Kidswell Bio Corporation

| Securities Code |

| TYO:4584 |

| Market Capitalization |

| 16,737 million yen |

| Industry |

| Healthcare |

| PDF version of this page |

| 4584OIV210716EN |

| Company Site |

| https://www.kidswellbio.com/ |

| IR Contact |

| info_ir@kidswellbio.com |

This writing is a brief note of the investment insights into the company’s shares. Kidswell Bio Corporation is characterised by its focus on regenerative medicine using CSC (Cardiac Stem Cells) and SHED (Stem cells from Human Exfoliated Deciduous teeth) on top of new biologics development, its pioneering position as a biosimilar producer vis-a-vis other Japanese bioscience companies by consistently earning more than 1 billion yen in sales, and the fact that the company is an equity accounted affiliate of Noritsu Koki (TYO7744). The company’s vision is to help children, and with regenerative medicine, it aims to treat intractable pediatric diseases. For details of the business and the management’s business plan, please refer to public materials. The company handout for the latest result presentation and the Five-year Medium-term Business Plan announced in February 2021 are recommended. These are disclosed on the company’s website.

Investment view

Kidswell Bio’s stock price has been sluggish for many years, but it appears to be finally passing through an interesting turning point. TSR beat TOPIX over the last six months thanks to the sharp stock price rise from the beginning of June 2021, and achieved good results. Over the last three months, the stock ranks 6th place out of 32 biotechnology stocks. By now investors can see a roadmap for medium- to long-term business outlook. Stock price appears to have begun to reflect investor expectations sensibly. Share price positive news flow is expected for some time and fairly rich news flow is expected towards FY2025 (FY03/2026). These should mainly center on the drug pipeline progress and the possibility of partnering. Until now, consistent deficits, huge extraordinary losses and significant dilution of per share value weighed on the share price, against the backdrop of the unclear outlook of new drug development. The impression is that BPS has been neglected so much, which must have been a great pain to shareholders. These share price drags should be resolved once the company returns to profitability. Stock price may be stepping into a stage where shareholder loyalty is rewarded.

Total Shareholder Return

| 1M | 3M | 6M | YTD | 1Y | 3Y | 5Y | 10Y | 20Y | IPO (Nov 2012) | |

|---|---|---|---|---|---|---|---|---|---|---|

| 4584 | 24.5 | 5.7 | 13.5 | 11.5 | -32.7 | -12.8 | -4.1 | -4.1 | -4.1 | -4.1 |

| TOPIX | 2.3 | -2.3 | 10.0 | 8.9 | 25.5 | 6.2 | 8.0 | 8.0 | 8.0 | 8.0 |

Made by Omega Investment by various materials

| Period | Revenue (mn, yen) | EBITDA (mn, yen) | EPS (yen) | PER (CE)(X) | PBR (X) | ROE (%) |

|---|---|---|---|---|---|---|

| 3/18 | 1,060 | 0 | -47 | 0.0 | 8.7 | 0.0 |

| 3/19 | 1,022 | 0 | -42 | 0.0 | 6.7 | 0.0 |

| 3/20 | 1,078 | 0 | -265 | 0.0 | 10.1 | 0.0 |

| 3/21 | 997 | 0 | -34 | 0.0 | 10.0 | 0.0 |

Thoughts on medium- to long-term stock price

Investors who patiently hold bioscience stocks, aiming at surprisingly high investment returns, should be interested in epoch-making new drug development and far less in biosimilars. As per the company, in a year or two, sales of biosimilar will grow steadily whilst R&D costs and fixed costs will stabilise. Importantly, this will result in a healthy financial cycle to support new drug development. Hence biosimilar and new drug development are organically linked. The management has confidence in delivering operating profit in the FY 2022 (FY03/ 2023). This is mainly thanks to the end of the significant investment in the biosimilar development of over the 15 years, as the spending for the manufacturing process of the fourth biosimilar to be marketed will be over. With cash flow generated by the company covering both R&D expenses and fixed costs, the company should see factors that have held back the stock price go away.

