Chiome Bioscience (Company note – 3Q update)

| Share price (12/11) | ¥131 | Dividend Yield (23/12 CE) | – % |

| 52weeks high/low | ¥261/117 | ROE(TTM) | -79.25 % |

| Avg Vol (3 month) | 4,677 thou shrs | Operating margin (TTM) | -148.61 % |

| Market Cap | ¥6.7 bn | Beta (5Y Monthly) | 0.94 |

| Enterprise Value | ¥5.7 bn | Shares Outstanding | 51.446 mn shrs |

| PER (23/12 CE) | – X | Listed market | TSE Growth |

| PBR (22/12 act) | 5.58 X |

| Click here for the PDF version of this page |

| PDF Version |

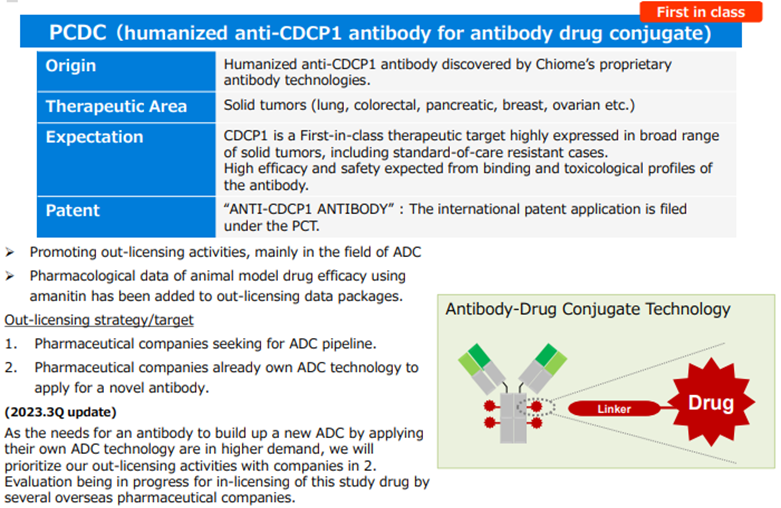

PCDC licensing activities progress. Consultations are underway with overseas pharmaceutical companies for out-licensing agreements.

◇Summary of 3Q results of FY12/2023.

In FY12/2023 3Q results, Chiome Bioscience’s Drug Discovery Support Business continued to do well, with sales increasing by approximately 20% YoY. The operating loss shrank. In addition, the company’s main business, the Drug Discovery and Development Business, saw its pipeline progressing steadily. In 3Q, the company is in discussions with several foreign pharmaceutical companies that are potential out-licensing candidates aiming to win a contract for PCDC. The company expects to sign a licensing agreement as early as FY2024 and receive an upfront contract payment.

The company’s share price has been volatile due to events such as earnings announcements, but on 22 November, it rose 9% on good trading volume to close at 147 yen in response to the previous day’s announcement of a patent assessment. Currently, the company’s pipeline includes the clinical trials of CBA-1205 and CBA-1535, which are progressing well. The out-licensing of the above PCDC is also in sight. The current share price is at an attractive level, given that the possibility of an upfront out-licensing payment in the not-too-distant future is on the horizon.

◇ Results for 3Q FY12/2023: Drug Discovery Support Business is expanding steadily, with sales increasing by approximately 20%.

The company’s 3Q results for FY12/2023 were sales of 524 million yen (+20.8% YoY), an operating loss of 905 million yen (vs an operating loss of 1,039 million yen in the previous year) and a net loss of 918 million yen (vs. a net loss of 1,027 million yen in the last year). In this 3Q, sales related to Drug Discovery and Development Business, such as upfront licensing payments and milestone income, were not recorded, and only sales from Drug Discovery Support Business were recorded. This business is growing steadily.

