TENPO INNOVATION (3Q Follow up)

Profitability rising on structural growth drivers

Margins rising on increase in successor contracts and guarantee fees

| Click here for the PDF version of this page |

| PDF Version |

SUMMARY

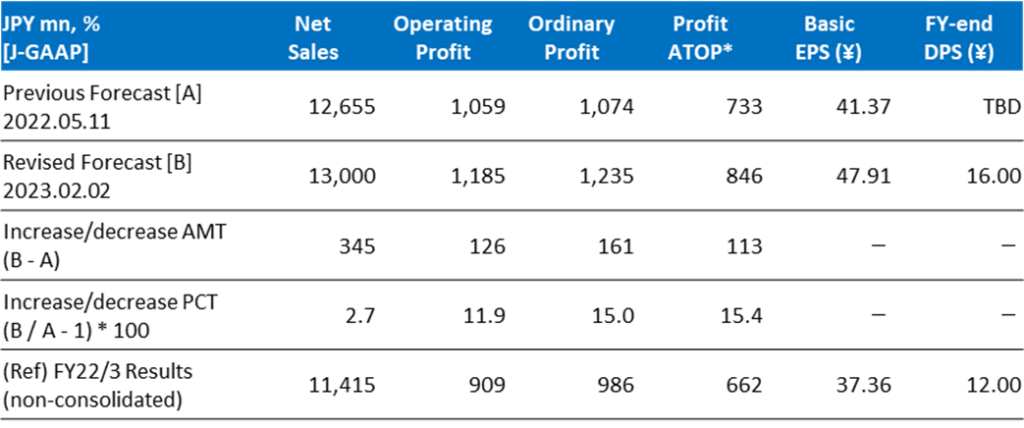

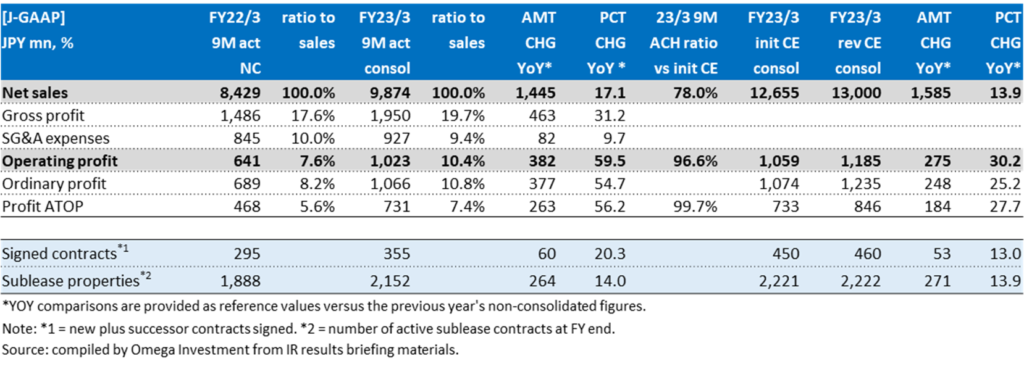

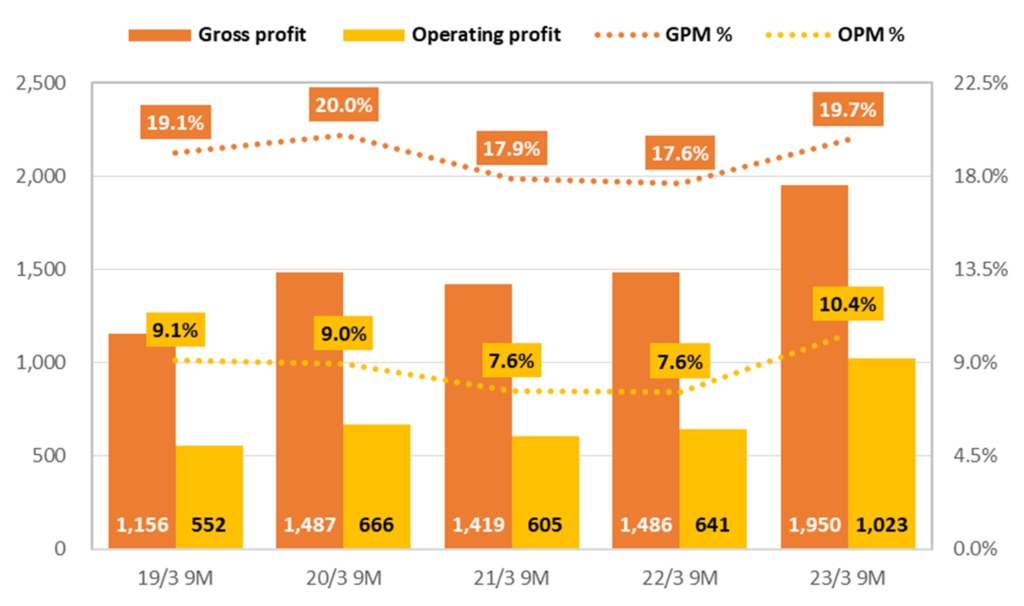

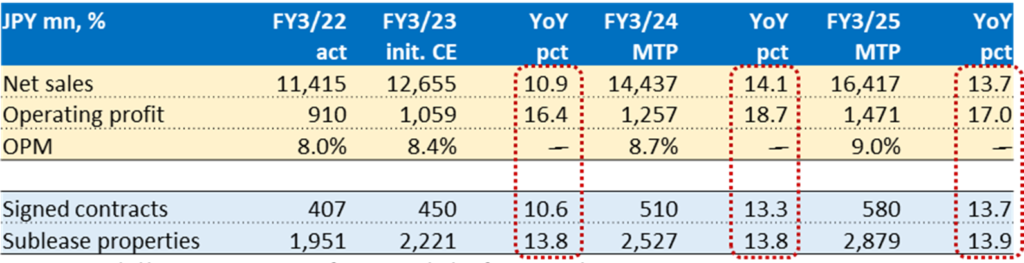

- TENPO INNOVATION announced 9M FY23/3 results at 15:30 on Thursday 2/2. Headline numbers were net sales increased +17.1% YoY, OP increased +59.5% YoY, GPM rose from 17.6% → 19.7%, and OPM rose from 7.6% → 10.4%. Profits increased significantly mainly due to several large and profitable sales in real estate transactions. Along with 3Q cumulative results, the Company also revised up full-term guidance after achieving 97% of OP in the first 9 months (see table below and on P5). New full-term forecasts are for net sales +13.9% YoY and OP +30.3% YoY. Net sales were only revised up slightly as the assumption for active subleased contracts at the end of the fiscal year is effectively unchanged and the target for signed contracts is up only marginally. The upward revision to profits reflects growth in profits is accelerating due to two structural drivers.

