Chiome Bioscience (Company Note – update)

| Share price (7/13) | ¥178 | Dividend Yield (22/12 CE) | – % |

| 52weeks high/low | ¥325/156 | ROE(TTM) | -59.2 % |

| Avg Vol (3 month) | 376.0 thou shrs | Operating margin (TTM) | -207.6 % |

| Market Cap | ¥7.4 bn | Beta (5Y Monthly) | 1.05 |

| Enterprise Value | ¥5.9 bn | Shares Outstanding | 42.736 mn shrs |

| PER (22/12 CE) | – X | Listed market | TSE Growth |

| PBR (21/12 act) | 4.49 X |

| Click here for the PDF version of this page |

| PDF Version |

Bio-venture challenging unmet needs with antibody drug discovery development

Points of interest

A biopharmaceutical company that challenges unmet needs by developing proprietary antibody drug discovery, with a pipeline of more than ten products, including two out-licensed products and two in-house developed products in the clinical stage. Aiming for first-in-class** drug discovery, the company is developing its drug discovery and development business using Tribody technology in addition to its proprietary ADLib®︎ technology.

*Unmet needs: unmet medical needs related to diseases for which no effective drugs or satisfactory treatments have been found.

**First-in-class: breakthrough medicines. An original drug that is novel and useful, differs from conventional drugs in its chemical structure from the backbone and significantly alters the traditional treatment system.

Summary

◇The following four points focus on investment in drug discovery biotech ventures.

- Is there a sufficient pipeline and R&D structure commensurate with the risks involved? How possible is it to secure out-licensing partners?

- Is there financial capability to enable the long-term development required for drug discovery?

- Is there a highly transparent information disclosure system for the progress of long-term, high-risk drug development?

- Is there a solid and reliable management structure to carry out these tasks?

◇The current business activities are twofold.

Drug discovery and development business: In-house or co-development of antibody drug discovery in disease areas with high unmet needs, and licensing of patents and other intellectual property rights relating to the resulting antibodies to pharmaceutical companies, to earn upfront payments, milestone payments and royalties. This is a pillar of the company’s future growth.

Drug discovery support business: business that supports drug discovery research conducted by pharmaceutical companies, diagnostics companies, universities and other research institutions, and earns income from service fees and other sources. It mainly provides major domestic pharmaceutical companies with antibody generation, antibody engineering and protein preparation services, utilising its antibody drug discovery technology platform. This is a ‘high value-added contract research business’ expected to generate stable revenues.

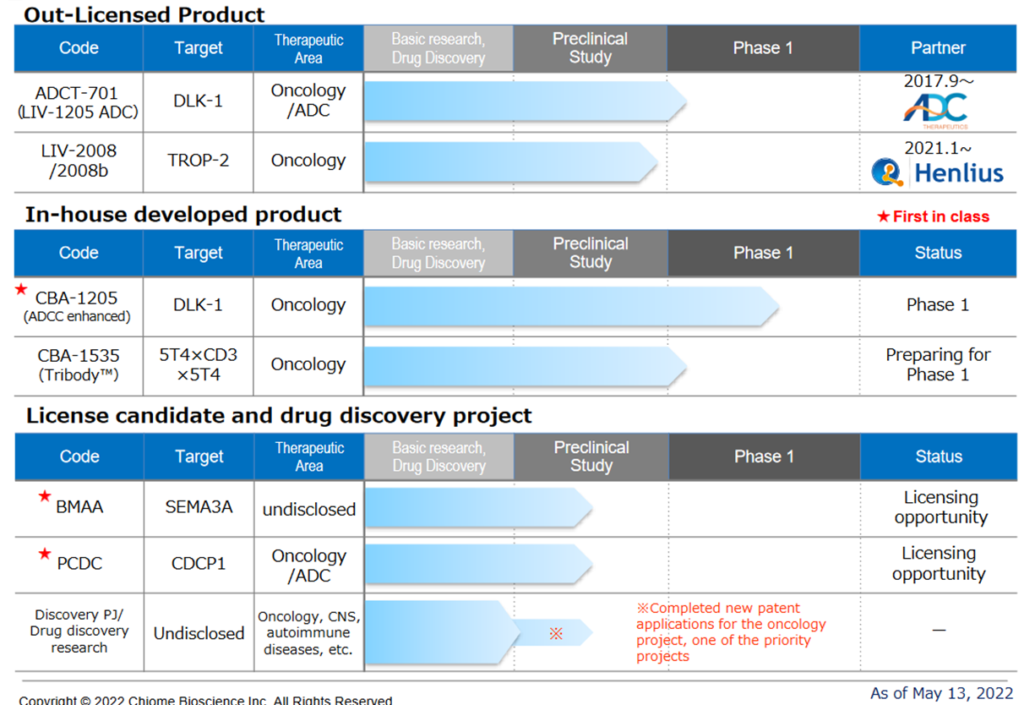

◇ Two products (ADCT-701 and LIV-2008/2008b) have been licensed in the drug discovery and development business. Two in-house developed products (CBA-1205 and CBA-1535) are in the clinical stage. In addition, two out-licensed candidates (pre-clinical stage) (BMAA, PCDC). In addition, the company has ten other drug discovery projects/exploratory research themes at any time.

◇ In the drug discovery support business, in addition to the Chugai Group, which has been a significant customer, the company has expanded its clientele to include Kyowa Kirin and Ono Pharmaceutical Industries. The business has recently grown to sales of 600 million yen a year.

◇ In FY2021/12, sales were 710 million yen, and R&D costs were 1.31 billion yen, resulting in an operating loss of 1.32 billion yen and a net loss of 1.29 billion yen. All pipelines are progressing well in the drug discovery and development business, with in-house developed CBA-1205 advancing to the second half of the Phase I clinical trials. In the drug discovery support business, the development of new customers is underway in addition to increased transactions with existing customers.

◇ The company’s share price has been on a downtrend, affected by the global adjustment of growth stocks. However, recently the share price appears to be bottoming out. The shares should be revalued if the company moves from the investment phase to the profitable stage through the out-licensing of its clinical development products.

Table of contents

| Summary | 1 |

| Key financial data | 2 |

| Focus on investment in drug discovery bio-venture | 3 |

| Pharmaceutical market trends | 4 |

| Business summary | 5 |

| Business domain/revenue models/core competencies | 5 |

| Drug Discovery and Development Business | 8 |

| Drug Discovery Support Business | 11 |

| R&D investment and finance trends | 11 |

| Financial results trends | 13 |

| FY12/2021 financial results actual | 13 |

| FY12/2022 Q1 financial results actual | 14 |

| FY12/2022 financial results forecast | 15 |

| Growth strategies and development investment | 15 |

| Stock price trends | 16 |

| Financial data | 18 |

| Company Profile | 19 |

| Company profile/History | 19 |

| Management/Status of major shareholders | 20 |

Key financial data

| Fiscal Year | 2016/12 | 2017/12 | 2018/12 | 2019/12 | 2020/12 | 2021/12 |

| Net sales | ||||||

| Drug Discovery and Development Business | 27 | 59 | 2 | 29 | 3 | 103 |

| Drug Discovery Support Business | 224 | 200 | 210 | 417 | 477 | 609 |

| Total net sales | 252 | 259 | 212 | 447 | 480 | 712 |

| Cost of sales/SG&A expenses | 1,294 | 1,147 | 1,751 | 1,849 | 1,764 | 2,047 |

| R&D expenses | 626 | 592 | 1,230 | 1,299 | 1,156 | 1,312 |

| Others | 667 | 555 | 521 | 550 | 607 | 735 |

| Operating loss | (1,042) | (887) | (1,539) | (1,401) | (1,283) | (1,334) |

| Ordinary loss | (1,047) | (883) | (1,533) | (1,410) | (1,291) | (1,329) |

| Net loss | (1,491) | (882) | (1,533) | (1,403) | (1,293) | (1,479) |

| Current assets | 4,681 | 4,196 | 2,609 | 2,561 | 3,248 | 2,216 |

| Cash and marketable securities | 4,553 | 4,027 | 2,328 | 2,105 | 2,686 | 1,790 |

| Total assets | 4,789 | 4,419 | 2,831 | 2,808 | 3,494 | 2,339 |

| Total net assets | 4,565 | 4,217 | 2,676 | 2,621 | 3,109 | 1,893 |

| Equity ratio (%) | 94.5 | 94.6 | 93.5 | 92.6 | 88.2 | 88.2 |

| Cash flow from operating activities | (969) | (867) | (1,688) | (1,537) | (1,360) | (1,131) |

| Cash flow from investing activities | 1,988 | (137) | – | (26) | (3) | (35) |

| Cash flow from financing activities | 1,433 | 478 | (10) | 1,341 | 1,944 | 271 |

| Increase/decrease in cash and cash equivalents | 2,452 | (525) | (1,698) | (222) | 580 | (895) |

Cash flow from financing activities: Funds from subscription rights of shares

Source: Omega Investment from Company materials

Focus on investment in drug discovery bio-venture

1) Promising pipeline

Drug discovery biotech ventures run a business model that is very different from companies in other industries, and equity investors require a unique perspective when investing. While the company earns short-term profits from its drug discovery support business, it has shifted its business focus to the drug discovery and development business. Drug discovery ventures usually have their own technologies and drug candidate compounds and carry out research and development until the initial drug effects are seen in pre-clinical or clinical trials, after which they out-license their products to pharmaceutical companies, including major companies, for large-scale clinical trials. According to various surveys* and other sources, the probability that a drug discovery candidate that reaches the Phase I (Phase I clinical trials) will eventually be launched is estimated to be around 10%, which in turn means that a pipeline of at least ten products must always be available.

