Vision (Price Discovery)

| Securities Code |

| TYO:9416 |

| Market Capitalization |

| 65,895 million yen |

| Industry |

| Information / Communication |

Profile

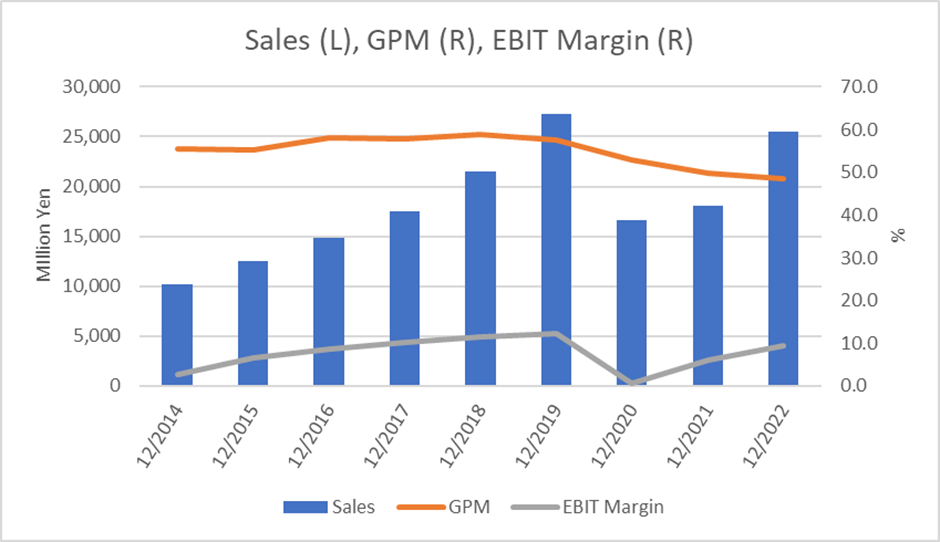

Wi-Fi router rental and information and communication services business. The latter includes subscription acquisition for various telecommunications services for businesses, mobile communications equipment sales, office automation equipment, and website production. Also involved in glamping operations.

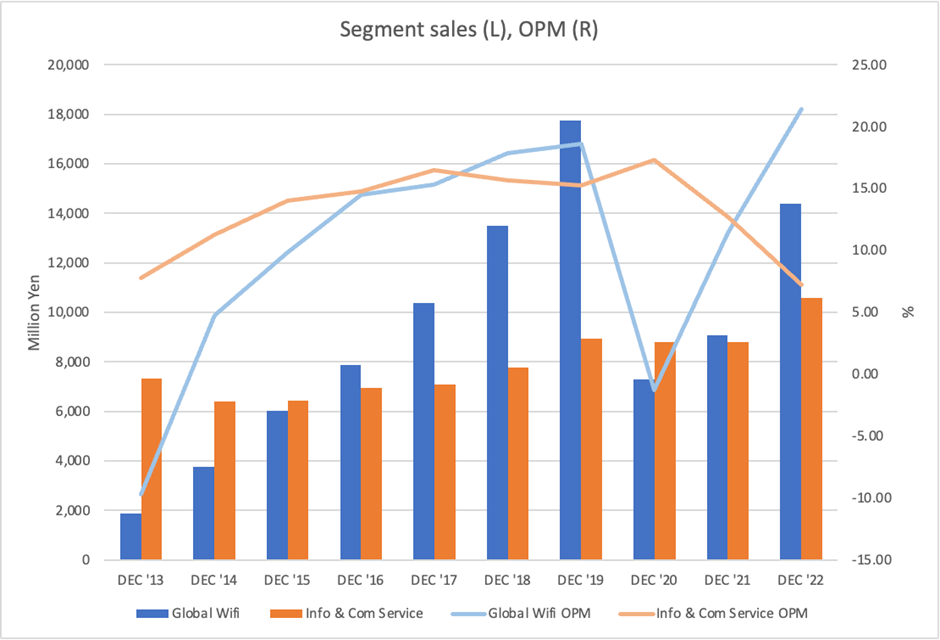

Segment, sales mix (%), (operating margin %) – Global WiFi 56 (21), Information and communication services 42 (7), Glamping tourism 1 (-36) (Dec.2022)

