Sportsfield (Company note – 4Q update)

| Share price (3/25) | ¥1,599 | Dividend Yield (24/12 CE) | 2.0 % |

| 52weeks high/low | ¥1,894 / 1,206 | ROE(23/12) | 56.1 % |

| Avg Vol (3 month) | 17 thou shrs | Operating margin (23/12) | 25.4 % |

| Market Cap | ¥5.9 bn | Beta (5Y Monthly) | N/A |

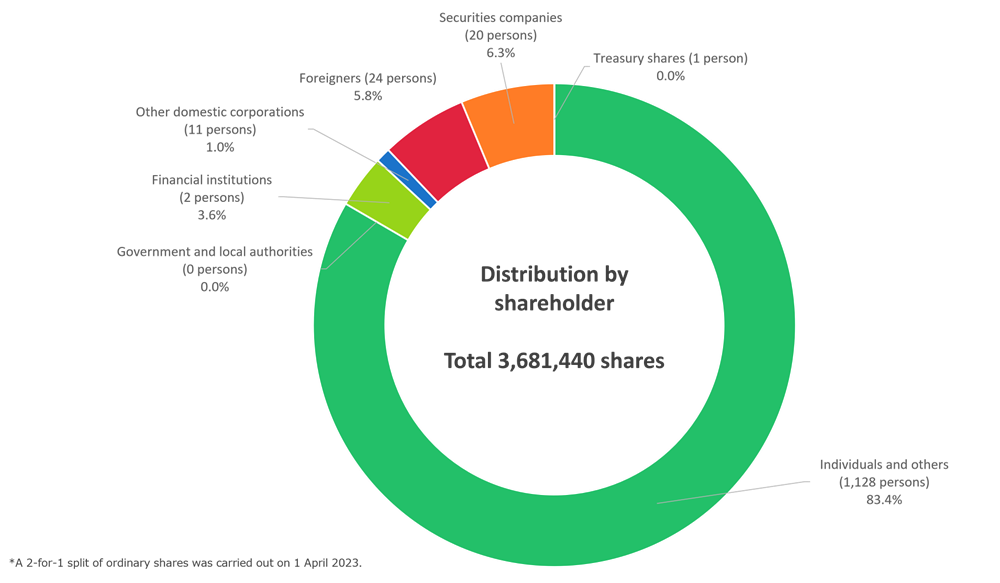

| Enterprise Value | ¥4.7 bn | Shares Outstanding | 3.68 mn shrs |

| PER (24/12 CE) | 9.9 X | Listed market | TSE Growth |

| PBR (23/12 act) | 4.2 X |

| Click here for the PDF version of this page |

| PDF Version |

Strong performance in 3Q FY12/2023 (Jul-Sep 2023). Upward revision of full-year forecasts and start of dividend payments announced.

Summary

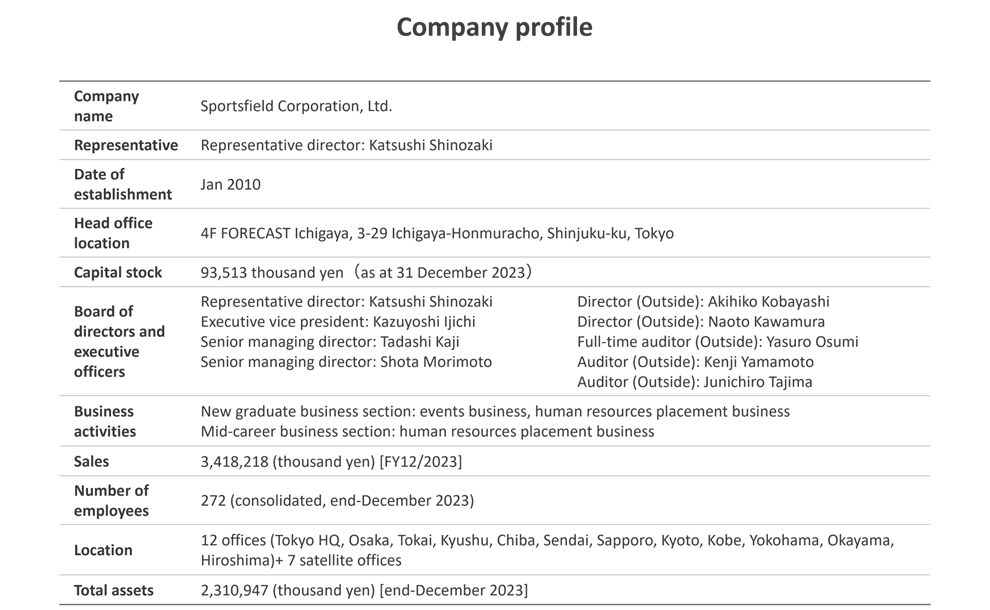

Company profile

◇Sportsfield Corporation Ltd. provides placement-related services, specialising in sports personnel nationwide. In FY12/2023, the company achieved sales of 3.42 billion yen and an ordinary profit of 870 million yen, boasting high sales margins and ROE.

