Cyber Security Cloud, Inc. (Price Discovery)

Priced up

Profile

A web security company that prevents attacks from hackers. The company develops web security using AI. Established in 2010, it is the leader in Japan offering WAF (Web Application Firewall) “Kogeki Shan-kun (Attack Interceptor)”.

| Securities Code |

| TYO:4493 |

| Market Capitalization |

| 23,853 million yen |

| Industry |

| Information / Communication |

Stock Hunter’s View

Japan’s top cloud-based WAF and AWS-approved security company.

According to Tokyo Shoko Research, the number of incidents of leakage or loss of personal information disclosed by listed companies and others during 2023 reached 175 cases, amounting to 40.9 million people, both record highs. Expectations are high for the Cyber Security Cloud to play an active role amid the demand for thorough information security governance.

Its flagship product, “Kogeki Shadan-kun,” is a security service that detects and blocks external cyber-attacks to protect servers and sites from information leaks and service outages. It is characterised by its attack detection AI engine that uses deep learning to detect not only common attacks but also unknown attacks and false positives at high speed. It boasts the largest share of the cloud WAF market in Japan.

In the Tokyo market, AWS’s recent investment plan for cloud infrastructure in Japan sent related stocks all over the place. Still, many consider the company the “real deal” as it has a long track record of providing services on the AWS development platform and is Japan’s only certified AWS WAF Ready Program launch partner.

Performance was strong, and the company recorded a significant increase in operating income to 468 million yen (up 81.4% YoY) for the third quarter (January-September) of the FY12/2023, disclosed last November. Due partly to the weaker yen, the company revised up its full-year forecasts. At the same time, it announced its entry into the MSS (Managed Security Services) domain, and its FY12/2024 plan, which will be presented in its earnings announcement on February 14, will be the focus of attention.

Investor’s View

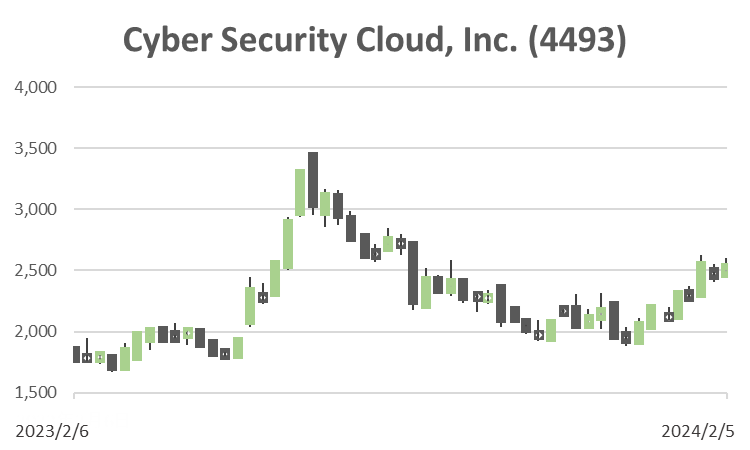

The company is a stable growth in the WAF market, but the stock price is priced up.