Stock Hunter’s View

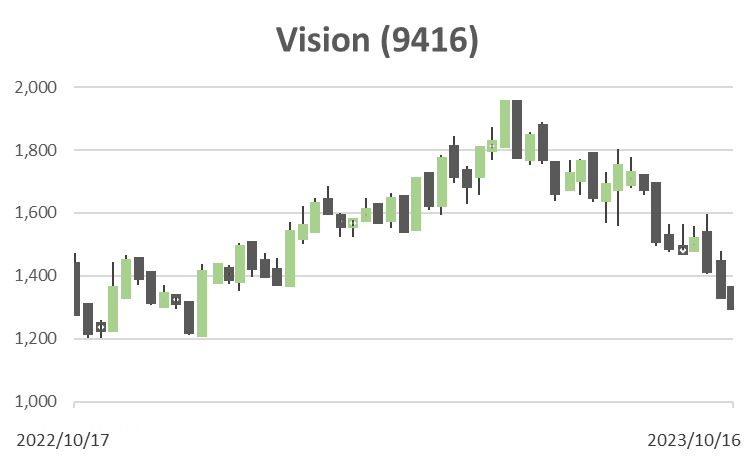

Share price looks set to await a catalyst for a comeback. The revised earnings guidance could err on the upside.

Given the rapid increase in the number of foreign tourists visiting Japan, the Japan Tourism Agency expects the number of tourists visiting Japan monthly to recover to pre-pandemic levels by the end of the year.

Further tailwinds are likely to help Vision’s performance recovery in Wi-Fi rentals. The number of Japanese departing Japan is gradually recovering for business and travel, and the number of global Wi-Fi users is increasing accordingly. Lending to visitors to Japan, who are among the first to recover, has also contributed to this, with the total number of users of the Wi-Fi router rental service topping 18 million in August.

Global Wi-Fi has seen robust growth in the number of rentals by visitors to Japan. In the outbound market, demand for unlimited data capacity plans and high-speed data communication plans is high, and customer spending has been maintained. In addition, the new glamping tourism business has started to take off. In the first half of the year, facilities at Lake Yamanakako went into full-scale operation. The company intends to utilise the network with OTAs and travel agencies built up through the sale of Global Wi-Fi for glamping sales.

Based on the 1H business performance trends, the company has revised its full-year operating profit forecast from 3.0 billion to 4.019 billion (up 66.5% YoY), the highest profit since FY12/2019, but this may prove conservative.

Investor’s View

Neutral – the impressive resilience is priced in. The earnings could come in higher than forecast. However, valuations reflect medium- to long-term fundamentals, so the share price multiples are unlikely to expand soon.

Wi-Fi rental recovery is remarkable

The company is continuing to recover well from the pandemic disaster. According to the company, there were 3.61 million outbound Japanese in Jan-Jun 2023, a level 38% of that in the same six months of 2019, so significant scope for recovery still appears. The number of foreign visitors to Japan during the same period was 10.71 million, 64% of that in 2019. The number of outbound Wi-Fi rentals and sales recovered to over 40% and 74%, respectively, compared to January-June 2019. Inbound rental volume was 147% and 158% in revenue vis-a-vis those in 1H 2019, with inbound unit customer prices improving significantly.

The earnings revision is due to the strong Wi-Fi performance, while the Information and Communication segment saw increased investment, and the segment’s profits were revised down. It is thought that the company has made a short-term decision to make an upfront investment utilising the CF from the strong Wifi performance. If the costs are temporary, as President Sano stated, the segment’s profitability should recover more visibly in the next 10-12 months.

