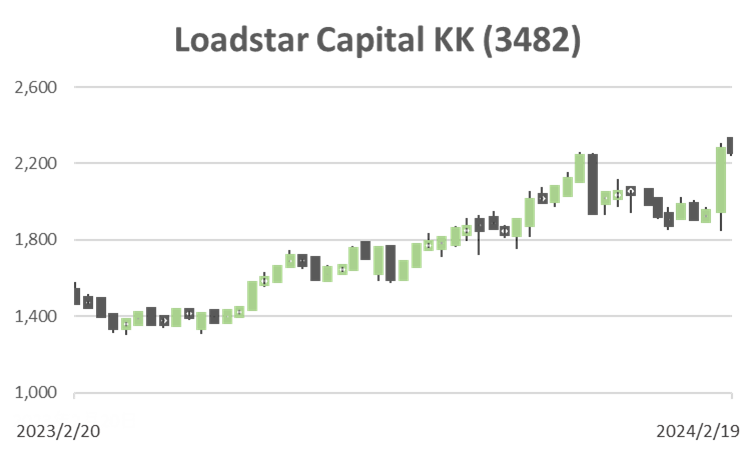

Loadstar Capital KK (Price Discovery)

Buy

Profile

Engaged in investment in mid-sized commercial buildings in Japan. Its core business is acquiring office space in Tokyo, adding value, and selling it. Sales split into 87% real estate investment, 9% real estate leasing, 2% asset management, and 2% crowdfunding. Established in 2012 by Tatshi Iwano.

| Securities Code |

| TYO:3482 |

| Market Capitalization |

| 48,721 million yen |

| Industry |

| Real estate |

Stock Hunter’s View

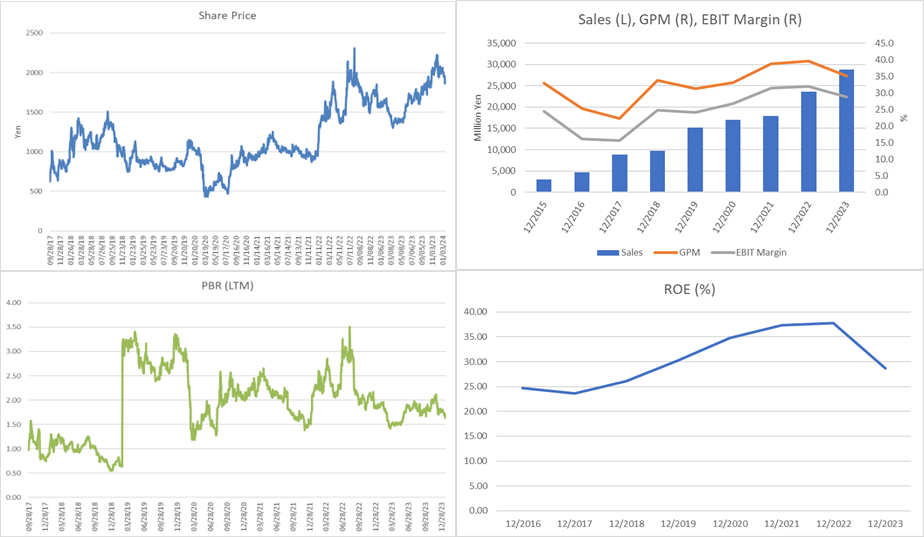

Profit increased for the 12th consecutive fiscal year, and dividends increased substantially.

Loadstar Capital operates a corporate funding business that acquires office buildings and other properties in Tokyo, adds value, and sells them. Since its establishment, the company has maintained stable earnings growth, and investors highly rate its recent earnings announcement.

For the fiscal year ending December 31, 2024, the company plans net sales of 37,658 million yen (up 31.1% YoY), an operating profit of 11,567 million yen (up 40.2% YoY), and a year-end dividend of 70 yen (52.50 yen in the previous year), marking the 12th consecutive year of increased profits and significantly higher dividends. While there has been an increase in the number of new entrants in the real estate revitalisation field in recent years, the company’s strength lies in its ability to find projects through its long-standing network.

In the previous fiscal year, the real estate investment business sold 13 properties, mainly small properties. On the other hand, the company acquired a large office building from Mitsubishi Estate (TSE 8802) and purchased several other small and medium-sized properties. President Tatsushi Iwano commented, “We have been able to buy more liquid properties and accumulate ideal assets.

The asset management business, the third primary business of the company, is also growing as a solid earnings source, with assets under management (AUM) surpassing 100 billion yen for the first time.

