Sportsfield (Company note – 2Q update)

| Share price (9/15) | ¥1,430 | Dividend Yield (23/12 CE) | 0.0 % |

| 52weeks high/low | ¥1,894 / 821.5 | ROE(22/12) | 71.8 % |

| Avg Vol (3 month) | 29 thou shrs | Operating margin (23/12CE) | 22.2 % |

| Market Cap | ¥5.2 bn | Beta (5Y Monthly) | N/A |

| Enterprise Value | ¥4.1 bn | Shares Outstanding | 3.6 mn shrs |

| PER (23/12 CE) | 11.7 X | Listed market | TSE Growth |

| PBR (23/6 act) | 4.4 X |

| Click here for the PDF version of this page |

| PDF Version |

Business remains solid in 2Q FY12/2023 (Apr-Jun 2023)

Summary

Company profile

◇Sportsfield Corporation Ltd. provides placement-related services to sports human capital nationwide. It is listed on the TSE Growth Market. FY12/2022 results were sales of 2.87 billion yen and a ordinary profit of 0.63 billion yen. The current medium-term management plan aims to achieve sales of 3.60 billion yen and a recurring profit of 0.77 billion yen in FY12/2024.

◇Specialised in recruiting sports talents and leading the market with a distinctive sales style: Sportsfield’s primary business is placement-related services for newly graduating sports students, particularly those belonging to college athletic teams. The market is estimated to be around 50,000 people nationwide per academic year. The company has established a system of analogue support provided by sales employees, most of whom have sports experience. The number of registered job seekers has grown to over 20,000 every year. The company also operates a well-established business with companies that wish to recruit sports human capital and is believed to be securing a leading position in a specific market.

◇Main business: Sales comprise (FY12/2022) 39% of New Graduate Events for new graduates belonging to college athletic teams (fees are received from exhibiting companies), 30% of New Graduate Placement Support business for newly graduating athletic students and students with other sports experience (provides employment counselling to students, introduces them to employing companies and receives a recruitment consulting fee from companies after a job offer is accepted), and Graduate Placement Support business (provides employment counselling to sports graduates, introduces them to employers and receives a placement fee from companies as a performance reward).

2Q of FY2023 update

◇2Q results remain strong: 2Q (Apr-Jun) 2023 results again confirm the business continues to be on track with fine growth from the previous year. Sales were 970 million (+13% YoY), operating profit 310 million yen (+4% YoY), ordinary profit 310 million yen (+4% YoY) and net profit attributable to owners of the parent was 200 million yen (+3% YoY). This shows that although the growth slowed from 1Q, the underlying growth remains robots, thanks to a strengthened operating base and improvement in the recruitment market. The results are fast compared to the company’s full-year forecasts.

◇Share price breaks for a pause: Although the company‘s share price adjusted once after the 1Q results announcement, it rose steadily from June to mid-July, hitting a yearly high of 1,894 yen on 19 July and then stayed around 1,750 yen. It adjusted to the 1,430 yen level after the 2Q results announcement. However, the uptrend in the share price since May 2022 is continuing., with this short-term adjustment reflecting a lowering of revenue growth and profit margins in 2Q. The share price does not look overheated, trading on a PER of 11.7x for FY12/2023. If the growth outlook for the next fiscal year becomes more visible, the share price should react to that favourably.

◇Points of interest:

First, whether or not the company will revise up its full-year forecasts.

Second, the likelihood of continued growth in the next financial year. In particular, the number of students graduating in March 2025 registered on Sponavi for student-athletic teams, the number of registrants for Spochalle for students with sporting experience, and the coverage ratio of those registered by the company’s sales staff.

Third, the establishment of a new revenue base outside of new graduates, such as the human resources introduction business for graduates and Spojoba, a recruitment website specialising in sports-related companies.

