Valtes (Price Discovery)

| Securities Code |

| TYO:4442 |

| Market Capitalization |

| 22,701 million yen |

| Industry |

| Information / Communication |

Profile

Valtes Co., Ltd. performs software testing and the sales are 100% enterprise demand. Testing is carried out either on-site at the customer or at the company’s test centres to improve the quality of the customer’s software. It also provides quality consulting, security audits and vulnerability assessments. The company started with software testing services for audio-visual equipment and then moved into office equipment and consumer electronics testing. It has expanded its service offering to include websites, smartphones and financial systems. The company was founded by Masafumi Tanaka in 2004, and is headquartered in Osaka, Japan.

Stock Hunter’s View

The share price looks likely to hit a new historic high. The company is going on the offensive in the blue ocean.

Software testing company VALTES (4442) is on track to break the highest price it hit in October 2020 (3,390 yen) since its IPO. The key driver was the upward revision to the company’s full-year earnings forecast for FY2023/3, announced on November 14. The company’s focus on the enterprise domain has been paying off, with larger projects and higher unit prices.

In the first half (Apr-Sep), the company achieved record highs in both sales and profits. Based on this, full-year sales were revised up from the previous forecast of 8,506 million yen to 8,847 million yen (up 31.9% yoy), and the operating profit guidance was increased from 801 million yen to 962 million yen (+68.8% yoy). The company expects profits in the second half to be at the same level as in the first half while accelerating investment to drive growth, such as hiring personnel and strengthening the organisational structure.

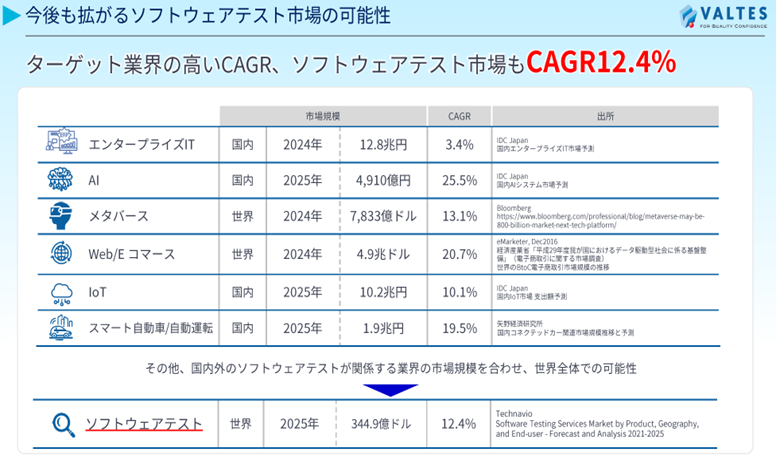

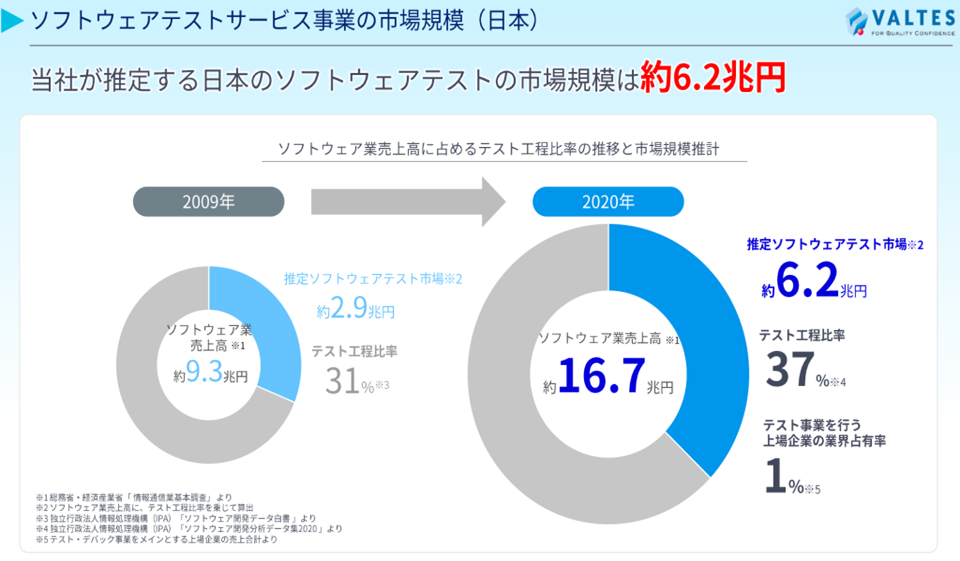

In recent years, the burden on the testing process in software development has increased in line with technological evolution. This is accelerating the outsourcing to third-party companies specialising in testing. The Japanese software market is estimated to be worth approximately 6.2 trillion yen (company estimate). However, the share of the top five companies is only a few per cent, so it is still an untapped market. The enterprise domain, in particular, is a potentially large market with high entry barriers. The medium- to long-term growth trend is expected to remain unchanged, with the increase in DX-related IT investment and the “2025 cliff” also providing commercial opportunities.

