LaKeel (Price Discovery)

| Securities Code |

| TYO:4074 |

| Market Capitalization |

| 9,764 million yen |

| Industry |

| Information / Communication |

A DX-related rebound candidate. Shift to stock-based revenue model underway.

Stock Hunter’s View

The stock price of LeKeel (TSE 4074) has been sinking to new lows every day but finally showed signs of bottoming out at the low 1,250-yen on 28 June. In addition to being a DX-related business in favour of individual investors, the current business is running well. There is an atmosphere of “waiting for an opportunity” for the stock price to re-emerge.

The company provides the cloud application development and operation platform “Lakeel DX”. Customer companies can develop and operate applications on platforms provided by major cloud providers such as Amazon and Microsoft.

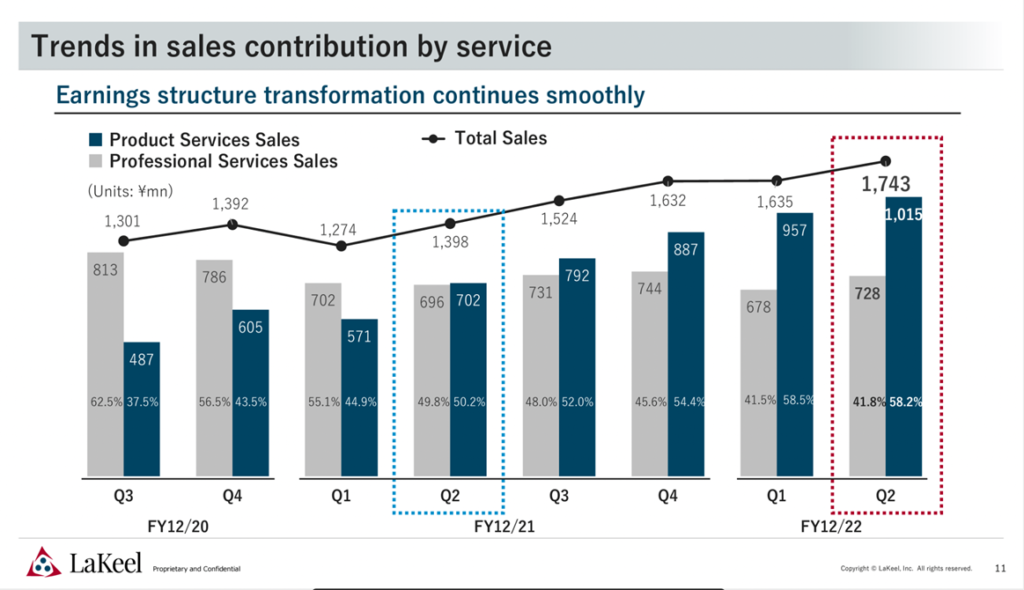

2Q (Jan-Jun) results were in line with the management’s plans, with sales up 26% yoy and operating profit up 36%. It should be noted that the proportion of sales from ‘product services’, which are licenced- and subscription-based and can be expected to be highly profitable and sustainable, rose to 58.4% (47.6% in 2Q FY2011) and now accounts for the majority of sales. This is a sign that the transformation of the profit structure is progressing well.

The video-delivered education service adopted by Tadano (TSE 6395) is available in six languages, with a view to its future introduction at overseas sites. The company is expanding overseas, mainly in Asian markets, including China, but there are hopes that this will lead to further expansion.

Investor’s View

Share price volatility remains high.

The IPO in July 2021 was ill-timed, and the shares should have crashed shortly afterwards as the growth stock fell due to rising rates and geopolitical risks. Naturally, we believe the most significant threat to the share price is that one cannot easily predict the global interest rate environment, which has an enormous impact on the growth stock. Hence, the share price volatility should remain high in the near term. By contrast, given the company’s strong earnings growth, the share price may reverse significantly in the short time when investors think that the rise in US interest rates has peaked.

The earnings are immune from the pandemic, financial market volatility and Ukraine.