Table of contents

| Summary | 1 |

| Key financial data | 2 |

| Financial results for 2Q of FY2023 | 3 |

| Share price trend | 7 |

| Points of interest | 8 |

| Financial results | 9 |

| Useful information | 11 |

Key financial data

| Fiscal Year | 2017/12 | 2018/12 | 2019/12 | 2020/12 | 2021/12 | 2022/12 | |

| Net sales | 1,106,727 | 1,516,370 | 1,917,813 | 1,883,269 | 2,130,256 | 2,866,214 | |

| Ordinary profit | 60,171 | 113,916 | 192,045 | 32,016 | -35,298 | 634,239 | |

| Net income | 41,031 | 72,809 | 132,965 | 17,055 | -79,133 | 412,318 | |

| Capital stock | 10,300 | 10,300 | 92,680 | 92,712 | 92,869 | 93,079 | |

| Total number of shares issued |

Ordinary shares (shares) Class A shares (shares) |

20,000 400 |

20,400 – |

881,600 – |

882,560 – |

897,400 – |

1,808,080 – |

| Net asset | 59,396 | 132,205 | 429,932 | 446,826 | 368,007 | 780,524 | |

| Total asset | 418,961 | 735,377 | 1,106,275 | 1,488,182 | 1,540,544 | 2,127,327 | |

| Book value per share*1 (Yen) | 18.20 | 40.50 | 121.92 | 126.58 | 102.53 | 215.87 | |

| EPS*1 (Yen) | 12.57 | 22.31 | 40.68 | 4.83 | -22.21 | 114.44 | |

| Equity to asset (%) | 14.2 | 18.0 | 38.9 | 30.0 | 23.9 | 36.7 | |

| ROE (%) | 100.6 | 76.0 | 47.3 | 3.9 | -19.4 | 71.8 | |

| Cash flow from operating activities | 108,208 | 82,994 | 198,181 | -88,974 | 53,789 | 609,537 | |

| Cash flow from investing activities | -32,962 | -75,085 | -24,984 | -32,077 | -67,943 | -7,100 | |

| Cash flow from financing activities | -82,366 | 191,526 | 149,891 | 396,399 | 18,139 | -120,077 | |

| Cash and cash equivalents at end of period | 163,792 | 363,227 | 686,315 | 961,663 | 965,648 | 1,448,007 | |

| Number of employees | 118 | 164 | 201 | 233 | 266 | 242 | |

(Unit: Thousand yen)

*1: A 40-for-1 split of ordinary shares was carried out on 4 October 2019, a 2-for-1 split of ordinary shares on 1 July 2022 and a 2-for-1 split of ordinary shares on 1 April 2023. Book value per share and EPS in the table are calculated assuming such splits were carried out at the beginning of the year ended 31 December 2017.

Source: Omega Investment from company materials.

Financial results for 2Q of FY2023

Sportsfield Corporation announced its financial results for 2Q (Apr-Jun) FY2023 after the close of trading on 10 August 2023. Following a fine 1Q, the company is continuing to grow steadily. The progress ratio against the full-year plan is also good YoY, and the KPIs for next year’s financial performance are off to a good start.

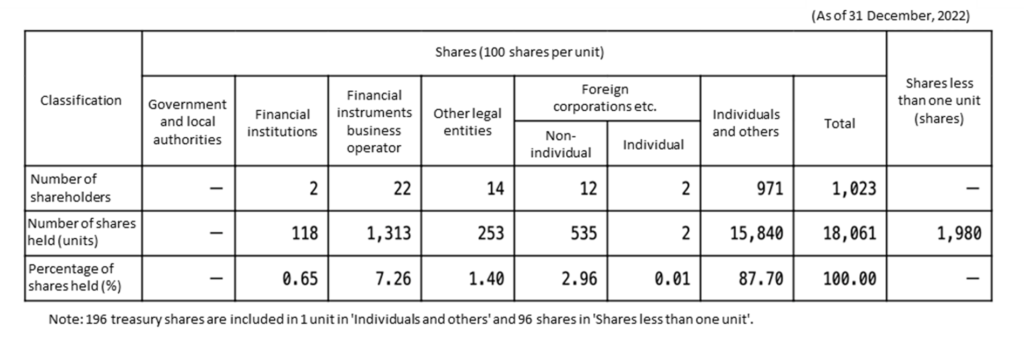

Strong financial results with another record-high

In the cumulative 2Q results (Jan-Jun), sales were 1.89 billion yen (+16% YoY), operating profit was 0.63 billion yen (+18% YoY), ordinary profit was 0.63 billion yen (+18% YoY), and net profit attributable to owners of the parent was 0.41 billion yen (+18% YoY) – all record highs. Operating and ordinary profit margins were also record highs. A breakdown of sales shows that growth has been broadly consistent, particularly in New Graduate Placement Support. The recovery of demand for jobs under the New Normal provides a tailwind to the company’s established operating base.