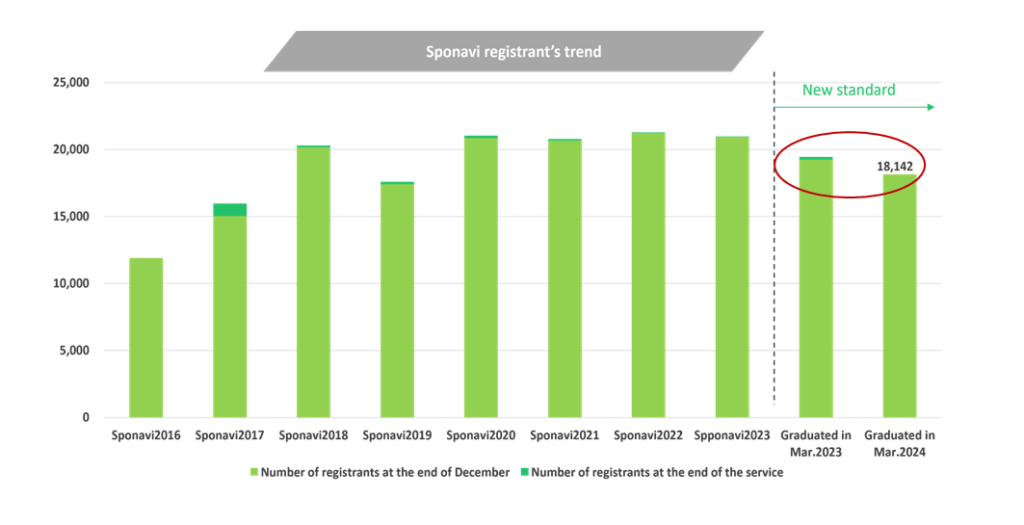

The company’s current main business is placement-related services for new graduates belonging to college athletic teams. It has established a system whereby sales staff, mainly those with sports experience, provide analog support to target students. The number of registered applicants for placement has grown to around 20,000 for each graduation year, and the company is making progress in developing job opportunities. The company is securing a leading position in this market.

◇Main business: sales comprise 40% of New Graduate Events for student athletic teams, 30% of the New Graduate Placement Support business for students with athletic and sports experience, and 26% of the Graduate Placement Support business (FY12/2023), with all sources of income coming from the corporate side.

FY12/2023 full-year results

◇Record high sales and profits exceeding the company’s full-year forecasts: for FY12/2023 (Jan-Dec), sales were 3.42 billion yen (+19% YoY), operating profit was 870 million yen (+37% YoY), ordinary profit was 870 million yen (+37% YoY), and net profit attributable to owners of the parent was 610 million (+48% YoY) yen. Sales, operating profit, ordinary profit, net profit attributable to owner of parent company, and operating profit margin all reached record highs. The company will start paying dividends with a target payout ratio of 20% as it has improved its financial base. The decision was made to pay a dividend of 33 yen per share, compared to the previously announced forecast of 30 yen per share.

Forecasts for FY12/2024 and recent developments

◇Forecasts for FY12/2024: sales of 3.75 billion yen (+10% YoY), operating profit of 900 million yen (+4% YoY), ordinary profit of 900 million yen (+4% YoY), net profit attributable to owner of parent of 590 million yen (-4% YoY), dividend per share of 32 yen (before taking into account a stock split at the end of March 2024). According to IR materials, the current KPIs have remained steady.

◇Development of reported shares: a 1:2 share split based on the end of March 2024, the intention of four internal directors who are major shareholders to sell their shareholdings (up to the equivalent of 2.6% of the total number of shares issued) between February and August 2024, and the establishment of an executive shareholding society in July 2024.

Share price and future highlights

◇Softer share price: The company’s share price has weakened following the announcement of its full-year results. This seems to be due to the company’s forecast for FY12/2024, which suggests a slowdown in growth and the concern about insider share sales.

◇Point of interest going forward: First, 1Q earnings trends. The earnings in the first quarter accounts for a high proportion of the full year’s earnings, and the result is a touchstone for the degree of achievement of the full year’s results. Secondly, the direction of the next medium-term management plan, which will cover the period from 2025 onwards. It is too early to expect the disclosure of details, but if the contours begin to emerge from the second half of the current financial year, this may hasten a reassessment of the shares’ upside potential. In this connection, the plan to stage up from the TSE Growth Market is also worth noting.

Table of contents

| Summary | 1 |

| Key financial data | 2 |

| FY12/2023 full-year results | 3 |

| A stock split, the sale of shareholdings of four internal directors who are major shareholders, the launch of an executive shareholding plan | 9 |

| Company forecasts for FY12/2024 | 10 |

| Share price trend | 13 |

| Points of interest | 14 |

| Financial results | 15 |

| Useful information | 17 |

Key financial data

| Fiscal Year | 2017/12 | 2018/12 | 2019/12 | 2020/12 | 2021/12 | 2022/12 | 2023/12 | |

| Net sales | 1,106,727 | 1,516,370 | 1,917,813 | 1,883,269 | 2,130,256 | 2,866,214 | 3,418,218 | |

| Ordinary profit | 60,171 | 113,916 | 192,045 | 32,016 | -35,298 | 634,239 | 869,134 | |

| Net income | 41,031 | 72,809 | 132,965 | 17,055 | -79,133 | 412,318 | 608,172 | |

| Capital stock | 10,300 | 10,300 | 92,680 | 92,712 | 92,869 | 93,079 | 93,513 | |

| Total number of shares issued |

Ordinary shares (shares) Class A shares (shares) |

20,000 400 |

20,400 – |

881,600 – |

882,560 – |

897,400 – |

1,808,080 – |

3,681,440 – |

| Net asset | 59,396 | 132,205 | 429,932 | 446,826 | 368,007 | 780,524 | 1,389,498 | |

| Total asset | 418,961 | 735,377 | 1,106,275 | 1,488,182 | 1,540,544 | 2,127,327 | 2,310,947 | |

| Book value per share*1 (Yen) | 18.20 | 40.50 | 121.92 | 126.58 | 102.53 | 215.87 | 377.48 | |

| EPS*1 (Yen) | 12.57 | 22.31 | 40.68 | 4.83 | -22.21 | 114.44 | 167.46 | |

| Equity to asset (%) | 14.2 | 18.0 | 38.9 | 30.0 | 23.9 | 36.7 | 60.1 | |

| ROE (%) | 100.6 | 76.0 | 47.3 | 3.9 | -19.4 | 71.8 | 56.1 | |

| Cash flow from operating activities | 108,208 | 82,994 | 198,181 | -88,974 | 53,789 | 609,537 | 448,887 | |

| Cash flow from investing activities | -32,962 | -75,085 | -24,984 | -32,077 | -67,943 | -7,100 | -68,115 | |

| Cash flow from financing activities | -82,366 | 191,526 | 149,891 | 396,399 | 18,139 | -120,077 | -371,385 | |

| Cash and cash equivalents at end of period | 163,792 | 363,227 | 686,315 | 961,663 | 965,648 | 1,448,007 | 1,457,392 | |

| Number of employees | 118 | 164 | 201 | 233 | 266 | 242 | 272 | |

(Unit: Thousand yen)

