Interworks Confidence (Price Discovery)

Weak Hold

Profile

Operates a temporary staffing, recruitment and outsourcing business focusing on the games, entertainment and media industries. Established in August 2014. Sales composition % (OPM%); Human resources 99 (28), Media 1 (24) <FY3/2023>

| Securities Code |

| TYO:7374 |

| Market Capitalization |

| 11,143 million yen |

| Industry |

| Service |

Stock Hunter’s View

Industry-specific vertical recruitment services. Merger increases comprehensiveness.

Interworks Confidence has developed a comprehensive range of key human resources services, including recruitment, freelance matching, and job advertisements. Its core business, temporary and outsourced staffing, specialises in the games and entertainment industry. Originally listed on the former Mothers market in June 2021 as Confidence, the company later merged with Interworks, which was listed on the Standard market in August 2023.

The core of the company’s business is the human resources business for the games industry, which it has been involved in since its establishment. The company’s approach is to move from a simple order-taking relationship to a strong partnership by starting with temporary staffing, getting deeply involved in projects, and then providing one-stop solutions to various issues and needs identified through in-depth communication with the client. In the nine and a half years since its establishment, the company has covered 90% of the major companies in the games industry.

After the merger, InterWorks’ recruitment and recruitment outsourcing functions, mainly for middle- and high-class professionals and job media, were added to the company’s coverage. Now that the company has penetrated the gaming and entertainment industry, it is targeting the DX, advertising and media, and Web 3.0 sectors as it expands into new areas.

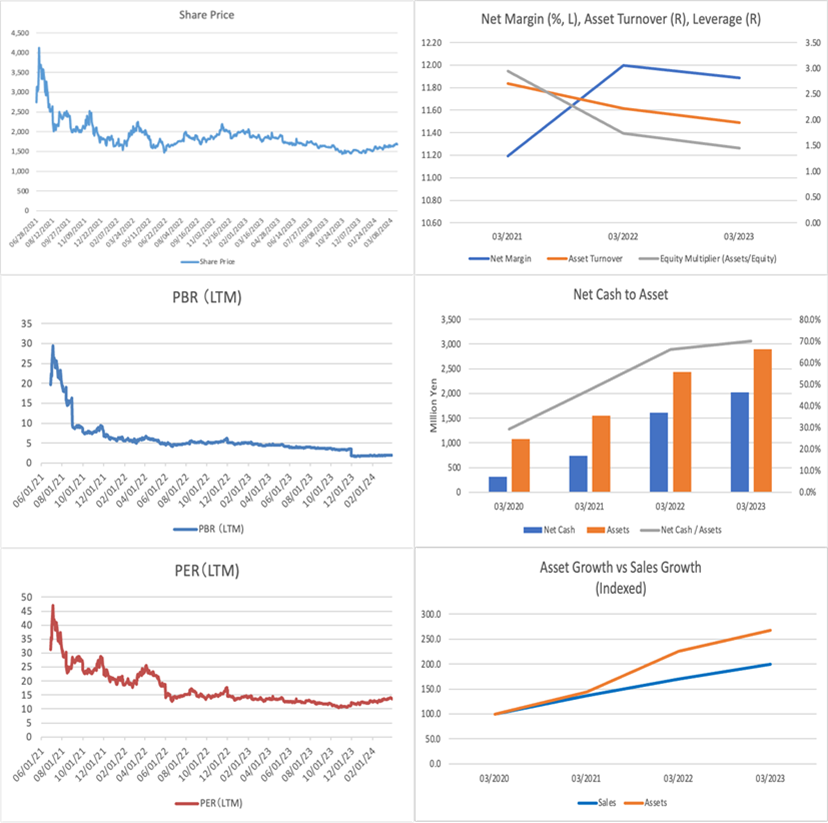

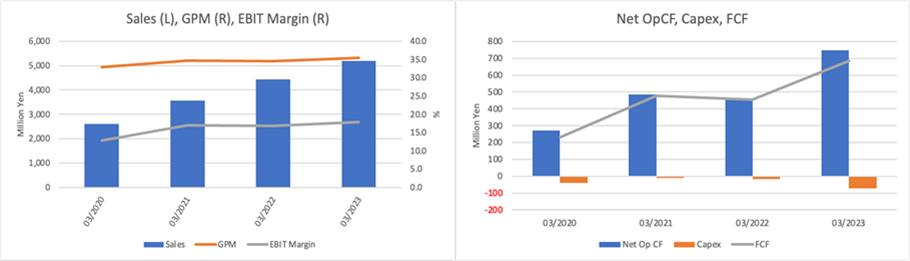

There have been no concerns about performance since the Confidence days, and the company plans sales of 8 billion yen (+53.9% YoY) and operating income of 1.12 billion yen (+20% YoY) for the current year ending 31 March 2024.

Investor’s View

Weak Hold; return on capital falls sharply due to cash expansion. Be prepared for a small-cap rally following the bull market.