In the 2Q (Apr-Jun) alone, sales were 970 million yen (+13% YoY), operating profit was 310 million (+4% YoY), ordinary profit was 310 million yen (+4% YoY), and net profit attributable to owners of the parent company was 200 million yen (+3% YoY). Over 1Q result, sales kept growing at a double-digit rate, but profit growth slowed. This is due to an increase in operating expenses. However, it is thought to be an intended increase to increase personnel and advertising costs to drive future business growth. As such, there is little to take this as negative at present.

The company maintains its full-year forecasts. The progress ratio in the first 2Q is better than previous year, with 59% for sales and 92% for operating profit against the full-year estimates. However, the current year is likely to be affected by earlier recruitment and placement activities and the seasonal nature of the company’s performance, making it difficult to grow in the second half of the year. Furthermore, as mentioned earlier, the company is also making strategic investments in personnel and advertising costs, so, understandably, it did not alter its full-year forecasts. There are currently no signs that the business environment has turned against the company, so there is no need to be particularly negative about the fact that the company did not revise up.

Source: company materials.

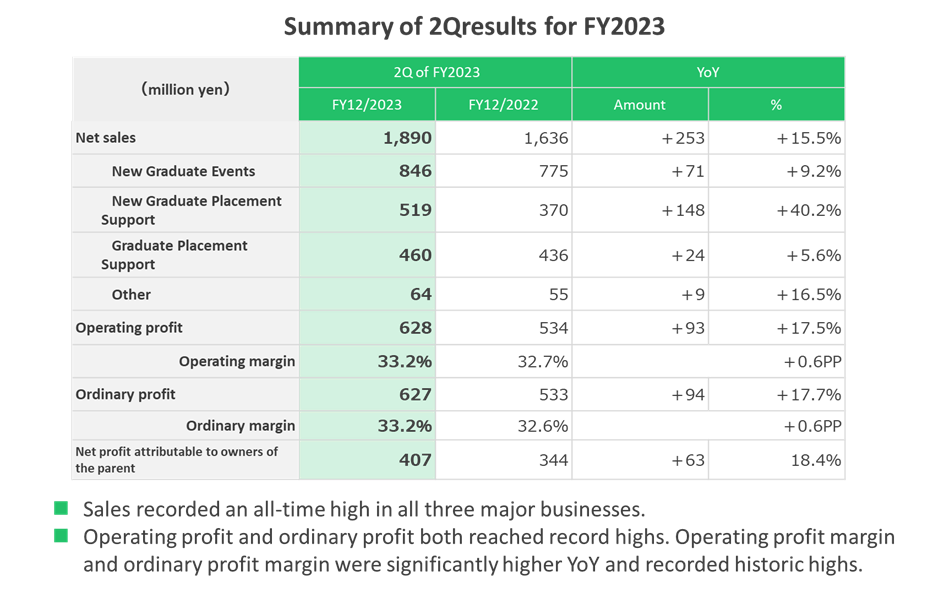

New Graduate Events

Cumulative 2Q sales were 850 million yen (+9% YoY). The number of events held fell slightly YoY, but a shift from online events to in-person and large-scale events drove the number of slots sold and sales.

Orders have been even more robust, with strong demand from companies to exhibit at events for March 2025 graduates, and the cumulative value of orders received appears to be doubling (+107% YoY), far exceeding that for graduates of March 2024. If orders for events are firm, the company can use its sales force to introduce human resources ahead of schedule, increasing the likelihood of growth in the coming year. The company’s performance in 3Q, which is usually a seasonal high point for orders, will be of great interest.

Source: company materials.

