Kidswell Bio (4Q results impression)

| Share price (5/12) | ¥438 | Dividend Yield (23/3 CE) | – % |

| 52weeks high/low | ¥864 / 327 | ROE(TTM) | -23.29 % |

| Avg Vol (3 month) | 138.7 thou shrs | Operating margin (TTM) | -45.51 % |

| Market Cap | ¥13.7 bn | Beta (5Y Monthly) | 1.29 |

| Enterprise Value | ¥13.7 bn | Shares Outstanding | 31.437 mn shrs |

| PER (23/3 CE) | – X | Listed market | TSE Growth |

| PBR (22/3 act) | 6.69 X |

| Click here for the PDF version of this page |

| PDF Version |

The company updated its medium-term plan

More focus on regenerative medicine business (SHED)

◇Summary of full-year results for FY2022/3

Kidswell Bio’s full-year results for FY2022/3 show net sales of 1.57 billion yen (up 57.5% year-on-year), an operating loss of 0.91 billion yen (compared with an operating loss of 0.96 billion yen in the previous year) and a net loss attributable to the parent company of 0.53 billion yen (compared with a net loss of 1.00 billion yen for the same period last year). Initial forecasts were for sales of 1.9 billion yen, an operating loss of 1.72 billion yen and a net loss attributable to the parent company of 1.32 billion yen. Although the company undercut its sales targets, losses were smaller than forecast. The reasons for this were a) the sales associated with the completion of MCB were carried forward to the following year, and b) sales of active pharmaceutical ingredients (APIs) related to the API manufacturing process for the fourth biosimilar (BS) product were also carried forward (the development schedule itself was not affected). On the other hand, the sales of subsidiary JRM resulted in a review of development costs related to JRM-001. As a result, R&D expenditure came in at only 1.15 billion yen, much lower than the initial forecast of 1.8 billion yen.

◇FY2023/3 full-year forecasts*

The company is forecasting revenues of 2.9 billion yen, an operating loss of 0.98 billion yen and a net loss of 1 billion yen for FY2023/3. As part of the sales expected for FY2022/3 will be booked in FY2023/3, sales this year will increase significantly. On the other hand, though the company had aimed to return to profitability in FY2023/3 ahead of schedule in its medium-term management plan announced in February 2021, this has now been postponed following the revisions described below.

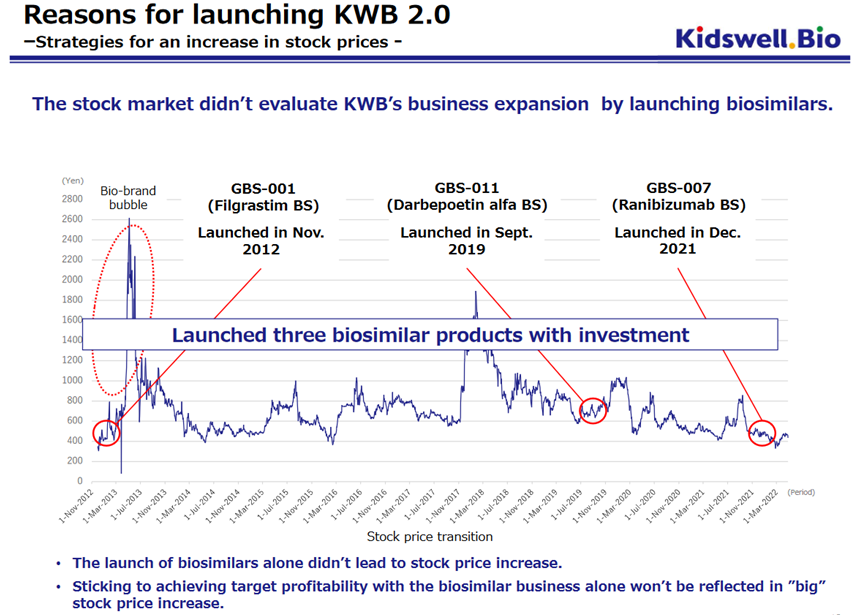

◇ KWB 2.0: update of the medium-term strategic plan

The company has published an update to its medium-term strategic plan (KWB 2.0) to realise its vision of KIDS WELL and ALL WELL as soon as possible while building on its strengths. The company has built up a track record as a leading BS company. Still, it recognises that the profitability of the BS business has been declining faster than expected, partly due to biosame’s emergence in the market. On the other hand, the regenerative medicine business (SHED), which the company has been focusing on in recent years, has made steady progress in development. The company appears to have decided that becoming a one-of-a-kind player that creates cell and gene therapy products based on SHED will help it realise its vision at an earlier stage and, as a result, enhance its corporate value. While the company has postponed an achievement of profitability in the immediate future, it has gained more confidence in the market potential of regenerative medicine (SHED) and its competitiveness in this field. We will continue to monitor the company’s future developments under the new management plan.

| JPY, mn, % | Net sales | YoY % |

Oper. profit |

YoY % |

Ord. profit |

YoY % |

Profit ATOP |

YoY % |

EPS (¥) |

| 2018/3 | 1,059 | -2.7 | -913 | – | -903 | – | -904 | – | -47.27 |

| 2019/3 | 1,021 | -3.6 | -805 | – | -816 | – | -856 | – | -43.84 |

| 2020/3 | 1,077 | – | -1,161 | – | -1,187 | – | -7,316 | – | -264.65 |

| 2021/3 | 996 | -7.5 | -969 | – | -991 | – | -1,001 | – | -34.79 |

| 2022/3 | 1,569 | 57.7 | -919 | – | -952 | – | -535 | – | -17.35 |

| 2023/3 (CE) * | 2,900 | – | -980 | – | -999 | – | -1,000 | – | -31.82 |

* Forecasts are based to non-consolidation, due to the transition to unconsolidated accounts from FY2023/3.