USS (Price Discovery)

Buy on weakness

Profile

Japan’s largest used car auction operator with 40% market share. Also buys used cars at auction. Established in 1980.

| Securities Code |

| TYO:4732 |

| Market Capitalization |

| 675,782 million yen |

| Industry |

| Service |

Stock Hunter’s View

Impact of industry scandals limited. Auctions are brisk due to export demand.

Last year, numerous allegations of fraud surfaced in the used car industry, including Big Motor (not listed). However, the impact was limited, and the used car distribution situation improved as the semiconductor shortage was resolved and new car production recovered. Furthermore, Japanese used cars are very popular overseas, and the weak yen has led to increased inquiries, keeping prices high.

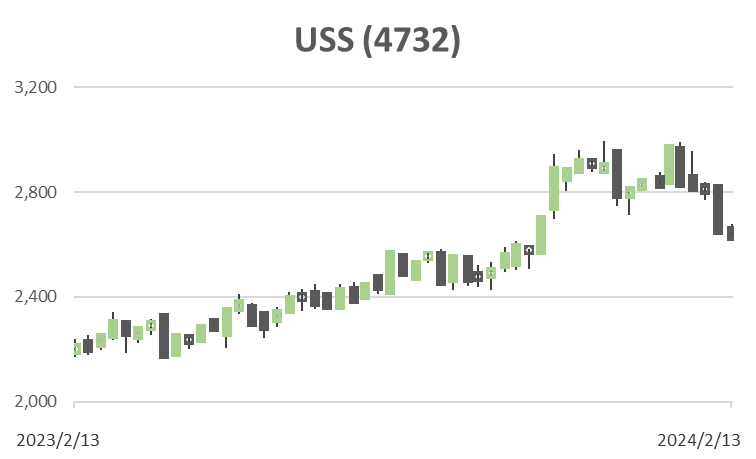

The Tokyo stock market has been reassessing related stocks, and used car auctioneer USS is no exception.

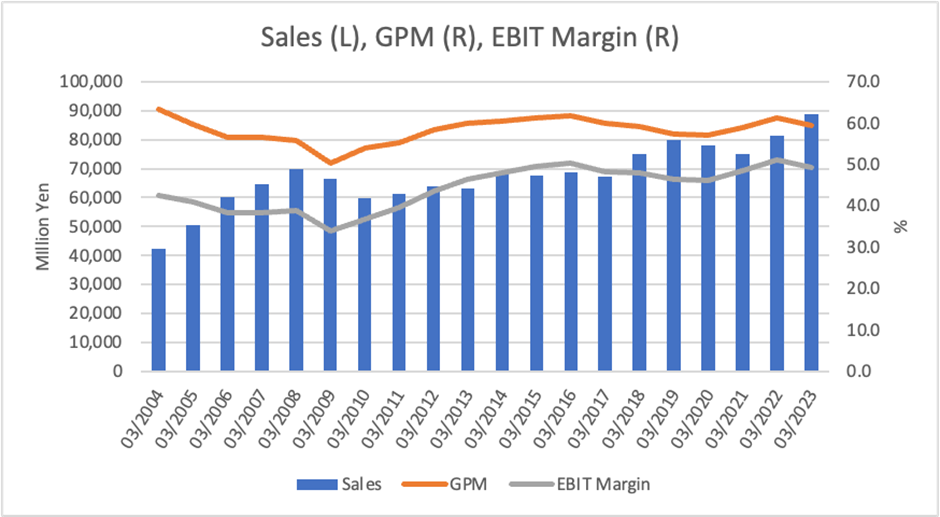

The company’s financial results for the third quarter (April-December) of FY3/2024, announced on March 6, came in nicely, with sales up 11% and operating income up 12%, respectively. Both are on track to meet the full-year forecasts. Auto auctions, the company’s mainstay business, were brisk on the back of export demand, and the increase in the number of vehicles on display and higher commissions boosted results. The number of visits and sales volume of “Rabbit,” an auto-buying speciality store, increased, reflecting improved customer appreciation.

The annual dividend is planned to be 73.1 yen per share, an increase for the 24th consecutive term. The company’s stable dividend policy makes it a good target for the new NISA (Nippon Individual Savings Account).

In recent years, the company has been developing its second mainstay business after auto auctions, and the progress of its auto loan service, which was launched in April last year, is also attracting attention.