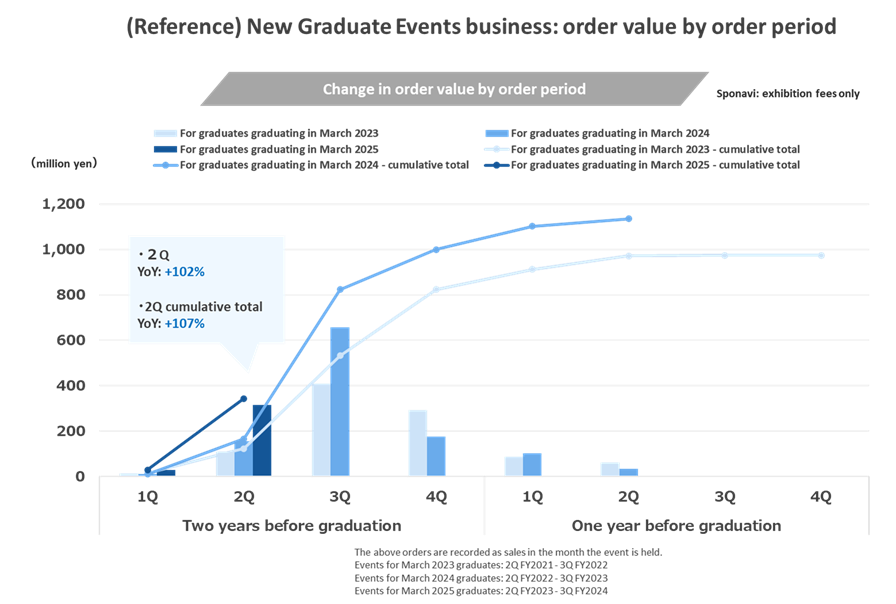

New Graduate Placement Support

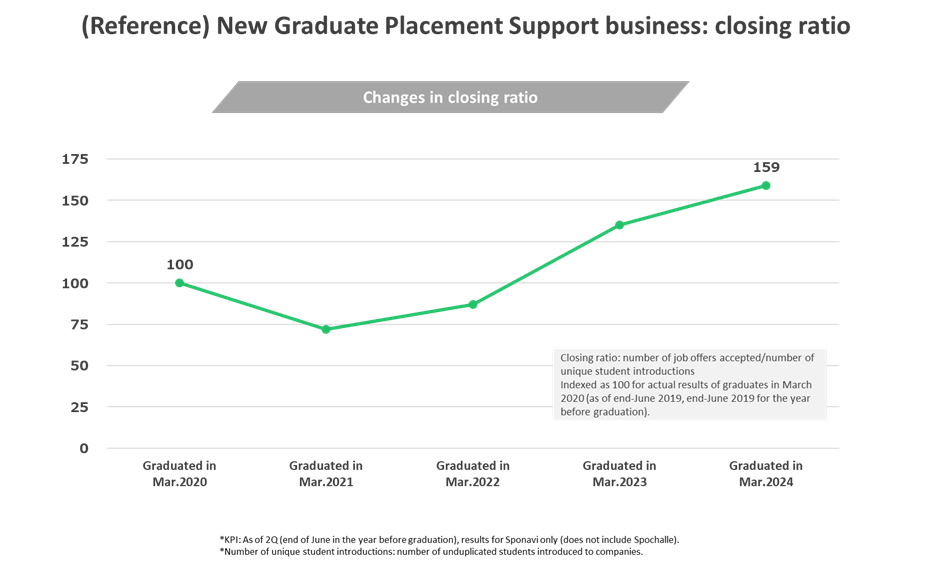

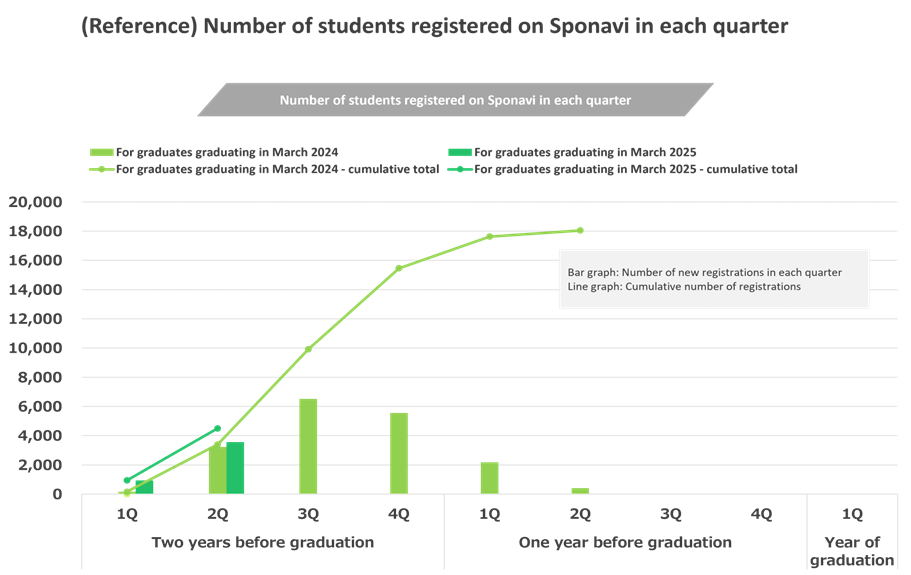

Cumulative 2Q sales grew significantly to 520 million (+40% YoY). The number of students registered on Sponavi, which indicates the number of student-athletic team members, was lower for students graduating in March 2024 than for those who graduated in March 2023. However, the company was able to raise the coverage ratio of students by its employees in response to earlier placement activity, and the number of unique company introductions increased significantly, leading to a high closing ratio and driving sales growth.

Source: company materials.

Source: company materials.

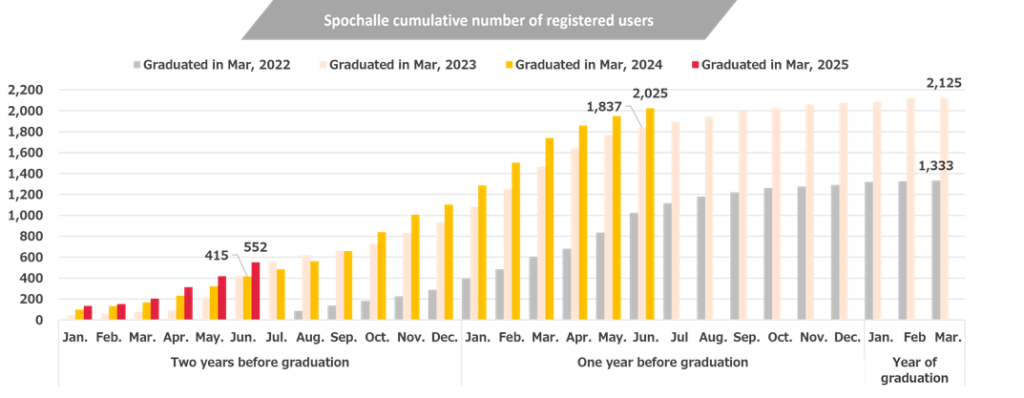

In addition to the growth of Sponavi, the contribution of Spochalle, an employment support service for people with sports experience, has become apparent. Cumulative 2Q sales were 90 million yen (+62% YoY). The number of registrants and the unique student introductions have grown significantly, so the company is taking on a new role as a driving force in the graduate recruitment business.

Source: company materials.

Graduate Placement Support

Cumulative 2Q sales grew steadily to a record high of 460 million yen (+6% YoY). Against a backdrop of strong corporate demand for recruitment, the number of registered users of Sponavi Career and Spochalle Jobchange increased YoY, and the number of unique human resources and unique company introductions also remained strong.

The cumulative number of registered members for one of the new businesses, Spojoba (a recruitment website specialising in sports-related companies and mainly offering online matching), continues to increase, and the site’s PV is stable at more than 1 million PV per month.

Healthy balance sheet

The balance sheet has changed little since the end of December 2022. Cash and deposits remain high. Interest-bearing debt is decreasing, and the net cash position is maintained. While liabilities have decreased, net assets have increased due to retained earnings, raising the equity ratio to 53.7%. This is positive regarding financial security but could be a negative factor in capital efficiency. Therefore, the question of how to maintain capital efficiency (e.g. ROE) through internal growth, external growth and shareholder returns will be more important than ever going forward.