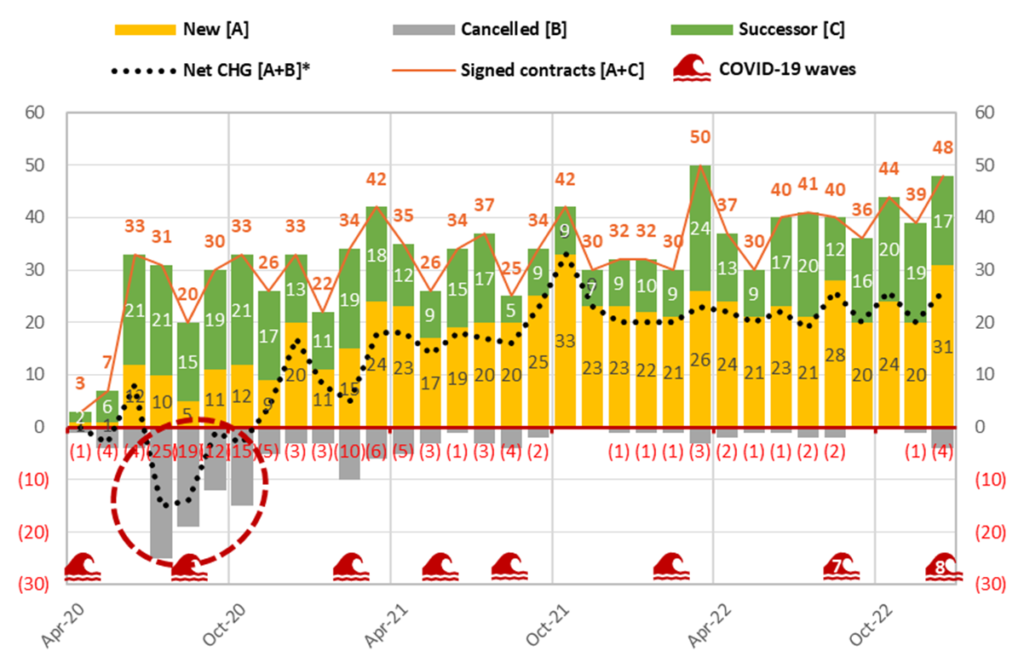

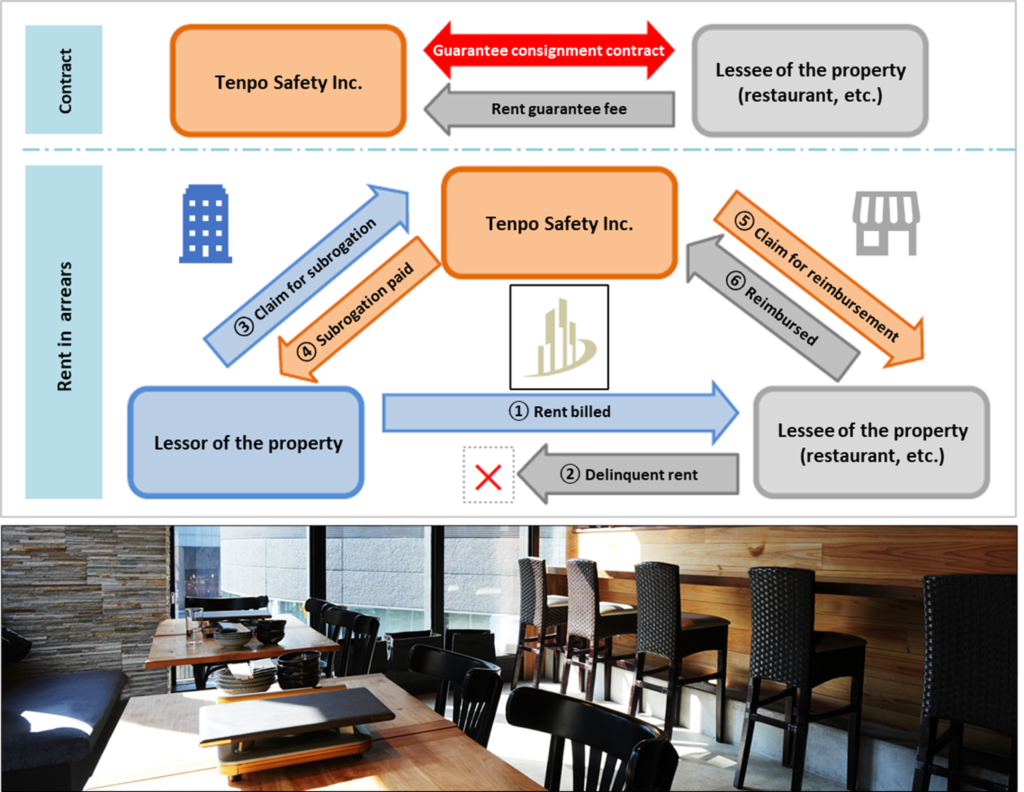

- ❶ The difficult environment for the restaurant industry overall is actually a favorable opportunity for the Company as more properties become available to procure for subleasing, and turnover in existing contracts increases the number of profitable successor contracts (no acquisition costs such as key money), and ❷ newly established store rent guarantee business has no cost of sales or operating expenses such as personnel cost, so net sales are basically equivalent to operating profit (nearly 100% OPM), and revenue is linked directly to the number of signed contracts each quarter, so profits are set to grow at a faster pace than net sales going forward thanks to these two structural drivers boosting margins.

- On Friday 2/10 at 16:30, the Company announced that the Board of Director resolved at its meeting held on 2/10 to repurchase up to 3.65% of shares outstanding (up to 650,000 shares) on Monday 2/13 at 08:45 at Friday’s closing price of 1,240, through off-hours trading on ToSTNeT-3 of the Tokyo Stock