Kohoku Kogyo (Price Discovery)

| Securities Code |

| TYO:6524 |

| Market Capitalization |

| 63,180 million yen |

| Industry |

| Electric equipment |

Profile

The company manufactures lead terminals, optical components, and devices for optical fibre communication networks. The lead Terminal segment includes lead terminals for aluminium electrolytic capacitors. The Optical Component and Devices segment includes optical communication parts. Overseas sales account for 65% of total sales. Established in 1959, it is located in Nagahama City on the shores of Lake Biwa.

Stock Hunter’s View

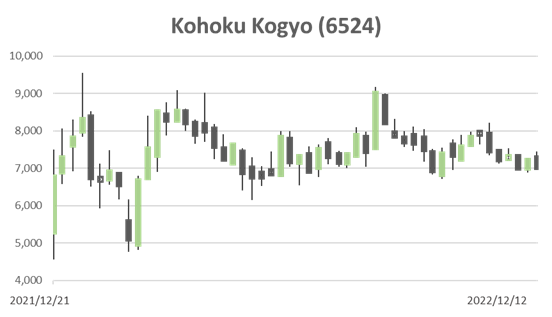

It’s time to sleep on stock ideas and prepare for the New Year. One of the stocks to pick up now is Kohoku Kogyo (6524).

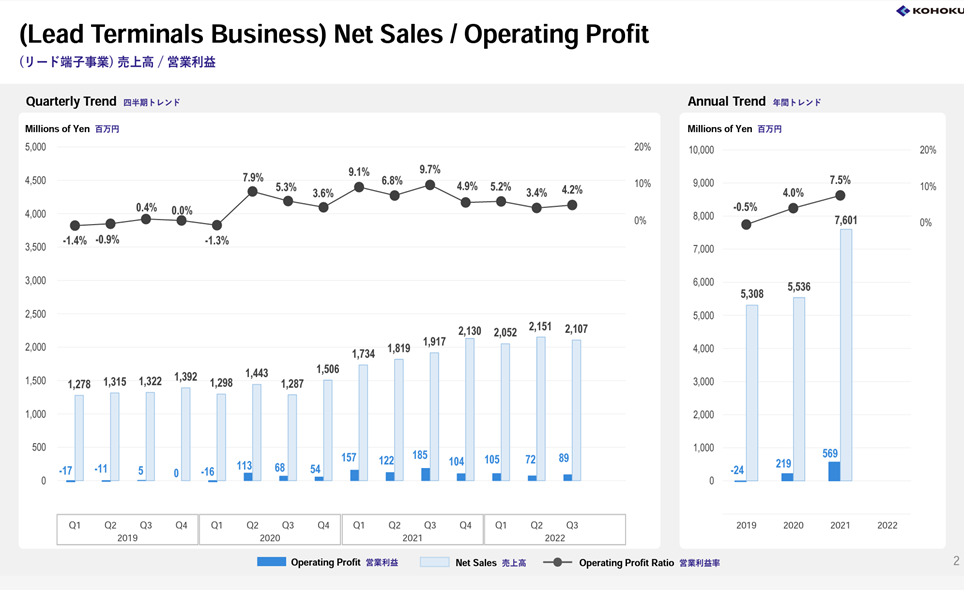

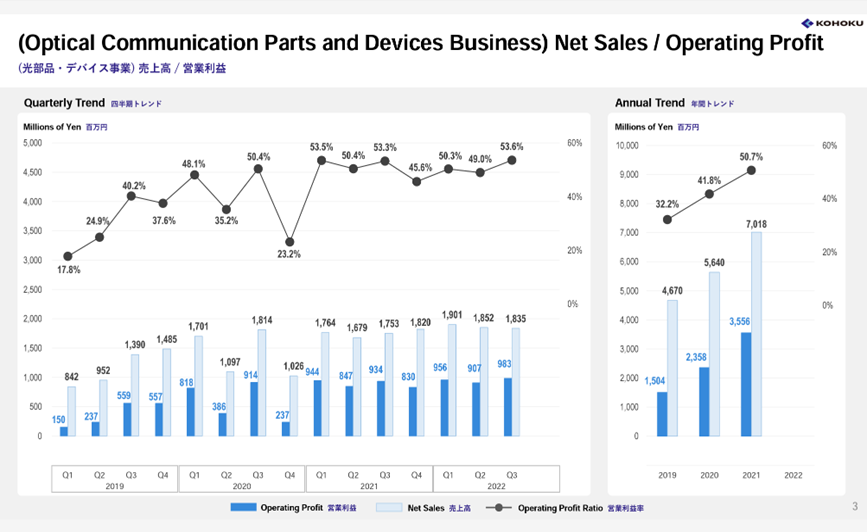

The company manufactures and sells lead terminals, a key component of aluminium electrolytic capacitors, and optical components and devices used in fibre-optic communication equipment and optical modules. In 3Q FY12/2022, both businesses registered sales increase. Still, the lead terminal business suffered a decline in profits due to lower EV production due to a shortage of semiconductors in the lead terminal business and rapidly deteriorating market conditions in the information and communications and consumer electronics equipment markets.

Nevertheless, sales, recurring profit and net profit in the first nine months of FY2022 were all at their highest levels since the company’s foundation. In the highly profitable optical components and devices business, optical isolators and other products continued to perform well against the expanding submarine cable market. Full-year recurring profit is forecast at 4,254 million yen (-2.5% yoy). But with the exchange rate assumption unchanged at 115 yen per USD, the company will likely beat its earnings forecasts.

Despite the near-term deterioration in market conditions, the company’s medium- and long-term growth trends remain “EV-isation” and “increased telecommunications traffic”. In the submarine cable market, the company should demonstrate its strength with a global market share of more than 50% in crucial component optical isolators.

