Tenpo Innovation

| Securities Code |

| TYO : 3484 |

| Market Capitalization |

| 15,543 million yen |

| Industry |

| Real estate business |

Observation

The company is an excellent niche that has achieved strong growth and an impressively high return on equity, while changing the controlling shareholder twice in the past due to the difficulties of these parent companies. Highly rated by investors, its market capitalization is nearly double that of its current parent company, Crops (TYO9428). TSR has been good since the IPO in October 2017. Since the actual start in 2005, the company has grown its business for a long time. Last year, due to concerns about the Corona disaster, the company’s stock underperformed TOPIX significantly. However, stocks are currently performing well. Despite some stagnation in the current momentum, business is running well overturning investor anxiety.

Total Shareholder Return

| 1M | 3M | 6M | YTD | 1Y | 3Y | 5Y | IPO (Oct 2017) | |

|---|---|---|---|---|---|---|---|---|

| 3484 | -2.3 | 1.8 | 4.5 | 7.9 | 43.7 | 14.5 | 12.8 | 12.8 |

| TOPIX | 0.5 | 1.0 | 6.2 | 10.3 | 28.4 | 6.9 | 5.0 | 5.0 |

Made by Omega Investment by various materials

Key Drivers

Tenpo Innovation is the only listed company that specializes in leasing for restaurants in the Tokyo metropolitan area. The company substantially acts on behalf of real estate owners to contract lease agreements with restaurants. The drivers of business expansion are constant demand generated by the intense moving in and out amongst 160,000 restaurants in the Tokyo metropolitan area, and the low lease cancellations with real estate owners, which leads to the steady accumulation of the number of leased properties. The latter has the background that under the Japanese Land Leasing Law, which generally considers lessees to be in a vulnerable position, leasing from real estate owners will continue unless Tenpo Innovation offers to cease.

BS is slim and is one of the factors of high ROE, because the company business requires inventory or equipment very little. Entrance barriers should be low. However, in the leasing business, the interests of many people are intricately intertwined involving real estate owners, real estate agents, open restaurants, and closing restaurants and opening restaurants. As such it is thought that the competitive edge, with which Tenpo Innovation creates excellent value, lies in its ability to proceed with contracts smoothly coordinating conflicting interests whilst utilising the long-time nurtured expertise in leasing for restaurants.

| Period | Revenue (mn, yen) | EBIT (mn, yen) | EPS (yen) | PER (X) | PER (X) | ROE (%) |

|---|---|---|---|---|---|---|

| 3/18 | 6,689 | 397 | 14 | 39.3 | 6.8 | 15.4 |

| 3/19 | 8,229 | 734 | 29 | 30.1 | 6.8 | 24.2 |

| 3/20 | 9,985 | 784 | 32 | 21.4 | 4.6 | 22.2 |

| 3/21 | 10,343 | 732 | 32 | 36.0 | 5.5 | 19.4 |

Conclusion

As far as shown in the business plan, the management does not seem to be ready to launch new innovations or renovations. Therefore, for the time being, there will unlikely be visible updates of the business model. The shares may well regain some premium in the short term, and business expansion could accelerate temporarily as the risk of Corona pandemic settles down, which should drive the share price performance. However, as per the next five years, the stock price premium will unlikely expand significantly. Rather, if the top line sales growth continues to slow, the shares could be derated gradually. There appear few serious business risks in the coming years. But in the longer term, competition should eventually become problematic due to low barriers to entry. The management maintains that with the company’s market share being just over 1% of the potential market demand there is large scope for growth. However, one has no idea as to at what percentage the company’s market share growth will saturate. In fact, the number of properties for leasing is increasing steadily, but the growth momentum is declining visibly. (Graph 2). In addition, if Crops fully consolidates the company through a share exchange, there is a risk that one day the shareholders suddenly own the shares of lacklustre growth and profits in exchange for the shares of Tenpo Innovation. The high premium attached to the company’s shares should contract if growth stocks lose popularity, and it is vice versa.