As discussed in the business overview, the company currently has two products already licensed out, two in the clinical stage and two in pre-clinical trials in its pipeline, and around ten drug discovery projects/exploratory research themes in progress at any one time. It is fair to say that the company has formed a portfolio that considers the risks inherent in bio-ventures.

Surveys*: ‘Clinical Development Success Rates 2006-2015’ Amplion, Biomedtracker, BIO 2016, etc.

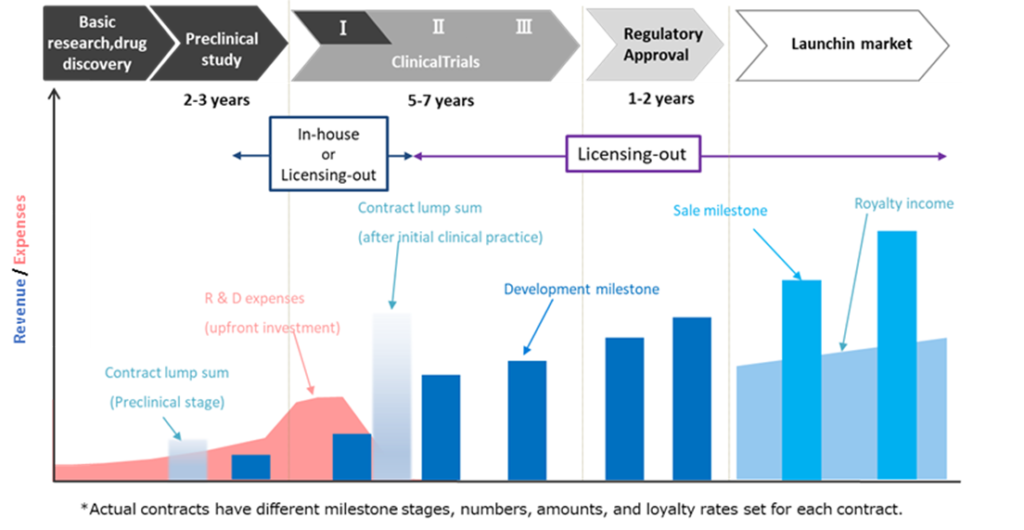

A general revenue picture of a drug discovery business

Source: Company materials

2) Finance capability

As shown in the R&D investment and financing trends to be revealed later, to continue in the drug discovery and development business, the company needs to spend around 1 billion yen annually on research and development, which is a challenge. The finance capability is required to ensure the necessary liquidity on hand without depleting the R&D fund. Over the past few years, the company has flexibly raised funds through the issue of subscription rights, and four new share issues have diluted the per-share value of existing shareholders by more than 100%. Further dilution will occur if new share fundraising is 1 to 2 billion yen versus the current market capitalisation of around 10 billion yen. To minimise the burden on existing shareholders, measures to increase the share price will also be required.

3) Transparency-conscious information disclosure system.

The drug discovery business can offer significant returns if successful, but the risks are also very high. Investors must dream of a long future payback and lock up their money. In addition, the specialised nature of the business makes it difficult to understand the details, especially compared to other technology companies. In addition, preclinical results do not necessarily mean success in humans, and only champion data (the best results) may be published when information is made public. Without due consideration, companies’ overly optimistic outlook or excessive future market expectations would harm both ventures and investors in the medium to long term.

Since the company transitioned to a new management structure, it has disclosed accurate and transparent information. In addition to reviewing its internal compliance and risk management systems, in terms of investor relations, President Kobayashi has shown a positive attitude towards information disclosure,for example, by using videos to disseminate information. Highly transparent information disclosure and dissemination are expected to create shareholder value that aligns more with the actual situation.

4) The robust and reliable management team

Managing a high-risk, high-return, and highly specialised drug discovery venture requires a high level of management skill. The company’s current management team shows that all directors and auditors have long experience in research and development and management departments at top companies in the pharmaceutical industry and academia. President Kobayashi has also been stationed overseas, which will be a plus when creating future business opportunities such as alliances with overseas companies. Currently, the management team meets the criteria of solidity and high reliability.

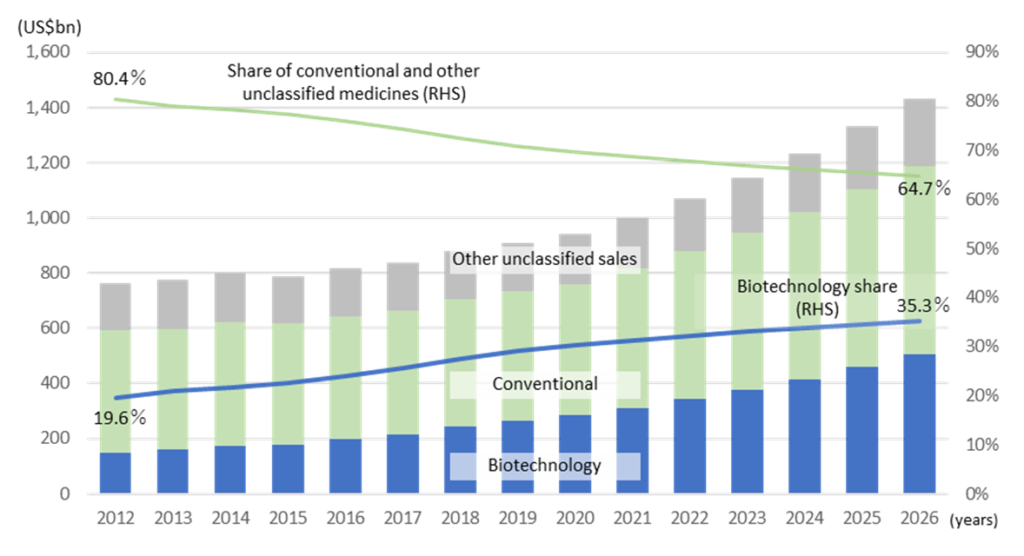

Pharmaceutical market trends

The world pharmaceutical market is a huge industry of ¥130tr a year, and in Japan alone, the market size is about ¥10tr a year. It takes around 10 years or more to develop a new drug, and it is not uncommon for the development cost to exceed ¥100bn. Since 1980’s, biopharmacy using biotechnology instead of conventional low-molecular-weight compound drugs has emerged. Biopharmacy that applies biomolecules such as genetically modified proteins is expected to grow at a high rate in the future. In the development of vaccines for COVID-19, biopharmaceutical technologies such as mRNA technology for Pfizer/Biontech and Moderna, and viral vectors for AstraZeneca are used.

Worldwide Prescription Drug and OTC Pharmaceutical Sales: Biotech vs. Conventional Technology

Sales ranking of prescription drugs, 2021

| NO | Product | Company | Main indication | Modality | Sales ($mil.) |

| 1 | Humira | Abbvie/Eisai | Rheumatoid arthritis | Antibody | 21,170 |

| 2 | Keytruda | Merck & Co. | Oncology | Antibody | 17,186 |

| 3 | Eliquis | Bristol Myers Squibb (BMS), Pfizer | Anticoagulant | Small molecule | 16,732 |

| 4 | Revlimid | BMS | Multiple myeloma | Small molecule | 12,821 |

| 5 | Ibrutinib | Abbvie, Johnson & Johnson (J&J) | Lymphoma | Small molecule | 9,777 |

| 6 | Eylea | Regeneron/Bayer/Santen | Age-related macular degeneration | Recombinant protein | 9,247 |

| 7 | Stelara | J&J/Mitsubishi Tanabe | Psoriasis | Antibody | 9,134 |

| 8 | Biktarvy | Gilead | HIV infection | Small molecule | 8,624 |

| 9 | Opdivo | Ono/BMS | Oncology | Antibody | 8,504 |

| 10 | Xarelto | Bayer, J&J | Anticoagulant | Small molecule | 8,044 |

In recent years, antibody drugs have accounted for a large proportion of large pharmaceutical products (blockbusters), with four of the top 10 ethical drug sales in 2021 being antibody drug products (previous page, table).

The table below compares antibody drugs with conventional small molecule drugs. Antibody drugs have many advantages such as being effective for diseases unique to individual patients and having few side effects. Developing antibody drugs requires a large amount of funding, which resulted in the skyrocketed price of the medicine, and the treatment cost will be extremely high.

