MIGALO Holdings (Price Discovery)

Speculative Buy

Profile

Develops, sells, leases, and rents real estate, mainly in the 23 wards of Tokyo. Supplies face recognition systems to condominiums and earns installation and usage fees. In addition to own-brand condominiums, the system has also been adopted by major developers such as Mitsubishi Estate. Commercialising the multi-platform FreeiD, which enables facial recognition in offices, condominiums, shopping, theme parks, etc., with a single facial recognition. Demonstration tests are underway in Kameoka City, Kyoto Prefecture, and a partial demonstration of linkage with the My Number Card has also been achieved. Percentage of sales % (OPM): Real Estate 96 (12), DX 4 (3) (2023.3)

| Securities Code |

| TYO:5535 |

| Market Capitalization |

| 13,863 million yen |

| Industry |

| Real estate |

Stock Hunter’s View

Moving away from a single-footed approach to the real estate business. Facial recognition is being introduced at a rapid pace.

Migalo HD has positioned the DX (Digital Transformation) promotion business as a growth pillar and is developing the face recognition platform FreeiD and DX support (system development services).

The core real estate business continues to see steady membership growth. Sales expansion has achieved stable earnings in response to investment real estate needs. In January this year, AKI Commerce and Associa Property, which own approximately 1,000 managed properties, were added to the group, further expanding the real estate economic zone.

The number of users of FreeiD is accelerating, with steady growth in the installation of the system on construction sites of major companies, in offices, and in condominiums developed by major developers. At present, there are no competitors to bat against, and in preparation for the full-fledged emergence of the market, the company is currently focusing on advancing facial recognition research and development and expanding the introduction of the system.

In addition, new uses are expanding, such as linkage with the My Number Card and face recognition payments. The aim is to grow into the distribution and retail sectors by reducing staffing, automating shop operations, etc. The commercialisation of face recognition payment services that enable shopping with a face pass, including POS linkage, will be considered.

Investor’s View

Speculative Buy. Share price drivers are short-term earnings momentum and investors’ interest in Japanese small-cap stocks.

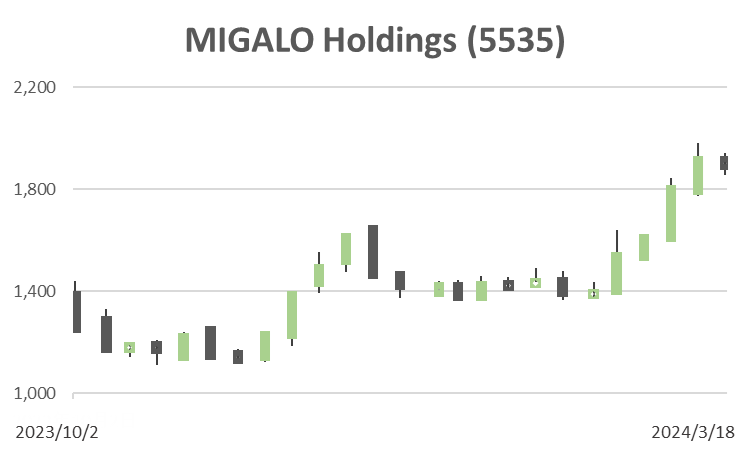

The IPO was in October last year, and the share price observation is just for a short period. The share price had been flat at around 1,500 yen YTD but has risen by 30% since the end of February, significantly outperforming the TOPIX. This is due to the increased interest in Japanese small-cap stocks amid the bull market and the company’s reassuring earnings momentum. The same makes us rate the shares a Speculative Buy.

