Sansei Landic (Company note – 3Q update)

| Share price (12/13) | ¥981 | Dividend Yield (24/12 CE) | 4.2 % |

| 52weeks high/low | ¥834/1,172 | ROE(23/12 act) | 10.2 % |

| Avg Vol (3 month) | 12.2 thou shrs | Operating margin (23/12 act) | 9.3 % |

| Market Cap | ¥8.42 bn | Beta (5Y Monthly) | 0.43 |

| Enterprise Value | ¥19.3 bn | Shares Outstanding | 8.584 mn shrs |

| PER (24/12 CE) | 8.1 X | Listed market | TSE Standard |

| PBR (23/12 act) | 0.6 X |

| Click here for the PDF version of this page |

| PDF Version |

The July-September period was fine. The Company looks more likely to achieve its full-year earnings targets.

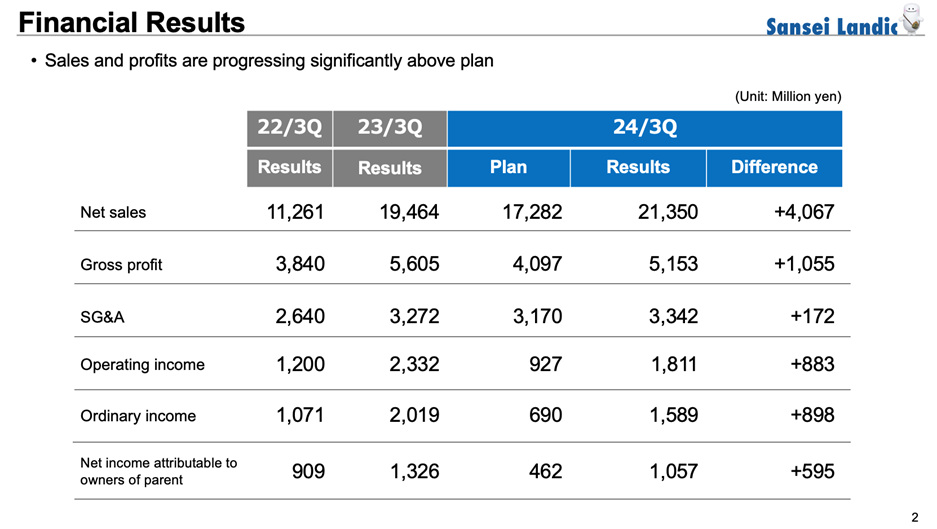

◇ FY12/2024 3Q financial highlights: The sales for the year’s second half are progressing ahead of schedule.

Sansei Landic’s (hereafter referred to as ‘the Company’) financial results for 3Q FY12/2024, announced on 12 November, 2024, showed a YoY revenue increase and decreased profits. However, since earnings are growing ahead of the Company’s financial forecasts for the year’s second half, the financial results give a sense of security about the full-year results.

Specifically, sales were 21.35 billion yen (+ 9% YoY), operating income was 1.81 billion yen (- 22% YoY), ordinary income was 1.58 billion yen (- 21% YoY), and net profit attributable to owner of parent was 1.05 billion yen (- 20% YoY). In the same period of the previous year, sales and profits increased sharply, and this year’s targets are a high hurdle to clear. However, actual results are progressing ahead of the sales schedule for the year’s second half, and revenue has increased. In addition, the level of profits is also high compared to the previous period. This is taken as a positive sign.

