Sportsfield (Company note – 3Q update)

| Share price (12/14) | ¥1,563 | Dividend Yield (23/12 CE) | 1.9 % |

| 52weeks high/low | ¥1,894 / 821.5 | ROE(22/12) | 71.8 % |

| Avg Vol (3 month) | 31 thou shrs | Operating margin (23/12CE) | 22.2 % |

| Market Cap | ¥5.7 bn | Beta (5Y Monthly) | N/A |

| Enterprise Value | ¥4.4 bn | Shares Outstanding | 3.6 mn shrs |

| PER (23/12 CE) | 10.5 X | Listed market | TSE Growth |

| PBR (23/6 act) | 4.6 X |

| Click here for the PDF version of this page |

| PDF Version |

Strong performance in 3Q FY12/2023 (Jul-Sep 2023). Upward revision of full-year forecasts and start of dividend payments announced.

Summary

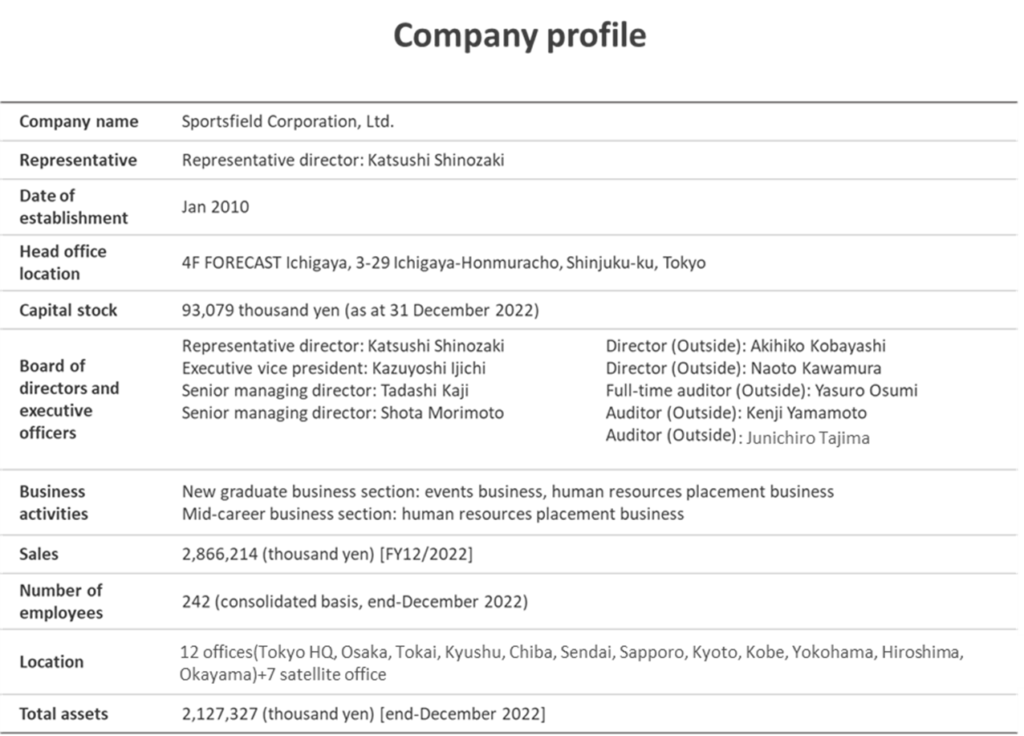

Company profile

◇Sportsfield Corporation Ltd. provides placement-related services to sports human capital nationwide. It is listed on the TSE Growth Market. FY12/2022 results were sales of 2.87 billion yen and an ordinary profit of 0.63 billion yen. The current medium-term management plan aims to achieve sales of 3.60 billion yen and an ordinary profit of 0.77 billion yen in FY12/2024.

◇Specialised in recruiting sports talents and leading the market with a distinctive sales style: Sportsfield’s primary business is placement-related services for newly graduating sports students, particularly those belonging to college athletic teams. The market is estimated to be around 50,000 people nationwide per academic year. The company has established a system of analogue support provided by sales employees, most of whom have sports experience. The number of registered job seekers has grown to over 20,000 every year. The company also operates a well-established business with companies that wish to recruit sports human capital and is believed to be securing a leading position in a specific market.