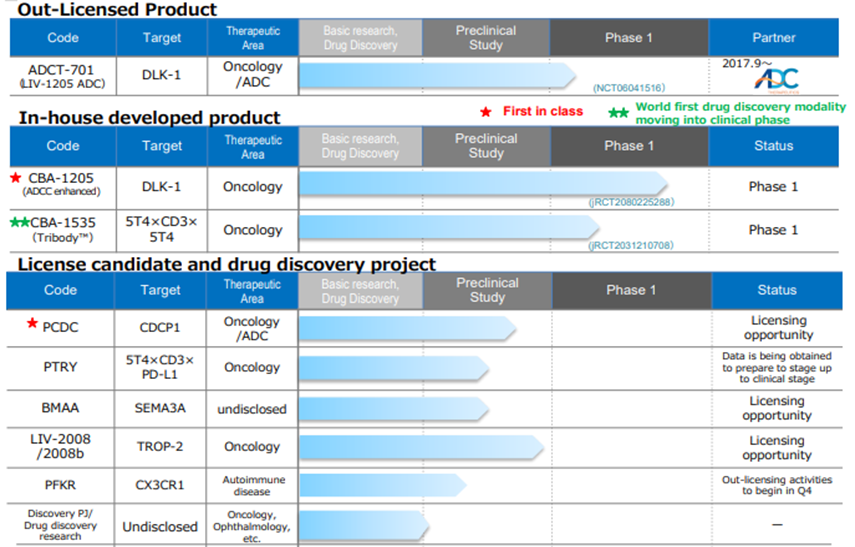

For information on the progress of each pipeline in Drug Discovery and Development Business, see the diagram on the next page. Each pipeline progresses well, but no sales were recorded during 3Q FY12/2023. Research and development costs within SG&A expenses amounted to 803 million and decreased by 113 million YoY, reflecting last year’s CMC-related costs for CBA-1535 and the absence of costs for the investigational formulation. As a result, the segment loss amounted to 803 million yen, corresponding to research and development costs.

Drug Discovery Support Business provides contract antibody production, antibody affinity enhancement and protein preparation services using the company’s antibody production technology platform, centred on the ADLib® system, which is the company’s proprietary antibody generation method, and provides research support to major domestic pharmaceutical companies in relation to antibody drugs. The stable revenue generated by Drug Discovery Support Business helps to secure research and development expenditure for Drug Discovery and Development Business. The business is steadily increasing the number of transactions and projects. In 3Q, the company signed a new comprehensive outsourcing contract with a major domestic pharmaceutical company and started new outsourcing work with a domestic diagnostics company.

As a result, 3Q FY12/2023 sales registered 524 million yen, or +20.8% YoY, and segment profit were 307 million yen, or +30.1%. The segment profit margin was 58.6%, meeting the company target of 50%.

| JPY, mn, % | Net sales |

YoY % |

Oper. profit |

YoY % |

Ord. profit |

YoY % |

Profit ATOP |

YoY % |

EPS (¥) |

| 2019/12 | 447 | 110.3 | -1,401 | – | -1,410 | – | -1,403 | – | -44.61 |

| 2020/12 | 480 | 7.4 | -1,283 | – | -1,291 | – | -1,293 | – | -36.06 |

| 2021/12 | 712 | 48.3 | -1,334 | – | -1,329 | – | -1,479 | – | -36.74 |

| 2022/12 | 630 | -11.5 | -1,258 | – | -1,243 | – | -1,242 | – | -28.26 |

| 2023/12 (CE) | – | – | – | – | – | – | – | – | – |

| 2022/12 3Q | 433 | -19.9 | -1,039 | – | -1,029 | – | -1,027 | – | -23.87 |

| 2023/12 3Q | 524 | 20.8 | -905 | – | -916 | – | -918 | – | -18.82 |

Note: The company discloses only the estimates for the Drug Discovery Support business (sales of 640 million yen), as it is difficult to make reasonable forecasts for the drug discovery and development business.

Drug discovery and development business – pipeline

Source: Supplementary financial data for 3Q of FY12/2023 (dated 14 November 2023).