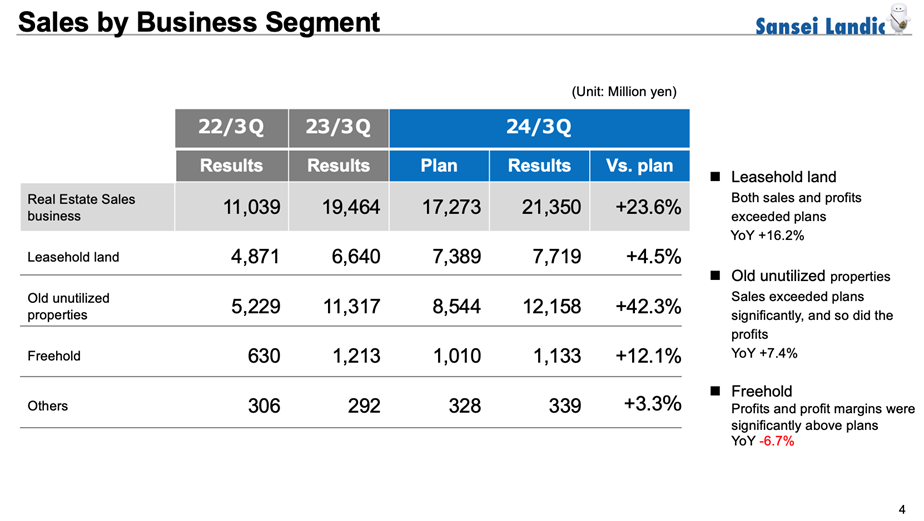

Looking at the breakdown of sales results, the proportion of the Leasehold land segment increased YoY, which has contributed positively to gross profit. However, due to some low-profitability projects involving Old unutilized properties in the first half, gross profit decreased despite the increase in revenue, and operating income declined.

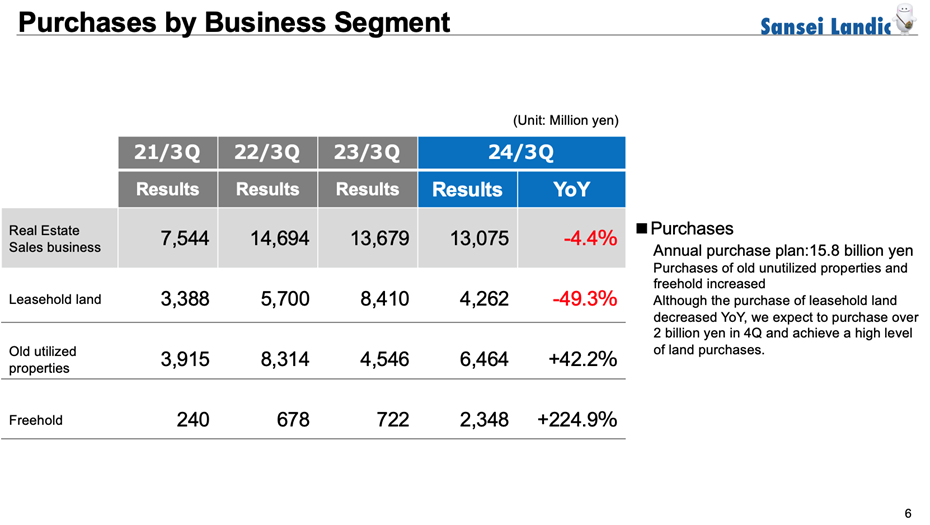

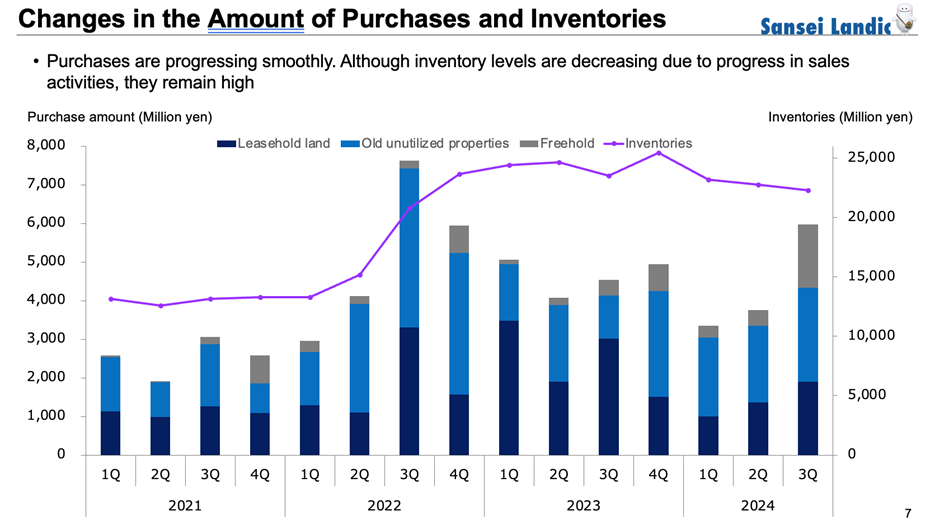

Cumulative purchases totaled 13.07 billion yen (down 4% YoY) and are on track to meet the annual purchase plan of 15.8 billion yen. The efforts to strengthen systematic sales to major suppliers are paying off. Looking at the composition of purchases, while there was a significant increase in purchases of Old unutilized properties and Freehold, there was a significant YoY decrease in purchases of Leasehold land, but purchases of approximately 2 billion yen are expected in the 4Q. As a result, the Company has stated that the total purchases for FY12/2024 will likely approach the actual results for FY12/2023 (18.6 billion yen). Furthermore, the Company has mentioned that it will not change its cautious stance on purchases and will not make any unreasonable purchases.