Main differences between antibody drugs and small molecule drugs

Antibody |

Small molecule |

|

Side effects |

Antibody, in general, is safe and causes less side effect, since it specifically targets cells and tissues relating to the disease, but not normal cells and tissues. |

It is safe and harmless when they are used according to the approved condition. |

Efficacy |

Antibody directly attacks targets or signals that causes the disease, i.e., antibody aims for cure of the disease, not supportive care. |

Aiming at fundamental treatment by attacking the disease mechanisms and causative agents at the root of the disease.They are often used for symptomatic treatment (e.g., pain relief). |

Administrationroute |

In general, injection and fusion at a hospital and clinic.(Self-injection is available in some cases) |

It can be taken at home by injection, orally, transdermally, eye drops, inhalation, etc. |

PK |

Longer half-life in serum, which allows less frequent dosing such as weekly or monthly. |

Relatively short half-life in serum. In some cases, daily dosing, 2-3 times a day, are required. |

Target specificity |

High (It’s an essential concept of antibody) |

Depends on the drug. |

Manufacturing process |

Culture of microorganism or animal cells. |

Chemical synthesis, culture of microorganism. |

Source: Omega Investment from Company materials

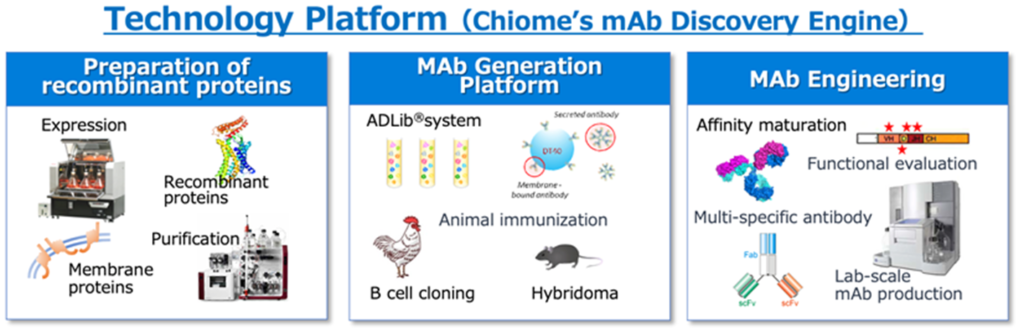

Business summary

With the corporate mission of “Shine light on unmet needs. Bring a brighter future to patients,” the Company has multiple antibody generation technologies, including its own ADLib®︎ system, and technologies and know-how related to protein and antibody engineering. The Company creates antibody drugs rapidly with high accuracy by integrating those technologies with its own operating technical platforms with extensive development facilities.

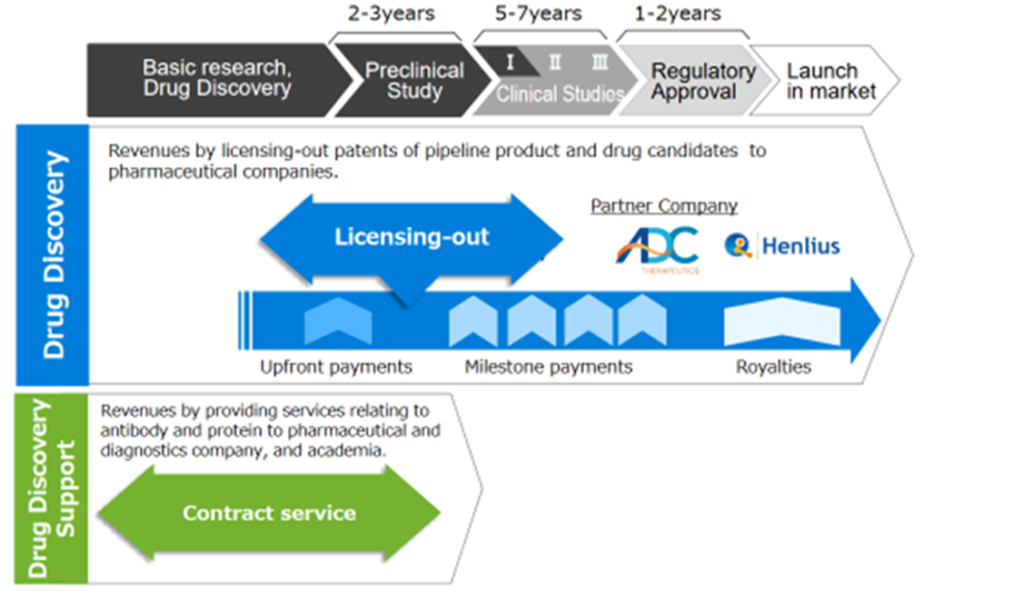

The Company’s business areas are shown below. Unlike Megapharma (a major pharmaceutical manufacturer), it adopts a business model typical to bio-ventures, and the Company focuses on basic research/drug discovery and preclinical studies. By licensing-out patents of pipeline product and drug candidates to pharmaceutical companies, the Company will receive upfront payments, milestone payments and royalties. Chiome has been focusing on the drug discovery and development business last few years and has recently started an initial clinical development.

The Company’s business domain in drug development

The company’s revenue model

See the diagram above for the company’s revenue model. Revenue from the drug discovery and development business is expected to come from upfront payments when medical candidates are licensed out to pharmaceutical companies in the early stages of development, subsequent development milestone income and royalty income. Although the company expects to receive significant revenues from a pharmaceutical product’s successful development and eventual launch, it requires a long development period. It carries the risk of abandoning the development process.

On the other hand, in the drug discovery support business, service fee income from antibody generation and drug discovery support to pharmaceutical companies and research institutions is paid regularly according to contracts. Although the business is not expected to generate significant future revenues as in the drug discovery business, it can generate steady cash flow in the current period.

Due to extensive upfront research and development costs and significant ongoing losses, drug discovery ventures are required to make regular financings. Still, the company combines both businesses to complement its short- and medium- to long-term cash flow.

Core competencies that support the Company’s business

Antibody drugs takes advantage of the mechanism of recognizing proteins possessed by bacteria and viruses, which are the immune system of the living body, as foreign substances (antigens), and making proteins (= antibodies) that react with the foreign substances to attack and eliminate foreign substances (antigen-antibody reaction). The Company has multiple antibody generation technologies, including the ADLib®︎ (Autonomously Diversifying Library) system that was originally developed. The original ADLib®︎ system is a monoclonal antibody generation system using chiken-immune cells, but the Company have also developed a human ADLib®︎ system in which the chicken antibody gene is replaced with a human antibody gene. The human ADLib®︎ system is a method for generating human antibodies from cultured cells in vitro without using a living body (animal). It has unique features that other antibody generation technologies do not have, such as (1) Human antibodies can be obtained in a short time, and (2) Utilizing the characteristic of autonomous diversification of genes, it is possible to continuously increase the affinity of antibodies, and (3) being unaffected by immune tolerance, unlike the immunization method of individual animals.

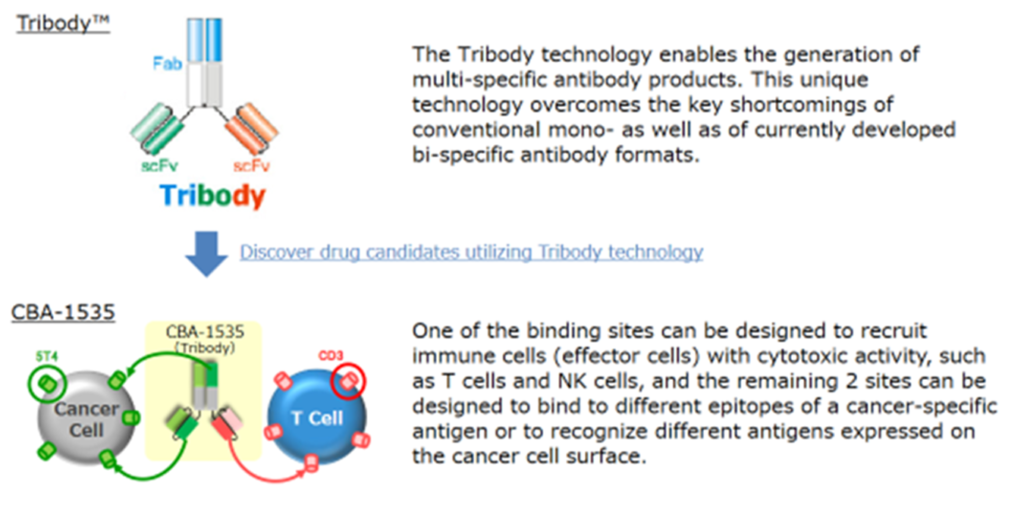

TribodyTM (multiplex specificity antibody generation technology)

The company has also been working on creating new antibodies using Tribody technology in recent years. Tribody️ (multi-specificity antibody creation technology) is a technology acquired in December 2018 through the signing of a transfer agreement with Biotechnol of the UK. While a normal antibody has one molecule that binds to one antigen, Tribody has three different antigen-binding sites within a single molecule, making it possible to combine other functions. Combining antibodies can be expected to produce a variety of effects that cannot be achieved with single antibodies, while at the same time improving research efficiency and enabling the creation of a continuous new pipeline of products. By positioning Tribody technology as the future technology platform, the company can fulfil its mission to accelerate advanced drug discovery research into unmet needs. The company’s first application of Tribody technology, CBA-1535, is now in the Phase I clinical development.

The company holds the following patents. More than half of the company’s researchers are PhDs, and the company has used its research and development capabilities to build a technology platform that includes the protein mentioned above preparation and antibody engineering in addition to antibody generation technology. The company can create optimal therapeutic antibodies for therapeutic targets by integrating these technologies.