◇Main business: Sales comprise (FY12/2022) 39% of New Graduate Events for new graduates belonging to college athletic teams (fees are received from exhibiting companies), 30% of New Graduate Placement Support business for newly graduating athletic students and students with other sports experience (provides employment counselling to students, introduces them to employing companies and receives a recruitment consulting fee from companies after a job offer is accepted), and Graduate Placement Support business (provides employment counselling to sports graduates, introduces them to employers and receives a placement fee from companies as a performance reward).

3Q of FY2023 update

◇The earnings remain robust and full-year forecasts were revised up: In 3Q FY12/2023 (Jul-Sep), net sales were 700 million yen (+15% YoY), operating profit was 80 million yen (+22% YoY), ordinary profit was 80 million yen (+24% YoY), and net profit attributable to owner of the parent was 50 million yen (+18% YoY). Earnings continue to grow well thanks to the bolstered operating base and the improving recruitment market. On a cumulative basis since the beginning of the fiscal year, sales, operating profit, and ordinary profit have all registered record highs.

Based on these results, the company has revised its full-year forecasts for sales, operating profit, ordinary profit, net profit attributable to owners of the parent and EPS upward.

◇Starting dividend payment: On 20 November, the company announced a change to its dividend policy. Judging that the company’s financial foundations are solid, the dividend payout ratio will be increased from nil to 20%, and the payment will commence at the end of FY12/2023. The company expects 30 yen a share, translating into a dividend yield of 1.8%. This is positive as it combines continued growth with a focus on capital efficiency.

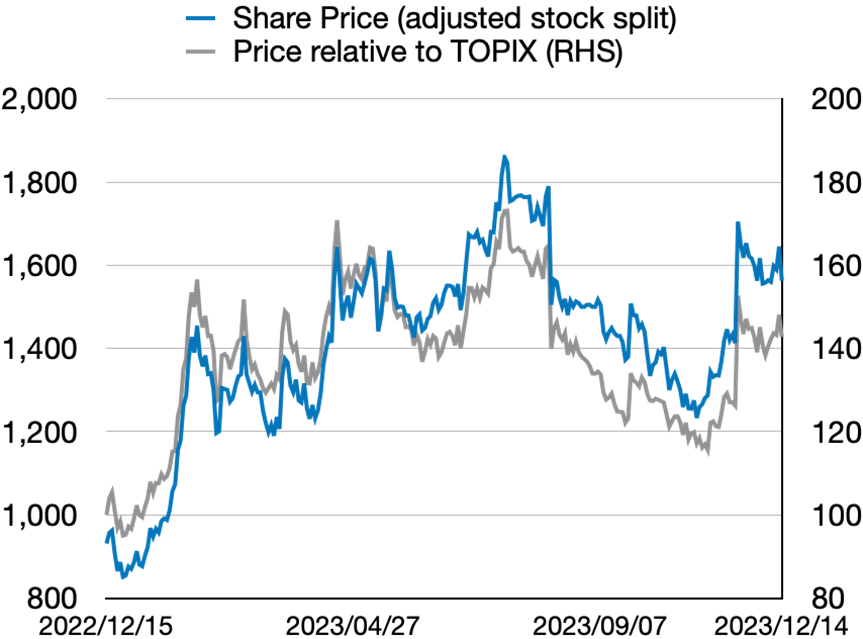

◇The share price is re-assessing growth: The company’s share price shot up on the 3Q result announcement and the start of dividend payments and looks likely to get close to the high of 1,894 yen reached in July this year.

◇Points of interest going forward: Firstly, the likelihood of further growth in the coming year. In particular, the number of students registered on Sponavi for student-athletic team students who will graduate in March 2025, the number of students registered on Spochalle for students with sports experience, and the coverage ratio by the company’s sales staff.

Secondly, establishing a new revenue base outside of new graduates, such as Graduate Placement Support and Spojoba, a recruitment website specialising in sports-related companies.