On the balance sheet, the sales of Old unutilized properties has progressed, and the balance of property for sale has decreased compared to the end of the previous fiscal year. In response to this, borrowings have also been reduced.

◇ Full-year financial forecast : No change from the initial plan

There are no changes to the full-year financial forecasts or dividends. Sales are 23.7 billion yen (+ 1% YoY), operating income is 1.8 billion yen (- 16%), ordinary income is 1.5 billion yen (- 15%), and net profit attributable to owner of parent is 1 billion yen (- 15%). The dividend per share is 41 yen (an increase of 8 yen; the 11th consecutive year of an increase). The acquisition of treasury stock is scheduled to be carried out in stages from 2025 onwards.

The progress ratio against the full-year plan shows that the Company has already achieved its profit targets. As mentioned earlier, this is because the progress in the year’s second half has been faster than expected. It is somewhat disappointing that the Company has not revised its full-year forecast upwards this time, but there is no need to view this negatively, as it is expected that sales in the 4Q will be more subdued than in the 3Q, and profits will also level off.

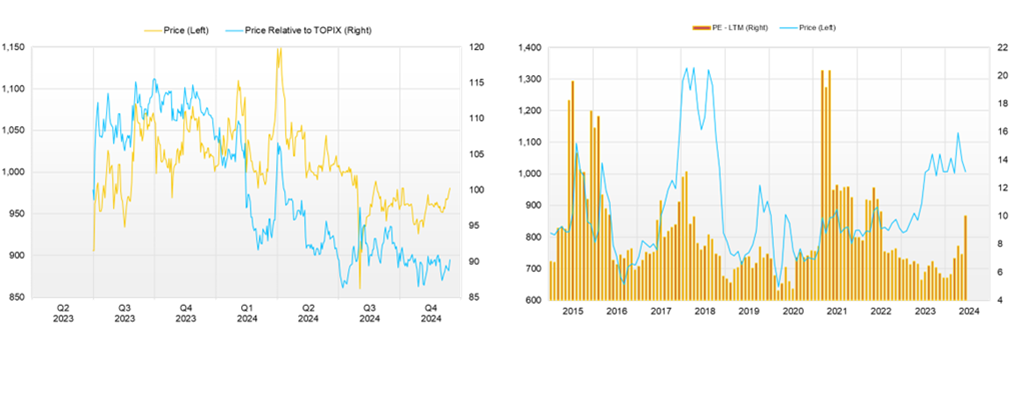

◇Share price trend and future highlights

The share price has been hovering from 950 to 1,000 yen since the announcement of the 2Q results and the new medium-term plan on August 9. The share price is not overheated, with a forecast PER of around 8 times, a PBR of 0.64 times, and a forecast dividend yield of around 4.2%. As the Company’s stable growth trajectory becomes clearer and management becomes more conscious of the cost of capital and the share price, we believe the share price will realize an upside.

From this perspective, the points to watch for in the near term are whether the total amount of purchases for the full year of FY12/2024 will steadily increase and approach the FY12/2023 result (18.6 billion yen), whether the content of these purchases will generally be high-quality projects, whether the Company will further strengthen its foundations in the core existing businesses, i.e., Leasehold land and Old unutilized properties, when and how will the business potential of derivative businesses and regional revitalization businesses be visualized, and how the Company will implement the acquisition of treasury stock and strengthen its shareholder return measures. We look forward to the announcement of the FY12/2024 financial results.

Company profile

Sansei Landic Co., Ltd. operates a real estate rights adjustment business. The Company makes a profit by adjusting the rights to properties it has purchased, mainly leasehold land and old unutilized properties, and then reselling them. It has captured stable profit opportunities in niche markets. In August 2024, the Company announced a new medium-term plan covering the period from August 2024 to fiscal 2027. ROE and PBR are expected to improve due to the growth strategy and improved capital efficiency.

