Chiome Bioscience (Company Note)

| Share price (7/19) | ¥295 | PER (21/12 CE) | –X |

| 52weeks high/low | ¥386/180 | PBR (20/12 act) | 3.78 X |

| ADVT (¥ mn, monthly) | ¥701 mn | ROE (20/12 act) | -45.60% |

| Mkt cap | ¥11.8 bn | DY (21/12 CE) | –% |

| Shrs out. | 40.291 mn, shrs | Shr eqty ratio (21/3) | 87.30% |

| Listed market | TSE Mothers | Foreign shareholding ratio | 2.90% |

| Click here for the PDF version of this page |

| 4583ChiomeCN210719EN |

Bio-venture challenging unmet needs with antibody drug discovery development

Points of interest

A bio-venture company that challenges to unmet needs by developing its own antibody drug discovery. 11 products in pipeline, and one of which is in the clinical stage. Drug Discovery and Development Business is steadily underway with the aim of first-in-class ** drug discovery.

**First-in-class: Breakthrough drug. In particular, it is an original drug that is highly novel and useful, has a different chemical structure from the conventional drug and skeleton, and significantly changes the conventional treatment system.

Summary

- Chiome Bioscience was founded in an aim to develop antibody drugs with its own antibody library ADLib®︎ system, which bases on the research and development results of RIKEN. Antibody drugs are expected to have high therapeutic effects and reduce side effects, as they activate once recognizing specific cells and tissues. Thus, they are expected to grow significantly in the future as the mainstream of drugs. The Company was Listed on TSE Mothers in 2011. In 2017, the management shifted a focus to the Drug Discovery and Development Business changing where the business heads for.

- The current business segments are the following two.

Drug Discovery and Development Business: In-house and/or joint development of antibody drug discovery in disease areas with high unmet needs*, licensing of intellectual property rights such as patent rights related to antibodies, the products of the drug discovery, to pharmaceutical companies. The Company will receive upfront payments, milestone payments and royalties. It is a core business for the Company’s future growth.

Drug Discovery Support Business: Providing support for drug discovery research conducted at research institutes such as pharmaceutical companies, diagnostic drug companies, and universities. The Company will receive service fees. The Company mainly provide antibody generation, antibody engineering and protein preparation utilizing its antibody drug discovery technology platform to major domestic pharmaceutical companies. This is a high value-added business expected to generate stable profits.

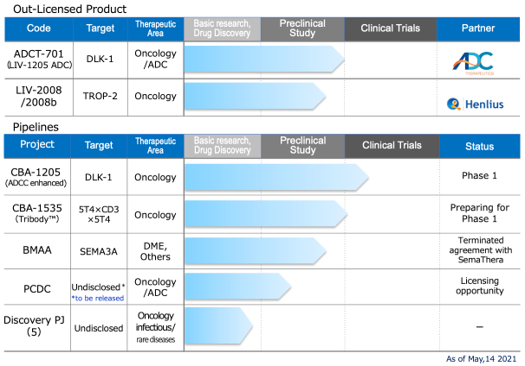

- Drug Discovery and Development Business; there are currently 11 products in the pipeline. Of the, 2 out-licensed products are in the preclinical stage. The Company’s in-house pipeline has 1 clinical trial, 3 preclinical trials, and 5 compounds in the drug discovery research stage.

- In the Drug Discovery Support Business; the Company have expanded its business partners to Kyowa Kirin and Ono Pharmaceutical in addition to main Chugai Pharmaceutical, which is the existing main customer. Sales grew 34% over the last three years. Chiome also was contracting the production of antibodies against COVID-19.

- In FY12/2020, Net sales were ¥480mn, R&D expenses amounted to ¥1.15bn, operating loss was ¥1.28bn, and net loss registered ¥1.29bn. The Company raised ¥1.94bn by stock acquisition rights, and cash and deposits at the end of FY12/2020 stood at ¥2.68bn. The pipeline for the Drug Discovery and Development Business is progressing well, with one new out-licensing and in-house developed CBA-1205 starting Phase 1 clinical trials. In the Drug Discovery Support Business, new customer development is in progress in addition to increasing transactions with existing customers.

◇The following points are considered as the focus of investment in drug discovery bio-ventures.

1.Does the company has sufficient pipeline and its R&D structure to drive it? Will it be able to out-license?

2.Finance capabilities to enable long-term development required for drug discovery.

3.Is there an information disclosure system to make the progress of long-term, high-risk drug development highly transparent?

4.Is the management solid and reliable enough to carry out these activities?

*Unmet needs: Currently, there is no medically unsatisfied need for diseases, etc. for which effective drugs and satisfactory treatments have not been found.

Interview : Head of R&D Division and Business Development Yoshinori Yamashita, Ph.D.

Table of contents

Key financial data

| Fiscal Year (Unit: ¥mn) | 12/2015 | 12/2016 | 12/2017 | 12/2018 | 12/2019 | 12/2020 |

| Net sales | ||||||

| Drug Discovery and Development Business | 0 | 27 | 59 | 2 | 29 | 3 |

| Drug Discovery Support Business | 280 | 224 | 200 | 210 | 417 | 477 |

| Total net sales | 280 | 252 | 259 | 212 | 447 | 480 |

| Cost of sales/SG&A expenses | 1,549 | 1,294 | 1,147 | 1,751 | 1,849 | 1,764 |

| R&D expenses | 828 | 626 | 592 | 1,230 | 1,299 | 1,156 |

| Others | 721 | 667 | 555 | 521 | 550 | 607 |

| Operating loss | (1,269) | (1,042) | (887) | (1,539) | (1,401) | (1,283) |

| Ordinary loss | (1,253) | (1,047) | (883) | (1,533) | (1,410) | (1,291) |

| Net loss | (1,282) | (1,491) | (882) | (1,533) | (1,403) | (1,293) |

| Current assets | 4,273 | 4,681 | 4,196 | 2,609 | 2,561 | 3,248 |

| Cash and marketable securities | 4,100 | 4,553 | 4,027 | 2,328 | 2,105 | 2,686 |

| Total assets | 4,918 | 4,789 | 4,419 | 2,831 | 2,808 | 3,494 |

| Total net assets | 4,564 | 4,565 | 4,217 | 2,676 | 2,621 | 3,109 |

| Equity ratio (%) | 92.2 | 94.5 | 94.6 | 93.5 | 92.6 | 88.2 |

| Cash flow from operating activities | (1,537) | (969) | (867) | (1,688) | (1,537) | (1,360) |

| Cash flow from investing activities | (26) | 1,988 | (137) | – | (26) | (3) |

| Cash flow from financing activities | 1,341 | 1,433 | 478 | (10) | 1,341 | 1,944 |

| Increase/decrease in cash and cash equivalents | (222) | 2,452 | (525) | (1,698) | (222) | 580 |