Major patents related to basic technology

Relation |

Title of invention |

Applicant |

Registration status |

ADLib®︎ systemBasic patent |

Method for promoting somatic homologous recombination and method for generating specific antibody |

RIKEN, the Company |

Established in Japan, US, Europe and China |

Induction of somatic homologous recombination |

RIKEN, the Company |

Established in Japan, US, Europe and China |

|

Human ADLib®︎ system |

Cells that generate human antibodies |

The Company |

Established in Japan, Europe, China. Pending in US. |

Methods of obtaining antibodies. |

The Company |

Established in Japan, US. Pending in Europe and China. |

|

Methods to promote diversification of variable antibody regions. |

The Company |

Established in Europe. Pending in Japan, US and China. |

Source: Omega Investment from Company’s annual report

Essential patents relating to lead antibodies

Relation |

Title of invention |

Applicant |

Registration status |

CBA–1205 |

Anti-human DLK-1 antibody with in vivo anti-tumour activity. |

The company (succeeded by Livtec) |

Established in seven countries, including Japan, US, Europe and China |

Cancer Therapeutics |

The company |

PCT-filed |

|

CBA–1535 |

Fusion protein containing three binding domains for 5T4 and CD3. |

The company |

Established in seven countries, including Japan, US, UK and China. Pending in Europe and other countries. |

LIV–2008 |

Anti-human TROP-2 antibody with in vivo anti-tumour activity (humanised). |

The company (succeeded by Livtec) |

Established in 10 countries, including Japan, US, UK and China. Pending in other foreign countries. |

Anti-human TROP-2 antibody with in vivo anti-tumour activity (mouse). |

The company (succeeded by Livtec) |

Established in 13 countries, including Japan, US and Europe |

|

BMAA |

Anti-semaphorin 3A antibodies and their use in treating Alzheimer’s disease and immune and inflammatory diseases. |

(Public) Yokohama City University, the company. |

Established in Japan, US and Europe |

PCDC |

Anti-CDCP1 antibody |

The company |

PCT-filed |

Source: Omega Investment from Company’s annual report

Drug Discovery and Development Business

This is in-house and/or joint development of antibody drug discovery in disease areas of high unmet medical needs. The Company receives up-front contract payments, milestone fees and royalties by licensing out intellectual property rights (patent rights, etc.) related to antibodies to pharmaceutical companies. In 2017, the company shifted from its previous business model, which relied on licensing out the ADLib®︎ system technology, to a more focused business model with a greater emphasis on drug discovery and development, which it is currently focusing on. The company’s current pipeline is as follows.

Drug discovery and development – pipeline

Out-Licensed Product

★ ADCT-701 (Humanized anti-DLK1 antibody ADC)

Target molecule |

DLK-1 |

Features |

Antibody-drug conjugate (ADC) of LIV-1205, a cancer therapeutic antibody targeting DLK-1, and PBD*1 *1Pyrrolobenzodiazepine: Drugs with antitumor properties |

Therapeutic Area |

Liver cancer, lung cancer, neuroblastoma etc. |

Patent |

Granted in Japan, US, EU, China etc. (Humanized anti-DLK1 antibody) |

Progress |

Out-licensed to ADC Therapeutics (ADCT, Switzerland) in September 2017; under development for clinical trials at ADCT as development number ADCT-701; ADCT is preparing a clinical trial for neuroendocrine cancer with the National Cancer Institut (NCI). |

Under the license agreement with ADC Therapeutics, ADC is granted the license only for development for PBD. The Company obtains the development rights for ADCs other than PBD, ensuring the flexibility of strategic development of anti-DLK-1 antibodies including CBA-1205.

★LIV-2008/2008b (Humanized anti-TROP2 antibody)

Target molecule |

TROP-2 |

Therapeutic Area |

Breast cancer (TNBC), colorectal cancer, pancreatic cancer, prostate cancer, etc. |

Expectations |

LIV-2008 is a humanized monoclonal antibody targeting cell surface antigen “TROP-2” which is overexpressed in breast cancer, colon cancer, lung cancer and several types of solid cancers and also expected to play a key role in the proliferation of cancer cells. |

Patent |

Patents granted in Japan, US, Europe, China, etc. |

Progress |

In January 2021, signed a license agreement with Shanghai Henlius Biotech. Licensed development, manufacturing and marketing rights in China, Taiwan, Hong Kong and Macau with sublicense. Grant options for rights worldwide. |

The economic terms of the license agreement with Shanghai Henlius Biotech include an upfront payment of 1 million dollars (recorded in FY2021/12). In addition, if the option right is exercised to develop, manufacture and market the drug worldwide, the upfront payment upon exercise of the option and milestones based on development and marketing progress total up to approximately 122.5 million dollars. In addition, the company will receive royalty income at a fixed rate based on the size of sales if the drug is launched.

In-house pipeline

☆CBA-1205 (Humanized afucosylated anti-DLK1 antibody)

First in class

Target molecule |

DLK-1 |

Features |

Antibodies for cancer treatment that identify and attack a protein called DLK-1, which is unique to hepatocellular carcinoma, etc. |

ADCC |

GlymaxX (ProBioGen) |

Therapeutic Area |

Intractable carcinomas such as hepatocellular carcinoma and lung cancer, etc. |

Expectations |

DLK-1 controls the proliferation and differentiation of immature cells such as stem cells and progenitor cells, and has been expressed on the surface of multiple cancer cells including liver cancer and is involved in its proliferation. A molecule that has become a potential target for new cancer treatments. First-in-class candidate antibody without competitors |

Patent |

Patents granted in Japan, US, Europe, China, etc. |

Progress |

The administration started at the National Cancer Centre in July 2020. The first part of the Phase 1 clinical trial completed safety evaluation in patients with solid tumours; the second part of the Phase 1 clinical trial was prepared from December 2021; administration to the first subject started in June 2022. To evaluate safety and efficacy in patients with hepatocellular carcinoma. |

CBA-1205 has been developed in-house and is well advanced in clinical development. The market potential for liver cancer drugs is 840 000 new cases yearly. The current standard of care is surgical therapy. Licensing activities will be initiated in parallel with the second half of the Phase I clinical trial, aiming to out-licensing from 2023 onwards at the earliest. The company is looking to become profitable on a single-year basis through early out-licensing or out-licensing after finishing Phase I clinical trials.

☆CBA-1535 (Humanized anti 5T4 antibody, multi-specific antibody)

|

Target molecule |

5T4xCD3x5T4 |

|

Background |

Cancer therapeutic antibody created using Tribody technology that recognizes three molecules. |

|

Therapeutic Area |

Malignant mesothelioma, small cell lung cancer, non-small cell lung cancer, triple negative breast cancer (TNBC), etc. |

|

Expectations |

A multispecific antibody that targets the known (known) cancer antigen 5T4, which has been confirmed to be safe as a clinical target, and the protein CD3 on T cells, which are immune cells. It induces T cell proliferation and activation and exerts strong cytotoxic activity (T Cell engager antibody). This is the first clinically developed item for Tribody, and is expected to be effective against intractable cancer. |

|

Patent |

Patents granted in Japan, UK, US and China. Patent pending in Europe, etc. |

A cancer therapeutic antibody created by TribodyTM technology, which the company has been focusing on in recent years. With no prospect of the new coronavirus infection being controlled, the company have switched from the originally planned clinical trial in the UK to a clinical trial in Japan, which will have relatively less impact on development. In February 2022, the company submitted a clinical trial plan notification to the Pharmaceuticals and Medical Devices Agency (PMDA). The world’s first clinical trials for Tribody were initiated at the National Cancer Centre Central Hospital and Shizuoka Cancer Centre.

Licensing candidates and drug discovery projects

☆BMAA (Humanized anti-Semaphorin3A antibody)

First in class

|

Target molecule |

SEMA3A |

|

Background |

An antibody obtained by humanizing the anti-semaphorin 3A antibody acquired by the Company’s original antibody generation technology ADLib®︎ system. Established as an antibody with both selectivity and function inhibitory activity through joint research with Professor Yoshiro Goshima of Yokohama City University. |

|

Therapeutic Area |

Not disclosed |

|

Expectations |

Expected to be indicated in a wide range of disease areas known to be associated with semaphorin 3A, including immunological and neurological diseases. |

|

Patent |

Patents granted in Japan, US and Europe |

|

Progress |

Completed joint research with overseas research institutes aimed at diseases in which semaphorin 3A is involved. Data on semaphorin 3A and from exploratory studies on the semaphorin family will be used for future business development activities. |

☆PCDC (humanised anti-CDCP1 antibody-drug conjugate)

First in class

|

Target molecule |

CDCP1 |

|

Background |

Solid cancer |

|

Therapeutic Area |

CDCP1 is a first-in-class target molecule for DME. It is expressed in various cervical cancers, including cancer types in the standard treatment regime (lung, colorectal, spleen, breast and ovarian cancers). It is expected to have a broad efficacy and safety profile based on its binding properties and toxicity profile. |

|

Expectations |

Anti-CDCP1 antibody (PCT international application pending). |

|

Patent |

Licensing activities are underway, focusing on ADC applications. Additional animal studies are being conducted in parallel; patent information on the application was published at the World Intellectual Property Organisation (WIPO) in July 2021. |

In addition to the publicly disclosed pipeline, the company has around ten drug discovery projects/exploratory research themes in progress at any time. Projects are underway in oncology, central nervous system and autoimmune diseases. The pipeline portfolio is developed based on drug discovery projects’ general probability of success. The company is continuing its efforts to create a new pipeline while reviewing scrap-and-build as appropriate, considering progress at the exploratory level.

