Careerlink (Price Discovery)

| Securities Code |

| TYO:6070 |

| Market Capitalization |

| 38,717 million yen |

| Industry |

| Service |

Profile

Careerlink’s core business is Business Process Outsourcing (BPO), with sales to the public sector growing in particular. BPO accounts for 60% of sales and is estimated to generate most of the company’s profits. Other activities include customer relationship management (CRM), mainly telemarketing-related temporary staffing, and manufacturing temporary staffing. The company breaks down sales as 84% administrative work, 13% manufacturing, 2% marketing and 1% other. Administrative work splits into 72% BPO, 16% general administrative work and 12% CRM-related business. Administrative work generates 94% of operating profit.

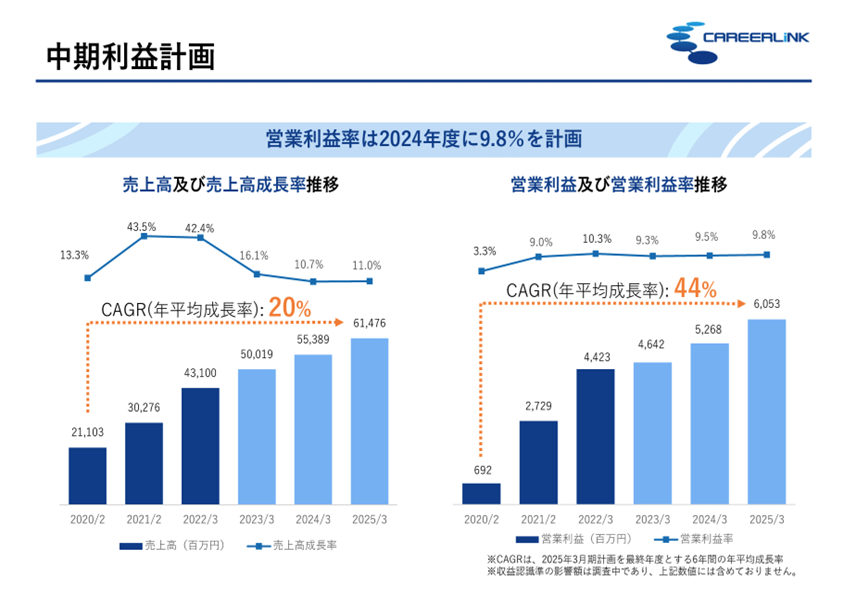

The share price has soared since 2020, reflecting the sudden improvement in earnings. Last year, it fell in a risk-off equity market but has performed at 2.2x YTD. EBIT growth of 44% this year, 5-year EBIT CAGR of +33% and ROE of over 40% compare with PER of just under 9x and PBR of 3.7x PBR. Analyst coverage is almost none.

Stock Hunter’s View

Public DX is the growth opportunity. Business for municipal BPO is currently performing exceptionally well.

Careerlink has continued to perform well by capturing demand for BPO for municipalities, such as for My Number Card (individual number card), benefits and COVID-19 vaccination projects.

The share price rose sharply following the upward revision to the full-year earnings forecast on 9 November, reaching a high of 3,290 yen marked at the beginning of the year on 29 November. As expected, the share price has been undergoing an adjustment, but when the adjustment is over, the share price may go up again towards the historic high price registered in February last year (3,475 yen).

Many of the new BPO project orders, including spot orders received in 1H, are expected to continue until the end of the current financial year, with spot outsourced contracting orders and extensions of existing outsourced contracting projects also expected in 3Q (Oct-Dec).

In the BPO-related business, the number of orders received in 2Q reached a record high on a quarterly basis due to strengthened sales capabilities. The number of orders received per project also increased, improving profitability. In addition, the number of municipalities with which the company does business is growing steadily amid the so-called ‘public DX’, developing digital infrastructure for local governments using My Number Card. The company already trades with 13 of the 20 ordinance-designated cities and hopes to expand to core cities and tap into private sector demand for peripheral services.

Investor’s View

Buy on near-term weakness

At first glance, a PBR of 3.7x and PER of 8.9x are difficult to understand, given a 40% earnings growth this fiscal year and an ROE of over 40%. We believe the reason is an imbalance whereby the speed of profit growth does not catch up with the inflating shareholders’ equity. If the company continues as it is now, ROE will decline rapidly. However, the business and management of the company are excellent, and the depressed PER is too much of a discount. The multiple may be re-rated over the next 12-15 months. Therefore, we would look to buy the shares. In the near term, the market could test the October bottom, and short-term technical indicators have heated up. Furthermore, a recession next year should slow down corporate orders to the company. Therefore, we are inclined to buy the shares on the near-term weakness. Long-term investors who already own shares should be comfortable keeping their positions.

Why PBR is not rated well

After the dividend, the company’s equity grows by c.a. 40%. Profit ATOP (net profit attributable to owners of the parent company) will be up +40% this year, when the momentum is expected to peak due to exceptional demand from the public sector due to the My Number card campaign. Profits will need to grow more to maintain a high ROE. Even assuming secular profit growth of 20%, ROE will decline markedly in the future.

