Kidswell Bio (Company Note – 2Q update)

| Share price (11/16) | ¥292 | Dividend Yield (23/3 CE) | – % |

| 52weeks high/low | ¥540/200 | ROE(TTM) | -32.17 % |

| Avg Vol (3 month) | 1,160.1 thou shrs | Operating margin (TTM) | -34.10 % |

| Market Cap | ¥9.1 bn | Beta (5Y Monthly) | 0.98 |

| Enterprise Value | ¥9.7 bn | Shares Outstanding | 31.471 mn shrs |

| PER (23/3 CE) | – X | Listed market | TSE Growth |

| PBR (22/3 act) | 5.82 X |

| Click here for the PDF version of this page |

| PDF Version |

SHED project progresses well, completing the world’s only MCB. Achieved operating profit in 2Q FY2023/3.

◇Summary of results for 2Q FY2023/3

In 2Q FY2023/3, Kidswell Bio’s biosimilars (BS) business, including GBS-007, performed well, recording half-year sales of 1 billion yen. In August, Master Cell Bank (MCB) for SHED (Stem cells from Human Exfoliated Deciduous teeth) was completed. Steady progress is also being made in joint research with academia towards practical applications. MCB is a key technological development for the company’s future SHED-based business and its completion is expected to accelerate various development activities from 2Q onwards. Against this backdrop, research and development costs were contained up to 2Q, which enabled the company to secure a surplus at the operating profit level. In addition, the continued growth of the biosimilars business is also a factor in the turn to profitability. The company targets of sales of 3 billion and operating profit of 1 billion for FY2025 are looking more and more realistic.

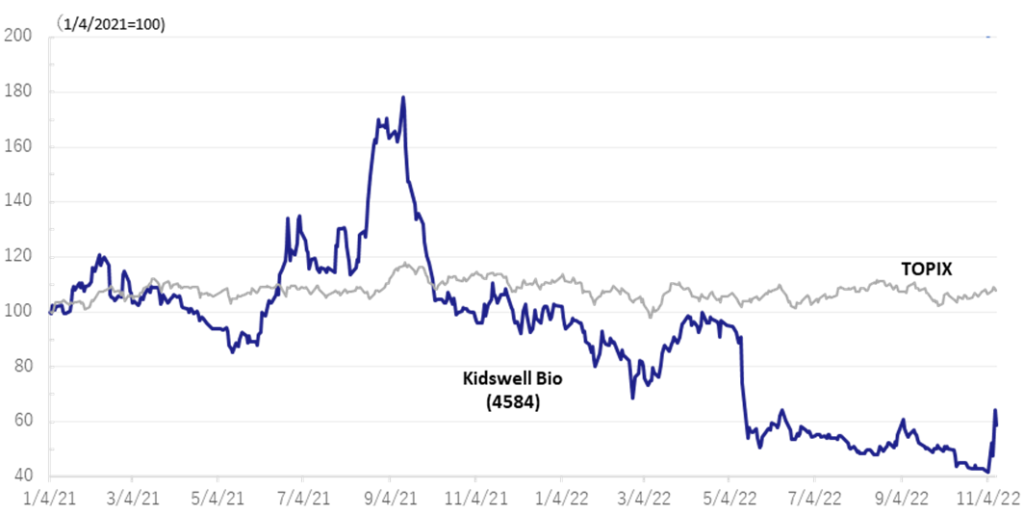

◇Stock prices rebounded sharply on the back of good results

The company‘s share price, which had adjusted sharply since the announcement of full-year results for FY2022/3 in May, rebounded sharply following the publication of research articles on November 7 on the results of research conducted in collaboration with Hamamatsu University School of Medicine. The announcement of the operating profit further boosted the share price. The share price shot up to a limit-high on the 9th, the day after the results were announced. The trading volume on the 10th was 22.9 million shares, an unusually high level in recent years. In addition to completing MCB, the company’s project to apply SHED to various diseases has become more concrete, clearing up the project’s uncertainty.