Share price trend

The company’s share price once adjusted after the announcement of 1Q results but rose steadily from June to mid-July, reaching a yearly high of 1,894 on 19 July and then staying around the ¥1,750 level.

However, the share price fell to 1,500 yen after the announcement of the Q2 results and has recently adjusted to the 1,430 yen level. This adjustment is thought to have reflected the decline in revenue growth and profitability in 2Q and that not much can be expected in terms of profit growth in 3Q and 4Q, considering the seasonality and the advance of placements.

However, the share price uptrend since May 2022 is continuing. Regarding share price valuations, the share price does not look overheated, trading on a PER of 11.7x for the company’s forecast for FY12/2023.

Hence, the share price is expected to rise as the company’s growth in FY12/2024 becomes more likely.

Next, we would like to summarise our focus on the share price drivers in the near term.

Points of interest

We would like to highlight three points of immediate interest.

Firstly, whether or not there is scope for an upward revision to the company’s full-year forecasts.

As the company’s cumulative 2Q results have progressed well against its full-year forecast, and the recruitment market environment appears favorable, it may beat its full-year forecast.

However, it should also be pointed out that there are a number of factors preventing the company from adding to its profit in the 2H of the year, including the seasonality of the company’s performance, which makes it difficult to grow in the 2H of the year, the possibility of upfront investment in personnel, advertising and other costs for sustainable growth over the medium term, and the possibility of new graduate placements being brought forward in this year.

Second, the likelihood of continued growth in the next fiscal year. In particular, the results of order booking for events for March 2025 graduates, the number of students registered on Sponavi for students-athletic teams scheduled to graduate in March 2025, the build-up of students registered on Spochalle for students with sports experience, and the coverage ratio of registered students by the company’s sales staff.

If these KPIs build up in the coming 3Q and 4Q, the likelihood of earnings growth in FY12/2024 will increase. As the current share price valuations are not overheated, the share price will then move to factor in FY12/2024 earnings. This is seen as the most crucial share price driver at present.

Needless to say, if the recruitment market were to start cooling down, the opposite could happen.

Source: company materials.

Thirdly, will the company launch new non-graduate drivers such as the graduate recruitment business and Spojoba, a recruitment website specialising in sports-related companies? This is likely to raise the company’s medium-term business potential and is expected to drive the share price when it does.

