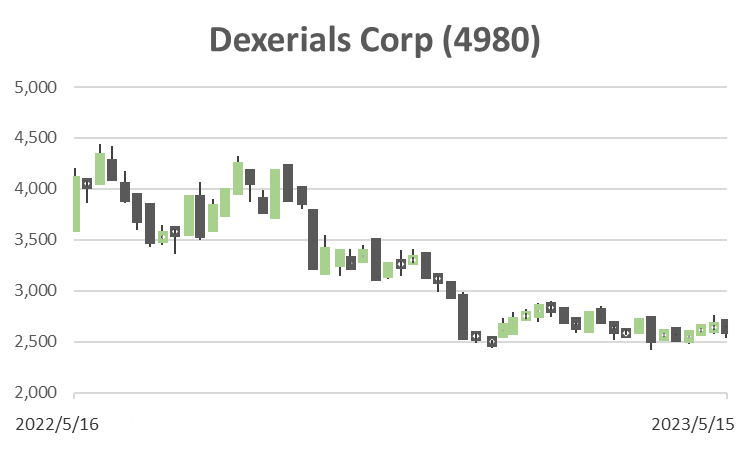

Dexerials (Price Discovery)

| Securities Code |

| TYO:4980 |

| Market Capitalization |

| 169,057 million yen |

| Industry |

| Chemistry |

Profile

Dexerials Corporation manufactures and sells electronic components, bonding materials, and optical materials. Its main products include anisotropic conductive film, optical elasticity resin, optical film, surface-mounted type fuse, industrial adhesive, double-coated tapes, and more. The company is headquartered in Tokyo and has factories in Tochigi and Miyagi prefectures. It was formerly Sony Chemical, a chemical electronic material manufacturer under the Sony group.

Stock Hunter’s View

Anticipating recovery in the latter half of the year. Expansion of high-value-added products.

Dexerials announced its 3/2023 results after the market close on the 10th. Although the company had chopped down its full-year OP estimate to 31 billion yen at the time of the previous (3Q) earnings announcement, the result exceeded this and achieved record-high profits. The sales expansion of differentiated technology products such as precision bonding resins, anisotropic conductive films, and optical films, along with contributions from newly consolidated subsidiaries, played a significant role.

The company is a major player in products such as anti-reflective films for displays, fluorescent films for LED backlights used in tablets, smartphones, and laptops. In the new FY2023, net sales (100 billion yen) and OP (25 billion yen) will decrease by 5.8% and 22.6% YoY, respectively. However, these projections are already factored into the market expectations. The assumed exchange rate of 125 yen as per USD is relatively cautious.

While the first half of FY2023 is expected to continue facing challenging business conditions, the second half will likely see a recovery in inventory adjustments, production adjustments, and IT equipment demand, improving earnings. Furthermore, the company’s proactive shareholder revert is rated well; it plans to increase the annual dividend by 10 yen to 75 yen a share over the last year and announced the cancellation of 3,550,600 treasury shares, representing 5.5% of the outstanding number of shares.

Investor’s View

Earnings are difficult to forecast. Risk is high if investors buy low valuations.

The management has stated that the stock price does not fully reflect the steady improvement in business performance. However, for investors, the predictability of the company is poor. The higher the current EPS and ROE, the lower the share price multiple. Investors become more concerned that even the top of the normal cycle may already have been significantly exceeded. Hence, the share price premium is unlikely to expand from here. Although PER is at five-year lows and PBR is at two-year lows, buying cyclical and unpredictable companies at cheap valuations is typically a considerable risk.

Valuations ーPBR, PER, EV/EBITDA

The company manufactures many electronic materials-related niche chemical products, and there is no disclosure to clear the fog in front of investors as to which individual products are driving profits and what the current volatile situation is. Unlike market data that provides an overview of sectors such as shipping, energy, automobiles, and semiconductors, those for niche chemical electronic materials like the company’s are few. The outlook for quantity and market conditions is always even more uncertain than that for semiconductor manufacturing equipment, as information on raw material prices, product prices, and manufacturing costs is scarce. Investors with long experience must be well aware that forecasting the earnings of chemical electronic product manufacturers, even among semiconductor-related companies, is particularly difficult.

