Noritsu Koki (Price Discovery)

| Securities Code |

| TYO:7744 |

| Market Capitalization |

| 117,439 million yen |

| Industry |

| Precision equipment |

Profile

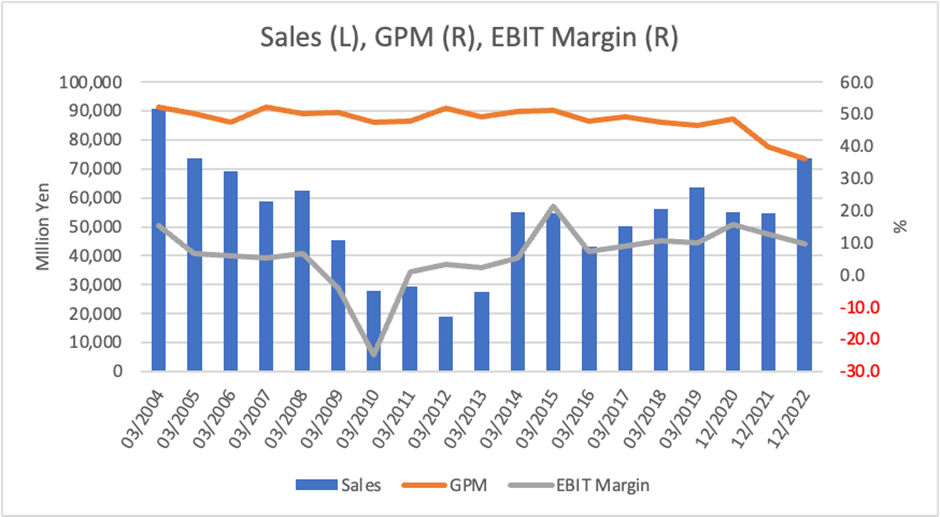

After various business acquisitions and divestments, the company now generates 80% of its sales from audio equipment and 89% from overseas. Founded in 1951, the company was originally a manufacturer of photographic development process equipment. Due to the spread of digital cameras, the company restructured itself through mergers and acquisitions from 2009. Currently, under the holding company’s umbrella are Teibow (parts business), which commands a 50% global market share for felt-tip pens, Alpha Theta, which has a 70% share of the worldwide market for DJ equipment under the brand name of Pioneer DJ, and JLab, a US manufacturer of earphones. Healthcare plans to downsize; in 2022, part of its stake in JMDC, a medical big data business, was transferred to OMRON (6645) for a huge profit and was removed from consolidation.

Stock Hunter’s View

Noritsu Koki ‘DJ equipment’ drives earnings growth. Demand remains strong.

Noritsu Koki transferred part of its holding in JMDC, which is responsible for the ‘healthcare’ business, to OMRON in February 2022, indicating a downsizing policy. The company is currently concentrating its core business on ‘manufacturing’ and is developing its parts and materials business, which manufactures felt leads for writing instruments, and its audio equipment-related business, which includes the development and sale of DJ equipment and earphones.

The company’s core business is DJ equipment, with consolidated subsidiary Alpha Theta, known for its ‘Pioneer DJ’ brand, performing particularly well; 2Q’s (Jan-Jun) operating profit was significantly higher than the company’s forecast. This was not because the sales booking was front-loaded on the order backlog that had built up amid a shortage of components but because demand was strong.

In audio equipment, there was a global drop in stay-at-home demand and buying restraint due to the inflationary economy. Still, there was no sign of a decline in demand for DJ equipment, both from individual and professional users. The broadening of the user base, the resumption of music events and the high popularity of Japanese DJ equipment overseas, as well as the ongoing depreciation of the yen since last year, are also considered to have provided a tailwind for the company.

Following the 1H results, the company has revised its full-year profit forecast upward from 7.6 billion yen to 11.2 billion yen (8.8 times the previous year’s figure). However, this only incorporates the 1H upswing and changes in exchange rate assumptions, and there is still earnings upside. We want to check the progress in the 3Q results (scheduled for 13 November).

