Tri-Stage

| Securities Code |

| TYO:2178 |

| Market Capitalization |

| 12,421 million yen |

| Industry |

| Service |

This writeup briefly summarizes the investment perspective and the main points of the business. For more information about the business, we recommend Shared Research report on the company website and the cartoon that introduces some business scenes.

Investment view

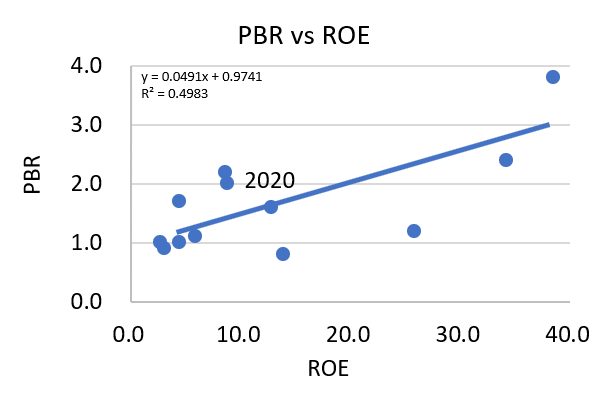

Investors looking at stocks in the marketing service sector, which is trading on 5 x book value, may tend to chase near-term business performance and sales momentum. However, we believe the attraction of the company’s shares lies in the outlook of structural improvement of the return on shareholder capital over a longer term. This comes as a result of the management plan that started in February 2019, whose essence is structural reform. In fact, the company’s management team conducted selection and deselection of their businesses in FY2/2020, and is delivering positive results by proving the added value of the TV business, WEB business, and DM business. Recently, the management has scaled down overseas business. They set a goal of net income of JPY1.3bn for FY2/2024, which looks like a realistic number. If this goal is achieved, ROE could get close to 20%. Turning to shares, they have been largely out of favour for a long time since the 2008 IPO. However, if organic growth of ROE is confirmed by investors, the stock price premium should expand. There is a high correlation between the company’s ROE and PBR.

Business landscape

The TV shopping market in Japan has matured and competition is fierce. Therefore, there is strong demand for consulting and solution businesses by mail-order companies that are trying to gain an advantage over competitors, and it is thought that the company has abundant opportunities to add value to its service. In this environment, it was timely for the company to shift to a strategy of incorporating DX and various innovations into direct marketing, including the use of AI. AI and DX should become cheaper and easier to obtain, so there is concern that other companies eventually catch up in the long run. However, in viewing the next five years, investors need not forecast the company excessively cautiously, because it is the only player that has abundant mail-order media handling volume and accumulated data and provides comprehensive support services from upstream to downstream of mail-order. The management’s new strategy could contribute to the momentum of the core business in a relatively short period of time rather than long.

Thoughts on valuations

On the other hand, the current PBR suggests to us that the company’s ROE, which has been good at just over 12% since last year, has not been evaluated in the share price very much. One of the major reasons could be the company’s governance structure, as well as the poor track record of a five year average ROE of only 3.5%. The company is Sojitz’s (TYO2768) equity-accounted affiliate, and Sojitz is the second largest shareholder with a 18.9% stake. In fact, 67.8% of all the shares are held by Sojitz and insiders, mainly the founders. In addition, the company runs a poison pill, a structure that is unlikely to reflect the dissenting opinions of minority shareholders. The proportion of outside directors is 28%. All put together, it is presumed that the company will unlikely be listed in the stock pick candidates of investors who place importance on fair governance for minority investment. There are almost no institutional investors or foreigners in the company’s shareholder list. Tri-stage is a good company, being able to capture opportunities created by business model innovations and changes in the environment, and it is thought to have the ability to increase the value of its business. In collaboration with Sojitz, that ability may be reinforced. It would be a shame if Tri-stage does not appear on the menu of long-term investors who are thinking about decades ahead, or if investors discount the fair value of the shares for reasons of unfair governance.

Business

[Sales composition%, Operating profit margin%] Direct marketing support 58 (4), DM38 (2), Overseas 2 (3), Retail 2 (-13) (FY02 / 2021)

The company was founded in CY2006 by a founder from Daiko Advertising Inc., an advertising agency under the wing of Hakuhodo DY Holdings (TYO 2433). It is a business that provides total support for mail order operation (direct marketing). Mail order operation requires both acquiring new customers and promoting repeat contracts. The company’s main businesses are the TV business (in the direct marketing support segment), the WEB business (in the direct marketing support segment), and the DM (direct mail) business.

The founder, Mr. Senoo, explains the company’s strengths as follows. 1) Optimal media suggestion based on rich data, 2) Video production that sells well based on logic, 3) Ordering system specializing in TV shopping.