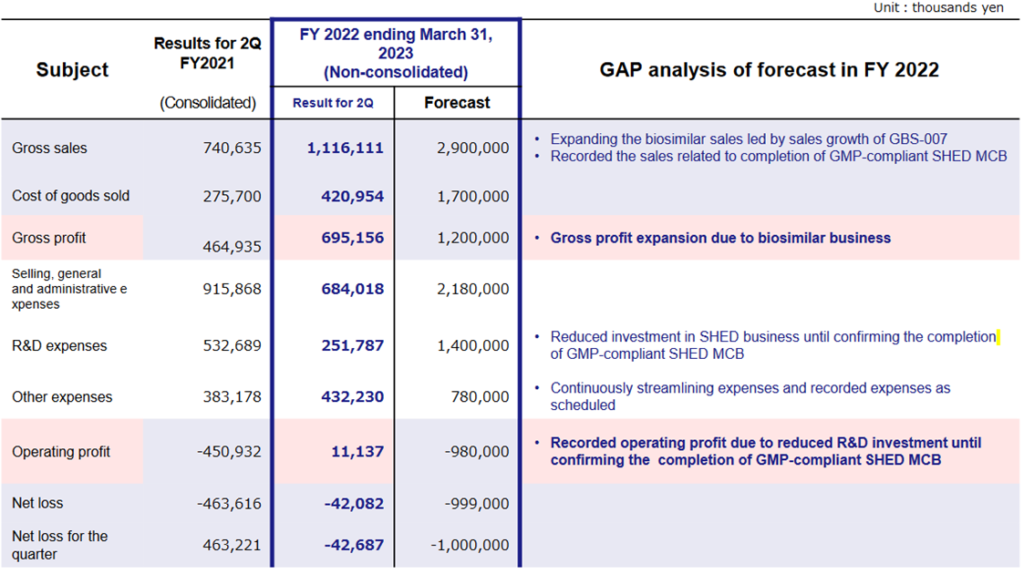

◇Results for 2Q of FY2023/3: achieved operating profit

The company’s 2Q results for FY2023/3 showed sales of 1,116 million yen, an operating profit of 11 million yen and a net loss of 42 million yen. On a half-year basis sales exceeded 1 billion yen for the first time and the company also achieved a positive operating profit. (In April 2022, the consolidated subsidiary Japan Regenerative Medicine Inc. was transferred to Metcela Inc., so from this financial year the company has been reporting on a parent-only basis.)

In terms of sales, the third BS product, GBS-007, has received more orders than expected since its launch in December 2021, contributing significantly to sales growth. Sales of existing BSs, GBS-001 and GBS-011 also remained strong. In addition, in 2Q, the company recorded revenues from completing SHED’s MCB. Furthermore, it appears that milestone revenue from the fourth BS product is also included.

In addition to an increase in gross profit due to growth in the BS business, the company achieved profitability at the operating profit level due to ongoing cost reductions and further curtailment of R&D investment until MCB is completed.

A bank loan of 1 billion yen was taken out at the end of June to secure working capital for the increased orders of GBS-007, with interest paid (13 million yen) and commission paid (30 million yen) recorded as non-operating expenses. Furthermore, a foreign exchange loss (10 million yen) related to the manufacture of active pharmaceutical ingredients overseas was also recorded as a non-operating expense, resulting in a recurring loss of 42 million yen.

| JPY, mn, % | Net sales |

YoY % |

Oper. profit |

YoY % |

Ord. profit |

YoY % |

Profit ATOP |

YoY % |

EPS (¥) |

| 2019/3 | 1,021 | -3.6 | -805 | – | -816 | – | -856 | – | -43.84 |

| 2020/3 | 1,077 | – | -1,161 | – | -1,187 | – | -7,316 | – | -264.65 |

| 2021/3 | 996 | -7.5 | -969 | – | -991 | – | -1,001 | – | -34.79 |

| 2022/3 | 1,569 | 57.7 | -919 | – | -952 | – | -535 | – | -17.35 |

| 2023/3 (CE) | 2,900 | – | -980 | – | -999 | – | -1,000 | – | -31.82 |

| 2022/3 2Q* | – | – | – | – | – | – | – | – | – |

| 2023/3 2Q | 1,116 | – | 11 | – | -42 | – | -42 | – | -1.36 |

* Figures through FY2022/3 are on a consolidated basis. Figures for 1Q FY2023/3 and thereafter are on a non-consolidated basis, and year-on-year comparisons are not shown.

