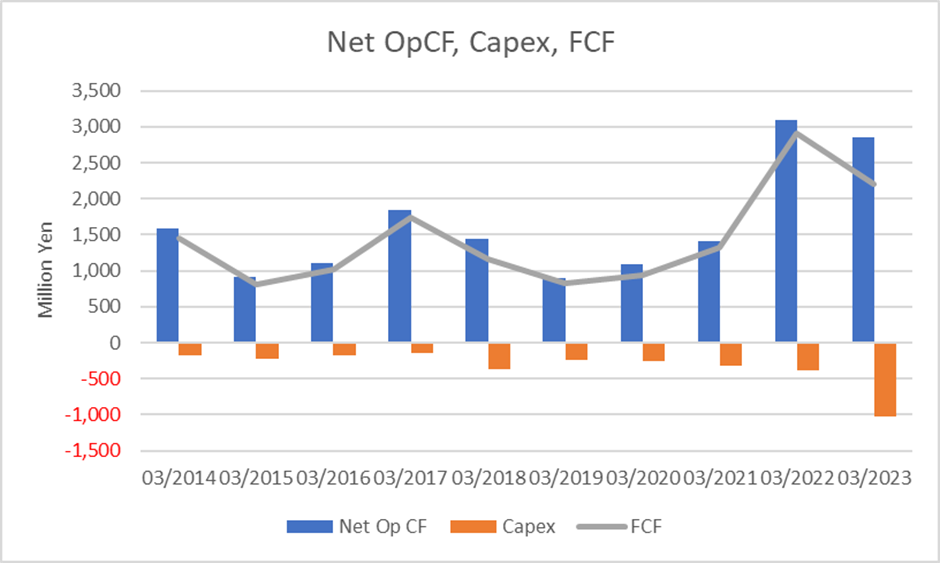

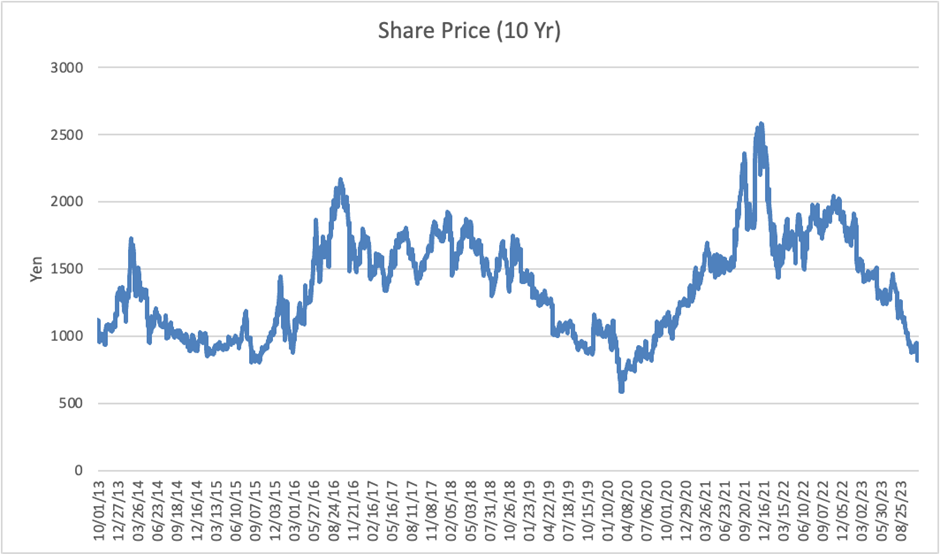

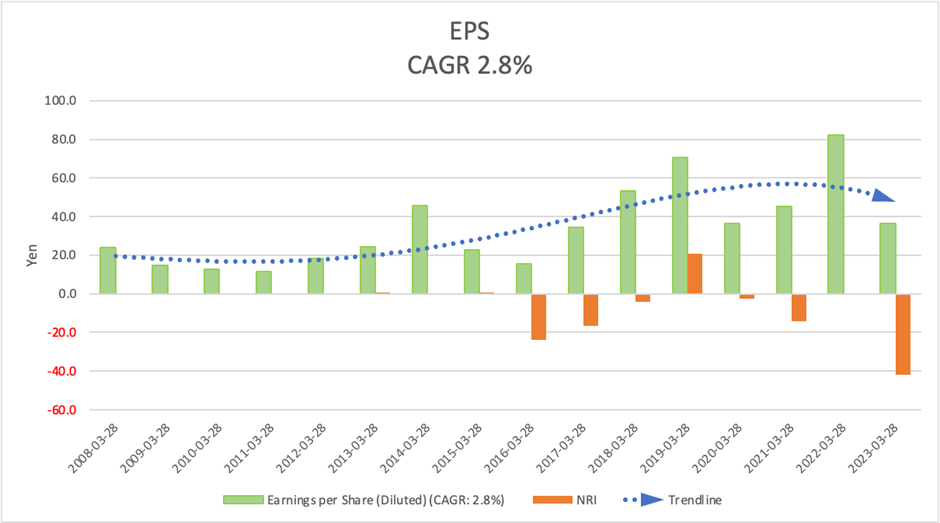

Both top-line and EPS without non-recurring items have been growing steadily for many years; CF is also increasing steadily. Despite this, the share price has kept falling since last year, and valuations have continued to decline. The share price is down 48% YTD, following a 23% fall last year.

Growth strategies are making investors cautious

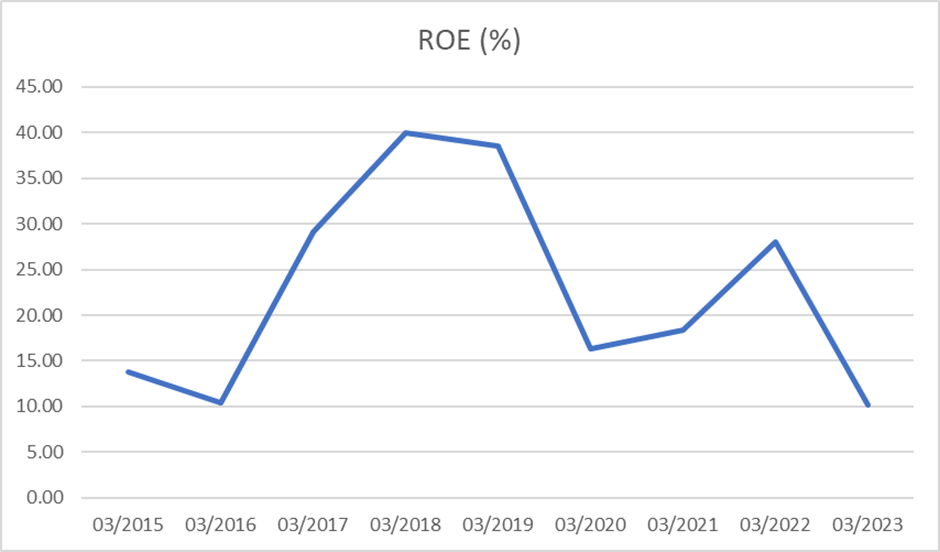

From a short-sighted perspective, the downward earnings revision is one reason for the grim performance of the share price. From a long-term perspective, we believe the share price and declining valuations are attributable to 1) concerns that the growth strategy in the past few years has backfired as significant impairments from previous M&A deals have started to appear, and 2) despite this, management remains keen on the acquisition strategy, and CF is not likely to be used meaningfully. While EPS without non-recurring items has grown steadily at a CAGR of over 8%, EPS growth has been only 2.8%, a factor that has led to a marked decline in ROE, which is losing its great appeal in the past days.

