Niterra (Price Discovery)

Buy

Profile

Niterra Co., Ltd. is the world’s largest automotive plugs and exhaust system sensors manufacturer. It is also a leading producer of ceramic products and tools for internal combustion engines in the automotive industry. The company’s two brands, NGK Spark Plugs and NTK Technical Ceramics, are the market leaders in their respective fields. In addition to these core businesses, Niterra Co., Ltd. also produces electronic components, medical equipment and fuel cells. The company manufactures in Japan and Brazil, with subsidiaries around the world assembling and selling components in their respective regions. The company was founded in 1936 and is headquartered in Nagoya.

Segment sales % (OPM%): automotive 79 (21), ceramics 19 (10), new business related 1 (-381), other 1 (39) (overseas) 82 (FY03/2023).

| Securities Code |

| TYO:5334 |

| Market Capitalization |

| 1,034,352 million yen |

| Industry |

| Glass and stone products |

Stock Hunter’s View

Plugs and sensors continue to improve profitability. Potentially positive catalysts in the semiconductor-related business.

Niterra holds the top share of the global market for spark plugs for automobile engine ignition and exhaust gas sensors.

Spark plugs and exhaust gas sensors make internal combustion engines more efficient and cleaner. The industry is restructuring in this area amid the trend towards EVs (electric vehicles). In July last year, the company agreed to take over the spark plug and exhaust gas oxygen sensor business from Denso (TSE 6902).

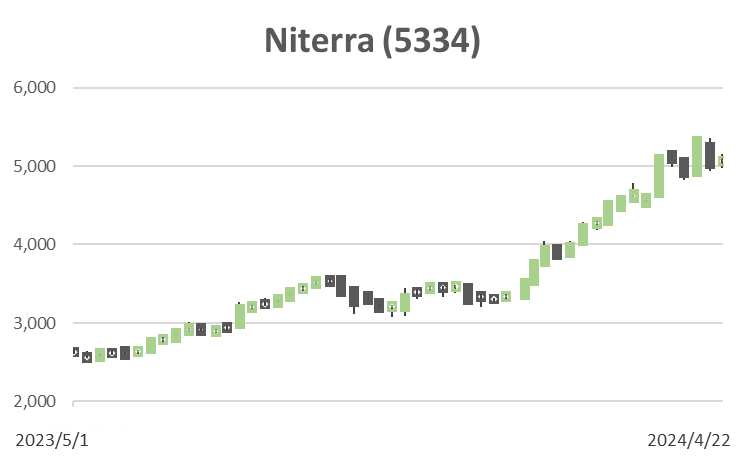

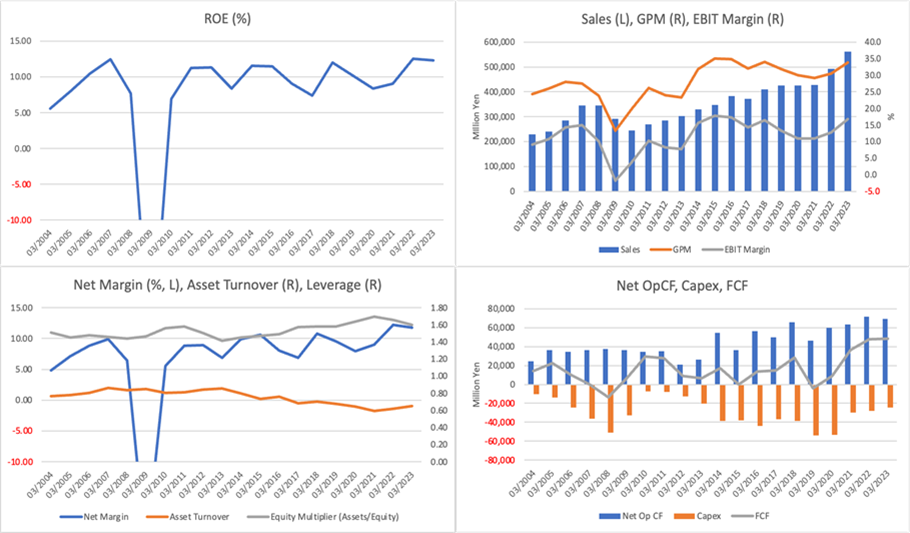

The results are scheduled to be announced on 30 April. The company’s results for FY3/2024 are set to reach a record high, with sales revenue of 607 billion yen (+7.9% YoY) and operating profit of 110 billion yen (+23.3% YoY). The replacement of nickel plugs with precious metal plugs is well underway, and the profitability of spark plugs continues to improve. Furthermore, orders for sensors are being won, with priority given to highly profitable projects. With the yen’s depreciation firmly entrenched, expectations are high for FY3/2025 results.

In addition, the company has proprietary technology in electrostatic chucks used in semiconductor manufacturing equipment, etc. The shift to 2mm in logic and the 8th generation of NAND is a “good opportunity to increase the share of deliveries”.

Investor’s View

Buy. The earnings momentum is strong, and the temporary dominance of hybrid vehicles due to stalling EV sales is positive for the share price. We are cautiously optimistic about the company’s short to medium-term.

