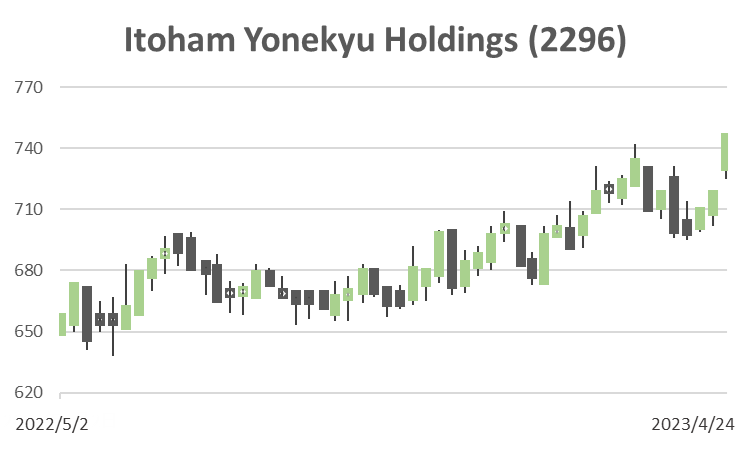

Itoham Yonekyu Holdings (Price Discovery)

| Securities Code |

| TYO:2296 |

| Market Capitalization |

| 215,229 million yen |

| Industry |

| Groceries |

Profile

Established through the merger of Ito Ham, the second-largest meat processing company, and Yonekyu, the seventh-largest, in 2016. The company is the second-largest in Japan’s meat and meat processing industry, behind NH Foods Ltd. (2282). It holds the top position in the ham and sausage market and is the second-largest in domestic meat sales. It is an equity-accounted subsidiary of Mitsubishi Corporation, which owns 39.6% of its shares. Ito Ham and Yonekyu were founded as food companies in 1928 and 1965. Net sales are split into 36% for processed foods (operating profit margin of 4%) and 64% for meat (3%), with overseas sales accounting for 13%.

Stock Hunter’s View

The company’s aggressive stance is impressive in the midst of accelerating recovery in the domestic meat industry. The food sector has reached its peak in “price increases”.

Itoham Yonekyu Holdings also raised prices by 5-20% for 161 processed food items from deliveries starting on April 1. The transition to Class 5 of COVID-19 will begin in Japan on May 8. With the situation where the full recovery of demand from the food service sector is expected based on the current outlook for the year, it is worth paying attention to this sector once again.

While the company faced difficulties in FY3/2023 due to delayed price transfers, the sale of meat for food service has been recovering as economic normalisation progresses. On the 21st of April, the company announced that it expects to overachieve its previous forecast with a projected operating profit of 23 billion yen (6.5% decrease YoY), which is 1 billion yen higher than its previous guidance. The sales volume of processed foods has also exceeded expectations, and the company is expected to continue to recover in the domestic meat industry.

At a time when the environment is improving, the company is not only focusing on recovery but also taking an aggressive stance. It recently announced rebuilding a meat processing plant in Mishima City, Shizuoka Prefecture. It is expected to be completed by 2026, and production capacity will be doubled from the current level. In addition, a new cattle processing and processing plant will be established in Towada City, Aomori Prefecture, in March 2024. Here, they aim to expand the domestic supply network and increase exports of Japanese beef to Europe and the United States. Moreover, there is plenty of topics, such as the exhibition of cultured meat at the 2025 Osaka-Kansai Expo and the 5-for-1 stock split at the end of September.

Investor’s View

Long-term BUY.