Cash flow from financing activities: Funds from subscription rights of shares

Source: Omega Investment from Company materials

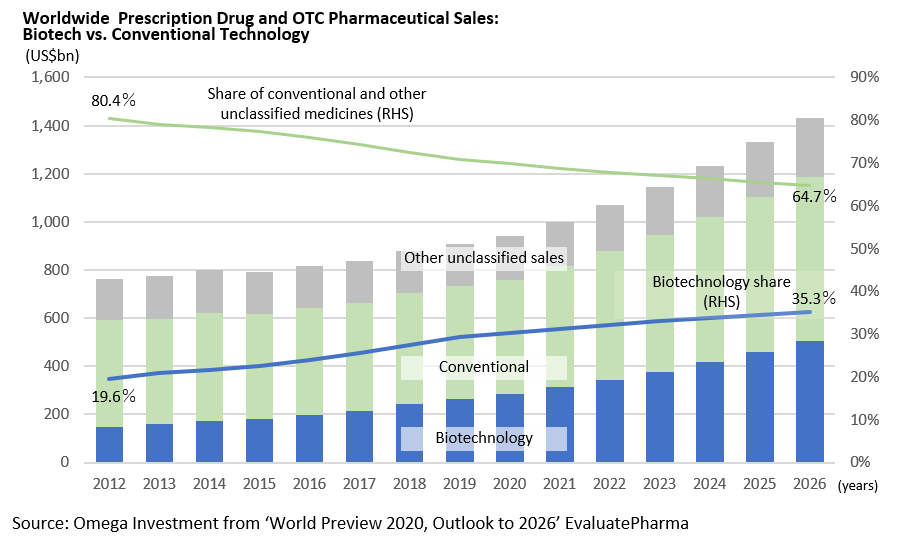

Pharmaceutical market trends

The world pharmaceutical market is a huge industry of ¥130tr a year, and in Japan alone, the market size is about ¥10tr a year. It takes around 10 years or more to develop a new drug, and it is not uncommon for the development cost to exceed ¥100bn. Since 1980’s, biopharmacy using biotechnology instead of conventional low-molecular-weight compound drugs has emerged. Biopharmacy that applies biomolecules such as genetically modified proteins is expected to grow at a high rate in the future. In the development of vaccines for COVID-19, biopharmaceutical technologies such as mRNA technology for Pfizer/Biontech and Moderna, and viral vectors for AstraZeneca are used.

In recent years, many of the large-scale drugs (blockbuster drugs) are antibody drugs.

| NO | Product | Company | Main indication | Modality | Sales ($mil.) |

| 1 | Humira | Abbvie/Eisai | Rheumatoid arthritis | Antibody | 20,389 |

| 2 | Keytruda | Merck | Oncology | Antibody | 14,380 |

| 3 | Eylea | Regeneron/Bayer/Santen | Age-related macular degeneration | Recombinant protein | 8,360 |

| 4 | Stelara | J&J | Psoriasis | Antibody | 7,975 |

| 5 | Opdivo | Ono/BMS | Oncology | Antibody | 7,888 |

| 6 | Enbrel | Amgen/Pfizer/Takeda | Rheumatoid arthritis | Recombinant protein | 6,346 |

| 7 | Trulicity | Eli Lilly | Diabetes | Peptide | 5,377 |

| 8 | Avastin | Roche | Oncology | Antibody | 5,321 |

| 9 | Ocrevus | Roche | Multiple sclerosis | Antibody | 4,612 |

| 10 | Remicade | J&J/Merck/Mitsubishi Tanabe | Rheumatoid arthritis | Antibody | 4,511 |

The table below compares antibody drugs with conventional small molecule drugs. Antibody drugs have many advantages such as being effective for diseases unique to individual patients and having few side effects. Developing antibody drugs requires a large amount of funding, which resulted in the skyrocketed price of the medicine, and the treatment cost will be extremely high.

Main differences between antibody drugs and small molecule drugs

|

Antibody |

Small molecule |

|

|

Side effects |

Antibody, in general, is safe and causes less side effect, since it specifically targets cells and tissues relating to the disease, but not normal cells and tissues. |

It is safe and harmless when they are used according to the approved condition. |

|

Efficacy |

Antibody directly attacks targets or signals that causes the disease, i.e., antibody aims for cure of the disease, not supportive care. |

Drugs, particularly molecularly targeted drugs, are designed to directly attack targets or signals that causes the disease ,i.e., it aims for cure of the disease, not supportive care. Small molecule drugs are often used as supportive care such like a painkiller. |

|

Administration route |

In general, injection and fusion at a hospital and clinic. (Self-injection is available in some cases) |

Injection, Oral, dermal, nasal, or topical, etc. Many of those can be taken at home under physician’s instruction. |

|

PK |

Longer half-life in serum, which allows less frequent dosing such as weekly or monthly. |

Relatively short half-life in serum. In some cases, daily dosing, 2-3 times a day, are required. |

|

Target specificity |

High (It’s an essential concept of antibody) |

Depends on the drug. |

|

Manufacturing process |

Culture of microorganism or animal cells. |

Chemical synthesis, culture of microorganism. |

Source: Omega Investment from Company materials

Business summary

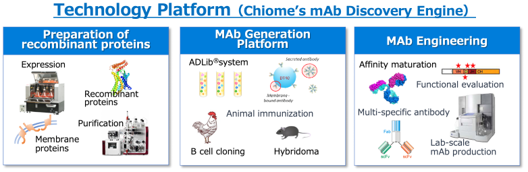

With the corporate mission of “Shine light on unmet needs. Bring a brighter future to patients,” the Company has multiple antibody generation technologies, including its own ADLib®︎ system, and technologies and know-how related to protein and antibody engineering. The Company creates antibody drugs rapidly with high accuracy by integrating those technologies with its own operating technical platforms with extensive development facilities.

