CNS (Company note – Full report)

Blue-chip client portfolio powering sustainable growth

Diversifying from contract development into consulting business

| Click here for the PDF version of this page |

| PDF version |

SUMMARY

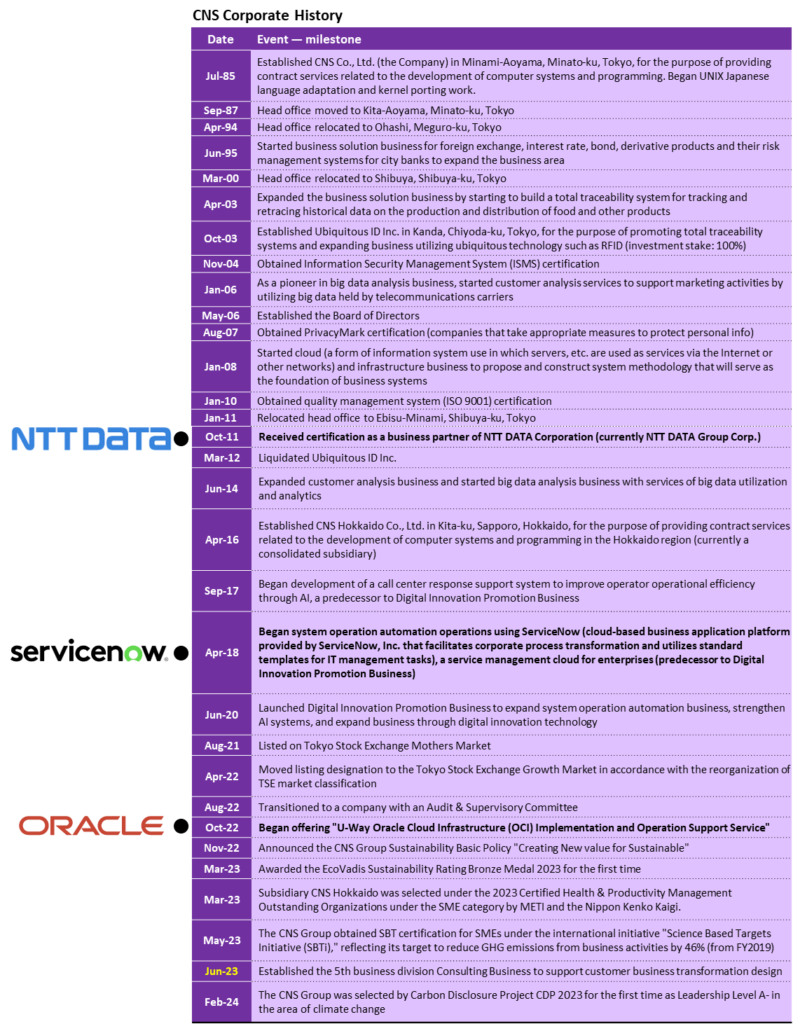

- CNS will mark its 40th anniversary since founding in 2025, initially established in 1985 to focus on developing business in Japan involving UNIX open systems. As part of the information services industry comprised of major system integrators and contract-based system software developers, CNS has accumulated extensive experience particularly in digital solutions using low code application platforms to help customers automate business operation workflows, steadily adding new arrows to its quiver to address key aspects of enterprise DX, ultimately aiming to support clients in business transformation design through its new Consulting Business division. n

- IDC Japan forecasts the domestic software development market to grow at 5Y CAGR of +9.4% through 2028, of which application development / deployment is forecast to grow at 5Y CAGR of +16.9%. Competitive advantages of the CNS Group include 35% of transactions are direct transactions with end users as prime contractor, and the remaining 65% are as primary subcontractor with top system integrators NTT DATA, NRI, NS Solutions, etc., enabling it to secure stable revenues and power sustainable growth, as well as advanced know-how in digital innovation solutions, with strengths in software engineers, business architects and data scientists.

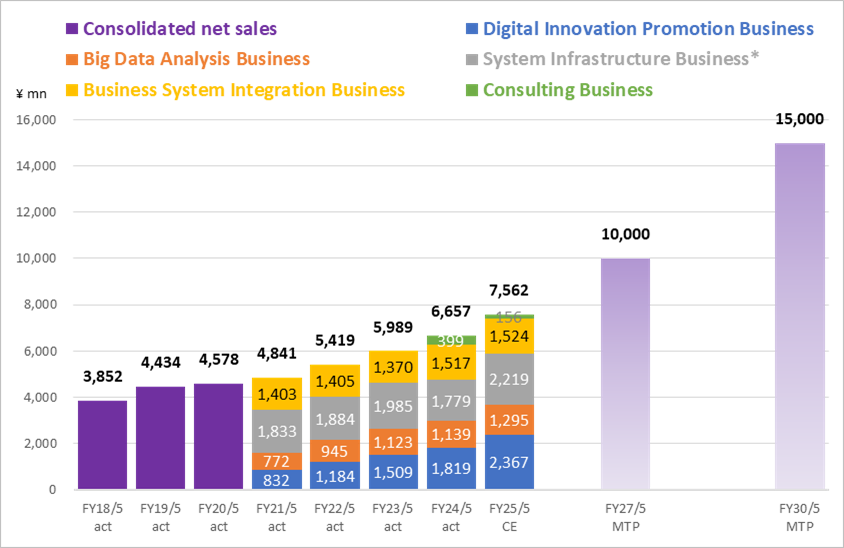

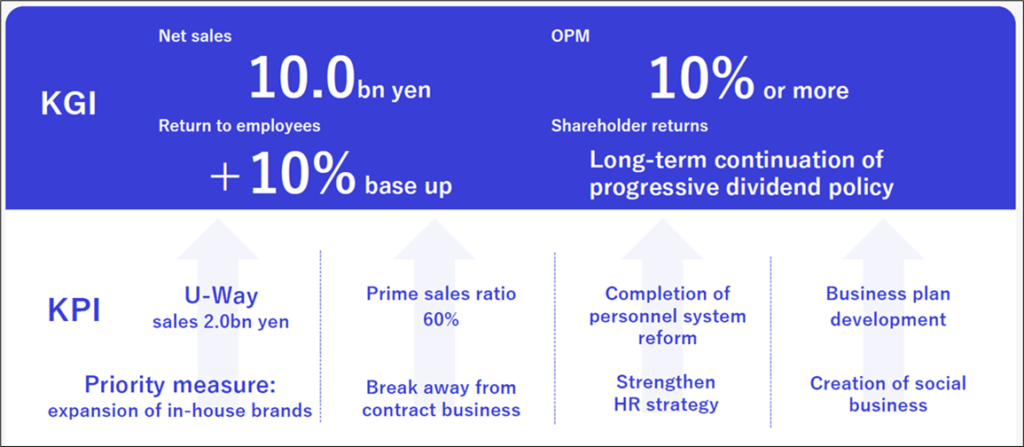

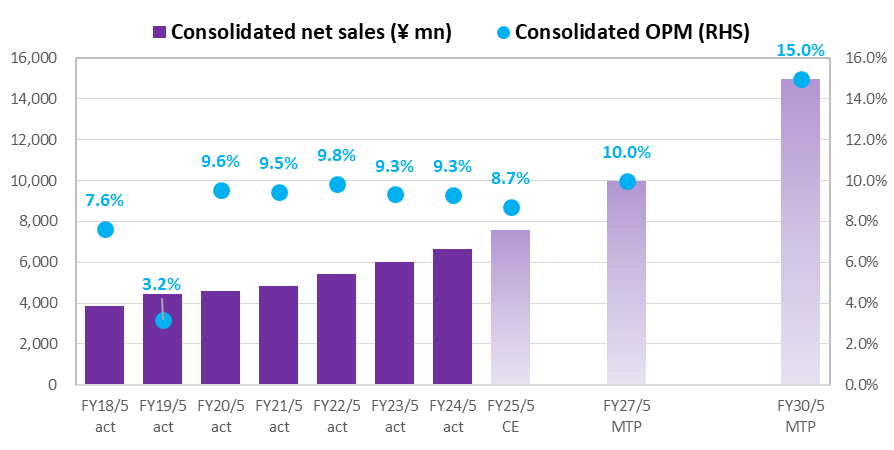

CNS New Medium-term Management Plan targets net sales 6Y CAGR +14.5%

Source: compiled by Omega Investment from IR results briefing materials. *System Infra includes cloud and on-premise.

