Komehyo Holdings (Price Discovery)

Buy

Profile

Japan’s largest buyer and seller of pre-owned brand-name goods and used goods. 94% of sales come from the Brand&Fashion business. Founded in 1947 by Daiji Ishihara, the company’s founder, who began his business peddling used clothing. Headquartered in Nagoya.

| Securities Code |

| TYO:2780 |

| Market Capitalization |

| 52,570 million yen |

| Industry |

| Retail trade |

Stock Hunter’s View

Renewed attention on inbound-related issues. Expect a full-fledged revival of Chinese visitors to Japan.

It was revealed that the preliminary amount of travel spending by foreigners visiting Japan in 2023 was 5,292.3 billion yen, a record high. Furthermore, a record number of 9 billion Chinese people are expected to travel during the 40 days around the Chinese New Year holiday this year.

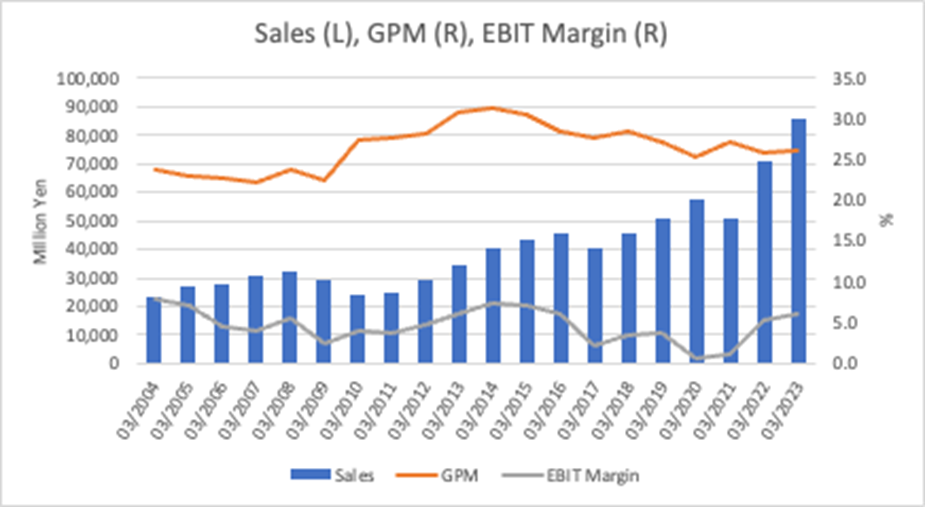

Komehyo HD, the leader in pre-owned brand-name goods, is another inbound-related stock, and there are expectations that profit growth will gain momentum from the 4Q (January-March) onward. The tailwind is only getting more robust with the high evaluation of Japanese reused products, price hikes for brand-new products, and the weak yen.

Despite the slow return of Chinese visitors to Japan, the company’s performance growth has not waned. As early as last August, it had already revised up its full-year forecast for FY3/2024. Operating income was revised from the initial forecast of 5.8 billion yen (+12% YoY) to 7.2 billion yen (+39% YoY ), and the company expects to record its highest consecutive year of profits.

In addition to strong individual purchases, retail sales, including inbound sales, were strong at sales outlets due to a full lineup of popular items purchased from corporates, particularly brand bags. Due to strong individual purchases, corporate sales, including corporate auctions, are also increasing.

In the 3Q results to be announced on February 13, the focus will be on the large-scale “KOMEHYO SHIBUYA” store that opened last November and the results of the year-end sales season.

Investor’s View

BUY. There is scope for PBR to expand in the near term. Long-term earnings forecasts are difficult. However, there is little concern about near-term earnings growth, and the current earnings momentum is strong.