Key financial data

| Unit: million yen | 2019/12 | 2020/12 | 2021/12 | 2022/12 | 2023/12 | 2024/12 CE |

| Sales | 18,020 | 17,775 | 16,836 | 15,533 | 23,269 | 23,700 |

| EBIT (Operating Income) | 1,861 | 847 | 1,118 | 1,469 | 2,155 | 1,800 |

| Pretax Income | 1,759 | 712 | 1,004 | 1,270 | 1,756 | 1,500 |

| Net Profit Attributable to Owner of Parent | 1,159 | 358 | 609 | 1,060 | 1,183 | 1,000 |

| Cash & Short-Term Investments | 4,134 | 4,330 | 5,361 | 3,837 | 3,770 | |

| Total assets | 19,294 | 20,071 | 20,051 | 28,977 | 30,976 | |

| Total Debt | 7,203 | 8,342 | 8,108 | 16,399 | 16,879 | |

| Net Debt | 3,069 | 4,012 | 2,747 | 12,562 | 13,109 | |

| Total liabilities | 9,399 | 10,004 | 9,749 | 17,921 | 18,899 | |

| Total Shareholders’ Equity | 9,895 | 10,067 | 10,302 | 11,056 | 12,077 | |

| Net Operating Cash Flow | -420 | -917 | 1,705 | -9,268 | -12 | |

| Capital Expenditure | 304 | 304 | 304 | 304 | 304 | |

| Net Investing Cash Flow | -71 | -288 | -51 | -267 | -766 | |

| Net Financing Cash Flow | 984 | 953 | -608 | 7,971 | 303 | |

| Free Cash Flow | -446 | -923 | 1,682 | -9,282 | -291 | |

| ROA (%) | 6.42 | 1.82 | 3.04 | 4.32 | 3.95 | |

| ROE (%) | 12.32 | 3.58 | 5.98 | 9.93 | 10.23 | |

| EPS (Yen) | 137.1 | 42.3 | 73.6 | 129.6 | 143.8 | 121.4 |

| BPS (Yen) | 1,170.2 | 1,192.9 | 1,249.5 | 1,356.8 | 1,465.5 | |

| Dividend per Share (Yen) | 23.00 | 25.00 | 26.00 | 28.00 | 33.00 | 41.00 |

| Shares Outstanding (Million Shares) | 8.46 | 8.47 | 8.47 | 8.49 | 8.58 |

Source: Omega Investment from company data, rounded to the nearest whole number.

Share price

FY12/24 3Q financial result

As mentioned above, profits decreased while revenue increased YoY in the 3Q of FY12/2024. However, profits were higher than the level of the year before last. Please check the following.

Source: Company materials

Source: Company materials

Source: Company materials

Source: Company materials

Financial data (quarterly basis)

| Unit: million yen | 2022/12 | 2023/12 | 2024/12 | ||||||

| 3Q | 4Q | 1Q | 2Q | 3Q | 4Q | 1Q | 2Q | 3Q | |

| (Income Statement) | |||||||||

| Sales | 3,096 | 4,272 | 6,486 | 5,494 | 7,485 | 3,804 | 7,207 | 5,785 | 8,358 |

| Year-on-year | -24.3% | 17.4% | 45.9% | 47.6% | 141.8% | -11.0% | 11.1% | 5.3% | 11.7% |

| Cost of Goods Sold (COGS) | 1,964 | 3,065 | 4,320 | 3,858 | 5,681 | 3,067 | 5,521 | 4,228 | 6,448 |

| Gross Income | 1,132 | 1,207 | 2,166 | 1,635 | 1,803 | 737 | 1,686 | 1,558 | 1,910 |

| Gross Income Margin | 36.6% | 28.2% | 33.4% | 29.8% | 24.1% | 19.4% | 23.4% | 26.9% | 22.9% |

| SG&A Expense | 845 | 938 | 1,048 | 1,097 | 1,128 | 914 | 1,115 | 1,102 | 1,125 |

| EBIT (Operating Income) | 287 | 269 | 1,118 | 539 | 676 | -177 | 571 | 455 | 785 |

| Year-on-year | -15.1% | 197.7% | 150.0% | 15.6% | 135.5% | -165.8% | -49.0% | -15.5% | 16.2% |

| Operating Income Margin | 9.3% | 6.3% | 17.2% | 9.8% | 9.0% | -4.7% | 7.9% | 7.9% | 9.4% |

| EBITDA | 297 | 286 | 1,145 | 559 | 692 | -161 | 587 | 476 | 806 |

| Pretax Income | 231 | 205 | 1,046 | 378 | 587 | -254 | 493 | 369 | 728 |

| Consolidated Net Income | 196 | 151 | 684 | 256 | 387 | -144 | 328 | 245 | 485 |

| Minority Interest | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Net Income ATOP | 196 | 151 | 684 | 256 | 387 | -144 | 328 | 245 | 485 |