Thirdly, the company’s statement on the direction or general framework of its next medium-term management plan.

Table of contents

| Summary | 1 |

| Key financial data | 2 |

| Financial results for 3Q of FY2023 | 3 |

| Share price trend | 7 |

| Points of interest | 8 |

| Financial results | 9 |

| Useful information | 11 |

Key financial data

| Fiscal Year | 2017/12 | 2018/12 | 2019/12 | 2020/12 | 2021/12 | 2022/12 | |

| Net sales | 1,106,727 | 1,516,370 | 1,917,813 | 1,883,269 | 2,130,256 | 2,866,214 | |

| Ordinary profit | 60,171 | 113,916 | 192,045 | 32,016 | -35,298 | 634,239 | |

| Net income | 41,031 | 72,809 | 132,965 | 17,055 | -79,133 | 412,318 | |

| Capital stock | 10,300 | 10,300 | 92,680 | 92,712 | 92,869 | 93,079 | |

| Total number of shares issued |

Ordinary shares (shares) Class A shares (shares) |

20,000 400 |

20,400 – |

881,600 – |

882,560 – |

897,400 – |

1,808,080 – |

| Net asset | 59,396 | 132,205 | 429,932 | 446,826 | 368,007 | 780,524 | |

| Total asset | 418,961 | 735,377 | 1,106,275 | 1,488,182 | 1,540,544 | 2,127,327 | |

| Book value per share*1 (Yen) | 18.20 | 40.50 | 121.92 | 126.58 | 102.53 | 215.87 | |

| EPS*1 (Yen) | 12.57 | 22.31 | 40.68 | 4.83 | -22.21 | 114.44 | |

| Equity to asset (%) | 14.2 | 18.0 | 38.9 | 30.0 | 23.9 | 36.7 | |

| ROE (%) | 100.6 | 76.0 | 47.3 | 3.9 | -19.4 | 71.8 | |

| Cash flow from operating activities | 108,208 | 82,994 | 198,181 | -88,974 | 53,789 | 609,537 | |

| Cash flow from investing activities | -32,962 | -75,085 | -24,984 | -32,077 | -67,943 | -7,100 | |

| Cash flow from financing activities | -82,366 | 191,526 | 149,891 | 396,399 | 18,139 | -120,077 | |

| Cash and cash equivalents at end of period | 163,792 | 363,227 | 686,315 | 961,663 | 965,648 | 1,448,007 | |

| Number of employees | 118 | 164 | 201 | 233 | 266 | 242 | |

(Unit: Thousand yen)

*1: A 40-for-1 split of ordinary shares was carried out on 4 October 2019, a 2-for-1 split of ordinary shares on 1 July 2022 and a 2-for-1 split of ordinary shares on 1 April 2023. Book value per share and EPS in the table are calculated assuming such splits were carried out at the beginning of the year ended 31 December 2017.

Source: Omega Investment from company materials.

Financial results for 3Q of FY2023

After the close of trading on 13 November 2023, Sportsfield Co., Ltd. (hereafter referred to as ‘the company’) announced its financial results for 3Q FY12/2023 (July – Sep). Fine growth continues, and the company revised up its full-year forecasts. The KPIs for next year’s performance – the value of orders for New Graduate Events for March 2025 graduates and the number of new registrations for Sponavi and Sponavi Agents – have both been steadily increasing, raising expectations of earnings growth in the coming year.