As investors gain more confidence in the possibility of the company generating operating income of 1 billion yen FY2025, there may be a reaction of the shares. In order for investors to be confident, they must confirm the steady earnings contribution of biosimilar, the stabilisation of the fixed costs and R&D expenses, and the possibility of new drug partnering. The company plans to launch three new regenerative biopharmaceuticals by SHED until FY2030. It is a very ambitious goal, and there has yet to be more info to judge this potential. This needs to be discussed between investors and the management. As mentioned in our investment view on Chiome (4583), expectations for the results of pharmaceutical R&D do not match amongst the developing companies, out-licensing companies, and investors, and the results do not necessarily come out in line with the expectations of investors. In addition, investment activities of the two biggest shareholders, who hold bulky amount of Kidswell Bio’s shares, are difficult to predict, and should be regarded as a risk.

As per the premium attached to the shares

There may have been some unknown supply and demand factor behind the recent rise in stock price. However, considering only the business fundamentals to have a think on what investor expectations were discounted in the stock price, we come up with the followings. 1) the view that the company’s forecast for achieving a surplus FY2022 is realistic. 2) It is uncertain that operating income will reach 1 billion yen toward the FY2025, but there is a possibility that new revenue streams such as new drug milestones will be added, and 3) The ongoing Phase3 clinical trials of JMR-001 is proceeding well, and there may be news about partnering in the near future.

While the outlook for the drug development has been made clearer, investors may not be optimistic enough as to whether the management will take care of the interests of minority shareholders to a satisfactory extent. The management posted an extraordinary loss of nearly 6 billion yen in the FY2019, while allowing an average annual share dilution of 20% over the past five years. As a result, BPS has diminished significantly. BPS was 182 yen in FY2016 but is now a little over 50 yen. It must have been a great pain to many loyal investors, who held the shares over many years.

Key Stats

| 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | |

|---|---|---|---|---|---|---|---|---|

| BPS (Y) | 108 | 26 | 33 | 182 | 134 | 133 | 52 | 50 |

| PBR x | 4.8 | 23.6 | 22.6 | 3.8 | 8.7 | 6.7 | 10.1 | 10.0 |

| Market Cap (Y-mn) | 4,995 | 5,889 | 8,653 | 13,347 | 25,881 | 17,221 | 14,487 | 14,930 |

| No of Shr | 9,536,420 | 9,576,420 | 11,541,768 | 19,135,846 | 19,135,846 | 20,342,446 | 27,646,894 | 29,622,755 |

Investment activities of the big shareholders are also risky. Noritsu Koki owns 31.97% of Kids Bio’s outstanding shares, and its book value is estimated to be around 500 yen per share. Noritsu Koki has discontinued its drug discovery business and is regarded as a major potential seller. Heights Capital of the US has been undertaking the third-party new share / rights financing by Kidswell Bio. As a result, as of June 30, 2021, Heights owns 9.0% of Kidswell Bio, including a potential stake equivalent to 8.7% of all shares. These two companies hold bulky shares in an aim to earn investment returns. There are no signs that they are interested in the management of Kidswell, but their investment activities are difficult to predict.

Below is a brief list of stock price relevant expectations and concerns.

Bull

- It is expected that financing in the capital market, which dilutes the value per share, will settle down and will not take place for some time after achieving a surplus. The management believes that R&D expenses will stabilize between 500 million yen and 1 billion yen in the near future. They think that the fixed cost will be around 800 million yen, which will unlikely inflate. As they assume, if the gross profit margin of biosimilars is about 70%, these costs will be covered by the operating cash flow and a slight surplus can be maintained. Unless the company develops biosimilars and drugs in-house from scratch, it is unlikely that R&D expenses will increase. Also, the management is decided that they will not spend on costly biosimilar manufacturing process development going forward.

- News flow should be positive for some time. First, the application for marketing approval of GBS-007, which will be the third marketed biosimilar, is expected in September 2021. Second, partnering of JRM-001,which is going under the Phase 3 clinical trials, may be reported. Third, there is a possibility that the profitability of FY2022 will be clear in the latter half of the current FY2021. And fourth, there is a possibility that a powerful new drug may be added to the biosimilar pipeline. Management is thinking about an IR meeting later this year to explain on R&D activity.