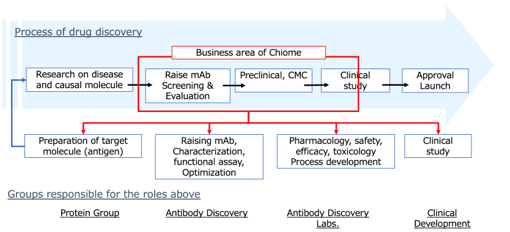

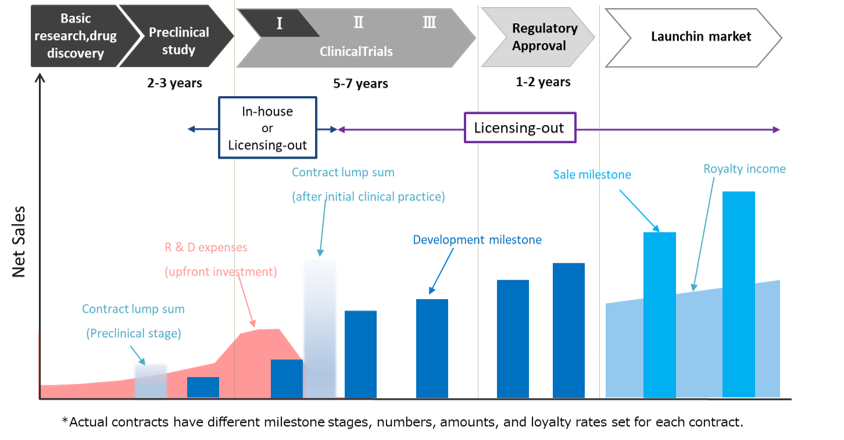

The Company’s business areas are shown below. Unlike Megapharma (a major pharmaceutical manufacturer), it adopts a business model typical to bio-ventures, and the Company focuses on basic research/drug discovery and preclinical studies. By licensing-out patents of pipeline product and drug candidates to pharmaceutical companies, the Company will receive upfront payments, milestone payments and royalties. Chiome has been focusing on the drug discovery business last few years and has recently started an initial clinical development.

The Company’s business domain in drug development

Core competencies that support the Company’s business

Antibody drugs takes advantage of the mechanism of recognizing proteins possessed by bacteria and viruses, which are the immune system of the living body, as foreign substances (antigens), and making proteins (= antibodies) that react with the foreign substances to attack and eliminate foreign substances (antigen-antibody reaction). The Company has multiple antibody generation technologies, including the ADLib®︎ (Autonomously Diversifying Library) system that was originally developed. The original ADLib®︎ system is a monoclonal antibody generation system using chiken-immune cells, but the Company have also developed a human ADLib®︎ system in which the chicken antibody gene is replaced with a human antibody gene. The human ADLib®︎ system is a method for generating human antibodies from cultured cells in vitro without using a living body (animal). It has unique features that other antibody generation technologies do not have, such as (1) Human antibodies can be obtained in a short time, and (2) Utilizing the characteristic of autonomous diversification of genes, it is possible to continuously increase the affinity of antibodies, and (3) being unaffected by immune tolerance, unlike the immunization method of individual animals.

More than half of the Company’s research scientist have doctoral degrees, and by utilizing their R&D capabilities, the Company is building a technology platform such as protein preparation and antibody engineering shown in the above figure, in addition to antibody generation technology. By making full use of these technologies in an integrated manner, the Company is able to create the optimal therapeutic antibodies for therapeutic targets.

Major patents related to basic technology*

|

Relation |

Title of invention |

Applicant |

Registration status |

|

ADLib®︎ system Basic patent |

Method for promoting somatic homologous recombination and method for generating specific antibody |

RIKEN, the Company |

Established in Japan, US, Europe and China |

|

Induction of somatic homologous recombination |

RIKEN, the Company |

Established in Japan, US, Europe and China |

|

|

Human ADLib®︎ system |

Cells that generate human antibodies |

The Company |

Pending in Japan, US, Europe and China |

* In addition to the above, 5 major patents related to lead antibodies

Source: Omega Investment from Company’s annual report

Based on these technologies, the Company is engaged in “Drug Discovery and Development Business” and “Drug Discovery Support Business.” Drug Discovery and Development Business is expected to generate a large amount of revenue when it is successfully developed and the drug is finally launched on the market, but it requires a long period of development and there is a risk of abandoning the development in the middle. Drug Discovery Support Business, on the other hand, cannot be expected to generate large scale profits in the future like the Drug Discovery and Development Business, but it can steadily earn cash flow at present. Drug discovery ventures also require regular financing to cover large R&D costs, but the Company combines both businesses to complement short-term and medium- to long-term cash flows.

Drug Discovery and Development Business

This is in-house and/or joint development of antibody drug discovery in disease areas of high unmet medical needs. The Company receives up-front contract payments, milestone fees and royalties by licensing out intellectual property rights (patent rights, etc.) related to antibodies to pharmaceutical companies. Since 2017, the Company has been focusing more on drug discovery development rather than relying on the technology out-licensing of the ADLib®︎ system. See the following pages for the Company’s current pipeline.

Drug discovery and development – pipeline

Interview : Head of Development Division and Clinical Development Shose Taoka MPHARM, MBA

Out-Licensed Product

★ ADCT-701 (Humanized anti-DLK1 antibody ADC)

|

Target molecule |

DLK-1 |

|

Features |

Antibody-drug conjugate (ADC) of LIV-1205, a cancer therapeutic antibody targeting DLK-1, and PBD*1 *1Pyrrolobenzodiazepine: Drugs with antitumor properties |

|

Therapeutic Area |

Liver cancer, lung cancer, neuroblastoma etc. |

|

Patent |

Granted in Japan, US, EU, China etc. (Humanized anti-DLK1 antibody) |

|

Progress |

Out-licensed to ADC Therapeutics (Switzerland) in September 2017. ADC is developing it for clinical trials under development number ADCT-701. Currently preparing for IND*2 application |

*2 IND application: Investigational New Drug; Applying for clinical trials in the United States.

Under the license agreement with ADC Therapeutics, ADC is granted the license only for development for PBD. The Company obtains the development rights for ADCs other than PBD, ensuring the flexibility of strategic development of anti-DLK-1 antibodies including CBA-1205.

★LIV-2008/2008b (Humanized anti-TROP2 antibody)

|

Target molecule |

TROP-2 |

|

Therapeutic Area |

Breast cancer (TNBC), colorectal cancer, pancreatic cancer, prostate cancer, etc. |

|

Expectations |

LIV-2008 is a humanized monoclonal antibody targeting cell surface antigen “TROP-2” which is overexpressed in breast cancer, colon cancer, lung cancer and several types of solid cancers and also expected to play a key role in the proliferation of cancer cells. |

|

Patent |

Patents granted in Japan, US, Europe, China, etc. |

|

Progress |

In January 2021, signed a license agreement with Shanghai Henlius Biotech. Licensed development, manufacturing and marketing rights in China, Taiwan, Hong Kong and Macau with sublicense. Grant options for rights worldwide. |

Chiome will receive US$1mn as an upfront payment upon signing the Exclusive License Agreement. In case Henlius exercises the option rights as described above, the total value of the agreement which Henlius shall pay to the Company will be US$122.5mn. In addition, after the launch of LIV-2008/2008b or related products (Product), Chiome is eligible to receive royalties based on Henlius’s sales of the Product.