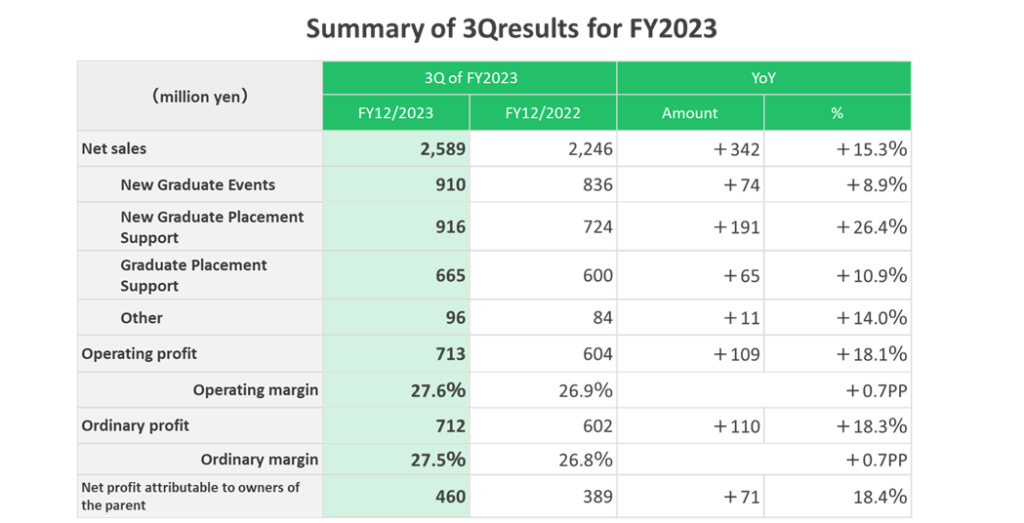

Record highs again

In cumulative 3Q results (Jan-Sep), sales reached 2.59 billion yen (+15% YoY), operating profit 710 million yen (+18% YoY), ordinary profit 710 million yen (+18% YoY) and net profit attributable to owner of the parent 460 million yen (+18% YoY), all new record highs. Operating and ordinary profit margins were also record highs. A breakdown of sales shows steady growth in all segments, particularly in New Graduate Placement Support. The post-pandemic recovery in job demand provides a tailwind to the company’s operating base, which it constructed.

In the 3Q (July-Sep) alone, sales were 700 million yen (+15% YoY), operating profit was 80 million yen (+22% YoY), ordinary profit was 80 million yen (+24% YoY), and net profit attributable to owner of the parent was 50 million yen (+18% YoY). The company’s business performance is seasonal, with growth tending to slow in the year’s second half. Despite this, it is able to drive sales and profits in the current fiscal year.

The company’s full-year forecasts were raised in the result announcement. The new estimates are sales of 3.38 billion yen (previous forecast: 3.19 billion yen; +18% YoY), operating profit of 830 million yen (680 million yen; +30%), ordinary profit of 830 million yen (680 million yen; +30%) and net profit attributable to owners of the parent of 540 million yen (440 million yen; +30%). A backward calculation suggests steady profit growth in Q4. This is a substantial figure given the usual seasonality of the company’s business performance. Still, given that the revision was made only in November, it can be presumed that the new full-year forecast is highly achievable. We would take it as positive.

Source: company materials.

