Digital Hearts Holdings (Analysis Report)

| Share price (8/8) | ¥1,328 | Dividend Yield (24/3 CE) | 1.58 % |

| 52weeks high/low | ¥2,053 / 1,227 | ROE(23/3) | 10.1 % |

| Avg Vol (3 month) | 99.5 thou shrs | Operating margin (23/3) | 8.22 % |

| Market Cap | ¥31.7 bn | Beta (5Y Monthly) | 0.89 |

| Enterprise Value | ¥28.9 bn | Shares Outstanding | 23.890 mn shrs |

| PER (24/3 CE) | 14.08 X | Listed market | TSE Prime section |

| PBR (23/3 act) | 3.36 X |

| Click here for the PDF version of this page |

| PDF Version |

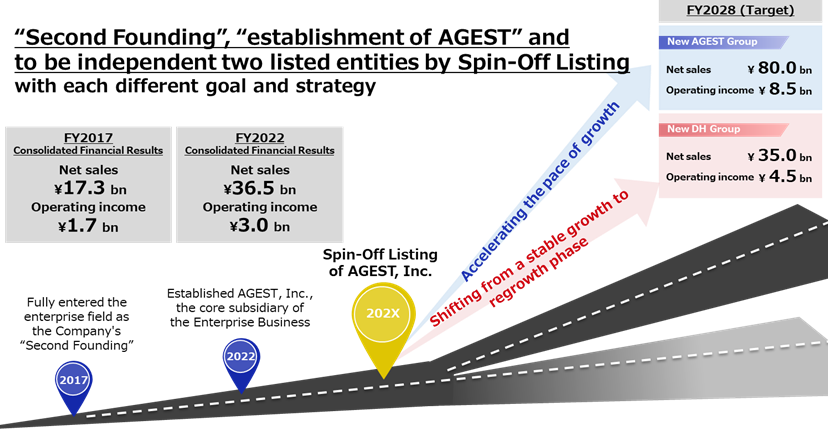

To achieve the next growth stage through spin-off listing of AGEST, Inc.

◇ Summary

▶Digital Hearts Holdings (hereafter referred to as ‘the Company’) announced in conjunction with the disclosure of its FY2023/3 full-year results that it will begin preparations for the spin-off listing of AGEST, Inc. The Company entered the Enterprise Business in earnest as its Second Founding in 2017. In April 2022, the group was restructured, and the business was transferred to AGEST, Inc. as its core business, and by Q4 FY2023/3, sales from this business had grown to almost half of the Company’s total sales, with operating profit now firmly in the black. The spin-off listing of AGEST, Inc. is intended to accelerate the future growth of this business further.

▶Meanwhile, the Entertainment Business, the Company’s founding business, continues to grow steadily as a cash cow in the oligopolistic domestic debugging market. New business opportunities have also arisen in this business, such as responding to globalisation and expanding into non-game areas. By clearly separating the Enterprise Business from the Entertainment Business, the Company plans to enable growth investment in the Entertainment Business and shift from a stable growth phase to the next growth stage.

▶In making this announcement, the Company stated that this is the start of preparations for a spin-off listing. Currently, AGEST, Inc. depends on the Company for its head office functions, and it would take a certain period to realise a spin-off listing on the TSE, as it would be necessary to establish a management structure, governance and head office functions as an independent listed company, which would also involve the redeployment of personnel. In addition, it is also necessary to address issues such as how to separate the Company’s current BS. Given these factors, the actual spin-off listing may take two to three years from now.

▶The spin-off listing is to utilise the spin-off taxation regime introduced in 2017. Still, the only other case implemented as a spin-off listing was in March 2020, when Koshidaka Holdings (2157) listed Curves Holdings (7085) separately. Although this case is not necessarily a helpful reference due to the different business structure and the fact that their business was affected by the spread of COVID-19 immediately after its listing, the performance of the combined market capitalisation of the two companies after their separate listing has been equal to or higher than that of the TOPIX.