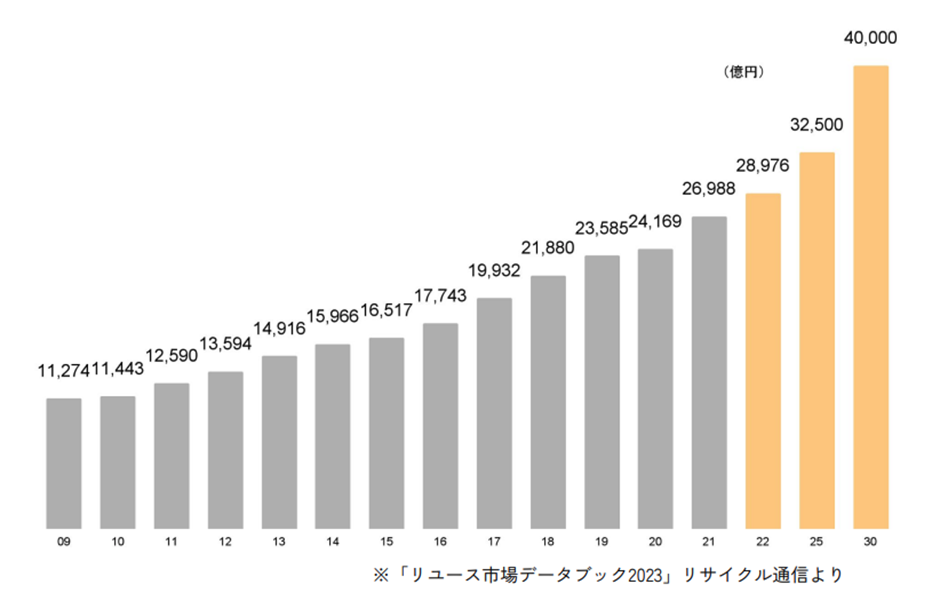

The drivers of the Company’s business expansion are the expansion of the domestic reuse market and rising unit prices. Inbound demand accounts for 10% of consolidated sales and is not as strong a driver as Stock Hunter suggests. For now, trends in the domestic market are most important.