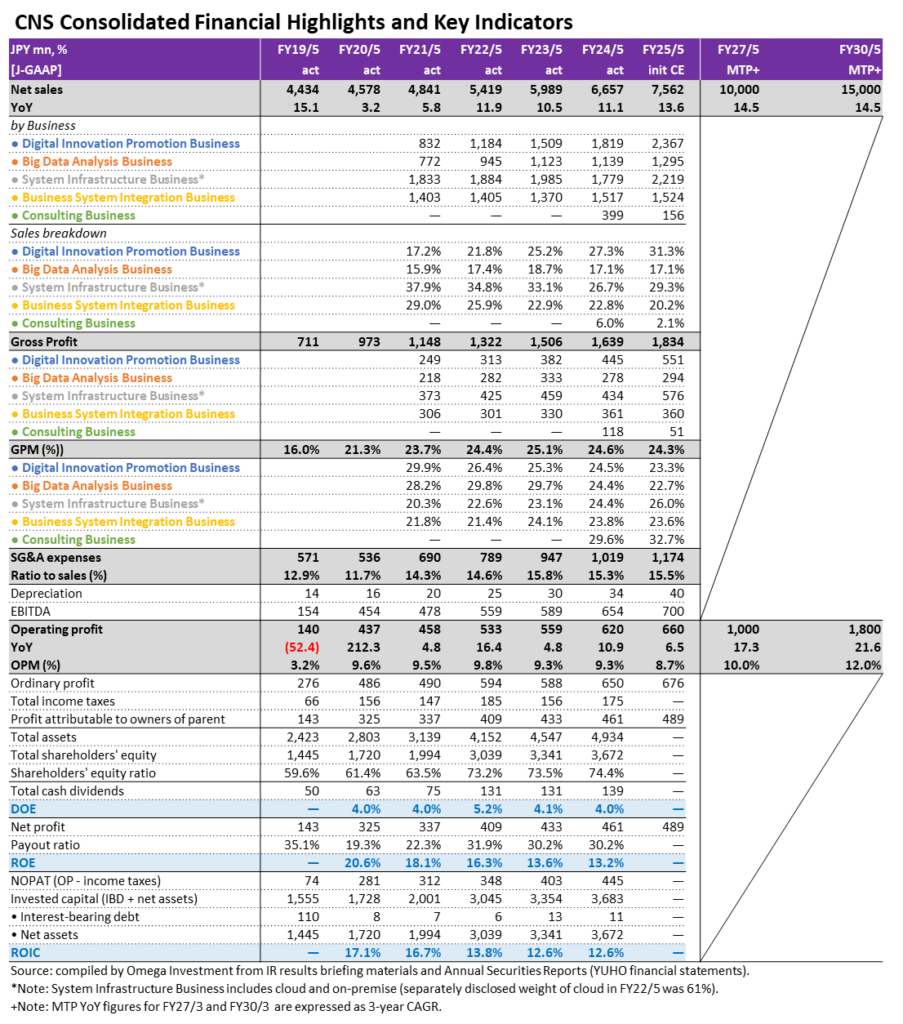

Financial Indicators

| Share price (9/5) | 1,526 | 25.5 P/E (CE) | 9.1x |

| YH (24/4/18) | 2,111 | 25.5 EV/EBITDA (CE) | 1.2x |

| YL (24/8/5) | 1,300 | 24.5 ROE (act) | 13.2% |

| 10YH (21/8/20) | 3,035 | 24.5 ROIC (act) | 12.6% |

| 10YL (23/1/17) | 1,270 | 24.5 P/B (act) | 1.21x |

| Shrs out. (mn shrs) | 2.906 | 25.5 DY (CE) | 3.21% |

| Mkt cap (¥ bn) | 4.434 | | |

| EV (¥ bn) | 0.872 | | |

| Equity ratio (5/31) | 74.4% | | |

Omega Investment’s case for CNS as an attractive opportunity

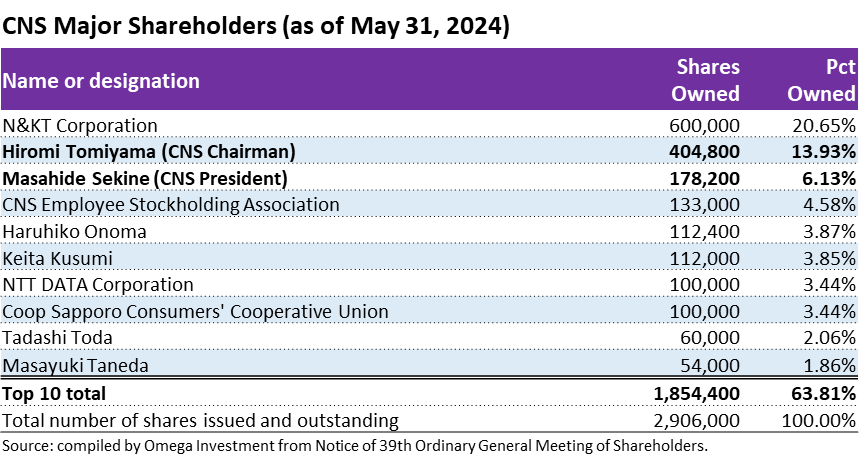

Omega Investment believes that CNS is one of those rare hidden gems among small cap growth companies waiting to be discovered. First, as an investor, it is reassuring that the chairman and president collectively own 40% of the shares outstanding, so their financial interests are directly aligned with shareholders. More importantly, management is taking steps to ensure a steady transition from the current DX-driven high market growth to sustainable growth regardless of underlying market conditions, including transforming the profit structure to higher margins not dependent on contract-based orders.

Table of Contents

| ❶ | INTRODUCTION — INDUSTRY BACKGROUND | |

| System integrators and contract-based system developers | 4 | |

| ❷ | BUSINESS OVERVIEW | |

| Business description, corporate history, customer strengths | 10 | |

| ❸ | EARNINGS REVIEW AND NEW MTP TARGETS | |

| 4Q FY24/5 results, and new medium-term management plan | 17 | |

| ❹ | SHARE PRICE INSIGHTS | |

| Share price/valuation trends, shareholder return policy | 23 |

PART ① INTRODUCTION

Industry Background – System Integrators and Contract-based System Developers

According to data from the 2024 White Paper on Information and Communications in Japan (July 2024), Ministry of Internal Affairs and Communications (MIC), the scope of Japan’s ICT industry includes the following nine sectors: telecommunications, broadcasting, information services, internet-related services, video, audio, and text production, ICT-related manufacturing, ICT-related services, ICT-related construction, and research. In 2022, nominal GDP of Japan’s ICT industry of ¥54.7 trillion (+1.5% YoY) accounted for 10.1% of nominal GDP for all industries of ¥540.7 trillion. While many of the above 9 sectors were effectively flat, information services (next page) and internet-related services posted solid YoY gains in a growing trend.

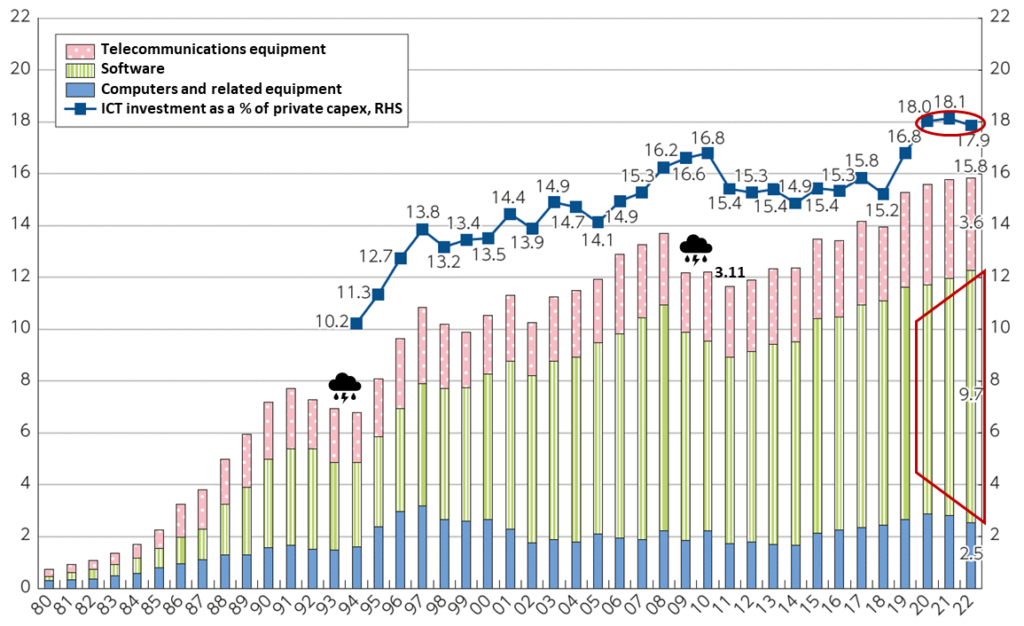

ICT investment by private enterprises in Japan in 2022 was 15.8 trillion yen in 2015 prices (+0.4% YoY). By category of ICT investment, software (contract development and package software) was 9.7 trillion yen, accounting for nearly 60% of the total, and the only one of the 3 categories posting a YoY increase. The ratio of ICT investment to private-sector capital investment in 2022 was 17.9%, down 0.2 points from the previous year, but still at a high level. Accelerating deployment of DX investment in the wake of COVID-19 has been a driving factor. Here, investment in information and communications capital goods refers to computers and related equipment, telecommunications equipment, and software. The use of cloud services, which have become increasingly popular in recent years, is not included in IT investment here because it is a purchase of services and not a purchase of capital goods.

A key takeaway from the graph below is the significant downsizing through 1994 in the wake of the peaking out of the asset bubble economy of the late 1980’s (fueled by financial sector capex), as well as retrenchment following the global financial crisis in 2009.

Trend of ICT Capital Investment by Private Enterprises in Japan (JPY trillion)

LHS: Trend of ICT Capital Investment by Private Enterprises (¥ trn, 2015 prices), RHS: ICT Investment as a % of Private-sector Capital Investment (%)

Source: excerpt from 2024 White Paper on Information and Communications in Japan (July 2024), Ministry of Internal Affairs and Communications, from “Survey on Economic Analysis of ICT in 2022“ https://www.soumu.go.jp/johotsusintokei/whitepaper/index.html