In-house pipeline

☆CBA-1205 (Humanized afucosylated anti-DLK1 antibody)

First in class

|

Target molecule |

DLK-1 |

|

Features |

Antibodies for cancer treatment that identify and attack a protein called DLK-1, which is unique to hepatocellular carcinoma, etc. |

|

ADCC |

GlymaxX (ProBioGen) |

|

Therapeutic Area |

Intractable carcinomas such as hepatocellular carcinoma and lung cancer, etc. |

|

Expectations |

DLK-1 controls the proliferation and differentiation of immature cells such as stem cells and progenitor cells, and has been expressed on the surface of multiple cancer cells including liver cancer and is involved in its proliferation. A molecule that has become a potential target for new cancer treatments. First-in-class candidate antibody without competitors |

|

Patent |

Patents granted in Japan, US, Europe, China, etc. |

|

Progress |

The first patient has been dosed CBA-1205 in First-in-Human Phase 1 study at the National Cancer Center in July 2020, and the first half of the phase 1 clinical trial is progressing steadily. Moving to Part 2nd half 2021 |

☆CBA-1535 (Humanized anti 5T4 antibody, multi-specific antibody)

|

Target molecule |

5T4xCD3x5T4 |

|

Background |

Cancer therapeutic antibody created using Tribody technology that recognizes three molecules. |

|

Therapeutic Area |

Malignant mesothelioma, small cell lung cancer, non-small cell lung cancer, triple negative breast cancer (TNBC), etc. |

|

Expectations |

A multispecific antibody that targets the known (known) cancer antigen 5T4, which has been confirmed to be safe as a clinical target, and the protein CD3 on T cells, which are immune cells. It induces T cell proliferation and activation and exerts strong cytotoxic activity (T Cell engager antibody). This is the first clinically developed item for Tribody, and is expected to be effective against intractable cancer. |

|

Patent |

Patents granted in Japan, UK and US. Patent pending in Europe, China, etc. |

Transferred technology to Celonic (Switzerland), a CMO* for trial manufacturing of APIs. Regulatory submission for Phase 1 initiation was expected at the end of 2021 or later. However, due to the pandemic of COVID-19 in the UK, 5T4 study in Japan should be considered as an alternative plan.

☆BMAA (Humanized anti-Semaphorin3A antibody)

First in class

|

Target molecule |

SEMA3A |

|

Background |

An antibody obtained by humanizing the anti-semaphorin 3A antibody acquired by the Company’s original antibody generation technology ADLib®︎ system. Established as an antibody with both selectivity and function inhibitory activity through joint research with Professor Yoshiro Goshima of Yokohama City University. |

|

Therapeutic Area |

Diabetic macular edema (DME) |

|

Expectations |

A drug that suppresses the onset of DME at an earlier stage than the only anti-angiogenic drugs used for DME (anti-VEGF drugs: Eylea, Lucentis) |

|

Patent |

Patents granted in Japan, US and Europe |

|

Progress |

From March 2018, SemaThera has been conducting evaluations based on option contracts. SemaThera will continue research and development of Sema 3A inhibitors in ophthalmology area and Chiome regains full rights to anti-Semaphorin 3A antibody for further development and licensing in all fields. |

* CMO: Contract Manufacturing Organization; Contract manufacturing organization for pharmaceutical products. A company that provide drug development and drug manufacturing services to a pharmaceutical company

☆PCDC: anti-X antibody for Antibody Drug Conjugate forma

First in class

Newly added to the pipeline as an ADC antibody. As an anti-Target-X humanized antibody against Target-X (expressed in a wide range of solid cancers including cancer types resistant to standard treatment. Lung, colorectal, pancreas, breast, ovarian cancer, etc.), a safe area is expected. Patent application have been filed and the Company has started activities to derive ADC applications.

As for the pipeline developed in-house, in addition to the above four projects, five drug discovery projects are under the activities aimed at development and out-licensing.

Drug Discovery Support Business

The Drug Discovery Support Business earns revenues from antibody generation service by using platform technology that Chiome possesses to support drug discovery research at pharmaceutical companies, or for diagnostic and research purposes at academia or institutes on fee-for-service scheme. It is a “high value-added contract research business” that provides antibody generation, antibody engineering, and protein preparation utilizing the antibody drug discovery technology platform owned by the Company. It is mainly for major domestic pharmaceutical companies and generates stable profits. It complements the Drug Discovery and Development Business, whose earnings are not stable and take time to come in. TSE Mothers requires listed companies to earn sales of at least ¥100mn/year and the revenue from this business help meeting the criteria. In addition, contract research business is expected to contribute to the expansion of the Drug Discovery and Development Business transactions in the future.

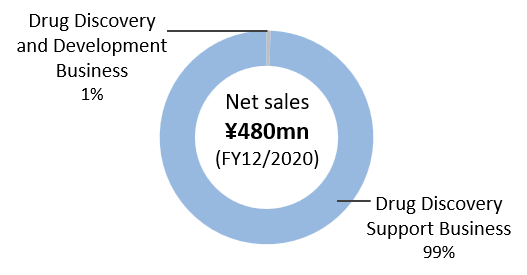

Chugai Pharmaceutical has been a major client for Drug Discovery Support Business. In recent years, the Company has been aggressively developing other business partners. Sales exceeded ¥400mn in FY12/2019 and FY12/2020, which made this business a main revenue stream accounting for more than 90% of the Company’s sales.

|

Major clients in Drug Discovery Support Business |

Contract date |

|

Chugai Pharmaceutical Co., Ltd. |

June, 2011 |

|

Chugai Pharmabody Research Pte. Ltd |

August, 2012 |

|

Mitsubishi Tanabe Pharma Co., Ltd. TANABE RESEARCH Laboratories U.S.A., Inc. |

December, 2016 |

|

Ono Pharmaceutical Co., Ltd. |

October, 2018 |

|

Kyowa Kirin Co., Ltd. |

July, 2019 |

Source: Omega Investment from Company data

In May 2021, the Company signed a collaborative research agreement for antibody discovery and development for diagnostic use with Mologic Ltd. (UK). Mologic is a leading developer of lateral flow and rapid diagnostic technologies, products and services. They provide fast, reliable and accurate point-of care diagnostic. Chiome uses the ADLib®︎ system to generate antibodies against multiple infectious disease antigens and evaluates them as diagnostic drug candidates in collaboration with Mologic., and Chiome will receive research fees from Mologic, and under the agreement, royalties if Mologic receives profits from the diagnostic products including antibodies generated by Chiome.