Exchange, pursuant to Article 156 of the Companies Act as applied pursuant to Article 165, Paragraph 3 of said Act. The reason given for the repurchase of its own shares is to improve capital efficiency and enable the execution of a flexible capital policy.

TENPO INNOVATION : Company revises up full-term FY23/3 guidance

FY23/3 Full-term Consolidated Financial Forecasts

Financial Indicators

| Share price (2/27) | 1,272 | 23.3 P/E (CE) | 25.9x |

| YH (23/2/27) | 1,272 | 23.3 EV/EBITDA (CE) | 14.5x |

| YL (22/1/27) | 790 | 22.3 ROE (act) | 21.1% |

| 10YH (23/2/27) | 1,272 | 22.3 ROIC (act) | 18.6% |

| 10YL (20/4/6) | 477 | 22.12 P/B (act) | 5.70x |

| Shrs out. (mn shrs) | 17.674 | 22.3 DY (act) | 1.29% |

| Mkt cap (¥ bn) | 21.916 | | |

| EV (¥ bn) | 17.740 | | |

| Equity ratio (12/31) | 29.4% | | |

PART ①:RESTAURANT INDUSTRY UPDATE

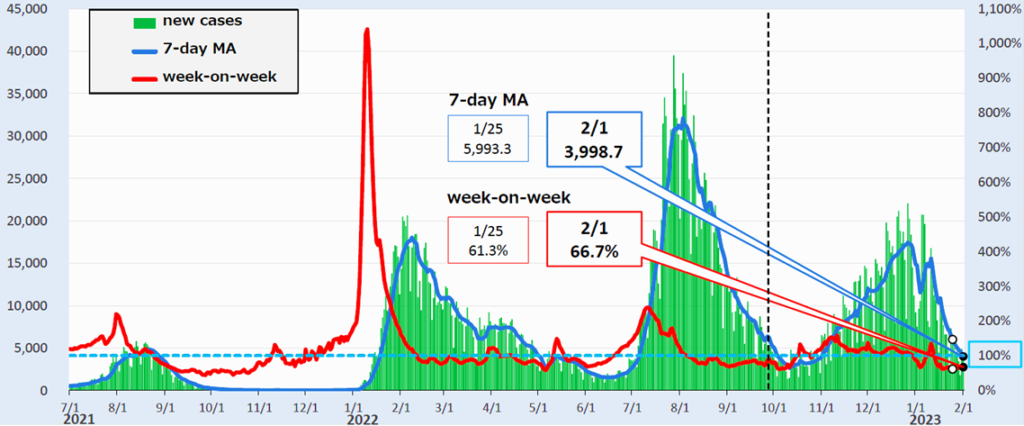

Greater Tokyo number of new positive cases, compared to previous week (as of 2023.02.02)

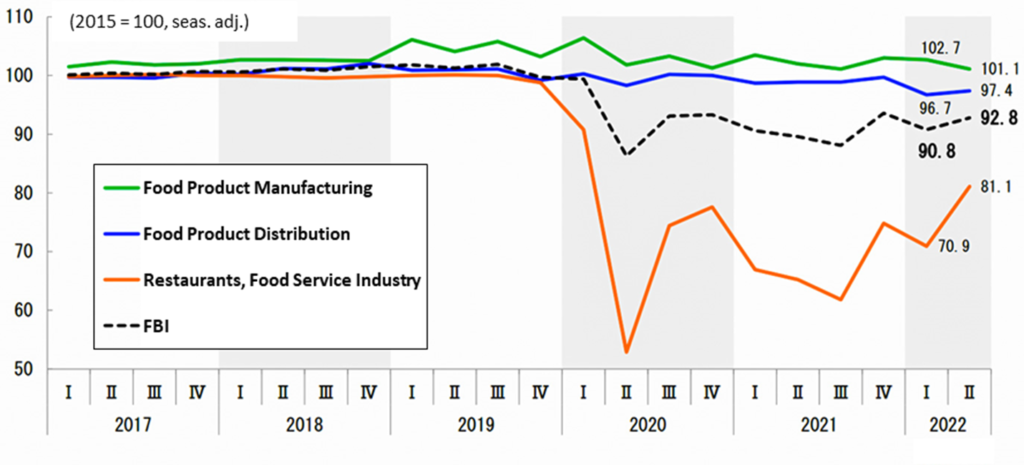

FBI Quarterly Breakdown of Component Industries (seasonally adjusted)

Japan Foodservice Assoc.