Dupont Model

Management maintains that the gap between ROE and PBR implies an upside to valuations. However, expectations, not performance, are reflected in the share price multiple, and PBR should be considered low as it incorporates expectations of declining ROE.

Prescription for the depressed PER

PER is the slope in the graph above, as PBR = PER x ROE. The reasons for the company’s low slope are 1) the view that the current high revenue growth and operating profit margin of around 10%, driven by special public sector demand, will not continue for long and, perhaps, 2) a lack of investor interest in the speed of profit growth that cannot sustain ROE. Management states that it will increase PER to 16x. However, the measure is to strengthen investor relations. If the leading cause of the poor valuation is not the lack of investor attention to the company in the equity market, the efforts will not be so effective. A good prescription would be to optimise the reinvestment rate and capital through dividends and share buy-backs and strengthen IR. In other words, the policy of cash flow recycling should be re-established. In this respect, it is positive that management aims to increase the dividend payment and raise the payout ratio to 30%.

The earnings stream is solid

Management raised its full-year Profit ATOP forecast by 39% in an upward revision on 9 November and expects a 40% yoy increase for the full year. This is due to higher-than-anticipated orders from local governments and increased BPO projects reflecting special demand from the My Number card campaign. Due to a change in accounting treatments, the company’s explanation is messy, but in short, 2Q sales were up 25%, and PATOP was up 53% YoY on an apple-to-apple basis.

A thought on the earnings drivers

What has significantly strengthened the earnings momentum is the boom in special BPO demand from municipalities rather than the company’s organic growth. The strong performance of BPO for the public sector is an exciting feature of the company, but it probably accounts for less than 50% of sales. We see few edges of the company in other businesses, such as temporary staffing, and the company is dwarfed by giants such as Pasona Group (2168) and PERSON Holdings (2181). The profits earned from BPO look bulky, but the company’s exposure to public orders needs to be disclosed, so it is unclear to what extent this is an earnings driver.

Data on contract length needs to be disclosed, and it is not known how much recurring revenue the company earns. It was revealed that spot sales were 17% of sales in the FY03/2022 company data, and the repeat rate for the government sector is over 80%. These do not make us think the company is a recurring revenue business. Orders related to My Number card are a tailwind, but with penetration rising quickly, demand should eventually run out before long.

The earnings visibility is deteriorating

November’s upward revision is the first earnings surprise since the minor negative surprise in 2017. The reason for the much better earnings was that BPO orders and profitability erred on the upside, although the temporary staffing business did not meet its order growth target. There is nothing to surprise with upward revisions in a strong earnings cycle, and that is fine for existing shareholders. On the other hand, the share price rise must have disappointed investors who were proactively considering starting a position. The degree of the revision was so large and abrupt, and was out of management’s expectations. This brings concern that this has become such a complex operating environment for investors to predict earnings. Presumably, as public sector orders increased, the earnings have become difficult to forecast, unlike the previous five years, when there were no surprises. Special demand from public sectors, such as for My Number card, will eventually run out. If public sector orders are much less predictable, there could be a significant downward revision if orders lose steam.

The feasibility of the medium-term management plan

Management’s performance targets for the period up to FY2024 are modest. However, they should not be relied upon if the company is going through a business cycle where the earnings visibility is so low. It is vital to have a check hearing from the management team.

Management’s operating profit target for FY2024 is 6.05 billion yen, which compares to the guidance for the current year of 4.6 billion yen. Three-year CAGR of +13% for sales, +11% for operating profit and a flattish operating profit margin seem a modest set of forecasts. The number of customer municipalities is expected to increase steadily from 102 in September 2022 to 161 in FY2024. 161 is explained as half of the 320 cities in Japan with a population of more than 100,000. The management explains that as most local governments will migrate to the ‘government cloud’, the company will have more opportunities to play an active role in using the cloud. As per Japanese corporations, the BPO usage rate is low at around 20%, compared to the 70% in Europe and the US, which bodes well for service providers. In contrast, if Japan’s local government usage rate is already 50%, demand may saturate in the not-too-distant future.

Governance and ownership

The company’s largest shareholder is Smart Capital Co, which holds 43.46% of the outstanding shares, and its president is Mr Naofumi Maeda, a director of Careerlink. Mr Maeda is also the third largest shareholder, with a 2.08% stake. Smart Capital is believed to be Mr Maeda’s asset management company. Careerlink’s governance is therefore subject to his sole control, and the structure of the company, which could lead to minority shareholders being neglected, is negative. However, there should be other reasons for the significant discount in the PER.

The company was initially established in 1996 as a subsidiary of Hyogo-based consumer finance company Shinki Co. to develop its call centre staffing and general office work business. Shinki was subsequently acquired by Shinsei Bank, which later divested from Careerlink in a restructuring. At that time, Mr Maeda, who was from the founding family of Shinki and was its president, is believed to have acquired the shares with his assets. It is a separate company unrelated to the financial boutique of the same name.