Price, Rations

| 2017 | 2018 | 2019 | 2020 | 2021 | Avg (%) | |

| Price Change | – | -22.4 | 49.7 | -18.5 | 7.7 | 4.1 |

| vs TOPIX (%^) | – | -4.6 | 34.5 | -23.3 | -1.2 | 1.4 |

| Div Yield (%) | – | 0.7 | 0.9 | 1.4 | 1.0 | 1.0 |

| 3/2018 | 3/2019 | 3/2020 | 3/2021 | 3/2022 CE* | CAGR to 3/2021 (%) | |

| Sales (Y-mn) | 6,689 | 8,229 | 9,985 | 10,343 | 11,334 | 15.6 |

| EBIT | 397 | 734 | 784 | 732 | 814 | 22.6 |

| Net Inc | 236 | 510 | 564 | 576 | 595 | 34.6 |

| EPS (Dil) (Y) | 13.8 | 28.8 | 31.7 | 32.3 | – | 32.8 |

| Divs PS (Y) | 4.00 | 7.00 | 9.00 | 9.00 | – | 31.0 |

| Shs Out (Dil) | 17 | 18 | 18 | 18 | – | 1.9 |

| BPS | 91 | 118 | 143 | 166 | – | 22.3 |

| Cash&ST Inv (Y-mn) | 1,686 | 1,862 | 2,543 | 2,909 | – | 19.9 |

| Assets | 6,974 | 8,587 | 10,234 | 10,430 | – | 14.4 |

| LT Debt | 0 | 0 | 0 | 0 | – | – |

| Net OP CF | 639 | 45 | 923 | 666 | – | 1.4 |

| Capex | -356 | -315 | -56 | -130 | – | -28.5 |

| FCF | 295 | 125 | 892 | 538 | – | 22.2 |

| 3/2018 | 3/2019 | 3/2020 | 3/2021 | 3/2022 CE* | Avg (%) | |

| Gross Margin % | 17.0 | 18.8 | 19.4 | 17.6 | – | 18.2 |

| EBIT Margin % | 5.9 | 8.9 | 7.8 | 7.1 | 7.2 | 7.4 |

| Net Margin % | 3.5 | 6.2 | 5.7 | 5.6 | 5.2 | 5.3 |

| ROA % | 3.4 | 6.6 | 6.0 | 5.6 | – | 5.4 |

| ROE % | 15.4 | 28.0 | 24.3 | 20.9 | – | 22.2 |

| Asset Turnover | 1.0 | 1.1 | 1.1 | 1.0 | – | 1.1 |

| Assets/Equity | 4.6 | 4.1 | 4.0 | 3.5 | – | 4.1 |

CE*: Company guidance

Key Stats 1

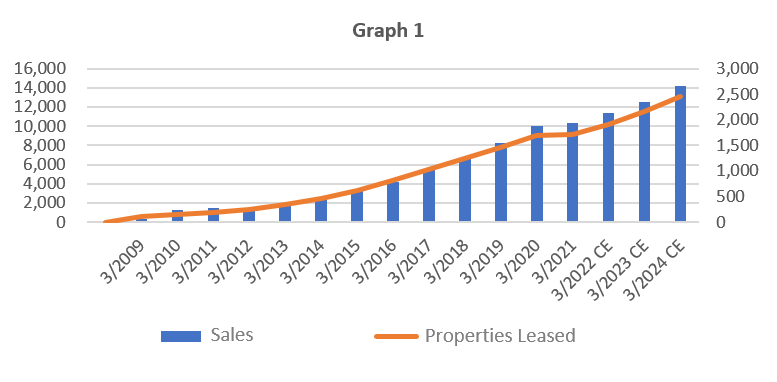

(3/2009~3/2017)

| 3/2009 | 3/2010 | 3/2011 | 3/2012 | 3/2013 | 3/2014 | 3/2015 | 3/2016 | 3/2017 | |