Investor’s View

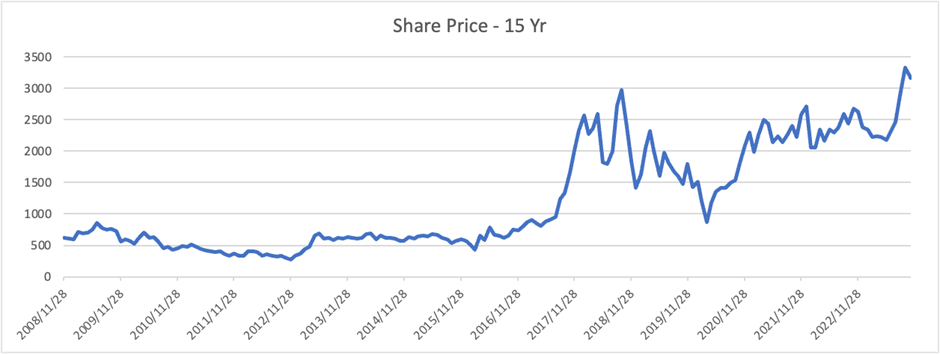

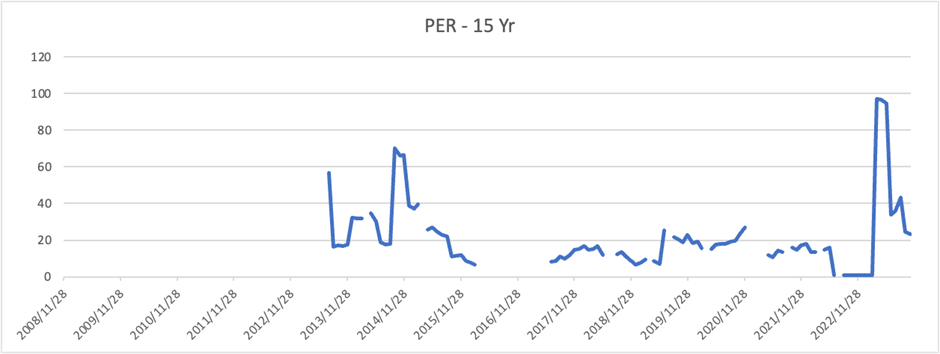

Trading buy – Not recommended for long-term accounts: Near-term earnings expectations are positive for the share price. However, the return on capital is structurally low, and the path to medium- and long-term improvement is not easy.

