Shinko Shoji (Price Discovery)

| Securities Code |

| TYO:8141 |

| Market Capitalization |

| 43,104 million yen |

| Industry |

| Wholesale business |

Profile

A semiconductor trading company involved in the sales, import, and export of electronic components and assembly products. The range includes memory products, microcomputers, large-scale system integrations, semiconductors, capacitors, ferrite cores, and colour liquid crystals. The primary focus is Renesas Electronics (TSE Prime 6723) products for automotive and industrial applications.

Stock Hunter’s View

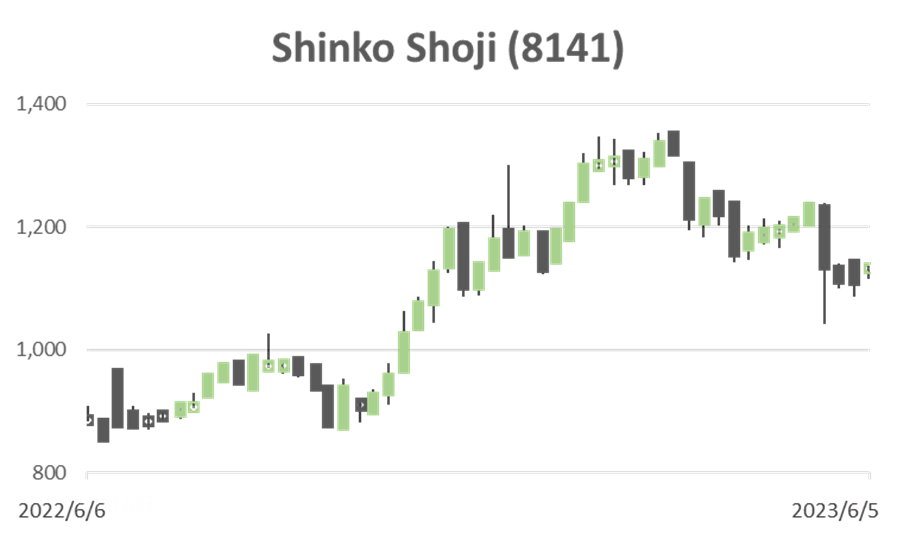

High dividend yield stock trading below book. Conservative earnings and dividend forecasts.

The shares of Shinko Shoji stand out as a laggard among those of semiconductor trading companies, which are attracting widespread buying interest. PBR is less than 1.0, and the expected dividend yield is 4.76% at the closing price of 2 June.

The management anticipates FY2024 sales and operating profit to fall by 5.1% and 29.9% YoY, respectively. However, the guidance looks as conservative as usual. The consolidated dividend payout ratio is targeted at 50%, and the current dividend forecast of 53 yen a share (69 yen in the previous year) should eventually be revised up.

In addition to being a distributor for Renesas Electronics, which is performing well, the company has raised its net profit forecast in its medium-term management plan from ¥3.7 billion in FY3/25 to ¥5 billion in FY3/26, which shows its confidence for the future. In the previous year, sales to industrial robots and semiconductor manufacturing equipment, as well as to automotive electrical equipment (LCD products) and household printers, were strong.

Regarding the medium term, Rapidus, a national company aiming to produce advanced semiconductors domestically, has announced its intention to promote the Hokkaido Valley concept, a major centre for high-tech companies in Hokkaido. This will likely be a tailwind for Shinko Shoji, which has a design and development base in Sapporo.

Investor’s View

Trading BUY.

The semiconductor market is expected to recover sooner rather than late

The semiconductor market is difficult to predict, but the view that it is in a bottoming-out phase has driven the popularity of semiconductor-related stocks. Some devices have completed inventory adjustments such as LCDs and MLCCs. Demand from hyper-scalers is strong despite temporary cutbacks in the investment budget. The potential for server platform upgrade transitions is positive. PCs have bottomed out to slightly up, while mobile consumer demand continues to be down. Industrial demand is flat to bottoming out. Automotive looks positive, with Japanese manufacturers anticipating substantial production volumes through the year’s second half. ADAS and EV-related demand is a tailwind, but the market is yet to be significant. Chinese demand is still being determined. The major long-term trend is that the driver of the semiconductor market cycle has progressed from smartphones to data centres and then to DX. Now, GX and generative AI are expected to be the following drivers.

Good for the short term, but there are no long-term attractions

The company’s fundamentals are cyclical. Buying the shares at the bottom of a market cycle with a lagging share price, high dividend yield, and cheap valuations is a sensible short-term investment strategy. On the other hand, apart from the possibility of a merger and acquisition among semiconductor trading companies, the company is not attractive for long-term holdings. Whether the medium-term management plan will be achieved as envisaged depends on trends in the semiconductor market, and while high targets are commendable, they are probably not figures that should be factored into the share price. We consider the low PBR to reflect the low quality of the business.