CTI Engineering (Price Discovery)

Buy

Profile

CTI Engineering is a Japanese company that provides consulting services for domestic and international infrastructure projects, including power generation, geotechnical services, underground construction, river and coastal planning engineering, and road bridge and tunnel construction. The company was founded in 1963. Sales by division (OPM %): Domestic construction consulting 70 (12), Overseas construction consulting 30 (4) [Overseas] 30 (FY12/2022)

| Securities Code |

| TYO:9621 |

| Market Capitalization |

| 70,583 million yen |

| Industry |

| Service |

Stock Hunter’s View

The construction consulting business continues to grow steadily. Management anticipates a full-year profit decline but made a good start in 1Q.

CTI Engineering is a construction consulting firm with strengths in water-related technologies. In past typhoon disasters, the company received disaster response requests from the Ministry of Land, Infrastructure, Transport, and Tourism, local governments, academic associations, etc., mainly in the fields of rivers and coasts, and responded to more than 100 requests. The company has a high ratio of certified engineers and other qualified personnel.

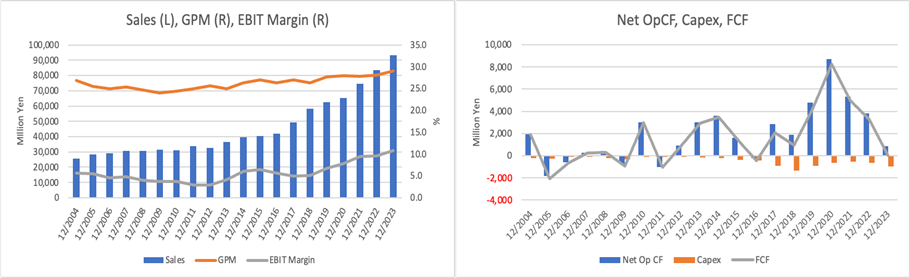

Orders for FY12/2023 reached a record high. Net sales increased for the 11th consecutive year, and operating profit increased for the 7th consecutive year. While the domestic business received a high proportion of orders from technological competition, orders from local governments through price competition also grew.

For the current fiscal year, however, the company plans lower sales and profits, with net sales of 89 billion yen (down 4.4% YoY) and operating profit of 8.4 billion yen (down 16.1% YoY). The company has set its order book at a low level to reduce the burden on employees, and it also plans to invest aggressively in human capital, technological development, R&D, and other areas.

However, when 1Q (January-March) results came in, the company got off to a good start with net sales of 29,189 million yen (up 17.9% YoY) and operating profit of 6,107 million yen (up 63.2% YoY). The company will continue to take orders in 2Q and beyond, carefully considering the engineers’ workload as planned.

Investor’s View

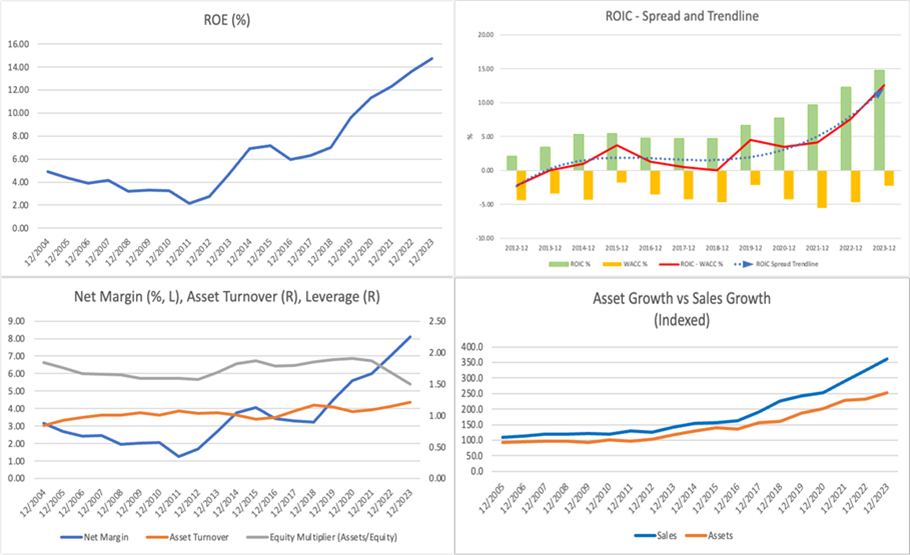

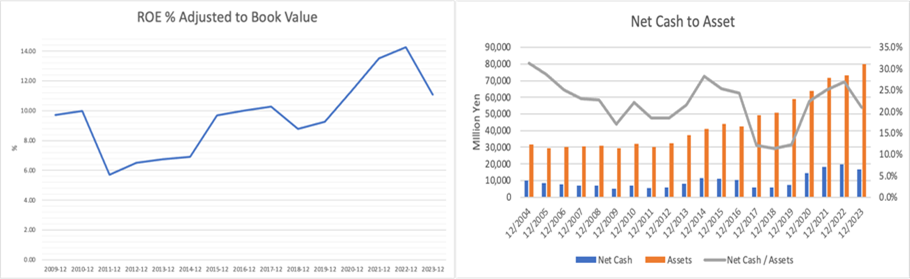

Buy. The earnings forecast is difficult, and PER expansion is unlikely. However, the stock is a little too undervalued relative to ROE. Economic value is being generated well. If management presents measures to raise the share price in the forthcoming new medium-term plan, it should send the share price higher.