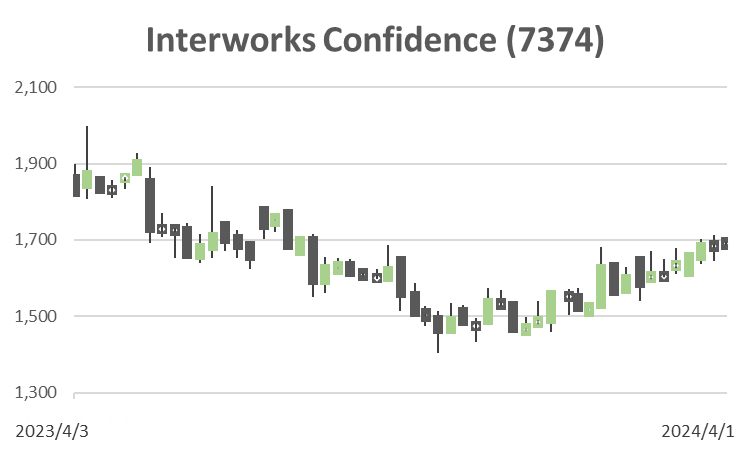

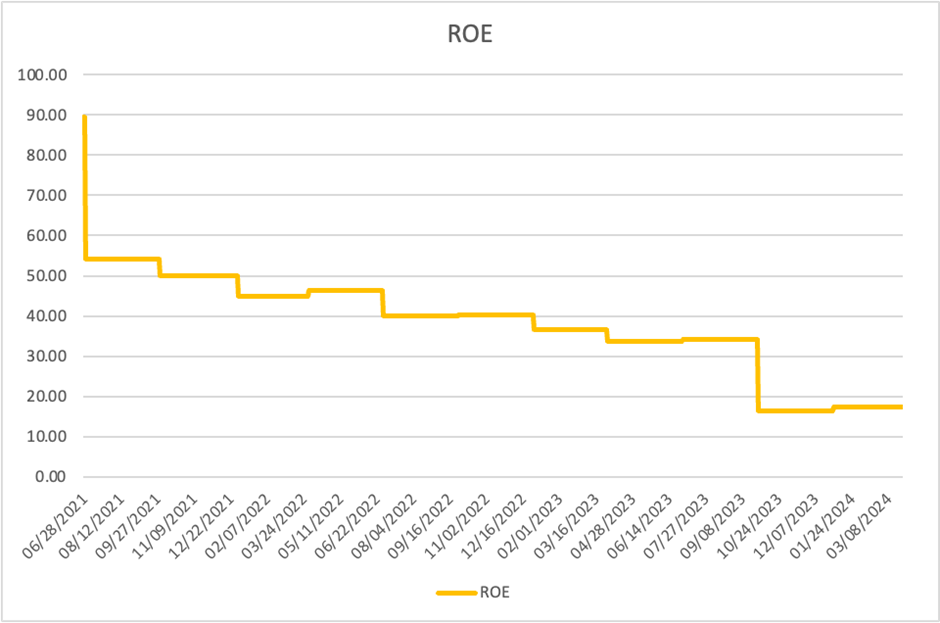

The business is good, cash is building up fast, and ROE is falling fast. ROE has fallen below 20%. The share price is losing the high premium it gained on the IPO. Earnings momentum is strong. Meanwhile, the share price dropped 20% in CY2023 and has only risen by 7% YTD, underperforming TOPIX by 10%.

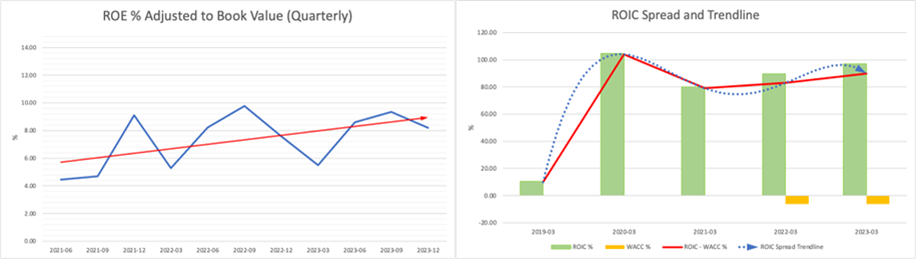

Return on capital will continue to decline

Top-line growth will continue for the foreseeable future. The EBIT margin is stable, and the business is excellent, producing a generous CF. However, if management continues to allow the BS to inflate, the return on capital will decline further, reducing the attraction of the shares.

The upside to share price

Considering where the long-term share price upside lies, it is likely 1) a further increase in top-line growth, 2) cash being used for profitable investments, and 3) the start of significant shareholder returns. The prediction that there could be a big MA is a concern for investors in Japan, a country where few MAs offer significant positive returns to investors. The company has only existed for ten years and only three years since its IPO. With a growing top line, management is unlikely to be interested in a significant shareholder return.

Weak Hold

On the flip side, the derating of PBR has led to an upward trend in the equity yield, now close to the market average of 8%. Unsurprisingly, the share price underperformance could end in the not-too-distant future. In addition, we rate the shares a Weak Hold because, considering the robust earnings momentum, the shares are not so bad to prepare for a small-cap rally after the huge large-cap swing. Significant ROIC spread is also rated well.