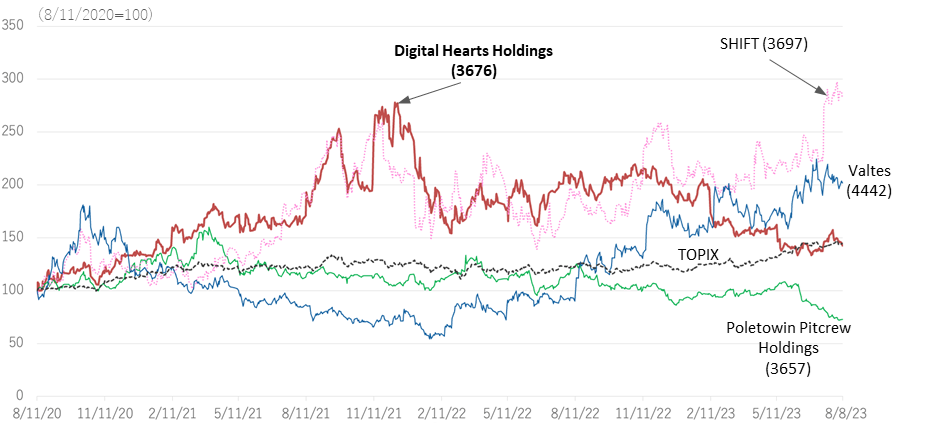

▶Looking at the valuations of other companies in the enterprise business (software testing), SHIFT (3697) is valued at a PER of 89.9x (based on company forecasts for the current year) and PBR of 20.6x (based on last year’s results). Valtes (4442) is valued at 29.2x and 10.3x, respectively, higher than the Company’s current price multiples (see table above right). When the new AGEST is listed as a result of the spin-off listing, it is expected to be valued highly as a high-growth stock like both companies. Meanwhile, the new DH Group plans to shift to a renewed growth trajectory. As a result, the new AGEST Group and the new DH Group will each offer investment opportunities that match the investment perspectives of respective investors.

| JPY, mn, % | Net sales | YoY % |

Oper. profit |

YoY % |

Ord. profit |

YoY % |

Profit ATOP |

YoY % |

EPS (¥) |

DPS (¥) |

| 2019/3 | 19,254 | 11.0 | 1,605 | -7.5 | 1,651 | -7.4 | 1,575 | 31.3 | 72.13 | 13.00 |

| 2020/3 | 21,138 | 9.8 | 1,394 | -13.2 | 1,372 | -16.9 | 792 | -49.7 | 36.31 | 14.00 |

| 2021/3 | 22,669 | 7.2 | 1,908 | 36.9 | 1,975 | 43.9 | 974 | 23.0 | 45.15 | 14.00 |

| 2022/3 | 29,178 | 28.7 | 2,696 | 41.3 | 2,774 | 40.4 | 1,778 | 82.5 | 82.25 | 15.00 |

| 2023/3 | 36,517 | 25.2 | 3,000 | 11.3 | 3,152 | 13.6 | 799 | -55.0 | 36.50 | 21.00 |

| 2024/3 (CE) | 40,750 | 11.6 | 3,120 | 4.0 | 3,160 | 0.2 | 2,100 | 162.6 | 95.86 | 21.00 |

Image of the spin-off listing of AGEST, Inc.

Source: The Company handout for the full year results for FY2023/3 (published on May 11, 2023)