Information Services Industry

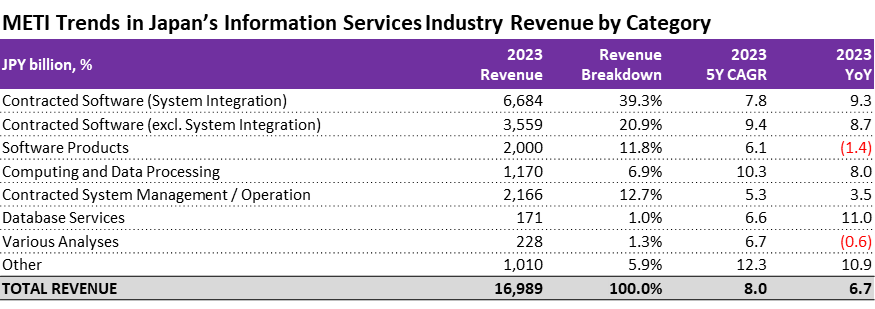

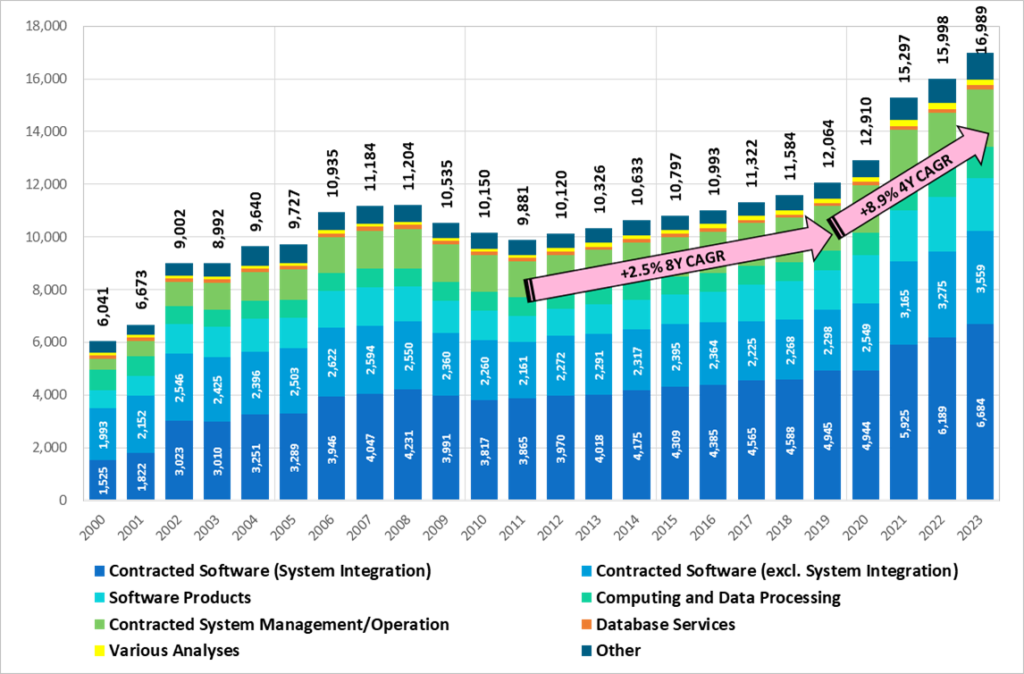

Data below from the Ministry of Economy, Trade and Industry’s Current Survey of Selected Service Industries, 2. Information Services, shows 2023 total revenue of ¥16.9trn increased +6.7% YoY. From a historical perspective, current growth rates are at the higher end of the range, driven by the aforementioned accelerated deployment of DX investments in the wake of the COVID pandemic, seeing a particular focus on cloud migration/integration, security and AI solutions, etc. Since the current series started in 2000, 23Y CAGR has averaged +4.6%, versus the low 8Y CAGR of +2.5% in the 2010s, and the high 4Y CAGR of +8.9% since COVID-19. IDC Japan forecasts the domestic cloud market will grow at 5Y CAGR of +16.3% through 2028 (2023a +29.6% YoY), driven by DX proliferation. IDC Japan also forecasts that domestic big data/analytics market spending will grow at 5Y CAGR of +14.3% through 2027, driven by generative AI/predictive AI for business visualization, etc.

Trend of Total Revenue in Japan’s Information Services Industry by Category (JPY billion)

Source: compiled by Omega Investment from METI’s Current Survey of Selected Service Industries (2. Information Services Industry) https://www.meti.go.jp/statistics/tyo/tokusabido/result/result_1.html

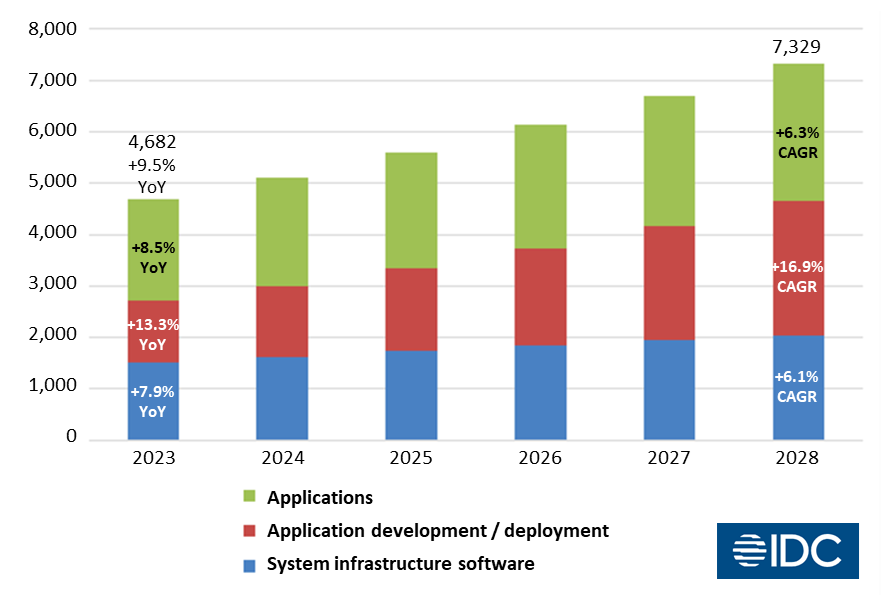

IDC Japan: 2023 Domestic Software Development Market +9.5% YoY

IDC Japan data below broadly corresponds to METI’s largest categories of 1) system integrators, ¥6,684bn (+9.3% YoY) and 2) system software developers, ¥3,559bn (+8.7% YoY), albeit with a slightly different target universe. IDC Japan estimates the 2023 domestic software development market was ¥4,682bn, +9.5% YoY. IDC Japan attributed the strong growth to rising enterprise interest in use of generative AI, demands for application modernization, and increased cybersecurity measures. In particular, cloud data platforms for maintaining business data, AI training data, and generated content, applications/ platforms for improving customer experience (CX) using AI, and software investment for cybersecurity/governance measures drove the market, estimating that public cloud service revenue of ¥1,859bn (+21.0% YoY), accounted for nearly 40% of the total.

By major category, the application development/deployment market was ¥1,196bn, +13.3% YoY, citing drivers of AI platforms (+58.8% YoY), analytics/BI (business intelligence) (+17.5% YoY) and database/data lake management (centralized repository designed to store and process large amounts of data in native formats, ignoring size limits) (+6.7% YoY). The application market was ¥1,968bn, +8.5% YoY, citing drivers of CRM market to improve digital CX (+13.4% YoY), content workflow management market (+10.7% YoY), and ERM market (+8.5% YoY) driven by renewal demand. The system infrastructure software market was ¥1,519bn, +7.9% YoY, citing drivers of security software market (+15.1% YoY) and the IT systems management market (+7.6% YoY) for cybersecurity/digital trust improvement.

IDC Japan Domestic Software Development Market Forecast (JPY bn): 5Y CAGR +9.4%

Source: excerpt from IDC Japan press release, May 22, 2024. https://www.idc.com/getdoc.jsp?containerId=prJPJ52246824

5Y CAGR +9.4% drivers:

Software investment for AI integration/AI linkage into applications including generative AI in enterprises, advancement of digital CX, modernization of enterprise IT systems, and cybersecurity measures.

Source IDC Japan (May 2024)

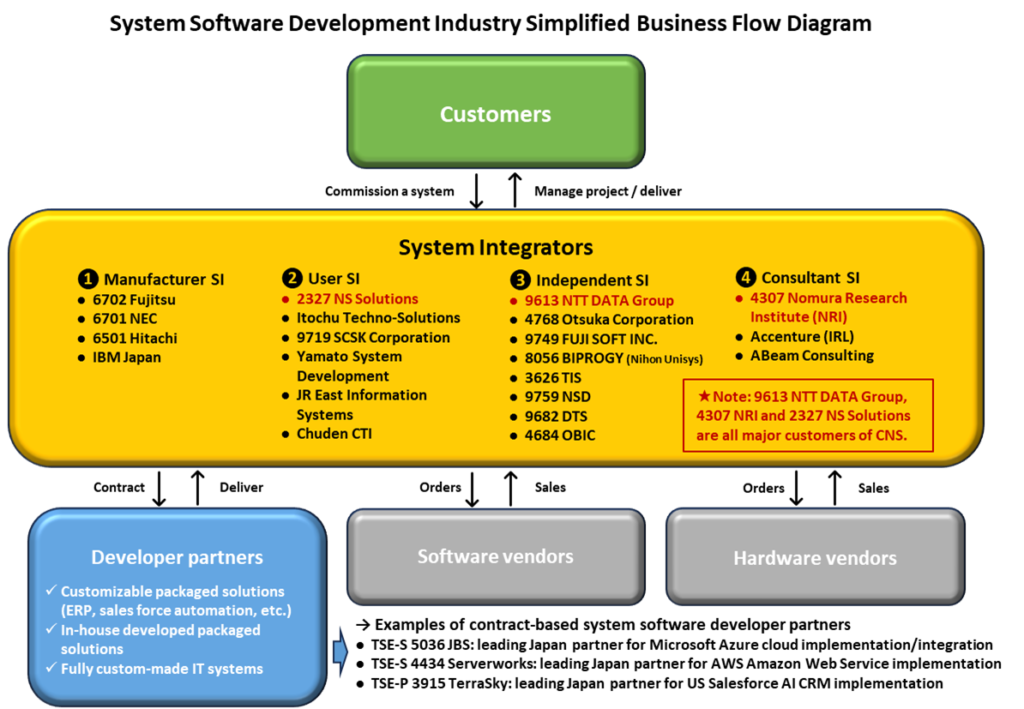

System Integrators and Contract-based System Software Developers

Based on the METI data on the previous page, large-scale system integrators account for ¥6.7trn, or 39% of total information services revenues, and their medium- to small-scale partner contract-based system software developers account for ¥3.6trn, or 21%, for a combined total of roughly 60% of the market. And the figure for system integrators does not include post-implementation operation and maintenance services, hardware manufacture and sales, and data center operation, etc. Major large-scale system integration projects often involve outsourcing certain parts to system software developers, as can be seen in the diagram below, and depending on project size and complexity, can include among developer partners prime contractors, followed by primary and secondary subcontractors.

In contrast with implementation of traditional on-premise dedicated IT systems which have heavy initial costs in procurement of servers and other hardware as well as infrastructure building (and subsequent maintenance) costs, the increasing shift to cloud-based software solutions increases affordability as well as reducing the customer burden of large in-house IT departments. IaaS/PaaS (infrastructure as a service/platform as a service) involve migrating/ replacing on-premise infrastructure with cloud-based Amazon AWS, Microsoft Azure, Google Cloud Platform, etc., offering customization of infrastructure elements (servers, networks, middleware), where SaaS (software as a service) involves the industry operator providing a complete package of hardware and software (fewer customization options). Due to evolving customer needs driven by DX proliferation, the trend for system software developers is shifting from downstream labor-intensive programming and testing to upstream in-house, bespoke system development, aiming to reposition in the hierarchy.

