Chiome Bioscience (Company Note 2Q update)

| Share price (8/20) | ¥244 | PER(21/12CE) | – X |

| 52weeks high/low | ¥328/178 | PBR(20/12act) | 3.46 X |

| ADVT (¥ mn, monthly) | ¥187 mn | ROE(20/12act) | -45.60% |

| Shrs out. | 40.291 mn, shrs | Mkt cap | ¥9.8 bn |

| Listed market | TSE Mothers | Shr eqty ratio (21/6) | 85.30% |

| Click here for the PDF version of this page |

| 4583CB2021Q2UD0827EN |

CBA1205 clinical trial progressing well

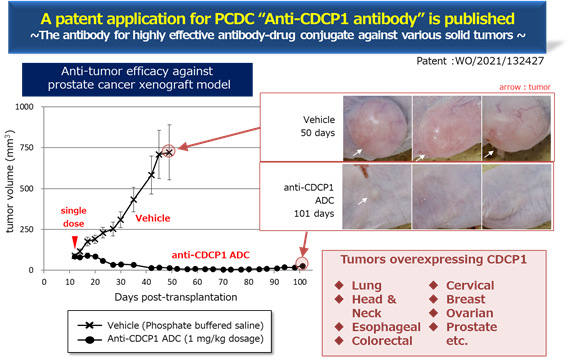

Starting out-licensing activities following the PCDC patent information disclosure

◇FY12/2021Q2 financial results: Sales increased by 122% YoY, losses shrank

Chiome Bioscience’s financial results for FY12/2021Q2 were net sales of ¥384mn (up ¥211 mn YoY), operating loss of ¥415mn (operating loss of ¥735mn in 12/2020Q2), ordinary loss of ¥409mn (ordinary loss of ¥735mn in 12/2020Q2), and net loss of ¥408mn (net loss of ¥736mn in 12/2020Q2). Net sales increased 122% and the losses shrank at all levels.

In the Drug Discovery Business, an up-front income for the out-licensing contract of LIV-2008 / 2008b was recorded in Q1, resulting in the sales of ¥103mn (¥1mn in 12/2020Q2). Sales of the Drug Discovery Support Business was ¥281mn, increasing by ¥ 110mn due to stable expansion of the sales to existing customers. R&D expenses were ¥459mn and decreased by ¥149mn. This is thanks to the declines in the cost of CMC development for CBA-1205 from the previous fiscal year.

As per BS, cash decreased by ¥385mn from the end of December 2020, and total assets were ¥3,328mn (¥3,494mn at the end of December 2020).

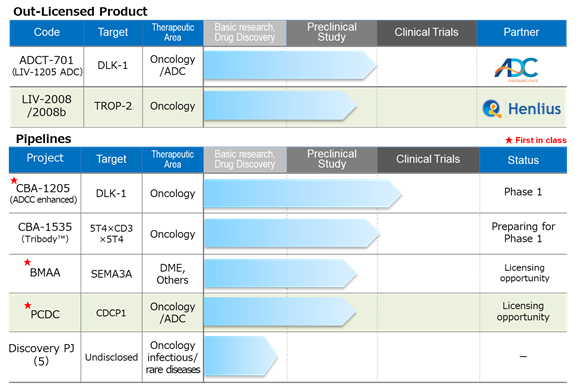

◇Pipeline progress: (see the figure in the next page)

* CBA-1205; The first half of the Phase I trial at the National Cancer Center is progressing well. The Company has changed the development plan and will acquire a larger amount of safety data than originally planned. The second half of the Phase I trial is scheduled to begin some time between the end of 2021 and the first half of 2022.

* CBA-1535; The investigational drug substance is being manufactured by CMO. Although CMC development was delayed from the initial schedule due to COVID-19, the Company maintains that there will be no impact on the clinical trial application schedule. They are considering a change to a clinical trial application in Japan instead of the UK, which they originally planned.

* BMAA: The Company focuses on in-house research and development, as the option contract with SemaThera terminated in May 2021. They will consider diseases other than diabetic macular edema.

