Nitto Denko (Price Discovery)

Buy

Profile

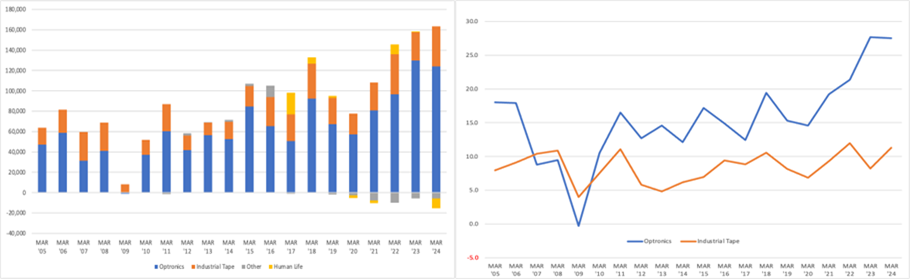

Nitto Denko Corporation manufactures and sells adhesives, optical films, semiconductors, electronic devices, and consumer products. It has many niche products that are market leaders. In the industrial tape segment, it manufactures and sells sealing, protection, processing, and automotive materials. The optronics segment provides optical films, printed circuits, and high-definition substrates. The human life segment offers manufacturing services for nucleic acids, nucleic acid synthesis materials, and medical-related materials. The company was established in 1918 and is headquartered in Osaka. Sales by business segment (OPM%): Industrial Tape 38 (11), Optronics 49 (26), Human Life 13 (-8), Other 0 [Overseas] 84 (FY3/2024)

| Securities Code |

| TYO:6988 |

| Market Capitalization |

| 1,774,323 million yen |

| Industry |

| Chemistry |

Stock Hunter’s View

Circuit materials for DC are solid. The exchange rate assumption is conservative, and the company will likely beat its full-year earnings forecasts.

Nitto Denko’s circuit materials for data centres (DC) are performing well. The company announced on 28 October that its operating profit for 2Q DY3/2025 (April to September) was 109.267 billion yen (up 69.5% YoY), a new record for 1H of a year.

The company has left its full-year financial forecasts unchanged, but it has achieved 60% of its targets. In addition, the company has revised its exchange rate assumption for 2H of the year from 152 yen to the dollar to 140 yen, which is, in essence, an upward revision. The company’s exchange rate sensitivity is such that a 1 yen depreciation against the dollar increases operating income by 13 billion yen. In the 1H of the current fiscal year, the impact of the weaker yen on profits was 17.1 billion yen.

The loss in the Human Life business (a loss of 4.5 billion yen) was negative, but on the other hand, sales of circuit materials in the first half of the year increased by 53% YoY due to a recovery in demand for hard disk drives (HDDs) for data centres. As a result, operating profit in the Optronics business increased by 66% YoY, covering the loss in the Human Life business.

Although the overall forecast for operating profit remains unchanged, the forecast for the Industrial Tape and Human Life segments has been reduced. In contrast, the forecast for the Optronics segment has been increased. The increase in the Optronics segment is because the Information Fine Materials segment has received additional orders for smartphones in China, and sales of circuit materials for HDDs have continued to be strong.

Investor’s View

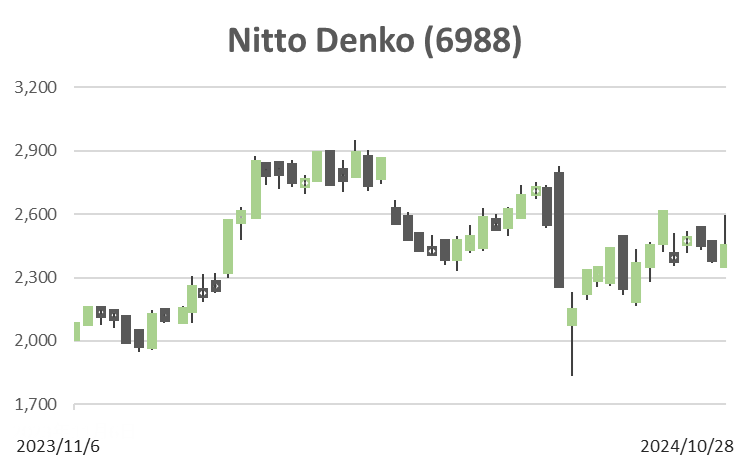

The company’s business performance is excellent, but there are signs that the momentum of its fundamentals is peaking out. However, it is undeniable that this business cycle may be different from previous ones. We see the decline in valuations since the beginning of the year as an opportunity to buy the shares.

Price (10 Year)

PBR (10 Year)

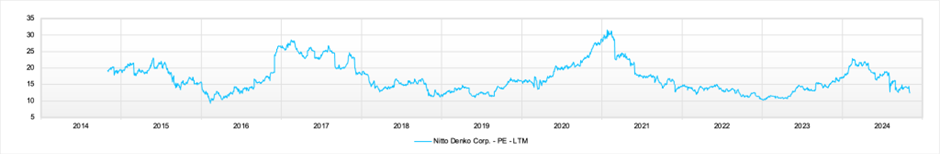

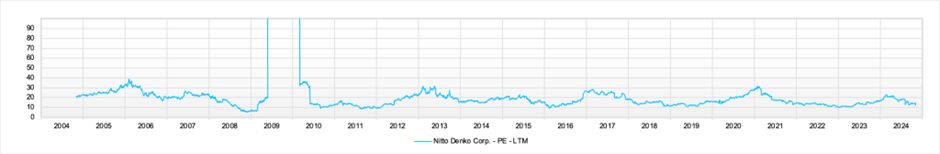

PER (10 Year)

