Asahi Intecc (Price Discovery)

Buy

Profile

Develops, manufactures, and sells guidewires and various catheters used for cardiovascular treatment. Has the largest market share in Japan. Has a 50% share of the U.S. market for PTCA guidewires. Manufactures in Thailand, Vietnam, and the Philippines. Sales breakdown % (OPM): Medical 87 (21), Devices 13 (23) [Overseas] 82 (FY6/2023)

| Securities Code |

| TYO:7747 |

| Market Capitalization |

| 810,690 million yen |

| Industry |

| Precision equipment |

Stock Hunter’s View

Overseas growth leveraging product competitiveness. The outlook for the next fiscal year is good.

ASAHI INTEC develops, manufactures, and sells guidewires and various catheters used in cardiovascular treatment. The company has the top market share in cardiovascular and non-cardiovascular applications in Japan, mainly for guidewires. The company boasts a 50% share (end-June 2024) of the PTCA guidewire market in the US.

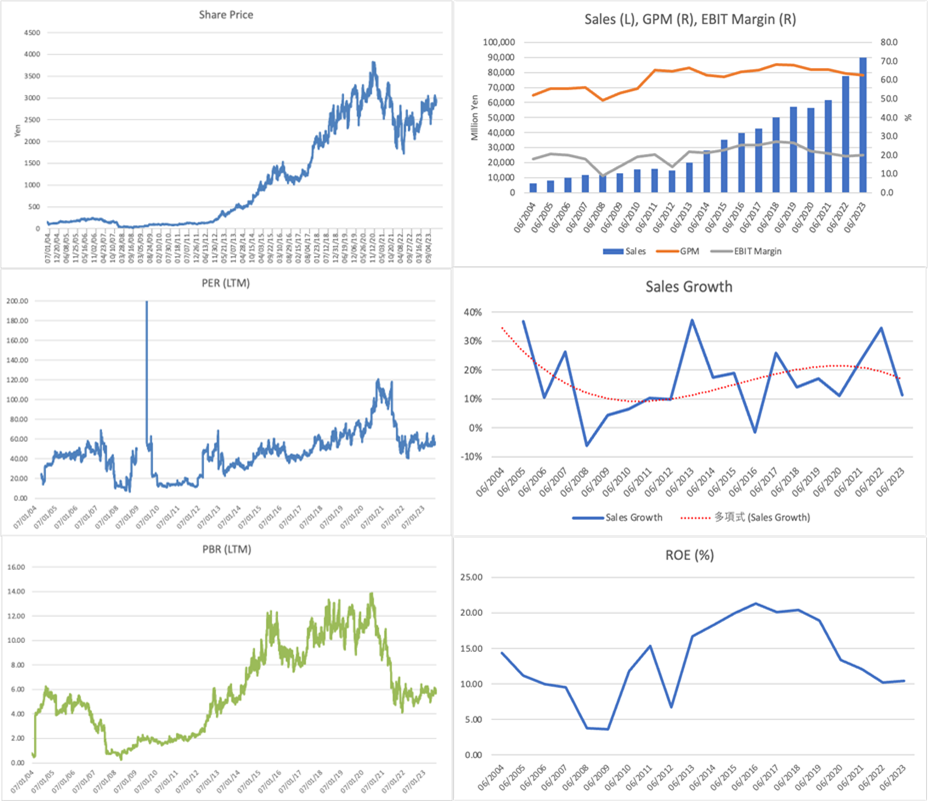

The financial results for Q2 (Jul-Dec) FY6/2024, announced on 14 February, showed sales of 54,341 million yen (+19.6% YoY) and operating profit of 13,498 million yen (+35.6% YoY). In addition to the positive impact of the weaker yen, the business performed well, particularly overseas, due to a recovery and expansion of caseloads and increased demand.

In the cardiovascular area, sales increased in all regions, particularly for PCI guidewires and penetrating catheters. Although there was an exceptionally high concentration of orders from distributors in the European (Eastern Europe) and Chinese markets, the business was still strong even considering these. In addition, sales in the non-cardiovascular field grew, particularly in China (all fields) and the US (peripheral vascular). At the same time, OEM transactions increased with new transactions, particularly in the US market.

The company will likely continue to grow, particularly overseas, due to its high product competitiveness. It focuses on developing products other than guidewires and devices for use in new areas such as the lower limb and brain. Over the next fiscal year, the company is expected to benefit from new product sales expansion, as well as from collaboration with Penumbra Inc. (peripheral vascular thrombus aspiration devices) in Japan and products in the gastrointestinal field.

Investor’s View

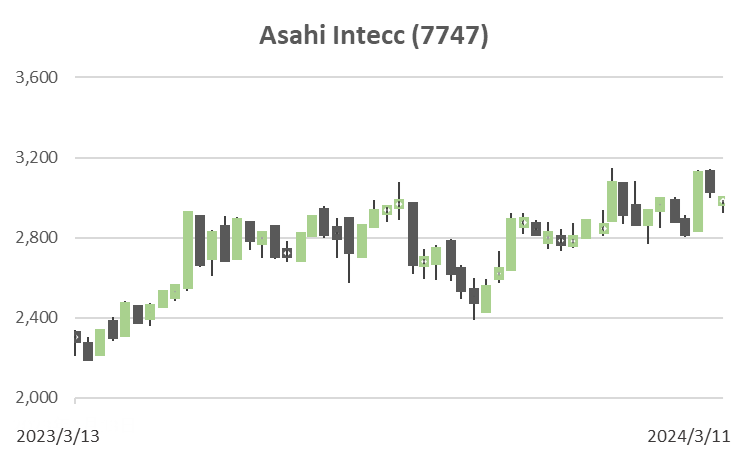

Long-term Buy: recommends returning to the shares.