* PCDC: In July 2021, the World Intellectual Property Organization published the patent information, and the Company is progressing the out-licensing activities. The target molecule is CDCP1, a first-in-class antibody that targets solid cancers (lung cancer, head and neck cancer, esophageal cancer, colorectal cancer and cervical cancer, etc.).

◇Utilisation and improvement of ADLib®︎ system:

The Company participated in the Grant Program of the Japan Agency for Medical Research and Development (AMED). By continuing to work on the core technology development utilising and improving the ADLib®︎ system, the company should be able to improve the technology related to the Drug Discovery Support Business and strengthen the in-house Drug Discovery pipeline.

|

JPY, mn, % |

Net sales |

YoY |

Oper. |

YoY |

Ord. |

YoY |

Profit |

YoY |

EPS |

|

12/2017 |

259 |

3.0 |

-887 |

– |

-883 |

– |

-882 |

– |

-33.48 |

|

12/2018 |

212 |

-18.1 |

-1,539 |

– |

-1,533 |

– |

-1,533 |

– |

-57.26 |

|

12/2019 |

447 |

110.3 |

-1,401 |

– |

-1,410 |

– |

-1,403 |

– |

-44.61 |

|

12/2020 |

480 |

7.4 |

-1,283 |

– |

-1,291 |

– |

-1,293 |

– |

-39.06 |

|

12/2021 (CE) |

– |

– |

– |

– |

– |

– |

– |

– |

– |

|

12/2020 Q2 |

173 |

23.1 |

-735 |

– |

-735 |

– |

-736 |

– |

-22.01 |

|

12/2021 Q2 |

384 |

122.1 |

-415 |

– |

-409 |

– |

-408 |

– |

-10.16 |

Drug discovery and development – pipeline

Source: Company materials

About the new progress in Q2;

* For the out-licensed product LIV-2008 / 2008b, a development plan has been formulated and is in progress at the out-licensing company Shanghai Henlius.

* For PCDC, the progress is as mentioned above. See the figure below for the evaluation of the efficacy of PCDC. It shows the antitumor effect of prostate cancer and the mice with Anti-CDCP1 ADC shows suppression of tumor . The Company is planning the derivation as an antibody for ADC.

Financial data

| FY, (¥mn) | 12/2019 | 12/2020 | 12/2021 | |||||||

| Q1 | Q2 | Q3 | Q4 | Q1 | Q2 | Q3 | Q4 | Q1 | Q2 | |

| [Statements of income] | ||||||||||

| Net sales | 64 | 77 | 142 | 165 | 91 | 82 | 139 | 169 | 246 | 139 |

| Drug Discovery and Development Business | 0 | 1 | 1 | 28 | 1 | 1 | 0 | 1 | 103 | 0 |

| Drug Discovery Support Business | 63 | 76 | 142 | 137 | 90 | 82 | 138 | 168 | 143 | 138 |

| Cost of sales | 27 | 26 | 58 | 52 | 61 | 46 | 59 | 70 | 64 | 62 |

| Gross profit | 37 | 51 | 84 | 113 | 30 | 36 | 80 | 99 | 182 | 77 |

| SG&A expenses | 464 | 374 | 503 | 346 | 456 | 346 | 424 | 303 | 337 | 337 |

| R&D expenses | 363 | 273 | 407 | 256 | 343 | 266 | 342 | 206 | 216 | 243 |

| Operating loss | -426 | -324 | -419 | -233 | -426 | -310 | -344 | -204 | -155 | -260 |

| Non-operating income | 0 | 1 | 4 | 0 | 2 | 0 | 3 | 0 | 7 | 0 |

| Non-operating expenses | 6 | 4 | 4 | 0 | 0 | 2 | 10 | 1 | 1 | 0 |

| Ordinary loss | -432 | -327 | -418 | -233 | -425 | -311 | -351 | -205 | -150 | -259 |