In BS, total assets at end-September 2023 amounted to 1,753 million yen. This is a decrease of 462 million yen compared to end-December 2022. Cash and deposits amounted to 1,341 million yen (end-December 2022: 1,727 million yen). The company signed an equity finance agreement in July 2023. By issuing new share warrants and the exercise of these warrants, the company increased capital and capital reserves by 165 million yen each from the end of the previous year.

◇Progress in the pipeline: The company extends the development plan to maximise the value of CBA-1205 for out-licensing.

<In-house developed products>.

*CBA–1205; Phase 1 clinical trial shows positive signs. Aiming to win multiple PR cases in stem cell cancer patients and maximise upfront licensing payments

The first half of the Phase I clinical trial of CBA-1205 in patients with solid tumours was conducted at the National Cancer Centre. The second part of the trial is being conducted in patients with hepatocellular carcinoma. In the first part, a high safety profile has already been confirmed, and the melanoma patients enrolled in the first part have continued to receive the drug for more than 27 months with SD (stable) evaluation with tumour shrinkage, and the drug is still being administered.

In addition, a partial response (PR: tumour reduction of 30% or more) was confirmed in one patient with hepatocellular carcinoma enrolled in the latter part of the study. Additional manufacturing of the investigational drug for long-term treatment is progressing, with supply scheduled to commence in 4Q. In order to further validate the potential of the drug as a therapeutic agent, the criteria for selecting patients for enrolment in clinical trials have been tightened, and the clinical trial period has been extended, with the aim of analysing the scientific relationship between PR cases and the administration of the drug. There is no change in the expected out-licensing schedule.

The company intends to continue the development of each pipeline by dividing its out-licensing activities into two categories: those aimed at early out-licensing and those aimed at increasing the economic value at the time of out-licensing by promoting in-house R&D activities and acquiring more cases. For CBA-1205, the company aims to maximise the upfront payment for out-licensing by targeting a group of companies that emphasise business feasibility and probability of success, as the company’s own clinical trials are progressing well.

*CBA–1535; First half of Phase I clinical trials (single agent)

The company submitted a clinical trial plan notification to the PMDA in February 2022. It started Phase I clinical trials at the National Cancer Centre Hospital and Shizuoka Cancer Centre from the end of June. In the first half of Phase I clinical trial, safety and efficacy signals were evaluated in patients with solid tumours. The drug will be administered in stages, starting from a low volume to find the maximum dose that can be safely administered and to assess the initial drug effect signal. The second part will assess efficient drug efficacy with immuno-oncology drugs. The company had previously planned to start the second part in parallel with the first part but has now changed its plan to start the second part after confirming the efficacy signal in the first part. The second part will begin in 2024. The schedule change is intended to enable the company to reasonably control its clinical development investment, considering the possibility of out-licensing the drug.

CBA-1535 is the world’s first clinical trial for TribodyTM and, if the concept is confirmed, will expand the applicability of TribodyTM to many cancer antigens. Combining the number of binding targets and the number of moves to which they bind is expected to provide benefits beyond conventional antibodies. Through the combined administration of multiple drugs, multiple medicinal effects can be expected from administering only one drug, which is expected to improve a patient’s quality of life and provide health economics benefits.

< Out-licenced products >

*LIV-1205;out-licensed to ADC Therapeutics, Switzerland, for ADC use only. ADCT, in collaboration with the National Cancer Institute (NCI), is scheduled to conduct a clinical trial in neuroendocrine cancer. The IND (Investigational New Drug) application for the Phase I clinical trial has been completed. The clinical trials are planned to be led by the NCI.

< Out-licensing candidates >

*PCDC; ADC (Antibody Drug Conjugate) is a type of biopharmaceutical in which a drug is conjugated to an antibody. It has the advantage that the antibody transports the drug to the targeted cell or tissue with pinpoint accuracy, making it easier to avoid side effects on non-target cells and tissues and to reduce the overall drug dosage. This technology is currently attracting attention in the field of anti-cancer drugs. The company has been promoting out-licensing activities focusing on ADC applications and has been accumulating animal test data, targeting pharmaceutical companies that want to expand their pipelines as ADCs and pharmaceutical companies that want antibodies for ADCs with their own ADC technology, by making contacts at domestic and international conferences. As a result, there is a high need for development by combining the company’s antibodies with the out-licensing company’s ADC technology, and the company is currently in discussions with several potential out-licensing candidates, mainly on the scientific side, under confidentiality agreements (some under sample evaluation agreements) with overseas pharmaceutical companies.