| Year-on-year | 34.7% | 145.2% | 82.2% | -24.4% | 97.9% | -195.1% | -52.0% | -4.0% | 25.2% |

| Net Income Margin | 6.3% | 3.5% | 10.5% | 4.7% | 5.2% | -3.8% | 4.6% | 4.2% | 5.8% |

| (Balance Sheet) | |||||||||

| Cash & Short-Term Investments | 4,979 | 3,837 | 3,569 | 4,266 | 5,388 | 3,770 | 4,479 | 4,988 | 4,728 |

| Total assets | 27,509 | 28,977 | 29,627 | 30,777 | 30,632 | 30,976 | 30,487 | 30,561 | 29,940 |

| Total Debt | 12,757 | 16,399 | 16,061 | 16,520 | 16,262 | 16,879 | 16,787 | 16,211 | 15,595 |

| Net Debt | 7,778 | 12,562 | 12,493 | 12,254 | 10,874 | 13,109 | 12,308 | 11,223 | 10,867 |

| Total liabilities | 16,622 | 17,921 | 18,064 | 18,944 | 18,412 | 18,899 | 18,354 | 18,163 | 17,173 |

| Total Shareholders’ Equity | 10,886 | 11,056 | 11,563 | 11,833 | 12,220 | 12,077 | 12,133 | 12,398 | 12,768 |

| (Profitability %) | |||||||||

| ROA | 4.10 | 4.32 | 5.50 | 4.81 | 5.08 | 3.95 | 2.75 | 2.66 | 3.02 |

| ROE | 9.19 | 9.93 | 12.43 | 11.42 | 12.79 | 10.23 | 6.98 | 6.74 | 7.32 |

| (Per-share) Unit: JPY | |||||||||

| EPS | 24.1 | 18.6 | 83.5 | 31.0 | 47.0 | -17.4 | 39.8 | 29.7 | 58.6 |

| BPS | 1,340.3 | 1,356.8 | 1,406.1 | 1,435.9 | 1,482.9 | 1,465.5 | 1,472.3 | 1,501.2 | 1,542.9 |

| Dividend per Share | 26.00 | 28.00 | 28.00 | 28.00 | 28.00 | 33.00 | 33.00 | 33.00 | 33.00 |

| Shares Outstanding(Million shares) | 8.48 | 8.49 | 8.58 | 8.58 | 8.58 | 8.58 | 8.58 | 8.58 | 8.58 |

Source: Omega Investment from company materials

Financial data (full-year basis)

| Unit: million yen | 2013/12 | 2014/12 | 2015/12 | 2016/12 | 2017/12 | 2018/12 | 2019/12 | 2020/12 | 2021/12 | 2022/12 | 2023/12 |

| (Income Statement) | |||||||||||

| Sales | 9,189 | 10,446 | 11,569 | 12,300 | 13,099 | 16,833 | 18,020 | 17,775 | 16,836 | 15,533 | 23,269 |

| Year-on-year | -3.0% | 13.7% | 10.8% | 6.3% | 6.5% | 28.5% | 7.1% | -1.4% | -5.3% | -7.7% | 49.8% |

| Cost of Goods Sold | 6,254 | 7,055 | 7,798 | 8,344 | 8,566 | 12,028 | 12,902 | 13,788 | 12,468 | 10,486 | 16,927 |

| Gross Income | 2,935 | 3,391 | 3,770 | 3,957 | 4,532 | 4,805 | 5,119 | 3,986 | 4,368 | 5,047 | 6,342 |

| Gross Income Margin | 31.9% | 32.5% | 32.6% | 32.2% | 34.6% | 28.5% | 28.4% | 22.4% | 25.9% | 32.5% | 27.3% |

| SG&A Expense | 2,034 | 2,204 | 2,216 | 2,295 | 2,434 | 2,702 | 2,891 | 2,750 | 2,877 | 3,031 | 3,569 |

| EBIT (Operating Income) | 902 | 1,187 | 1,300 | 1,446 | 1,762 | 1,766 | 1,861 | 847 | 1,118 | 1,469 | 2,155 |

| Year-on-year | 74.3% | 31.6% | 9.6% | 11.2% | 21.9% | 0.2% | 5.4% | -54.5% | 31.9% | 31.5% | 46.7% |

| Operating Income Margin | 9.8% | 11.4% | 11.2% | 11.8% | 13.5% | 10.5% | 10.3% | 4.8% | 6.6% | 9.5% | 9.3% |