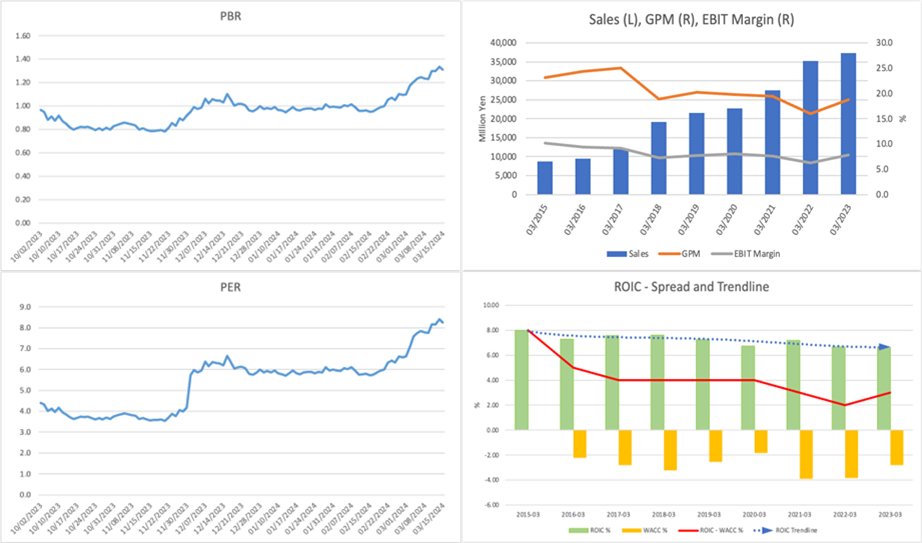

Depressed share price multiples reflect real estate industry discount

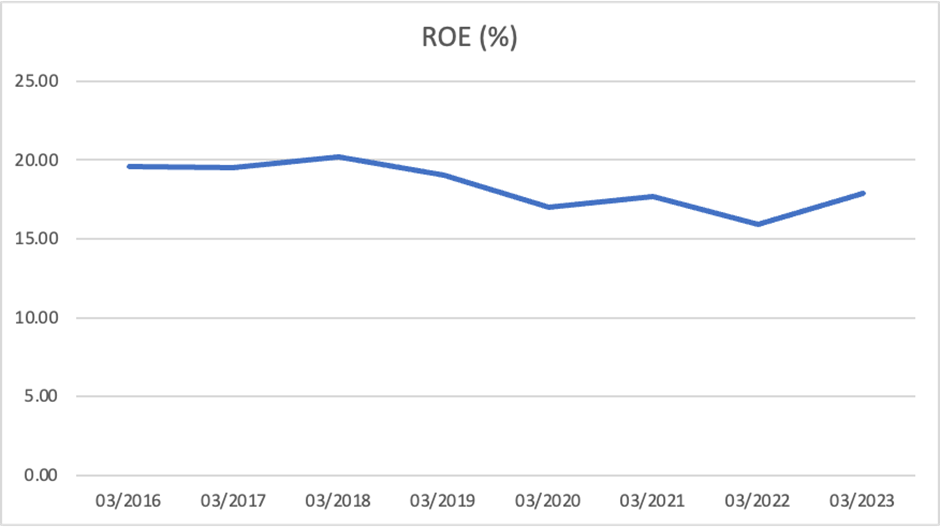

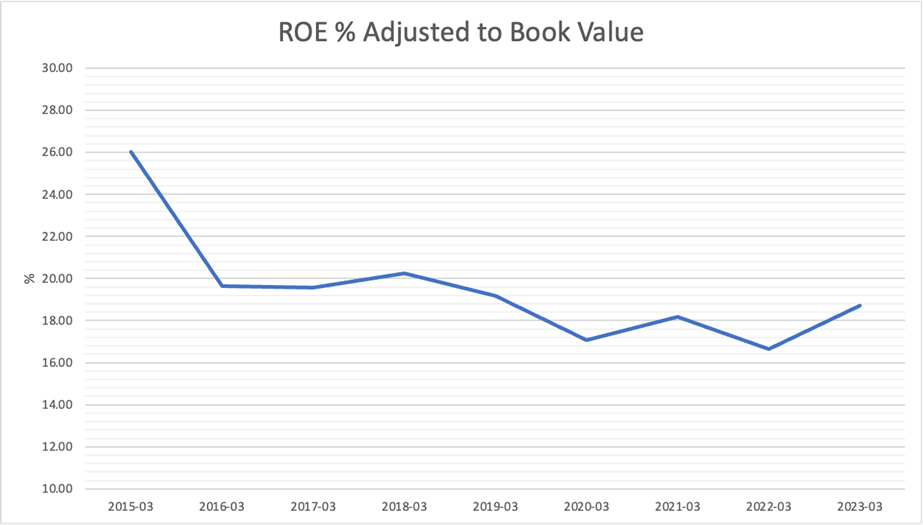

The shares of a company with an ROE of just under 20%, good economic value creation, and consecutive 20 fiscal periods of revenue and profit growth are currently trading at a PER of 8.3x and PBR of 1.3x. This reflects the typical real estate industry discount, as the real estate business is highly dependent on the economic environment, and long-term earnings are unpredictable.