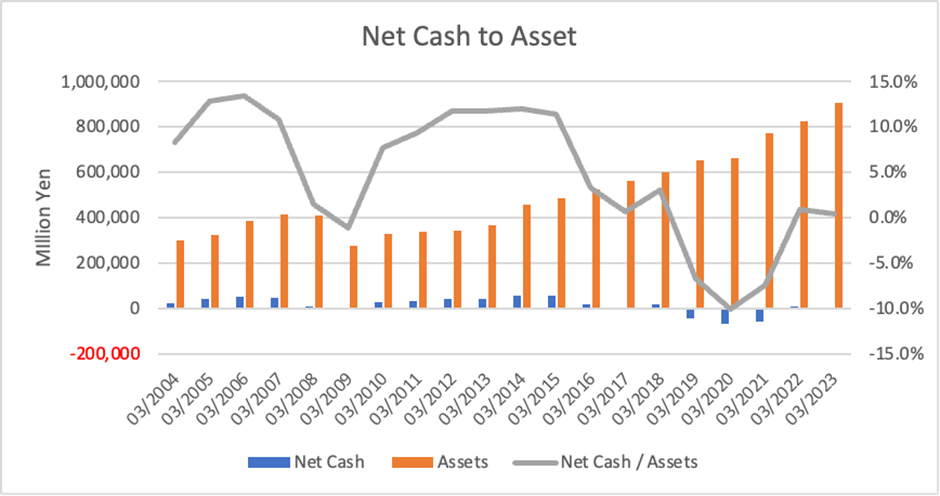

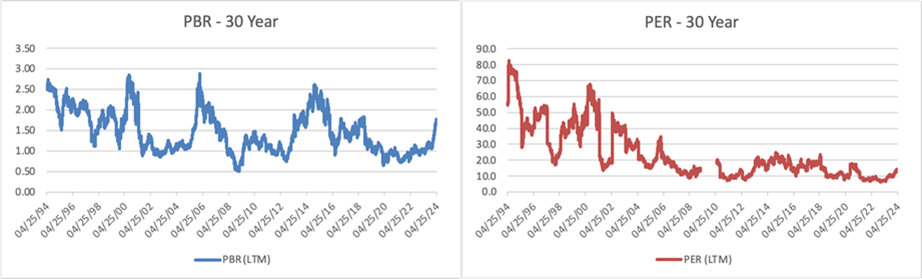

The share price outperformed TOPIX by 27% and 12% in CY2022 and 2023, respectively, and has been the stellar outperformer since the beginning of the year, rising 51%. The share price was depressed for several years due to EV concerns and was below book value for two years in 2020 and 2021. The current PBR is 1.7x, the highest since 2018.

The share price recovery from a severe slump can be attributed to rising profit growth expectations and the slowdown in EV sales, revealing a near-term hybrid dominance. While ROEs of around 10% have remained unchanged in recent years, investors’ profit growth expectations have rounded up with accelerating sales and EBIT margin rises from March 2022. CF has also improved markedly, and FCF has increased. Management is willing to buy back shares. The dividend payout ratio is targeted at 40%, and the company is proactive in improving governance for shareholders, with a majority of external directors.

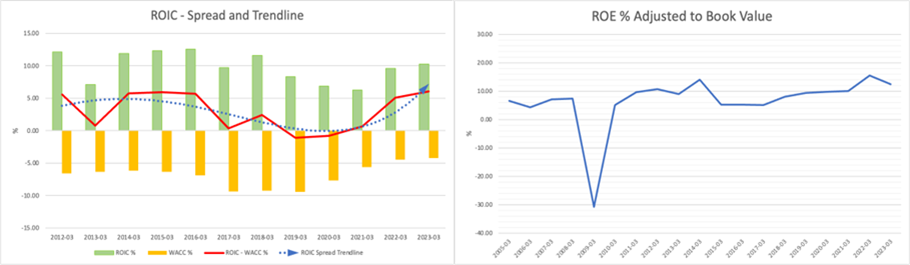

Since bottoming out, the ROIC spread has also trended upwards; PBR has increased, but equity yield is still attractive at around 10%.

The company has just under 50% global share in spark plugs. 70% of the spark plug sales are for aftermarket use, sold via distributors and mass retailers, and the profit margin is high. The management has presented a scenario in which the production of vehicles with internal combustion engines will peak in 2030, and the number of automotive parts assembled in new cars will also decrease. On the other hand, the demand for replacement aftermarket products will continue beyond that. The proportion of precious metal plugs will also increase, and sales are expected to rise. Prices for aftermarket products are three times higher than for new vehicles. Global market share is also likely to increase.

These management forecasts are considered reasonable. While we should not assume that the long-term shift to EVs will be delayed, considering significant policy influences in key countries, a situation where EVs are stalling due to battery problems and hybrid vehicles will dominate for a few years is positive for the share price.

It will take a long time before most of the world’s vehicle fleet is made up of EVs. Long-term de-rating risks are undeniable, but it would be too early to factor them in. Given the progress in improving governance, we optimistically expect management to take various measures for shareholders well before the company’s future is finally in jeopardy.