Investor’s View

Buy on timely weakness

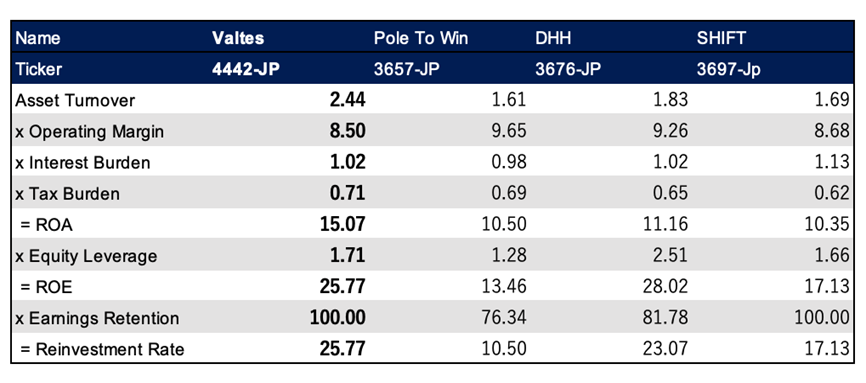

The shares have shot up amidst the stock market rally since mid-October, which was spurred on by management’s announcement on November 14 of solid growth and upward earnings revisions. This is a share price rally that buys momentum rather than a correction in valuations based on bottom-up analysis. Therefore, there is little reason to chase the strength, and buyers could bear high risk. TTM yoy sales growth reached +35% in Q2; it should pivot soon rather-than-not, triggering profit-taking and shorting. Over a more extended period, the company is one of the leading candidates for continued solid growth due to strong tailwinds from DX demand. While the economy slows down, there should be opportunities to buy the shares. Then the shares could do well under a recessionary economy thanks to solid earnings. In comparison with the peers, high ROE reflects good asset efficiency. If the company increases its equity leverage, it can achieve far higher ROE than its peers. The fair value on our DCF model is around 1,800 yen, suggesting a significant downside to the share price. It should be noted that we do not have confidence in our long-term earnings forecast due to the poor earnings visibility of the company.

Bull

The company’s return on equity is structurally high. A large BS is not necessary. The company’s asset turnover is exceptionally high relative to the other three software testing companies, contributing to its ROE advantage. The company’s operating margin is not significantly different from its peers, but it is good.

The software testing market is benefiting from a strong tailwind, and the company’s current growth is robust: In Q2, unit price, number of active engineers and number of projects were +11% yoy, +18% and +30%, respectively, confirming a high level of growth and a positive performance.

The software testing market is expected to continue growing. According to the company, the size of the domestic software testing market was worth 6.2 trillion yen in 2020. Just under 40% of this is in the testing process, but listed companies undertaking the testing business account for only 1% of sales. There needs to be more IT personnel in software development companies. The need for outsourcing testing processes should continue.

Barriers to entry are being built. There are many players in the market, and competition is intense. However, it will be challenging for companies to enter the market where engineers and customers are increasingly entrenched, as in the case of Valtes.

The software testing market in the enterprise sector, the company’s domain, is promising. High unit prices and long-term contracts also characterise this market. In the financial industry, particularly, the projects are large, and the services required are challenging, so service providers are likely to be limited. According to the company’s explanations, the finance-related software market is a considerable segment of the approximately 6 trillion yen market at 1 trillion yen. Other large software markets are those related to logistics and distribution.

The ability to create new businesses one after another, despite being small, is fascinating. In Q2, the management introduced test automation tools, cloud-based services for cyber-attack security, and the inclusion of xR (VR, AR) technology, which is attracting attention in the metaverse.

Potential to achieve scale through MA. While the company has been limited to corporate alliances or seed or early-stage investments, President Tanaka stated that the company would consider middle-layer, relatively large deals going forward. It has yet to be known whether expansion through acquisitions would generate a satisfactory return for shareholders or whether the company has the PMI skills. Contrary to the company’s proactive statements, the reality is that it seems cautious about MA.

Bear

TTM yoy sales growth, which reached +35% in Q2, may pivot sooner rather than later, after a sharp improvement from 5% 15 months ago. For investors trading momentum, the pivot will be an opportunity for profit-taking or shorting.

DCF estimates are negative. We do not have confidence in our long-term earnings model, but a fair value per share discounted at 5%, assuming +15% sales and +20% EBIT, of around 1,800 yen, suggests a significant downside to the share price. Our assumptions assume sales of 9.7 billion yen and an operating margin of 10% in FY2023, in line with management’s medium-term plan of targeting 10 billion yen in the same year.

Volatility in global equities remains high, and there are downside concerns about the shares, which have soared speculatively. With their solid earnings backing and poor liquidity, the shares were in the spotlight during the sharp rise in Japanese equities from mid-October. We believe the stock market has yet to enter an uptrend.

We have yet to expect the company to capture overseas market demand. The overseas market is vast, and President Tanaka is dreaming big. The company has a bridgehead in the Philippines, but it is small, and there is no evidence to raise expectations about its potential. According to the company, the CAGR for the global market is 12.4% until 2025, which bodes well.