- Management has confidence in their forecast of surplus in FY2022. This should be achieved by expanding sales of biosimilar, which will add one item to its current list of two, and by the reduction in the R&D expense and no inflation of the fixed costs. R&D expenses will be a heavy earnings drag in FY2021 totalling 1.8 billion yen , but the management thinks that it will be reduced to the normal level of about 700 million yen in the following fiscal year. The main reason is the end of large investment on the manufacturing process of biosimilar products. This expectation should be considered as already factored in the stock price.

- The management of Kidswell Bio forecasts sales of 3 billion yen and operating income of 1 billion yen in FY2025. Investors are as yet skeptical, but if this target begins to look realistic, share price could react positively. The driver will be milestones from regenerative medicine development and the marketing of the fourth biosimilar. In addition, the management has a policy of not investing in the manufacturing process of biosimilar products and does not think that R&D expenses will be a big burden.

- Utilizing CSC (Cardiac Stem Cells), which is one of the two leading regenerative medicine cells, JRM-001 is most advanced on the company’s regenerative drug pipeline and is expected to add to the revenue stream before long. JRM-001 is rapidly completing Phase III clinical trials as an alternative treatment to surgery for children with functional single ventricles. Management hopes to start collaboration with partner pharmaceutical companies by FY2022 and achieve manufacturing and marketing approval by FY2024. Assuming a price of 15 million yen for an estimated 500 cases in Japan, the best-case sales are calculated to exceed 7 billion yen. In practice, drug price reductions, penetration time, competition, etc. must be considered before the treatment becomes available to all patients. Through partnering, Kidswell Bio plans to seek opportunities for its indications for other heart diseases such as dilated cardiomyopathy, and shifts to off-the-shelf cell therapy, which is advantageous in terms of manufacturing cost and supply over autologous cell therapy. It is positive that the company will think about overseas markets. However, it is way too early to incorporate these expectations into the stock price.

- With another promising regenerative medicine cell, SHED (Stem cells from Human Exfoliated Deciduous teeth), the company plans to launch three products by FY2030. Being an extremely challenging target, if it becomes likely, the stock price may react significantly. But it is also too early for the shares to reflect such expectations. SHED is one of the most suitable cells for regenerative medicine because of its regenerative ability and safety. In addition to pediatric congenital diseases, SHED is a highly active stem cell derived from children and can be applied to diseases of the elderly, which the company also aims at. From FY2030 onward, the company plans to develop the second-generation super SHED, or enhanced cell therapy “designer cells”, to chase even higher therapeutic goals.

- Regarding SHED, the management believes that there is a considerable gap between the company’s view and the investor’s understanding. In the future, if this gap is closed to some degree by the company’s R&D explanation, it will be positive for the stock price. However, what the actual outcome will be is a different thing.

- The launch of new biopharmaceuticals is targeted for the first half of the 2030s, and regenerative medicine will take the lead. It is a story of the very long run. However, as per the stock price, there is a possibility that the news flow will prove positive, as the company is aiming to out-license to partners and start joint development by 2025. The target diseases are malignant lymphoma, pulmonary hypertension, and vasculitis, but they cannot be factored into the stock price yet.

- The company plans to develop biosimilars of blockbusters, including Opdivo, by 2030. biosimilar plays a large role if they replace those epoch-making medicines that are highly effective and are expanding application. However, competition can be intense.

- With the bolstered drug pipeline, Kidswell Bio has set up a Product Strategy Office, and has shifted to a structure that closely manages the portfolios of the three businesses that President Tani had under his direct control. The head of the office appointed has experience at Astellas and US venture capital.

Bear

- Sales and profits will not necessarily increase linearly by the targeted FY2025. The management’s forecast is that milestone income will drive the business performance towards the end of this medium term. Hence, investors should forecast the progress carefully.

- In biosimilar, it is positive that patents for big biopharmacy in Japan will expire one after another, but competition is intensifying. New entrants have increased ranging from major pharmaceutical companies to small and medium-sized pharmaceutical companies. This happens because technological innovation has made it possible to mass-produce biosimilar products at low cost. Kidswell Bio also thinks there is plenty of room for them to cut back on costs, but if multiple products compete in the market, selling price could drop quite seriously. In Japan, the Ministry of Health and Welfare sets drug prices, which are revised annually and reviewed four times a year if certain conditions are met, such as annual sales exceeding 35 billion yen.