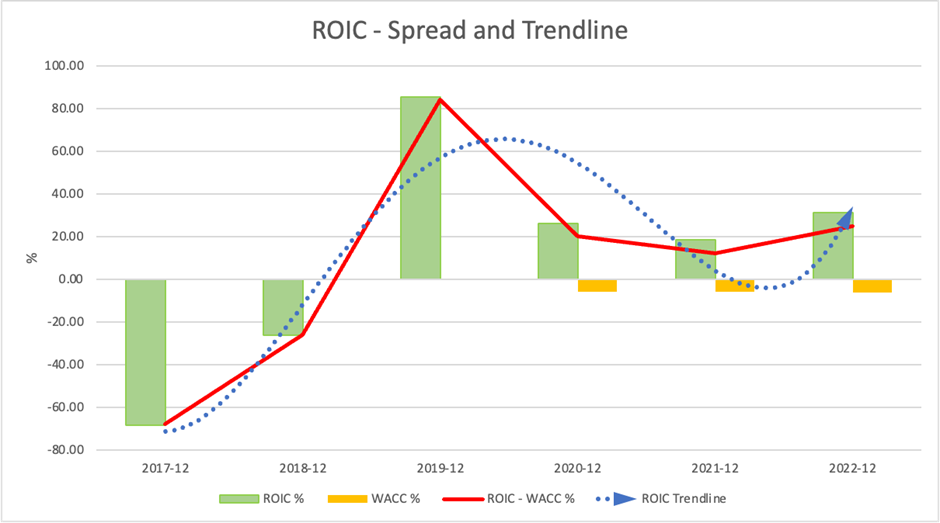

Four years have passed since the IPO, and valuations have settled down. The shares are trading on 50 times the earnings and 14 times the book. ROE is about 20%, and sales continue to grow at around +10%. Profitability is stable at 70% in GPM and EBIT margin of ca 15%-17%.

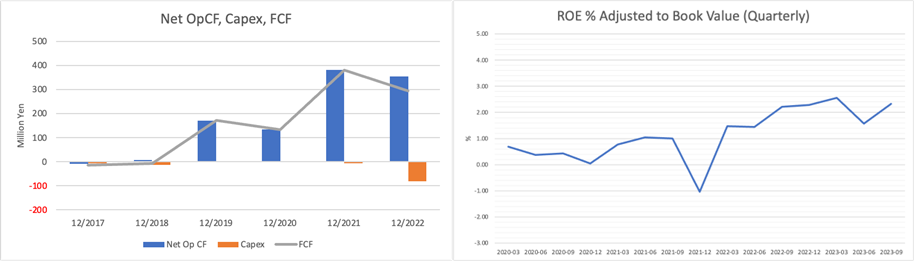

There is no surprise in the company’s ability to generate CF. Cash is snowballing, accounting for 64% of total assets at the end of December 2023. No significant investment plans or aggressive shareholder return ideas exist, so the high CF generation capacity will likely weigh on ROE. The DCF fair value is around 1,500 yen, and with a PBR-adjusted ROE of 2%, the stock is expensive even on a yield basis.

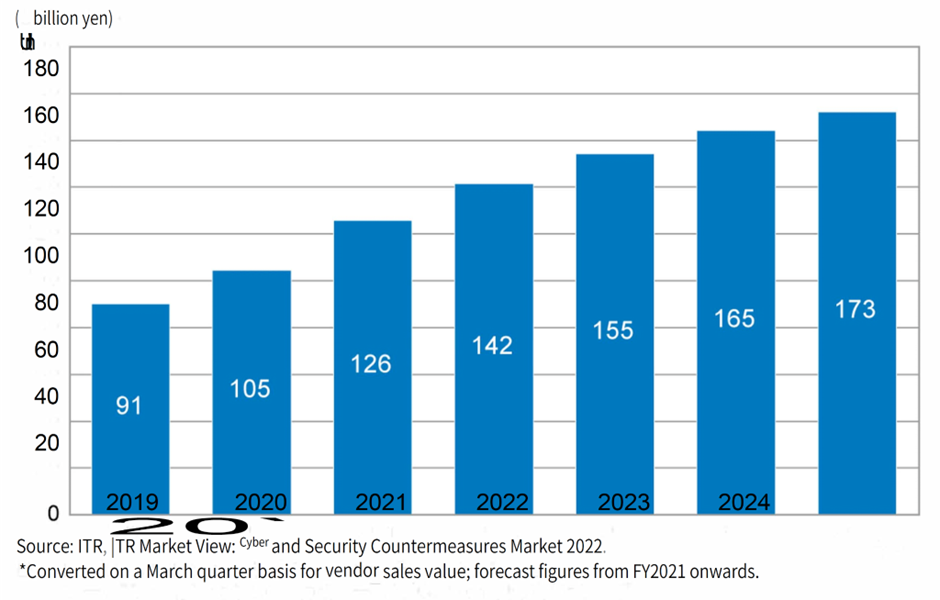

The domestic WAF market is smaller than one might think. The market is expected to grow steadily but not exponentially. The company is small in size, with sales of about 3 billion yen, and even if the top line grows in the double-digit range, it is felt that the already high share price multiples will not expand further.

WAF market size trends and forecasts (2019-2025 forecast)

Company material translated by Omega Investment