◇ Background to the AGEST, Inc. spin-off

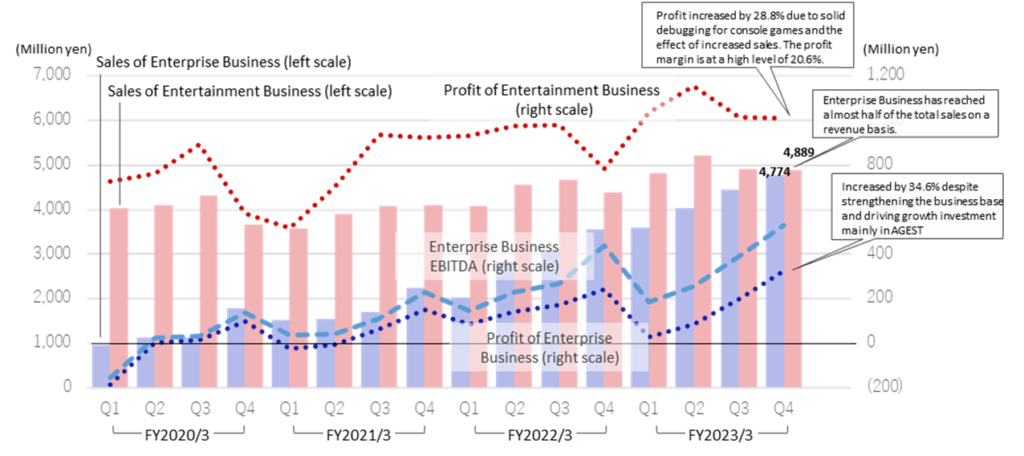

In conjunction with the disclosure of its full-year results for FY2023/3, the Company announced that it would start preparations for the spin-off listing of AGEST, Inc. Although the announcement was initially perceived as a surprise, it is an inevitable direction for the Company as it charts its future growth strategy. The Company entered the Enterprise Business in earnest in 2017 as its Second Founding phase. In April 2022, a group restructuring was carried out, and the Enterprise Business was transferred to a structure centered on AGEST, Inc. Due to heavy up-front investment in the Enterprise Business, profits continued to decline even in the company-wide financial results for a period of time. However, the business has been profitable on an EBITDA basis since Q2 FY2020, partly due to an increase in the top line through aggressive M&A. The business has also been profitable on an operating income basis since FY2021. By Q4 FY2023/3, sales from this business had grown to almost half of the Company’s total sales, and the Enterprise Business had become a major earnings driver. The Company intends to further accelerate the growth of this business through the spin-off listing of AGEST, Inc.

Meanwhile, the Entertainment Business, the Company’s founding business, continues to grow steadily as a cash cow in the oligopolistic domestic debugging market. FY2023/3 sales in this business grew by 12.0% YoY due to the strong domestic console games market and accelerated overseas expansion of content, but the CAGR over the past five years indicates that the growth was stable at 4.9% (the CAGR of the Enterprise Business over the same period was 54.7%). The Company plans not to rest on its laurels of stable growth in the Entertainment Business but to shift to the next growth trajectory by expanding into new markets, including non-gaming areas in Japan, new technology-related areas and overseas.

Sales/Profit by Segment (Quarterly basis)

Source: Prepared by Omega Investment based on company data

The Enterprise Business and the Entertainment Business have grown to become the two main business segments of the Company. However, the nature of the two businesses is very different, and each requires a high level of individual expertise. For example, in the Enterprise Business, software is becoming increasingly complex as DX (digital transformation) accelerates, while development times are becoming shorter, requiring the knowledge and know-how of a company specialising in software testing, such as the use of advanced technologies like test automation and a development style that considers testing from the early stages of development. The Entertainment Business, on the other hand, will require expertise that differs from that of the Enterprise Business to utilise the approximately 8,000 registered testers, including game enthusiasts, and the solid customer base it has built up since its establishment and to expand its overseas business and enter into cutting-edge technological fields such as non-game fields and the Metaverse in the future. When considering further growth by utilising the characteristics of each business, the critical point of the AGEST spin-off listing would be to maximise the growth potential of both businesses by separating and becoming independent of management, capital and human resources rather than having the two businesses under the current holding company structure.