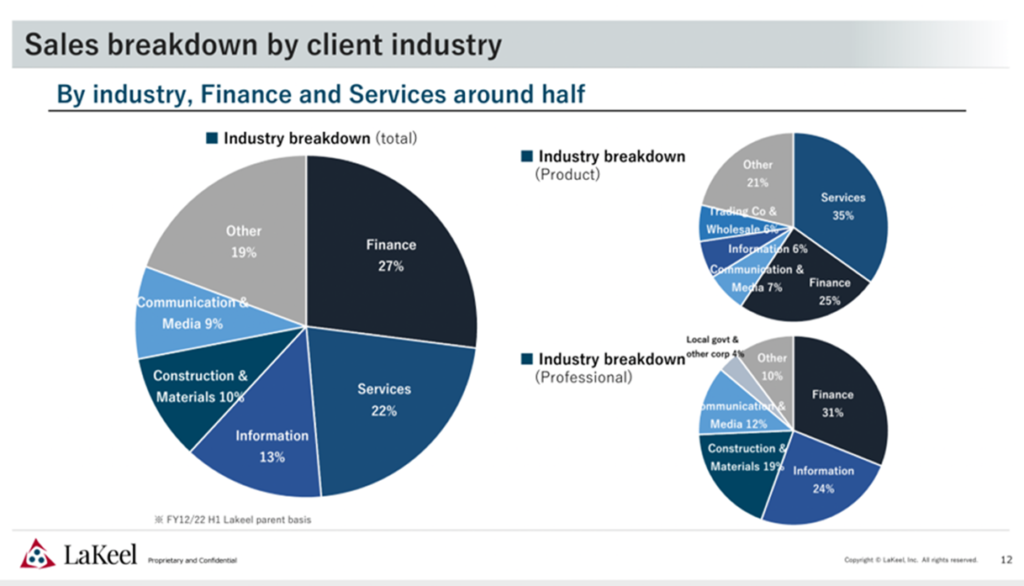

Top-line growth is high, driven by product services, and profit margins are visibly improving. Undeniably, the strong business momentum reflects the strong DX investment appetite. The management attributes this to the growing product services, particularly in the financial sector. In 2Q, sales of product services grew by 55% yoy while consolidated sales rose by 26% yoy. We would sensibly assume that product services will drive top-line growth in the foreseeable future.

PBR could expand further

While profit margins are set to improve, BS looks unlikely to inflate, so there is scope for further upside in the current ROE of 16%. Should ROE reach nearly 20%, the shares’ PBR, currently 3.4x, could expand further. Investors should be reminded that NASDAQ trades on a PBR of 4.5x for an ROE of 16%. Current earnings are running in line with the management forecasts. If they meet their targets for the full year, the three-year CAGR for EPS will mark 67%. The shares’ PER, around 17x now, is hard to predict as it depends on short-term investor sentiment. Nevertheless, we do not feel there is any significant downside to the current 40% premium to TOPIX.

Some uncertainties

We are concerned that the professional segment, registering saturating growth, may eventually weigh on the earnings. The company explains that its growth driver is the booming domestic DX market, which is expected to exceed JPY 2 trillion by 2027 at a six-year CAGR of 19%. We would want to scrutinise this assertion. Furthermore, there is not much in the company’s IR to convince us of its firm edges over many peers. The results presentation materials of small DX companies and video explanations are alike and do not ring a bell at all. However, there have been many cases where a 1×1 discussion with the top executives was persuasive enough. It should be worthwhile for investors to revive efforts such as individual online interviews, just not sitting in the chairs looking at screens all day.

Almost no institutional investors are in the company

The market cap, which has shrunk to JPY 10 billion, is too small for many institutional investors. However, once they start to buy the shares, the share price could rise quickly and significantly. Currently, the institutional investor ratio is low at less than 2%, even with the addition of Sumitomo Life Insurance to Nikko Asset Management’s 0.1%.