Tomy Company Ltd. (Price Discovery)

| Securities Code |

| TYO:7867 |

| Market Capitalization |

| 145,241 million yen |

| Industry |

| Other products |

Profile

Tomy is a leading Japanese toy company, founded by Eiichiro Tomiyama in 1924 and headquartered in Tokyo. The company specialises in the planning, manufacturing, and sales of toys, household goods, card games, and baby care products. Its representative brands include “Tomica” miniature cars, “Plarail” railway toys, and “Licca-chan” dolls. The company has a strong focus on younger age groups. Tomy merged with Takara in 2006. It acquired the American toy company RC2 in 2011, which proved to be an unsuccessful venture. In 2015, Harold George Meij became the first non-family member to serve as president of the company since its founding. Under his leadership, the company achieved a V-shaped recovery by 2017.

Stock Hunter’s View

FY3/2024 earnings will grow as headwinds ease. ispace’s IPO is also a positive catalyst for the share price.

Tomy Company Ltd. is expected to see its business performance improve in FY3/2024. Staple products such as “Tomica” and “Plarail” contribute steadily to the earnings. In FY3/2023, the company faced headwinds such as exchange rate fluctuations, rising raw material prices, and logistical disruptions, but its 3Q operating profit was only down 2.7% YoY.

At present, the trading card game “Duel Masters,” which is celebrating its 20th anniversary, and the amusement machine “Pokemon Mezastar,” which is being developed by T-ARTS Company, Ltd. (Takara Tomy A.R.T.S.), are both performing well. The Gacha business (capsule toy) is also expected to continue to perform well against the backdrop of the popularity of capsule toys.

The company is also generating considerable buzz. ispace, popular in its recent IPO, announced that its lunar exploration program “HAKUTO-R” will land on the moon as early as the 26th of this month if successful. The moon lander will carry the “SORA-Q” lunar exploration robot developed by JAXA and Tomy, scheduled to demonstrate its exploration technology after landing. On the 13th of April, it was also announced that a 1/1 scale model of the robot would be sold to the general public from September 2, further increasing recognition of the company’s space-related activities. Additionally, in 2024, the company will celebrate its 100th anniversary, and surprise announcements such as commemorative products and dividends are eagerly anticipated.

Investor’s View

With the poison pill defense set aside, Tomy is a reasonably good company. Investors can wait for the valuations to decline. 10 Year TSR is good, registering a CAGR of 9.4% compared to TOPIX’s 8.2%. The 5-year beta is 0.96.

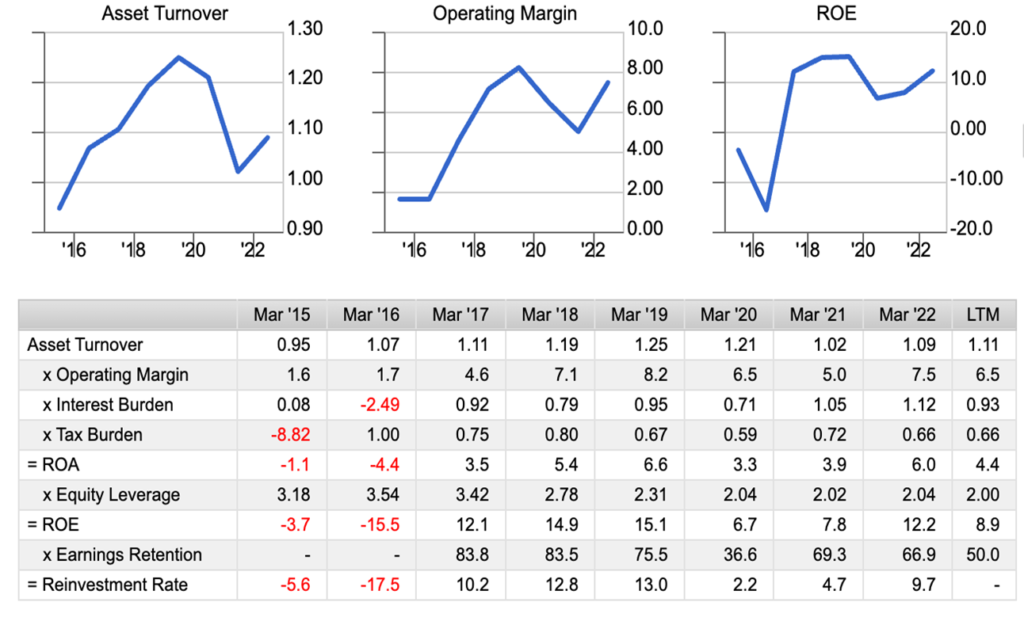

There is great potential for improving the return on equity, but we do not think the management will take action