In the TV shopping business, the company provides consulting and solution services such as media selection, sales promotion planning, and provision of order call centers. The company trades with about 150 customers, and the revenue composition ratio by product is health food / pharmaceutical 50%, cosmetics 25%, household goods 15%, and food 10%. This mix is attributable to two major customers that primarily sell health foods, pharmaceuticals, and beauty cosmetics. The top five customers account for half of sales. The WEB business is the business of its subsidiary Adflex Communications Co., Ltd., which provides AI tools aimed at improving the advertising of direct marketing companies. The DM business is Mail Customer Center Co., Ltd., which was acquired in November 2012. It sends direct mails to encourage consumers to continue purchasing. It handles 300 million mails a year, being the top in the industry.

Bulls

- Investors are interested in near-term performance and sales, but the company’s medium-term plan seems to be focused on improving profitability. This points to upside in the shares, which have been out of favour trading on lacklustre valuations. By FY2/2021, structural reforms and cost reductions progressed significantly, and sales had to decline but profitability improved visibly. ROE rose significantly to 12.7% thanks to the rapid improvement in profit margin. The high asset turn of more than 3 times is one of the attractions of Tri-stage, which makes the company’s ROE sensitivity to the bottom-line profit margin high. The forecast is that higher return on capital will be realized by maintaining lean operations by improving added value and asset efficiency. Operating cash flow improved significantly in FY2/2021 to reach the level since 2009. Consequently, free cash flow increased significantly.

- The good business results since last year due to the structural reform drove the stock price in 2020, but the stock price since the outset of 2021 has lost the momentum. It appears that stocks are not valued from a long-term perspective, and the impression is that they have been overlooked. Technically, stock prices are still in the oversold territory since the IPO.

- It is positive that management sets net income, which is directly linked to ROE, as the target of the business plan. The goal of doubling it in three years is challenging but looks realistic. ROE could reach nearly 20% if net income of 130 million yen is achieved in FY2/2024 if BS does not inflate so much from here. ROE for FY2/2022 is forecast to be less than 13%. There is a relatively high correlation between the company’s ROE and PBR, and it is possible that PBR, which is currently 1.6 times, will rise to about 2.0 if the net income target is achieved.

- Current business is not necessarily undergoing a big recovery, but top line sales are going more momentum, recovering from the gradual rebound. The momentum of TTM operating income and TTM operating profit margin has been stable in the last four quarters, suggesting that the company business is fairly solid despite the corona pandemic.

- Possibility of TOB by Sojitz. Sojitz made Plamatels Corporation, which was listed on JASDAQ, private by TOB in February 2021. However, Sojitz consolidates a total of 435 companies, including 303 subsidiaries and 132 equity-accounted affiliates. It is unlikely that Tri-Stage is at the top of Sojitz’s TOB candidate list.

Bear

- The shares performed well in the short period of time in 2020 and 2015, but the performance is flattish over five years. TSR has fallen short of TOPIX for 5 or 10 years, so the shares are a long-term underperformer. It has been a long while since the IPO in CY2008, and the long-term shareholders must have been disappointed. In the last six months, although the position was small, a certain US investor of good profile closed their investments in the company.

Total Shareholder Return

| 1M | 3M | 6M | YTD | 1Y | 3Y | 10Y | 20Y | IPO (Aug 2008) | |

|---|---|---|---|---|---|---|---|---|---|

| 2178 | 0.0 | -8.7 | -13.9 | 3.4 | -0.7 | -4.2 | 3.0 | 3.0 | 2.7 |

| TOPIX | -2.0 | -2.0 | 4.1 | 7.2 | 27.2 | 5.9 | 10.2 | 10.7 | 10.0 |

Made by Omega Investment by various materials

- The insider ratio is overwhelmingly high at 67.8%, and the dissenting opinions of minority shareholders are not reflected in the company management. The main breakdown is Mr. Maruta, the founder on the board, 21.5%, Sojitz 18.9%, Mr. Seno, the founding chairman of the board, 6.8%, and the treasury stock 17.9%. Mr. Fukuda, a director, also serves as the general manager of Sojitz’s business division. The proportion of outside directors is only 28%.

- The company runs a poison pill, which we consider unfair to minority shareholders. Management explains that one of the countermeasures against inappropriate acquirers is the free allotment of stock rights. The company states that the improper acquisition of its shares will hinder its value-enhancing operations under a capital and business alliance with Sojitz. There should not be many investors that concur with the idea that only Sojitz is permanently considered to be the best partner. Minority shareholders have no way of influencing the company with this thinking. Sojitz came to hold 18.94% of the company’s outstanding shares through the disposal of treasury stock by Tri-Stage’s third-party allotment in May 2016.

