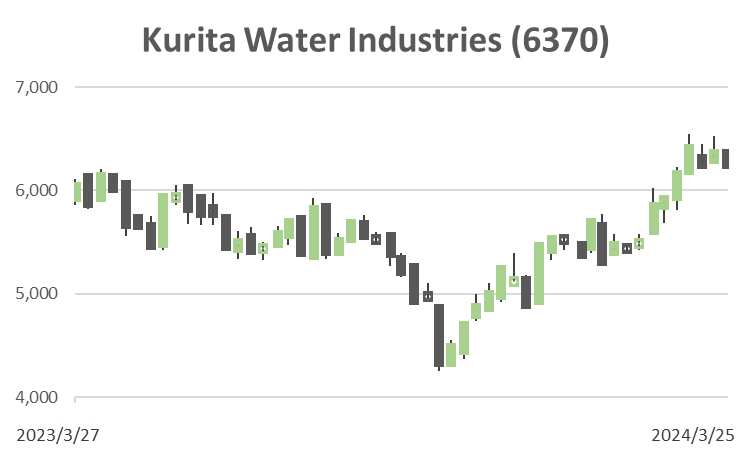

Kurita Water Industries (Price Discovery)

Sell on Strength

Profile

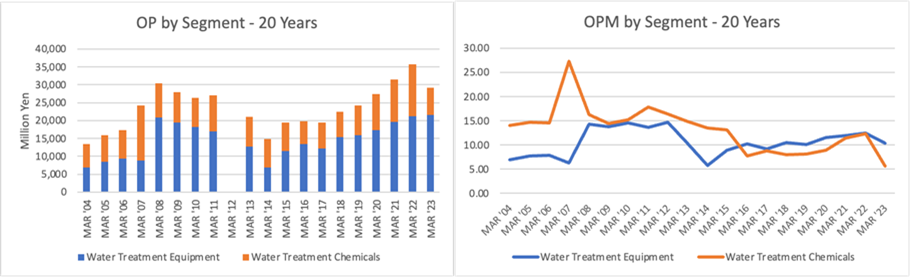

Largest water treatment company in Japan. It operates in the water treatment chemicals and water treatment equipment businesses. The ultrapure water supply business is a good source of earnings. The water treatment chemicals business sells water treatment chemicals for air-conditioning, oil refining, pulp and paper processing, etc. The water treatment equipment business manufactures and sells water production systems for industry, drinking water treatment systems, and sewage treatment systems. Sales breakdown % (OPM%); Water Treatment Chemicals 40 (6), Water Treatment Equipment 60 (10) [Overseas] 49 (3/2023)

| Securities Code |

| TYO:6370 |

| Market Capitalization |

| 726,254 million yen |

| Industry |

| Machinery |

Stock Hunter’s View

A leader in niche water treatment-related products in Japan, with profitability expected to recover noticeably from FY3/2025 onwards.

Kurita Water Industries is the largest integrated water treatment company. In addition to water treatment chemicals used in factories and buildings, the company also manufactures and sells water treatment equipment essential for the manufacture of semiconductors and liquid crystals, supplies ultrapure water, purifies soil and groundwater, and cleans industrial plants. The company’s strength lies in its ability to propose solutions using its comprehensive range of chemicals, equipment and maintenance capabilities.

Current electronics industry orders are driven by equipment for South Korea and China. The precision cleaning business is soft due to lower customer utilisation rates, but there are signs of a bottoming out in the ultrapure water supply business. In the general industrial sector, recovery in the chemicals business has been slow, but the maintenance and equipment businesses are robust. Earnings are steadily improving due to price increases and the effect of a review of orders.

A further recovery in profitability is expected from FY2025 onwards. There are ample opportunities to win domestic and international orders in the electronics industry, and the company plans to select orders steadily from many semiconductor-related projects. In the general industrial sector, the expansion of the CSV business will continue to attract attention.

Recently, the recycling of used disposable diapers has been gaining ground as a new business in resource recycling. In addition, chemicals that contribute to improved thermal efficiency are expanding in the oil refining and petrochemicals business, and success stories are emerging, particularly in South Korea. The horizontal development of good examples will likely lead to increased business performance.