*1: A 40-for-1 split of ordinary shares was carried out on 4 October 2019, a 2-for-1 split of ordinary shares on 1 July 2022 and a 2-for-1 split of ordinary shares on 1 April 2023. Book value per share and EPS in the table are calculated assuming such splits were carried out at the beginning of the year ended 31 December 2017.

Source: company materials.

FY12/2023 full-year results

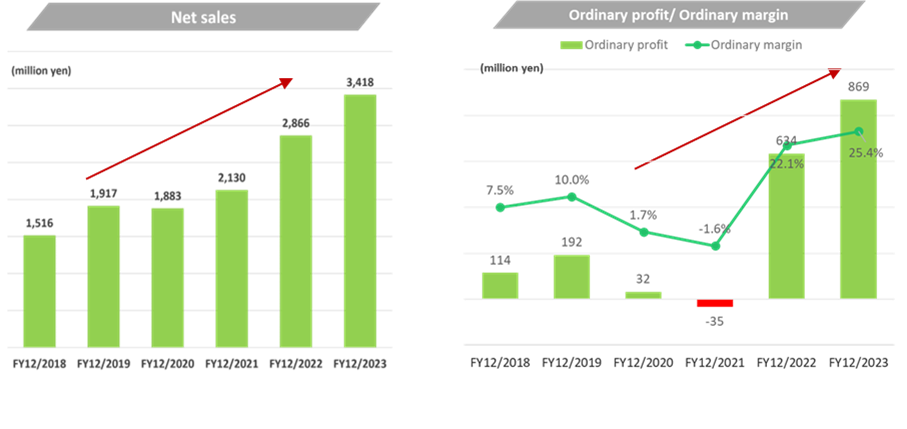

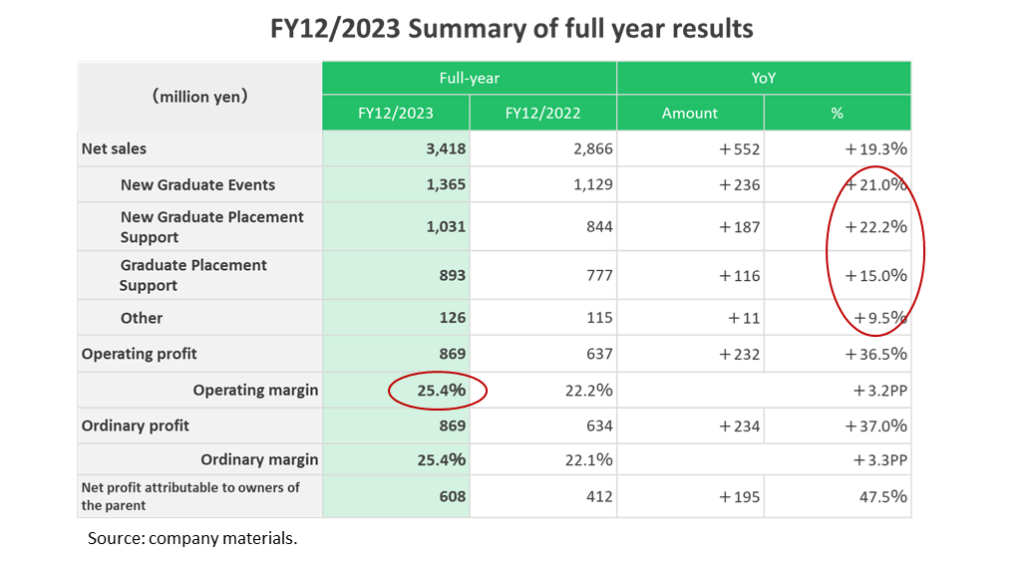

Sportsfield Corporation Ltd. announced its full-year of FY12/2023 (Jan-Dec) results after the close on 13 February 2024. The company revised up when it announced its 3Q results, but the results exceeded these forecasts at the sales and each stage of profit, resulting in record high sales and profits.

Record highs

For FY12/2023 (Jan-Dec), sales were 3.42 billion yen (+19% YoY), operating profit was 870 million yen (+37% YoY), ordinary profit was 870 million yen (+37% YoY), and net profit attributable to owner of the parent was 610 million yen (+48% YoY). Sales, operating profit, ordinary profit, net profit attributable to owner of parent company, and operating profit margin all reached record highs. Compared to the company’s financial performance before the coronavirus epidemic, sales and profit margins are higher, indicating that the company is turning the recovery in the recruitment market into an accurate business.

Source: company materials.

New Graduate Events, New Graduate Placement Support , and Graduate Placement Support all show balanced double-digit revenue growth.

The growth in performance in the fourth quarter was remarkable. Traditionally, 4Q has tended to be less profitable. This time, however, recruitment demand for students graduating in March 2025 strengthened early on, and the company saw a significant increase in sales from New Graduate Events in response.

Tax credits from applying the tax incentive for wage increases have also contributed to the increase in net profit attributable to owner of parent (as discussed below, the company plan for FY12/2024 does not take such credits into account, although wage increases are planned in the company plan).

Commencement of dividend payments

Having achieved an equity ratio of over 50% and net assets of over 1 billion yen, the company has deemed that it has made progress in improving its finances and will start paying a dividend with a target payout ratio of 20%. The dividend is set at 33 yen per share, compared with the previously announced forecast of 30 yen per share.

