KLab

| Securities Code |

| TYO : 3656 |

| Market Capitalization |

| 26,457 million yen |

| Industry |

| Information / Communication |

The company plans, develops and manages mobile online games. It earns 80% of sales from 3 games. Overseas sales ratio is 35%.

This article briefly summarizes the points of the stock investment into the company. Please have a read of other public materials for details of the business.

Investment View

The attractions of the company’s business are a) capabilities of long-term management of big hit games, b) proven strength in the growing overseas markets, and c) revenue stream from several hit games. Although its business performance fluctuates significantly in the short term, the company is thought to run on a structure that generates more stable cash flow vis-a-vis its peers in the same online game industry over the long term. In fact, in the seven years since 2014, the company has consistently earned good operating cash flow. It should also be noted that during the same period, BPS has grown well at a CAGR of +10%.

With online game stock investment one can aim for impressively high returns if any new game makes a big hit, but the risk is also high. Various investment strategies are conceivable to build long positions in active funds. One of the easiest ways to do this is to pick up multiple stocks of different profiles and valuations to diversify risk, and patiently keep the position for some years to capture the opportunities for high investment returns. Being one of the good candidates that fit this approach, KLab is worth a look. The company aims to achieve operating profit of 10 billion yen in FY2023 with some new games. This is five times the OP of FY2020. It is encouraging for shareholders that the company maintains that new games will continue to be released after FY2022 and that business performance will improve sharply by FY2023.

Setting a market cap cut-off at 10 billion yen in consideration of liquidity, there are only 15 investable stocks left in the online game sector if mixi (2121) is not included. So, there are not so many choices. Baillie Gifford, an excellent stock picker from Scotland, owns four of these in bulky volume.

Risks pertaining to any Japanese online game stock include difficulty in predicting business performance, saturation of the domestic market, deteriorating earnings without any hits, unpredictability of successful games, and intensifying competition amongst domestic and foreign online game makers as the market has become virtually borderless. Investors should value the shares cautiously.

Total Shareholder Return

| 1M | 3M | 6M | YTF | 1Y | 3Y | 5Y | 10Y | IPO (Sep 2011) | |

|---|---|---|---|---|---|---|---|---|---|

| 3656 | -5.8 | -13.6 | -25.4 | -31.6 | -34.8 | -13.1 | -1.5 | 1.1 | 1.1 |

| TOPIX | 0.5 | 0.3 | -0.6 | 6.3 | 21.2 | 6.0 | 10.4 | 13.3 | 13.3 |

Made by Omega Investment by various materials

| Period | Revenue (mn, yen) | EBIT (mn, yen) | EPS (yen) | PER (X) | PBR (X) | ROE (%) |

|---|---|---|---|---|---|---|

| 12/17 | 26,778 | 4,633 | 84 | 20.2 | 5.3 | 24.9 |

| 12/18 | 32,674 | 4,995 | 69 | 12.4 | 2.1 | 17.8 |

| 12/19 | 31,110 | 1,674 | 10 | 25.8 | 2.0 | 2.5 |

| 12/20 | 33,952 | 2,149 | 20 | 38.3 | 2.1 | 4.6 |

Business

The company plans, develops and manages the operation of mobile online games. Online games are split into mobiles, PC, and consoles that require dedicated terminals. KLab’s main market is mobiles such as smartphones in particular. The game is basically free, and in-app purchases are the company’s source of revenue. The company is characterised by the fact that it earns about 80% of sales by 3 games, which is different from other game makers that tend to rely on a single game. With a high overseas sales proportion of 35%, the company ranks fourth in this regard in the internet contents gaming sector. Its IP subject is the IP of other companies, which is different from the likes of GungHo Online Entertainment (TYO3765), which runs on its own IP. The company’s IP subjects are mostly popular Japanese manga and animation.