JF was established in 1974 under approval of the Ministry of Agriculture, Forestry and Fisheries. The number of regular and supporting member companies has reached 800, representing an estimated market size of approx. ¥25 trillion with 5 million workers.

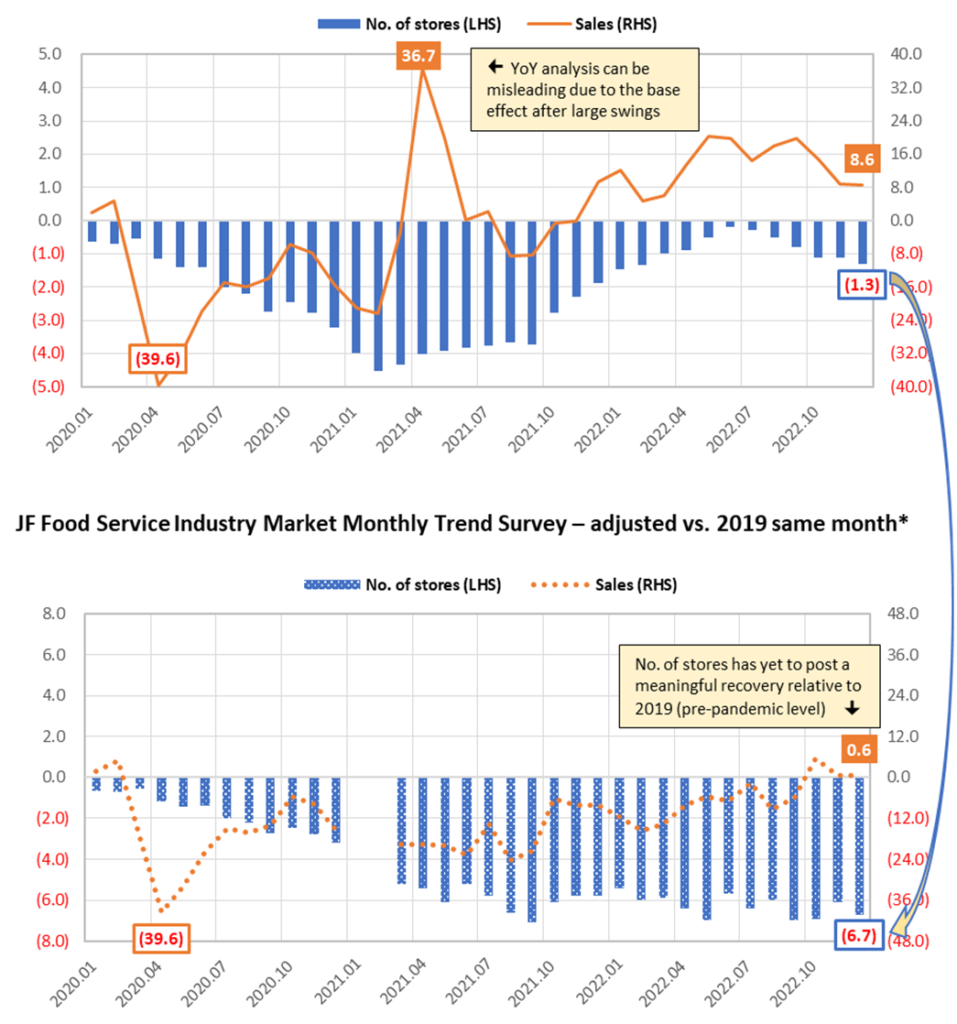

JF Food Service Industry Market YoY Trend Survey – Monthly Results Reports

Net store closures of restaurants in the all-stores data on the right is clearly a lagging indicator relative to sales. The middle graph on the right suggests the impact from the global pandemic appears to be mitigating.

However, YoY figures, by definition, are versus the same month in the previous year, which can be deceptive after large declines.

In order to strip out the base level effect, from Mar-2021, the JF monthly survey results report added two new columns to include sales and no. of stores comparisons versus the corresponding month in 2019 (see lower graph on the right).