Results for 2Q FY2023/3 (PL)

On the BS, cash and cash equivalents at the end of 2Q stood at 1.87 billion yen due to the previously reported bank borrowings and the issue of the 4th unsecured convertible bond with stock acquisition rights. Meanwhile, the corresponding non-current liabilities increased to 1.90 billion yen. As a result, total assets at the end of 2Q stood at 4.25 billion yen, an increase of 0.79 billion yen from the end of FY2022/3.

◇Cell therapy business (regenerative medicine): the SHED MCB is completed. Collaborative research also begins to yield results.

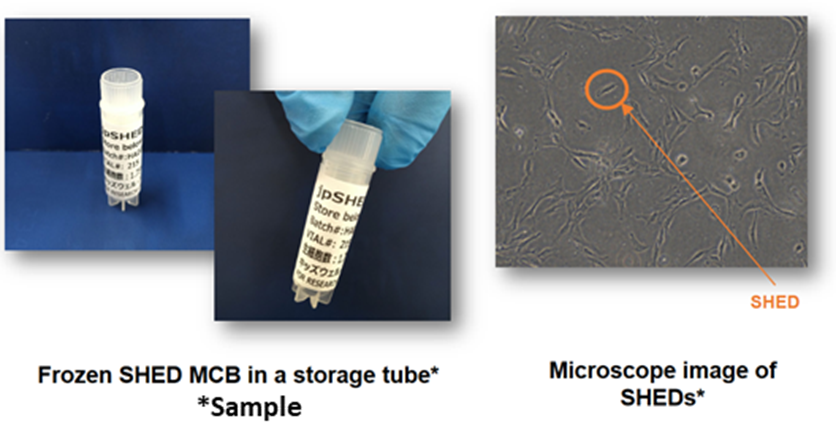

*MCB completion: Establishing a stable supply system for the raw materials needed for research and development is an important factor in the practical application of SHED. The company has been working to establish an MCB supply system with ChiVo Net for donor recruitment, university hospitals, Nikon CeLL innovation and others to produce the raw materials. The company started the GMP manufacturing required to establish MCB in October 2021 and completed manufacturing MCB in August 2022.

The world’s first SHED MCB completed

*Progress in collaboration with academia and companies: Collaboration with external parties is essential for the commercialisation of SHED. The company has been conducting joint research and other activities with academia and companies. Progress was also made in this area during 2Q (see table below).

Progress in collaboration with academia and others

| Date of publication |

Business partner | Contents |

| Nov. 7 | Dept. of Neurosurgery, Hamamatsu Univ. School of Medicine |

High research results confirmed in basic research on novel treatments for brain tumours using second-generation SHEDs. Jointly published research articles. |

| Oct. 24 | Tokai National Higher Education and Research System |

In research on the treatment of cerebral palsy, the therapeutic effect of SHED on animal models of the disease was confirmed, and the creation of a candidate therapeutic agent containing SHED was successfully achieved. Signed a joint patent application agreement with Tokai National Higher Education and Research System and applied for a patent for this invention. |

| Sep. 27 | Showa Denko Materials Co., Ltd. | Basic transaction agreement for the development of manufacturing methods and the production of investigational drugs for the practical application of regenerative medicine products that make use of SHED’s features. |