The start of the dividend signals that the company has established its financial base and will respond to the needs of a diverse range of investors. It is also expected to have a positive effect on maintaining the level of ROE.

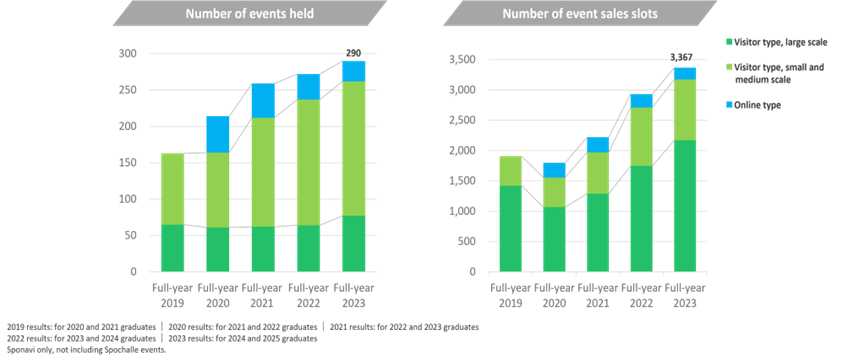

New Graduate Events

Full-year sales were 1.37 billion yen (+21% YoY). Both the number of events held and the number of slots sold increased YoY. The shift from online to in-person and large-scale events continued, driving the number of slots sold and sales.

Source: company materials.