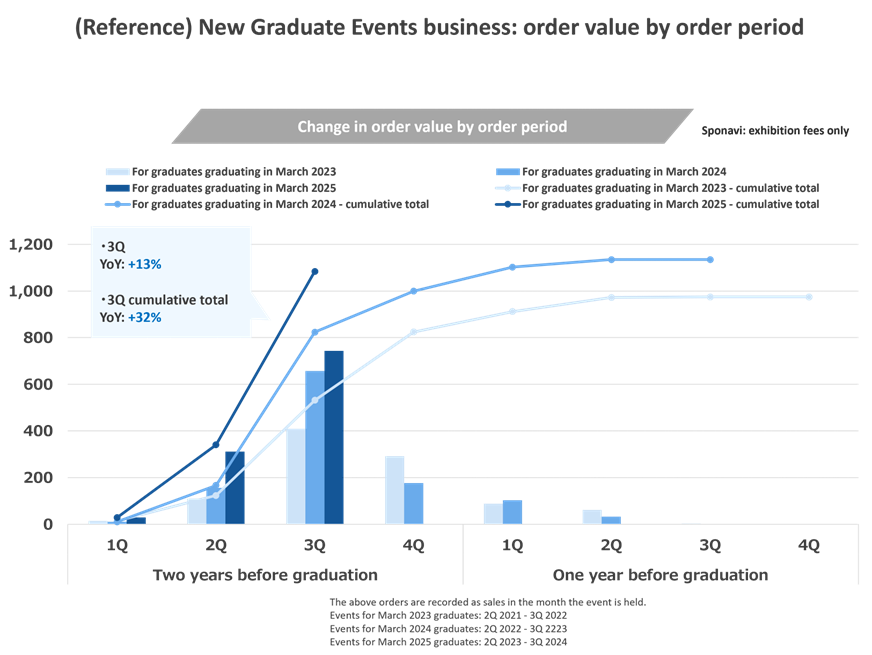

New Graduate Events

Cumulative 3Q sales were 910 million yen (+9% YoY). The number of events held fell slightly YoY, but a shift from online events to in-person and large-scale events drove the number of slots sold and sales.

Orders, which spell for next year’s performance, remain solid. Demand from companies to exhibit at events for March 2025 graduates is strong, with cumulative orders for these events up 32% year-to-date compared to those for March 2024 graduates. If orders for these events are successful, the company can use its sales force to introduce individual students to human capital ahead of schedule, so the increase in orders is a positive sign for growth in the coming year.

Source: company materials.

New Graduate Placement Support

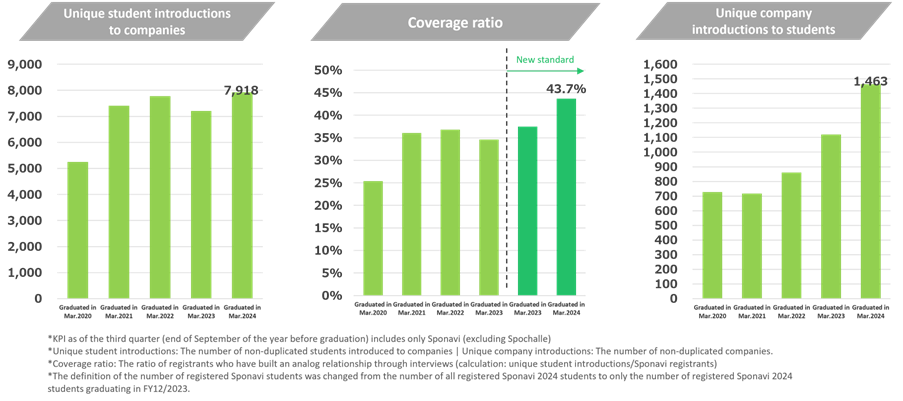

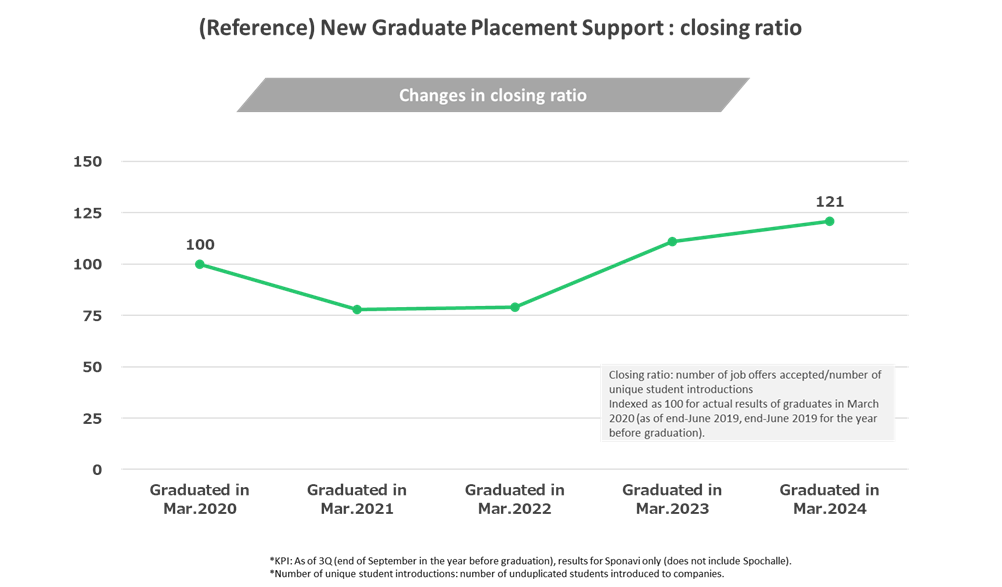

Cumulative 3Q sales grew significantly to 920 million yen (+26% YoY). Although the number of students registered on Sponavi, which indicates the number of athletic teams students registration, was slightly lower for students graduating in March 2024 than for those graduating in March 2023, the company was able to raise the student coverage ratio by its employees in response to the earlier start of job hunting, and the number of unique company introductions increased significantly, resulting in a high closing ratio. The number of students has exceeded that of the same period of the previous year.