Investor’s View

The stock price is not particularly undervalued, and no rush to buy. We recommend building a position slowly, picking up the stock on occasional weakness.

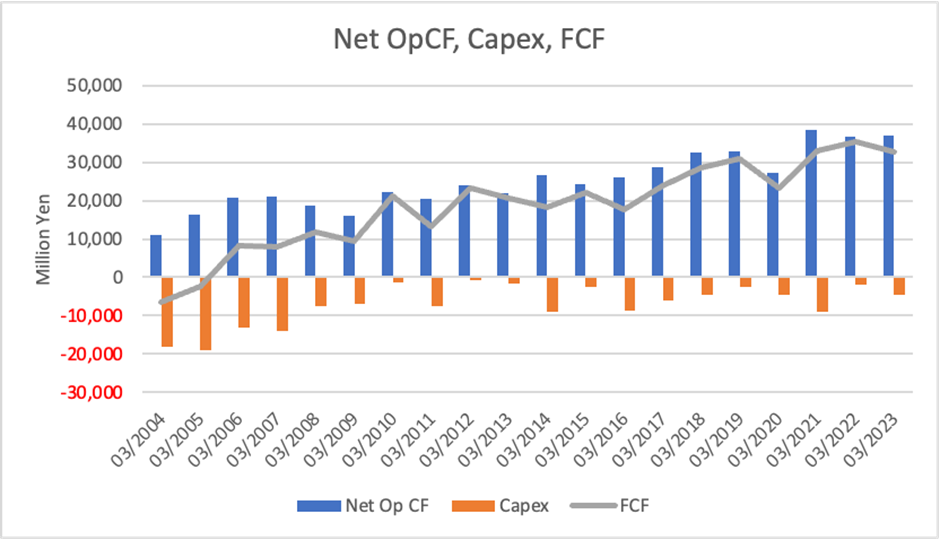

Excellent CF Generation

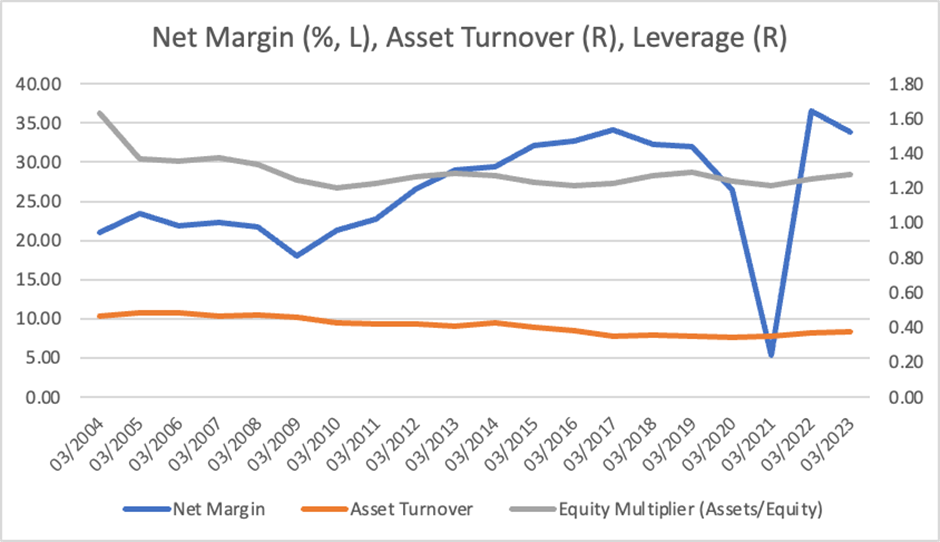

The most striking feature of the company’s fundamentals is its excellent CF generation capability. This is solely attributed to the high profitability of the core businesses. The net income margin has been well over 30% in recent years. Over the past five years, including FY3/2020, when COVID-19 took a significant hit, the profit margin averaged 26.8%. This ranks the company 98th among all Japanese listed stocks and about 50th among companies with a market capitalisation of 100 billion yen or more.