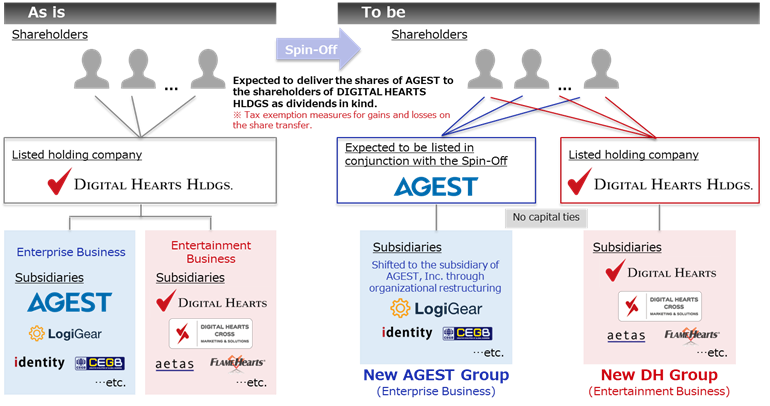

◇ Schemes for spin-off listings

The Company explains the scheme of the spin-off listing as shown in the diagram below. First, a group reorganisation will be carried out, whereby subsidiaries of Digital Hearts Holdings that operate enterprise businesses, such as LOGIGEAR CORPORATION, will become subsidiaries of AGEST, Inc., and the new “AGEST Group” will be established. The Company plans to obtain listing approval from the Tokyo Stock Exchange as the new “AGEST Group” and then distribute the shares of AGEST, Inc. held by Digital Hearts Holdings to its shareholders in kind. As a result, the capital relationship between AGEST and Digital Hearts Holdings will be dissolved, and a parent-subsidiary listing will be avoided. The Company’s shareholders will then own shares in AGEST and Digital Hearts Holdings after the spin-off listing. The specifics of how assets, liabilities and equity on the balance sheet will be divided between the two new companies are still to be worked out. Shareholders will own shares in both companies, which will theoretically be equivalent before and after the implementation of this scheme.

Spin-off listing schemes

Source: The Company handout for the full year results for FY2023/3 (published on May 11, 2023)

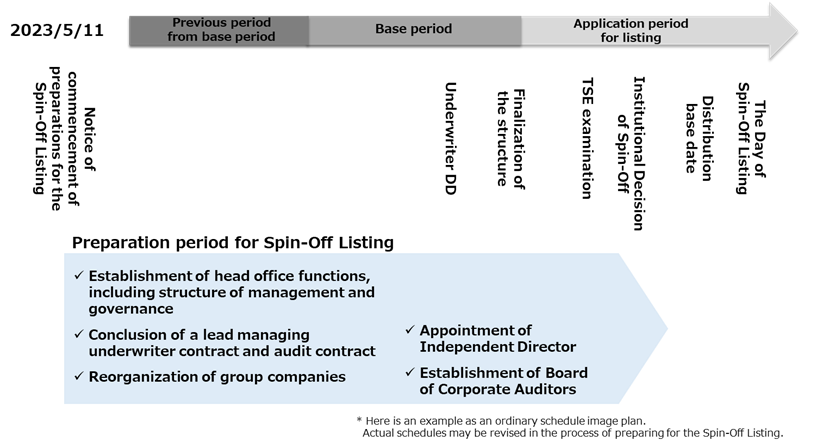

◇ Spin-off listing schedule

The announcement is the start of preparations for a spin-off listing, and the Company has not yet decided on the timing or other details. In the case of another company (Koshidaka Holdings), discussed below, a spin-off listing was achieved approximately six months after the spin-off announcement (October 10, 2019) (Curves Holdings listing on March 2, 2020). Koshidaka Holdings originally acquired Curves Holdings through an M&A transaction, which would have facilitated the spin-off. In the case of AGEST, on the other hand, it is expected to take a certain amount of time to implement the spin-off listing due to the need to strengthen AGEST’s head office functions (currently dependent on Holdings company) and the fact that AGEST will not be listed on its own, but as a group including subsidiaries operating enterprise business.

Spin-off schedule image

Source: The Company handout for the full year results for FY2023/3 (published on May 11, 2023)

Establishing the structure required for the new AGEST to become a listed company will involve the transfer of human capital within the Company, etc., and the intention seems to be to promote this project more lubriciously by announcing it early. According to the timetable above, implementing the spin-off listing will likely take around two to three years.

◇ Growth strategies after spin-off listing

The Company indicated the goals of the new AGEST Group and the new DH Group after the spin-off listing of the AGEST, Inc. and the specific measures to achieve them, as follows:

1. New AGEST Group

The Digital Hearts brand is firmly established in the entertainment industry, but as it is not suited to enterprise software testing, etc., the Company has been working on building the AGEST brand. If the spin-off listing is realised, AGEST will take another step forward as an independent listed IT company to become a QA company offering advanced quality technology on a global level. The Company is strengthening its “Shift Left” QA solution (supporting quality improvement from the development and build process, rather than just testing in the final development process), which it has been promoting up to now, and actively investing in the human resources, processes and technology needed to achieve this. The Company aims to build a “Smart Software Testing Factory” globally by training the next generation of QA engineers and fully using M&A.

