Kaga Electronics (Price Discovery)

| Securities Code |

| TYO:8154 |

| Market Capitalization |

| 120,262 million yen |

| Industry |

| Wholesale business |

Profile

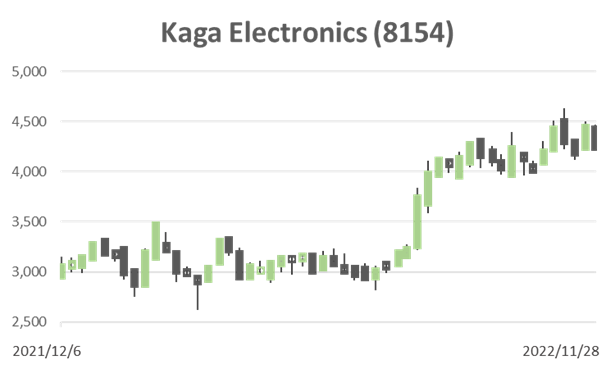

Independent electronic components trading company. The main electronic components business, which accounts for 90% of sales and profits, is doing very well. An independent trading company has a strong procurement network, can secure supplies from various sources. The company is capturing demand well under the shortage of semiconductor electronic components. The PMI of Kaga FEI (former Fujitsu Electronics), which was acquired, has also been effective and contributed to operating profit. The share price went up from 1,500 yen in CY2019 to 4,190 yen by now. But PER is 5x, and PBR is 0.9x, which compares to an ROE of around 16% , 5-year CAGR of +19% for ESP and +11% for BPS. TTM sales have been rising steadily since 4Q-CY2021 and are currently over +20% YoY. TTM OPM almost doubled in the same period. Share price performed +37% in 2021 and soared on a significant upward earnings revision in August 2022, rising 30% YTD. By region, sales are 53% in Japan, 24% in China, 7% in the US and 4% in India. Investment is underway to expand EMS production capacity. Revised medium-term management plan to be announced when 4Q results are revealed in May 2023.

Stock Hunter’s View

Entering a phase where the company’s competence is to be valued.

The upward revision was announced but still scope for further upside to the earnings.

KAGA ELECTRONICS (8154) is attracting attention as an undervalued stock with strong earnings performance. The company announced on 8 November that its 2Q results (Apr-Sep) for FY3/2023 were a record high for the period and revised its full-year forecasts upwards for the second time in this fiscal year. The electronic components business saw earnings increase through spot sales efforts in the automotive and industrial equipment sectors, despite ongoing shortages in the supply of certain semiconductors and electronic components. The EMS business also performed well with major customers, particularly in the automotive and medical equipment sectors.

OP was revised from the previous forecast of ¥24 billion to ¥28 billion (+33.9% yoy), but this was merely a sliding scale of the 1H increase, and the 2H forecast remains unchanged. As 2Q progress against the revised forecast has reached 65.5%, the earnings will likely exceed the new forecasts.

The company’s proactive approach to shareholder returns, including the payment of special dividends for eight consecutive years since FY3/2015, is also well-rated. It plans to pay an annual dividend of JPY 200 (JPY 120 in the previous year) a share, including a special dividend and commemorative dividend of JPY 60 this year.

Despite such strength, the shares are undervalued, with a PER in the 5x range and a PBR below 1x. SANKYO (6417), the former largest shareholder, has continued to sell shares since the beginning of this year, finally reducing its shareholding to below 5%. The company may have already sold out, and fundamentals will once again be the focus of investors’ attention.

Investor’s View

TRADING BUY. Long-term investors should look to buy on weakness next year.

The rise in the share price since early 2020 can be attributed to a sharp increase in profits due to tight supply and demand for semiconductors and electronic components. The company remains in the upward earnings revision cycle. A double position could be sensible if one expects the favourable environment persists for the next 12-15 months. However, without confidence in the operating environment forecast, one should expect the semiconductor electronic components market to normalise before long and the share price to lose positive momentum. Of course, such expectations will be factored into the share price ahead of reality. From how the CEO spoke at the November results presentation, there will likely be another upward revision when he reveals the 3Q results on 2 February 2023. This observation must be largely factored in, but what grows will be the positive expectation of next year’s earnings. Therefore, we would long the stock in the near term. However, there is a risk that the share price could fall sharply once 3Q results are announced, beginning to discount the normalisation of the business environment. Hence, we recommend profit-taking earlier than not. The stock rating is, therefore, a TRADING BUY.

Long-term investors should pick up the stock sometime next year

For investors running long-term money, there should be plenty of opportunities to accumulate the shares next year. The shares will likely be sold off as fears of an economic recession kick in. In the event of equity risk-off on recessionary grounds, the shares should underperform significantly, given a 52-week beta of 1.30 with an R2 of 0.46. A multiple below book value for a company with the ability to earn a stable ROE of ca 10% and a PER of only around 5x is an extremely cheap valuation. If multiples fall further, the shares are worth purchasing.