New Graduate Placement Support

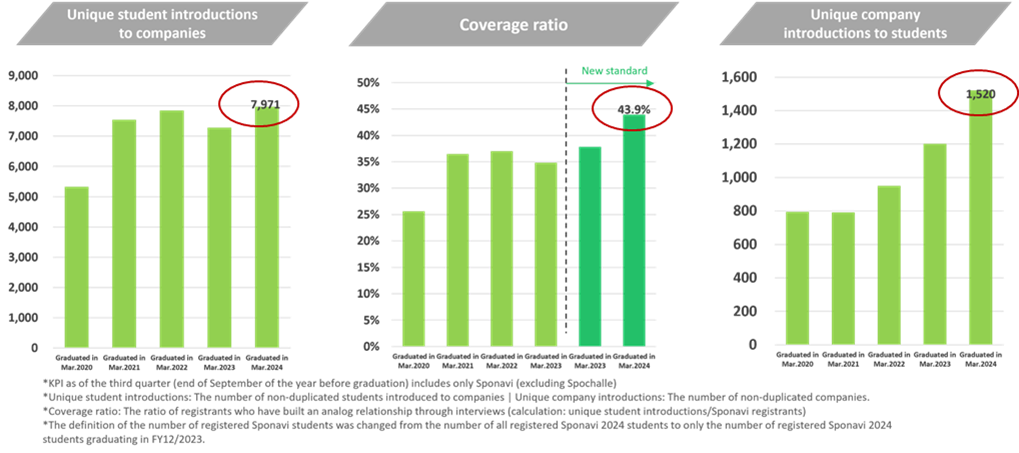

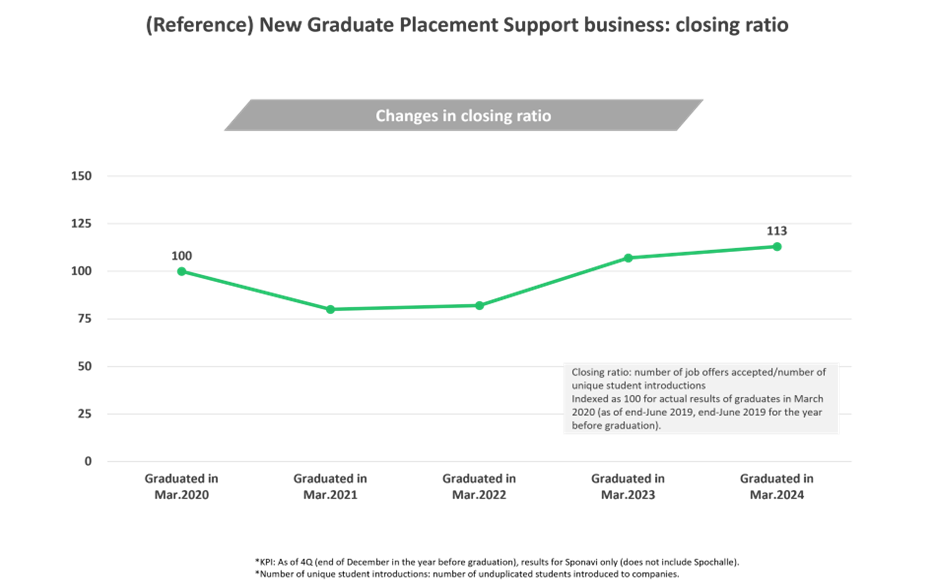

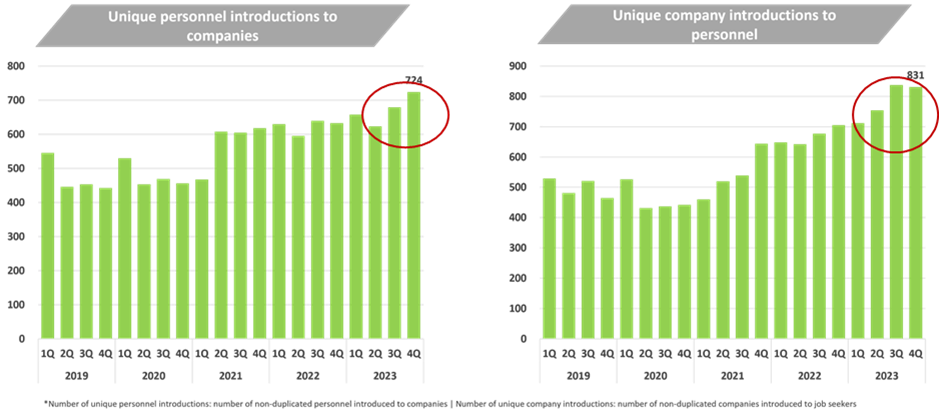

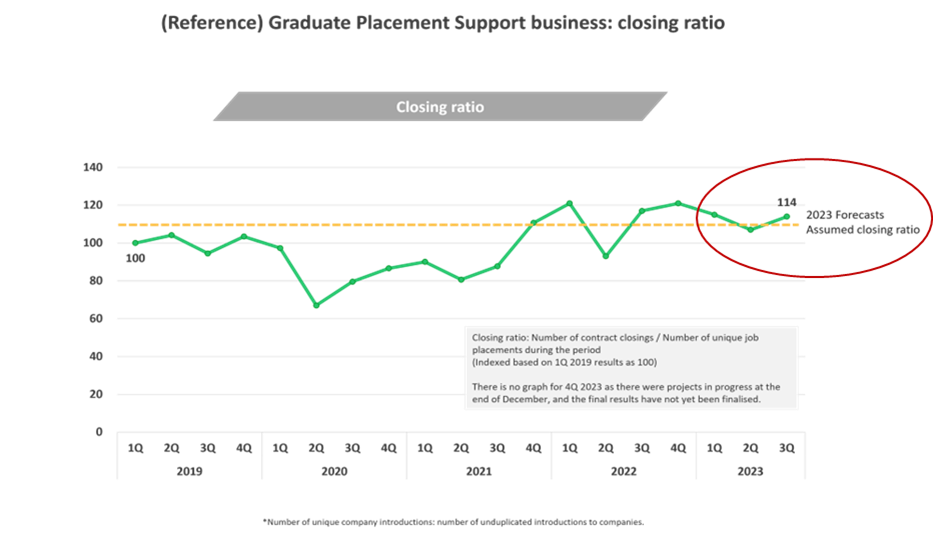

Full-year sales were 1.03 billion yen (+22% YoY). The number of students registered on Sponavi, which indicates the number of student-athletic teams registered, was slightly lower for students graduating in March 2024 than for those graduating in March 2023. However, the company was able to raise the coverage ratio of students by its employees in response to earlier placement activity, and the number of unique company introductions increased significantly, leading to a high closing ratio. The number of unique student introductions reached a record high.

Source: company materials.

Source: company materials.

Source: company materials.

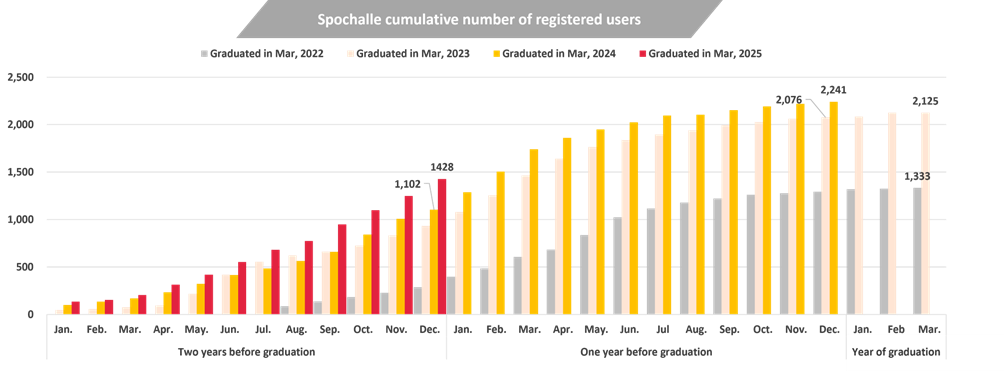

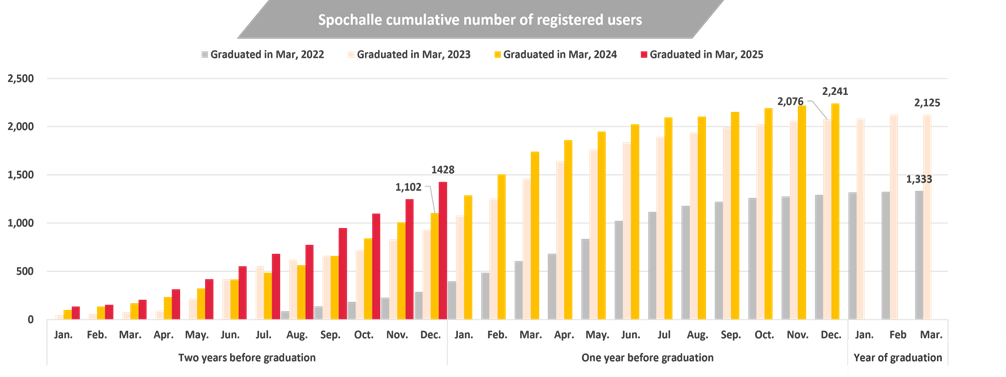

The growth of Spochalle (a placement support service for sportspeople, including those with experience in circles, clubs, off-campus sports teams, and high school club activities) also continued, with full-year sales of 160 million yen (+26% YoY). With the number of registrations and unique student introductions growing substantially, Spochalle has accounted for 16% of sales in the New Graduate Placement Support business.

Source: company materials

Graduate Placement Support

Full-year sales of 890 million yen (+15% YoY) were also a record high.