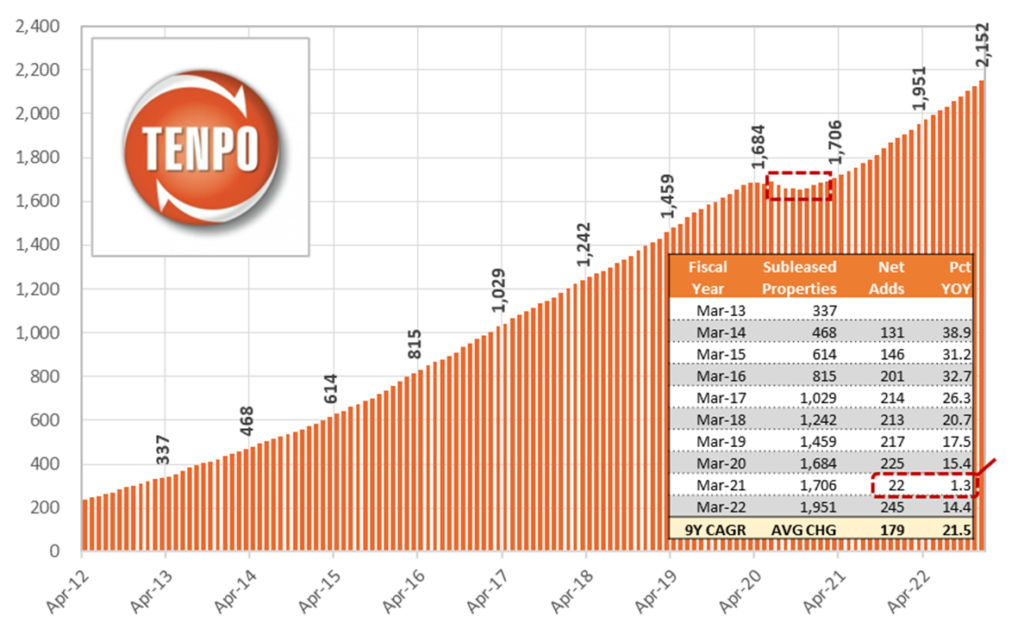

TENPO INNOVATION subleased store properties are uncorrelated with the market

According to the JF Food Service Industry Market YoY Trend Survey for December 2022, total stores declined -1.3% YoY, but relative to December 2019, declined -6.7%, yet to post a meaningful recovery. For the same period, subleased restaurant store properties for TENPO INNOVATION increased +14.0% YoY, and relative to December 2019, increased +31.7%. In other words, there is no correlation between TENPO INNOVATION subleased restaurant store properties and the underlying market trend for total stores. They are uncorrelated. The graph below shows the long-term monthly trend of the Company’s subleased restaurant store properties.

Expertise in finding and subleasing relatively small, low rent, vacated- furnished restaurant store properties, many in central Tokyo.

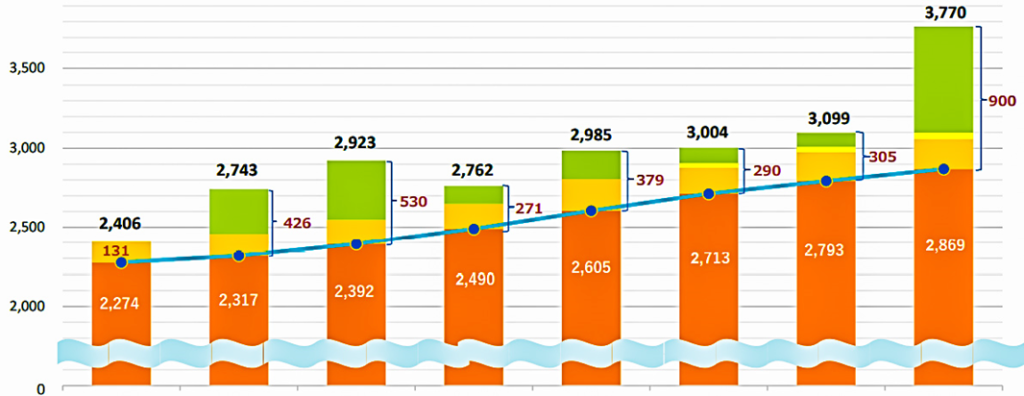

Monthly trend of subleased store properties: textbook definition of stable high growth

Monthly trend of sublease contract transactions during the pandemic

*Note: net change = “New – Cancelled” as well as reflects transfer from “sublease to leasehold” and “leasehold to sublease” (Dec 2021: -2; Jan 2022: -1; Oct 2021: +2; Nov 2022: +1; Dec 2022: -1).