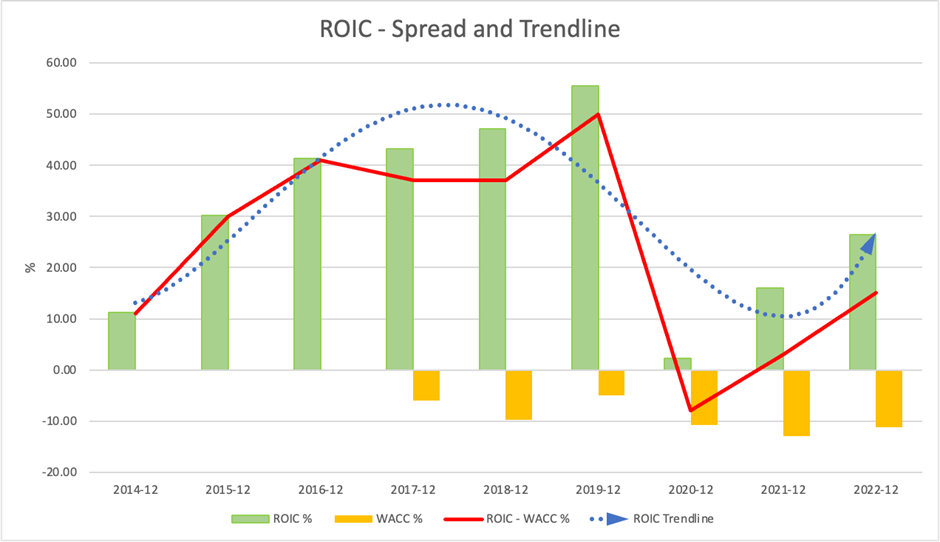

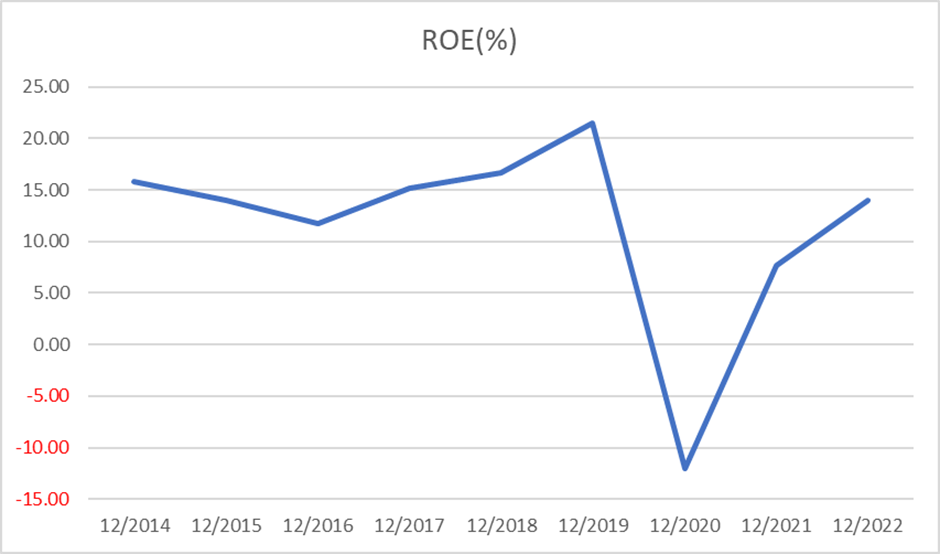

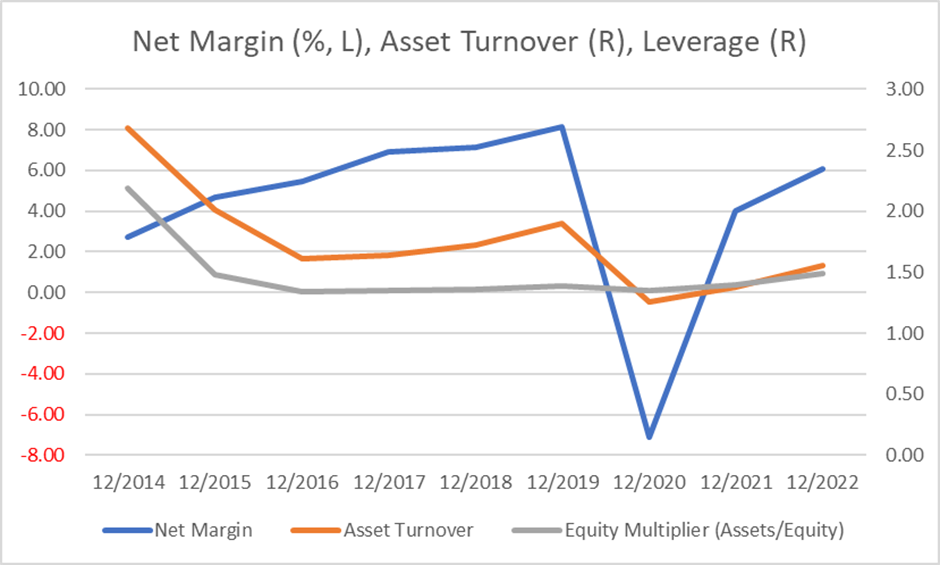

ROE will recover steadily

The recovery of asset turnover has been a little slow but is expected to recover as sales grow. Momentum for ROE recovery will increase along with it. ROIC is recovering well, and returning to pre-pandemic levels will not take long.