Source: compiled by Omega Investment based on business flow diagrams from major system integrators’ Annual Securities Reports (YUHO financial statements).

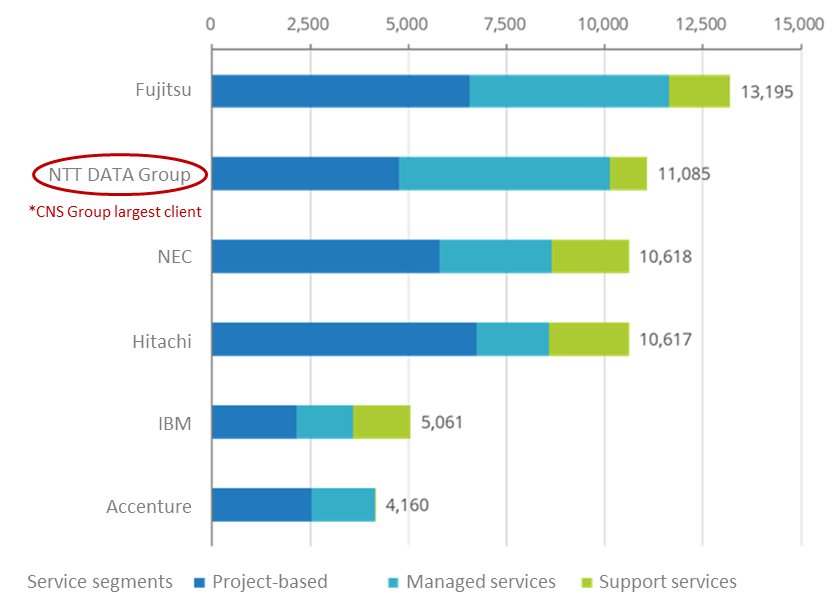

IDC Japan 2023 Sales Ranking for Domestic IT Services Market Vendors (¥100 million)

Source: excerpt from IDC Japan press release, July 12, 2024.

https://www.idc.com/getdoc.jsp?containerId=prJPJ52433424

IDC Japan reported that the domestic IT services market in 2023 reached ¥6,460.8bn, +6.0% YoY. By service segment, all of the top 10 vendors in all segments had positive growth. In particular, in the project-based market, six of the top ten vendors achieved year-on-year revenue growth of 10% or more. In the managed services market, while the negative impact of conventional IT outsourcing continued, growth was driven by cloud migration/ modernization of existing systems and an increase in managed cloud services after building new systems in the cloud. In support services, in addition to the expansion of software maintenance due to the increased adoption of packaged applications, hardware maintenance also expanded as the semiconductor and components supply shortage/delays caused by the COVID pandemic was largely resolved and hardware equipment sales grew.

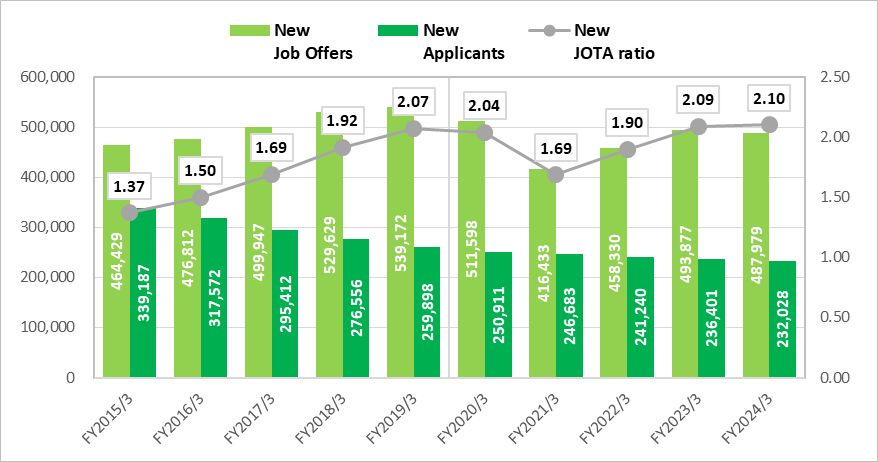

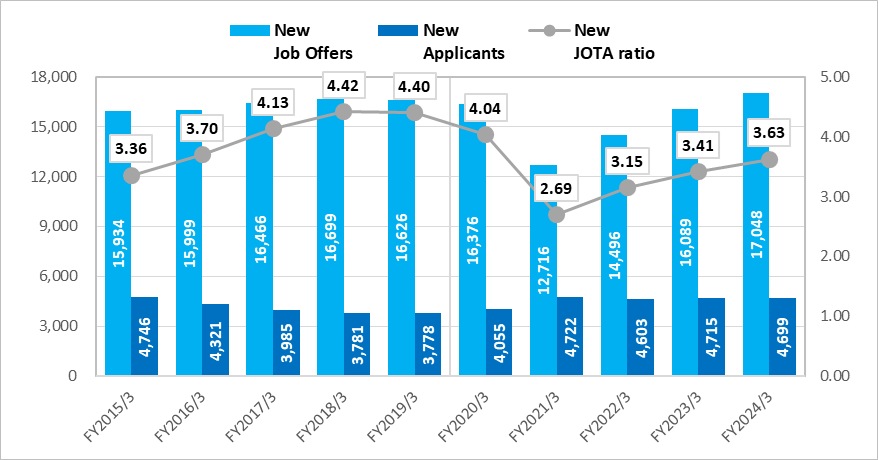

No. 1 challenge for achieving sustainable growth is securing sufficient IT engineers

Ministry of Health, Labour and Welfare (MHLW) data shown below highlights the chronic shortage of IT engineers, as evidenced by the new job offers-to-applicants ratio for IT engineers nearly twice as high as that for all occupations. The background for this dates back 30 years to the painful industry downsizing following the collapse of the asset bubble economy of the late eighties referenced on P4, and college students subsequently choosing to focus on curriculums other than engineering. Fast forward to the present and double-digit growth in demand driven by DX proliferation, with industry-wide profits hampered by rising recruitment costs and other inducements/conditions to secure sufficient IT engineers.

Monthly Average Trend of New Job Offers to Applicants Ratio – All Occupations

Monthly Average Trend of New Job Offers to Applicants Ratio – IT Engineers

Source: compiled by Omega Investment from MHLW monthly survey of EMPLOYMENT REFERRALS FOR GENERAL WORKERS.(monthly data tabulated on job openings, applications, and persons who found employment made available at the Public Employment Security Offices).

https://www.mhlw.go.jp/toukei/list/114-1b.html

Figures calculated by averaging nationwide monthly data for each fiscal year.

PART ② BUSINESS OVERVIEW

Introduction

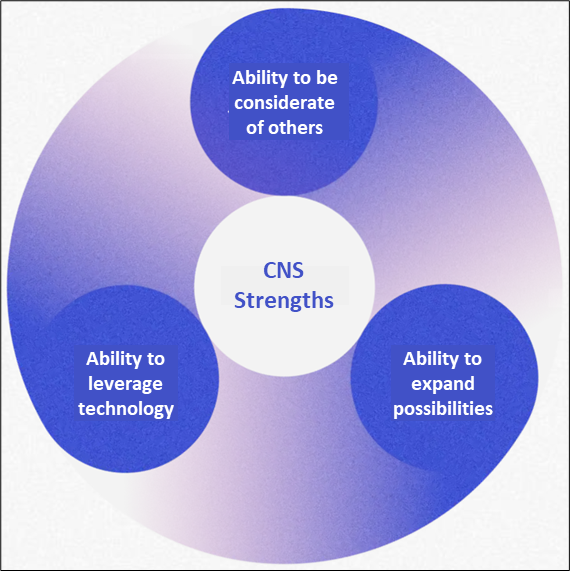

CNS was established in 1985, focusing on UNIX, which at the time was beginning to spread in the US as an open system, and began working on internationalization and Japanese language adaptation of the system. Since then, CNS has accumulated considerable experience in open systems for finance, manufacturing, communications, and distribution, and was an early entrant into system configuration services utilizing the Internet. Currently, CNS provides not only engineering services, but also consulting services that help customers realize management strategies and business innovation, as well as services focused on business operations and system operation. CNS is an IT solutions company that creates new value to advance society by combining the following three strengths: the ability to be considerate of others, the ability to leverage technology, and the ability to expand possibilities, and by continually providing solutions that go “beyond the right answer.”

① Ability to be considerate of others

CNS is a partner to its customers, working to build a relationship of trust. CNS listens carefully to fully understand the customer’s goals and objectives, and by looking forward from the same perspective, uncovers the actual problems that need to be addressed.

② Ability to leverage technology

CNS is constantly on the lookout to keep up with the latest technologies and trends. CNS also works to make effective use of existing technologies. It provides one-of-a-kind unique solutions by optimally combining technology with the latent unmet needs of customers.

③ Ability to expand possibilities

CNS boldly ventures into cutting-edge and developing fields and perseveres to see things through. Then by combining the diverse experience and knowledge it has accumulated, CNS continues to broaden the services it can provide and expand the possibilities for customers’ businesses.

Source: compiled by Omega Investment from CNS Corporate Guide.

Source: compiled by Omega Investment from the CNS FY23/5 Annual Securities Report (YUHO financial statements), and IR news releases since that document was filed.