Investor’s View

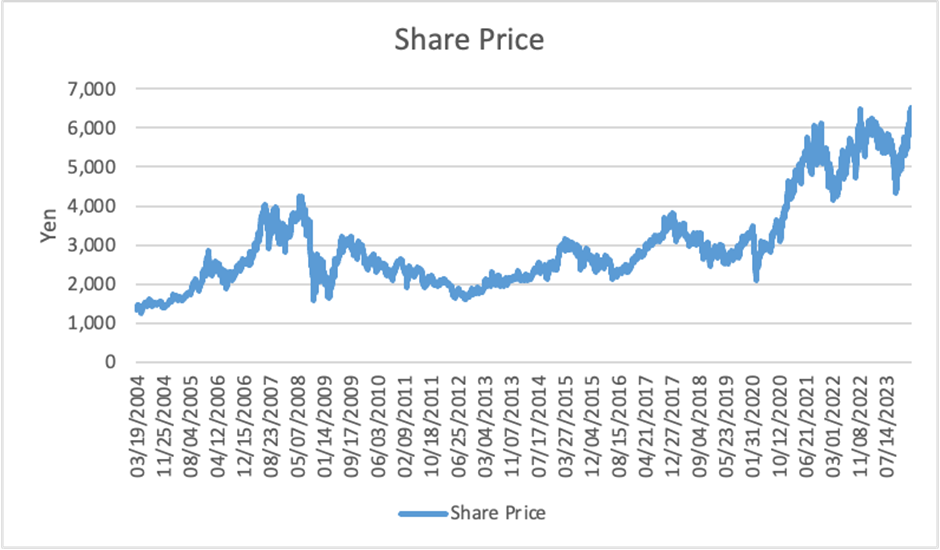

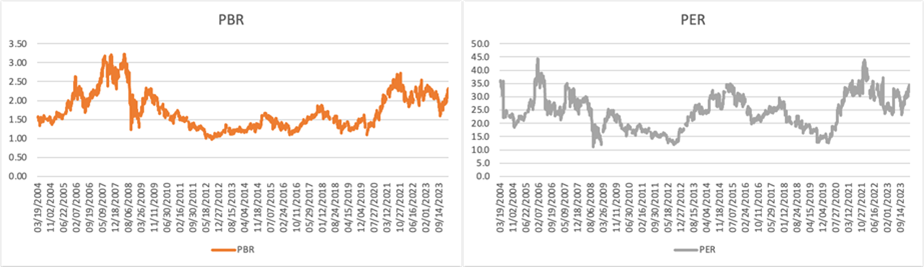

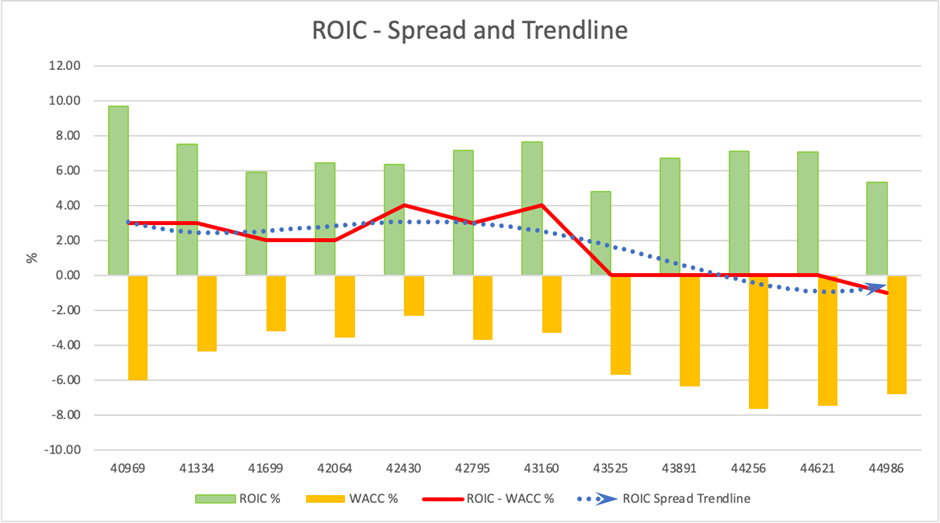

Sell on strength. The share price has discounted positive expectations as a semiconductor-related stock. It still needs to be determined whether the return on capital and economic value will expand as steadily as management portrays.