[Sales composition%, OPM%] Game 99 (20) Others 1 (44) [Overseas] 35 <FY12 / 20>

Industry Sector

The market capitalization of the internet contents game sector, which consists of 32 stocks, is 3 trillion yen. It is valued at a simple average PBR of 3.18 times, with KLab stock being the 11th cheapest. By market cap, it is the 11th biggest though comprising just 0.8% of the whole sector. NEXON (TYO3659: market cap 1,91 trillion yen) has an outstandingly large market cap and accounts for 64% of the sector. DeNA (TYO2432: 254 bn yen), GungHo Online Entertainment (217 bn yen), GREE (TYO3632: 162 bn yen) and colopl (TYO3668: 107 bn yen) are in the second group that account for 25%. The remaining 27 companies with a market cap of less than 100 billion yen account for 12% of the sector.

If mixi (TYO2121: 1.95 trillion yen), which is classified as a net content consumer stock, is counted in, the sector will have a market cap of 4.96 trillion yen with 33 stocks. The PBR of 15 online game stocks with a market capitalization of 10 billion yen or more has been sharply down in the last 7 to 8 years, with the only exception of NEXON, and KLab is no excep

Price, Ratios

| 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 5Yr Avg(%) | |

| Price Change | -38.5 | -17.2 | 169.6 | -53.6 | -1.9 | 10.1 | -29.9 | 21.4 |

| vs TOPIX (%) | -48.5 | -15.4 | 149.9 | -35.8 | -17.1 | 5.2 | -34.9 | 17.4 |

| Div Yield (%) | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 |

| 2/2016 | 2/2017 | 2/2018 | 2/2019 | 2/2020 | 2/2021 | 5Yr CAGR(%) | ||

| Sales (Y-mn) | 20,913 | 19,600 | 26,778 | 32,674 | 31,110 | 33,952 | 10.2 | |

| EBITDA | 2,626 | 1,899 | 5,297 | 6,083 | 3,579 | 4,071 | 9.2 | |

| EBIT | 2,198 | 1,275 | 4,633 | 4,995 | 1,674 | 2,149 | -4.0 | |

| Net Inc | 700 | -814 | 3,127 | 2,570 | 384 | 757 | 1.8 | |

| EPS (Dil) (Y) | 18.9 | -22.3 | 81.3 | 66.6 | 10.0 | 19.9 | 1.1 | |

| Divs PS (Y) | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | – | |

| Shs Out (Dil) | 37 | 37 | 38 | 39 | 38 | 39 | 0.8 | |

| BPS | 26,960 | 149 | 338 | 388 | 407 | 431 | 9.8 | |

| Cash&ST Inv (Y-mn) | 4,852 | 4,661 | 6,695 | 4,749 | 8,298 | 8,618 | 12.2 | |

| Assets | 12,633 | 12,134 | 18,610 | 19,245 | 23,719 | 23,567 | 13.3 | |

| Working Capital | 5,747 | 4,915 | 5,735 | 4,922 | 8,650 | 7,825 | 6.4 | |

| LT Debt | 31 | 1 | 5 | 106 | 1,303 | 1,004 | 99.9 | |

| Net OP CF | 1,228 | 1,553 | 5,073 | 3,796 | 1,785 | 4,172 | 27.7 | |

| Capex | -1,283 | -1,125 | -2,227 | -3,491 | -2,223 | -945 | – | |

| FCF | 1,156 | 1,460 | 4,898 | 3,594 | 1,785 | 4,172 | 29.3 | |

| 2/2016 | 2/2017 | 2/2018 | 2/2019 | 2/2020 | 2/2021 | 5Yr Avg(%) | ||

| Gross Margin % | 32.1 | 26.5 | 35.7 | 32.3 | 22.6 | 20.6 | 27.5 | |

| EBITDA Margin % | 12.6 | 9.7 | 19.8 | 18.6 | 11.5 | 12.0 | 14.3 | |

| EBIT Margin % | 10.5 | 6.5 | 17.3 | 15.3 | 5.4 | 6.3 | 10.2 | |

| Net Margin % | 3.3 | -4.2 | 11.7 | 7.9 | 1.2 | 2.3 | 3.8 | |

| ROA % | 5.5 | -6.6 | 20.3 | 13.6 | 1.8 | 3.2 | 6.5 | |

| ROE % | 7.4 | -8.3 | 28.8 | 19.0 | 2.6 | 4.8 | 9.3 | |

| Asset Turnover | 1.6 | 1.6 | 1.7 | 1.7 | 1.4 | 1.4 | 1.6 | |

| Assets/Equity | 1.3 | 1.3 | 1.5 | 1.3 | 1.5 | 1.4 | 1.4 | |

| Current Ratio | 3.1 | 2.6 | 2.0 | 2.1 | 2.7 | 2.3 | 2.3 | |

| Quick Ratio | 3.1 | 2.6 | 2.0 | 2.1 | 2.7 | 2.3 | 2.3 |

Bull

- •The structure that earns 80% of sales with 3 games stablises the business performance. Most of the peers in the industry are dependent on one big hit game, and at these companies, sales decline significantly as revenue from the big hit name deteriorates. GungHo and mixi hinge on one game that generates ca 60% of their total revenues.