| Extraordinary income | 2 | 1 | 6 | 0 | 0 | 0 | ||||

| Extraordinary expenses | ||||||||||

| Loss before income taxes | -430 | -326 | -412 | -233 | -425 | -310 | -351 | -205 | -150 | -247 |

| Total income taxes | 1 | 0 | 1 | 0 | 1 | 0 | 1 | 1 | 11 | 1 |

| Net loss | -431 | -326 | -413 | -234 | -425 | -311 | -352 | -206 | -161 | -248 |

| [Balance Sheets] | ||||||||||

| Current assets | 3,048 | 3,206 | 2,807 | 2,561 | 2,309 | 2,805 | 3,316 | 3,249 | 3,294 | 3,088 |

| Cash equivalents and ST marketable securities | 2,776 | 2,899 | 2,469 | 2,106 | 1,967 | 2,472 | 2,881 | 2,686 | 2,580 | 2,302 |

| Non-current assets | 219 | 217 | 242 | 247 | 247 | 249 | 249 | 246 | 244 | 241 |

| Tangible assets | 15 | 14 | 12 | 11 | 10 | 9 | 8 | 7 | 6 | 6 |

| Investments and other assets | 204 | 204 | 230 | 236 | 237 | 240 | 241 | 239 | 237 | 235 |

| Total assets | 3,267 | 3,423 | 3,049 | 2,808 | 2,556 | 3,054 | 3,566 | 3,495 | 3,537 | 3,329 |

| Current liabilities | 177 | 207 | 154 | 145 | 315 | 427 | 378 | 343 | 378 | 428 |

| Short-term borrowings | 142 | 199 | 199 | 180 | 180 | 190 | ||||

| Non-current liabilities | 41 | 41 | 41 | 41 | 42 | 42 | 42 | 42 | 42 | 42 |

| Total liabilities | 219 | 248 | 196 | 187 | 357 | 469 | 420 | 385 | 420 | 470 |

| Total net assets | 3,048 | 3,175 | 2,853 | 2,622 | 2,199 | 2,585 | 3,146 | 3,110 | 3,118 | 2,859 |

| Total shareholders’ equity | 3,048 | 3,175 | 2,853 | 2,622 | 2,199 | 2,585 | 3,146 | 3,110 | 3,118 | 2,859 |

| Capital stock | 5,856 | 6,084 | 6,132 | 6,132 | 6,133 | 846 | 1,303 | 1,388 | 1,471 | 1,471 |

| Legal capital reserve | 5,846 | 6,074 | 6,122 | 6,122 | 6,123 | 2,446 | 2,903 | 2,987 | 3,071 | 3,071 |

| Retained earnings | -8,682 | -9,008 | -9,421 | -9,655 | -10,080 | -736 | -1,088 | -1,294 | -1,455 | -1,703 |

| Subscription rights to shares | 28 | 26 | 20 | 22 | 24 | 30 | 28 | 29 | 30 | 19 |

| Total liabilities and net assets | 3,267 | 3,423 | 3,049 | 2,808 | 2,556 | 3,054 | 3,566 | 3,495 | 3,537 | 3,329 |

| [Statements of cash flows] | ||||||||||

| Cash flow from operating activities | -677 | -1,537 | -528 | -1,360 | -560 | |||||

| Loss before income taxes | -755 | -1,401 | -734 | -1,290 | -396 | |||||

| Cash flow from investing activities | – | -26 | – | 3 | – | |||||

| Purchase of investment securities | – | – | – | – | – | |||||

| Cash flow from financing activities | 1,248 | 1,341 | 894 | 1,944 | 176 | |||||

| Proceeds from issuance of common shares | 1,249 | 1,345 | 697 | 1,769 | 166 | |||||

| Net increase in cash and cash equiv. | 570 | -222 | 366 | 580 | -384 | |||||

| Cash and cash equiv. at beginning of period | 2,328 | 2,328 | 2,105 | 2,105 | 2,686 | |||||

| Cash and cash equiv. at end of period | 2,899 | 2,105 | 2,472 | 2,686 | 2,301 |

Source: Omega Investment from Company materials