- Shareholders still doubt whether shareholder-friendly capital measures will be considered in the future. Half of Kidswell Bio is estimated to be owned by individual investors. In FY2019 Kidswell Bio made Cell Technology a consolidated subsidiary by issuing new shares. At the same time, the management booked a huge extraordinary loss of 6.1 billion yen to write down the goodwill resulted from this consolidation. A large number of new shares was the main reason for the 35% dilution of shareholders’ equity per share in one year. Consequently, the BPS, which was 182 yen in 2016, dropped to just over 50 yen. This must have been a great pain of shareholders. Kidswell Bio’s share dilution progressed at a CAGR of 21% over the five years, resulting in a 2.6 fold increase in the number of shares.

- Possibility of selling pressure by the largest shareholder. Noritsu Koki, the largest shareholder, holds 31.97% of the shares of Kidswell Bio. Their book value is calculated to be 496 yen a share at the end of December 2020. Noritsu Koki has lost interest in bioscience and has defined it as a discontinued business, which leads to the possibility of selling its stake in Kidswell Bio at some point. If there is a lump sum transfer through off-market transactions, it is possible that shareholders who try to control the management of Kidswell Bio appear, and the business plan may be re-written.

- Possibility of consistent sales of shares by Heights Capital of the US. The management of Kidswell Bio has confirmed in direct contact with Heights that their investment in Kidswell Bio will not exceed 10%, and some sales endorsed that. However, Heights’ stake is as large as 10% of the total number of shares, and it is estimated that it owns nearly 9% of potential shares, so it cannot be ignored as a potential seller.

A look at fair value of the shares

It is extremely difficult to calculate a convincing fair value for any biotechnology stock. On the other hand, it is an interesting exercise to consider various measurements. DCF model is one of the powerful valuations, which is based on the detailed forecasts of the main pharmaceuticals in the drug pipelines. Here is just a simple and rather unsophisticated approach. Hopefully, we should be able to present a more sophisticated calculation at some point in the future.

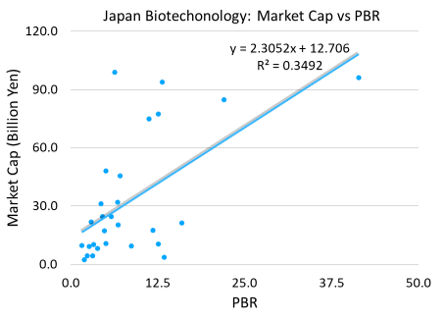

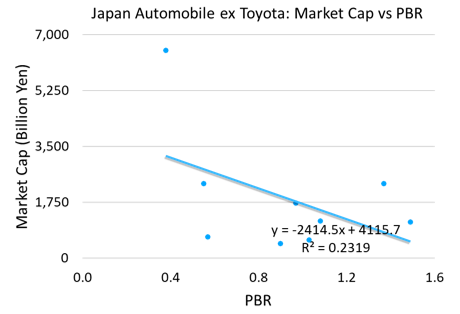

Of the 33 biotechnology stocks, 28 trade at a market capitalization of 100 billion yen or less, with an average market capitalization of 33 billion yen and a PBR of 8.6 times. At a glance, there is some correlation between market capitalization and PBR. In this particular industry, investors tend to be optimistic with high market capitalization and they allow high PBR to these stocks. This is the exact opposite of the automobile sector. It may be because biotechnology is thought to be in the development stage of its industrial life cycle whereas automobiles are thought to have matured. Considering that a share price is formed by BPS and PBR that multiplies it, the dynamics seems to be that investors attach more premiums to the stocks of companies which deliver solid momentum for BPS growth. It should perhaps be endorsed by the observation that once successful, biotechnology businesses are able to remain profitable over the long-term on high return on capital.

Currently the stock price of Kidswell Bio is around 600 yen. Assuming the share price rises to 1200 yen and if the shares should trade on a PBR of 8.6x, which is the sub-sector average, the implied BPS will be 140 yen. Current BPS is around 50 yen, so this is about three times higher. If this incremental change of BPS is translated into a post-tax profit, it will be worth 2.7 billion yen. How many years will it take for Kidswell Bio to earn that much in total? Conversely, if the current shares are valued at a sub-sector average PBR of 8.6 x, the fair price will be 430 yen. It indicates the stock price is priced 40% above the sub-sector.