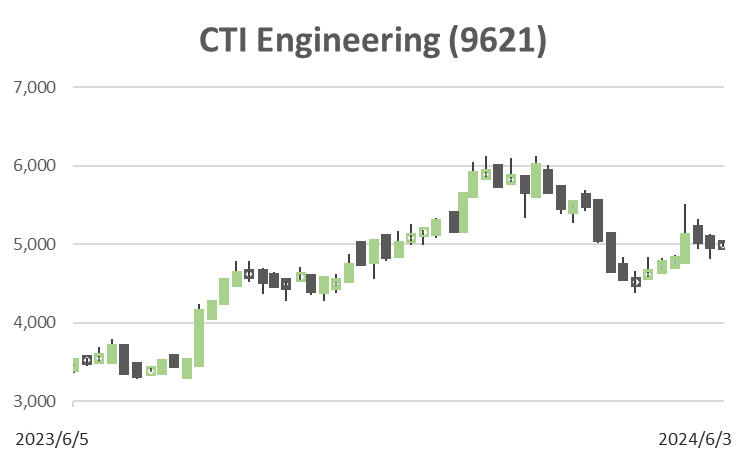

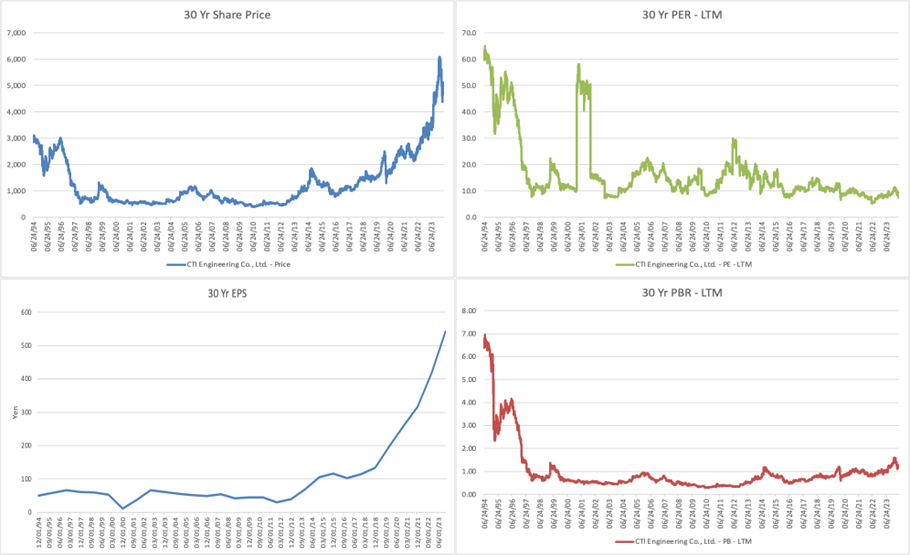

The stock price has increased fivefold compared to 2017, as EPS has increased fivefold over the same period; the driver of EPS is the government’s 5-year Accelerated Measures for Disaster Prevention, Mitigation, and National Land Resilience through to FY2025. Domestic businesses generate 90% of operating profit and 70% of sales. Since 2017, PBR has recovered from 0.6x to 1.2x, while PER, which was around 10x, is almost flat, and the current forecast PER is around 11x. The stock price is at a 30-year high range.

Stock price reflects earnings growth straightforwardly, but there has been little change in the premium attached to the long-term stock price. This is likely due to the difficulty in forecasting earnings. Roughly speaking, the company’s profits are determined by public works budgets, competitiveness, and ability to make proposals. As a consulting business, we suspect construction costs, such as material and labor, will not be a direct factor. Investors can’t predict sales and profit margins of several years out with any degree of accuracy. Experienced investors should have encountered many such stocks. The company’s earnings driver is domestic public works projects, but the government and local governments’ future of public works budgets is uncertain. The business environment could change suddenly with a change of government. Experience shows that public works budgets are sometimes good and sometimes bad, and many investors are doubtful about the future because the past has been so good.

On the other hand, an ROE of over 14% is attractive and less worrisome, at least in the next 10-12 months. In contrast, the book value of 1.2x is too low.

In addition, the forthcoming Medium-term Management Plan may prove to be a positive catalyst for the stock price. Management is correctly aware of valuation issues and WACC. Although management has yet to take any specific measures, they seem interested in improving the stock price. Furthermore, the stock’s earnings yield is attractive enough.

The overseas business accounts for 30% of sales but is not a significant factor in the stock price. Sales by region have grown at a CAGR of 10% domestically and internationally for the past five years. In the past three years, overseas sales have grown at a CAGR of 20%, but as a percentage of operating income, it is only 10%. What is essential for equity investment is the future of the domestic business, which is difficult to predict.