Exchange rate sensitivity poses a huge risk

The significant impact of exchange rate fluctuations on earnings and the lack of helpful sensitivity guidance, such as those released by the automobile and machinery sectors, are significant risks for investors. The earnings improvement in FY2022 was largely due to the benefits of a weak yen. Without it, sales and profits would have declined YoY.

Shareholder awareness and business portfolio transformation are positive

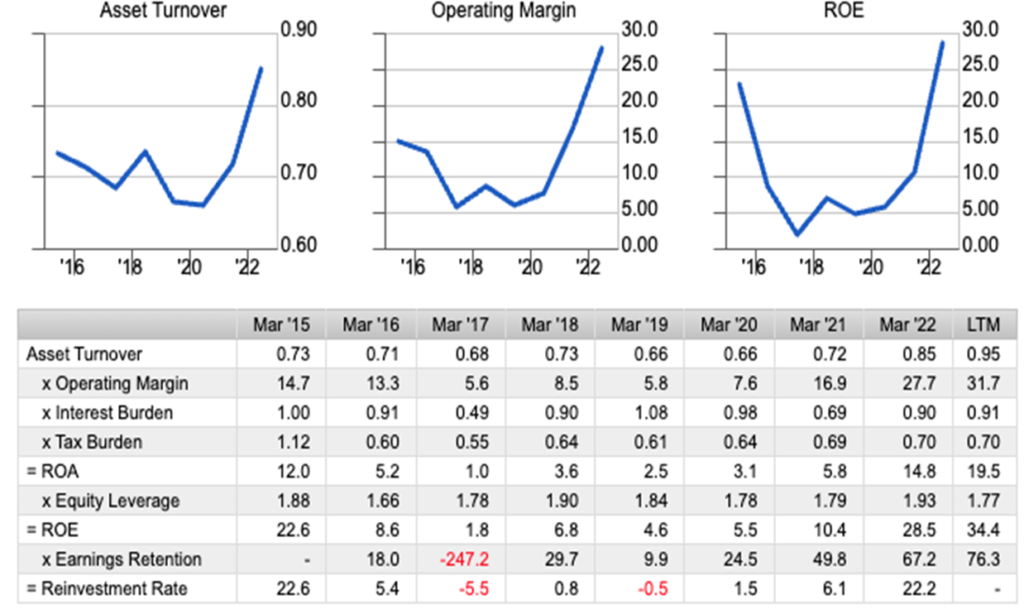

Although profits are forecast to decline this year, the management will raise dividends and maintain its policy of reverting to shareholders 40% of pre-depreciation profits. The management’s proactive treatment of investors, including the announced cancelling of treasury stocks, is highly rated. The ongoing transformation of the business portfolio is also rated well. In the recent earnings call, the management reported actively shifting towards areas with a long lifecycle, which helps mitigate business volatility. Specifically, the company’s business expansion is progressing from consumer IT devices such as smartphones and PCs to areas such as automobiles, electric bikes, power tools, and communication. Over the past four years, new fields, including the automotive industry, have expanded. The acquisition of Kyoto Semiconductor in March last year allowed the company to enter the optoelectronics sector to grow its business in the communication field. As per existing businesses, the company has successfully streamlined and expanded high-value-added products. As a result, the profit margin has significantly improved, and ROE shot up.

Dupont Model

The stock price premium will expand if investors can be reasonably confident with their expectations.

Despite all the positives mentioned above, the difficulty in predicting earnings remains unchanged. The stock price quadrupled between 2020 and 2021, driven by the momentum of profit expansion, trailing behind. Vitally important for investors is that they have reasonable confidence in their expectations. The management team has yet to recognise that the difficulty in achieving this is an inherent defect of the shares. If they acknowledge this and make some moves, it may expand the premium attached to the shares.