Source: Company materials

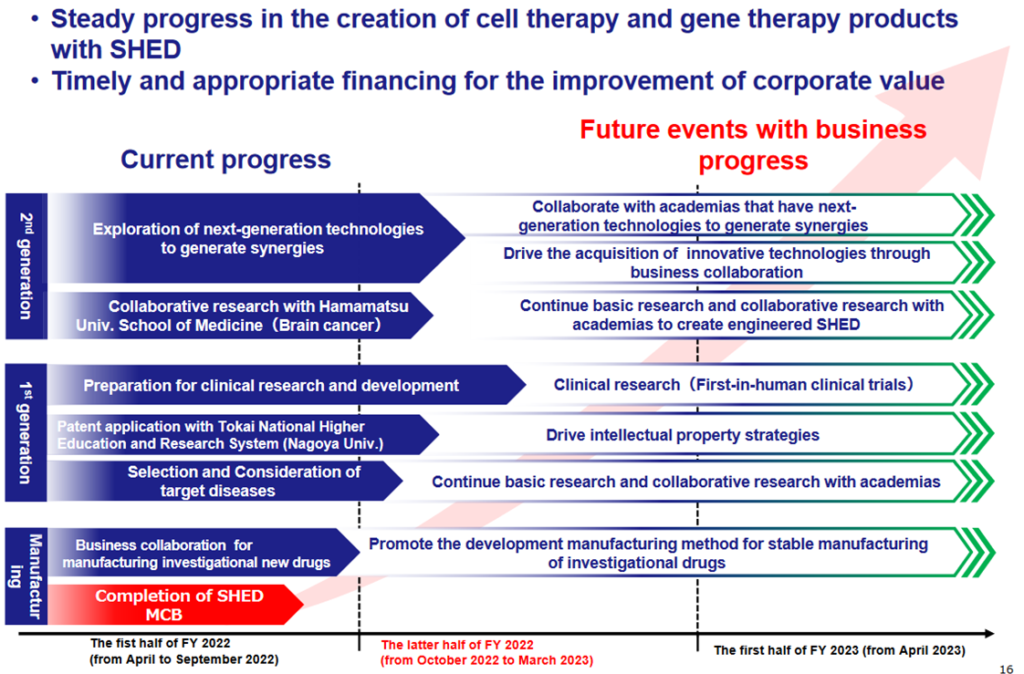

Upgrading the R&D stage with the completion of MCB

*Business development towards practical application of SHED: With the completion of MCB, the company’s SHED business has made significant progress. See the diagram above for future stages of research and development. By collaborating with academia and others, the company will consider early practical applications in first-generation SHED, followed by designer cell applications in second-generation SHED. Furthermore, beyond that, the use of SHED for other modalities through the provision of SHED will be considered.

*New COO position: As an R&D-based drug discovery venture, Masayuki Kawakami has led basic research and exploration as CTO at the company. To expand the SHED business and promote clinical development and product strategy with a greater awareness of commercialisation, the management executive structure has been strengthened. Thus, Mr. Kawakami has been appointed to the newly created position of Chief Operating Officer (COO). He will be responsible for translating basic research into clinical development and commercialisation.

Executive Officer, Chief Operating Officer (COO):Masayuki Kawakami

Personal history:

Kyoto Univ. Graduate School of Engineering, Ph.D

Worked for research laboratories of FUJIFILM Corp. mainly in oncology area with Harvard Univ. and Novartis (then Sandoz). Worked for Toyama Chemical Corp. and then for FUJIFILM Pharmaceuticals USA to promote an anti-influenza drug clinical development. Joined the company in 2017; appointed Executive Officer CTO in 2018 and Executive Officer COO in 2022.

*Reinforcement of IP strategy: As a drug discovery venture company, the company has been formulating and promoting R&D and business development strategies. As the SHED business expands, the company plans to focus on IP strategies in conjunction with R&D and business development strategies. Strategic patent applications and patent lifecycle management are promoted. In addition to domestic patent applications, the company will also promote the acquisition of patents in Europe, the US and major Asian countries. Specifically, the company intends to promote its IP strategy by filing ‘substance (cell) patents’ to differentiate SHED from other cells, ‘use patents’ to secure rights for the treatment of target diseases, and ‘formulation’ and ‘administration method’ patents to extend the patent term.