Other research in the area of infectious diseases and technological improvements is also conducted in collaboration with domestic academia and funded by the National Agency for Medical Research and Development (AMED).

Drug Discovery Support Business

The drug discovery support business earns service fees and other income by supporting drug discovery research conducted by pharmaceutical companies, diagnostic companies, universities and other research institutions. It is a “high value-added contract research business” that mainly provides major domestic pharmaceutical companies with antibody generation, antibody engineering and protein preparation using the company‘s antibody drug discovery technology platform and is capable of generating stable revenues. It complements the drug discovery and development business in terms of revenue, where the contribution to substantial income is unstable and takes time to be realised. In addition, contract research transactions are expected to contribute to the future expansion of transactions in the drug discovery business. The primary services are as follows.

Service item |

Contents |

Protein and antigen preparation, antibody expression and purification |

Expression and purification of recombinant proteins (antigens) for antibody prodcution and antibodies for cell research and development applications. Expression and purification methods are selected according to type and analysed for purity and physical properties. |

Stable expression cell line generation |

To ensure a stable supply of recombinant proteins (antigens and antibodies), recombinant technology is used to create cell lines that efficiently express recombinant proteins. |

Antibody generation using the ADLib® system and other systems |

The ADLib® system uses antibody generation technologies such as hybridoma and B cell cloning to produce monoclonal antibodies for use in drug discovery research. The system proposes antibody generation plans tailored to customer needs, utilising knowledge and expertise in antibody drug discovery. |

Antibody affinity enhancement work using the ADLib® system |

By using the technology and know-how of the ADLib® system to improve antibody binding strength (antibody affinity), it is expected to generate antibody drugs with higher drug efficacy. |

Source: Omega Investment from Company’s annual report

The Chugai Pharmaceutical Group has been the primary customer among pharmaceutical companies, but in recent years, the company has actively developed its business partners. Sales grew from 410 million yen in FY2019/12 to 470 million yen in FY2020/12 to 600 million in FY2021/12 and are expected to grow to 620 million yen in FY2022/12.

Major clients in Drug Discovery Support Business |

contract progressive type |

Contract date |

Chugai Pharmaceutical Co., Ltd. |

Entrusted comprehensive transaction |

June, 2011 |

Chugai Pharmabody Research Pte. Ltd |

Entrusted comprehensive transaction |

August, 2012 |

Mitsubishi Tanabe Pharma Co., Ltd.TANABE RESEARCH Laboratories U.S.A., Inc. |

Entrusted comprehensive transaction |

December, 2016 |

Ono Pharmaceutical Co., Ltd. |

Entrusted comprehensive transaction |

October, 2018 |

Kyowa Kirin Co., Ltd. |

Entrusted comprehensive transaction |

July, 2019 |

Source: Omega Investment from Company data

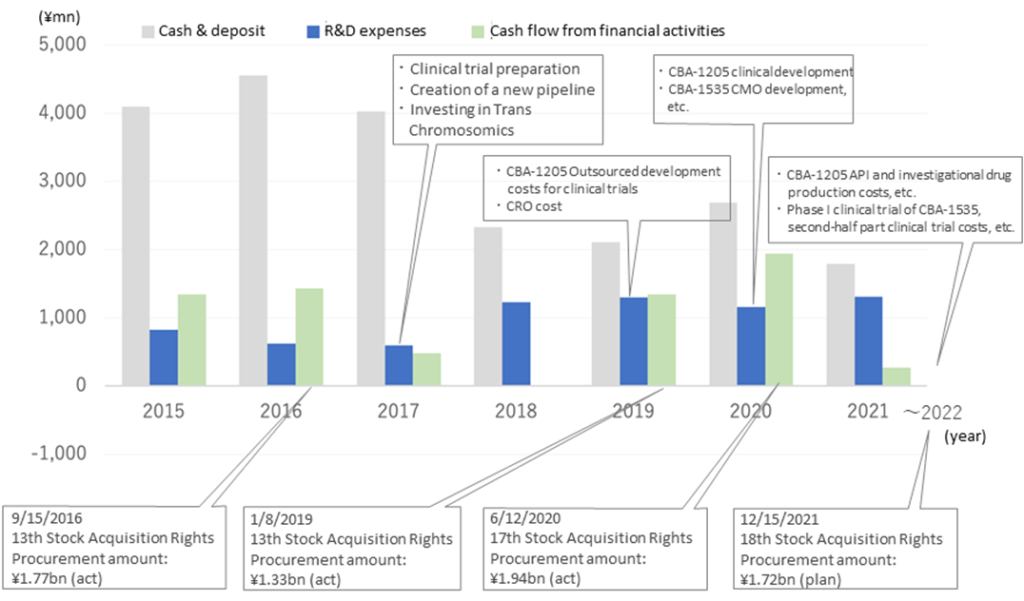

R&D investment and finance trends

For drug discovery venture companies that require a large amount of R&D funds over a long period of time, stable

For drug discovery venture companies that require a large amount of R&D funds over a long period of time, stable finance is extremely important to make commercial success and survive. In 2017, the management of the Company decided to shift the focus to the Drug Discovery and Development Business, and financing became an even more important task in order to promote the business vigorously.

In September 2016, January 2019, June 2020 and December 2021, the Company raised funds through third-party allotment by issuing stock acquisition rights. The issuance of new shares through a public offering or third-party allotment would have a serious impact on the stock price, because if the Company is to raise the whole required fund in one go, it will cause huge dilution at once. In addition, bank borrowing will impair financial soundness as debt ratio increases. Although other financing methods are possible (MSCB, etc.), subscription rights is agile and takes into consideration the impact on existing shareholders.

Trends in cash and deposit balance, R&D expenses and cash flow from financial activities

As a result, however, dilution has occurred by about 20% each time due to the resulting new shares, and the existing shareholders are burdened with it. It can be said that it added to the downtrend of stock prices in recent years (see chart on page 17). In promoting finance further, it is important that the Company achieves steady research and development results, so the shares are valued well by investors.

Details of financing by issuing stock acquisition rights

13th Stock Acquisition Rights |

14th Stock Acquisition Rights |

17th Stock Acquisition Rights |

18th Stock Acquisition Rights |

|

Allocation date |

September 15, 2016 |

January 8, 2019 |

June 12, 2020 |

December 15, 2021 |

No. of stock acquisition rights issued |

5,567 |

6,428 |

70,000 |

80,000 |

No. of stock acquisition rights exercised |

4,220 (Number of amortized stock acquisition rights: 1,347, September, 2018) |

6,428 |

70,000 |

23,125 (as of end of May 2021) |

Issuance price |

¥4,514 per stock acquisition right(Total ¥25,129,438) |

¥709 per stock acquisition right(Total ¥4,557,452) |

¥101 per stock acquisition right(Total ¥7,070,000) |

¥210 per stock acquisition right(Total ¥16,800,000) |

No. of potential shares due to the issuance |

5,567,000 shares |

6,428,000 shares |

7,000,000 shares |

8,000,000 shares |

Maximum dilution rate |

24.81% |

24.01% |

21.04% |

19.86% |

Allocate destination |

Merrill Lynch Japan Securities |

Merrill Lynch Japan Securities |

SMBC Nikko Securities |

SMBC Nikko Securities |

Amount of funding (plan) |

¥2,894,402,438(Approximate amount of deduction) |

¥1,482,281,452(Approximate amount of deduction) |

¥2,414,070,000(Approximate amount of deduction) |

¥1,728,800,000(Approximate amount of deduction) |

Amount of funding (actual) |

¥1,777mn |

¥1,336mn |

¥1,941mn |

¥333mn(as of end of May 2021) |

Specific use of raised funds(Amount; Timing) |

Preparation for clinical trials and implementation of initial clinical trials¥1,300mn; 1/2017〜12/2019 |

Pre-IND submission and early-phase clinical trials for CBA-1535¥1,200mn; 4/2019〜12/2021 |

Pre-clinical study for a new ADC pipeline and research on discovery projects in oncology and infectious/rare diseases.¥762mn |

CBA-1205 API and investigational drug production costs, etc.:¥500mn |

Creation and introduction of new pipelines¥300mn; 12/2016〜12/2018 |

Expansion and licensing-in of new pipelines¥282mn; 1/2019〜12/2020 |

Development of new pipeline by utilizing multispecific antibody generation technology (Tribody)¥80mn |

Development research and biomarker search costs to enhance the value of CBA-1205: ¥350mn |

|

Investing in companies with advanced technology and seeds, M&A¥1,294mn; 10/2016〜12/2018 |

Acquisition of new antibody generation technologies and new pipelines.unappropriated |

Costs for the second half of Phase I clinical part of the CBA-1535 clinical trial and concomitant investigational drugs: ¥678mn |

||

Capital investment/expenditure on expansion and replacement of research equipment:¥200mn |

Source: Omega Investment from Company materials

Financial results

1)FY2021/12 financial results – a 48% increase in revenue and an operating loss of 1.3 billion yen.