- KLab analyses that the winning online game companies meet either of the followings. (1) The big hit games have been driving profits for many years, (2) the portfolio is composed of multiple hits, and (3) overseas profits are earned. KLab meets (2) and (3). Regarding (1), the management is looking at big hit releases in FY2022 and FY2023, aiming for a significant increase in profits. As of August 2021, in the pipeline of the company are three new developments and three development support models. Beside these, there are candidates for projects, which are two for new development and six for development support models.

- Albeit to some extent, the company appears to be able to lessen earnings deterioration of the existing games and sustain a profit stream over the long-term. Specifically, measures are taken to maintain the retention rate of players and increase revenue per player through timely introduction of campaigns and in-game items. Currently, three games, “Captain Tsubasa : Dream Team” , “BLEACH Brave Souls” and “Love Live! School Idol Festival ALL STARS” earn 80% of sales, and four games inclusive of these generate most of the company’s revenue.

- The overseas market is expected to grow, and the company, which is already successful overseas, should have a good chance to grow further. Good at converting and operating IPs of Japanese manga and animation, which have gained popularity overseas, KLab should be able to take advantage of its strength to a full extent. A little less than 50% of the global market is mobile online games, which Newzoo, an international game industry intelligence, expects to grow at an annual rate of 10% by 2023. In every country in the world, smartphones and line speeds with sufficient specifications to enjoy online games are in place. As mentioned above 35% of KLab’s sales are overseas. The US and China are 9% and 6%, respectively.

- The company’s business plan is solid and is felt to be secure although no notable innovations are indicated. The main strategy is to increase profits by stable operation of existing games, and to increase sales and profits by releasing new games. In addition, it plans to create growth by developing casual games and expanding development support for overseas game development. While these new measures look unlikely to deliver large returns, they should add to stable income whilst reducing the overall business risk of a game developer. Thus, it is positive for long-term cash flow. WACC should decrease as business risk is reduced; it will be positive for the valuation of the stock. The management aims for sales of 50 billion yen and operating profit of 10 billion yen in FY2023.

- Cost is under good control. Cost control is attributable to good control of fixed costs. While moving forward the new game development, the company has been able to keep labor costs, personnel expenses and outsourcing fees almost flat throughout the past few years.

- Sensible cash flow recycling is in place. Investment since FY2014 totaled 20 billion yen against the total operating CF of 19.9 billion yen, meaning that all the CF has been reinvested in the business. ROE during the same period averaged a nice 11%. It is positive that all the reinvestment in the high-risk core business is covered by the CF created by the company itself. This should strike shareholders, who look to gain large returns eventually, as reasonable, although the company has not paid any dividend since the IPO. As a result, the equity ratio rose to 71% in FY2020, and 90% of KLab’s invested capital is shareholders’ equity, which is expensive. Currently, the company is in the process of share buyback to the tune of 500 million yen by the end of CY2021. This is not huge, but it is regarded as a sensible financial strategy to try and lessen the inflation of the cost of capital and is rated well.