Business description

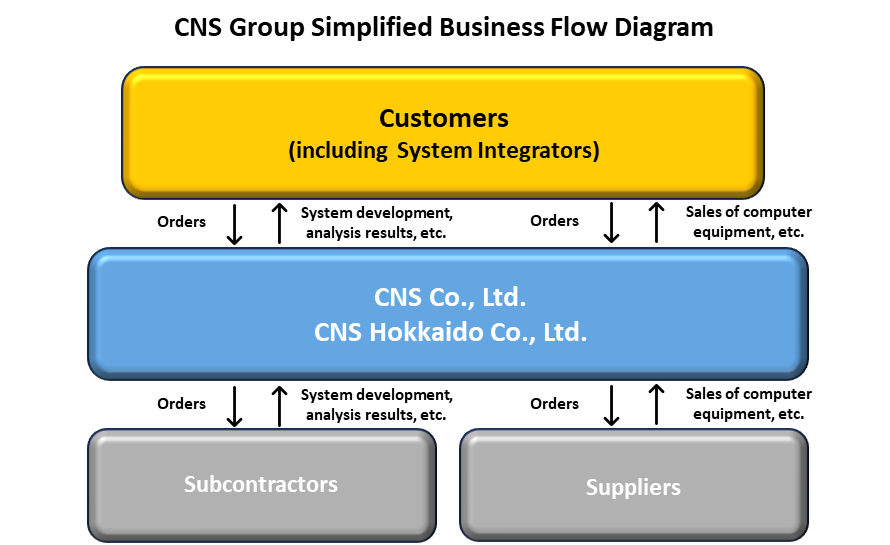

The CNS Group consists of the parent and consolidated subsidiary CNS Hokkaido, both engaged in the single segment of System Engineering Services Business. The exhibit below shows a simplified business flow chart. The general development process of this business, as well as major customers and alliance business partners, are summarized in the text boxes on the left. Since there is only a single business segment, segment information is omitted from official earnings filings, however, CNS does classify its business under 5 business divisions, for which the Company does disclose net sales and gross profit for each, which is helpful in understanding the main growth drivers of consolidated earnings.

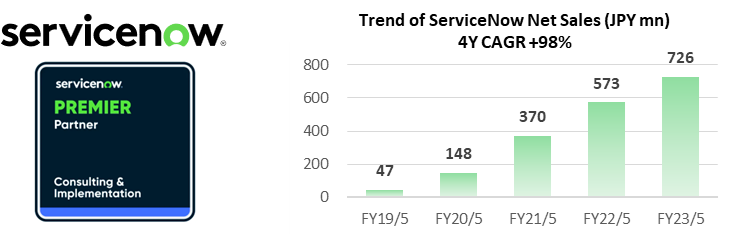

① Digital Innovation Promotion Business

In the system technology area, CNS is promoting initiatives to reform system maintenance and operations using the ServiceNow cloud platform, which provides digital workflows promoted in collaboration with NTT DATA to facilitate enterprise DX. Technical efforts in the digital technology area include database technology consulting, which covers the selection, migration, and implementation of the most appropriate database for the customer’s system, as well as architectural design, feasibility verification and performance design, performance testing, and tuning. CNS has experience in performance consulting.

② Big Data Analysis Business

CNS is developing business that contributes to improving the convenience of society by utilizing various data accumulated by companies. CNS creates models to analyze big data such as user information, activity logs, and location information, conducts the analysis, and addresses customer’s business issues from the results. The Company has experience consulting on business actions, and building and developing forecasting models to solve management and business issues in a wide range of fields, including telecommunications, finance, advertising, distribution, and retail. CNS partners with SAS Institute Japan, one of the leaders in this industry.

Development Process

The CNS Group is mainly engaged in the “System Engineering Services Business,” and the general development process of this business is as follows:

Requirement definition process ⇒ Basic design process ⇒Detailed design process ⇒ Manufacturing process ⇒Unit testing process ⇒Integration testing process ⇒ Comprehensive testing process

Source: compiled by Omega Investment based on business flow diagrams from CNS Annual Securities Report (YUHO financial statements).

Major Customers

NTT DATA Corporation

Nomura Research Institute, Ltd.

NTT DATA Group Corporation

DSB Information System Co., Ltd.

NS Solutions Corporation

KeyAlliances (business partners):

Amazon Web Services

NTT Communications Corporation

NTT DATA Corporation

ServiceNow

SAS Institute Japan, Inc.

Zabbix LLC

IBM Japan, Ltd.

Oracle Corporation Japan

Hitachi, Ltd.

③ System Infrastructure Business

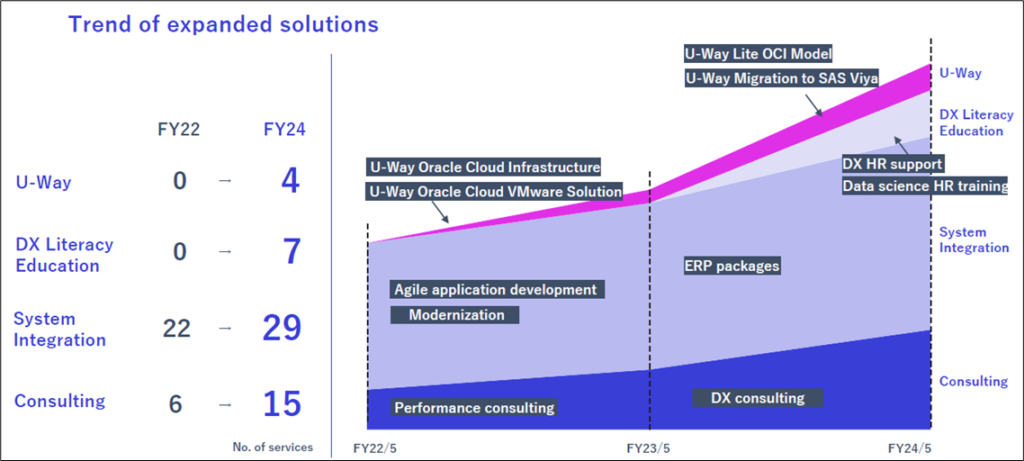

This business involves solving customer problems, proposing and building optimal system infrastructures for computers, networks, and other system infrastructures required to useenterprise business systems and services such as e-commerce (EC) and social networking services (SNS) that are used all the time. CNS also provides support for system infrastructure operations. In cloud technology, the fundamental platform technology for DX, the Company has experience of implementations for AWS, OCI, and many others. Under the CNS original in-house brand “U-Way” launched in October 2022, the following commercial products/ services utilizing Oracle Cloud Infrastructure (OCI) have been released:

◼ U-Way Oracle Cloud Infrastructure Implementation and Operations Support Services

◼ U-Way Oracle Cloud VMware Solution Migration and Implementation Support Services

◼ U-Way Lite OCI Base Model

◼ U-Way Lite OCI DB Model

④ Business System Integration Business

Providing overall support from system planning considering the customer’s business issues, to requirement definition, development, testing, and post-implementation operations. CNS uses applications to implement solutions to individual customer business needs and issues. In particular, CNS has experience accumulated through close relationships with customers regarding credit risk and financial regulatory compliance in the financial industry and customer management and sales management in the distribution industry, and it can provide one-stop services from upstream consulting to operation and maintenance work.

⑤ Consulting Business

This business division was newly established in June 2023. CNS participates from the planning and strategy phases related to DX, and accompanies and supports customers from project execution to business transformation. CNS also provides IT literacy education to foster a digitally competent organizational culture, support for human resource development to resolve the shortage of digital human resources, and technical advisory services.

➡ 3 competitive advantages of CNS

❶ Direct transactions with end users account for 35% (FY23/5)

The system integrator (SI) industry described in Part 1, which undertakes the configuration of enterprise IT systems, has a hierarchical structure, with prime contractors that receive orders held by major IT companies from end users, followed by primary and secondary subcontractors. 35% of CNS transactions are as prime contractor, a high level. The 65% of transactions as primary subcontractor are mainly from major system integrators, and CNS receives many orders for high unit price projects that require a high level of technology.

❷ Ongoing relationships with leading SI firms (stable business base)

CNS continues to maintain ongoing stable business relationships with leading system integrators such as NTT DATA Group and Nomura Research Institute Group (see P12). CNS is currently promoting the “ServiceNow” cloud platform, which provides digital workflows promoted in collaboration with NTT DATA to facilitate enterprise DX, and which has been achieving strong growth in sales. The ongoing relationships with these blue-chip system integrators has enabled CNS to secure stable revenues, powering sustainable growth.

❸ Advanced know-how in digital innovation solutions

In the digital solutions area, CNS established a competitively advantageous position as a result of early efforts with leading system integrators. CNS has particular expertise in the following 3 areas as defined by the Information-technology Promotion Agency (IPA): Software engineer ̶ embody new products, services, and business transformation mechanisms by utilizing the latest digital technology applications and infrastructure services, Business architect ̶ work together with customers to create new businesses and promote ways to achieve business transformation, and Data scientist ̶ examine ways to utilize customer data and create operational change and business from the results of data analysis.

CNS President and Representative Director Masahide Sekine (57)

“Best Cloud Integrator Partner of the Year” at the Oracle Japan Award 2024

CNS has been strategically utilizing Oracle Cloud Infrastructure (“OCI”) since 2019 when the Tokyo Region was opened at Oracle Cloud. Internally, CNS has built low-code applications using Oracle Apex and Oracle Autonomous Database from the use of Oracle Base Database Service, streamlined case management operations and eliminated document management, and Oracle Container Engine for Kubernetes to automate the construction of OCI services. By utilizing the service internally, CNS improves product knowledge and accumulates know-how, etc. In addition, CNS receives consulting services from Oracle Corporation Japan to train in-house engineers and acquire the latest technical information.

In September 2022, the Company released its first original brand “U-Way” and has started providing services utilizing the following four OCI products since October of the same year.

◼ U-Way Oracle Cloud Infrastructure Implementation and Operations Support Services

◼ U-Way Oracle Cloud VMware Solution Migration and Implementation Support Services

◼ U-Way Lite OCI Base Model

◼ U-Way Lite OCI DB Model

[Reason for the award]

In the OCI business, CNS contributed to the expansion of the OCI business through company-wide efforts that greatly exceeded the results of the previous fiscal year.

[About the Oracle Japan Award 2024]

The Oracle Japan Award 2024, announced on July 5, 2024, recognizes the most significant achievements in their respective fields by certified partners and their significant contributions to the development of Oracle’s business through the use of Oracle’s products and services.