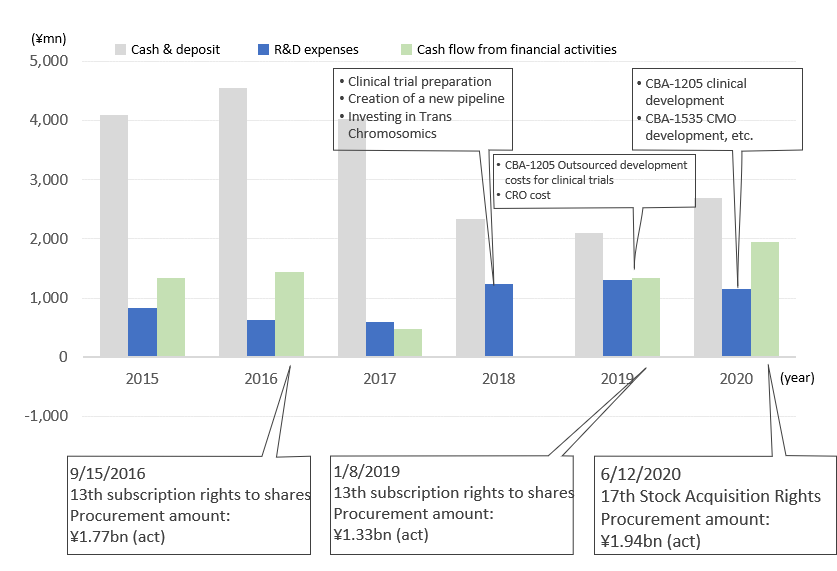

R&D investment and finance trends

For drug discovery venture companies that require a large amount of R&D funds over a long period of time, stable finance is extremely important to make commercial success and survive. In 2017, the management of the Company decided to shift the focus to the Drug Discovery and Development Business, and financing became an even more important task in order to promote the business vigorously.

In September 2016, January 2019 and June 2020, the Company raised funds through third-party allotment by issuing stock acquisition rights. The issuance of new shares through a public offering or third-party allotment would have a serious impact on the stock price, because if the Company is to raise the whole required fund in one go, it will cause huge dilution at once. In addition, bank borrowing will impair financial soundness as debt ratio increases. Although other financing methods are possible (MSCB, etc.), subscription rights is agile and takes into consideration the impact on existing shareholders.

Trends in cash and deposit balance, R&D expenses and cash flow from financial activities

As a result, however, dilution has occurred by about 20% each time due to the resulting new shares, and the existing shareholders are burdened with it. It can be said that it added to the downtrend of stock prices in recent years (see chart on page 13). In promoting finance further, it is important that the Company achieves steady research and development results, so the shares are valued well by investors.

Details of financing by issuing stock acquisition rights

|

13th Stock Acquisition Rights |

14th Stock Acquisition Rights |

17th Stock Acquisition Rights |

|

|

Allocation date |

September 15, 2016 |

January 8, 2019 |

June 12, 2020 |

|

No. of stock acquisition rights issued |

5,567 |

6,428 |

70,000 |

|

No. of stock acquisition rights exercised |

4,220 (Number of amortized stock acquisition rights: 1,347, September, 2018) |

6,428 |

70,000 |

|

Issuance price |

¥4,514 per stock acquisition right (Total ¥25,129,438) |

¥709 per stock acquisition right (Total ¥4,557,452) |

¥101 per stock acquisition right (Total ¥7,070,000) |

|

No. of potential shares due to the issuance |

5,567,000 shares |

6,428,000 shares |

7,000,000 shares |

|

Maximum dilution rate |

24.81% |

24.01% |

21.04% |

|

Allocate destination |

Merrill Lynch Japan Securities |

Merrill Lynch Japan Securities |

SMBC Nikko Securities |

|

Amount of funding (plan) |

¥2,894,402,438 (Approximate amount of deduction) |

¥1,482,281,452 (Approximate amount of deduction) |

¥2,414,070,000 (Approximate amount of deduction) |

|

Amount of funding (actual) |

¥1,777mn |

¥1,336mn |

¥1,941mn |

|

Specific use of raised funds (Amount; Timing) |

Preparation for clinical trials and implementation of initial clinical trials ¥1,300mn; 1/2017〜12/2019 |

Pre-IND submission and early-phase clinical trials for CBA-1535 ¥1,200mn; 4/2019〜12/2021 |

Pre-clinical study for a new ADC pipeline and research on discovery projects in oncology and infectious/rare diseases. ¥1,764mn; 7/2020〜12/2022 |

|

Creation and introduction of new pipelines ¥300mn; 12/2016〜12/2018 |

Expansion and licensing-in of new pipelines ¥282mn; 1/2019〜12/2020 |

Development of new pipeline by utilizing multispecific antibody generation technology (Tribody) ¥250mn; 7/2020〜6/2022 |

|

|

Investing in companies with advanced technology and seeds, M&A ¥1,294mn; 10/2016〜12/2018 |

Acquisition of new antibody generation technologies and new pipelines. ¥400mn; 1/2021〜12/2022 |

Source: Omega Investment from Company materials

Focus on investment in drug discovery bio-venture

1) Promising pipeline

Drug discovery bio-ventures have a business model that is significantly different from other industry, and investment requires scrutiny from a unique perspective. While securing short-term revenue from the Drug Discovery Support Business, the Company has shifted its focus to the Drug Discovery and Development Business. Usually, drug discovery ventures have their own technology and drug discovery candidate compounds and develop their research and development until the initial drug efficacy is seen in preclinical or clinical trials. Large-scale clinical trials after that are licensed out to major pharmaceutical companies. According to various surveys*, the probability of launching of a drug candidate reaching Phase 1 is around 10%. It means that it is necessary to always run at least about 10 products in the pipeline.

The Company currently has two out-licensed products. As to the in-house pipeline, 4 products are under clinical and preclinical studies, and 5 products are under exploratory research, so the line-up looks decent. LIV-1205 was licensed out in September 2017, and so was LIV-2008/2008b in January 2021. The Company is achieving results in terms of pipeline monetization.

Surveys*: ‘Clinical Development Success Rates 2006-2015’ Amplion, Biomedtracker, BIO 2016, etc.

(General) profit image of drug discovery business

2) Finance capabilities

As mentioned in the previous chapter, in order to continue the drug discovery business, the Company needs R&D expenses of about ¥1bn every year, and its financing is an important issue. Over the last few years, it has been agile in raising funds through the issuance of stock acquisition rights, but with these three new stock issuances, the dilution of existing shareholders has reached 44%. With regard to the fund raising going forward, there is a concern that the current market capitalization of about ¥10bn may be diluted further if new shares are issued to the tune of ¥1 to 2bn. To neutralize this, there must be good stock price rise.