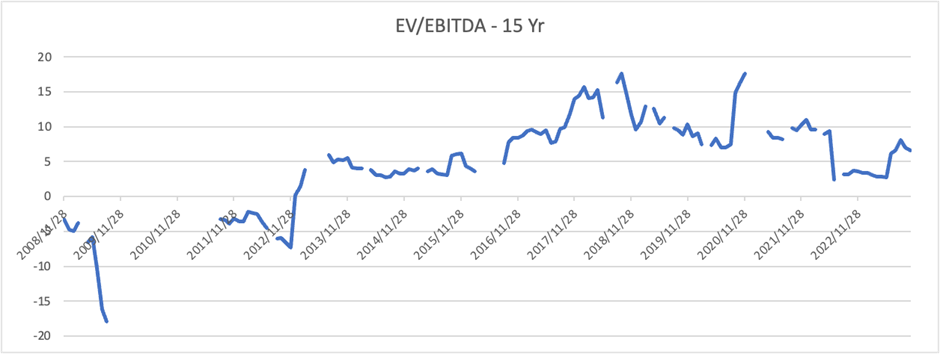

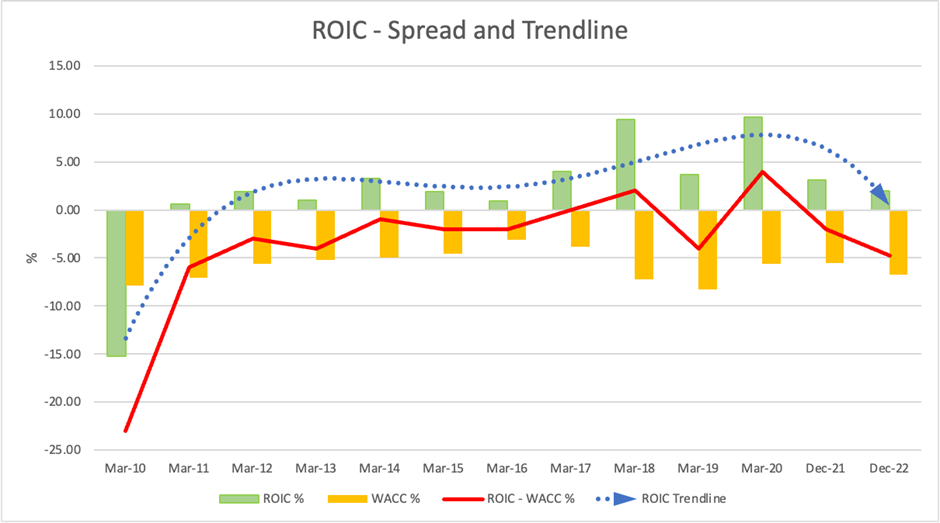

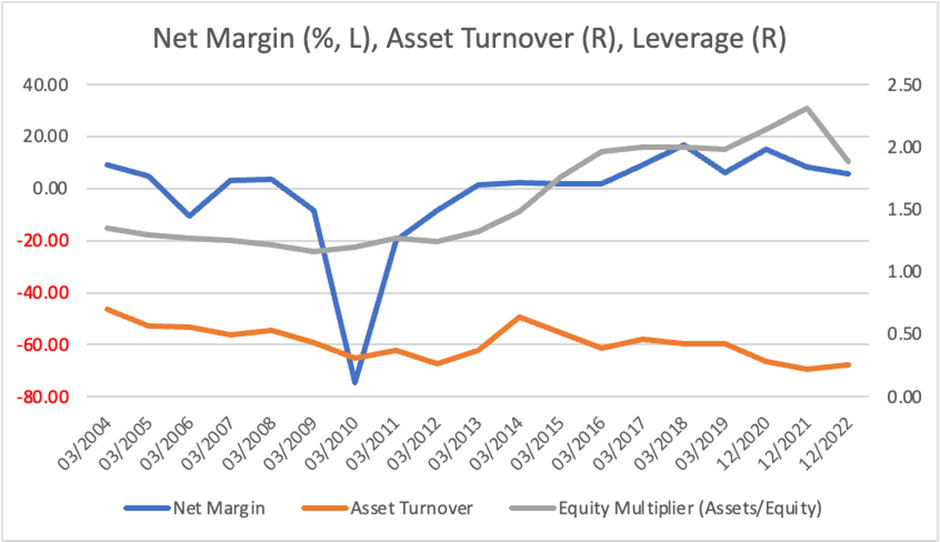

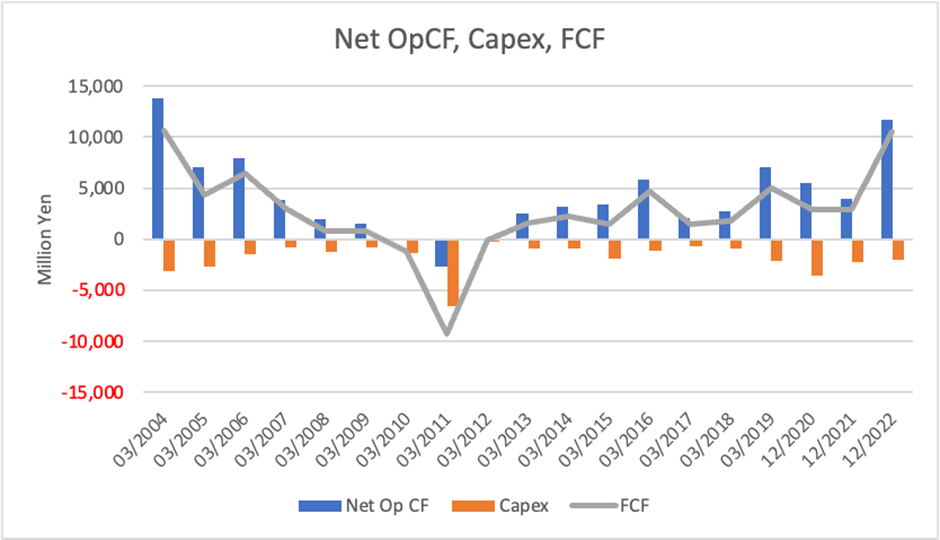

The company has generated little economic value over many years. This is because ROIC is permanently low; low ROIC is due to an extremely low asset turnover. The low asset turnover is mainly due to the accumulation of intangible assets, such as goodwill, due to aggressive mergers and acquisitions. Furthermore, cash increased by as much as 106 billion yen in 2022 due to partially selling subsidiary shares to downsize the healthcare business. This was despite repaying hefty borrowings. For reference, the company’s market capitalisation is 113 billion yen. According to the company explanation, at the end of December 2022, cash assets, goodwill and intangible assets accounted for 84% of total assets. Of these, goodwill and intangible assets accounted for 48% of total assets.