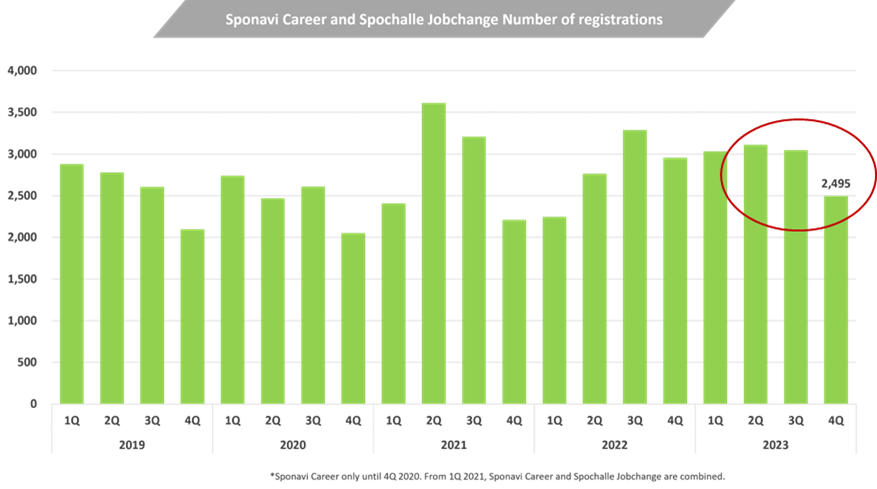

The number of new registrations for Sponavi Career and Spochalle Jobchange remained high until 3Q but declined slightly in 4Q. However, the number of unique personnel introductions and unique company introductions are both at high levels due to the steady response to registrations.

Another positive aspect of the company’s new business is the increase in job placement projects from one of its new businesses, Spojoba (a recruitment website specialising in sports-related companies and mainly offering online matching), which has contributed to its performance.

Source: company materials.

Source: company materials.

Source: company materials.

Source: company materials.

A stock split, the sale of shareholdings of four internal directors who are major shareholders, the launch of an executive shareholding plan

The company made the following announcements regarding shares.

Stock split (announced 20 December 2023)

A two-for-one share split with an effective date of 29 March 2024 (Friday).

Sale of shareholdings of four in-house directors who are also major shareholders (announced 13 February 2024)

Four in-house directors who are also major shareholders (Representative Director Katsushi Shinozaki, Executive Vice President Kazuyoshi Ijichi, Senior Managing Director Tadashi Kaji, and Senior Managing Director Shota Morimoto) will each sell 24 000 shares on and off the market through a securities company. The period is from 14 February 2024 to 7 August 2024. In total, this will amount to 2.6% of the shares outstanding.

The aim is to improve the liquidity of the shares as part of measures to increase market capitalisation and use it as a stepping stone for future upgrades to the prime market.

Launch of the Directors’ Shareholding Association (announced 13 February 2024)

Apart from the above, an executive shareholding society, to which directors and auditors can voluntarily join, is planned to be launched in July 2024. This is expected to improve share liquidity.

Of the above three points, the most worrying is the sale of the shareholding of major shareholders, i.e., internal directors. As this is a sale of shares by insiders, the stock market is likely to regard it as a cause for alarm.

However, the scale of the sale is limited, and, in the medium term, it can be seen as contributing to improving the liquidity of the shares and diversifying the shareholder structure.

Company forecasts for FY12/2024

Company forecasts for FY12/2024

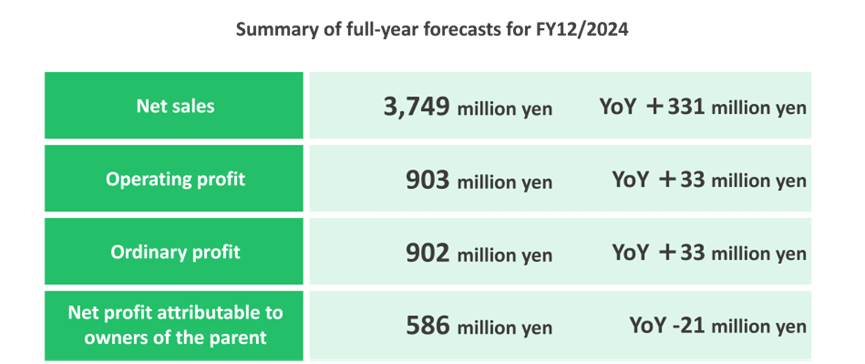

The company forecasts full-year sales of 3.75 billion yen (+10% YoY), operating profit of 0.90 billion yen (+4% YoY), ordinary profit of 0.90 billion yen (+4% YoY), net profit attributable to owner of parent of 0.59 billion yen (-4% YoY), net profit per share of 161.6 yen (before taking into account the share split at the end of March 2024; 80.8 yen afterward). The dividend per share was set at 32 yen (before taking into account the stock split at the end of March 2024 and 16 yen after taking into account the stock split at the end of March 2024).

Despite the forecast of higher operating and ordinary profit, net profit attributable to owner of parent is expected to be lower YoY. This is mainly due to the fact that the FY12/2023 tax credit for applying the tax incentive scheme for wage increases has not been taken into account in the forecast for FY12/2024. Hence, it is not based on any particularly adverse assumptions.

Source: company materials.

KPI

New Graduate Events orders, Sponavi registrants, and Spochalle registrants, KPIs related to new graduates, have all been steadily increasing. With the recruitment of new graduates moving earlier in the year, the company is well-positioned to hold events ahead of schedule and allocate sufficient sales resources to place human capital afterward.

In Graduate Placement Support business, the company is expected to steadily increase its revenues through the expansion of new channels, such as Sponavi Career and Spochalle Jobchange, as well as Spojoba and Spotive, to increase the number of unique job seekers.

The following is a sequential inspection of the key KPIs related to new graduates.