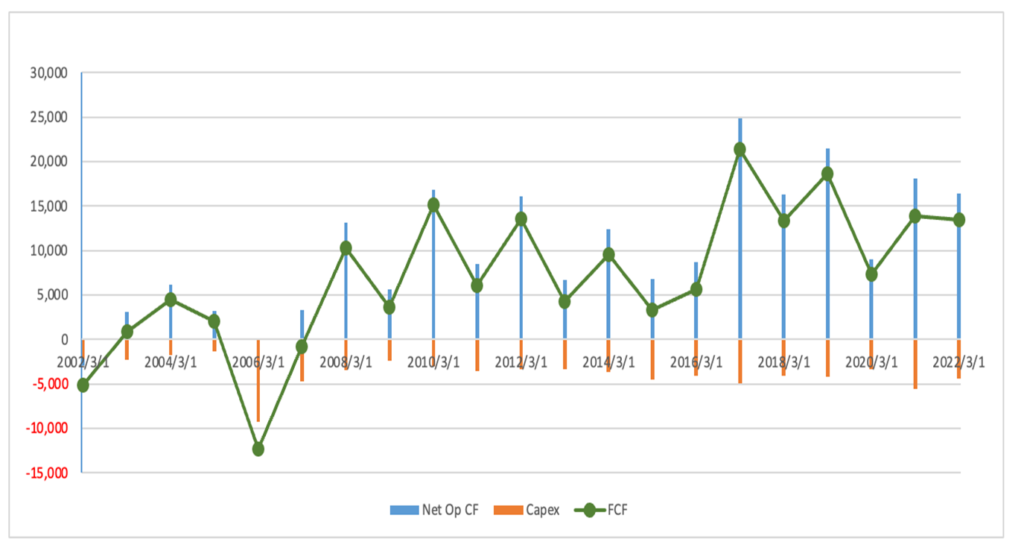

The company’s greatest attraction is the CF generation. Unfortunately, this has not been adequately returned to investors and has only accumulated within the company. If management focuses on this aspect, the long-term TSR will visibly improve, significantly impacting the share price.

20YR Net operating CF, Capex, Free cash flow (Y-mn yen)

Correction of the balance sheet defects, such as the net cash of around 20 billion yen and an equity ratio of 50%, will significantly improve the return on equity. If the management takes serious measures in response to the recent request from JPX regarding “management that considers capital costs and share prices,” the share price could rise significantly. However, the company’s shares are healthy in valuation and price performance, so management will unlikely propose measures that investors would rate highly. Therefore, the secular ROE potential well in excess of 15% will not materialise. However, if many leading companies become more proactive in improving their return on capital, Tomy will be in line with them.

Dupont Model

Valuations are slightly expensive

The earnings are somewhat unpredictable due to the slightly distorted cyclical nature, but overall, they are stable. The resilience is high, as seen in the recovery from COVID-19. A significant drop in the share price is an opportunity for substantial investment returns. However, the share price appears to have already discounted the recovery pointed out by Stock Hunter. That is, the consensus forecast of FY3/2023 EBIT increasing by 20% compared to 2020 and a further 17% growth YoY in FY3/2024 has been mostly reflected in the share price through a strong share price recovery since 2021. The current TOPIX PER is 13.1x, and PBR is 1.25x, while the company’s shares trade on slightly expensive 13.7x and 1.5x, respectively.

The top line is cyclical no growth

Excluding the effects of currency fluctuations, the driver of the company’s sales are brand, character, hit, and new businesses. These are difficult for investors to measure, so the earnings visibility is not so good. However, the flattish long-term sales trend gives investors a sense of security. The absence of long-term growth is not attractive to growth-oriented investors.

20YR Sales (Y-mn yen, LHS), ROE (%, RHS), Profit margins (%, RHS)

The domestic market is robust, while the overseas business is lacklustre

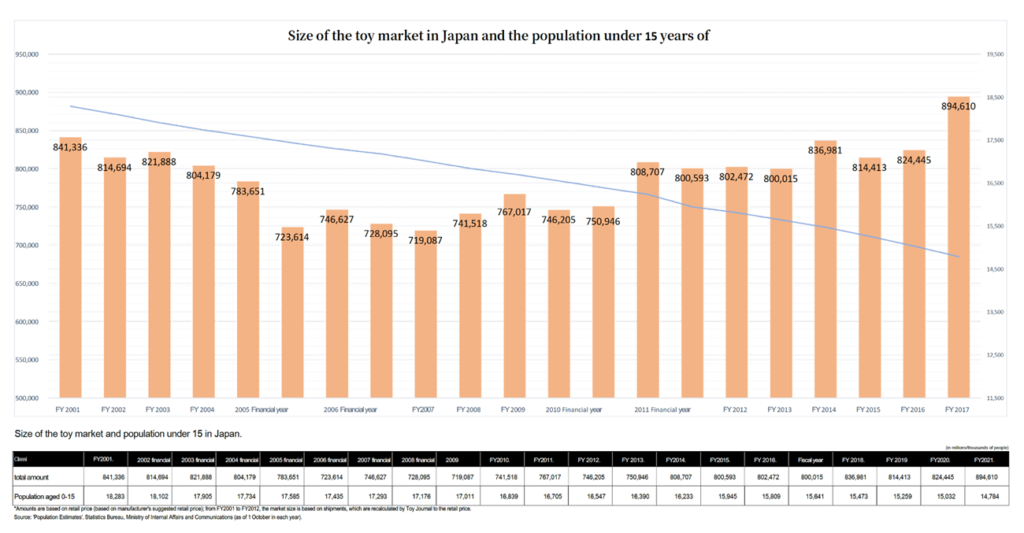

In its midterm plan, the company has set expansion to the high-end target market and the global market as its strategies in response to Japan’s accelerating depopulation. These initiatives, however, need more novelty. As for the expansion of the high-end target market, a trend of adults purchasing toys has already taken root in the domestic market.

Japan toy market size (bar, LHS) and the population under 15 years old (Line, RHS)

On the other hand, overseas expansion has yet to yield results. In the first half of FY2022, the overseas sales ratio was 40%, with Japan accounting for 60%, North America 22%, Asia 10%, Europe 5%, Oceania 2%, and other regions 1%. Although there were temporary negative factors such as the weak yen and inventory adjustments, overseas earnings, excluding Asia, remained at break-even. 90% of the earnings still come from Japan. Many investors still remember the huge bottom-line deficit resulting from significant impairment losses in the overseas business in FY3/2016.

Is Tomy a space development name?

The release of a 1/1 scale model of the lunar exploration robot SORA-Q, co-developed with JAXA (Japan Aerospace Exploration Agency) and due to be released on the moon, is an interesting move to link space development with entertainment. However, this may not necessarily be a positive catalyst for the share price. Nevertheless, knowing about this product is not so meaningless.