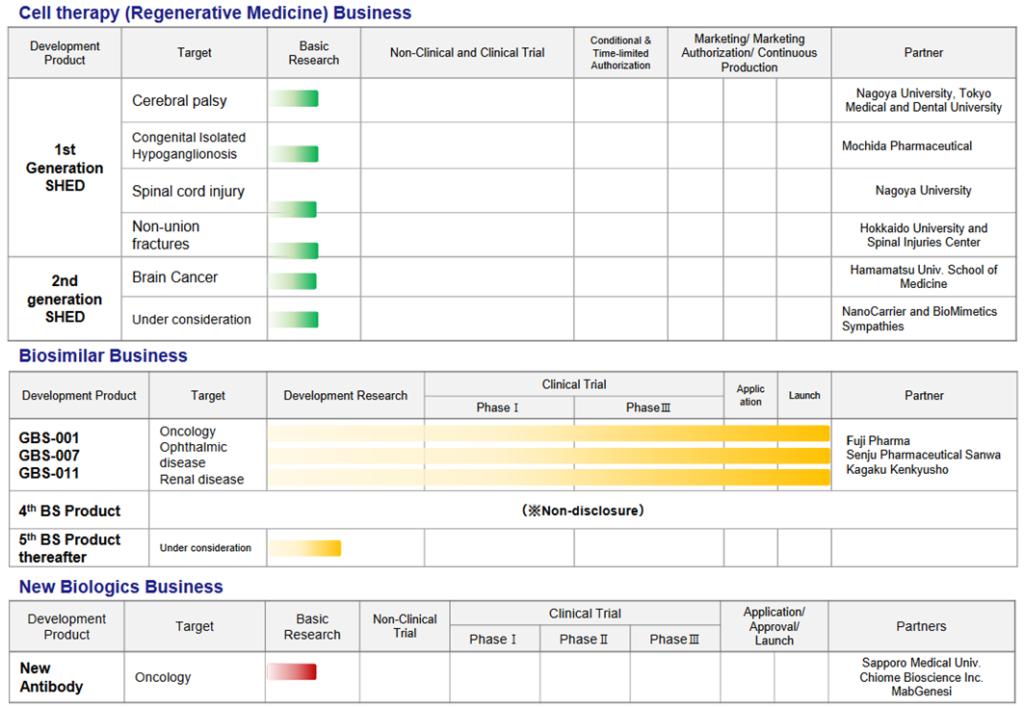

◇Biosimilars business: better-than-expected sales of GBS-007

*Ranibizumab (GBS-007): On December 9, 2021, the third product in the BS business, ranibizumab BS, an anti-VEGF antibody drug for age-related macular degeneration, was launched by development partner Senju Pharmaceutical. The BS has attracted a lot of attention as it is the first BS in the ophthalmology field, and sales have been strong, with orders exceeding initial forecasts. As previously reported, the company has raised funds to support increased production.

*Filgrastim (GBS-001): GBS-001 have already been launched by the partner company, and cost-reduction measures have also been taken to improve profitability. It is reported that Mochida Pharmaceutical has decided to discontinue sales of GBS-001, but it is explained that this will not affect the company’s forecasts for the current financial year or its medium-term management plan.

◇New biologics business: joint research agreement with Chiome Bioscience.

*Collaborative research with Chiome Bioscience: The company has positioned the new biologics business as part of its key future growth strategy. However, as developing new bio drugs requires a vast amount of research resources, joint research with other companies that are strong in their respective fields of expertise is effective. In June, the company announced an alliance with Chiome Bioscience (TYO: 4583), which has strengths in the field of antibody drugs.

◇ Forecast for FY2023/3: Initial guidance unchanged, but operating loss may be less than forecast.

The forecast for FY2023/3 of sales of 2.9 billion yen, an operating loss of 0.98 billion yen and a net loss of 1 billion yen remains unchanged from the initial forecast. Sales up to 2Q are less than 40% of the full-year forecast, but the company target looks achievable as sales of GBS-007 and other BSs are expected to remain strong. Meanwhile, the company has set its full-year forecast for R&D expenditure at 1.4 billion yen and expects an operating loss of 980 million yen. However, up to 2Q, R&D expenditure was 250 million yen, and even considering that R&D expenditure is heavily weighted towards the second half of the year, it is difficult to imagine the company spending 1 billion yen or more in the second half of the year. It is highly likely that the full-year operating loss will be smaller than the company guidance.

Pipeline Updates

◇Stock price: rebounding on good results and progress of SHED.

The company’s share price has adjusted significantly since the announcement in May of its financial results for FY2022/3 when it announced the postponement of achieving profitability in FY2023/3. However, the share price rebounded sharply following the publication of a paper on November 7 on the results of research conducted in collaboration with Hamamatsu University School of Medicine. The announcement of an operating surplus further boosted the share price performance. The share price shot up to a limit-high on the 9th, the day after the results were announced. The trading volume on the 10th was 22.9 million shares, an unusually high level in recent years. In addition to the completion of MCB, the company’s project to apply SHED to various diseases has become more concrete, clearing up uncertainty regarding the project. The company’s share price is worth a close watch.