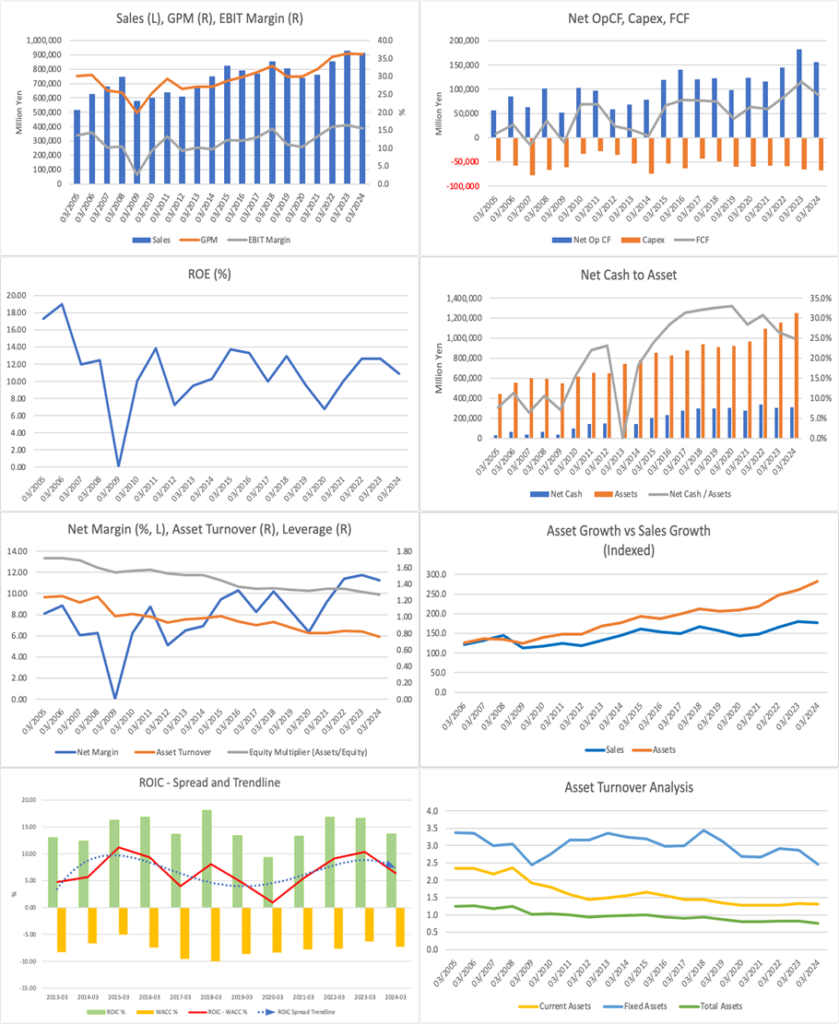

The company’s share price is linked to its business performance, which is cyclical. The operating profit margin for Industrial Tape has remained within a specific range for 20 years, and it is a stable earnings-generating division. The business has many niche products, but the top-line growth is not tremendous. The company’s performance is cyclical because the Optical segment, which accounts for an overwhelming proportion of profits, fluctuates wildly. The electronics and IT markets drive this business.

Operating profit by business segment (left, in million yen), operating profit margin (right, %)

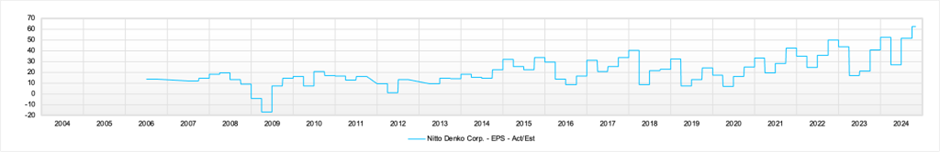

The Optical business is seeing rising profit margins and sales reaching unprecedented levels, suggesting that this cycle may differ from the past. However, there are signs of a peak-out in ROE, PL profit margin, and ROIC spread. The company’s fundamental earnings mechanisms have remained the same. If the market environment remains unchanged, the company is at the top of the business cycle and its earnings momentum will likely decline.

The business cycle of the tech industry, driven by AI and the exponential growth in global data capacity, may be long. The increase in global data capacity and HDD’s resulting higher capacity is positive for Nitto Denko’s circuit materials. The company has plenty of room to implement growth strategies in this field, backed by its excellent product development capabilities. The management team is confident that the company will continue to contribute to and maintain a high market share in the OLED market, which is expected to see accelerated growth in smartphones, notebook PCs, and tablets. They expect the current niche-top sales ratio of 44% to increase, reaching 50% by 2030. Of course, these are just the management’s forecasts.

We are still determining whether this cycle is long and profitable. However, we would like to draw attention to the fact that the valuation of the company’s shares has fallen in terms of both PBR and PER YTD, which suggests that investors carefully discount the possibility that the current excellent earnings will not maintain their brilliance for much longer. Mag7’s astonishing increase in market capitalization indicates that the tech cycle is different this time, and investors’ cautious valuation of the company’s shares is a little hasty. Therefore, the significant decline in valuations since the beginning of the year represents an investment opportunity.

Price (LT)

PBR (LT)

PER (LT)

ROE (LT)

EPS (LT)

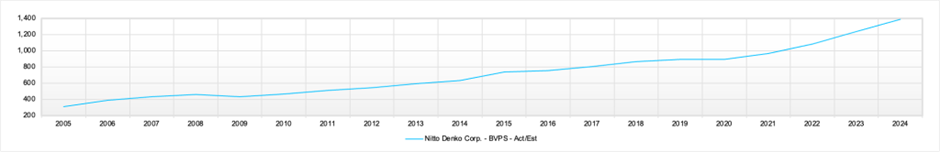

BPS (LT)