Investor Activity

Originally Kidswell Bio, which was formerly called Gene Techno Science before the renaming in July 2021, was a Noritsu Koki’s subsidiary under their healthcare division. Noritsu Koki lost interest in the drug discovery business and moved Kidswell Bio to a business group to discontinue, but still incorporates Kidswell Bio in its consolidated accounts as an equity-method affiliate. Noritsu Koki does not lay a hand on the management of Kidswell Bio. There appears to be no personnel who can advise on bioscience business. The management of Kidswell Bio reports business results to Noritsu Koki on a regular basis. They are now a shareholder who solely aims for investment returns.

Heights Capital Management, Inc’s stake equals to a 9.0% of Kidswell Bio’s outstanding number of shares even after the selling of a 1% stake in May 2021, if the rights and CBs are considered. To date, they have mainly undertaken a third-party allotment of Kidswell Bio’s new shares and the rights via CVI Investments, Inc., which is under their wing. Heights Capital Management, Inc. is part of the Susquehanna International Group headquartered in the US. Susquehanna is a private company and is a group of investors investing in various financial markets in the US, Europe, Asia and elsewhere in the world. Their equity investment portfolio suggests to us that they are more of a long-term investor. They seem to employ Mr. Willam Chen, a renowned poker player, as head of the quantitative arbitrage team.

Kidswell Bio’s management regularly meets with Heights investment manager to explain their business. Kidswell Bio sees Heights as an investor who nurtures investees while building good relationships with them. According to Kidswell Bio, Heights runs a policy of not putting pressure on management of the investee and not investing more than 10% of all the shares. In fact there were some sales of shares, which appears to be in line with that principle. However, Heights owns huge stakes of over 10% in some other Japanese companies such as OKWAVE (3808) and 3D Matrix (7777), and their investment principles are not clear.

Regarding IR activities

Kidswell Bio’s IR activities are fairly active. They sit at 30 to 40 individual investor meetings a year. Recently, the contacts with foreign investors are on the rise. Going forward, the likelihood of a profitable FY2022 and FY2025 may well increase, while the drug pipeline develops. if the management continues to actively share information with investors and promotes constructive discussions with them, perhaps, it will be positive for the share price.

Business

- Kidswell Bio aims to fulfill its social mission basing itself on the healthcare for children, and renamed itself to Kidswell Bio in July 2021. The company envisions business that eventually includes care after the drug is delivered to the patient.

- The current company’s drug pipeline consists of eight biosimilars, three new biologic pharmaceuticals, and nine new biotechnology items for regenerative medicine and cell therapy. The business model is to aim for high returns with new drugs while bolstering the financial strength by the profits earned by biosimilars. Three biosimilars are being marketed, which earn the current consolidated sales. Being the only listed bioscience company that generates sales of 1 billion yen by biosimilars, Kidswell Bio is ahead of the peers in that respect.

- Nine items in the new biotechnology business pipeline, which is regenerative medicine, are divided into JRM-001, which aims at functional single ventricle diseases using CSC (intracardiac stem cells) and the regenerative treatment by SHED (deciduous dental pulp stem cells). JRM-001 is currently in Phase 3 trials, and attracts high interest from investors. All SHEDs projects are in the stage of basic research and are before clinical tests. The management wants to launch three products by 2030. After that, they look to develop second-generation SHED by incorporating next-generation designer cells. The three new biologics in the pipelines target diseases such as vasculitis, pulmonary hypertension, and malignant lymphoma. The launching target is the first half of the 2030s.

- Biosimilars earns cash for Kidswell Bio’s new drug development. More importantly, it is significant if biosimilars replace use of great but expensive drugs, considering the global medical situation. Low price of biosimilars will help the national healthcare administration as well as patients. The company values the social significance of making such a large contribution.

- The largest shareholder is Noritsu Koki (7744), which holds a 31.97% of the outstanding share. In June 2016, it acquired a majority stake in Gene Techno Science Co., Ltd. (presently Kidswell Bio Corporation) to consolidate it as a subsidiary. In April 2019, GTS was made an equity-accounted affiliate.