|---|---|---|---|---|---|---|---|---|---|

| Sales | 299 | 1,247 | 1,477 | 1,464 | 1,856 | 2,528 | 3,248 | 4,227 | 5,386 |

| Properties Leased | 115 | 148 | 180 | 243 | 342 | 470 | 614 | 815 | 1,029 |

| Contracts | – | – | – | – | – | – | – | – | – |

| Operating Profit (Y-mn) | – | – | – | – | – | – | – | – | 312 |

| OP Margin | – | – | – | – | – | – | – | – | 5.8% |

| Net Incom (Y-mn) | – | – | – | – | – | 62 | 110 | 182 | 200 |

| BPS (Yen) | – | – | – | – | – | 38 | 44 | 54 | 65 |

(3/2018~3/2024)

| 3/2018 | 3/2019 | 3/2020 | 3/2021 | 3/2022 CE | 3/2023 CE | 3/2024 CE | CAGR 3YR | |

|---|---|---|---|---|---|---|---|---|

| Sales | 6,689 | 8,229 | 9,985 | 10,342 | 11,334 | 12,547 | 14,174 | 11.1% |

| Properties Leased | 1,242 | 1,459 | 1,684 | 1,706 | 1,916 | 2,161 | 2,451 | 12.8% |

| Contracts | – | 362 | 397 | 314 | 420 | 470 | 520 | 18.3% |

| Operating Profit (Y-mn) | 397 | 734 | 785 | 731 | 814 | 934 | 1,077 | 13.8% |

| OP Margin | 5.9% | 8.9% | 7.9% | 7.1% | 7.2% | 7.4% | 7.6% | – |

| Net Incom (Y-mn) | 236 | 510 | 564 | 576 | – | – | – | – |

| BPS (Yen) | 91 | 118 | 143 | 166 | – | – | – | – |

CE: Company estimates

Key Stats 2

|

FY 3/2019 |

FY 3/2019 |

FY 3/2019 |

||||||||||

|

Q1 |

Q2 |

Q3 |

Q4 |

Q1 |

Q2 |

Q3 |

Q4 |

Q1 |

Q2 |

Q3 |

Q4 |

|

|

Succession Contract* |

– |

– |

– |

– |

– |

– |

– |

– |

29 |

55 |

51 |

48 |

|

New Customer |

– |

– |

– |

– |

– |

– |

– |

– |

14 |

26 |

41 |

50 |

|

New Contract |

71 |

79 |

110 |

102 |

101 |

100 |

91 |

105 |

43 |

81 |

92 |

98 |

|

No. of Contract |

1,284 |

1,335 |

1,395 |

1,459 |

1,526 |

1,584 |

1,634 |

1,684 |

1,689 |

1,659 |

1,677 |

1,706 |

|

Churn |

– |

– |

– |

– |

– |

– |

– |

– |

-9 |

-56 |

-23 |

-19 |

|

Churn Rate |

– |

– |

– |

– |

– |

– |

– |

– |

-0.5% |

-3.3% |

-1.4% |

-1.1% |

*Succession contracts: leases signed with new tenants for closed properties.

Made by Omega Investment by various materials.

Bulls

- The number of leased properties of the company has been steadily expanding for a long period of time, and this trend will likely continue further. There are about 160,000 restaurants in the Greater Tokyo capital region, which includes Tokyo and the neighboring Kanagawa, Saitama and Chiba. The management estimates that of those restaurants about 110,000 are marketable. The number of leased properties of the company in FY3/2021 was 1706. The estimated market share vis-a-vis the total number of restaurants is just over 1%, so there is plenty of room for demand expansion for the time being. From FY3/2017 to FY3/2021, the company’s leased properties and sales posted CAGR of +13% and +18%, respectively. Operating profit registered +24%, whilst BPS grew by a CAGR of +26%. The management looks to achieve 5,500 properties for lease in FY3/2029 and aims at a 5% market share. This seems to be a very high hurdle.

- The company’s business is structurally able to generate high ROE and ROIC. The essence of the company’s business is thought of as stakeholder adjustment, which naturally retains a good profitability. It does not require inventory or equipment, so the BS is lean. All these contribute to high reruns on capital. Asset turnover of 1.0 is sound. Financial leverage is high, and the equity ratio is reasonable. The company runs a real estate business, but it is small in size.