Stock price transition (last 6 years)

Relative share price (4584, TOPIX)

Financial data

FY (¥mn) |

2020/3 |

2021/3 |

2022/3 |

2023/3 |

||||||||||

1Q |

2Q |

3Q |

4Q |

1Q |

2Q |

3Q |

4Q |

1Q |

2Q |

3Q |

4Q |

1Q |

2Q |

|

[Statements of income] |

||||||||||||||

Net sales |

284 |

30 |

419 |

345 |

121 |

53 |

547 |

276 |

303 |

438 |

642 |

186 |

610 |

505 |

Cost of sales |

77 |

8 |

359 |

209 |

5 |

35 |

46 |

34 |

122 |

154 |

183 |

91 |

292 |

128 |

Gross profit |

207 |

22 |

60 |

136 |

116 |

19 |

500 |

242 |

182 |

283 |

460 |

94 |

318 |

377 |

SG&A expenses |

417 |

423 |

381 |

365 |

354 |

463 |

465 |

565 |

491 |

425 |

442 |

580 |

356 |

328 |

R&D expenses |

235 |

249 |

201 |

213 |

138 |

265 |

198 |

363 |

297 |

236 |

237 |

380 |

105 |

147 |

Operating profit (loss) |

-210 |

-401 |

-321 |

-229 |

-238 |

-445 |

36 |

-323 |

-309 |

-142 |

18 |

-486 |

-37 |

49 |

Non-operating income |

0 |

0 |

1 |

0 |

0 |

1 |

1 |

1 |

2 |

0 |

0 |

1 |

0 |

3 |

Non-operating expenses |

2 |

1 |

20 |

4 |

7 |

5 |

4 |

8 |

6 |

8 |

15 |

7 |

43 |

13 |

Ordinary profit (loss) |

-212 |

-402 |

-340 |

-233 |

-244 |

-450 |

33 |

-330 |

-314 |

-150 |

4 |

-493 |

-80 |

39 |

Extraordinary income |

4 |

0 |

0 |

2 |

|

|

|

|

|

|

418 |

0 |

– |

– |

Extraordinary expenses |

5,939 |

0 |

0 |

194 |

0 |

1 |

8 |

0 |

|

|

– |

– |

||

Profit (loss) before income taxes |

-6,147 |

-402 |

-340 |

-425 |

-244 |

-451 |

26 |

-331 |

-314 |

-148 |

421 |

-493 |

-80 |

39 |

Total income taxes |

1 |

0 |

3 |

-2 |

1 |

0 |

0 |

1 |

0 |

1 |

52 |

-51 |

0 |

1 |

Net profit (loss) |

-6,147 |

-403 |

-342 |

-424 |

-245 |

-451 |

25 |

-330 |

-314 |

-149 |

369 |

-441 |

-80 |

38 |

[Balance Sheets] |

||||||||||||||

Current assets |

2,761 |

2,390 |

3,238 |

3,322 |

3,573 |

3,218 |

3,329 |

3,346 |

2,794 |

3,203 |

3,722 |

3,326 |

4,079 |

4,035 |

Cash equivalents and short-termsecurities |

1,654 |

1,602 |

2,482 |

2,033 |

2,658 |

2,502 |

1,830 |

1,461 |

874 |

974 |

1,253 |

1,187 |

1,532 |

1,874 |

Non-current assets |

330 |

427 |

418 |

270 |

379 |

393 |

340 |

588 |

728 |

656 |

178 |

177 |

225 |

224 |

Tangible assets |

2 |

2 |

2 |

2 |

2 |

2 |

2 |

3 |

3 |

2 |

2 |

2 |

1 |

1 |

Investments and other assets |

328 |

425 |

416 |

268 |

374 |

389 |

336 |

582 |

722 |

651 |

173 |

173 |

220 |

220 |

Total assets |

3,091 |

2,817 |

3,656 |

3,592 |

3,952 |

3,611 |

3,670 |

3,934 |

3,522 |

3,859 |

3,901 |

3,503 |

4,304 |

4,259 |

Current liabilities |

421 |

550 |

529 |

881 |

772 |

858 |

925 |

1,114 |

823 |

1,034 |

1,045 |

1,129 |

1,175 |

651 |

Short-term borrowings |

25 |

25 |

25 |

25 |

25 |

|

|

|

|

|

||||

Long-term debts to be repaid

|

75 |

250 |

300 |

|||||||||||

Non-current liabilities |

25 |

24 |

1,224 |

1,224 |

1,384 |

1,287 |

1,231 |

1,209 |

1,051 |

826 |

718 |

656 |

1,485 |

1,908 |

Long-term debt |

|

|

1,200 |

1,200 |

1,340 |

1,240 |

1,200 |

1,100 |

900 |

700 |

700 |

625 |

1,450 |

1,875 |

Long-term borrowing |

|

|

600 |