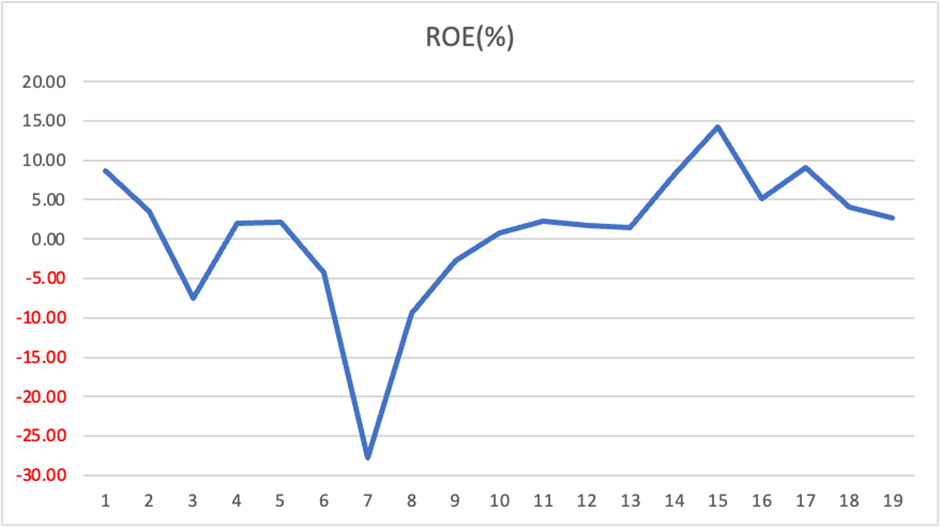

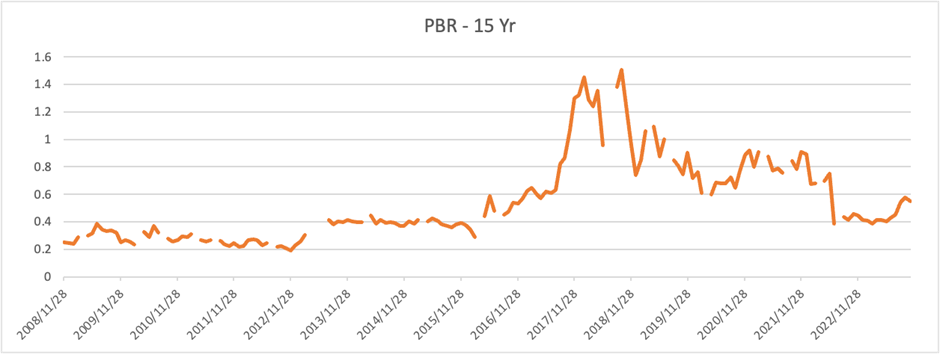

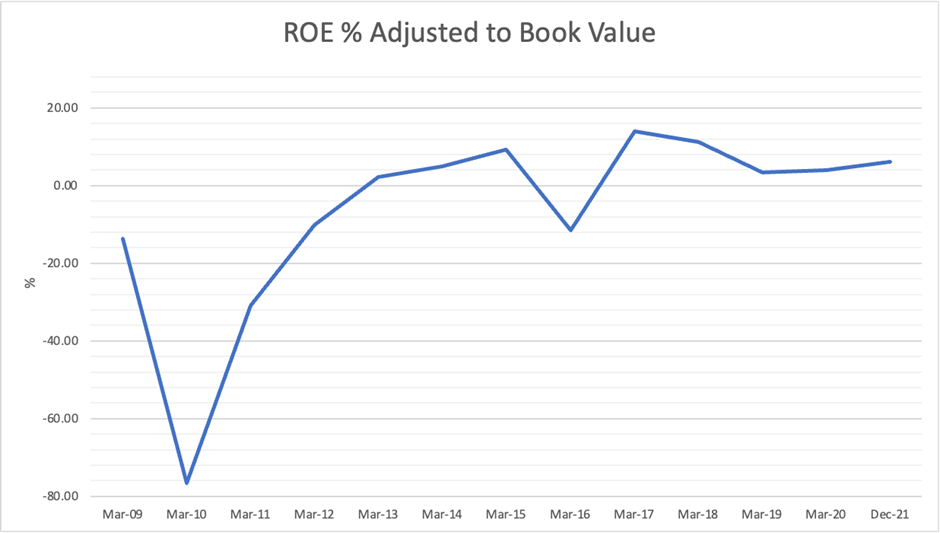

The structurally low ROE is the reason behind the depressed PBR of the company’s shares. Management states that the challenge is to improve the low asset turnover ratio to achieve 8% in ROE over the medium-term, with cash to be invested. While this is positive for investor expectations, one cannot optimistically forecast the underlying ROE to be significantly rounded up, given that aggressive M&A activity will likely continue. Cash will only transform into other assets, while the increase in goodwill will raise amortisation costs, weighing on net profit margins. Regarding profitability, management is keen to highlight EBITDA. However, profitability after amortisation is relevant to minority investors, as it drives ROE directly. The average PBR-adjusted ROE is 4.5% over three years, comparing unfavourable to the stock market average.

Positives for the medium- to long-term share price include: 1) CF generation is good, with a 10% upside to the share price at a fair value of around 3,400 yen based on our DCF estimate; 2) the management’s ability to complete