The company’s FY2021/12 results showed a 27.6% increase in sales in the drug discovery support business, with overall sales up 48.3% (712 million yen) and an operating loss of 1,334 million yen (1,283 million yen in FY2021/12).

Sales in the drug discovery and development business amounted to 103 million yen (the previous year: 3 million yen) due to an upfront payment for the LIV-2008/2008b licence agreement in 1Q. Sales in the drug discovery support business were 609 million yen. Sales increased by 132 million yen due to stable transactions with existing customers, mainly domestic pharmaceutical companies. In terms of costs, 1,312 million yen was spent on research and development, an increase of 155 million yen year-on-year, due to CBA-1535 investigational drug manufacturing costs and other CMC development costs.

In BS, cash and deposits at the end of December 2021 amounted to 1,790 million yen, a decrease of 895 million yen compared to the end of December 2020. In addition, non-current assets decreased by 124 million yen due to a loss on the valuation of investment securities of the investee. Total net assets amounted to 1,893 million yen, a decrease of 1,479 million yen in retained earnings due to the net loss for the year, compared with 3,109 million yen at the end of the previous year. Total assets amounted to 2,339 million yen (previous year-end: 3,494 million yen). Capital and capital reserves increased by 128 yen million each due to the exercise of subscription rights. The equity ratio fell by 8.8 pt from 88.2% at the end of December 2020 to 79.4%.

◇Progress in the pipeline:

<Out-licensed products>

*LIV-1205; out-licensed to ADC Therapeutics, Switzerland, for ADC use exclusively with PBDs, with preparations underway for IND filing and clinical trials in 2022 as ADCT-701. A collaboration with the National Cancer Institute (NCI) in neuroendocrine cancer is also planned.

*LIV-2008; in January 2021, a licence agreement was signed with Shanghai Henlius Biotech, Inc. in China. Granting development, manufacturing and marketing rights in China, Taiwan, Hong Kong and Macau. As mentioned above, this agreement’s upfront payment (1 million dollars) has been recognised as sales in FY2021/12. Licensing activities are ongoing in addition to Henlius.

<In-house developed products>

*CBA-1205; the first half part of a phase 1 trial in patients with solid tumours conducted at the National Cancer Centre has been completed. The clinical trial showed that the target and this antibody are safe, and higher volumes of safety data were obtained than at the beginning. The development schedule is progressing well. At the end of 2021, the company decided to move to the second half part of the Phase I trial in patients with hepatocellular carcinoma. The company envisages two scenarios for the timing of the out-licensing agreement. It envisages out-licensing based on data from the first part as early as 2023 and by 2025 at the latest.

*CBA-1535; Tribody manufacturing process established and GMP API and investigational drug production completed. As previously reported, given the impact of the new coronavirus infection, the decision was made to change the clinical trial application to one in Japan, where the impact on development would be minimal, instead of the originally planned clinical trial in the UK. On 16 February 2022, a clinical trial notification was submitted to the PMDA. The trial is the world’s first clinical trial to verify the mechanism of action of Tribody and, if the concept is confirmed, will expand the potential of Tribody’s application to many cancer antigens.

Revenue trends

| JPY, mn, % | Net sales |

YoY % |

Oper. profit |

YoY % |

Ord. profit |

YoY % |

Profit ATOP |

YoY % |

EPS (¥) |

DPS (¥) |

| 2018/12 | 212 | -18.1 | -1,539 | – | -1,533 | – | -1,533 | – | -57.26 | 0.00 |

| 2019/12 | 447 | 110.3 | -1,401 | – | -1,410 | – | -1,403 | – | -44.61 | 0.00 |

| 2020/12 | 480 | 7.4 | -1,283 | – | -1,291 | – | -1,293 | – | -39.06 | 0.00 |

| 2021/12 | 712 | 48.3 | -1,334 | – | -1,329 | – | -1,479 | – | -36.74 | 0.00 |

| 2022/12 (CE) | – | – | – | – | – | – | – | – | – | 0.00 |

| 2021/12 1Q | 246 | 171.1 | -155 | – | -149 | – | -160 | – | -4.00 | – |

| 2022/12 1Q | 128 | -47.8 | -486 | – | -491 | – | -492 | – | -11.66 | – |

*As it is difficult to calculate a rational earnings forecast for the Drug Discovery and Development Business, the Company discloses only sales of ¥6.2mn for the Drug Discovery Support Business in the earnings forecast for FY12/22.

<Out-licensing candidates>

*BMAA; secured in-house development opportunities following the termination of the option agreement with SemaThera in May 2021. Completed joint research with overseas research institutes targeted at diseases involving semaphorin 3A. Future business development activities will be linked to the semaphorin 3A data acquired to date and data from exploratory studies on the semaphorin family.

*PCDC; licensing activities and additional animal studies are underway with a focus on ADC applications; in July 2021, patent information on the application was published at the World Intellectual Property Organisation (WIPO); in July 2021, the patent information was published at WIPO. The target molecule is CDCP1, a first-in-class antibody targeting solid tumours (lung, head and neck, oesophageal, colorectal, cervical and other cancers).

*Drug discovery research projects; In drug discovery research projects other than those listed above, the induction and development plans for priority projects to enhance the pipeline will be reviewed, and existing projects will be revised or abolished; research activities will continue on two of the five priority drug discovery projects. In addition, the company will continue its efforts to create a new drug discovery pipeline in the future by conducting drug discovery research on around ten themes at any one time, including other drug discovery projects.

◇ Progress in drug discovery support business: extension of contract research with the Chugai Group

As a drug discovery venture, the drug discovery support business is a stable source of income for the company. In October 2021, the company extended its contract research agreements with Chugai Pharmaceutical and Chugai Pharmabody Research, two of its early customers. It extended the contract with Chugai Pharmaceutical for three years until 31 December 2024 and with Chugai Pharmabody Research for five years until 31 December 2026.

◇ Use and improvement of the ADLib®︎ system:

The company continued utilising and improving its core technology, the ADLib®︎ system. In May 2021, it signed a joint research agreement with Mologic in the UK to generate antibodies for diagnostic use in infectious diseases using the ADLib®︎ system. In addition, a patent was granted in Japan for the ADLib®︎ system’s method of obtaining antibodies. Furthermore, Tokyo Medical and Dental University announced research results on the development of a treatment for Alzheimer’s disease using anti-HMGB1 obtained by the human ADLib®︎ system. This is expected to improve the technology related to the drug discovery support business and contribute to strengthening the in-house drug discovery pipeline.

◇ Funding was raised through the issue of subscription rights

On 15 December 2021, the company issued its 18th warrant (with an exercise price amendment clause) through a private placement, with SMBC Nikko Securities as the allottee, raising approximately 1.7 billion yen. See p. 12 for details on the use of funds. Securing funds for research and development is one of the most critical issues for drug discovery ventures, and the company is on track to ensure cash for the next two years or so.

2) FY2022/12 1Q results – 47.8% decline in sales, operating loss of ¥480 million.

The company’s 1Q results for FY2022/12 show sales of 128 million yen (-47.8% YoY) and an operating loss of 486 million yen (vs an operating loss of 155 million yen in the same quarter of last fiscal year). In 1Q FY2021/12, an upfront payment of 103 million yen was recorded in the drug discovery and development business, whereas there was no such payment this year.

In the drug discovery business, R&D costs were 446 million yen, an increase of 229 million yen year-on-year, and segment loss was 446 million yen, compared with a segment loss of 113 million yen a year earlier, as a result of the costs associated with the completion of the manufacturing of the investigational drug CBA-1535.

The drug discovery support business continued to enjoy stable interaction with existing customers, mainly domestic pharmaceutical companies. Sales to 128 million yen (-10.1%), segment profit to 70 million yen (-10.7%). The main reason for the decline in sales was the inclusion of a large spot project in the same period of the previous year. Looking at Q1 alone, the new Accounting Standard for Revenue Recognition, introduced this year, also had a slight impact. The segment profit margin was 55.1%, meeting the target of 50%.

In BS, cash and deposits at the end of March 2022 amounted to 1,744 million yen, a decrease of 46 million yen from end-December 2021. In addition, current assets decreased by 211 million yen, partly due to the reversal of advance payment and recording it as an expense in the current period, following the completion of the production of the CBA-1535 investigational medicinal product. Total net assets amounted to 1,653 million yen (1,893 million yen at the end of the previous year) because of a 126 million yen increase in capital stock and capital reserve, respectively, due to the exercise of subscription rights, but a 488 million yen decrease in retained earnings due to the net loss for the year. Total liabilities and net assets amounted to 2,126 million yen (vs 2,339 million yen at the end of the previous year). The equity ratio fell by 3.1 pt from 79.4% at the end-December 2021 to 76.3%.

3) FY2022/12 full-year forecast: drug discovery support business (forecast: 620 million yen) is progressing on target.

Regarding the forecast for FY2022/12, the company only announces revenues of 620 million yen from the drug discovery support business, which is expected to generate ongoing revenues. Depending on the progress of drug discovery projects, upfront payments and milestone revenues may be received. On the other hand, the company expects to continue to spend around 1 billion yen a year on R&D investment due to the high costs of clinical trials and investigational drug manufacturing as each pipeline progresses, which is likely to result in losses like those in FY2021/12.