PCDC out-licensing plan

Source: Supplementary financial data for 3Q of FY12/2023 (dated 14 November 2023).

*PTRY;a Tribody™ antibody that is expected to add an immune checkpoint inhibitory function to the T cell engager function of CBA-1535 and has shown strong anti-tumour effects in early evaluations in animal models. The results of a collaborative study on cancer immunotherapy conducted with the Italian public research institute Ceinge-Biotechnologie Avanzate were published in the international journal Journal of Experimental & Clinical Cancer Research Journal of Experimental & Clinical Cancer Research, an international journal. A patent application has been completed for the results obtained through this collaboration. In vivo efficacy data in a lung cancer model have confirmed that it exerts a strong tumour growth inhibitory effect.

*PFKR; PFKR targets CX3CR1, a type of GPCR, as a therapeutic target and is a new out-licensing candidate in the autoimmune CNS area that we are collaborating with National Institute of Neurology and Psychiatry. The expected indications include secondary progressive multiple sclerosis (SPMS). A patent application has already been filed. The number of patients with multiple sclerosis is estimated to be around 7,000 in Japan and more than 3 million worldwide.

◇Progress in Drug Discovery Support Business: New master service agreements signed with major Japanese pharmaceutical companies.

Drug Discovery Support Business recorded sales of 524 million yen, an increase of approximately 20% YoY, as mentioned above. The company has earned a high reputation for its technical service capabilities among major Japanese pharmaceutical companies, and business with existing customers has steadily increased. The Drug Discovery Support Business is also steadily growing, with a new comprehensive outsourcing agreement with a major Japanese pharmaceutical company signed in 3Q and new outsourcing work (spot projects) with a domestic diagnostics company recently started.

◇ Forecasts for FY12/2023: Sales in the Drug Discovery and Development Business are in line with plans. Expected to end up at the same level as the previous year

For FY12/2023, the company has announced sales of 640 million yen from the Drug Discovery Support Business alone, which is expected to generate ongoing revenues. In terms of costs, annual R&D investment expenditure of around 1 billion ye is expected to continue due to the high costs of clinical trials and investigational drug production as each pipeline progresses. If the Drug Discovery and Development Business is not expected to generate revenue in 4Q, the company will likely post a loss for the full year to the same degree as the previous year. The progress ratio of the Drug Discovery Support Business sales at the time of the 3Q results was 81.9%.

◇Share price: Focus on the out-licensing of PCDC and future value enhancement of the pipeline

The company’s share price has been volatile due to events such as the announcement of financial results. After temporarily falling to the 110 yen level in mid-October, the share price rose 9% on 22 November with nice trading volume and closed at 147 yen in response to the announcement of the patent assessment the previous day. The progress of PCDC also seems to have been taken as positive by the market. As is well known, the Drug Discovery and Development Business requires billions of yen for research and development and a decade of time, making it difficult to achieve results quickly. Investors must be long-term and tolerate high risk. It is important to assess the progress of each pipeline, the likelihood of out-licensing and profit trends as appropriate. The company’s current pipeline includes the successful clinical trials of CBA-1205 and CBA-1535 and the licensing out of PCDC. The company is intensifying its out-licensing activities to record upfront income from the out-licensing of PCDC and to return to profitability in a single year at the earliest possible date. Considering the possibility of the company recording an upfront payment from the out-licensing of PCDC in the not-too-distant future, the current share price is attractive. We will continue to monitor the company’s future development.

