Tenpo Innovation (Price Discovery)

Buy

Profile

Tenpo Innovation Co Ltd is engaged in the store sub-leasing business. It rents store properties from real estate owners and sublet them to eating and drinking tenants. Sales mix (OPM%): Shop subleasing 93 (8), Property sales 7 (29) (FY03/2023)

| Securities Code |

| TYO:3484 |

| Market Capitalization |

| 16,154 million yen |

| Industry |

| Real Estate |

Stock Hunter’s View

Transition to holding company structure in October. Steady progress in ‘laying the groundwork’ for growth.

Tempo Innovation is a leading operator of shop sub-leasing businesses for restaurants in Tokyo and the three prefectures of the Tokyo metropolitan area. Over recent years, the company has expanded its business areas to include the real estate trading business, which buys and sells income-generating properties, mainly shop properties, and the shop rent guarantee business.

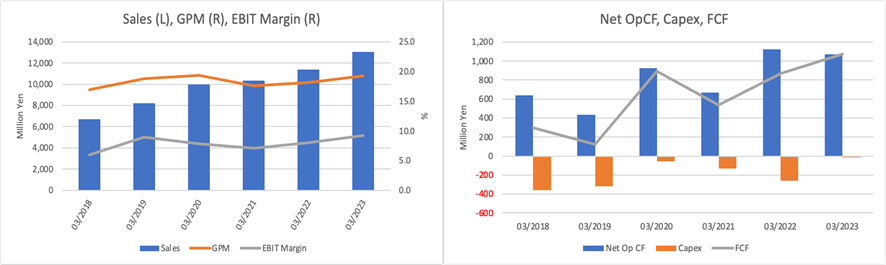

The number of properties in the mainstay sub-leasing business has been steadily increasing, and the number of contracts concluded has remained high in the last six quarters. While many restaurants closed during the pandemic disease, there was strong demand for small, well-located properties in the city centre, which made the company unscathed.

Although FY3/2024 and FY3/2025 will be a period of laying the groundwork for future growth, including the transition to a holding company structure and active recruitment, the company is expected to maintain a trend of increased sales and profits. The transition to a holding company structure is planned to take the form of a company split, with the company name to be changed to Innovation Holdings on 1 October 2024.

Thanks to several initiatives, including changes to the dividend policy and shareholder incentive plans, the ‘average daily trading value’ has been cleared towards the criteria for maintaining a listing on the Prime Market. The remaining criterion is ‘market capitalisation of shares in circulation,’ and progress should be closely monitored.

Investor’s View

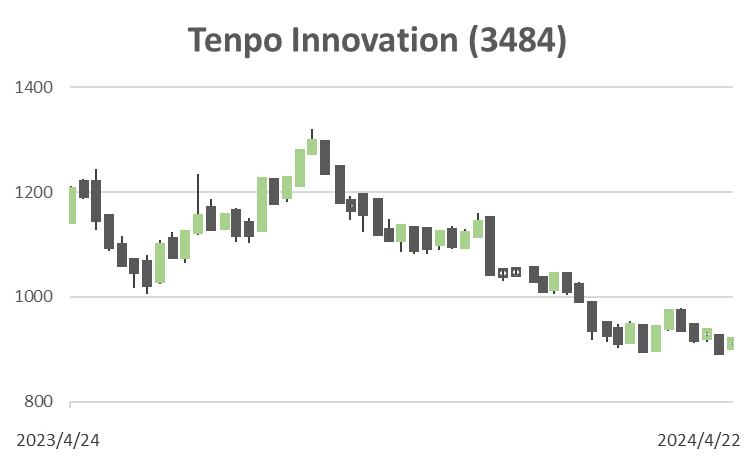

Buy. The share price is at an interesting weakness, having discounted the temporary contraction in profit margins.