Stock yield is below the market average

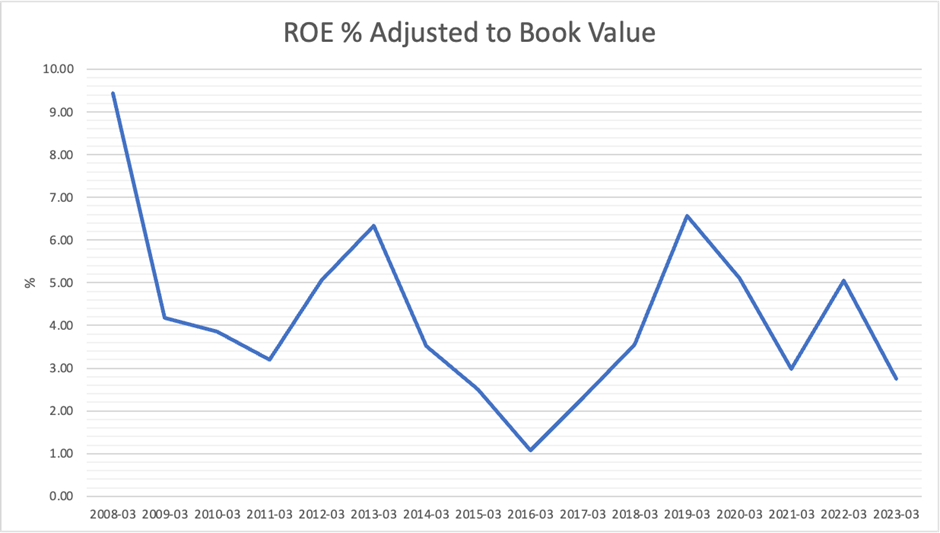

Also, the below-market-average yield of the company’s shares may contribute to the weak share price. ROE achieved 10% even in the previous year when there were major impairments. However, the PBR-adjusted ROE has been below 5% for several years and is inferior to the current TOPIX PBR-adjusted ROE of 6.6% (8.64 / 1.31 = 6.59).