- The churn rate for leased properties under contracts with real estate owners is very low, averaging just under 1% for five years. As mentioned above, thanks to Japan’s Land Leasing Law, which considers lessees to be in a vulnerable position, lease contracts with real estate owners will continue unless Tenpo Innovation terminates the contract. This explains the extremely low churn rate. Consequently, the number of the company’s leased properties steadily increases.

- The spread between tenant rents and the rents the company pays to real estate owners is expected to reflect supply and demand and consolidate to certain levels in the long run. Robust demand generated by restaurant openings and closings in the Tokyo metropolitan area is thought to provide support for the downside of the spreads. When the real estate market weakens, perhaps the tenant fee will go down first, which could influence Tenpo Innovation’s short-term business performance negatively. It should work the opposite when the real estate market strengthens.

- Upside in DOE. DOE since the IPO is as high as 8.1% on average. Thanks to high ROE, there is scope for lifting the already high DOE further. The average DOE spread (ROE-DOE) over the same period is 12.2%, which is satisfactory for both short-term and long-term investors. The management does not appear to be aware of this perspective. However, going forward, if reinvestment opportunities become scarce, they have an option to maintain shareholder satisfaction by proactively increasing dividends.

- An attractive gift for individual shareholders will be put into effect. From FY3/2022, shareholders who hold more than 300 shares of the company as of March 31 every year and who have held more than 100 shares continuously for more than one year will be presented with a JF Gourmet Card worth 5,000 yen. It can be used at 35,000 stores nationwide, centering on the restaurant chain stores, including major family restaurants, fast food restaurants, pubs, etc. Holding 300 shares will mean a total yield of 2.9% if this gift is counted in on top of the dividend yield of 1%. This should raise the interests of individual investors to some degree if not so significantly. Shareholder gifts are taxable, but the reality is that the tax authorities cannot accurately grasp and tax them.

Bears

- The management plan shows nothing that suggests possibility of innovation and/or renovation of existing business models. Some investors should be happy with this, as it makes growth and profit forecasts predictable. However, it is disappointing that there is no landscape that could raise the premium of the shares significantly.

- The growth rate of leased properties is still good, but the momentum is declining year by year. (Graph 2). The company’s market share is still insignificant; hence it would be strange if the secular growth had already weakened. It is unclear if this is due to competition, the company’s lack of capacity, or some other factor. As the company explains its history in its investor handout, the starting point of the business is in April 2005, when a business utilizing vacant properties was executed under the wing of REINS International INC, which made Gyukaku restaurant successful. It has been quite a long time since then. It is a business model with low barriers to entry, and competition may be intense in some parts of the market where growth has matured. Since there are no other listed companies of the same business model, investors cannot cross-check and understand the competition.

- The company does not disclose the vacancy rate of leased properties, so the reality cannot be clearly seen. The tenant churn rate averaged 9.5% for the four years up to FY3/2020. It increased from 8.3% in FY3/2016 to 10.4% in FY3/2020. It is difficult to analyse to what extent the consistent increase in churn is a problem. However, according to the company‘s explanation, in most cases it is possible to contract with the next tenant without delay as the company runs highly liquid properties, and if new tenants do not come up for a certain period, the the lease contract with the owner will be terminated to minimize the risk. If so, rising churn does not pose an imminent problem. If restaurants are closed one after another and the vacancy rate rises due to the corona pandemic, it would be difficult to forecast how that could affect the company’s business performance.

- As per cash flow, the impression is that the company may have little or no idea about what to do with excess cash generation. While operating cash flow is stable, investment is inactive and cash tends to increase on the BS. Because the ROE of the core business is very high, cash flow should be actively spent for the core business. If there is no need or opportunity to reinvest, excess cash should be returned to shareholders. It is not clear if there are no reinvestment opportunities, if management is intentionally accumulating cash in anticipation of some risk or big investment opportunity, or if the management does not have any idea on cash flow recycling at all.

