BlueMeme (Price Discovery)

| Securities Code |

| TYO:4069 |

| Market Capitalization |

| 7,642 million yen |

| Industry |

| Information / Communication |

Profile

BlueMeme develops enterprise systems using low-code technology and agile methods and provides consulting services, education business, and sales support for software licences.

Stock Hunter’s View

Growing demand for low-code development in DX. The company’s attraction comes from ‘digital labour’ and ‘local DX talent’.

BlueMeme’s strength lies in its unique project management method, which uses low-code and agile methods, and in contracted system development with short lead times and small teams. The business has high growth potential, as demand for low-code development is increasing due to the diversification and speed of DX.

On the other hand, upfront investment in personnel training, R&D, etc., has been heavy, resulting in a 15% operating profit decline in the previous FY3/2023, and the earnings are expected to remain unchanged in FY3/2024. The focus will likely be on whether the increase in professional staff through recruitment and training will progress as planned, as customers` inquiries are strong and the customer base is expected to expand as the tie-up with MKI (Mitsui Knowledge Industry, a subsidiary of Mitsui&Co(TSE8031)) goes into full swing.

There is a wide variety of approaches to reviewing share prices from a medium- to long-term perspective. The boom in generative AI has led to a surge in demand for ‘prompt engineering’. This job involves communicating the system’s content to AI and low-code tools, mastering the use of generative AI. The company and MKI plan to provide digital labour services for prompt engineering during the current financial year, targeting demand in the “automation area” of DX promotion.

In addition, the Government of Japan, which aims to unify and standardise municipal information systems nationwide by the end of March 2026, intends to encourage local civil servants to reskill to solve the shortage of DX personnel in regional areas. One of the company’s strengths is its unique training system for developing non-IT personnel into ready-to-work engineers, and in recent years it has developed this know-how into a ‘regional DX human resources development course’ for local governments. The company recently signed a location agreement with Kumamoto Prefecture and Kumamoto City to promote regional DX human resources development.

Investor’s View

BUY. One of the few stocks to play generative AI. It is at a stage where the cash pile should be invested.

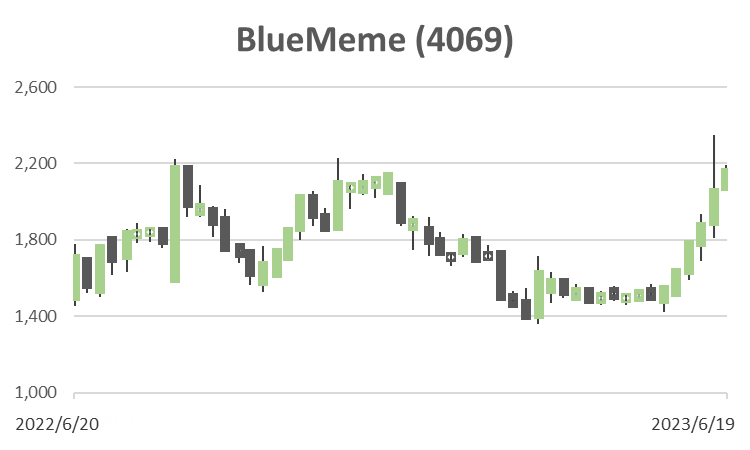

All investors will agree that if the bull market in Japanese equities does not break down, small-cap stocks, which have been underperforming since the beginning of the year, could soon see cyclical buying and make significant returns. The shares of BlueMeme have started to pick up ahead of this. We believe this is because the company’s prompt engineering has attracted attention as generative AI becomes a popular market theme. The trigger was the 14 June announcement of joint research with Kyushu University on constructing large language models using quantum AI. Given the reality of the generative AI theme, the enormous impact on the world economy, and the scarcity of related equities, the newly attached equity premium will not be easily peeled off.

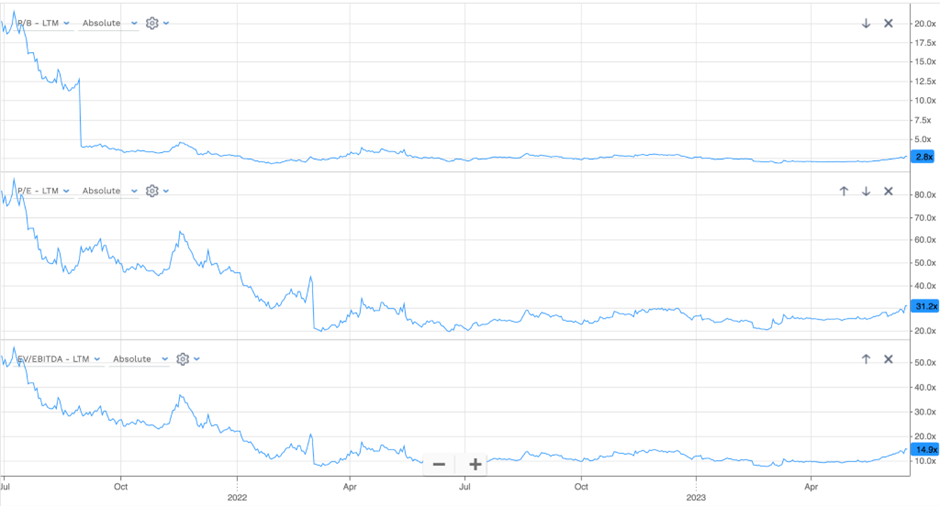

Investor expectations have been stable and high

At the time of the IPO in June 2021, expectations were high for the company as a growth stock, and the shares traded at a significant premium. Top line and profits did not grow much, and the share price multiple soon shrank to a more realistic level. However, valuations have since stabilised at relatively high levels. Although the share price was weak from the IPO to May this year, a PER of over 30x and a P/B multiple of 2,8x suggest that investors view the shares positively.