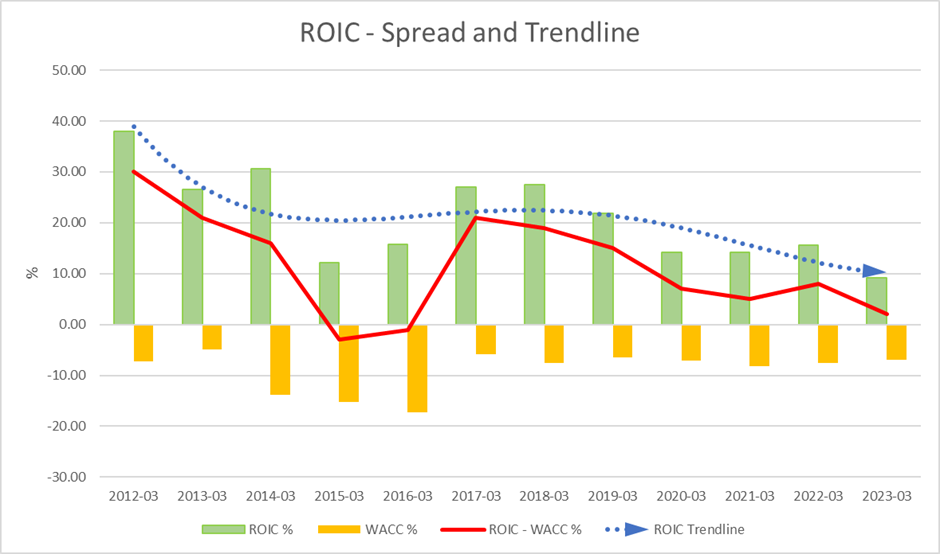

The ROIC spread is shrinking down

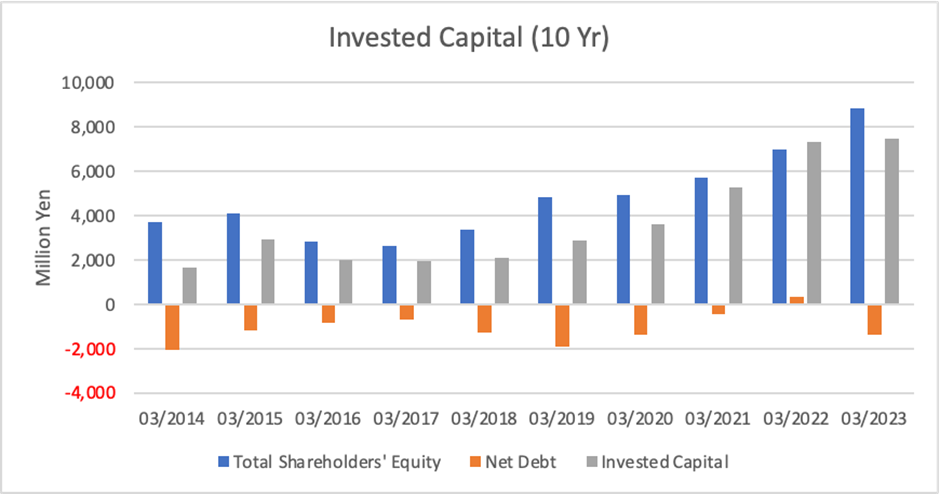

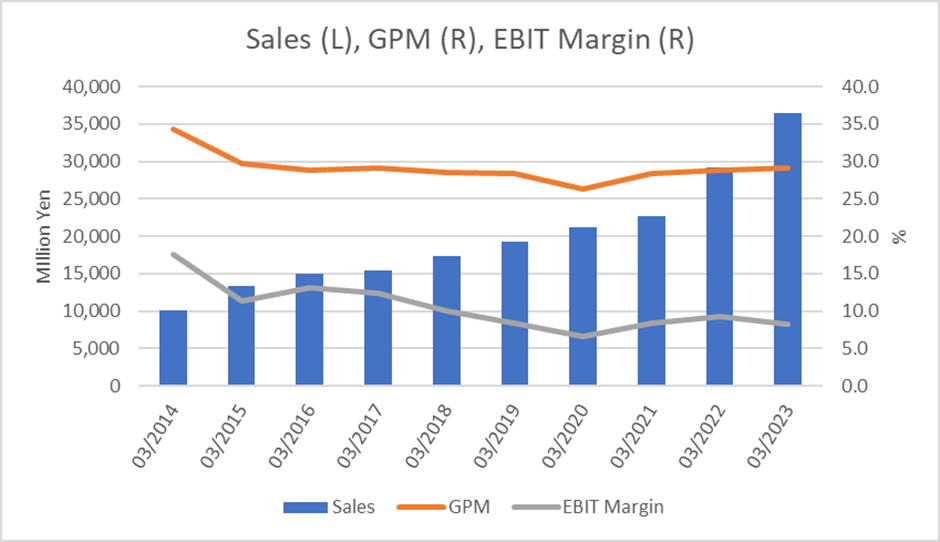

Furthermore, ROIC is declining and no longer generating economic value, which is negative for the share price. Sales are growing, EBIT margins are flat, invested capital is building up, and NOPAT is under-levelled for investors.

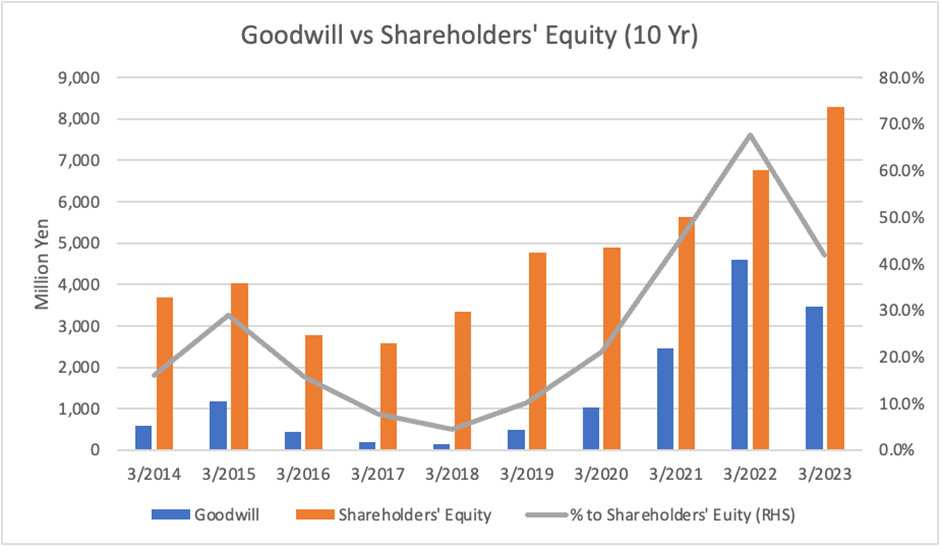

Goodwill poses significant risks for investors

Goodwill has piled up rapidly, and according to management policy, there is an undeniable possibility that CF will continue to be transformed into goodwill. Goodwill is at a high level relative to shareholders’ equity, almost half the current level. It is also a BS item with considerable information asymmetry, which poses significant risks for investors. This risk is thought to have weighed down on PBR over the past few years, which has declined significantly.