Source: company materials.

Source: company materials.

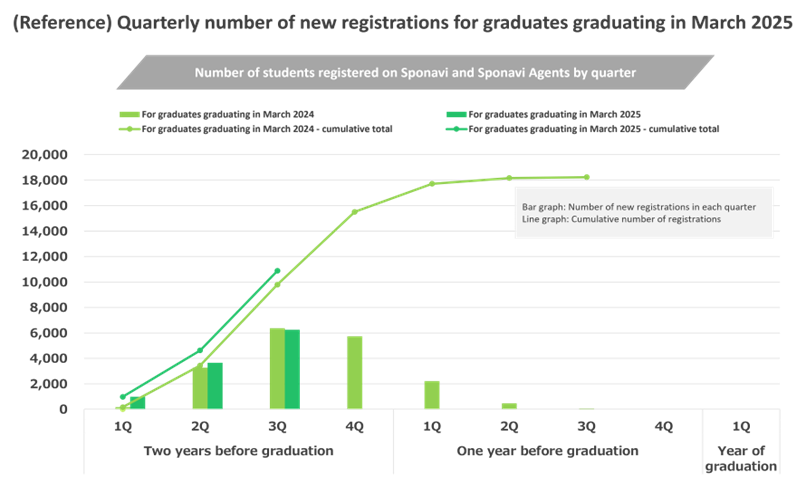

Another important KPI for the coming year is the increase in the number of new registrations for graduates graduating in March 2025, which has also exceeded the pace of results for graduates graduating in March 2024, suggesting continued growth in the coming year.

Source: company materials.

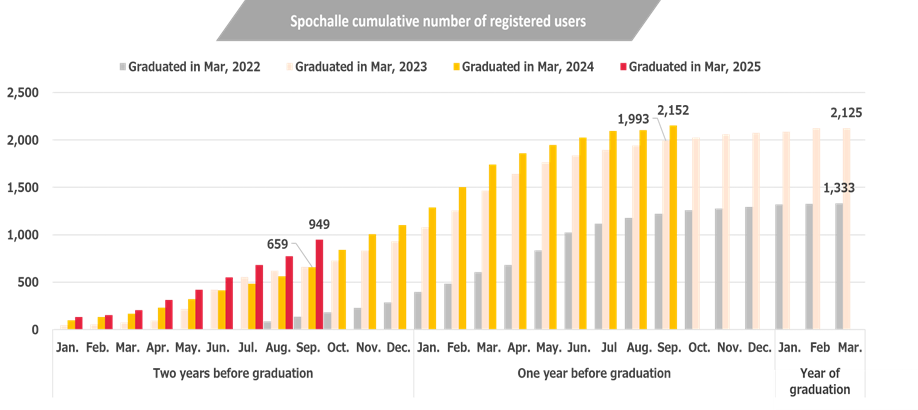

The growth of Spochalle (an employment support service targeting sports personnel, including those with experience in circles, clubs, off-campus sports teams and high school club activities) also continues. Cumulative 3Q sales were 140 million yen (+37% YoY). The number of registrations and unique student introductions grew significantly, accounting for 15% of sales in the New Graduate Placement Support business.

Graduate Placement Support

Cumulative 3Q sales of 670 million yen (+11% YoY) were also a record high. The number of new registrations for Sponavi Career and Spochalle Jobchange remained high in 3Q, and corporate demand for recruitment remained strong, with the number of unique human capital introductions and unique company introductions increasing YoY. It is also positive that the number of human resources introductions from one of the new businesses, Spojoba (a recruitment website specialising in sports-related companies and mainly offering online matching), has increased and is contributing to earnings.