Source: excerpt from CNS July 10, 2024 press release. From left to right: Toshimitsu Misawa, Corporate Executive Officer, President, Oracle Corporation Japan; Masahide Sekine, President and Representative Director, CNS Corporation; Morikazu Sano, Managing Executive Officer, Alliance Management, Oracle Corporation Japan

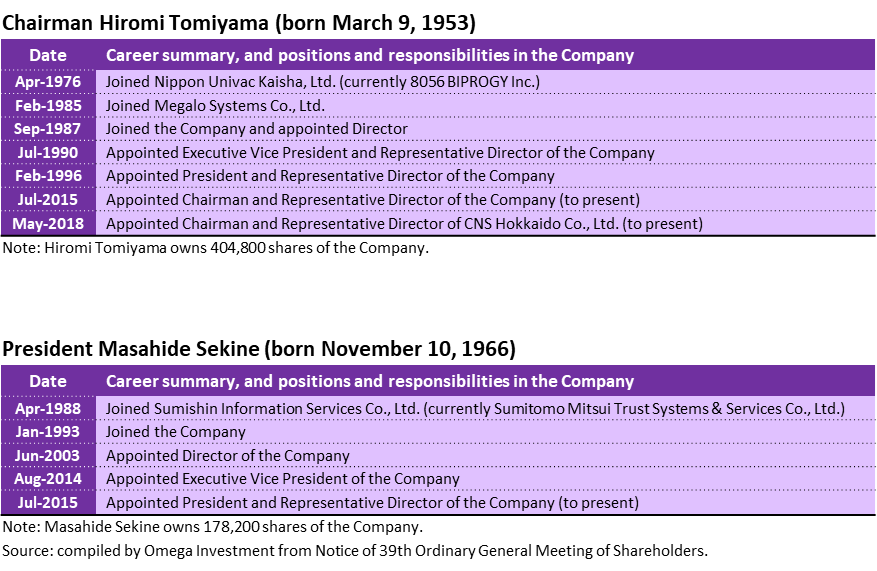

Quality and Strengths of CNS top management

Hiromi Tomiyama has served as Representative Director of the Company for more than 30 years, and he has demonstrated strong leadership as the person in charge of strategic planning and execution of the Company’s overall business operations, and he has made timely and appropriate decisions and supervised management.

Since becoming a Director of the Company, Masahide Sekine has served as General Manager of the Infrastructure Systems Division (currently the Digital Technology Promotion Division and the System Platform Division) and the Strategic Support Services Division (currently the Applied Analytics Division and the Business Solutions Division), and he possesses a wealth of experience and insight. Since assuming the position of President, he has appropriately managed and supervised the overall management of the Company and contributed to the development of the Company by formulating and implementing various measures as growth strategies for “strengthening the business base (securing and developing human resources),” “strengthening collaboration through the utilization of alliances with customers,” and “expanding digital solutions,” etc.

It is worth noting that the Chairman and President collectively own 20% of total shares issued and outstanding (see the list of major shareholders on P25), so the financial interests of top management are directly aligned with those of all shareholders.

PART ③ EARNINGS REVIEW

FY24/5 Consolidated Financial Results

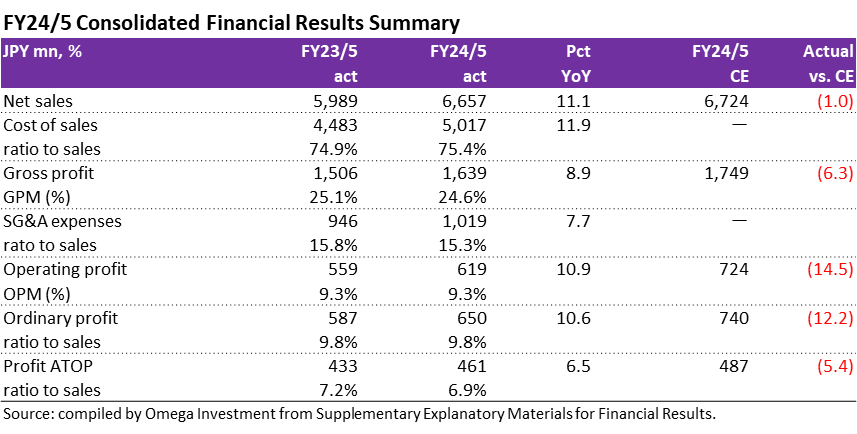

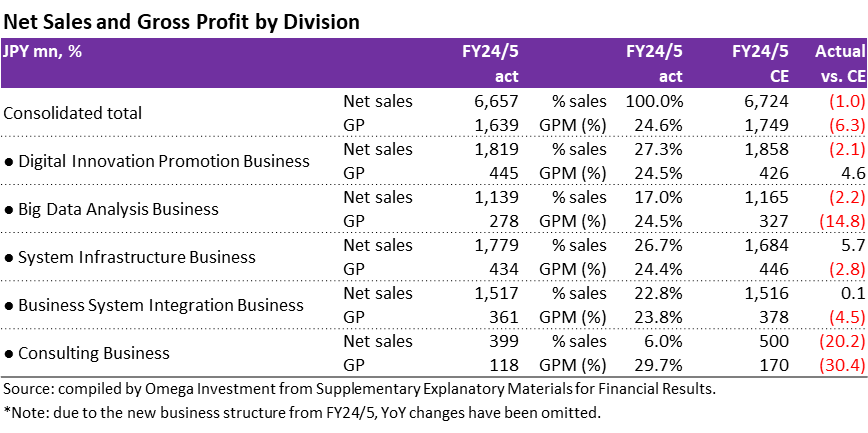

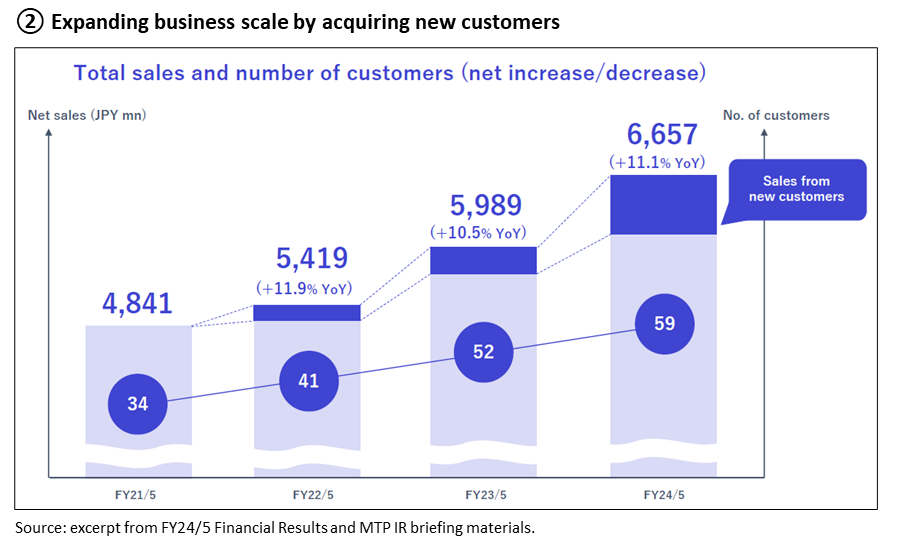

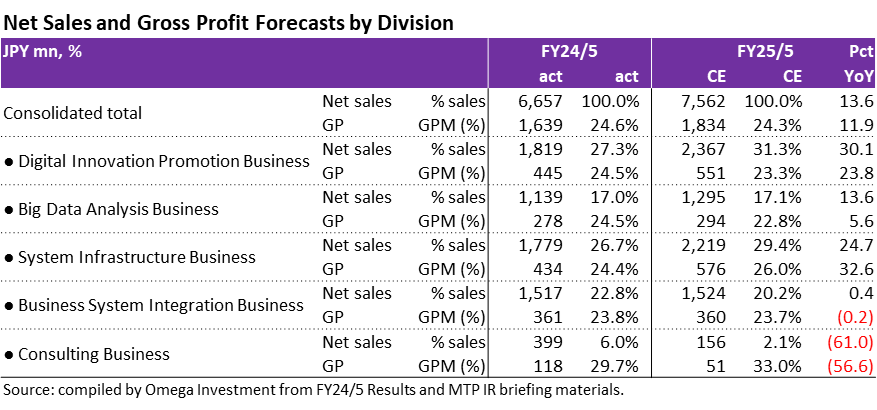

As can be seen from the first table below, FY24/5 net sales increased +11.1% YoY, driven by strong gains across the year in Digital Innovation Promotion Business and Business System Integration Business. Due to reorganization of the business structure, YoY trends by business division are not shown in the second table. System Infrastructure Business was reorganized, and certain resources were transferred to Digital Innovation Promotion Business, Business System Integration Business, and Consulting Business. Resources belonging to Big Data Analysis Business were transferred to Consulting Business.