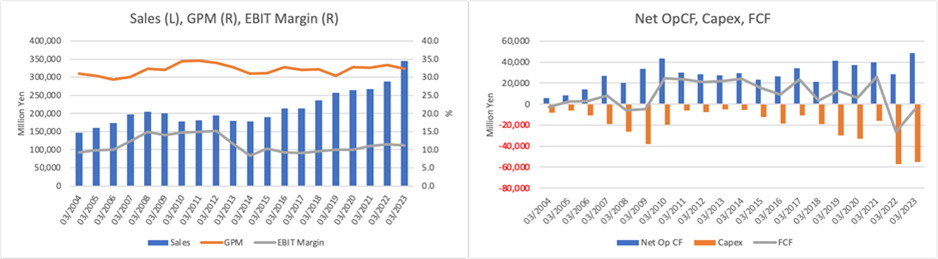

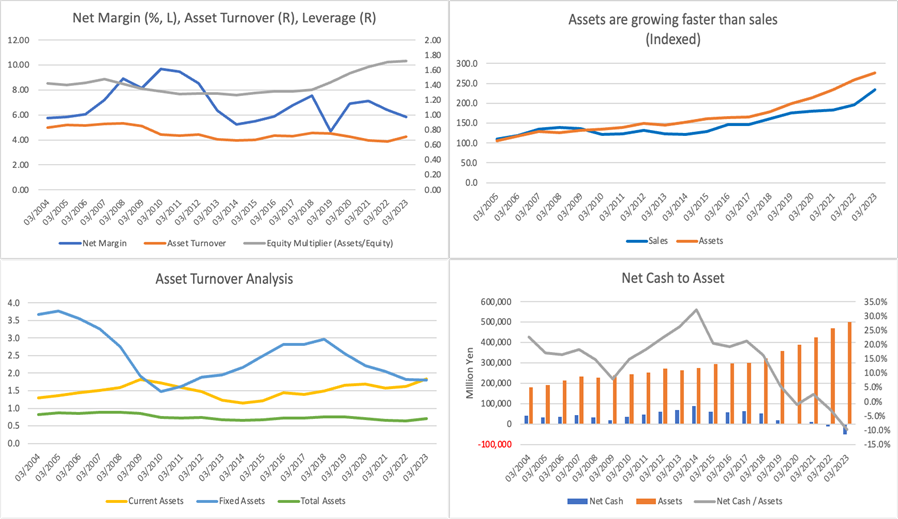

The company operates in water treatment, an essential and enduring business in various industries. From an investor’s perspective, the share price is strong when the semiconductor market is booming but dull otherwise. This may be because organic growth still needs to be improved, return on capital is insufficient, and even when sales accelerate, profits are not as high as expected due to a surge in capital expenditure and higher depreciation costs. No notable innovations have been realised for a long time, and there is no sense that there has been any significant change in the long-standing business model.