BS has plenty of room for optimization

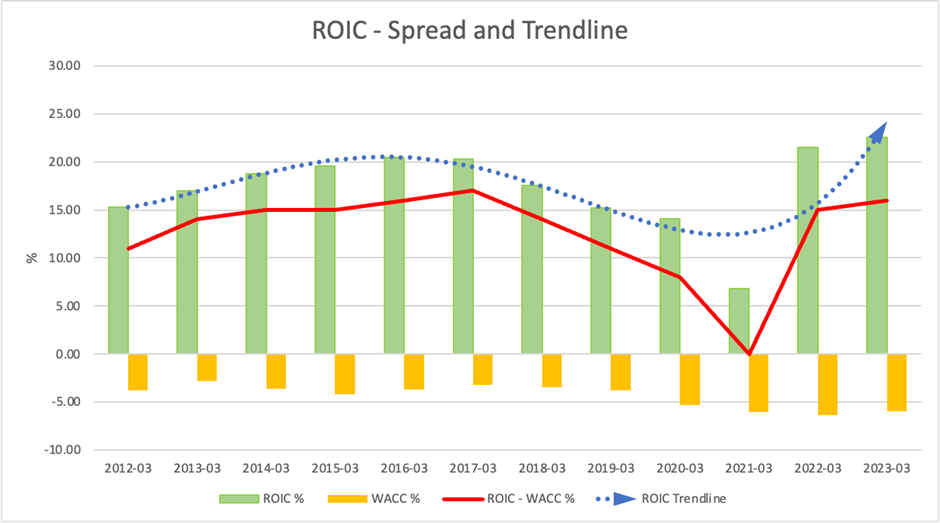

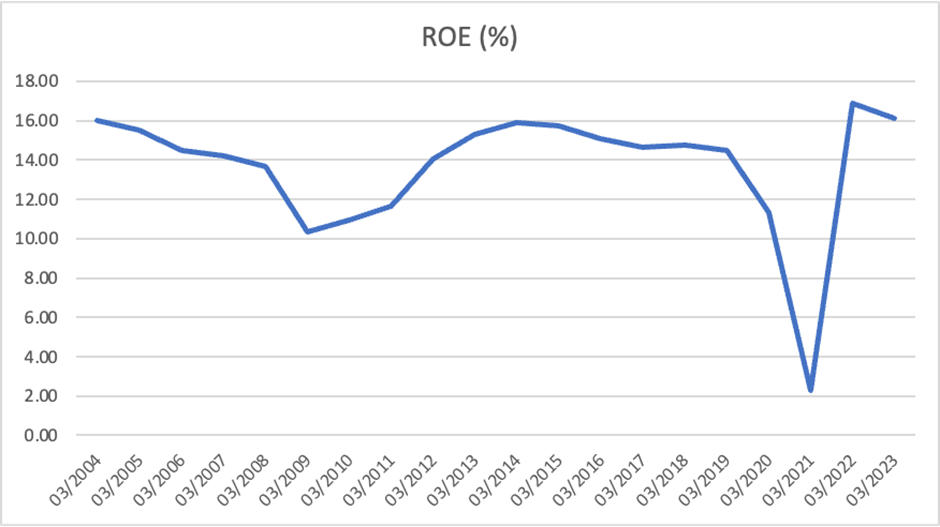

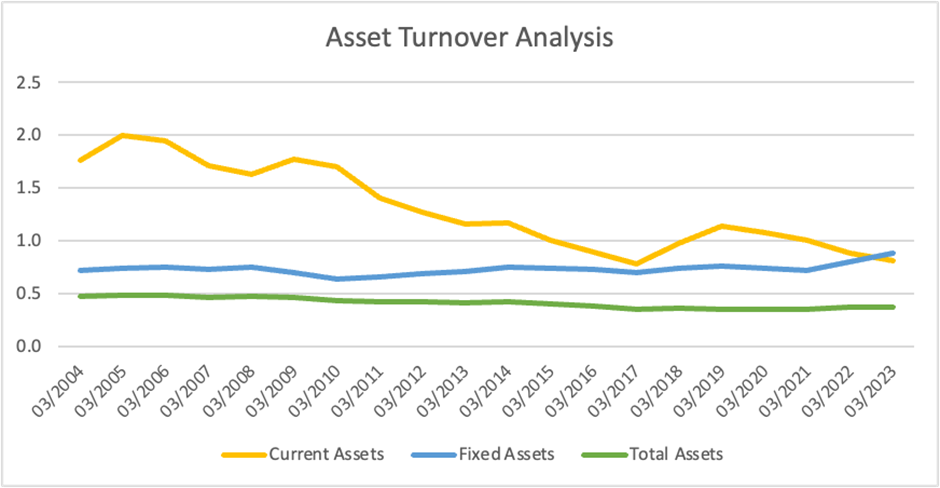

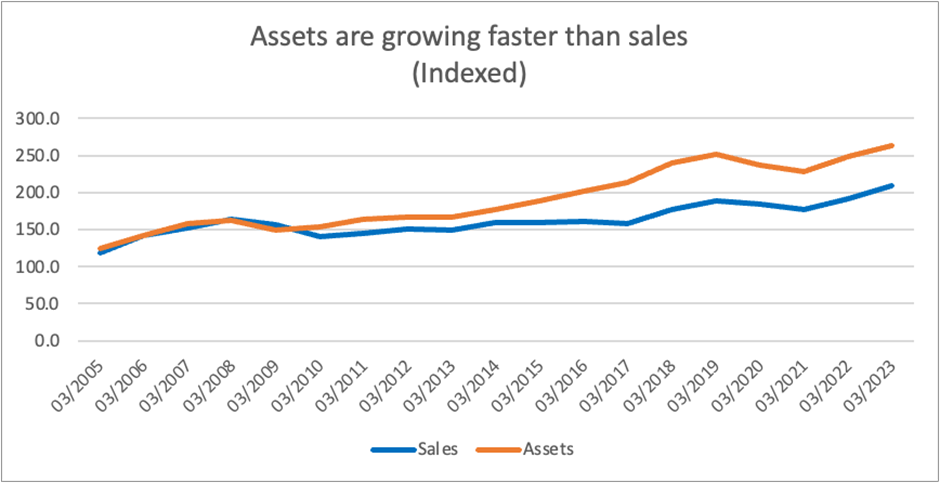

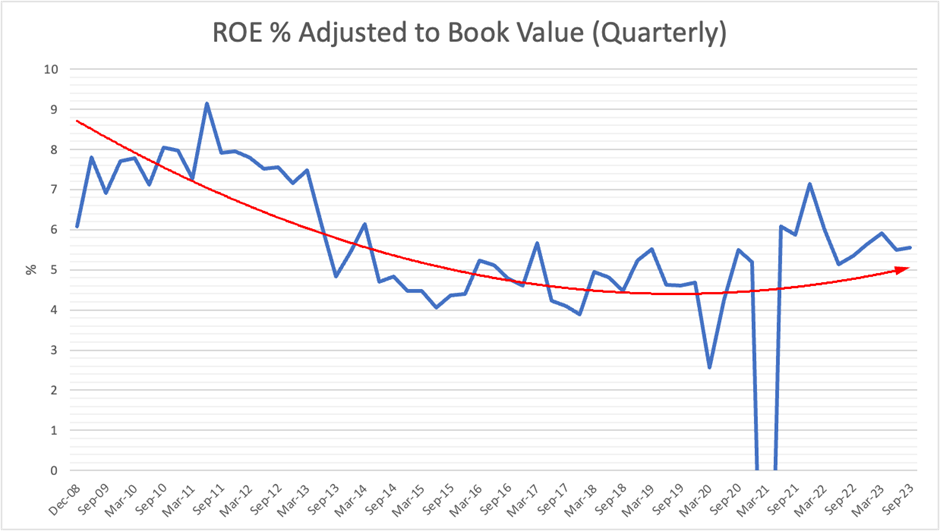

However, when assessed by the five-year average ROE, the company ranks 682nd among all listed companies and 191st among companies with a market capitalisation of 100 billion yen, falling far behind the ranking by PL profitability. This is because its BS is a significant drag on ROE. The asset turnover ratio is as low as that of railroads and electric power companies.

Good performance in a no-growth market

Since the Lehman Shock, Japan’s auto auction market has lost growth but has remained flat at about 700,000 units annually. The company has been steadily increasing its market share, which is a big positive. The market share was 21% in 1999 and reached 41% in 2022, endorsing the company’s competitiveness. As Stock Hunter points out, the current earnings are running robust.

Management is keen to increase share value

Combined with good business management, the management team is also forward-looking financially, committed to ROE of 15%, achieving a dividend payout ratio of 55%, and raising dividends year by year. They are also keen on share buybacks. The president has stated the importance of balancing investment in growth with shareholder returns. These are very well rated.