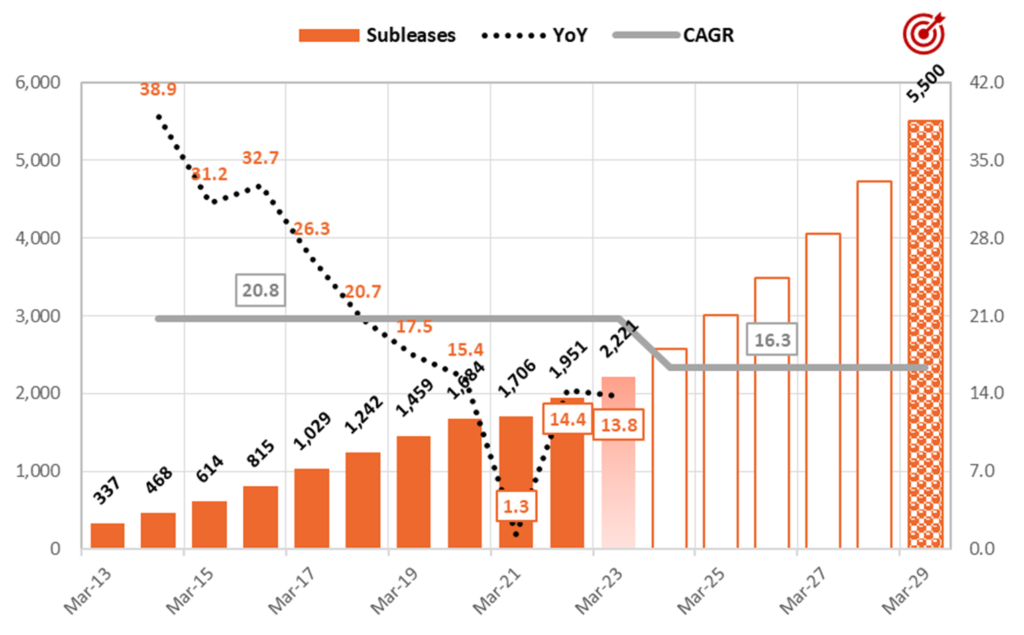

TENPO INNOVATION: Sustainable double-digit growth with high stability

The graph above shows the Company’s medium-term target for 5,500 subleased properties by the end of FY3/29, implying 6-year CAGR of +16.3% per year. This target was not randomly formulated by simply assigning a certain CAGR growth rate, rather, it is equivalent to a roughly 5% market share of the estimated 110,000 viable candidate restaurant store property universe in Tokyo and the three surrounding prefectures, based on the total number of 160,000 restaurants from the 2016 Economic Census of Business Activity. In order to achieve this target, a key initiative in the Company’s Medium-Term Management Plan is to boost its salesforce from the current 40 professionals (14 store procurement, 26 finding subleasing tenants) to 100 (30 store procurement, 70 finding subleasing tenants). Please refer to P10 in the REFERENCE section for details of initiatives in the MTP.

TOKYO × TENPO INNOVATION

Grab Tokyo.

The world’s largest number of passengers Shinjuku Station: 3.59 million

The world’s largest number of restaurants Metropolitan Tokyo: 79,601

The world’s top gastronomic city No. of Michelin-star restaurants: 226

We compete in this city with the highest potential.

The world’s most traversed pedestrians Shibuya

The world’s best subculture district Akihabara

There is more we can do.

99% untapped market.

We will not stop and will keep pushing forward.

It will become a big swell and envelop this city.

From because we can do it → so we will do it.

PART ② EARNINGS RESULTS

Company revises up full-term guidance after achieving 97% of OP in the first 9M

3Q cumulative (9M) results are summarized in the table below. Net sales increased +17.1% YoY, OP increased +59.5% YoY, GPM rose from 17.6% → 19.7%, and OPM rose from 7.6% → 10.4% (see margins graph on P8). In addition to the contribution from new high margin rent guarantee business, margins got a strong boost from the sale of 5 properties which included several large-scale profitable properties (see below). The number of signed contracts topped 100 for the fifth consecutive quarter at 131 (new record), and the number of profitable successor contracts also increased to 56. Total active restaurant store sublease properties reached 2,152 (+14.0% YoY).

The current business environment is extremely favorable for the business model given active turnover in restaurant openings and closings. TENPO INNOVATION specializes in properties having 1) relatively small scale and reasonable rent, 2) good location and 3) vacated furnished, and as such, are always in high demand. While the quarterly sales amount for RE sales fluctuates from quarter to quarter, it is achieving its target of one property sale and one procurement each quarter (3Q 5 sales and 5 acquisitions, 3Q-end inventory 3 properties). Although the primary objective of this business is to maintain a good relationship with RE brokers by paying meaningful commissions in return for good information on sublease candidates, the Company has recently also received interest from existing owner landlords to purchase properties, enhancing a stable supply pipeline without referrals. New store rent guarantee business is summarized on the next page.

Quarterly Trend of Sales Breakdown by Income Category (JPY mn)

TENPO INNOVATION FY23/3 3Q cumulative (9M) Consolidated Financial Results Summary

PART ③ TOPICS

Store rent guarantee business of Tenpo Safety Inc. commenced on April 1, 2022

Since the Revised Civil Code went into effect from April 2020, rent guarantees for store lease properties are expanding socially as a system that benefits both property landlords and tenants. In the past, the Company had tenants enter a rent guarantee contract automatically upon application, and the business was consigned to outside providers of rent guarantees. However, with over 17 years experience in subleasing over 2,000 restaurant store properties, and unique screening know-how, the Company is fully capable of assessing the risk of its subleased properties. The Board of Directors resolved on March 24, 2022 to establish a wholly-owned subsidiary with the aim of keeping this income stream in-house.

According to the Company, every contract signed requires entering a rent guarantee agreement, and the rent guarantee fee is equivalent to roughly 1 month’s rent. The newly established Tenpo Safety Inc. handles 70-80% of these contracts, the remainder deemed to carry a higher level of risk are outsourced. Therefore, with signed contracts running at over 100 per quarter, roughly 80 contribute directly to Group profits each quarter. As described on the cover page, this business carries a virtual 100% OPM, and growth is linked directly to signed contracts. Along with the rise in profitable successor contracts, store rent guarantee business will be a structural driver of margins going forward.