mergers and acquisitions is highly rated amidst generally poor M&As in Japan. The valuation discount may improve if the company’s skills as a business investor, as demonstrated by the 2022 healthcare business exit, are recognised; 3) the company has hefty cash for M&A, and there is significant room for financial leverage through re-expansion of borrowings to positively impact ROE, and 4) If the cash accumulated in the BS is returned to investors in some form, the impact on the share price will be significant.

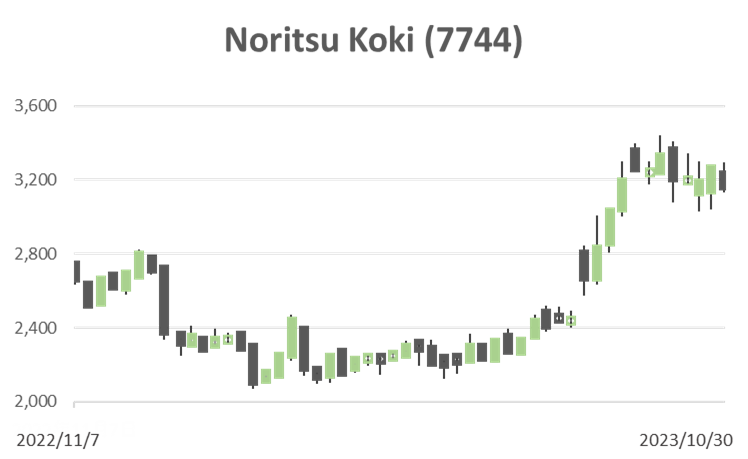

In terms of the near-term share price, the top line of audio equipment is strong, and the impact of the yen’s depreciation on the company, which has an overwhelmingly high proportion of overseas sales, is significant. The shares’ short-term should be considered positive.

In contrast, medium- to long-term share price concerns include: 1) ROE and ROIC do not satisfy investors, and the path to improvement is not easy, and 2) business development relying on M&A means low visibility, and it is doubtful that it will lead to a sustained improvement in EBIT margins. Therefore, investors would want to be cautious in their valuations.