- Should the parent company, Crops, take over the company through a share exchange, shareholders would be forced to give up investing in high-profit, high-growth shares, and instead hold parent company shares, whose ROE and growth are way below those of Tempo Innovation. This will be particularly disappointing. Bulky sales of the parent share will weigh on the share price of Crop.

- The insider stake in the company’s outstanding shares is 65.7%. The parent company, Crops, owns 56.3%, with the rest being three directors and an employee stock ownership plan. The ratio of external directors is 33%. Therefore, there is no way for the dissenting opinions of minority shareholders. To reduce the excessive power of the insiders, the management can propose to shareholders to increase the number of external directors to a majority of the board, and if that is realised, compare take-over by the parent, selling or issuing shares to outside investors.

- A situation where the market capitalization of the parent company is significantly lower than that of the subsidiary, such as CROPS and Tenpo Innovation, is an opportunity for investors seeking controlling stake in the parent company. Minority shareholders will welcome it if the acquirer is serious about increasing shareholder value. Crop’s stock has been poorly rated by investors. Although the acquisition of Tenpo Innovation was successful, they do not appear to be excellent management. However, two-thirds of Crop’s shares are held by founding family and friendly shareholders such as banks, so it is unlikely that an acquirer will appear.

Business

- The company rents properties from real estate owners and earns profit margins and renewal fees mainly by leasing them, usually with fixtures and furniture, so it is a lease business. 90% of lease customers are restaurants, which concentrate in the metropolitan area. The company is the only listed company specializing in store leasing business. The real estate business is being operated to complement the store leasing business, but the scale is small.

- Revenue streams are divided into one-time and subscription. The former is one-off income such as commission fee like key money from new contracts and sales of fixtures and furniture of the unoccupied properties. The latter is the rent income from the leased property, the renewal fee of the lease contract, etc., which is the income that keeps flowing in as long as the lease contract continues. The company calls one-time revenue as initial and subscription revenue as running. According to their definition, the sales for FY3/2021 are divided into running 88.6%, initials 4.2%, and real estate 7.2%.

- Unlike other subscription businesses, the company’s business model is characterized by a small decrease in rental properties. This is because when you rent a property from a real estate owner, you are granted a lease right, and the lease right cannot be canceled by the real estate owner, so the contract will continue unless Tempo Innovation offers termination.

- The number of stores leased by the company is concentrated in the Greater Tokyo capital region, which includes Tokyo, Kanagawa, Saitama and Chiba, where demand from restaurant opening and closing is robust almost permanently. The main customers are small businesses. The data of the Ministry of Internal Affairs and Communications published by the company in the management plan handout is a little old being those of CY2016, but according to this, the number of restaurants in the Greater Tokyo capital region was about 160,000. Of these, there were 79,601 in Tokyo. By scale, small businesses account for 72.6% in Tokyo. Tokyo accounts for about 92% of Tenpo Innovation’s properties. 3 central wards (Minato, Chuo, Chiyoda) account for about 28%, and 4 sub-center wards (Shinjuku, Shibuya, Toshima, Bunkyo) account for about 26%.

- President Hara explains, “Because it is a business that rents a property from the owner and lends that property, in other words, it is a lender agency business.” The company is not a real estate agent or real estate manager. Also it is not the same as the usual sublease business, where a building is built and rented in a lump sum. When the company rents a property from a real estate owner, it goes through the real estate company. After renting, the property is lent to a restaurant tenant. The company will be a party to conclude the contract with an opening restaurant and will play a role in coordinating the conflicting interests of the real estate owner and the restaurant.

- Since real estate owners, real estate agents, opening restaurants and closing restaurants are involved in the contract, it is a characteristic of the lease business that the interests are intricate. Tenpo Innovation is familiar with store properties and is able to coordinate conflicting interests to facilitate contracts.

- The company specialises only in store properties, and does not touch upon houses, offices, warehouses, and parking lots, which are common trades by real estate agents. According to the company, very few real estate companies are engaged in store leasing business with this business model. In addition, Tenpo Innovation is the only company nationwide that is only engaged in the store rental business. Therefore, it is the only listed company of this business model.