3) Information disclosure system with consideration for transparency

Once again, if the drug discovery business makes success, you can expect big returns, but the risks are also very high. Dreaming of a long-term payback, drug discovery companies continue investment. Also, compared to other technology companies, it is not easy for an amateur to understand the business in detail for lack of knowledge. Preclinical results do not necessarily mean success in humans, and only champion data (best results) may be published when disclosing information. In the medium to long term, it will be negative for both venture companies and investors if companies show excessively optimistic outlooks and expectations for future without giving due consideration.

Based on the reflection that the information disclosure was not proper under the former management team, the new management strives to disclose accurate and highly transparent information. In addition to reviewing the internal compliance system and risk management system, President Kobayashi seems to be very positive about information disclosure and appearing on the video messaging. Hopefully, highly transparent disclosure should contribute to creating fair stock value.

4) Robust and reliable management team

Being high-risk, high-return and requiring high expertise, the management of drug discovery venture must have extremely advanced management skills. All the directors and corporate auditors on the Company’s management team have long experience in the R&D and management departments of top companies in the pharmaceutical industry and academia. In addition, President Kobayashi has overseas work experience, which should help the Company work on creating business opportunities such as alliances with overseas companies. At present, the management is seen to meet the criteria of solidity and high reliability.

Financial results

1) FY12/2020 financial results: 7.4% increase in Net sales, ¥120mn reduction in operating loss

The Company’s full-year financial results for the fiscal year ending December 2020 was Net sales of ¥480mn (up 7.4% over the previous year), operating loss of ¥1,283mn (¥1,401mn loss in the previous year), and ordinary loss of ¥1,291mn (¥1,410mn loss in the previous year) and net loss of ¥1,293mn (¥1,403mn loss in the previous year).

The Drug Discovery and Development sales has decreased significantly from ¥29mn to ¥3mn, without the milestone income of ADCT-701 and the option fee for the BMAA evaluation period in the previous fiscal year. The Drug Discovery Support Business earned sales of ¥477mn, which saw an increase of ¥59mn from the previous year thanks to rising contract research transactions and accounted for more than 99% of total sales. R&D expenses were ¥1,156mn and decreased by ¥142mn from the previous year, as the cost of CBA-1205 formulation dropped.

The balance of cash and deposits at the end of FY12/2020 was ¥2.6bn, an increase of ¥580mn from the end of FY12/2019. Although operating cash flow was negative at ¥1,360mn, this was more than offset by to positive cash flow from financing activities, which registered at ¥1,944mn on the issuance of shares by the exercise of stock acquisition rights.

a) Drug Discovery and Development Business (see figure on page 5 for pipeline)

- Phase 1 clinical trial of antibody CBA-1205 for cancer treatment started in July 2020

- CBA-1535: The process of manufacturing investigational drug begins for clinical development. Patents granted in Japan, UK and US.

- Agreed to change the license agreement with ADCT and ADCT’s right is narrowed down to develop only PBD related ADC. Chiome secure development and license rights for other ADC of CBA-1205 and strength the Company’s position in development and licensing. This amendment will also give more flexibility to the Company and hence increase the corporate value.

b) Drug Discovery Support Business

- Sales Increased 14.4% YoY by expanding business with major customers

- The Company provided technical support services to new customers, including antibody generation for COVID-19 by leveraging know-hows in protein production and ADLib® systems.

Revenue trends

| JPY, mn, % | Net sales | YoY % | Oper. profit | YoY % | Ord. profit | YoY % | Profit ATOP | YoY % | EPS (¥) | DPS (¥) |

|---|---|---|---|---|---|---|---|---|---|---|

| 2017/12 | 259 | 3.0 | -887 | – | -883 | – | -882 | – | -33.48 | 0.00 |

| 2018/12 | 212 | -18.1 | -1,539 | – | -1,533 | – | -1,533 | – | -57.26 | 0.00 |

| 2019/12 | 447 | 110.3 | -1,401 | – | -1,410 | – | -1,403 | – | -44.61 | 0.00 |

| 2020/12 | 480 | 7.4 | -1,283 | – | -1,291 | – | -1,293 | – | -39.06 | 0.00 |

| 2021/12 (CE) | – | – | – | – | – | – | – | – | – | 0.00 |

| 2020/12 Q1 | 90 | 42.3 | -426 | – | -424 | – | -425 | – | -12.78 | – |

| 2021/12 Q1 | 246 | 171.3 | -155 | – | -149 | – | -160 | – | -4.00 | – |

c) Technology

- The patent of human ADLib® system was granted in Japan.

For the outlook of FY12/2021, it is expected that the preparations for Phase 1 clinical trials and clinical development each pipeline in the Drug Discovery Business will proceed well. Drug Discovery Support Business sales will reach ¥530mn, up 11% from the previous year, by continuing to expand its customer base as well as increasing revenue from existing customers.

2) FY12/21 Q1 financial results ~ 171.3% increase in Net sales, OL decreased by ¥270mn

The Company’s FY12/2021 Q1 financial results was net sales of ¥246mn (up 171.1% YoY), operating loss of ¥155mn (¥426mn loss in the previous year), and ordinary loss of ¥149mn (¥424mn loss in the previous year) and net loss of ¥160mn (¥425mn loss in the previous year).

The Drug Discovery and Development Business recorded a up-front income for the out-licensing contact of LIV-2008/2008b, resulting in sales of ¥103mn (¥0mn the previous year). Sales of the Drug Discovery Support Business were ¥143mn, increasing %53mn YoY thanks to stable transactions with existing customers. R&D expenses amounted to ¥216mn and declined by ¥126mn YoY. This is thanks to the decrease in the cost of CBA-1205.

The topics in Q1 are as follows.

a) Drug Discovery and Development Business

- CBA-1205: Dose escalation part of Phase I Study to see safety is going well on track at National Cancer Center Hospital. Expect moving to Part 2 in HCC patients in 2nd half 2021

- LIV-2008 / LIV-2008b licensed to Shanghai Henlius Biotech, Inc. (January 2021, license agreement)

b) Drug Discovery Support Business

- Sales grew by 59% YoY due to increased transactions with major customers

- A joint research agreement was signed with Mologic Ltd. (UK) to generate diagnostic antibodies

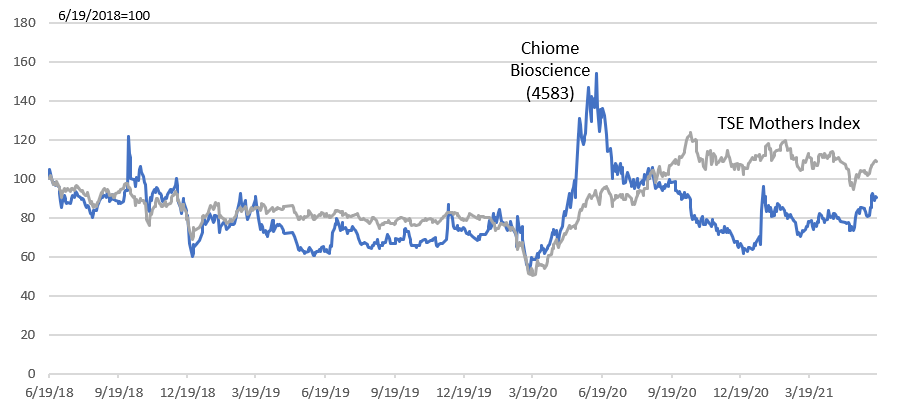

Stock price trends

Drug discovery bio-ventures have limited short-term revenue and losses are expected for long term, and common stock price valuation methods cannot be applied. DCF and the likes are difficult to use considering the unclear sales scale at the time of drug launching in future and the uncertainties until that. There will be no choice but to make a comprehensive judgment by scrutinizing the progress of the pipeline and the financing capabilities.