PBR, PER, EV/EBITDA since June 2021 IPO

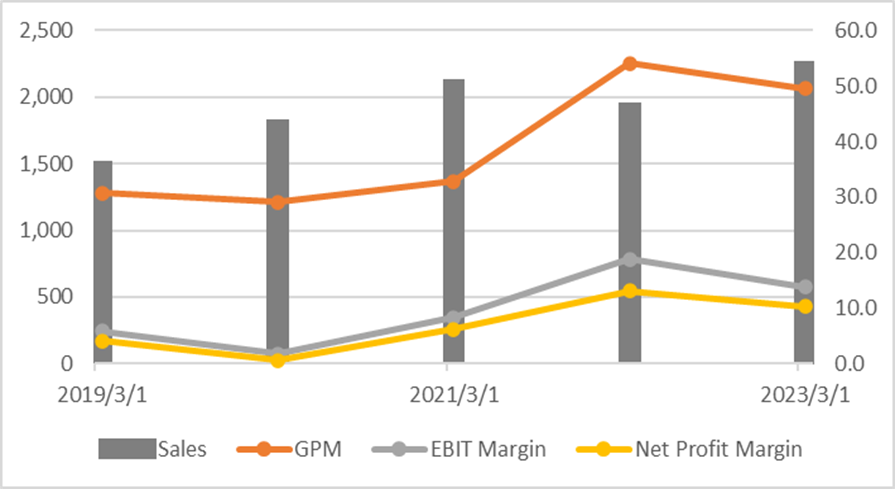

Attractive profit margins, but top-line growth is lacklustre

Gross margins have expanded steadily and are at a high level. Operating profit margins are also high, albeit with some fluctuation, and the profitability of the bottom-line profit is attractive. However, the four-year CAGR for top-line sales is only 10%. Despite an 18% increase in sales in management’s forecast for the current financial year, net income is expected to remain flat. These performance trends will be unsatisfactory for investors who give high multiples to DX-driven stocks.

Sales (LHS, mn yen), GPM, EBIT Margin, Net Profit Margin (RHS, %)

The trend in equity spreads is a significant risk for equity investors

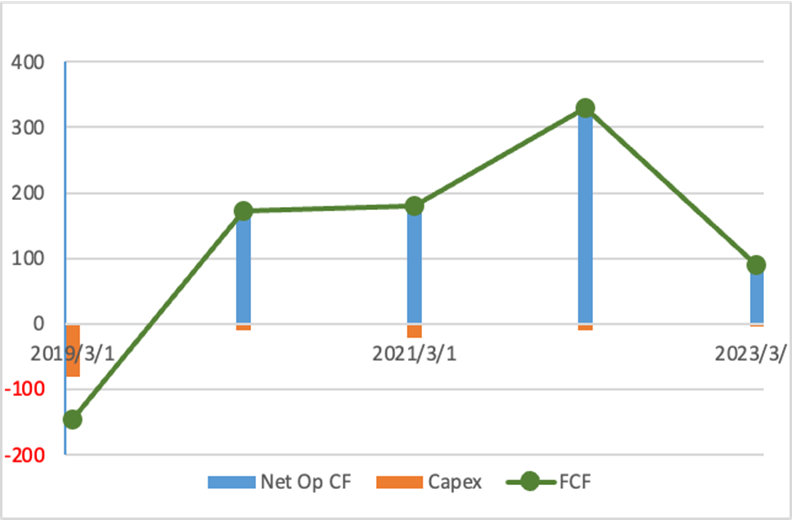

A structure where over 70% of the B/S is cash (2.2 billion yen) and almost no interest-bearing debt, with fine CF generation, is positive for debt investors. Equity investors are dissatisfied with the money from the IPO left uninvested for growth. The management team is agile, with effective leadership from President Matsuoka. If the company makes good investment decisions, the premium on the share price should increase.

Business is CF rich, and if this B/S structure is unchanged, asset turnover and leverage will continue to edge down, weighing on ROE. ROIC has fallen from 21.9% in FY3/2021 to 9.3% in FY3/2023 going through IPO. Our estimate of the current WACC is 6.3%, and the trend in the equity spread looks unfavourable. If the management leaves it unchecked, such a B/S could provoke big shareholder disappointment, a significant risk for equity investment. With a PBR of 2.8x, the company is not subject to JPX’s management advice for companies allowing poor PBR. However, BlueMeme is at a tipping point where management should enhance its share price awareness and focus much more on return on equity, not just P/L growth.

Operating CF, Capex, FCF (mn yen)