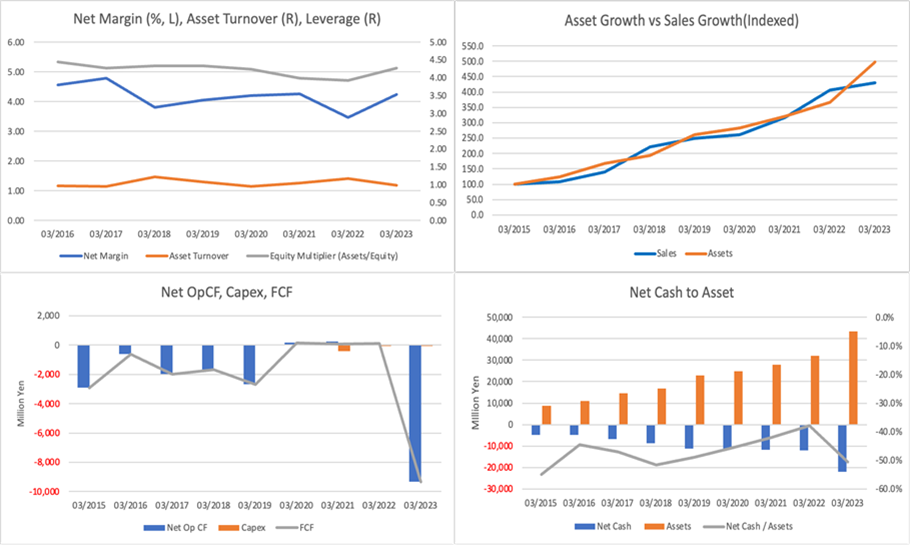

The company’s ROE is high because its leverage is over 4x. Its PL margins and asset turnovers are not particularly attractive. ROE should fall quite significantly when the property market shrinks down.

The majority of revenues come from the conventional real estate business

New businesses that bring DX into the real estate business, such as the face recognition business, are interesting. However, most of the company’s current revenues come from the conventional real estate business, while it is difficult to forecast revenues from the DX business. Therefore, the shares deserve price multiples awarded to the real estate business. The founding president, Mr Nakanishi, wants a PER of around 20x. For investors to value the shares that highly, a situation must be achieved where DX is expected to account for the majority of earnings and stable growth is foreseeable in the long term. PBR-adjusted ROE looks attractive, but one should not be misled by this, given the difficulty of forecasting long-term earnings.

Key takeaways relating to share price

The following summarizes the share price-relevant points taken from the company’s documents and videos. The IR materials for institutional investors to consider long-term ownership are insufficient.

- Sales and profits have increased for 20 consecutive years. Shareholder returns are strengthened through dividends.

- From investors’ point of view, the company operates without significant differences from other companies in developing and selling investment condominiums, purchasing and renovating second-hand properties, and brokerage, leasing, and management, mainly in the 23 wards of Tokyo. These are compact investment and residential condominiums of 25 square metres, 1LDK (One bedroom), etc., which the major players do not handle.

- In the first nine months of FY3/2024, new-build investment properties accounted for 38% of sales, second-hand investment properties 38%, own-brand residential flats 16%, and own-brand flats 3%. Facial recognition is introduced to own-brand properties.

- No medium-term plan has been announced, though the company’s target is to sell 100 billion yen in 2029. The real estate market size that can be approached is estimated at 2.1 trillion yen in the Tokyo metropolitan area alone, which compares to the previous year’s sales of 35.6 billion yen. The pipeline of construction plans, currently undisclosed, is under consideration for publication.

- According to the company, Japan’s facial recognition market is worth 1.4 trillion yen, and the market it can approach is worth 50 billion yen. The company currently generates only 300 million yen in sales. However, it states that it has no competition in facial recognition. This means that there are no suppliers with IT and real estate know-how. We believe the potential market is so large that new entrants will likely emerge in various ways.

- Facial recognition matching systems have been developed by NEC, Panasonic, Google, and Amazon with huge investments and have been introduced at places like airports. MIGALO chooses from among these engines when its customers introduce facial recognition for their properties. It can capture small demand as a business, such as for a single nursery school, which the big players do not touch.

- Although Panasonic and NEC are involved in developing face recognition engines, MIGALO is the only company that has introduced an ID platform and even handled payments. It intends to strengthen patents and drive top-line condominium and payment face recognition revenue. The face recognition business is a new business launched in 2020.