The Company’s stock price has been on a downward trend after a major adjustment in 2014. The Company adopted a new management in 2017 and started focusing on the Drug Discovery Business. The management team actively invested in the business by securing the necessary funds. The progress was developed well, with two out-licensing contracts, so the drug discovery business is seen to be proceeding steadily.

One of the events to draw investors’ attention in the future is the progress of CBA-1205 (humanized anti-DLK-1 monoclonal antibody), which is being developed in the in-house pipeline. The Company is conducting its own Phase 1 clinical trials, which is proceeding ahead of schedule, demonstrating the Company‘s high R&D capabilities. CBA-1205 is a first-in-class intractable cancer therapeutic antibody. Liver cancer, which is a hypothetical indication, is the second leading cause of cancer-related death in the world and is expected to have great market size. When the Company announced the conclusion of a clinical trial contract with the National Cancer Center in July 2020, the stock price reacted significantly. The clinical trial is scheduled to proceed to Part 2 of the phase 1 clinical trial in the latter half of 2021. Further progress of the clinical trials and signs of initial drug efficacy should influence the stock price to a greater extent.

Stock price transition (last 5 years)

Mothers Index Chart for TSE (last 3 years)

Financial data

| FY (¥mn) | 2012/3 | 2013/3 | 2014/3 | 2014/12 | 2015/12 | 2016/12 | 2017/12 | 2018/12 | 2019/12 | 2020/12 |

| [Statements of income] | ||||||||||

| Net sales | 633 | 324 | 435 | 278 | 280 | 252 | 260 | 213 | 448 | 481 |

| Cost of sales | 213 | 119 | 174 | 89 | 138 | 138 | 85 | 102 | 163 | 236 |

| Gross profit | 420 | 205 | 261 | 189 | 142 | 114 | 174 | 111 | 285 | 245 |

| SG&A expenses | 427 | 618 | 970 | 1,054 | 1,412 | 1,157 | 1,062 | 1,650 | 1,687 | 1,529 |

| R&D expenses | 178 | 309 | 443 | 575 | 828 | 627 | 592 | 1,230 | 1,299 | 1,157 |

| Operating loss | -7 | -413 | -709 | -866 | -1,270 | -1,042 | -888 | -1,539 | -1,402 | -1,284 |

| Non-operating income | 2 | 1 | 20 | 2 | 20 | 8 | 7 | 5 | 5 | 5 |

| Non-operating expenses | 37 | 13 | 17 | 20 | 4 | 12 | 2 | 14 | 13 | |

| Ordinary loss | -43 | -425 | -706 | -883 | -1,254 | -1,047 | -884 | -1,534 | -1,410 | -1,292 |

| Extraordinary income | 3 | 6 | 5 | 3 | 9 | 1 | ||||

| Extraordinary expenses | 37 | 2 | 30 | 460 | 2 | |||||

| Loss before income taxes | -43 | -425 | -743 | -886 | -1,281 | -1,501 | -880 | -1,531 | -1,401 | -1,291 |

| Total income taxes | 2 | 2 | 19 | 0 | 2 | -10 | 2 | 2 | 2 | 3 |

| Net loss | -44 | -427 | -758 | -863 | -1,283 | -1,491 | -883 | -1,534 | -1,404 | -1,294 |

| [Balance Sheets] | ||||||||||

| Current assets | 1,096 | 1,085 | 4,515 | 5,737 | 4,274 | 4,682 | 4,197 | 2,610 | 2,561 | 3,249 |

| Cash equivalents and ST marketable securities | 1,013 | 989 | 4,350 | 5,576 | 4,100 | 4,553 | 4,027 | 2,329 | 2,106 | 2,686 |

| Non-current assets | 169 | 212 | 498 | 520 | 645 | 108 | 223 | 221 | 247 | 246 |

| Tangible assets | 146 | 117 | 373 | 399 | 436 | 35 | 23 | 16 | 11 | 7 |

| Investments and other assets | 14 | 86 | 73 | 73 | 187 | 72 | 200 | 205 | 235 | 238 |

| Total assets | 1,266 | 1,297 | 5,013 | 6,257 | 4,919 | 4,789 | 4,419 | 2,831 | 2,808 | 3,494 |

| Current liabilities | 212 | 238 | 347 | 295 | 238 | 169 | 161 | 113 | 145 | 342 |

| Short-term borrowings | 80 | 111 | 21 | 46 | 50 | 4 | 180 | |||

| Non-current liabilities | 9 | 21 | 107 | 123 | 117 | 55 | 41 | 41 | 41 | 41 |

| Total liabilities | 220 | 259 | 454 | 418 | 355 | 224 | 202 | 154 | 186 | 384 |

| Total net assets | 1,046 | 1,038 | 4,559 | 5,839 | 4,564 | 4,565 | 4,218 | 2,677 | 2,621 | 3,109 |

| Total shareholders’ equity | 1,046 | 1,038 | 4,515 | 5,827 | 4,564 | 4,565 | 4,218 | 2,677 | 2,622 | 3,110 |

| Capital stock | 1,028 | 1,213 | 3,349 | 4,435 | 4,445 | 5,186 | 5,455 | 5,455 | 6,132 | 1,387 |

| Legal capital reserve | 1,018 | 1,203 | 3,339 | 4,425 | 4,435 | 5,176 | 5,445 | 5,445 | 6,122 | 2,987 |

| Retained earnings | -1,000 | -1,427 | -2,185 | -3,048 | -4,344 | -5,835 | -6,717 | -8,251 | -9,654 | -1,293 |

| Subscription rights to shares | 49 | 13 | 17 | 28 | 37 | 36 | 28 | 22 | 28 | |

| Total liabilities and net assets | 1,266 | 1,297 | 5,013 | 6,257 | 4,919 | 4,789 | 4,419 | 2,831 | 2,808 | 3,494 |