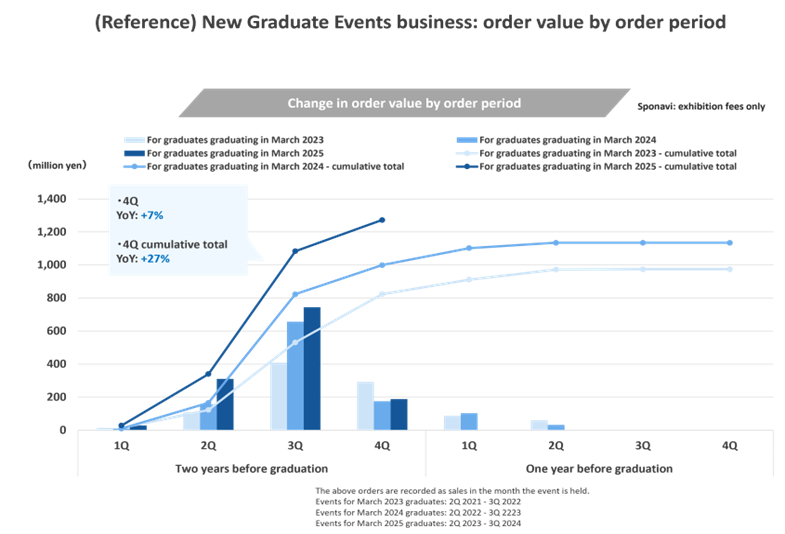

KPI for New Graduate Events business: order value

There is a strong need for companies to exhibit at events for graduates graduating in March 2025, and the cumulative order value for such events has increased by +27% compared with events for graduates graduating in March 2024. Of these orders, a reasonable amount is expected to be received for events scheduled from the start of FY12/2024, so the expectation is high for sales in 1Q of FY12/2024.

Source: company materials

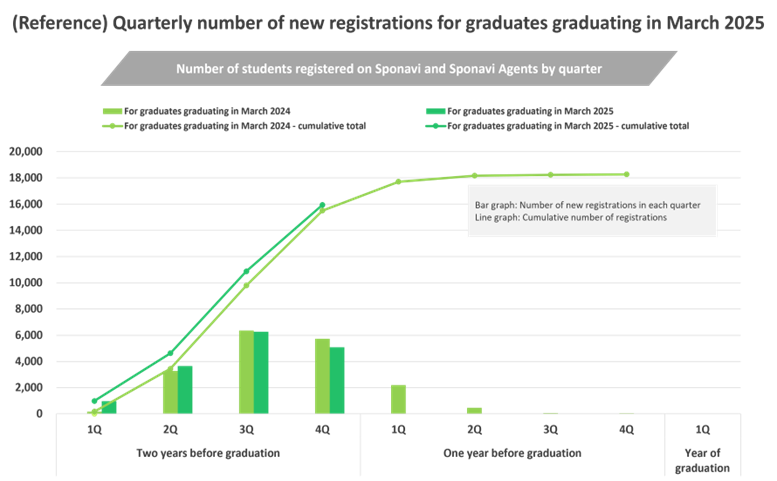

KPI of New Graduate Placement Support business : new registrations for Sponavi and Sponavi Agents for March 2025 graduates

The number of new registrations for graduates graduating in March 2025 also exceeded the pace of results for March 2024 graduates, increasing the potential for business expansion.

Source: company materials.

KPI of New Graduate Placement Support business: cumulative number of registered Spochalle graduates in March 2025

The cumulative number of registered Spochalle graduates (placement support service for sports personnel, including those with experience in clubs, club associations, extramural sports teams, and high school club activities) for graduates graduating in March 2025 has also been steadily increasing.

Source: company materials.

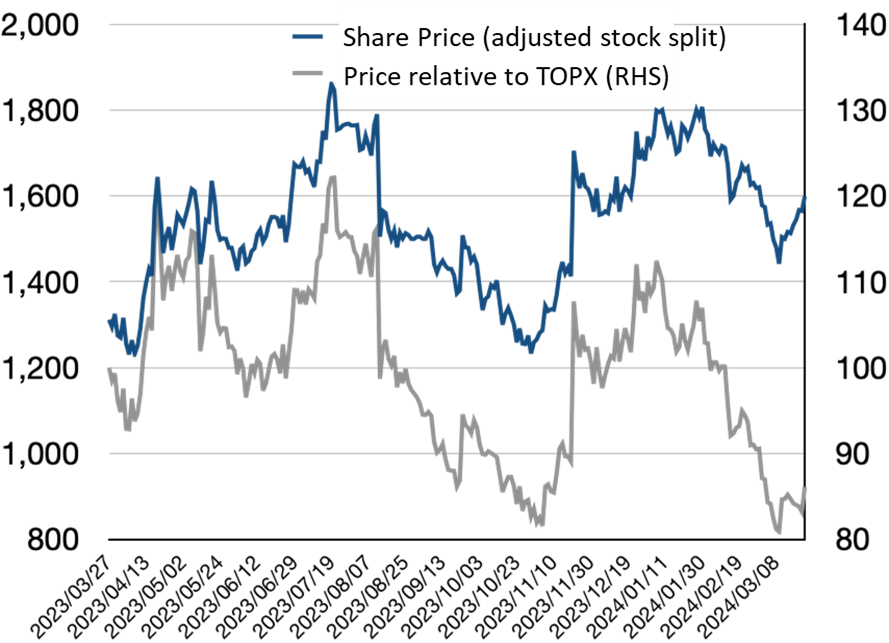

Share price trend

The company’s share price has been slowly weakening following the announcement of full-year results. However, it has recently recovered slightly. The soft share price is thought to be because, although FY12/2023 was a good year, its FY12/2024 forecasts call for a slowdown in the growth of sales, operating profit, and ordinary profit and a slight decline in net profit attributable to owner of parent, as well as a downward trend in ROE despite the high level, and concerns about the sale of the shareholding of the company’s principal shareholders, i.e., internal directors.

The TOPIX index (relative share price) has fallen to its lowest level in the past year.

Points of interest

We would like to highlight three points that are of immediate interest.

Firstly, the company’s current performance and the degree of earnings upside in its FY12/2024 forecasts.

