Mizuho Financial Group (Price Discovery)

Moderate Overweight

Profile

One of Japan’s three megabanks. The second largest bank in Japan after Mitsubishi UFJ Financial Group and almost on par with Sumitomo Mitsui Financial Group. As of March 2023, Mizuho’s domestic lending share was 6.7%, higher than SMFG’s 7.1% and MUFG’s 8.1%. Domestically, Mizuho has more corporate lending than SMFG, which has more retail business. Its overseas weighting is slightly smaller than MUFG’s. In recent years, cooperation between banks, trusts and securities companies has accelerated.

| Securities Code |

| TYO:8411 |

| Market Capitalization |

| 7,560,617 million yen |

| Industry |

| Banking business |

Stock Hunter’s View

Interest rates have revived, interest margins have expanded, and PBR and ROE are expected to improve.

In this year’s “Shunto” wage negotiations (spring wage negotiations), large companies and small and medium-sized enterprises recorded a high rate of wage increase of 4.69%. With the focus on the ‘virtuous cycle between wages and prices’, the Ministry of Internal Affairs and Communications (MIC) released its preliminary CPI for March (29 March), showing that the composite index excluding fresh food rose 2.4% YoY, exceeding the Bank of Japan’s target of 2% for 23 consecutive months.

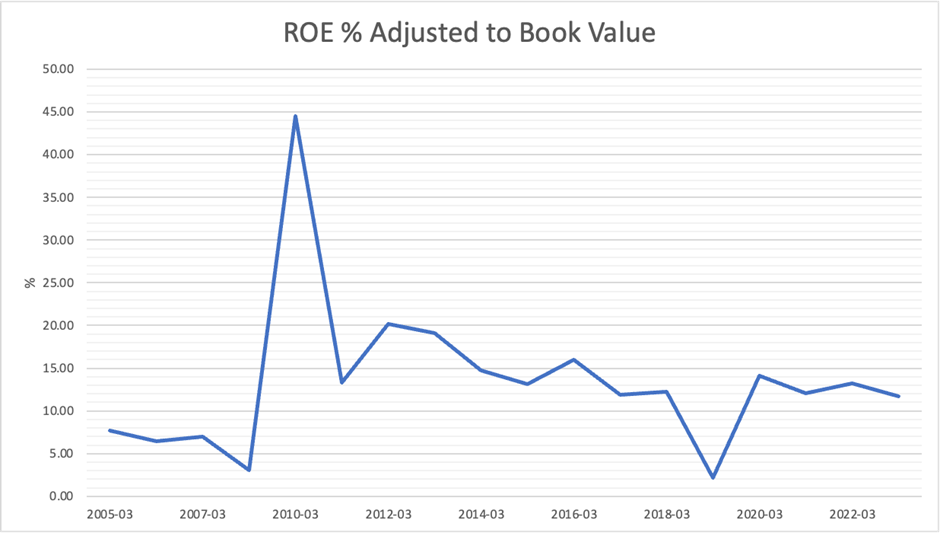

Lifting negative interest rates will benefit the financial sector in general, including regional banks and life and non-life insurers. Still, given their high liquidity and large market capitalisation, the focus should be on megabanks. The improvement in interest margins will lead to higher profits, and in the medium term, ROE and PBR ratios are expected to improve.

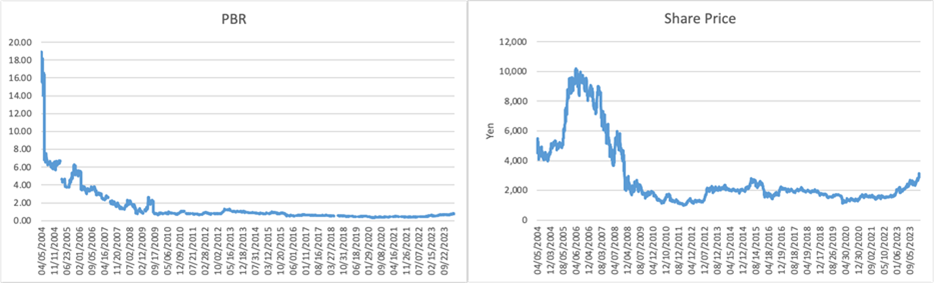

Mizuho Financial Group, in particular, is considered to have relatively significant earnings improvements during rising interest rates among megabanks. Furthermore, its P/B ratio is 0.7x, the lowest among megabanks. Many major investment management companies have been strengthening their voting standards recently. The bank is also a representative example of a company that falls under the ‘PBR less than 1x and ROE less than 8%’.

The company’s current performance is strong, and it is expected to continue steadily increasing profits and dividends from FY2025 onwards. The dividend yield is 3.4%, and the risk of dividend cuts is small due to the company’s progressive dividend policy, making it attractive as a medium—to long-term dividend stock.

Investor’s View

Expectations of improved domestic margins and efforts to raise PBR are favourable for the share price. Organic growth is less attractive.

The organic growth of Japanese megabanks is not very attractive: BS is inflated by policy shareholdings and delivers an ROE of around 6-7%. The shares trade below book value. JP Morgan Chase’s ROE is around 15%, and PBR is around 2x, which is a stark difference.

However, the equity yield on megabank shares that trade below book value is around 10%, making them a rare undervalued large-cap stock in the Japanese stock market.

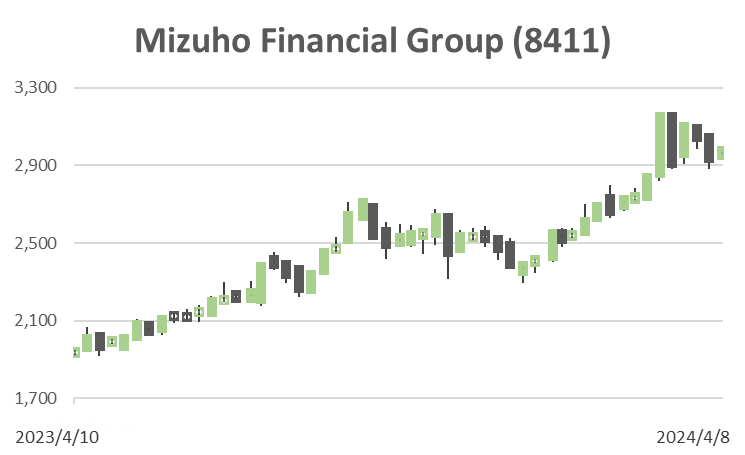

Share prices have factored in changes in monetary policy

The three megabanks’ fundamentals are similar. The same applies to share prices: the three companies’ share prices continued to fall since 2015 but have performed well since bottoming out in March 2020: they rose by around 30% each in 2022 and 2023 and have increased by just under 30% YTD. A significant driver for bank stocks is monetary policy developments. The stock market has factored in the removal of the BOJ’s extraordinary easing with excellent foresight.

There are various supportive factors, but share price hinges on the economic environment

Expectations of an improvement in domestic interest rates will likely support share prices in the near term. It is up to investors to decide what to expect regarding interest rates. In addition, unwinding of cross-holdings, dividend enhancement and management’s efforts to improve PBR are also positive. Management has stated that it will accelerate net profit growth from a CAGR of 7% in FY2019-2022 to 10% in FY2023-FY2025. In contrast, it should be pointed out that the management of megabanks remains dependent on the economic environment, and the rule of thumb is that management teams are slow unless exposed to a financial crisis, so there are no high expectations for organic growth in normal times.