| [Statements of cash flows] | ||||||||||

| Cash flow from operating activities | -49 | -373 | -552 | -789 | -1,245 | -970 | -867 | -1,689 | -1,537 | -1,360 |

| Loss before income taxes | -43 | -425 | -743 | -886 | -1,281 | -1,501 | -880 | -1,531 | -1,401 | -1,290 |

| Cash flow from investing activities | -4 | -115 | -189 | -619 | -1,780 | 1,989 | -137 | -26 | -3 | |

| Purchase of investment securities | -1,189 | -3,812 | -301 | -150 | ||||||

| Cash flow from financing activities | 419 | 463 | 4,103 | 2,131 | 124 | 1,434 | 479 | -10 | 1,341 | 1,944 |

| Proceeds from issuance of common shares | 465 | 366 | 4,200 | 2,152 | 21 | 1,461 | 529 | 1,346 | 1,769 | |

| Net increase in cash and cash equiv. | 367 | -25 | 3,361 | 726 | -2,818 | 2,453 | -526 | -1,699 | -222 | -580 |

| Cash and cash equiv. at beginning of period | 646 | 1,013 | 989 | 4,350 | 4,918 | 2,101 | 4,553 | 4,027 | 2,329 | 2,105 |

| Cash and cash equiv. at end of period | 1,013 | 989 | 4,350 | 5,076 | 2,101 | 4,553 | 4,027 | 2,329 | 2,105 | 2,686 |

| FCF | -53 | -488 | -741 | -1,408 | -3,025 | 1,019 | -1,004 | -1,689 | -1,563 | -1,364 |

Company Profile

Company Profile

Sales by segment

Chiome Bioscience Inc.

【Headquarters, Research Laboratories】

Sumitomo-Fudosan Nishi-shinjuku bldg. No.6,

3-12-1 Honmachi, Shibuya-ku, Tokyo

【Drug Discovery Laboratories】

Teikyo University Biotechnology Research Center 1F, 2-13-3 Nogawahonmachi,

Miyamae-ku, Kawasaki-city, Kanagawa

Number of Employees : 42 (Average temporary workforce : 14)

History

| Month/Year | Event |

| Feb. 2005 | Chiome Bioscience Inc. (capital: ¥10mn) was established in the Bunkyo district of Tokyo to commercialize the ADLib® system developed through the collaboration of the Genetic Dynamics Research Unit at RIKEN and the Saitama Small and Medium Enterprise Development Corporation (currently Saitama Industrial Development Corporation). |

| Apr. 2005 | Concluded an agreement with RIKEN to commercialize the ADLib® system, and research activities begins. |

| May 2005 | ADLib® System was described in the journal Nature Biotechnology as “an innovative rapid antibody generating technology to be the first in the world that employs promotion of DNA recombination.” |

| Jul. 2005 | Obtained an exclusive license to commercialize platform technology (the ADLib® System) from RIKEN Institute and the Japanese Science and Technology Agency. And CHIOME can sublicense this technology to other third parties. |

| May 2008 | The R&D Division has relocated to RIKEN-WAKO Incubation Plaza to allow for the expansion of research facilities. |

| Aug. 2010 | Concluded a payment based technology transfer agreement with the Japan Science and Technology Agency on the platform technology – the ADLib® System. |

| Dec. 2011 | Listed on Tokyo Stock Exchange Mothers. |

| Dec. 2013 | Acquired a majority of Liv Tech, Inc.’s capital. |

| Jul. 2015 | Merged with Liv Tech, Inc. |

| Oct. 2015 | Invested in EVEC, Inc. |

| Feb. 2017 | Acquired new shares of Trans Chromosomics, Inc. issued in a third- party allotment. |

| Sep. 2017 | Executed a License Agreement with ADC Therapeutics SA for the development, manufacture, and commercialization of an ADC of LIV-1205. |

| Dec. 2018 | Executed an Asset Purchase Agreement of Tb535H (currently CBA-1535) and Trisoma® technology with Biotecnol Limited |

| Jan. 2021 | Executed a License Agreement with Shanghai Henlius Biotech, Inc. for the development and commercialization of the anti-TPOR-2 antibodies, LIV-2008/2008b |

Management (Director)

President, CEO: Shigeru Kobayashi

Executive Director, CFO: Arihiko Bijohira

| Shigeru Kobayashi has previously worked at Kyowa Hakko Kogyo Co., Ltd. (currently Kyowa Kirin Co., Ltd.). He has also served as the President at Kyowa Hakko UK, Ltd. (currently Kyowa Kirin Ltd.) and Kyowa Pharmaceutical, Inc. (currently Kyowa Kirin Pharmaceutical Development, Inc.) |

| Arihiko Bijohira has previously worked at Institute of business Consulting and Investment Co., Ltd., Pfizer Japan Inc. and Taiho Pharmaceutical Co. Ltd. |

Executive Director: Akiyuki Furuya

Executive Director: Haruhisa Kubota

| Akiyuki Furuya has previously served as Executive Director of Daiichi Pharmaceutical Co., Ltd (currently Daiichi Sankyo Co., Ltd),and as President & CEO of Daiichi radioisotope laboratories, LTD (currently FUJIFILM RI Pharma Co., Ltd), and as President & CEO of Perseus Proteomics Inc. |

| Haruhisa Kubota has previously worked at Ministry of Health and Welfare, Pharmaceuticals and Medical Devices Agency (PMDA) and Japan Association for the Advancement of Medical Equipment (JAAME). He also served as Managing Executive Officer at Daiichi Sankyo Co., Ltd., and as Executive Vice President at Daiichi Sankyo Biotech Co., Ltd. He currently works at Clinical Research Center of National Center for Global health and Medicine. |

Status of major shareholders

| Name | Number of shares owned | Ratio of the number of shares owned to the total number of issued shares (%) |

| SBI SECURITIES Co., Ltd. | 1,172,479 | 2.96 |

| Rakuten Securities, Inc. | 985,600 | 2.49 |

| Kunihiro Ohta | 962,700 | 2.43 |

| Matsui Securities Co., Ltd. | 813,700 | 2.05 |

| Monex, Inc. | 418,015 | 1.05 |

| Tetsuo Iisaku | 377,000 | 0.95 |

| Daiwa Securities Co. Ltd. | 322,300 | 0.81 |

| Takehiko Shibata | 273,000 | 0.69 |

| Japan Securities Finance Co., Ltd. | 265,400 | 0.67 |

| Fukutaro Yamato | 251,400 | 0.63 |

| Total | 5,841,594 | 14.78 |

Source : The Company annual report (FY12/20)