- Three of the eight board members are independent external directors. The ratio of 38% is relatively high. If this is reflection of the management’s inclination to incorporate the opinions of minority shareholders, it is rated well. As per the shareholding, the insider ratio is low at 15%. Most of them are the stakes of founding chairman Tetsuya Sanada, who owns 10.5%. Mr. Sanada returned the representative right in March 2019, and the presidency was handed over to Mr. Morita, the current president.

Bear

- The PBR of 15 internet contents gaming stocks with a market cap of 10 billion yen or more has fallen sharply in the last 7 to 8 years, with NEXON being the only exception. KLab is no exception. This suggests to us that largely investors’ positive expectations for the sector have been detached. Perhaps the backdrop to this is the concern over the disappearing domestic market growth due to the saturation of smartphone diffusion and the intensifying competition as a result of activating cross border trades in the world, where game makers can make money by distributing games directly overseas. Already, in the sales rankings of games around the world, domestic games and overseas games are competing for rankings in almost every country.

- Deterioration of the existing games. The number of players of the same online game tends to decrease year by year. Accordingly, revenue shrinks down. In addition, players are very changeable. Current sales of the company are running weak due to the sluggish existing games.

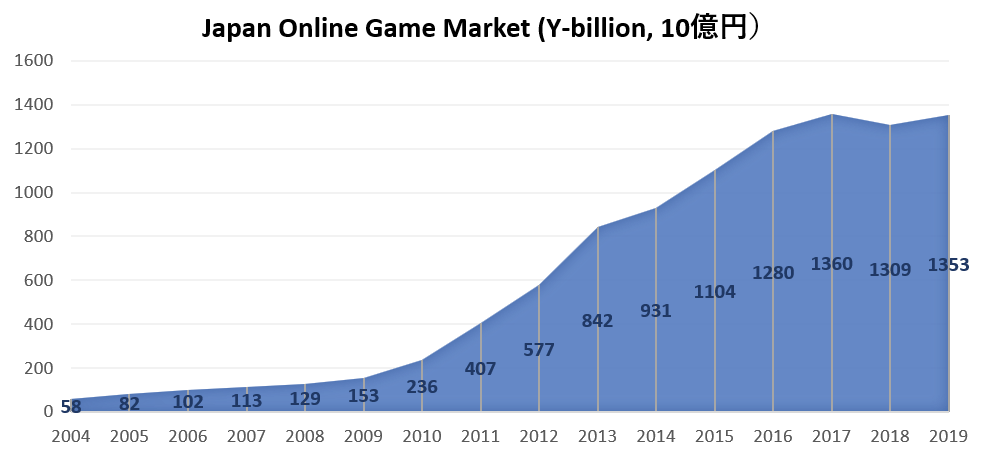

- Possibility of saturation of the domestic online game market. According to a survey by JOGA (Japan Online Game Association), the size of the domestic online game market in 2019 increased by a slight 3% from the previous year. The market for smart devices accounts for more than 90% of the whole market. In recent years, the diminishing market growth has become so visible that the market is thought to have saturated. Presumably, the diffusion of smartphones has slowed down the growth of the number of game players, and the direct distribution from abroad such as China has had significant impact. Japanese market may well suffer structural difficulties.

- The company looks not keen on spending money on creating blockbuster games. CF is not that big compared to major companies and the management does not seem to have an idea of leverage. Rather the company wants to stick with a business style that runs multiple games of decent popularity for a long time. Overall the company is solid and does have a risk-taking nature, however, it would not venture to go far to take a huge risk.

- The company is not keen on developing its own original games. The company specialises in developing games using other companies’ IPs. However, the profit margin is lower than that of the original game because the company must pay about 20% of the sales as copyright royalties. There is no track record of KLab that proves its planning and development capabilities of original games.