Tenpo Safety Inc. Store Rent Guarantee Business Overview

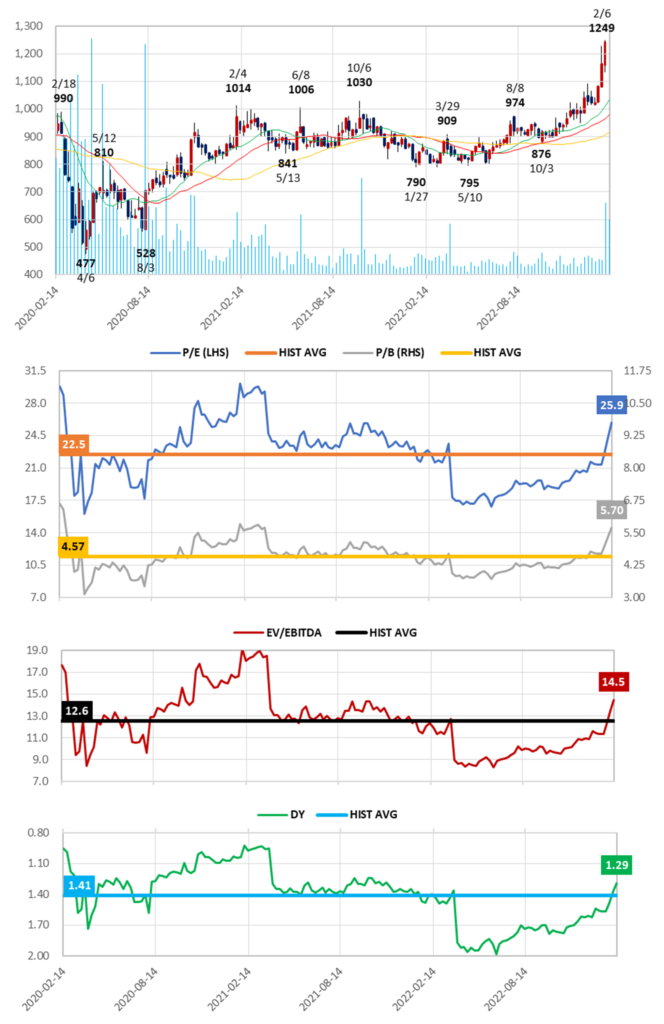

PART ④ SHARE PRICE

3Y Share Price Chart, 13W/26W/52W MA, Volume and Trend of Valuations and Trend of Valuations

Key takeaways:

❶ The current P/E and EV/EBITDA are trading on 15% premiums, each to their respective historical averages. As previewed in our previous note, based on H1 progress ratios for OP and profit ATOP, full-term guidance was revised up on 3Q results.

❷ The equity ratio on the surface may appear low at 29.4%, however this reflects the fact that the B/S is comprised of a large amount of deposits paid and received. The Company is debt-free, and the B/S is extremely healthy.

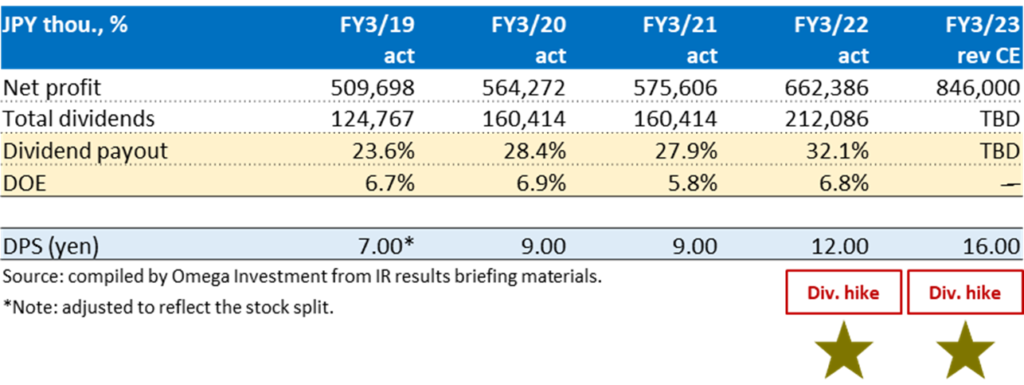

❸ The company disclosed guidance for FY-end DPS of ¥16.00 per share, a dividend hike of ¥4.00 per share versus FY22/3.

❹ Short-term technical indicators have now become slightly overbought: 14d RSI 91.5, MACD 62.7 (signal 38.0, histogram 24.8), 26W divergence +26.8%, 52W +35.5%, Bollinger band +2.6 std. deviations (+2.6σ), fast stochastics %K 97.0, %D 88.2.

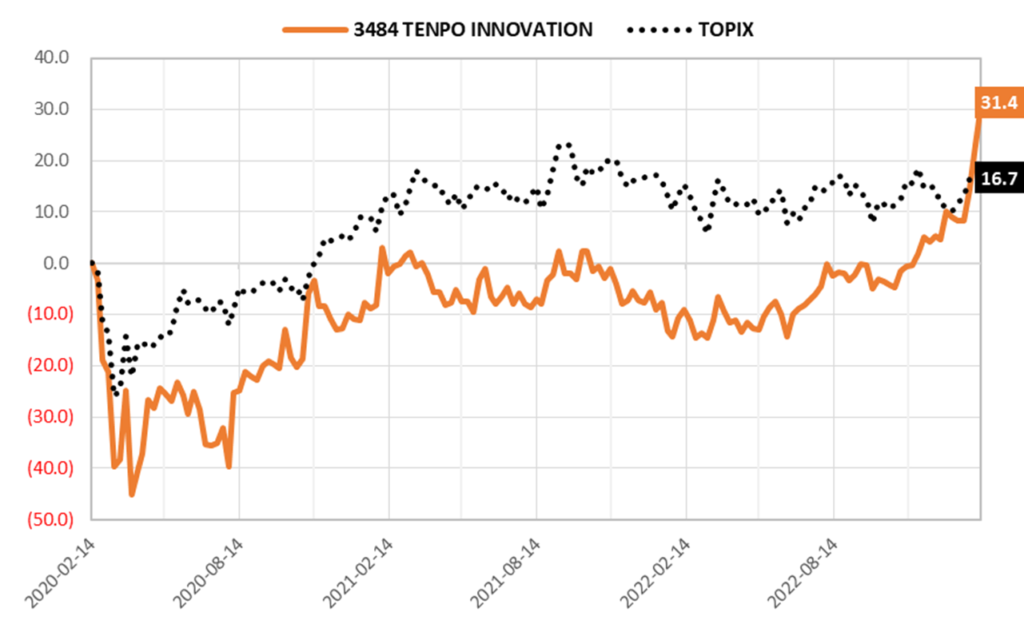

3Y Relative Share Price Performance and 5Y Trend of GP/OP and GPM/OPM

The share price had underperformed TOPIX over the last 2½ years, largely due to misperception from association with the struggling restaurant industry under COVID-19.