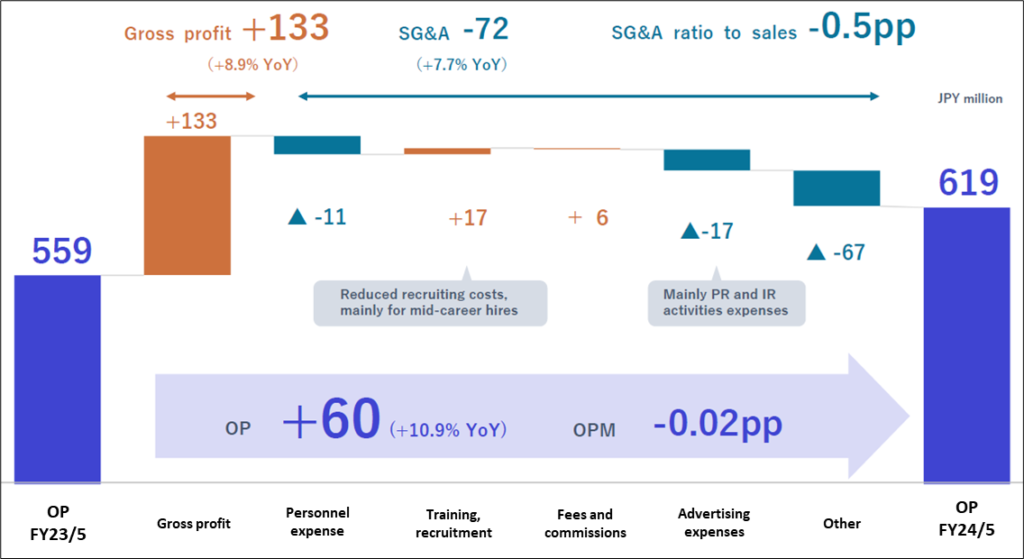

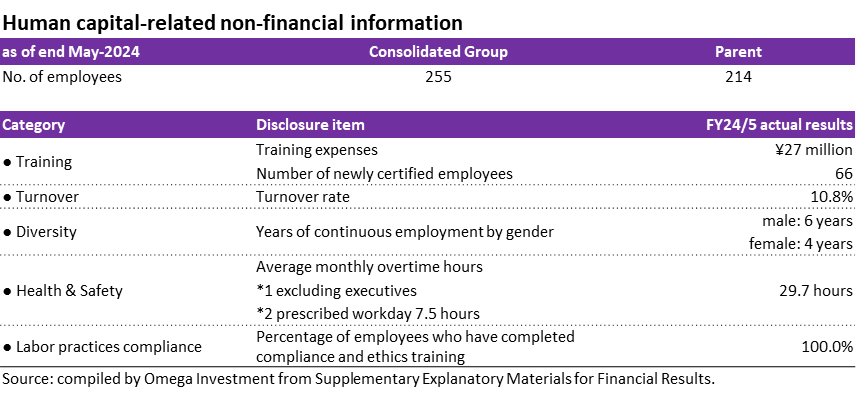

Gross Profit increased +8.9% YoY, with progress in negotiations by business divisions to raise unit prices and an increase in high-margin projects contributing. Operating profit increased +10.9% YoY, in addition to the increase in gross profit, benefitting from the 0.5pp decline in the ratio of SG&A expenses due to reduced recruiting costs mainly for mid-career hires (see OP factor analysis graph on the following page). OPM was flat YoY at 9.3%, with the 0.5pp decline in GPM offset by the 0.5pp decline in the SG&A ratio. Unfortunately, OP fell short of plan by 14.5% due to the poor performance of CNS Hokkaido, and the delayed startup of Consulting Business.

In terms of net sales by division, the biggest contributors to the +11.1% increase in consolidated net sales were Digital Innovation Promotion Business, +20.6% YoY (an increase of ¥310mn) and Business System Integration Business, +10.7% (an increase of ¥147mn). Despite the 10.4% decline in System Infrastructure Business due to the aforementioned reorganization, actual results actually came in ahead of plan.

In terms of gross profit by division, the biggest contributors to the +8.9% increase in consolidated GP were Digital Innovation Promotion Business, +16.5% YoY (an increase of ¥63mn, and ¥19mn ahead of plan) and Business System Integration Business, +9.5% (an increase of ¥31mn). However, due to some unprofitable projects arising in Business System Integration Business of CNS Hokkaido, GP in this division posted a shortfall of ¥17mn.

CNS Hokkaido was significantly affected by the sluggish performance of major customers and changes in their policy regarding system investment. In response to unprofitable projects, the company shifted to a policy of completing unprofitable projects in about two months, and making proposals that best fit the business conditions of large customers, aiming to secure orders that were achievable. For FY25/3, countermeasures include actively seeking projects outside of Hokkaido.

Newly launched Consulting Business started off with a shortage of consultants, as the business was commenced with existing engineers. Therefore, sales activities were focused on existing customers and establishing and building contact points with customers in various industries. Efforts were also focused on building a track record in business transformation design projects, but the inability to hire consultants as planned had a negative impact, resulting in sales that fell over 20% short of plan. GPM was also lower than expected at 29.7% due to a lack of securing new consulting projects (GP posted a shortfall of over 30%, see the second table on the previous page).

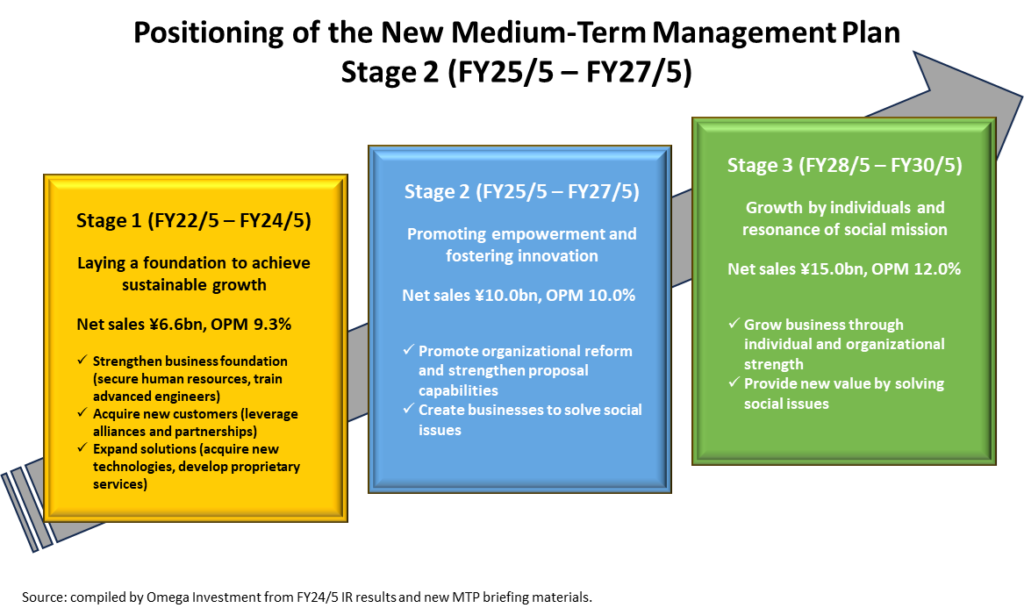

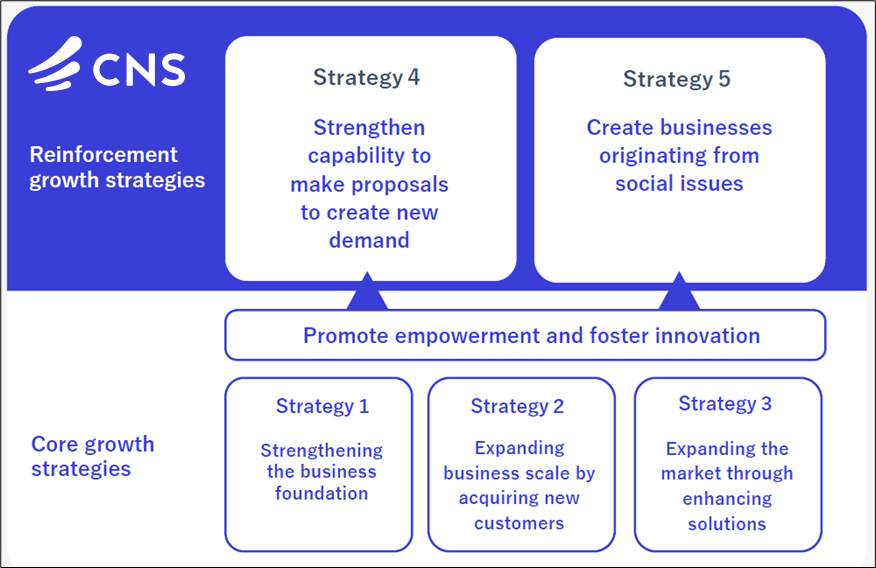

Before covering the strategies and objectives of the new Medium-term Management Plan (FY25/3 – FY27/3), CNS reviewed its previous MTP, summarizing the achievements of its three main growth strategies of 1) strengthening the business foundation, 2) expanding business scale by acquiring new customers, and 3) expanding the market through enhancing solutions, positioning Stage 1 as laying a foundation to achieve sustainable growth, for the core growth strategy of expanding business transformation design through DX (see P3).

FY24/5 Operating Profit Factor Analysis

Source: excerpt from FY24/5 Financial Results and Medium-Term Management Plan (FY25/5 – FY27/5) IR briefing materials.

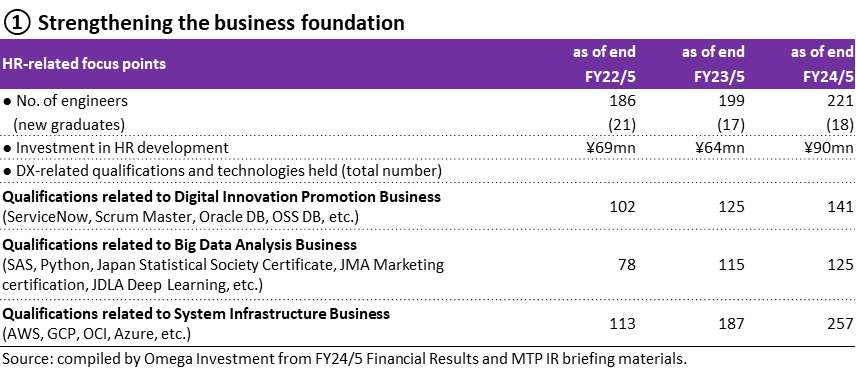

Review of Stage 1 (FY22/5 – FY24/5), the 3 years following the IPO in Aug-2021

First, operating performance during Stage 1 was consolidated net sales 3Y CAGR +11.2% and operating profit 3Y CAGR +10.6%, achieving double-digit growth in both sales and profit. The following exhibits summarize progress on the three growth strategies.

③ Expanding the market through enhancing solutions

Standardization and systemization of know-how related to digital innovation technologies and development of service menus, with a steady increase in the number of services.

Source: excerpt from FY24/5 Financial Results and MTP IR briefing materials.

Source: excerpt from FY24/5 Financial Results and MTP IR briefing materials.

Overview of Stage 2 (FY25/5 – FY27/5)

Accelerate toward the Group’s vision by powerfully promoting new growth pillars based on CNS core growth strategies by promoting empowerment and fostering innovation

(see the exhibit on P3 for positioning of the new Medium-term Management Plan).

Initiatives in Stage 2 for the new reinforcement growth strategies

Regarding ④ Strengthen capability to make proposals to create new demand, the aim is to increase customer contact points by moving away from a contract-based business posture and turning to the offense, perceiving issues and needs from the customer’s perspective, and strengthening proposal capabilities to make proactive proposals. Toward this end, 1) accumulate successful experiences to increase corporate value of customers, 2) expand customer contact points through self-initiated proposal activities, and 3) establish a company-wide sales organization.