Announcement of increase in dividend payout ratio

The dividend payout ratio was raised from nill to 20%, and dividend payments will commence.

On 20 November, the company announced a change in its dividend policy. The dividend payout ratio will be raised from zero to 20%, as the company believes it has solidified its financial base and will start paying dividends from the end of FY12/2023. A dividend of 30 yen is planned, giving a dividend yield of 1.8%.

This increase in the dividend payout ratio is positive and is a milestone in balancing sustained growth and attention to capital efficiency going forward.

The company’s financial structure has been such that cash, deposits and net assets have built up during periods of earnings growth. And as sales and profits have continued to grow, there has been concern about a decline in capital efficiency. Going forward, the commencement of dividend payments will reduce the rate of retained earnings, limiting the pace of net assets inflation. This is positive as the company has stepped up to a stage where it can pay more attention to capital efficiency while continuing to expand its financial base for medium- and long-term growth. This is also likely to attract investors interested in receiving more dividends.

Share price trend

The company’s share price has soared on the announcement of 3Q results and the start of dividend payments and looks set to reach the high of 1,894 yen registered in July this year.

Points of interest

We would like to highlight three points of immediate interest.

First, the likelihood of sustained growth in the coming year. As we have already seen, the value of event orders for March 2025 graduates is growing steadily. Thus, the focus will now be on the number of students registered on Sponavi for students-athletic team students graduating in March 2025, Spochalle registrations for students with sports experience and the trends in the coverage ratio of registrants by the company’s sales staff. In addition, the level of activities in the recruitment market also needs to be monitored.

Secondly, how well the company will strengthen its new revenue base outside of new graduates, such as Graduate Placement Support and Spojoba, a recruitment website specialising in sports-related companies.

Third, will there be any company statement on the direction of the next medium-term management plan, and what could it entail? The latest upward earnings revision by the company shows that it will overachieve the profit target for the final year of the current medium-term management plan (2022-2024) in FY12/2023, given that the KPIs that account for FY12/2024 performance are also growing steadily, one cannot help but wonder what the next medium-term management plan aims to achieve. Although it is too early to say, we hope that the company will give us some indication of the direction or general framework of the plan.

In that case, in addition to numerical profit and loss targets, we would like to hear from the company reiteration of its policy on expanding growth drivers and its approach to capital efficiency. We would also like to see the company gradually detail its path to moving to the TSE Prime Market and its possible countermeasures should the recruitment market cool down next.