What to aim for in a spin-off listing

Source: The Company handout for the full year results for FY2023/3 (published on May 11, 2023)

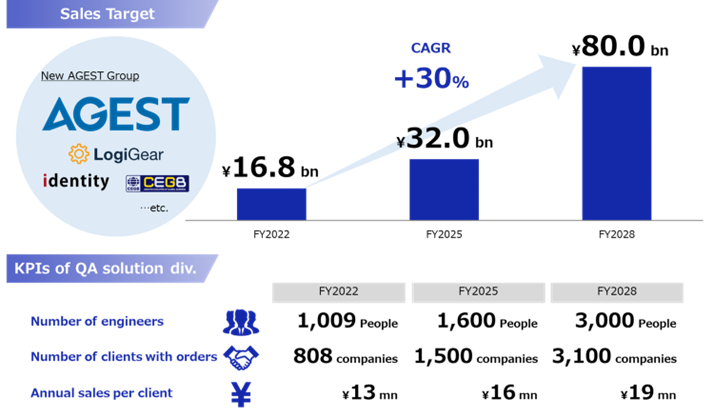

New AGEST Group numerical targets

Source: The Company handout for the full year results for FY2023/3 (published on May 11, 2023)

Based on these strategies, the figures in the above chart are set as numerical targets for the new AGEST Group. For the top line, although with a CAGR growth of around 50% in the last three years and therefore the base is high, growth of about +30% can be expected considering 1) increased IT investment due to the recent DX progress, and 2) increased outsourcing needs due to a shortage of IT personnel and the need for more sophisticated and specialised testing.

2. New DH Group

While it is true that the spin-off listing of AGEST, Inc. will likely attract attention to the new AGEST Group, at the same time, the new DH Group’s growth strategy should be focused on. Until now, the Company’s (the DHH Group as a whole) growth strategy tends to be seen as the Enterprise Business, while the Entertainment Business has often viewed as a cash cow for stable growth. By spinning off AGEST, Inc. this time, the Company aims to pursue a new growth strategy as an Entertainment Business, which is also considered a major point of this spin-off listing.

New DH Group

Source: The Company handout for the full year results for FY2023/3 (published on May 11, 2023)

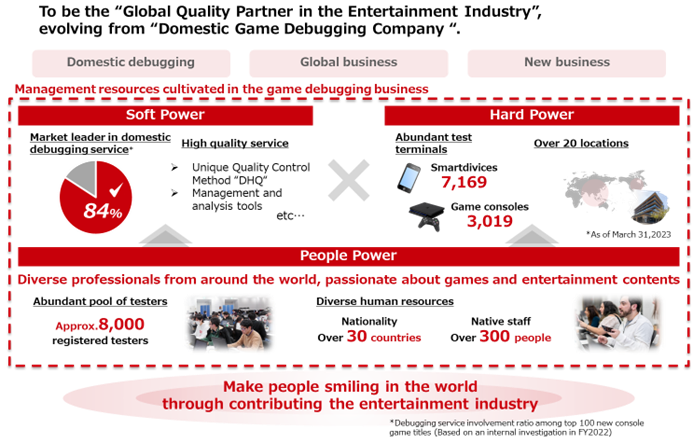

The Company holds a dominant position with a significantly high market share in the domestic debugging market (see diagram below on previous page). And the Company is outstanding in terms of management resources such as hard power and people power, too. However, it is also true that the domestic debugging market’s medium- to long-term growth potential is not particularly high. Therefore, the new DH Group aims to move from being a “Domestic Game Debugging Company” to a “Global Quality Partner Company in the Entertainment Industry”. By spinning off AGEST, the new DH Group will focus on its business strategy and expand into new markets, including non-game areas in Japan and new technologies (Metaverse, Web3, generative AI, etc.), as well as Southeast Asia, North America, Europe and other overseas markets.