The return to office in Japan has become more pronounced, while the hotel market is strong due to inbound demand. In addition to domestic investors with firm demand, some European and U.S. investors appear to be resuming investment, and favourable market conditions are expected to continue.

Investor’s View

BUY. Short-term earnings momentum is strong, while equity yield is supportive.

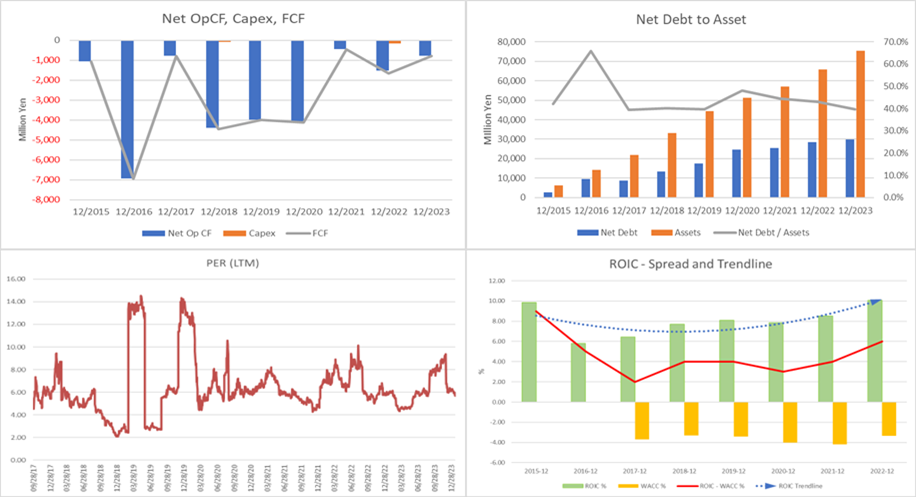

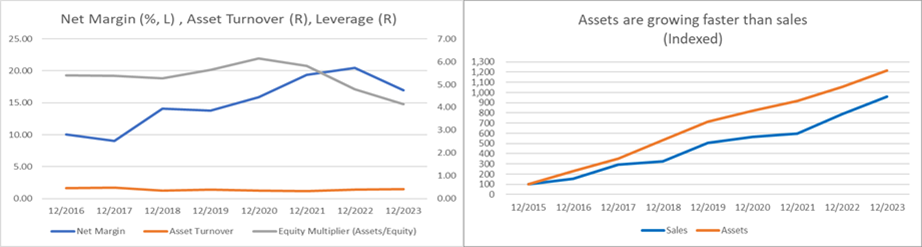

The top line has grown at a CAGR of 24% over the past five years, and ROE has remained in the 30% range over the same period. The company continues to grow while raising a large amount of debt and expanding its balance sheet. As a result, operating CF has been in the red in every fiscal year. Assets are growing faster than sales due to the ever-increasing real estate for sale.

High ROE owes to the excellence of the business

The company’s ability to maintain a high ROE despite a significantly low asset turnover due to inventory expansion is due to its high leverage. However, from a long-term perspective, it should be noted that the company’s high ROE is due to the excellence of its business, which delivers high profit margins. This should be rated well.

The earnings momentum is strong

The recent presentation of FY2023 financial results showed that the company is progressing in expanding its business by acquiring and selling properties. Cost control is good. Even if the BOJ unlocks negative interest rates, the favourable financing environment will not change. Global interest rates have remained low for a long time, and there is an abundance of funds going into real estate domestically and internationally. The company’s strong performance will also persist, and earnings momentum is expected to remain strong in the next 10-12 months. It is too early to expect any modulation in the real estate market other than intuitive concern.

Investors are seeing unprecedented top business cycle performance

Of course, the real estate market will eventually collapse; from a 20- or 30-year long-term perspective, the company is at the top of an unprecedented business cycle. Performance figures at the top of an unprecedented business cycle

Of course, the real estate market will eventually collapse; from a 20- or 30-year long-term perspective, the company is at the top of an unprecedented business cycle. One should never forget that the company’s performance since its IPO in 2017, as indicated by various graphs, is only an extreme period in the business cycle.

Stock price multiples are supportive of short-term investment

Real estate market cycles are difficult to forecast. The company’s CF is structurally in the red during boom periods, which makes our DCF fair value in red ink. Fair value based on long-term fundamental forecasts for a flow-based real estate company like the company would not be helpful.

The stock price mainly depends on the short-term earnings outlook. PER is only a short-term indicator. However, the current multiple of around 6x is relatively reassuring. The stock price is not overheated, having underperformed slightly since the beginning of the year. BS is not over-expanding its debt.