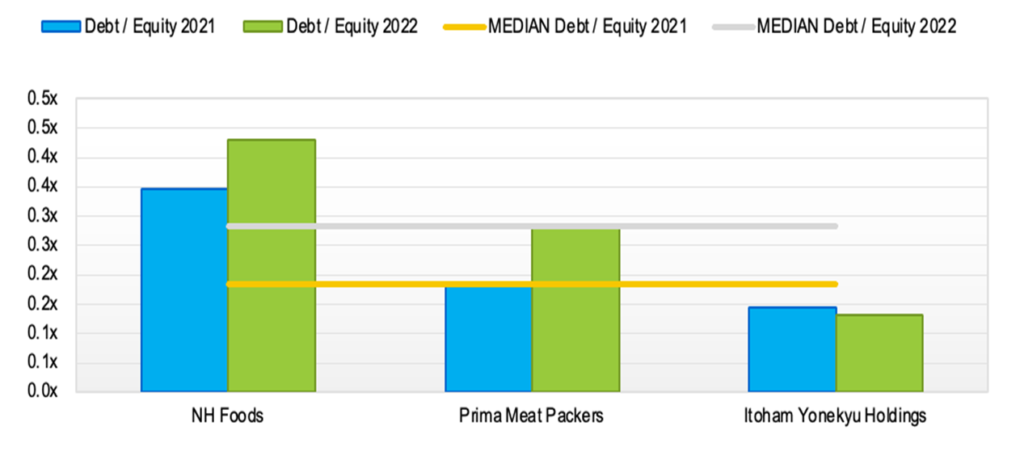

It is a good company with fine cash flow generation. But its ROE is lacklustre, and the shares are out of favour and trade below book value. However, the management’s awareness of the share price and profitability on capital is increasing. Fortunately, there is scope for a good improvement in PL and BS. In addition to the improving market environment, compression of the valuation discount should also be positive for the share price. Compared to NH Foods (2282), the company is considered undervalued despite a greater potential for lifting its return on capital, making it a preferred choice.

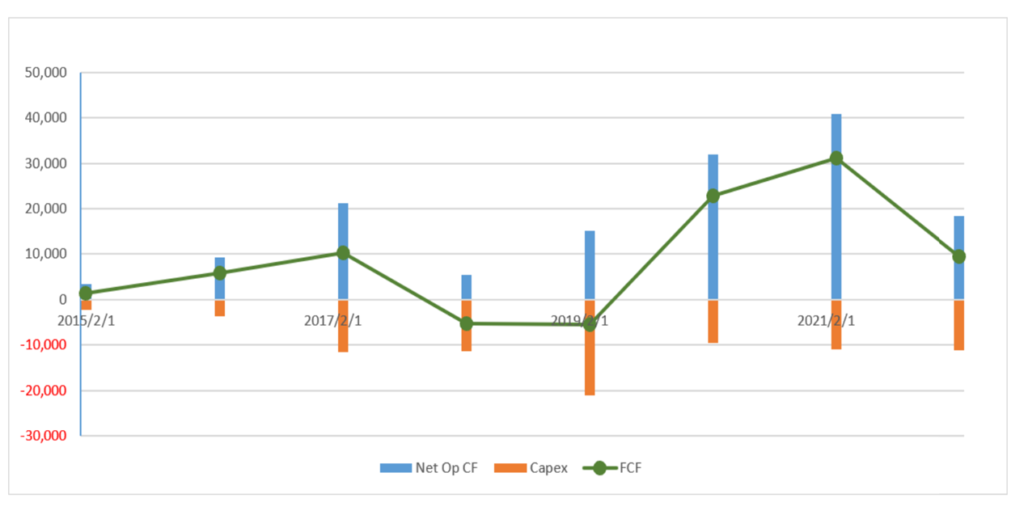

Net operating CF, Capex, Free cash flow (Y-mn yen)

Compared to the top company in the industry, NH Foods, NH Foods has slightly better quality, but the difference is reflected in the valuation gap. If Itoham Yonekyu improves its leverage, the difference will be eliminated. The company’s equity ratio is high at 57%, so there is much room for improving leverage. Since the merger in 2016, synergy has been gradually kicking in over time. Going forward, there is a possibility that the PL profit margin will improve through synergy benefits in production and logistics.

Leverage

NH Foods is investor-focused. The share price discount should shrink.

Turning to the management of NH Foods, they have clear targets and are aligned with investors’ perspectives. Their numerical targets include achieving an ROE of 9% or higher and an ROIC of 7% or higher by the end of March 2027. They have publicly stated their goal of expanding the ROIC spread, anticipating a spread of 7% or more by the end of March 2027 through a decrease in WACC, improvement in operating profit margin, and stability in asset turnover. While these targets are not particularly attractive, if the return on capital of a share trading on a PBR of 0.8 visibly improves, it would not be surprising if the valuation discount shrinks. Management anticipates a decrease in capex and the creation of a significant CF in FY2026, which could lead to a large shareholder return.