Financial results

Full-year financial results

Financial period |

FY12/2019 |

FY12/2020 |

FY12/2021 |

FY12/2022 |

FY12/2023 |

FY12/2024 |

Consolidated, Japanese GAAP |

(IPO) |

Company

|

Medium-term

|

|||

[Statements of income] |

||||||

Net sales |

1,918 |

1,883 |

2,130 |

2,866 |

3,381 |

3,600 |

Operating profit |

194 |

16 |

-32 |

637 |

828 |

768 |

Ordinary profit |

192 |

32 |

-35 |

634 |

827 |

767 |

Net profit before income taxes |

192 |

32 |

-81 |

634 |

||

Net profit attributable to owners of

|

133 |

17 |

-79 |

412 |

537 |

|

[Balance Sheets] |

||||||

Total assets |

1,106 |

1,488 |

1,541 |

2,127 |

||

Total liabilities |

676 |

1,041 |

1,173 |

1,347 |

||

Total net assets |

430 |

447 |

368 |

781 |

||

Total borrowings |

334 |

731 |

749 |

630 |

||

[Statements of cash flows] |

||||||

Cash flow from operating activities |

198 |

-89 |

54 |

610 |

||

Cash flow from investing activities |

-25 |

-32 |

-68 |

-7 |

||

Cash flow from financing activities |

150 |

396 |

18 |

-120 |

||

Free cash flow |

173 |

-121 |

-14 |

602 |

||

Cash and cash equivalents at end of period |

686 |

962 |

966 |

1,448 |

||

[Efficiency] |

||||||

Ratio of ordinary profit to sales |

10.0% |

1.7% |

-1.7% |

22.1% |

24.5% |

21.3% |

ROA |

14.4% |

1.3% |

-5.2% |

22.5% |

||

ROE |

47.3% |

3.9% |

-19.4% |

71.8% |

||

[Per-share] Unit : Yen |

||||||

EPS (Adjusted for stock splits, etc.) |

41 |

5 |

-22 |

114 |

148 |

|

BPS (Adjusted for stock splits, etc.) |

122 |

127 |

103 |

216 |

||

DPS (Adjusted for stock splits, etc.) |

0 |

0 |

0 |

0 |

30 |

|

[Number of employees] |

||||||

Number of consolidated employees |

201 |

233 |

266 |

242 |

(Unit: million yen)

Source: Omega Investment from company materials. The per-share indicators EPS and BPS are adjusted for the 1:2 share split carried out in April 2023.

Quarterly results

2022Q1 |

2022Q2 |

2022Q3 |

2022Q4 |

2023Q1 |

2023Q2 |

2023Q3 |

|

Net sales |

774 |

862 |

609 |

619 |

919 |

971 |

698 |

New Graduate Events |

507 |

267 |

61 |

292 |

578 |

267 |

64 |

New Graduate Placement support |

79 |

290 |

354 |

119 |

92 |

426 |

396 |

Graduate Placement Support |

158 |

277 |

164 |

176 |

213 |

247 |

204 |

Other |

28 |

26 |

29 |

31 |

34 |

30 |

32 |

Operating profit |

232 |

301 |

69 |

32 |

315 |

312 |

84 |

Ordinary profit |

231 |

301 |

68 |

31 |

314 |

312 |

84 |

Net profit attributable to owners of

|

148 |

196 |

45 |

23 |

205 |

202 |

53 |

Source: Omega Investment from company materials.

Useful information

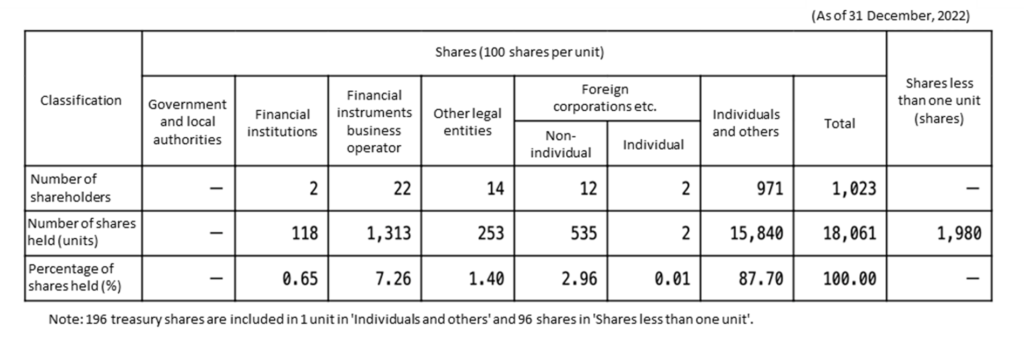

Principal shareholders

| Name | Number of shares owned |

Ratio of the number of shares owned to the total number of issued shares (%) |

| Katsushi Shinozaki | 409,000 | 22.62 |

| Kazuyoshi Ijichi | 209,600 | 11.59 |

| Tadashi Kaji | 209,600 | 11.59 |

| Shota Morimoto | 209,600 | 11.59 |

| Rakuten Securities, Inc. | 27,400 | 1.51 |

| Sportsfield Employee Stock Ownership Plan | 25,200 | 1.39 |

| Nomura Securities Co., Ltd. | 19,700 | 1.08 |

| Toyotaro Shigemori | 16,800 | 0.92 |

| NOMURA PB NOMINEES (Standing proxy: Nomura Securities Co., Ltd.) | 16,200 | 0.89 |

| Medical Corporation Takemura Medical Nephro Clinic | 16,000 | 0.88 |

| Katsumi Takemura | 16,000 | 0.88 |

| Total | 1,175,100 | 64.99 |

Shareholder composition