Financial results

Full-year financial results

Financial period |

FY12/2019 |

FY12/2020 |

FY12/2021 |

FY12/2022 |

FY12/2023 |

FY12/2024 |

Consolidated, Japanese GAAP |

(IPO) |

Company

|

Medium-term

|

|||

[Statements of income] |

||||||

Net sales |

1,918 |

1,883 |

2,130 |

2,866 |

3,186 |

3,600 |

Operating profit |

194 |

16 |

-32 |

637 |

680 |

768 |

Ordinary profit |

192 |

32 |

-35 |

634 |

677 |

767 |

Net profit before income taxes |

192 |

32 |

-81 |

634 |

||

Net profit attributable to owners of

|

133 |

17 |

-79 |

412 |

440 |

|

[Balance Sheets] |

||||||

Total assets |

1,106 |

1,488 |

1,541 |

2,127 |

||

Total liabilities |

676 |

1,041 |

1,173 |

1,347 |

||

Total net assets |

430 |

447 |

368 |

781 |

||

Total borrowings |

334 |

731 |

749 |

630 |

||

[Statements of cash flows] |

||||||

Cash flow from operating activities |

198 |

-89 |

54 |

610 |

||

Cash flow from investing activities |

-25 |

-32 |

-68 |

-7 |

||

Cash flow from financing activities |

150 |

396 |

18 |

-120 |

||

Free cash flow |

173 |

-121 |

-14 |

602 |

||

Cash and cash equivalents at end of period |

686 |

962 |

966 |

1,448 |

||

[Efficiency] |

||||||

Ratio of ordinary profit to sales |

10.0% |

1.7% |

-1.7% |

22.1% |

21.2% |

21.3% |

ROA |

14.4% |

1.3% |

-5.2% |

22.5% |

||

ROE |

47.3% |

3.9% |

-19.4% |

71.8% |

||

[Per-share] Unit : Yen |

||||||

EPS (Adjusted for stock splits, etc.) |

41 |

5 |

-22 |

114 |

122 |

|

BPS (Adjusted for stock splits, etc.) |

122 |

127 |

103 |

216 |

||

DPS (Adjusted for stock splits, etc.) |

0 |

0 |

0 |

0 |

0 |

|

[Number of employees] |

||||||

Number of consolidated employees |

201 |

233 |

266 |

242 |

(Unit: million yen)

Source: Omega Investment from company materials. The per-share indicators EPS and BPS are adjusted for the 1:2 share split carried out in April 2023.

Quarterly results

2022Q1 |

2022Q2 |

2022Q3 |

2022Q4 |

2023Q1 |

2023Q2 |

|

Net sales |

774 |

862 |

609 |

619 |

919 |

971 |

New Graduate Events |

507 |

267 |

61 |

292 |

578 |

267 |

New Graduate Placement support |

79 |

290 |

354 |

119 |

92 |

426 |

Graduate Placement Support |

158 |

277 |

164 |

176 |

213 |

247 |

Other |

28 |

26 |

29 |

31 |

34 |

30 |

Operating profit |

232 |

301 |

69 |

32 |

315 |

312 |

Ordinary profit |

231 |

301 |

68 |

31 |

314 |

312 |

Net profit attributable to owners of

|

148 |

196 |

45 |

23 |

205 |

202 |

Source: Prepared by Omega Investment from the company’s IR material.

Useful information

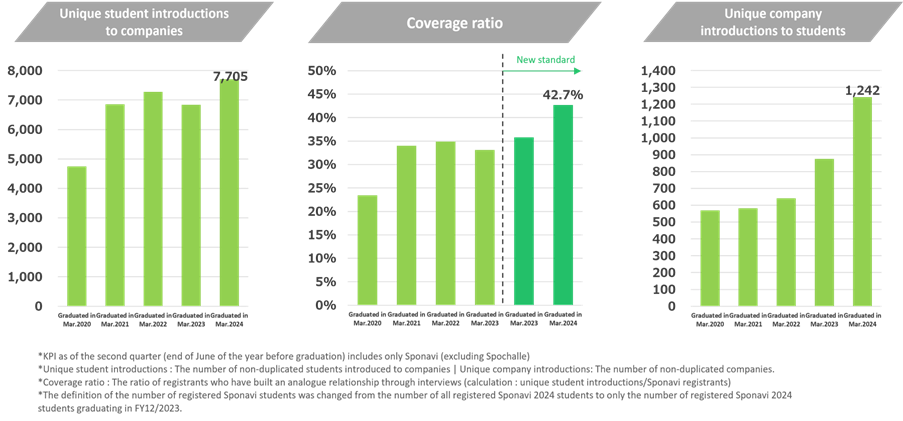

Principal shareholders

| Name | Number of shares owned |

Ratio of the number of shares owned to the total number of issued shares (%) |

| Katsushi Shinozaki | 409,000 | 22.62 |

| Kazuyoshi Ijichi | 209,600 | 11.59 |

| Tadashi Kaji | 209,600 | 11.59 |

| Shota Morimoto | 209,600 | 11.59 |

| Rakuten Securities, Inc. | 27,400 | 1.51 |

| Sportsfield Employee Stock Ownership Plan | 25,200 | 1.39 |

| Nomura Securities Co., Ltd. | 19,700 | 1.08 |

| Toyotaro Shigemori | 16,800 | 0.92 |

| NOMURA PB NOMINEES (Standing proxy: Nomura Securities Co., Ltd.) | 16,200 | 0.89 |

| Medical Corporation Takemura Medical Nephro Clinic | 16,000 | 0.88 |

| Katsumi Takemura | 16,000 | 0.88 |

| Total | 1,175,100 | 64.99 |

Shareholder composition