Nevertheless, Itoham Yonekyu’s potential catch-up is more interesting

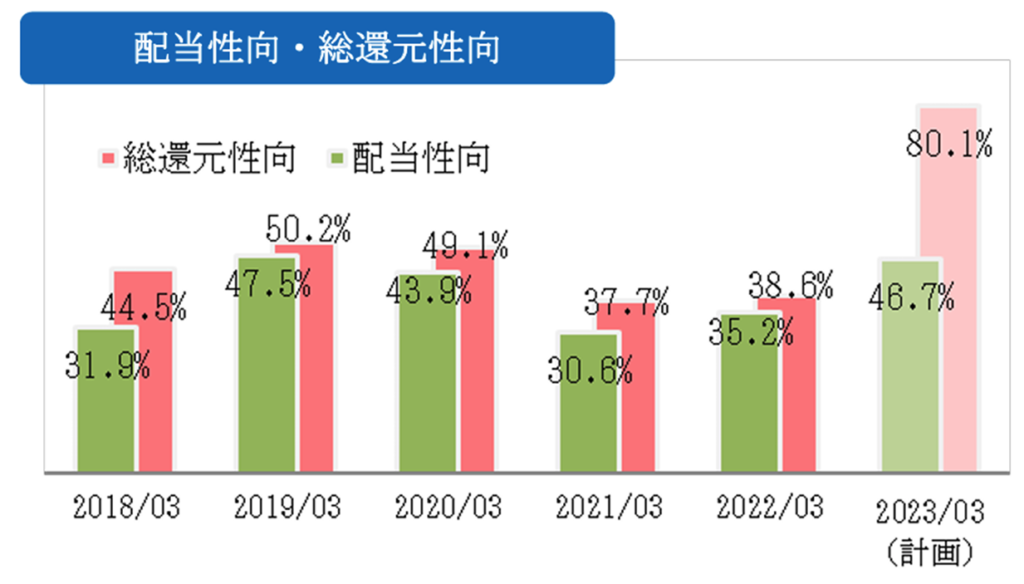

On the other hand, the management of Itoham Yonekyu has not been as clear as NH Foods in discussing share value and capital efficiency, and the trend of improving ROE is unclear. However, the investment opportunity lies in the outlook that the company will likely catch up in these areas. Management has taken a more proactive stance, and clear goals and a reconstruction of CF usage may be announced before long. The company is already actively rewarding shareholders, which is rated well. This year, it significantly increased share buybacks, and the total shareholder return has increased substantially. The fact that the company is looking to improve ROIC is also positive. The main factor for low ROE is the low business profit margin. The company aims to improve this by enhancing competitiveness in the market. Last year, while NH Foods’s shares underperformed TOPIX by 6%, the company’s shares beat the benchmark by 12%. The shares are believed to have started incorporating such positive expectations.

Shareholder Reverts – Dividend Payout Ratio (Green), Total Reverts including Share BB (Pink)

The operating profit margin is expected to improve through synergy effects in production and logistics.

The merger of Itoham and Yonekyu was a good fit. They differed in areas such as business region, variety of processed foods and meat products, customer base, and production methods. Therefore, the synergy effect is significant. After several years since integration, there are prospects for creating synergy through factory and logistics base reorganisation, in addition to procurement, sales, management, and development. Quantitative predictions are difficult for investors to make, but the improvement in operating profit margin will positively impact ROE.

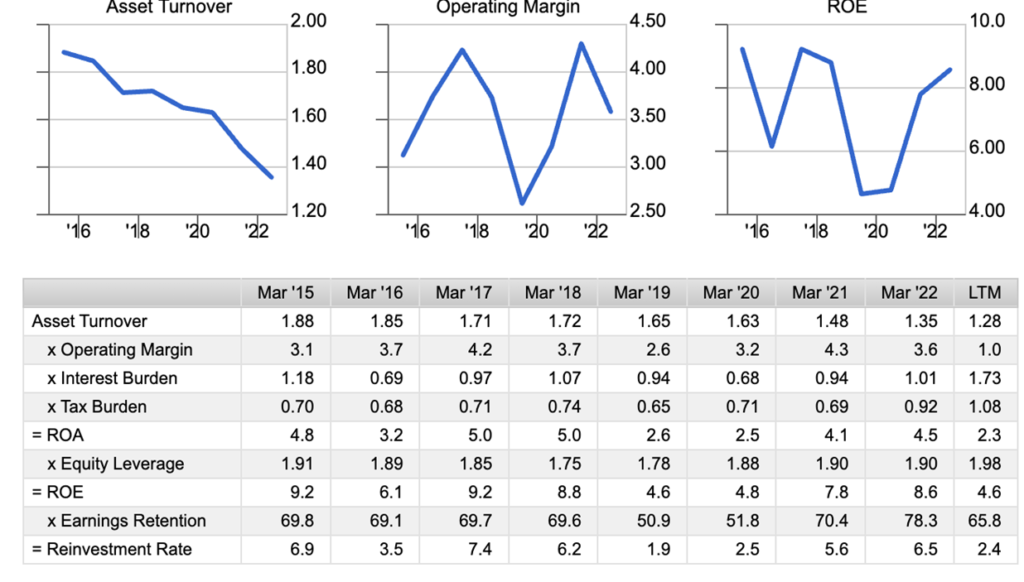

Dupont model – Itoham Yonekyu Holdings (2296)

Dupont model – NH Foods Limited (2282)

The company do not cross-hold shares

The company own securities worth 30 billion yen, which accounts for approximately 6% of the balance sheet. According to the company’s explanation, all shares held are those of subsidiaries and affiliates. The company does not own shares for financial investment or cross-hold shares.