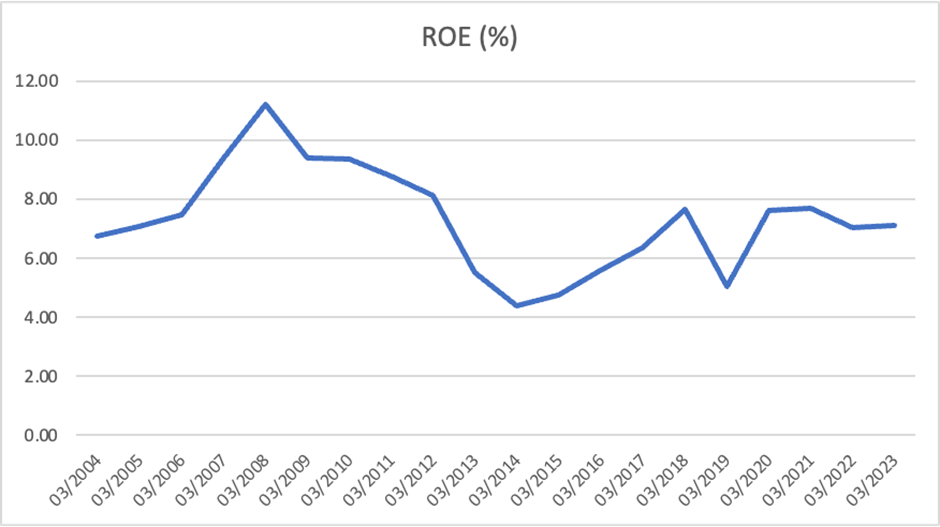

The targets of the new medium-term management plan are reasonable

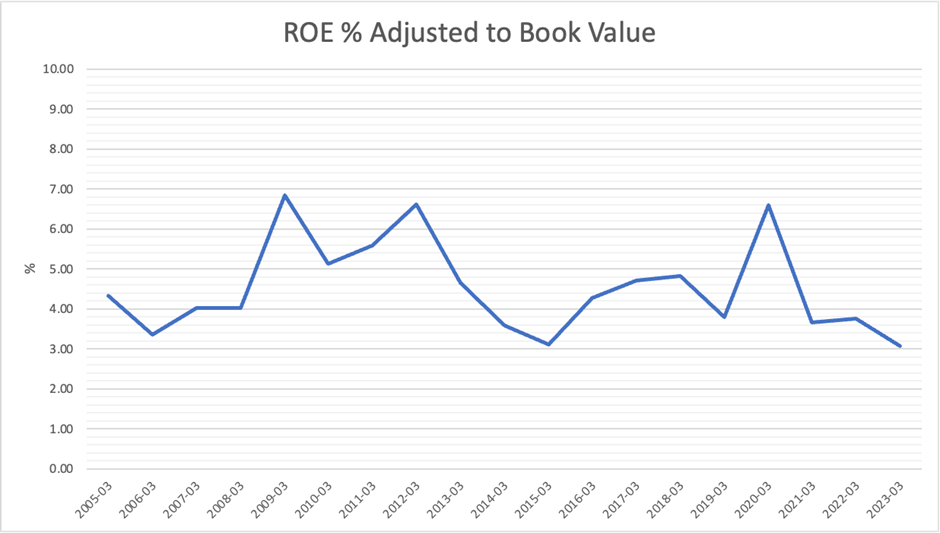

Although the company sets reasonable medium-term management targets, it tends not to achieve them. In the previous medium-term plan, the sales growth target was achieved, but the target of ROE of 10% or more was underachieved. In the new medium-term plan, to maximise corporate value, the targets for FY3/2028 are sales of 450 billion yen, ROE of at least 12%, ROIC of at least 10%, stable operating CF generation, dividend increase, share buyback, and capital cost optimisation.

Costs and assets tend to increase rapidly during periods of semiconductor market growth

Management’s forecast that “the semiconductor market’s CAGR to 2027 is expected to exceed 6%, continuing to generate large investments” sounds reasonable. However, as mentioned earlier, during the accelerated semiconductor market growth phase, the company will invest heavily in installing ultrapure water equipment at customer sites. This leads to a sharp increase in depreciation and amortisation costs while the asset expands to weigh on ROE. This trend has already been evident in the last two years.

Significant efforts on the cost of capital are required to restore the falling ROIC spread towards economic value creation.

Water treatment chemicals’ profit margins are lacklustre

It is also a concern that water treatment chemicals, once highly profitable, have been experiencing a trend of falling margins. Top-line sales struggle to grow and are expanding slower than expected.

Positive expectations for the share as a semiconductor-related stock may have been mostly discounted

However, unlike two years ago, when expectations were disappointing, the current boom in the semiconductor market seems realistic and has been positive for the share price in the short term. Although Kurita Water is a mid-cap name, the shares have tracked the performance of large-cap stocks well, although underperforming TOPIX slightly YTD. Nevertheless, we feel that positive expectations for the shares as a semiconductor-related name have been mostly reflected in the share price, reaching the ¥5,000-¥6,000 range. The equity yield is about half that of the Japanese stock market.

Governance is improving

Governance arrangements that separate management oversight and execution are favourable for investors. One area of focus is whether there is a built-in mechanism for the smooth replacement of management teams that fail to deliver results that satisfy shareholders without the need for activist lobbying.