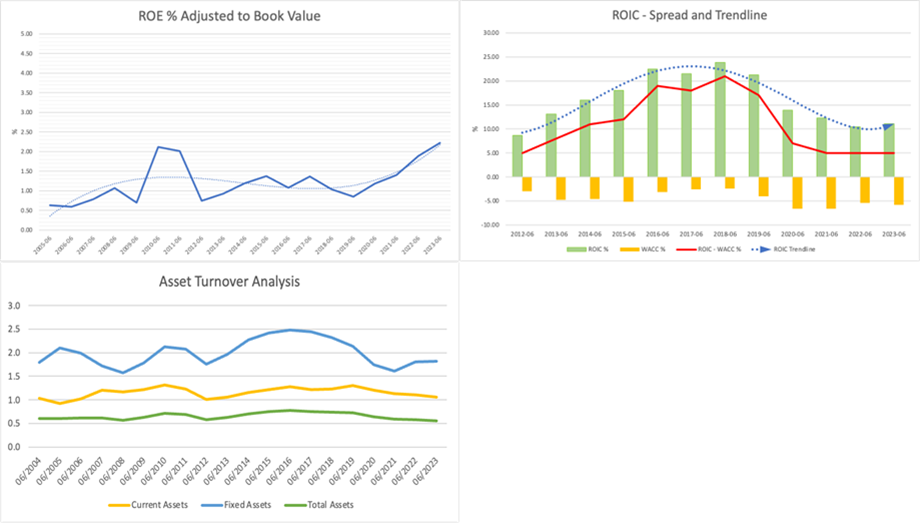

The shares lost 9% to the TOPIX YTD; they barely beat the index by 7% in 2023 but performed poorly in 2021 and 2022. Around 2017, more than ten years after listing, the company began to expand its BS noticeably. The size expansion was all-encompassing, and not only fixed assets but also current assets, such as accounts receivable, expanded. In 2021, the BS expansion was noticeably reflected in a decline in ROE. At that time, many investors would have downgraded fair value by lowering their long-term growth rate assumptions, predicting that top-line growth would soon be saturated with sales growing tenfold in the 15 years since the IPO in 2004.

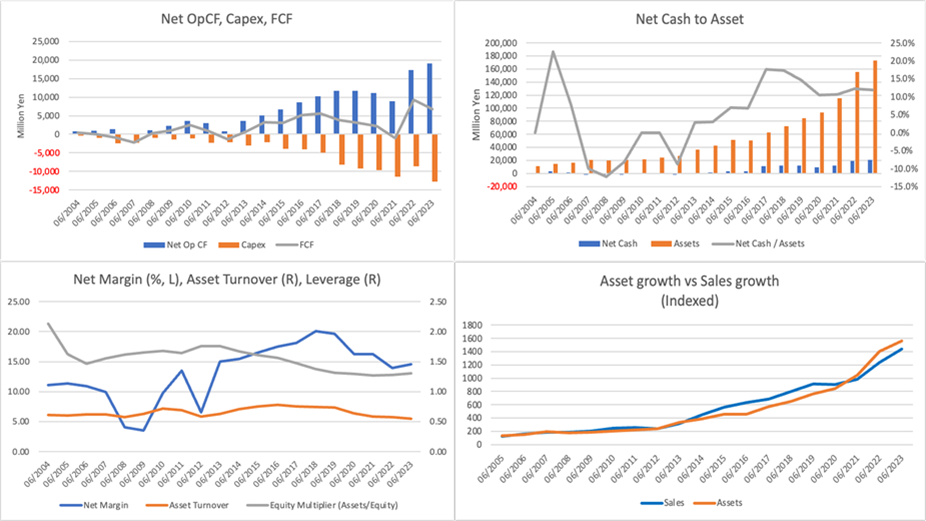

Spending CF quite proactively

Capital investment in recent years has been all-encompassing region-wise, boosting in Japan and abroad. This includes establishing and expanding plants in Thailand, Hanoi, and Cebu, expanding domestic R&D centres, and constructing a new head office building in Japan. In FY6/2023, investment in constructing new head-office buildings was significant. This investment is continuing, and the capital expenditure for the current financial year will register an unprecedented 17 billion yen. The graph clearly shows a trend of actively spending operating CF on investment.

Unscathed growth potential should be reaffirmed

The return on the significant investment will realise in the future, and a decline in ROE and profit margins ahead of that is inevitable. It is important to note that the potential demand for catheters in the catheter market has always been significant as countries worldwide become more developed and Western-style obesity increases and that Japan, with the best catheter doctors in the world, will continue to lead the market. The company’s products and feedback from these highly skilled physicians have grown in popularity.

Timely opportunity to build a long position

The share price is still expensive in terms of PBR-adjusted ROE. However, if one observes the development since the IPO, the share price has always been high, reflecting investors’ strong growth expectations. In comparison, the share price is now relatively undervalued. There has been no problem with the company’s competitiveness, and the investment expansion will eventually result in earnings. Therefore, we would optimistically forecast that ROE and profitability will revert when the investment phase of business expansion is over. Accordingly, economic value creation is expected to regain momentum. The current share price offers an excellent opportunity for building long positions, as high valuations have eased after factoring in the softening phase in earnings and ROE. We recommend investors who have once sold return to the shares to build an active bet.