Share price (4 years)

Financial data

| FY (¥mn) | 2020/12 | 2021/12 | 2022/12 | 2023/12 | |||||||||||

| 1Q | 2Q | 3Q | 4Q | 1Q | 2Q | 3Q | 4Q | 1Q | 2Q | 3Q | 4Q | 1Q | 2Q | 3Q | |

| [Statements of income] | |||||||||||||||

| Net sales | 91 | 82 | 139 | 169 | 246 | 139 | 157 | 171 | 128 | 149 | 156 | 197 | 169 | 189 | 165 |

| Drug Discovery and Development Business |

1 | 1 | 0 | 1 | 103 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Drug Discovery Support Business | 90 | 82 | 138 | 168 | 143 | 138 | 157 | 171 | 128 | 149 | 156 | 197 | 169 | 189 | 165 |

| Cost of sales | 61 | 46 | 59 | 70 | 64 | 62 | 78 | 86 | 57 | 69 | 72 | 83 | 73 | 76 | 67 |

| Gross profit | 30 | 36 | 80 | 99 | 182 | 77 | 79 | 84 | 70 | 80 | 84 | 114 | 95 | 112 | 98 |

| SG&A expenses | 456 | 346 | 424 | 303 | 337 | 337 | 515 | 568 | 557 | 373 | 344 | 334 | 321 | 545 | 344 |

| R&D expenses | 343 | 266 | 342 | 206 | 216 | 243 | 401 | 451 | 446 | 245 | 225 | 219 | 193 | 408 | 202 |

| Operating profit | -426 | -310 | -344 | -204 | -155 | -260 | -436 | -483 | -486 | -292 | -260 | -220 | -225 | -433 | -246 |

| Non-operating income | 2 | 0 | 3 | 0 | 7 | 0 | 2 | 4 | 0 | 16 | 0 | 5 | 0 | 0 | 1 |

| Non-operating expenses | 0 | 2 | 10 | 1 | 1 | 0 | 1 | 6 | 4 | 1 | 1 | -1 | 1 | 1 | 9 |

| Ordinary profit | -425 | -311 | -351 | -205 | -150 | -259 | -434 | -486 | -491 | -278 | -261 | -214 | -227 | -434 | -254 |

| Extraordinary income | 0 | 0 | 0 | 6 | 0 | 1 | 0 | 1 | |||||||

| Extraordinary expenses | 0 | 0 | |||||||||||||

| Loss before income taxes | -425 | -310 | -351 | -205 | -149 | -247 | -433 | -636 | -491 | -278 | -255 | -214 | -226 | -434 | -254 |

| Total income taxes | 1 | 0 | 1 | 1 | 11 | 1 | 1 | 0 | 1 | 2 | 1 | 1 | 1 | 1 | 1 |

| Net income | -425 | -311 | -352 | -206 | -161 | -248 | -434 | -637 | -492 | -279 | -257 | -215 | -227 | -435 | -254 |

| [Balance Sheets] | |||||||||||||||

| Current assets | 2,309 | 2,805 | 3,316 | 3,249 | 3,294 | 3,088 | 2,675 | 2,216 | 2,005 | 1,792 | 1,955 | 2,092 | 1,964 | 1,566 | 1,633 |

| Cash and deposits | 1,967 | 2,472 | 2,881 | 2,686 | 2,580 | 2,302 | 2,071 | 1,790 | 1,744 | 1,471 | 1,592 | 1,727 | 1,566 | 1,245 | 1,341 |

| Non-current assets | 247 | 249 | 249 | 246 | 244 | 241 | 274 | 122 | 121 | 128 | 126 | 123 | 120 | 118 | 119 |

| Tangible assets | 10 | 9 | 8 | 7 | 6 | 6 | 4 | 4 | 3 | 3 | 2 | 2 | 2 | 1 | 1 |

| Investments and other assets | 237 | 240 | 241 | 238 | 237 | 235 | 269 | 118 | 117 | 124 | 122 | 120 | 118 | 117 | 117 |