| EBITDA | 968 | 1,260 | 1,406 | 1,532 | 1,833 | 1,822 | 1,912 | 896 | 1,161 | 1,517 | 2,236 |

| Pretax Income | 810 | 1,044 | 1,196 | 1,329 | 1,672 | 1,539 | 1,759 | 712 | 1,004 | 1,270 | 1,756 |

| Consolidated Net Income | 456 | 626 | 724 | 854 | 1,111 | 1,007 | 1,159 | 358 | 609 | 1,060 | 1,183 |

| Minority Interest | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Net Income ATOP | 456 | 626 | 724 | 854 | 1,111 | 1,007 | 1,159 | 358 | 609 | 1,060 | 1,183 |

| Year-on-year | 95.4% | 37.5% | 15.6% | 17.9% | 30.2% | -9.4% | 15.1% | -69.1% | 70.5% | 73.9% | 11.6% |

| Net Income Margin | 5.0% | 6.0% | 6.3% | 6.9% | 8.5% | 6.0% | 6.4% | 2.0% | 3.6% | 6.8% | 5.1% |

| (Balance Sheet) | |||||||||||

| Cash & Short-Term Investments | 1,186 | 2,276 | 2,254 | 2,435 | 3,558 | 3,594 | 4,134 | 4,330 | 5,361 | 3,837 | 3,770 |

| Total assets | 8,919 | 8,793 | 11,398 | 10,833 | 16,916 | 16,777 | 19,294 | 20,071 | 20,051 | 28,977 | 30,976 |

| Total Debt | 3,780 | 2,414 | 3,958 | 2,712 | 7,439 | 6,048 | 7,203 | 8,342 | 8,108 | 16,399 | 16,879 |

| Net Debt | 2,594 | 139 | 1,704 | 277 | 3,881 | 2,454 | 3,069 | 4,012 | 2,747 | 12,562 | 13,109 |

| Total liabilities | 5,051 | 3,531 | 5,363 | 3,977 | 8,909 | 7,869 | 9,399 | 10,004 | 9,749 | 17,921 | 18,899 |

| Total Shareholders’ Equity | 3,868 | 5,262 | 6,034 | 6,856 | 8,006 | 8,908 | 9,895 | 10,067 | 10,302 | 11,056 | 12,077 |

| (Cash Flow) | |||||||||||

| Net Operating Cash Flow | -664 | 1,761 | -1,451 | 1,611 | -3,666 | 1,617 | -420 | -917 | 1,705 | -9,268 | -12 |

| Capital Expenditure | 97 | 91 | 58 | 111 | 57 | 66 | 61 | 21 | 40 | 28 | 304 |

| Net Investing Cash Flow | -175 | -111 | -116 | -184 | 107 | -64 | -71 | -288 | -51 | -267 | -766 |

| Net Financing Cash Flow | 1,136 | -612 | 1,588 | -1,278 | 4,667 | -1,495 | 984 | 953 | -608 | 7,971 | 303 |

| Free Cash Flow | -714 | 1,697 | -1,491 | 1,536 | -3,692 | 1,572 | -446 | -923 | 1,682 | -9,282 | -291 |

| (Profitability %) | |||||||||||

| ROA | 5.69 | 7.07 | 7.17 | 7.68 | 8.01 | 5.98 | 6.42 | 1.82 | 3.04 | 4.32 | 3.95 |

| ROE | 12.48 | 13.72 | 12.82 | 13.24 | 14.96 | 11.90 | 12.32 | 3.58 | 5.98 | 9.93 | 10.23 |

| (Per-share) Unit: JPY | |||||||||||

| EPS | 66.0 | 90.2 | 90.1 | 104.9 | 134.4 | 119.6 | 137.1 | 42.3 | 73.6 | 129.6 | 143.8 |

| BPS | 560.5 | 664.8 | 744.2 | 841.3 | 958.0 | 1,054.5 | 1,170.2 | 1,192.9 | 1,249.5 | 1,356.8 | 1,465.5 |

| Dividend per Share | 3.00 | 6.00 | 10.00 | 12.00 | 18.00 | 21.00 | 23.00 | 25.00 | 26.00 | 28.00 | 33.00 |

| Shares Outstanding (Million shares) | 6.90 | 7.91 | 8.11 | 8.15 | 8.35 | 8.45 | 8.46 | 8.47 | 8.47 | 8.49 | 8.58 |

Source: Omega Investment from company materials