Investor’s View

Good for GARP investors

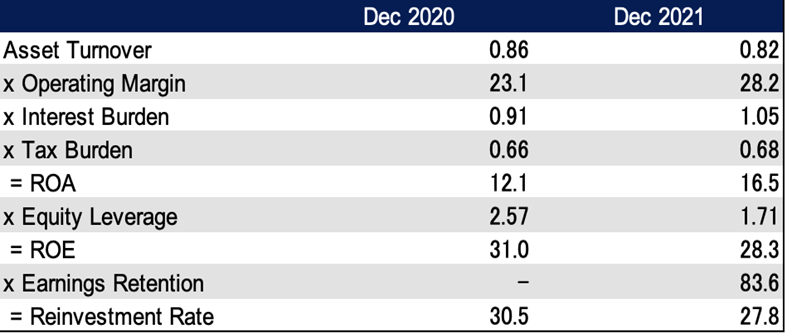

With a market capitalisation of 64 billion yen, the company has many highlights. The business is robust, with an ROE of ca 20% and an OPM of 30%, which is outstanding for a Japanese manufacturing company. The company has many niche products and, unlike most manufacturing companies, has price dominance, which is a strength of the company and makes the stock attractive. On the other hand, the stock is widely known to foreign investors, and there have been many 1×1 contacts this year.

We would be a buyer taking the opportunity of this year’s share price weakness

The company’s share price has fallen 2.6% YTD, slightly underperforming TOPIX. The lacklustre share price may be due to the temporary standstill in the lead terminal business, as noted by Stock Hunter, and the expected fall in ROE due to BS inflation. However, the PER and PBR look undervalued relative to growth, making it a good stock for GARP investors. We would buy the shares aggressively to generate significant long-term returns. The fair value indicated by a DCF estimate assuming sales and EBIT growth rates of +20% and +30%, respectively, and discounted at 5%, is 11,600 yen.

If management moves to raise ROE, the shares will become even more interesting

It is evident to all investors that cash is expanding rapidly and pushing down ROE. Management expects ROE to fall to 20.0% by the end of the current FY2022. They can easily sustain ROE at high levels if they rebuild the cash flow recycle policy and optimise capital. Unlike bureaucratic companies, there is a good chance that the company, which is enterprising and communicates with foreign investors, will listen to investors. This is one of the exciting aspects of investing in the company’s shares, as the management’s move to optimise BS would dramatically impact the share price value, and yet it is not a difficult task.

Dupont Model