◇ Case study of another company: Koshidaka Holdings (2157)

The spin-offs will utilise the spin-off taxation regime introduced in 2017 that encourages companies to restructure their businesses. Still, the only similar case of another company implementing a spin-off is when Koshidaka Holdings (2157), which operates the karaoke business Manekineko, etc., spun off Curves Holdings (7085), its fitness subsidiary, in March 2020. (Other similar spin-off listing plans have been announced by Toshiba (6502), Melco Holdings (6676) and Sony Group (6758) and are attracting attention as a means of increasing corporate value through business restructuring.)

Although the spin-off listing of Curves Holdings by Koshidaka Holdings is not necessarily helpful due to the different business structure and the impact of COVID-19 immediately after the listing, the performance of the combined market capitalisation of the two companies since their separate listing has been equal to or higher than that of TOPIX.

Relative trends of market capitalisation (Koshidaka Holdings, Curves Holdings and TOPIX)

In the case of Koshidaka Holdings and Curves Holdings, Koshidaka Holdings acquired Curves Holdings through M&A and they were initially different companies, and the two business themselves have little relevance and synergy. Therefore, the decision that it would be more efficient for each to have its own management strategy was the reason for the spin-off listing.

See the table above on the next page for the financial statements of Koshidaka Holdings and Curves Holdings before and after listing. Following the separation, the trademark rights (19 billion yen) of the Curves business held by Koshidaka Holdings were transferred to Curves Holdings. Some long-term debts were also transferred to Curves Holdings.

On the occasion of the spin-off listing of AGEST, Inc., the balance sheets of the two new companies will be finalised after internal consideration of the separation of each balance sheet item into the new AGEST and the new Digital Hearts Holdings and after checking with the auditors.

Financial statements of Koshidaka Holdings and Curves Holdings before and after separation

| Code | 2157 | 7085 | 2157+7085 | ||

| Company name | Koshidaka Holdings |

Curves Holdings |

|||

| Financial year | August 2019 | August 2020 | August 2019 | August 2020 | August 2020 |

| P/L | |||||

| Net sales | 65,804 | 43,303 | 28,036 | 25,082 | 68,385 |

| Operating profit | 9,507 | 1,147 | 5,436 | 1,167 | 2,314 |

| Net profit attributable to owners of the parent |

6,226 | -231 | 3,706 | 764 | 533 |

| EPS | 76.57 | -2.84 | 60.89 | 8.73 | 5.89 |

| BS | |||||

| Total assets | 72,087 | 44,555 | 34,224 | 36,837 | 81,392 |

| Current assets | 20,762 | 13,753 | 11,281 | 15,275 | 29,028 |

| Cash and deposits | 12,582 | 9,890 | 5,350 | 9,533 | 19,423 |

| Non-current assets | 51,324 | 30,802 | 22,943 | 21,562 | 52,364 |

| Intangible fixed assets | 22,536 | 351 | 22,083 | 20,789 | 21,140 |

| Total liabilities | 40,272 | 21,644 | 26,482 | 28,695 | 50,339 |

| Current liabilities | 15,023 | 10,468 | 8,018 | 7,262 | 17,730 |

| Non-current liabilities | 25,249 | 11,175 | 18,464 | 21,432 | 32,607 |

| Total net assets | 31,815 | 22,911 | 7,742 | 8,142 | 31,053 |

| Shareholders’ equity | 31,518 | 22,741 | 7,599 | 8,005 | 30,746 |

| Total liabilities and net assets | 72,087 | 44,555 | 34,224 | 36,837 | 81,392 |

| Net assets per share | 391.24 | 281.01 | 94.07 | 86.76 | 367.77 |

| Shareholders’ equity ratio | 44.1 | 51.4 | 22.6 | 22.1 | - |

Note: August 2019 figures for Curves Holdings are the data within Koshidaka Holdings before the spin-off. Curves Holdings raised approximately 2.2 billion yen through the public offering at the time of its spin-off listing, which is included in these figures.

Source: Prepared by Omega Investment based on financial statements of both companies.

◇ Thoughts on valuation

One of the critical points of the spin-off will be that by spinning off AGEST as a dedicated enterprise business software testing company, the new AGEST will be valued at the valuations worthy of this business. Until now, the Company has been valued in tandem with the Entetprise Business and the Entertainment Business. There has not been so much of a discount as a conglomerate discount, but it is also true that it has been difficult to see the valuations of the Enterprise Business itself.