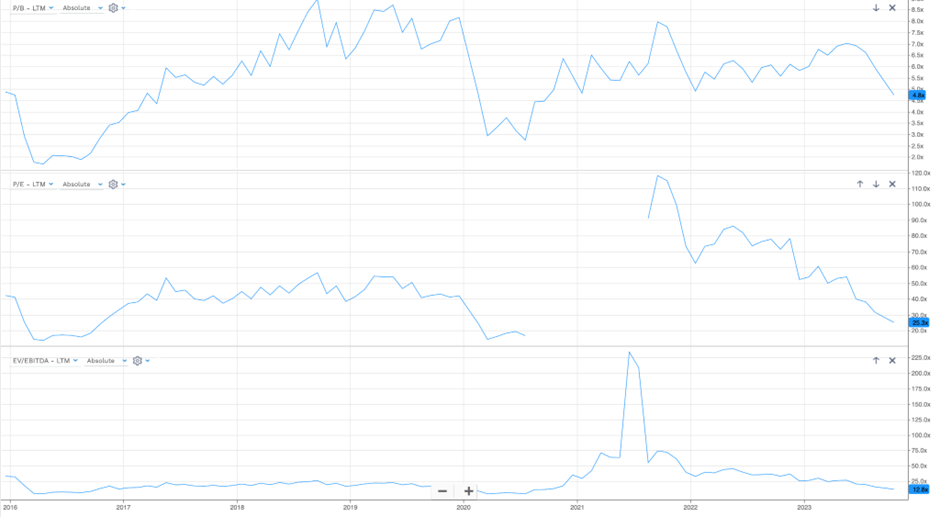

However, recovery is priced in

The share price has made strong returns over the last year and the year before and should be considered to have largely factored in the company’s impressive resilience. Following the remarkable fall in the share price since July this year, both PER and PBR have adjusted to their pre-pandemic levels.

PBR, PER, EV/EBITDA

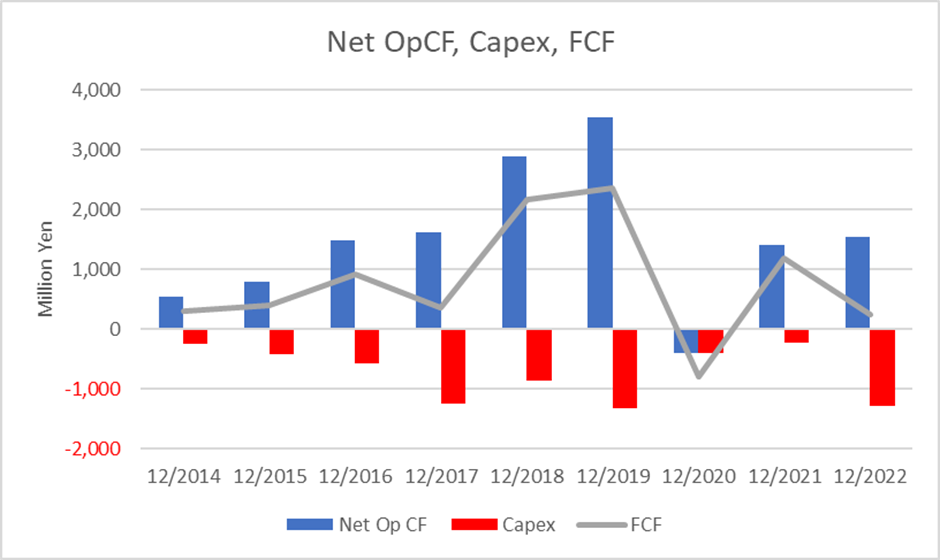

The use of the ample CF generation will determine share price valuations

CF generation will improve in the coming years, and cash will grow rapidly. Should the tourism boom saturate in the next few years, investors’ predictions on how the company will spend the cash pile will drive share price valuations from here onwards. Fortunately, the management’s business skills and awareness of the share price are reasonably good.