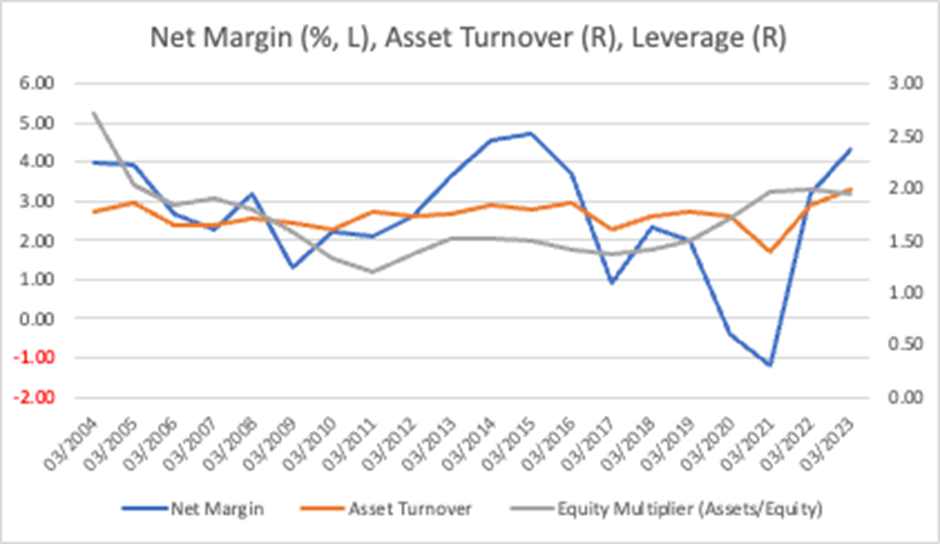

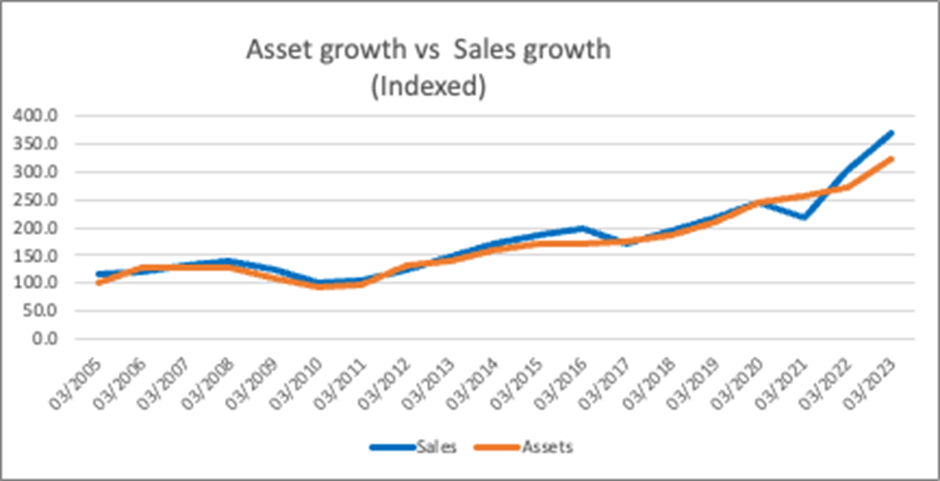

The Company is a Good Business

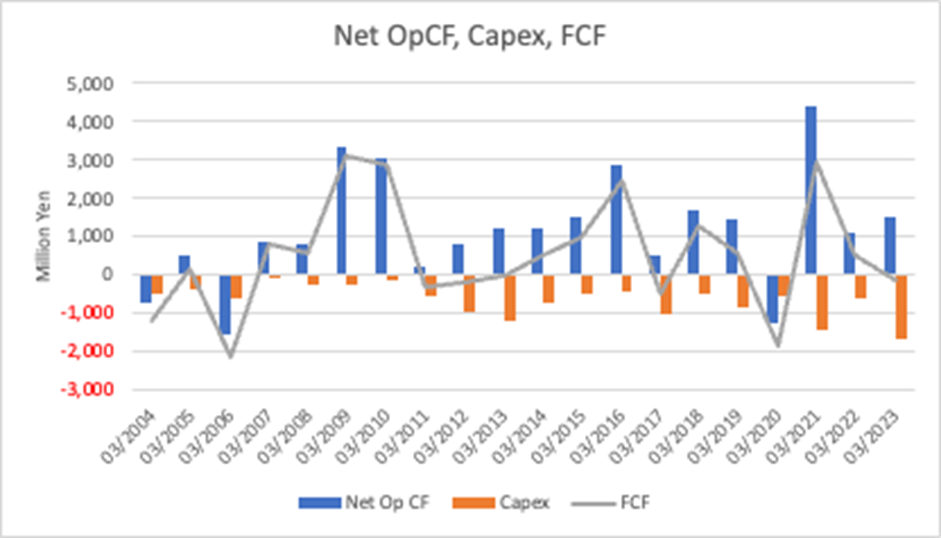

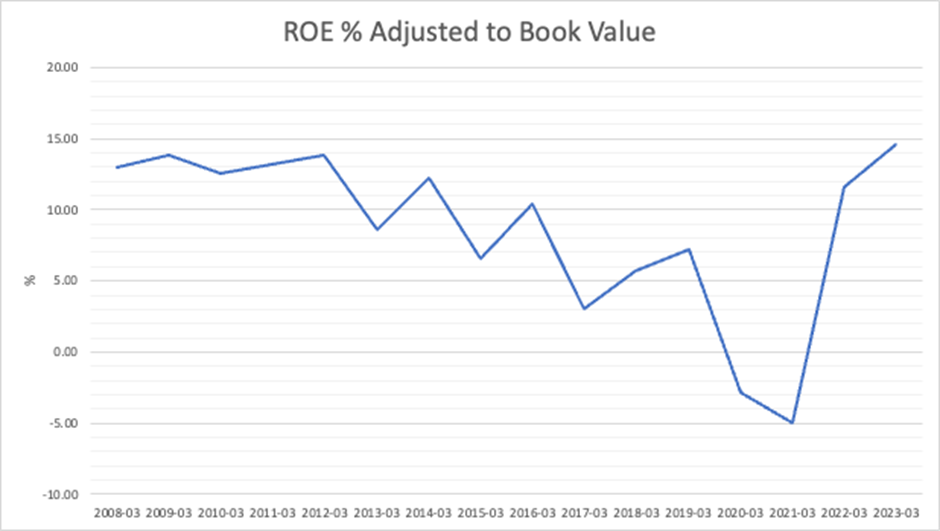

We think the Company is growing sales by skillfully capturing market demand. Also, the company’s structure allows growth without diluting return on equity. In fact, over time, asset growth has matched sales growth comfortably. While the nature of the business means that inventory fluctuations decisively affect BS assets, President Ishihara notes that inventory turnover can be well controlled even as inventories increase thanks to multiple sales channels. Inventory accounts for about 40% of assets; turnover has generally been in the 3-4x range over the last five years.

90% of consolidated sales are domestic

10% of consolidated sales are overseas, and 90% are domestic. Domestic customers are primarily in their 40s and 50s. E-commerce sales account for less than 40%. Retail sales account for 41% and corporate sales for 59%. In terms of purchases, individuals account for 78% and corporations 22%; in GPM, individual purchases are higher than corporate purchases, and in sales, retail sales are higher than corporate sales. Hence, the trend of rising retail sales ratio is positive for the earnings.

Inbound demand is 10% of sales and has already returned considerably

12% of domestic sales are duty-free; thus, 10% of consolidated sales are inbound demand. Domestic duty-free sales breakdown is 43% China, 13% Taiwan, 10% the Philippines, 8% the U.S., 5% Thailand, and 21% other regions. President Ishihara emphasised in his latest result presentation that buyers in their 30s and 40s account for 60% of domestic duty-free purchases. China accounted for 50% during the 2014/2015 shopping spree, so inbound demand has risen significantly.