Performance comparison of four software testing companies

| Code | 3676 | 3657 | 3697 | 4442 | |

| Company name | Digital Hearts Holdings |

Poletowin Pitcrew Holdings |

SHIFT | Valtes | |

| Financial year | March, 2023 | January, 2023 | August, 2022 | March, 2023 | |

| Share price (8/8) | 1,328 | 655 | 32,130 | 3,645 | |

| Market cap. (million yen) | 31,727 | 24,992 | 572,641 | 26,062 | |

| PER (CE, x) | 14.08 | 12.48 | 89.90 | 29.86 | |

| PBR (Act, x) | 3.36 | 1.42 | 20.57 | 10.34 | |

| PSR (Act, x) | 0.87 | 0.60 | 7.12 | 2.77 | |

| Β (Five-years) | 0.89 | 0.79 | 1.27 | 0.75 | |

| Financial indicators (%) | |||||

| ROE | 10.12% | 4.50% | 17.66% | 31.61% | |

| ROA | 4.31% | 3.20% | 11.00% | 18.55% | |

| ROIC | 13.63% | 7.69% | 18.68% | 28.49% | |

| DPS (CE, yen) | 21.00 | 15.00 | 0.00 | 0.00 | |

| Financial data (TTM) | |||||

| Net sales (million yen) | 36,517 | 41,267 | 75,358 | 9,059 | |

| Three-year growth rate (%) | 20.0% | 16.1% | 37.9% | 22.9% | |

| Operating profit (million yen) | 3,000 | 2,309 | 8,169 | 2,703 | |

| Three-year growth rate (%) | 29.1% | -11.9% | 51.4% | 44.4% | |

| Operating. Profit margin (%) | 8.2% | 5.6% | 10.8% | 10.7% | |

| Composition of sales | |||||

| Enterprise Business | 45.9% | – | 92.9% | 100.0% | |

| Entertainment Business | 54.1% | – | 7.1% | 0.0% | |

Source: Prepared by Omega Investment, based on company data and other sources.

A comparison of the four software testing companies (see table below on previous page) shows that the two companies that specialise or are close to specialising in the enterprise business are superior in terms of growth, profitability and share price performance and are highly valued in the equities market. SHIFT (3697) has grown significantly under the leadership of its founder through aggressive M&A and expansion of its workforce. Despite its relatively short history since listing, Valtes (4442) has also achieved 22.9% sales growth in the last three years and has also shown high ROE and ROA figures.

In the software testing business, headcount multiplied by unit price for engineers is one of the critical factors for growth, but in addition to expanding its corporate scale through M&A, the Company is also trying to differentiate itself through QA quality by pursuing cutting-edge quality technology, as mentioned above. If these strategies make steady progress in the future and bottom-line performance is achieved in addition to the top-line growth to date, valuations on a par with peers can be fully expected.

Relative trends of market capitalisation (four software testing companies, TOPIX)

On the other hand, it might be worth mentioning Keywords Studios (KWS.L) as a benchmark for the new DH Group. Keywords Studios was established in 1998 and headquartered in Dublin, Ireland. It has over 50 studios and 7,000 staff in 21 countries and territories, providing creative and technical services to the video games industry worldwide. The Company is highly regarded by its customers for providing solutions and resources for all game business challenges, from game development to game debugging, translation and customer support. FY2022/12 sales of 690 million euros, operating profit of 71 million euros and net income of 47 million euros. Keywords Studios is listed on the London Stock Exchange and had a market capitalisation of 1.19 billion GBP on Aug 7. See the table on the next page for a comparison of valuations with Keywords Studios.