- The business model is simple, and AI technology and various DX methods, which are seen as extra strengths, will become cheaper and much easier to obtain in the future. Currently Tristage is the only company that provides all mail-order-related business support conceivable centering on TV shopping. But, as the management points out, there are many companies that compete for each business. Catch-up of other companies in the same industry or new entry poses a big risk in the long run.

- In part by the negative impact of structural reforms, the financial indicators important to shareholders have been left at levels significantly below their satisfaction over the past five years. BPS growth of CAGR +2.6% is way too low. Dividends have been cut back and dividend yield has halved. The average ROE of 3.5% is extremely disappointing for shareholders.

Price, Ratios

|

2015 |

2016 |

2017 |

2018 |

2019 |

2020 |

2021 |

5Yr Avg (%) |

|

|---|---|---|---|---|---|---|---|---|

|

Price Change |

55.3 |

4.1 |

-19.8 |

-45.7 |

15.6 |

48.4 |

-14.0 |

0.5 |

|

vs TOPIX (%) |

45.3 |

5.9 |

-39.5 |

-27.9 |

0.3 |

43.6 |

-21.9 |

-3.5 |

|

Div Yield (%) |

3.0 |

3.0 |

4.5 |

3.7 |

2.2 |

1.5 |

1.8 |

3.0 |

|

2/2016 |

2/2017 |

2/2018 |

2/2019 |

2/2020 |

2/2021 |

5Yr CAGR (%) |

||

|

Sales (Y-mn) |

3,712 |

47,268 |

55,721 |

53,764 |

50,427 |

47,783 |

5.2 |

|

|

EBIT |

895 |

1,395 |

1,032 |

810 |

596 |

1,320 |

8.0 |

|

|

Net Inc |

475 |

761 |

386 |

-992 |

183 |

849 |

12.3 |

|

|

EPS (Dil) (Y) |

17.2 |

27.2 |

13.2 |

-34.1 |

6.7 |

33.4 |

14.2 |

|

|

Divs PS (Y) |

18.75 |

22.52 |

10.00 |

7.00 |

7.00 |

7.00 |

-17.9 |

|

|

Shs Out (Dil) |

28 |

28 |

29 |

29 |

27 |

25 |

-1.7 |

|

|

BPS |

233 |

307 |

293 |

248 |

247 |

266 |

2.6 |

|

|

Cash&ST Inv (Y-mn) |

3,469 |

6,189 |

6,230 |

6,318 |

6,349 |

7,451 |

16.5 |

|

|

Assets |

9,880 |

16,695 |

18,020 |

16,296 |

15,524 |

15,226 |

9.0 |

|

|

LT Debt |

107 |

2,063 |

8,404 |

7,475 |

8,145 |

8,082 |

81.5 |

|

|

Net OP CF |

719 |

837 |

740 |

855 |

819 |

1,949 |

22.1 |

|

|

Capex |

-113 |

-222 |

-144 |

-173 |

-141 |

-94 |

na |

|

|

FCF |

678 |

782 |

709 |

769 |

762 |

1,931 |

23.3 |

|

|

2/2016 |

2/2017 |

2/2018 |

2/2019 |

2/2020 |

2/2021 |

5Yr Avg (%) |

||

|

Gross Margin % |

9.6 |

10.9 |

10.1 |

11.1 |

12.1 |

11.2 |

11.1 |

|

|

EBIT Margin % |

2.4 |

3.0 |

1.9 |

1.5 |

1.2 |

2.6 |

2.1 |

|

|

Net Margin % |

1.3 |

1.6 |

0.7 |

-1.8 |

0.4 |

1.8 |

0.5 |

|

|

ROA % |

4.1 |

5.7 |

2.2 |

-5.8 |

1.1 |

5.5 |

1.8 |

|

|

ROE % |

6.6 |

10.6 |

4.4 |

-12.7 |

2.7 |

12.7 |

3.5 |

|

|

Asset Turnover |

3.2 |

3.6 |

3.2 |

3.1 |

3.2 |

3.1 |

3.2 |

|

|

Assets/Equity |

1.8 |

1.9 |

2.1 |

2.4 |

2.3 |

2.3 |

2.2 |

Made by Omega Investment by various materials

- Retail business and overseas business have their own opportunities, and unrealized losses were written down. However, it should be tough to scale up these to levels that will have a significant impact on consolidated business results. ROIC may be sacrificed if the scale is chased in a short period of time. Fortunately, the management appears to be considering scaling down both businesses to avoid this.

Sub-sector

The market capitalization of the marketing services sector, which consists of 30 companies, is 518 billion yen. The top five companies account for 61% of the sector market capitalization. These are Appier Group (4180), Intage Group (4326), Aidma Holdings (7373), Macromill (3978), LEGS (4286). Tri-Stage ranks the 10th in market capitalization. This sub-sector belongs to the media business sector.