Long-term earnings forecasts are difficult to predict

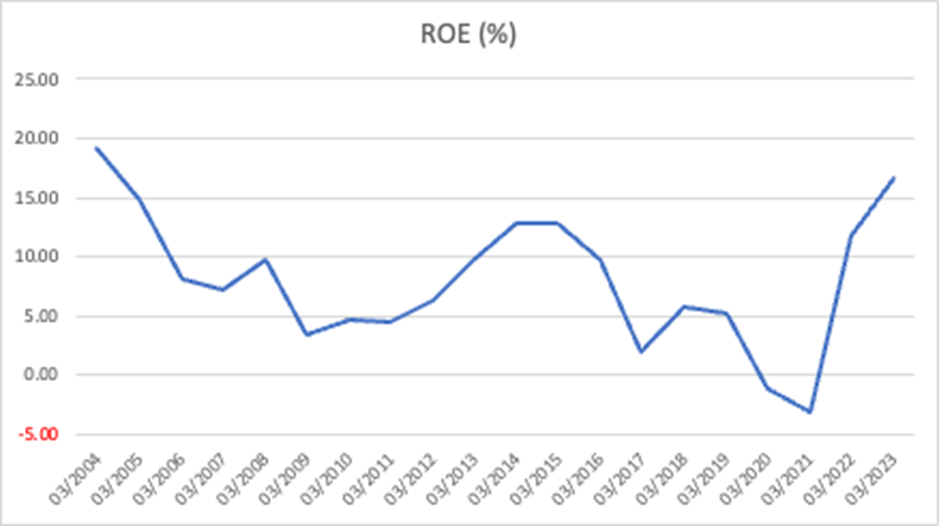

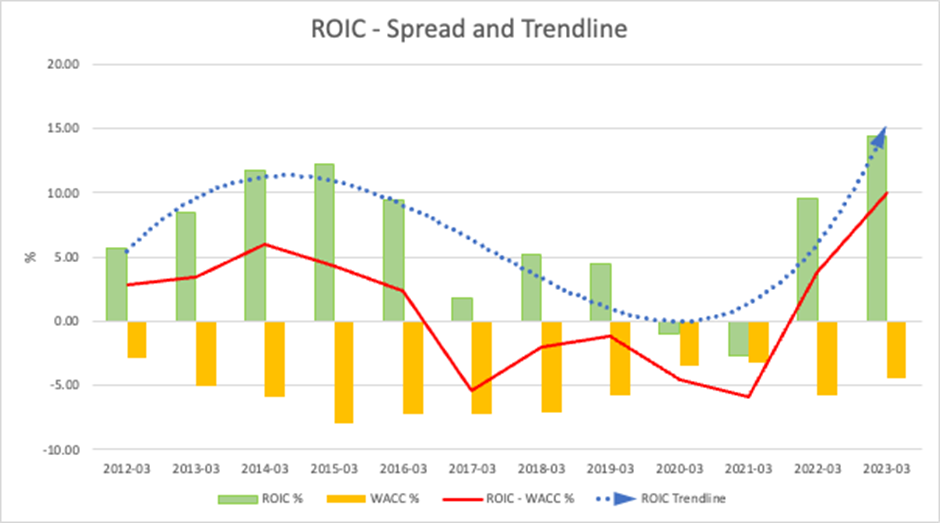

It is difficult to predict from company data whether the expansion of the domestic reuse market will continue to grow steadily as projected by the industry, how competition will affect the company, and how these factors will affect ROE and ROIC.

Domestic Reuse Market Size (100 million yen)

(Source) Company material

The reuse market is a new demand, and detailed research would be required before investing based on long-term earnings forecasts. However, there is little concern about earnings growth in the near term, and the current strong earnings momentum is very attractive. The stock price is also undervalued.

The shares are undervalued

A PBR of 1.9x has deviated upward from the 0.5x to 1.7x range since 2016, but the equity yield calculated by ROE/PBR is double the stock market average, suggesting scope for PBR to expand.

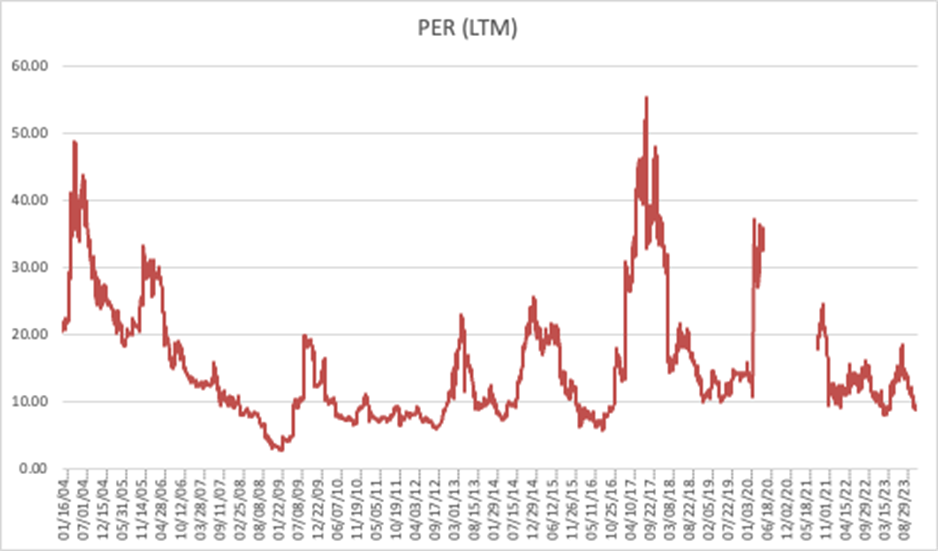

The PER is at the low end of the 10-year range.