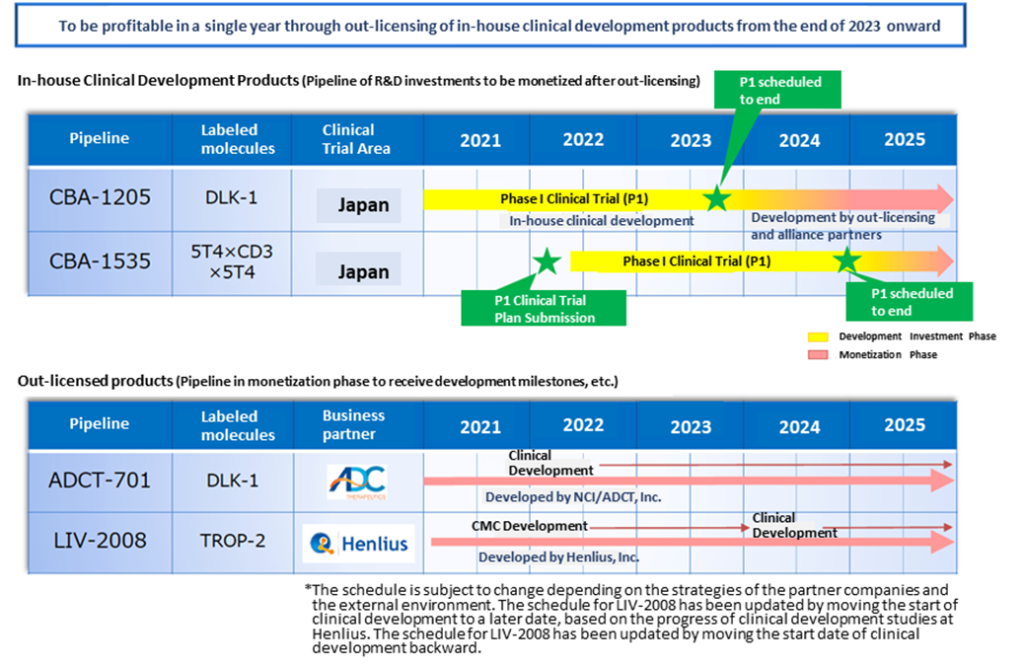

Growth strategies and development investment

The company is committed to sustainable growth and development through creating and developing multiple antibody drug discovery pipelines and monetising through out-licensing. To this end, the company intends to continue to invest in R&D and growth to develop new out-licensed products and development candidate pipelines even after the current in-house product-stage pipeline has been out-licensed. The company aims to increase its corporate value by focusing on the creation of several antibody drug candidates that address unmet needs, increasing product value and commercialising them through out-licensing.

The main pipeline development plans are shown in the diagram below. Clinical trials for in-house clinical developments are progressing well, and CBA-1205 will be out-licensed as soon as possible after 2023. Depending on the timing and amount of out-licensing, the company may even achieve a profit in a single year. CBA-1535 is also making progress in the world’s first clinical trials in the Tribody format.

Main pipeline development plans

See the diagram on the next page for an image of the company’s future earnings. Although this is the company’s envisioned image and is not 100% guaranteed, the company plans to realise upfront payments, milestone payments and royalties as it progresses with out-licensed products (ADCT-701, LIV-2008) and in-house clinical developments (CBA-1205, CBA 1535), the company plans to realise upfront licensing payments, milestone and royalty income in line with progress, allowing it to anticipate changes in its business revenue and expenditure structure.

On the other hand, the key to future growth is still excellent scientists/human resources. The competition for talent in the science sector is becoming increasingly fierce. Still, the company uses referral recruitment and other methods to hire people with the ability to make an immediate impact. The number of employees at the company has steadily increased from 38 at the end of FY12/09 to 42 at the end of FY12/2020 to 49 at the end of FY12/2021. While research facilities of drug discovery companies are often located in the suburbs, the location of the company’s head office in the city centre appears to be a positive factor in attracting personnel.

Changes in the income and expenditure structure due to out-licensing of in-house developed products

Stock price trends

As mentioned above, drug discovery biotech ventures have limited short-term revenues and long-lasting losses, so valuations based on ordinary financial analysis are not very meaningful. In addition, it is difficult to assess the value of a company using DCF or other methods, given the scale of sales when a drug is launched in the future and the uncertainties that may arise until the drug is launched. The only way to make a comprehensive judgement would be to scrutinise the progress of the pipeline, the ongoing financing situation and management trends.

The company’s share price has been on a downward trend since the significant correction in 2014 (see graph on next page). In the aftermath of the global growth stock correction since late 2021, the share price of domestic drug discovery ventures has also been on a downward trend but has recently appeared to have bottomed out. The trend of declining biotech stocks has dragged down the company’s share price after hitting a high of 386 yen on 8 July 2021 in the same year. On the other hand, the company’s drug discovery projects are making steady progress and positive news, such as clinical trial applications and patent filings, continue to be announced.

A notable future event is the progress of CBA-1205 (humanised anti-DLK-1 monoclonal antibody), which is being developed in the company’s pipeline. CBA-1205 is a first-in-class therapeutic antibody for the treatment of intractable cancer. It is expected to have a significant market potential as liver cancer; the desired indication is the second leading cause of cancer-related deaths worldwide. The share price reacted strongly when the company announced the conclusion of a clinical trial agreement with the National Cancer Centre in July 2020; in December 2021, the company moved into the second half of the Phase I clinical trial, and in June 2022, it began administering the first subject. If the clinical trial progresses further and early signs of drug efficacy are confirmed, future revenue opportunities such as upfront licensing payments will become a reality and could have a more significant impact on the share price. The potential for an upshoot from the future development of CBA-1535 should also be expected.

Stock price transition (last 5 years)

Relative chart; Chiome Bioscience (4583) and TOPIX (3 years)