Keywords Studios (KWS.L) market capitalisation trends over the last five years

DHH, New DH Group, Keywords Studios Comparison

| Code | 3676 | KWS.L | ||

| Company name | Digital Hearts Holdings |

New DH Group | Keywords Studios |

|

| Financial year | March, 2023 | March, 2029 | December, 2022 | |

| Share price (8/8, yen, 8/7, GBP) | 1,328 | – | 1,498 | |

| Market cap. | 31,727 | – | 1,187 | |

| PER (CE, x) | 14.08 | – | 13.97 | |

| PBR (Act, x) | 3.36 | – | 2.47 | |

| PSR (Act, x) | 0.87 | – | 2.02 | |

| Financial indicators (%) | ||||

| ROE | 10.12% | – | 9.21% | |

| ROA | 4.31% | – | 6.67% | |

| ROIC | 13.63% | – | – | |

| DPS (CE, yen) | 21.00 | – | 0.02 | |

| Financial data (TTM) | ||||

| Net sales | 36,517 | 35,000 | 690.72 | |

| Three-year growth rate (%) | 20.0% | +12% | 28.4% | |

| Operating profit | 3,000 | 4,500 | 718 | |

| Three-year growth rate (%) | 29.1% | – | 49.4% | |

| Operating profit margin | 8.2% | 12.9% | 10.4% | |

Source: million yen, million GBP, million euros

Prepared by Omega Investment based on financial statements of both companies.

Keywords Studios’ business model will be a good reference for the new DH Group as it aims to become a global quality partner in the entertainment business, targeting not only the domestic but also the global market.

◇ Significance of spin-off listings for investors

The spin-off listing of AGEST, Inc. will create the new AGEST Group and the new DH Group, enabling the two companies to manage their businesses in line with their respective growth strategies going forward. The views on individual valuations are set out below. Investors are expected to become more interested in the new stocks as the portfolio exposure can be more precisely adjusted, and the nature of the two companies businesses will become more apparent. This will result in a shareholder list worthy of each of the stocks.

As a result of the focus on the two companies’ businesses on their respective business areas, their business value will be scrutinised, and the share prices will be elaborately revalued after the spin-off. The share price of the new AGEST Group will be determined by the trading of investors with high growth expectations over a short to medium time span, who pay high multiple for risk and are willing to accept share price volatility. On the other hand, the share price of the new DH Group is expected to be priced by investors who also expect the next stage of growth, in addition to the high return on equity and business predictability that have traditionally characterised the Entertainment Business.

At present, specific calculations are difficult because the composition of the balance sheets of both companies has not yet been determined. Still, more accurate valuations will become possible in the process of clarifying various information, including that on balance sheet composition.

a) A view on the new AGEST Group

The growth element of the Enterprise Business, which was previously integrated with the Entertainment business and therefore difficult to value, will become more visible as an investment target, which is expected to have a significant impact on the valuation of the new AGEST Group. There are concerns that the amortisation burden of goodwill from M&As will be a drag on profit growth in this business, but this should not be a significant problem for investors looking for growth.

In terms of cash flow, the new AGEST Group will no longer be able to utilise the CF generated by the Entertainment Business as at present, but it is expected to increase investment to accelerate the growth of the Enterprise Business under a different capital policy than in the past. The new AGEST Group will be better characterised as a growth stock focusing on its growth strategies.

b) Valuation of the new DH Group

After the spin-off of AGEST, Inc., the valuation premiums for the shares of the new DH Group will likely be 1) visible CF generation capability, 2) high return on capital, and 3) clarification of the business as an investment target. On the other hand, 1) saturation or expected shrinkage of the game debugging market, 2) increased business risk due to overseas business expansion, and 3) rising costs in an inflationary economy are discount factors. Eliminating the amortisation burden associated with the Enterprise Business will reveal solid EPS growth and drive market capitalisation.

Furthermore, if the need to provide CF to the Enterprise Business is eliminated, the ample CF will enable further investment in growth areas and ensure the renewed growth of the Entertainment Business. In addition, investors will expect the same or better shareholder returns than before, which will be a significant attraction for the new DH Group shares.

In summary, the spin-off listing of the Enterprise Business is generally considered positive for investors. The new AGEST Group and the new DH Group becoming separate companies, it will clarify and focus their respective business strategies, resulting in a clearer and feasible future growth path. As a result, investors can consider the two companies as suitable investment targets for their respective stances. One issue that needs to be addressed is that the spin-off listing may take two to three years from now. Until then, uncertainties will make it difficult for investors to determine the right time to make an investment decision. The Company plans to provide more concrete information as the spin-off project progresses, which should gradually dispel this uncertainty.

Digital Hearts Holdings (3676) Share Price Trend (3Year-to-date)