| Total assets | 2,556 | 3,054 | 3,566 | 3,495 | 3,537 | 3,329 | 2,950 | 2,339 | 2,126 | 1,920 | 2,081 | 2,215 | 2,085 | 1,685 | 1,753 |

| Current liabilities | 315 | 427 | 378 | 343 | 378 | 428 | 468 | 392 | 419 | 390 | 376 | 370 | 469 | 486 | 4887 |

| Short-term borrowings | 142 | 199 | 199 | 180 | 180 | 190 | 199 | 183 | 183 | 188 | 188 | 184 | 304 | 298 | 316 |

| Non-current liabilities | 42 | 42 | 42 | 42 | 42 | 42 | 53 | 53 | 53 | 54 | 54 | 54 | 54 | 54 | 54 |

| Total liabilities | 357 | 469 | 420 | 385 | 420 | 470 | 522 | 446 | 473 | 444 | 431 | 424 | 523 | 540 | 542 |

| Total net assets | 2,199 | 2,585 | 3,146 | 3,110 | 3,118 | 2,859 | 2,428 | 1,893 | 1,653 | 1,476 | 1,650 | 1,790 | 1,562 | 1,144 | 1,211 |

| Total shareholders’ equity | 2,199 | 2,585 | 3,146 | 3,110 | 3,118 | 2,859 | 2,428 | 1,857 | 1,621 | 1,445 | 1,631 | 1,777 | 1,549 | 1,132 | 1,189 |

| Capital stock | 6,133 | 846 | 1,303 | 1,388 | 1,471 | 1,471 | 1,472 | 1,515 | 1,642 | 1,695 | 1,916 | 2,097 | 2,097 | 2,106 | 2,262 |

| Legal capital reserve | 6,123 | 2,446 | 2,903 | 2,987 | 3,071 | 3,071 | 3,072 | 3,115 | 3,242 | 3,295 | 3,516 | 3,696 | 3,696 | 3,706 | 3,861 |

| Retained earnings | -10,080 | -736 | -1,088 | -1,294 | -1,455 | -1,703 | -2,136 | -2,773 | -3,262 | -3,544 | -3,801 | -4,016 | -4,244 | -4,679 | -4,934 |

| Subscription rights to shares | 24 | 30 | 28 | 29 | 30 | 19 | 19 | 35 | 31 | 30 | 18 | 13 | 12 | 12 | 22 |

| Total liabilities and net assets | 2,556 | 3,054 | 3,566 | 3,495 | 3,537 | 3,329 | 2,950 | 2,339 | 2,126 | 1,920 | 2,081 | 2,215 | 2,085 | 1,685 | 1,753 |

| [Statements of cash flows] | |||||||||||||||

| Cash flow from operating activities | -528 | -1,361 | -560 | -1,131 | -660 | -1,191 | -595 | ||||||||

| Loss before income taxes | -734 | -1,290 | -396 | -1,466 | -768 | -1,237 | -661 | ||||||||

| Cash flow from investing activities | – | 3 | – | -35 | – | – | 0 | ||||||||

| Purchase of investment securities | – | – | – | – | – | – | – | ||||||||

| Cash flow from financing activities | 894 | 1,944 | 176 | 271 | 341 | 1,127 | 113 | ||||||||

| Proceeds from issuance of common shares | 697 | 1,769 | 166 | 253 | 336 | 1,126 | – | ||||||||

| Net increase in cash and cash equiv. | 366 | 580 | -384 | -895 | -319 | -63 | -481 | ||||||||

| Cash and cash equiv. at beginning of period | 2,105 | 2,105 | 2,686 | 2,686 | 1,790 | 1,790 | 1,727 | ||||||||

| Cash and cash equiv. at end of period | 2,472 | 2,686 | 2,301 | 1,790 | 1,471 | 1,727 | 1,245 | ||||||||

Note) For the cash flow statement, Q2 is the cumulative of Q1 to Q2, and Q4 is the cumulative of Q1 to Q4. Therefore, the beginning balance will be the beginning balance of Q4 for both Q2 and Q4.

Source: Omega Investment from Company materials.