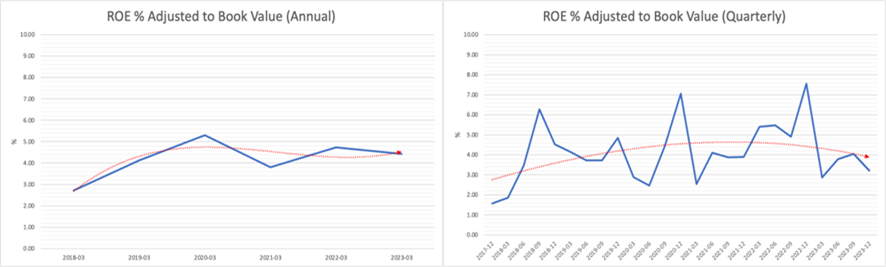

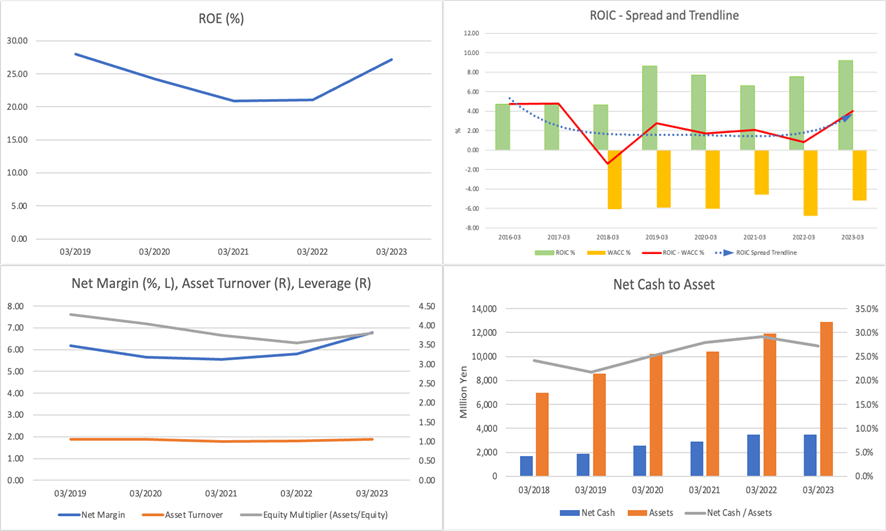

The company’s attraction lies in its very high ROE and stability. The high ROE is due to the excellent bottom-line profit margin and the equity multiplier (asset/equity). The company is debt-free, and WACC is high. However, ROIC is sufficiently high, and economic value creation is positive. Cash flow generation is also highly rated.

The share price slump since the beginning of the year is thought to be the result of short-term concerns that the company’s profits were down in 3Q and that it can, at best, meet its FY3/2024 forecast of flat earnings YoY.

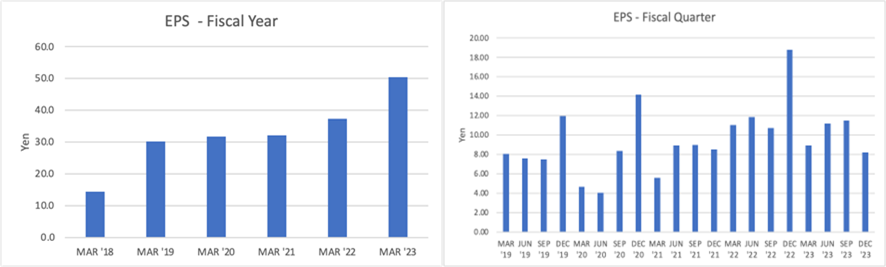

The aggressive procurement of subleased outlets and personnel recruitment has led to a contraction in current profit margins. On the other hand, as noted by Stock Hunter, the top line is growing steadily. EPS fluctuates widely from quarter to quarter and is difficult to forecast accurately, but the long-term trend is expected to be stable and positive.

Sub-leasing demand from metropolitan restaurants will always be soli,d and short-term costs will eventually subside, with EPS returning to secular growth rates. Accordingly, PBR is expected to regain its premiums. See our analyst report for more information on the earnings forecasts and the operating environment.

https://omega-inv.com/2024/03/21/3484cn_3q2/

Management’s increase of the target payout ratio from 30% to 40% from FY2024 is also positive for the share price.