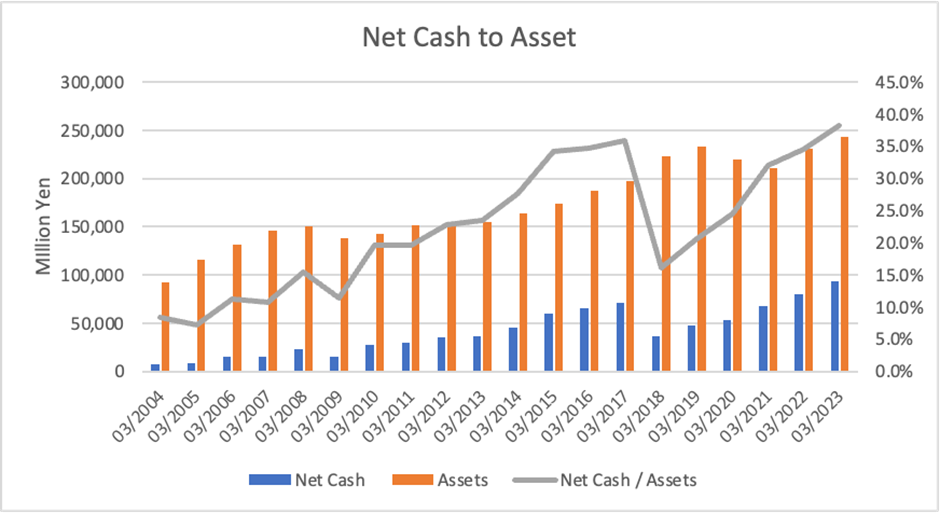

Too much cash

However, as mentioned earlier, the company’s CF generation is overwhelming, and the current degree of shareholder return and investment do not satisfy shareholders more than now. Currently, the high PL margin is diluted by BS inefficiencies, and potentially high ROE is not being realised. Even though the nature of the business may require a large amount of working capital, we believe that the net cash position of 40% of assets is excessive.

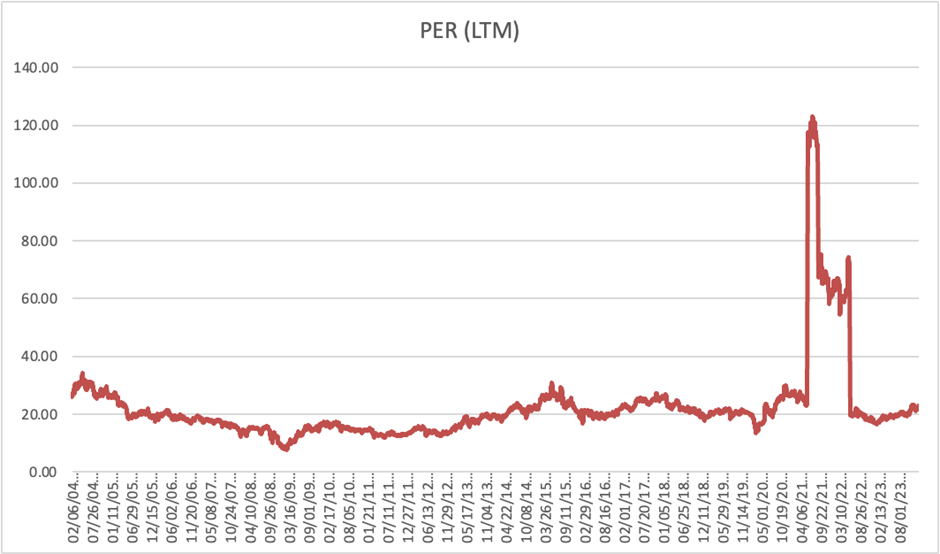

The stock price does not look particularly undervalued

The stock has been an outperformer for two years, 2022 and 2023, factoring in the recovery from COVID-19. Since the beginning of the year, the stock has fallen 6% and underperformed TOPIX by 15%. Our DCF calculation, discounted at 6%, gives a fair value of about 2,000 yen a share. In addition, while the PBR-adjusted ROE has been recovering moderately, it is not attractive, near the stock market average.

Accumulate the shares over the long term

Management is positive about increasing equity value and may move to optimise the BS at some point. This will accelerate the creation of economic value. It would be a good idea to slowly build a long-term position by picking up the shares on occasional weakness. There is no need to rush to buy at the current share price.