600 |

600 |

600 |

600 |

600 |

600 |

600 |

600 |

525 |

1,350 |

1,275 |

Convertible bonds |

|

|

600 |

600 |

740 |

640 |

600 |

500 |

300 |

100 |

100 |

100 |

100 |

|

Total liabilities |

446 |

573 |

1,752 |

2,105 |

2,156 |

2,145 |

2,156 |

2,324 |

1,873 |

1,860 |

1,763 |

1,785 |

2,661 |

2,560 |

Total net assets |

2,644 |

2,244 |

1,904 |

1,487 |

1,796 |

1,466 |

1,514 |

1,610 |

1,648 |

1,999 |

2,138 |

1,719 |

1,643 |

1,699 |

Total shareholders’ equity |

2,644 |

2,244 |

1,904 |

1,487 |

1,796 |

1,466 |

1,514 |

1,610 |

1,648 |

1,999 |

2,138 |

1,719 |

1,444 |

1,500 |

Capital |

612 |

612 |

612 |

612 |

842 |

892 |

912 |

1,032 |

1,150 |

1,420 |

1,420 |

1,421 |

1,424 |

1,433 |

Legal capital reserve |

9,917 |

9,917 |

9,917 |

9,917 |

10,147 |

10,197 |

10,217 |

10,338 |

10,456 |

10,725 |

10,726 |

10,727 |

10,730 |

10,739 |

Retained earnings |

-7,908 |

-8,311 |

-8,653 |

-9,077 |

-9,322 |

-9,773 |

-9,748 |

-10,079 |

-10,393 |

-10,542 |

-10,173 |

-10,614 |

-10,710 |

-10,672 |

Stock acquisition right |

38 |

43 |

51 |

57 |

70 |

82 |

101 |

116 |

134 |

145 |

165 |

185 |

199 |

199 |

Total liabilities and net assets |

3,091 |

2,817 |

3,656 |

3,592 |

3,952 |

3,611 |

3,670 |

3,934 |

3,522 |

3,859 |

3,901 |

3,503 |

4,304 |

4,259 |

[Statements of cash flows] |

||||||||||||||

Cash flow from operating activities |

-604 |

-1,325 |

-104 |

-1,267 |

-857 |

-1,169 |

-709 |

|||||||

Loss before income taxes |

-6,548 |

-7,314 |

-695 |

-999 |

-462 |

-533 |

-42 |

|||||||

Cash flow from investing activities |

-106 |

-137 |

-5 |

-22 |

– |

526 |

-23 |

|||||||

Expenditure on acquisition ofintangiblefixed assets |

|

– |

|

– |

|

-3 |

|

-3 |

|

– |

-1 |

– |

||

Purchase of investment securities |

-100 |

-100 |

– |

– |

– |

– |

-50 |

|||||||

Sales of investment securities |

– |

– |

– |

– |

– |

526 |

– |

|||||||

Cash flow from financing activities |

40 |

1,221 |

579 |

718 |

370 |

369 |

1,446 |

|||||||

Income from the issuance ofconvertible bond-type bonds withstock acquisition rights |

970 |

|||||||||||||

Income from issuance of shares byexercising stock acquisition rights |

– |

599 |

599 |

599 |

– |

– |

499 |

|||||||

Income from issuance of stockacquisition rights |

40 |

40 |

– |

138 |

370 |

369 |

– |

|||||||

Proceeds from issuance of new shares |

– |

3 |

4 |

4 |

– |

– |

– |

|||||||

Net increase in cash and cash equiv. |

-670 |

-240 |

468 |

-571 |

-486 |

-273 |

713 |

|||||||

Cash and cash equiv. at beginning of period |

2,009 |

2,009 |

2,032 |

2,032 |

1,461 |

1,462 |

1,160 |

|||||||

Cash and cash equiv. at end of period |

1,602 |

2,032 |

2,501 |

1,461 |

974 |

1,187 |

1,874 |

Note: Consolidated basis until FY2022/3; non-consolidated basis from 1Q FY2023/3. For the statement of cash flows, the figures for 2Q are the cumulative figures for the period from 1Q to 2Q, and the figures for 4Q are the cumulative figures for the period from 1Q to 4Q. Therefore, the opening balance is also the balance at the beginning of each quarter.

Source: Omega Investment from company materials.