Regarding ⑤ Create businesses originating from social issues, identify social issues in Japan, uncover target customers and projects, and accumulate know-how on how to utilize the capabilities of each business to match issues, identify needs and develop solutions, with the aim of becoming a social business leading company. Strategies across all businesses include 1) accumulate know-how for developing solutions to social issues, 2) cultivate customer contact points with local communities (including municipalities), and 3) create and develop social businesses. Focus strategies for Consulting Business include 1) strengthen the sales force of Consulting Business, 2) establish consulting methods for solving social issues, and 3) draft solution models and apply them to projects.

Key targets for FY27/5, the final year of MTP Stage 2

Source: excerpt from FY24/5 Financial Results and MTP IR briefing materials.

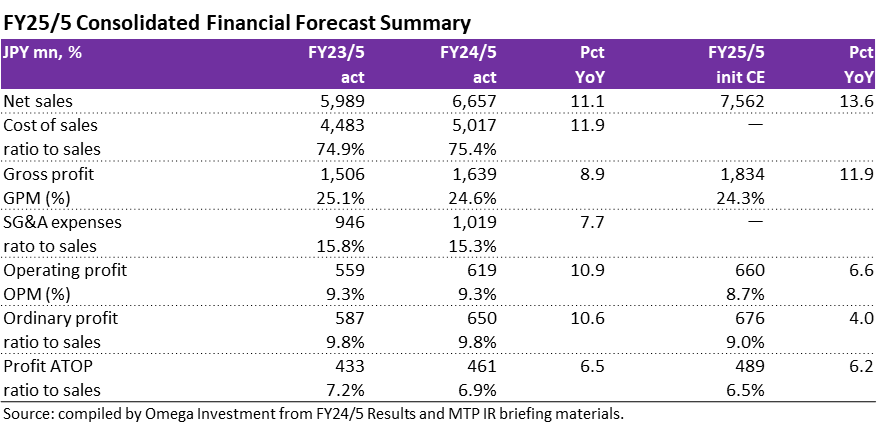

Outlook for FY25/5

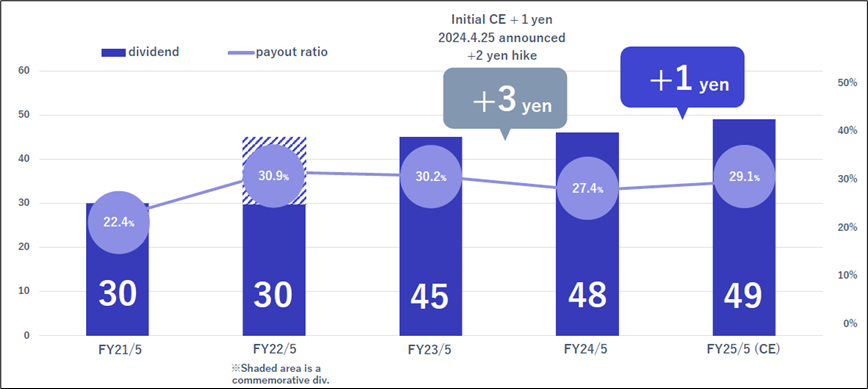

The CNS Group will celebrate its 40th Anniversary since founding during the fiscal year ending May 31, 2025. Initial forecasts are summarized in the two tables below. Headline number are consolidated net sales +13.6% YoY, gross profit +11.9%, operating profit +6.6% YoY, and profit attributable to owners of parent +6.2%. The main reason for the slowdown in profit growth relative to accelerating top line growth is factoring in implementation of a uniform 8% base increase and regular salary increases of approximately 11%, which are aimed at improving work ethic and attracting and retaining talented employees, as well as the anticipation of a certain level of expenses due to planned leading investments in innovation creation. CNS will aggressively make forward-looking investments to change the Group profit structure and achieve dramatic growth toward the final year of the new Medium-term Management Plan Stage 2 (FY25/5 – FY27/5). The initial indication is for a +1yen hike to ¥49 per share under its new progressive dividend policy (see P25 for details).

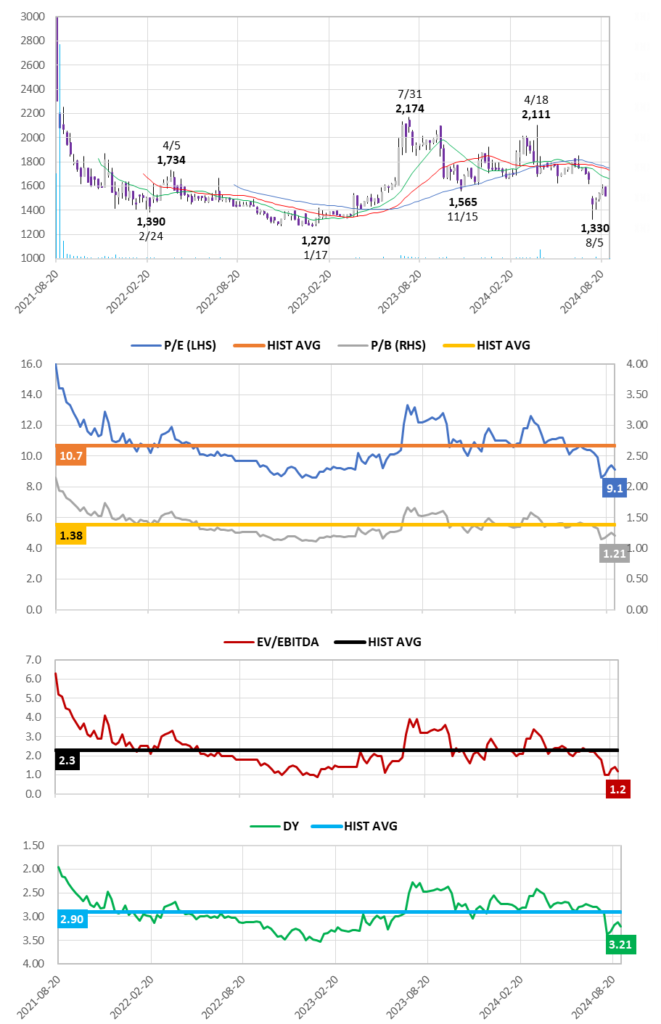

PART ④SHARE PRICE INSIGHTS

3-Year Weekly Share Price Chart, 13W/26W/52W MA, Volume and Valuation Trends

Source: compiled by Omega Investment from historical price data. Forecast values based on current Company estimates

Key takeaways:

❶ The P/E and P/B ratios are trading 15% and 13% below their respective historical averages.

❷ EV/EBITDA on 1.2x is one of the lowest in the industry by far, and is trading 46% below its historical average.

❸ The DY at 3.21% is one of the highest among peers, and some have yet to pay a dividend, trading 11% above its historical average.

➡Even adjusting for the lower liquidity of the TSE Growth Market shown on the following page using the TSE Mothers index, CNS valuations are all trading at the bottom of their listing ranges, presenting a contradiction with the underlying strong earnings, and prospects for double-digit growth to continue for the next 4-5 years.

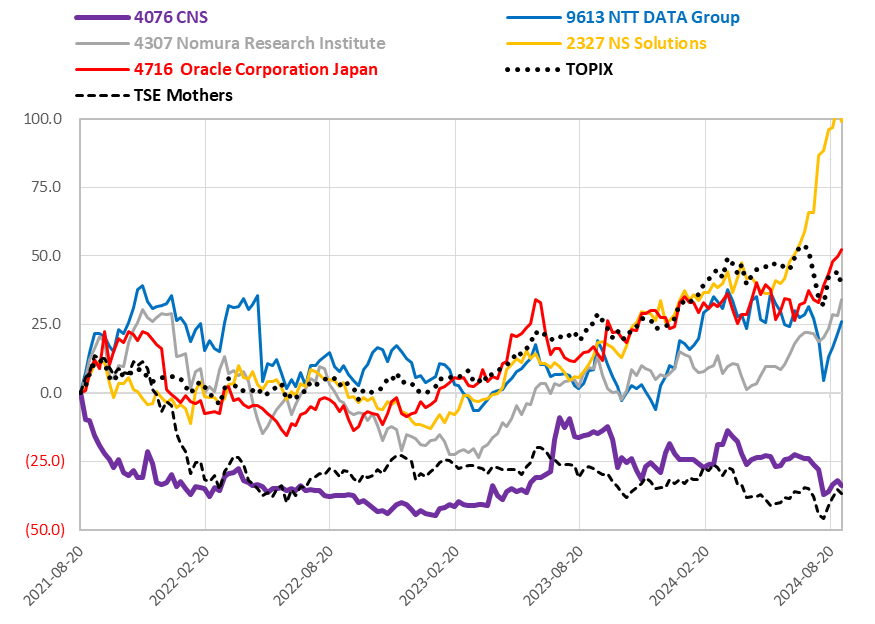

3-Year Relative Share Price Performance versus Major Customers and Partners

One clear takeaway from the relative performance chart on the right is some discount for lower liquidity of the TSE Growth market.

However, to put the low valuations on the previous page in perspective, we compared CNS valuations with averages for the 3 cloud integrators shown on the bottom of P7: 5036 JBS, 4434 Serverworks and 3915 TerraSky.

The average P/E and P/B for the 3 cloud integrators is 55.3x and 2.23x, versus CNS 9.1x and 1.21x. Of the 3, only JBS has a DY of 2.58% (the others are not paying dividends), versus CNS 3.21%. Average EV/EBITDA for the 3 is 14.9x, versus CNS 1.2x. Average ROE and ROIC for the 3 is 6.3% and 6.5%, versus CNS 13.2% and 12.6% (effectively double).

➡Omega Investment believes CNS is a rare hidden gem waiting to be discovered.

Shareholder return policy

Expanding business by quickly identifying changes in the ICT industry and being proactive in taking on challenges in new fields, based on the trust and track record with major system integrators and ongoing relationships with them ➡ these business characteristics enable CNS to secure stable revenues. In order to achieve sustainable growth together with shareholders, continuation of the progressive dividend policy to increase dividends in line with profit growth, with a target payout ratio of 30% or more.

Source: excerpt from FY24/5 Financial Results and MTP IR briefing materials.