The earnings of the company’s core business, graduate-related business, are seasonal, concentrating on the 1Q and 2Q. The placement market for new sports graduates is seen as less of a concern from a macro perspective, and the company’s key KPIs are also performing well. However, investors may be cautious, wanting to see 1Q results, as the company is preparing for a share offering by a major shareholder. The immediate test will be whether a good 1Q will come in good and will raise investors’ confidence in the outlook for 2Q and beyond.

Second, the direction of the next medium-term management plan which is expected to begin anew in 2025.

Investors’ attention is shifting to the direction of the next medium-term management plan. This is because, of the planned figures for the final year of the current medium-term management plan, ordinary profit has already been achieved in FY12/2023, sales are also expected to be achieved in FY12/2024, and the ordinary profit margin on sales is also trending above the plan.

It is too early for the company to disclose details, but if the contours begin to emerge from the second half of the current financial year onwards, this may hasten a reassessment of the shares’ upside. This is a crucial point to watch.

Third, and related to the above point, is the plan to move from the TSE Growth Market to the Prime Market.

A move to the Prime Market is expected to bring a number of benefits, including an increase in the depth of the investor base and improved liquidity of shares. It remains to be seen whether this will be one of the goals of the next medium-term management plan.

Financial results

Full-year financial results

Financial period |

FY12/2019 |

FY12/2020 |

FY12/2021 |

FY12/2022 |

FY12/2023 |

FY12/2024 |

Consolidated, Japanese GAAP |

(IPO) |

Company

|

||||

[Statements of income] |

||||||

Net sales |

1,918 |

1,883 |

2,130 |

2,866 |

3,418 |

3,749 |

Operating profit |

194 |

16 |

-32 |

637 |

869 |

903 |

Ordinary profit |

192 |

32 |

-35 |

634 |

869 |

902 |

Net profit before income taxes |

192 |

32 |

-81 |

634 |

869 |

|

Net profit attributable to

|

133 |

17 |

-79 |

412 |

608 |

586 |

[Balance Sheets] |

||||||

Total assets |

1,106 |

1,488 |

1,541 |

2,127 |

2,311 |

|

Total liabilities |

676 |

1,041 |

1,173 |

1,347 |

921 |

|

Total net assets |

430 |

447 |

368 |

781 |

1,389 |

|

Total borrowings |

334 |

731 |

749 |

630 |

259 |

|

[Statements of cash flows] |

||||||

Cash flow from operating activities |

198 |

-89 |

54 |

610 |

449 |

|

Cash flow from investing activities |

-25 |

-32 |

-68 |

-7 |

-68 |

|

Cash flow from financing activities |

150 |

396 |

18 |

-120 |

-371 |

|

Free cash flow |

173 |

-121 |

-14 |

602 |

381 |

|

Cash and cash equivalents at end of period |

686 |

962 |

966 |

1,448 |

1,457 |

|

[Efficiency] |

||||||

Ratio of ordinary profit to sales |

10.0% |

1.7% |

-1.7% |

22.1% |

25.4% |

24.1% |

ROA |

14.4% |

1.3% |

-5.2% |

22.5% |

27.4% |

|

ROE |

47.3% |

3.9% |

-19.4% |

71.8% |

56.0% |

|

[Per-share] Unit : Yen |

||||||

EPS (Adjusted for stock splits, etc.) |

41 |

5 |

-22 |

114 |

167 |

162 |

BPS (Adjusted for stock splits, etc.) |

122 |

127 |

103 |

216 |

377 |

|

DPS (Adjusted for stock splits, etc.) |

0 |

0 |

0 |

0 |

33 |

32 |

[Number of employees] |

||||||

Number of consolidated employees |

201 |

233 |

266 |

242 |

272 |

Source: Omega Investment from company materials.

The per-share indicators EPS and BPS are adjusted for the 1:2 share split carried out in March 2023.

A 1:2 share split is planned for the end of March 2024, which is not reflected in the EPS, BPS, and DPS above.

Quarterly results

2022 Q1 |

2022 Q2 |

2022 Q3 |

2022 Q4 |

2023 Q1 |

2023 Q2 |

2023 Q3 |

2023 Q4 |

|

Net sales |

774 |

862 |

609 |

619 |

919 |

971 |

698 |

829 |

New Graduate Events |

507 |

267 |

61 |

292 |

578 |

267 |

64 |

455 |

New Graduate Placement support |

79 |

290 |

354 |

119 |

92 |

426 |

396 |

115 |

Graduate Placement Support |

158 |

277 |

164 |

176 |

213 |

247 |

204 |

228 |

Other |

28 |

26 |

29 |

31 |

34 |

30 |

32 |

30 |

Operating profit |

232 |

301 |

69 |

32 |

315 |

312 |

84 |

156 |

Ordinary profit |

231 |

301 |

68 |

31 |

314 |

312 |

84 |

156 |

Net profit attributable to

|

148 |

196 |

45 |

23 |

205 |

202 |

53 |

148 |

Source: Omega Investment from company materials.

Useful information

Principal shareholders

| Name of shareholder | Number of shares held (shares) |

Percentage of shareholding (%) |

| Katsushi Shinozaki | 818,000 | 22.22 |

| Kazuyoshi Ijichi | 419,200 | 11.38 |

| Tadashi Kaji | 419,200 | 11.38 |

| Shota Morimoto | 419,200 | 11.38 |

| Custody Bank of Japan, Ltd. (Trust Account) | 127,600 | 3.46 |

| Reiichi Sasaki | 82,000 | 2.22 |

| Morgan Stanley MUFG Securities Co., Ltd. | 62,500 | 1.69 |

| THE BANK OF NEWYORK MELLON 140042 | 59,700 | 1.62 |

| Sportsfield Employee Shareholding Association | 56,600 | 1.53 |

| Fujio Ishimura | 53,300 | 1.44 |

Shareholder composition (as of 31 December 2023)