The shares are rising as tailwinds in the business environment are attractive

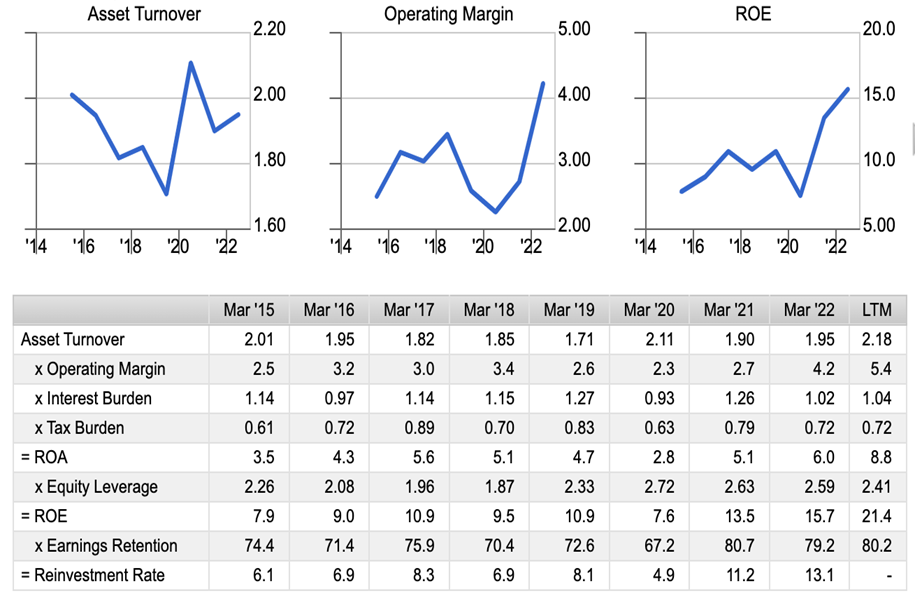

Both profits and ROE improved sharply due to the short supply of semiconductors and electronic components. However, investors continue to value the share price quite cautiously. They reflect the view that the current earnings growth is transitory and not structural. ROE, around 10% for almost a decade, has doubled, and PBR has widened accordingly but is still 0.9x; PER remains low at 4.8x, down from a recent peak of 15x at the end of 2021. The share price rose due to attraction in the tailwind of the business environment and not because the company business or management is rated better.

No improvement in business structure

This unsympathetic view of the value of the business should be only sensible. Apart from temporary cost controls, no measures have changed the profit structure. Management has explained that the current profit boost is primarily attributable to higher sales volumes. In reality, the contribution of price effect under the tight supply-demand markets should not be so small. The volume/price effects are temporary. In recent years, the semiconductor cycle has become diluted, making it much more difficult to predict when the next boom will occur. More exposure to manufacturing business through the expansion of EMS’s overseas production capacity is positive for ROE and PL margins. It is rated well being a good use of cash flow. However, it will take more than a few years to contribute to earnings.

Why are multiples so low?

The reasons for the depressed multiples of a trading company’s share price are:

- Poor earnings visibility.

- Paper-thin P/L profit margins, which will only improve with considerable business reforms.

- The unclear real value of the balance sheet to external investors, although trading companies do business by making full use of their balance sheets.

The management of specialised trading companies is surprisingly stable, and ROE is not necessarily low. This is because they have excellent equity leverage and asset turnover. However, OPM of two or three per cent bores and is difficult to increase, so the upside in return on equity is lacklustre. The lack of investor interest lies in the fact that the management’s power does not easily extend to shareholders. Analyst coverage is few.

Kaga Electronics – Dupont Model

Drivers that turn around the share price premium

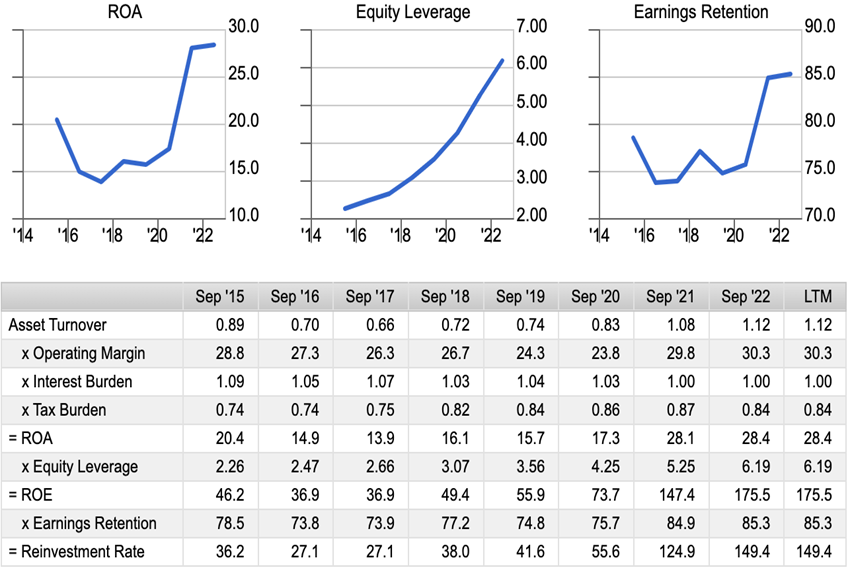

If management focuses on share buybacks and sharply increases equity leverage, the share price should go up significantly. The company repurchased 1,220,000 shares in 1Q 2022, doubling its shareholding position. It now holds 8.49% of the outstanding shares, making it the second largest shareholder after President Isao Tsukamoto, who is from the founding family. The company’s approach to performance-linked dividends is reasonable, with JPY 60 of the current year’s dividend of JPY 200 reflecting a single-year business performance. With a cash flow that can afford to pay generous dividends and a high credit rating, the company does not need a 40% equity ratio. Equity leverage should be maximised for shareholders’ benefits through share buybacks, even if the dividend is reduced to zero. For reference, the following is Apple’s return on equity factor analysis, which shows how an ROE close to 180% is constructed.

Apple – Dupont Model