Financial data

2013/3 |

2014/3 |

2014/12 |

2015/12 |

2016/12 |

2017/12 |

2018/12 |

2019/12 |

2020/12 |

2021/12 |

|

[Statements of income] |

||||||||||

Net sales |

324 |

435 |

278 |

280 |

252 |

260 |

213 |

448 |

480 |

712 |

Cost of sales |

119 |

174 |

89 |

138 |

138 |

85 |

102 |

163 |

235 |

290 |

Gross profit |

205 |

261 |

189 |

142 |

114 |

174 |

111 |

285 |

245 |

422 |

SG&A expenses |

618 |

970 |

1,054 |

1,412 |

1,157 |

1,062 |

1,650 |

1,687 |

1,528 |

1,756 |

R&D expenses |

309 |

443 |

575 |

828 |

627 |

592 |

1,230 |

1,299 |

1,156 |

1,312 |

Operating loss |

-413 |

-709 |

-866 |

-1,270 |

-1,042 |

-888 |

-1,539 |

-1,402 |

-1,283 |

-1,334 |

Non-operating income |

1 |

20 |

2 |

20 |

8 |

7 |

5 |

5 |

5 |

13 |

Non-operating expenses |

13 |

17 |

20 |

4 |

12 |

2 |

– |

14 |

13 |

8 |

Ordinary loss |

-425 |

-706 |

-883 |

-1,254 |

-1,047 |

-884 |

-1,534 |

-1,410 |

-1,291 |

-1,329 |

Extraordinary income |

– |

– |

– |

3 |

6 |

5 |

3 |

9 |

1 |

12 |

Extraordinary expenses |

– |

37 |

2 |

30 |

460 |

2 |

– |

– |

– |

149 |

Loss before income taxes |

-425 |

-743 |

-886 |

-1,281 |

-1,501 |

-880 |

-1,531 |

-1,401 |

-1,290 |

-1,466 |

Total income taxes |

2 |

19 |

0 |

2 |

-10 |

2 |

2 |

2 |

3 |

13 |

Net loss |

-427 |

-758 |

-863 |

-1,283 |

-1,491 |

-883 |

-1,534 |

-1,404 |

-1,293 |

-1,479 |

[Balance Sheets] |

||||||||||

Current assets |

1,085 |

4,515 |

5,737 |

4,274 |

4,682 |

4,197 |

2,610 |

2,561 |

3,248 |

2,216 |

Cash equivalents and ST marketable securities |

989 |

4,350 |

5,576 |

4,100 |

4,553 |

4,027 |

2,329 |

2,106 |

2,686 |

1,790 |

Non-current assets |

212 |

498 |

520 |

645 |

108 |

223 |

221 |

247 |

246 |

122 |

Tangible assets |

117 |

373 |

399 |

436 |

35 |

23 |

16 |

11 |

7 |

4 |

Investments and other assets |

86 |

73 |

73 |

187 |

72 |

200 |

205 |

236 |

238 |

118 |

Total assets |

1,297 |

5,013 |

6,257 |

4,919 |

4,789 |

4,419 |

2,831 |

2,808 |

3,494 |

2,339 |

Current liabilities |

238 |

347 |

295 |

238 |

169 |

161 |

113 |

145 |

342 |

392 |

Short-term borrowings |

111 |

21 |

– |

46 |

50 |

4 |

– |

– |

180 |

183 |

Non-current liabilities |

21 |

107 |

123 |

117 |

55 |

41 |

41 |

41 |

41 |

53 |

Total liabilities |

259 |

454 |

418 |

355 |

224 |

202 |

154 |

187 |

384 |

446 |

Total net assets |

1,038 |

4,559 |

5,839 |

4,564 |

4,565 |

4,218 |

2,677 |

2,622 |

3,109 |

1,893 |

Total shareholders’ equity |

1,038 |

4,515 |

5,827 |

4,564 |

4,565 |

4,218 |

2,677 |

2,622 |

3,081 |

1,857 |

Capital stock |

1,213 |

3,349 |

4,435 |

4,445 |

5,186 |

5,455 |

5,455 |

6,132 |

1,387 |

1,515 |

Legal capital reserve |

1,203 |

3,339 |

4,425 |

4,435 |

5,176 |

5,445 |

5,445 |

6,122 |

2,987 |

3,115 |

Retained earnings |

-1,427 |

-2,185 |

-3,048 |

-4,344 |

-5,835 |

-6,717 |

-8,251 |

-9,655 |

-1,293 |

-2,773 |

Subscription rights to shares |

49 |

13 |

17 |

28 |

37 |

36 |

28 |

22 |

28 |

35 |

Total liabilities and net assets |

1,297 |

5,013 |

6,257 |

4,919 |

4,789 |

4,419 |

2,831 |

2,808 |

3,494 |

2,339 |

[Statements of cash flows] |

||||||||||

Cash flow from operating activities |

-373 |

-552 |

-789 |

-1,245 |

-969 |

-867 |

-1,688 |

-1,537 |

-1,360 |

-1,131 |

Loss before income taxes |

-425 |

-743 |

-886 |

-1,281 |

-1,501 |

-880 |

-1,531 |

-1,401 |

-1,290 |

-1,466 |

Cash flow from investing activities |

-115 |

-189 |

-619 |

-1,780 |

1,988 |

-137 |

– |

-26 |

-3 |

-35 |

Purchase of investment securities |

– |

-1,189 |

– |

-3,812 |

-301 |

-150 |

– |

– |

– |

– |

Cash flow from financing activities |

463 |

4,103 |

2,131 |

124 |

1,433 |

478 |

-10 |

1,341 |

1,944 |

271 |

Proceeds from issuance of common shares |

366 |

4,200 |

2,152 |

21 |

1,461 |

529 |

– |

1,346 |

1,769 |

253 |

Net increase in cash and cash equiv. |

-25 |

3,361 |

726 |

-2,818 |

2,453 |

-526 |

-1,699 |

-223 |

580 |

-895 |

Cash and cash equiv. at beginning of period |

1,013 |

989 |

4,350 |

4,918 |

2,100 |

4,553 |

4,027 |

2,328 |

2,105 |

2,686 |

Cash and cash equiv. at end of period |

989 |

4,350 |

5,076 |

2,100 |

4,553 |

4,027 |

2,328 |

2,105 |

2,686 |

1,790 |

FCF |

-488 |

-741 |

-1,408 |

-3,025 |

1,019 |

-1,004 |

-1,689 |

-1,563 |

-1,364 |

-1,166 |

Company Profile

Company Profile

Sales by segment

Chiome Bioscience Inc.

【Headquarters, Research Laboratories】

Sumitomo-Fudosan Nishi-shinjuku bldg. No.6,

3-12-1 Honmachi, Shibuya-ku, Tokyo

【Drug Discovery Laboratories】

Teikyo University Biotechnology Research Center 1F, 2-13-3 Nogawahonmachi,

Miyamae-ku, Kawasaki-city, Kanagawa

Number of Employees : 49 (Average temporary workforce : 13)

History

| Month/Year | Event |

| Feb. 2005 | Chiome Bioscience Inc. (capital: ¥10mn) was established in the Bunkyo district of Tokyo to commercialize the ADLib® system developed through the collaboration of the Genetic Dynamics Research Unit at RIKEN and the Saitama Small and Medium Enterprise Development Corporation (currently Saitama Industrial Development Corporation). |

| Apr. 2005 | Concluded an agreement with RIKEN to commercialize the ADLib® system, and research activities begins. |

| May 2005 | ADLib® System was described in the journal Nature Biotechnology as “an innovative rapid antibody generating technology to be the first in the world that employs promotion of DNA recombination.” |

| Jul. 2005 | Obtained an exclusive license to commercialize platform technology (the ADLib® System) from RIKEN Institute and the Japanese Science and Technology Agency. And CHIOME can sublicense this technology to other third parties. |

| May 2008 | The R&D Division has relocated to RIKEN-WAKO Incubation Plaza to allow for the expansion of research facilities. |

| Aug. 2010 | Concluded a payment based technology transfer agreement with the Japan Science and Technology Agency on the platform technology – the ADLib® System. |

| Dec. 2011 | Listed on Tokyo Stock Exchange Mothers. |

| Dec. 2013 | Acquired a majority of Liv Tech, Inc.’s capital. |

| Jul. 2015 | Merged with Liv Tech, Inc. |

| Oct. 2015 | Invested in EVEC, Inc. |

| Feb. 2017 | Acquired new shares of Trans Chromosomics, Inc. issued in a third- party allotment. |

| Sep. 2017 | Executed a License Agreement with ADC Therapeutics SA for the development of an ADC of LIV-1205. |

| Dec. 2018 | Executed an Asset Purchase Agreement of Tb535H (currently CBA-1535) and Trisoma® technology with Biotecnol Limited |

| Jan. 2021 | The licence agreement with Shanghai Henlius Biotech for developing, manufacturing and marketing humanised TROP-2 monoclonal antibodies LIV-2008 and LIV-2008b for treating cancer in Greater China. |

| Dec. 2021 | Advancing CBA-1205, a candidate antibody for cancer treatment, into the second part of the Phase I clinical trials. |

Management (Director / Auditor)

President, CEO: Shigeru Kobayashi

Executive Director, CFO: Arihiko Bijohira

| Shigeru Kobayashi has previously worked at Kyowa Hakko Kogyo Co., Ltd. (currently Kyowa Kirin Co., Ltd.). He has also served as the President at Kyowa Hakko UK, Ltd. (currently Kyowa Kirin Ltd.) and Kyowa Pharmaceutical, Inc. (currently Kyowa Kirin Pharmaceutical Development, Inc.) |

| Arihiko Bijohira has previously worked at Institute of business Consulting and Investment Co., Ltd., Pfizer Japan Inc. and Taiho Pharmaceutical Co. Ltd. |

Executive Director: Akiyuki Furuya

Executive Director: Haruhisa Kubota

| Akiyuki Furuya has previously served as Executive Director of Daiichi Pharmaceutical Co., Ltd (currently Daiichi Sankyo Co., Ltd),and as President & CEO of Daiichi radioisotope laboratories, LTD (currently FUJIFILM RI Pharma Co., Ltd), and as President & CEO of Perseus Proteomics Inc. |

| Haruhisa Kubota has previously worked at Ministry of Health and Welfare, Pharmaceuticals and Medical Devices Agency (PMDA) and Japan Association for the Advancement of Medical Equipment (JAAME). He also served as Managing Executive Officer at Daiichi Sankyo Co., Ltd., and as Executive Vice President at Daiichi Sankyo Biotech Co., Ltd. He currently works at Clinical Research Center of National Center for Global health and Medicine. |

Audit & Supervisory Board Member: Matsuo Kikuchi

Audit & Supervisory Board Member: Yoshiyuki Yamakawa

| Matsuo Kikuchi has previously served as Executive Officer, General Manager of Pharmacology Research Laboratories I of Research Division, Executive Officer, Division Deputy Manager of Ikuyaku. Integrated Value Development Division, and also as a member of the Audit and Supervisory Board of Mitsubishi Tanabe Pharma Corporation. |

| Yoshiyuki Yamakawa has previously worked at Nippon life Insurance Company and Innotech Corporation. He has also served as the Executive Vice President at Sosei Co. Ltd. He currently serves as the CEO at Hibiki Partners, Inc. |

Audit & Supervisory Board Member : Niro Sakamoto

| Niro Sakamoto has previously served as Managing Executive Officer of Corporate Planning Department of Daiichi Fine Chemical Co., Ltd(currently kyowa Pharma Chemical Co.,Ltd) and also served as Managing Executive Officer of Corporate Planning Department and General Affairs Department of Kyowa Kirin Co.,Ltd. |

Corporate Governance Structure

The company has a board of auditors with four directors (including two external directors) and three auditors (both full-time and part-time external). Currently, all seven directors and auditors are Japanese men.

Status of major shareholders

| Name | Number of shares owned | Ratio of the number of shares owned to the total number of issued shares (%) |

| Kunihiro Ohta | 962,700 | 2.36 |

| SMBC Nikko Securities Inc. | 737,900 | 1.80 |

| Rakuten Securities, Inc. | 658,800 | 1.61 |

| SBI SECURITIES Co., Ltd. | 574,321 | 1.40 |

| Matsui Securities Co., Ltd. | 537,400 | 1.31 |

| Tetsuo Iisaku | 477,000 | 1.16 |

| Koji Yoshimura | 360,000 | 0.88 |

| Shigeo Onosawa | 317,100 | 0.77 |

| Fukutaro Yamato | 316,000 | 0.77 |

| Monex, Inc. | 308,852 | 0.75 |

| Total | 5,250,073 | 12.87 |

Source : The Company annual report (FY12/21)