Digital Hearts HD is a good business. Improvement of ROE and ROIC spread is crucial for share price recovery.

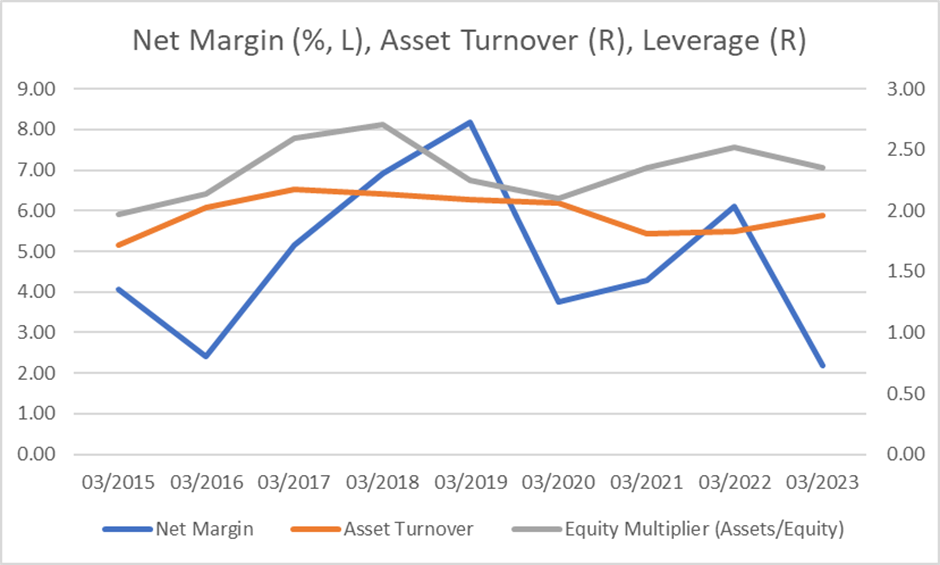

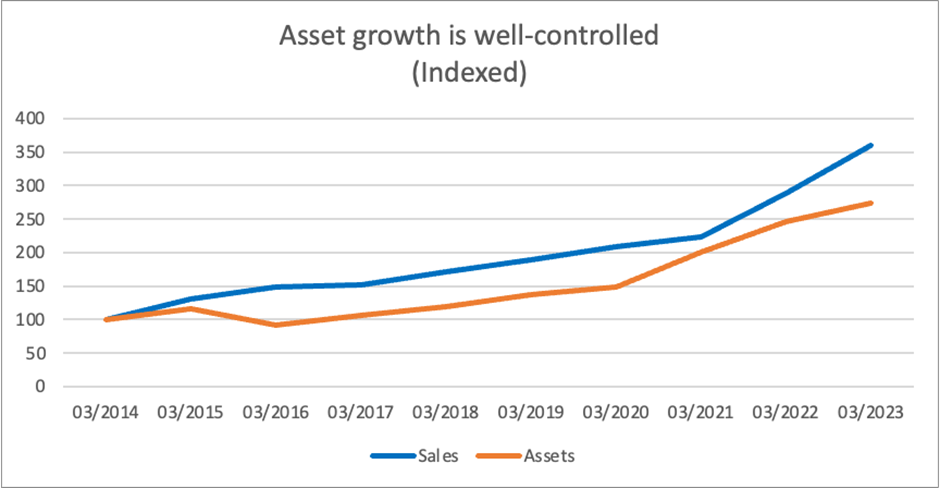

Apart from the fact that the growth strategy through mergers and acquisitions has not resulted in results that satisfy shareholders and that the goodwill built up in the BS is a concern, management has been raising the underlying EPS so well, as we saw at the beginning of this write-up. Asset turnover is good and stable, and the company is moderately leveraged. Asset growth is well controlled relative to sales growth. Overall, we rate the company as a good business, apart from the current growth strategy and its progress along the way. A deeper communication with investors, while precisely controlling the risk-return of the growth strategy, will restore valuations. In doing so, management should fully grasp what and how much equity investors demand. Attempts to improve the trend of the ROE and ROIC spread should form positive expectations among investors and drive the share price.