Not only has the Company resumed double-digit growth in net sales, growth in profits is accelerating due to the structural drivers of rising successor contracts and the new addition of extremely high margin rent guarantee business.

◆While the short-term investment opportunity due to underperformance based on market misperception about COVID-19 has been achieved, Omega Investment believes the long-term opportunity from the graph on P4 still offers large upside potential on a medium-term horizon.

REFERENCE

TENPO INNOVATION Medium-Term Management Plan

Priority initiative to strengthen and enhance the sales force

The Company has the following medium-term and long-term targets.

By FY3/25, increase the Sales Dept. from 40 professionals to 100 (currently 14 in charge of property procurement → 30, 26 in charge of finding tenants → 70)

- Subleased store property net adds to 600 per year (by FY3/26)

- Contracts signed to 1,000 per year (by FY3/27)

By FY3/29, increase the number of active subleased store properties to 5,500

- Net sales ¥30 billion

- Operating profit ¥3 billion

- OPM 10.0%

As TENPO INNOVATION is the only specialist firm engaged in this restaurant store property subleasing business, this is no easy task, and cannot be accomplished by simply directing a headhunting firm to find the required personnel (they simply do not exist). Management fully recognizes that the way forward is to find suitable personnel and provide advanced level on-the-job training by existing professional staff. The point is that there is a lot of technical background knowledge required about property specifications such as the correct amperage requirements for electricity supply, drainage pipe diameter, etc., as well as expertise and know-how in retail properties, the restaurant industry, the city, restaurant facilities, and legal matters.

The Company summarizes its HR strategy for the Sales Dept. in a 3-point plan: ① increase staff, ② provide advanced OTJ training and ③ transfer capable sales staff to property procurement. Management envisions this extensive training for sales staff to find tenants for subleasing will take one year. Specifically, it will try to develop a standard method of passing on the expert knowledge involving the 237 items/steps from introduction of the property to concluding a subleasing agreement. Then, recognizing that procurement has a high level of difficulty and strategically holds the highest importance to future growth, it will optimize transfer and assignment of capable sales staff.

Then, in order to achieve the second long-term goal above of increasing the number of active subleased store properties to 5,500 by FY3/29, management will employ a strategy of ④ procurement area focus. Specifically, roughly 30 procurement staff will cover approximately 1,000 station areas and 2,000 real estate agents. For terminal stations with more than 1 million passengers and major real estate agencies, multiple procurement staff will be assigned. The target is to achieve procuring roughly 600 store properties per year (or 50 per month) by FY3/26.

Shareholder Return Policy

The Company’s basic policy is to pay stable dividends while strengthening its management base. The dividend per share (DPS) for the fiscal year ending March 31, 2023 was disclosed on February 2, 2023, marking a second consecutive dividend hike.

Trend of Dividends Paid and Payout Ratio

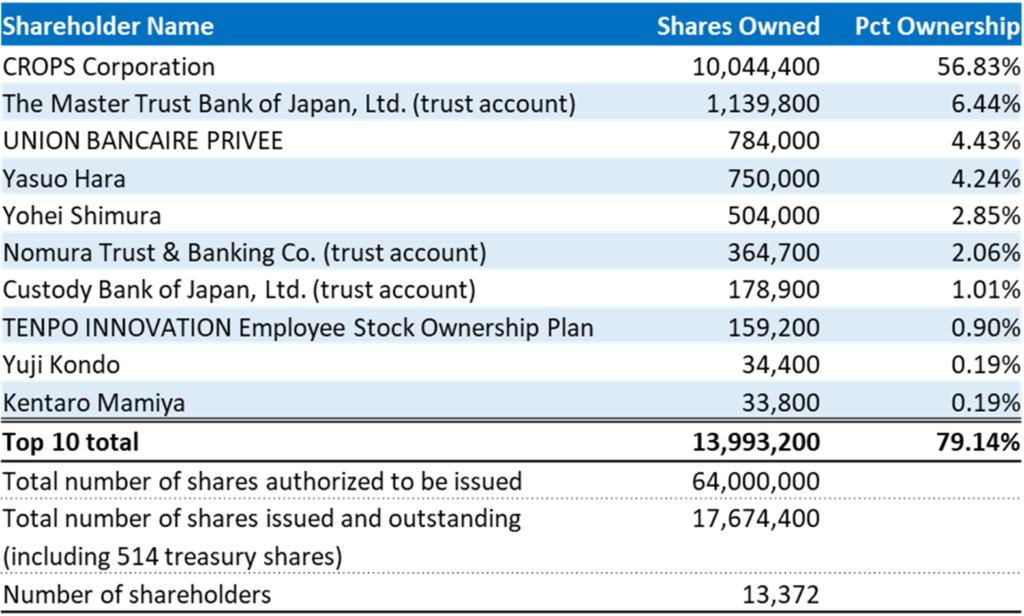

Major Shareholders (as of March 31, 2022)