Sportsfield (Company note – 1Q update)

| Share price (6/12) | ¥1,510 | Dividend Yield (23/12 CE) | 0.0 % |

| 52weeks high/low | ¥1,690/458.5 | ROE(22/12) | 71.8 % |

| Avg Vol (3 month) | 38 thou shrs | Operating margin (23/12CE) | 22.1 % |

| Market Cap | ¥5.4 bn | Beta (5Y Monthly) | N/A |

| Enterprise Value | ¥4.7 bn | Shares Outstanding | 3.6 mn shrs |

| PER (23/12 CE) | 12.4 X | Listed market | TSE Growth |

| PBR (22/12 act) | 7.0 X |

| Click here for the PDF version of this page |

| PDF Version |

A good start in 1Q of FY 12/2023 (Jan-Mar 2023)

Summary

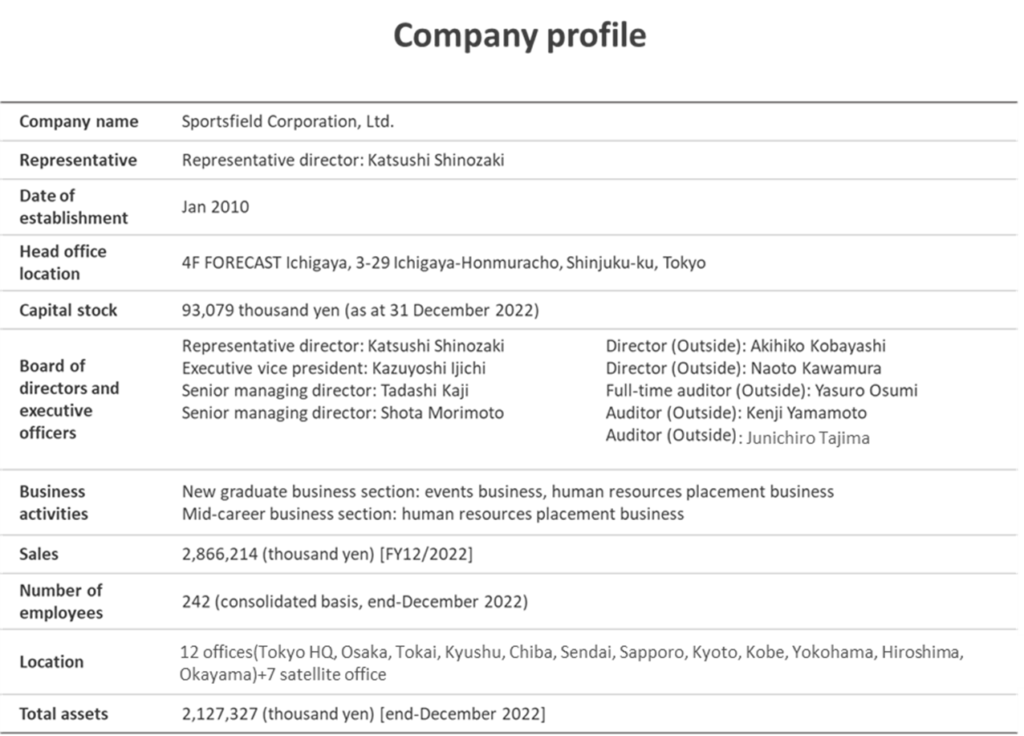

Company profile

◇Sportsfield Corporation Ltd. provides placement-related services to sports human capital nationwide. It is listed on the TSE Growth Market. FY12/2022 results were sales of 2.87 billion yen and a recurring profit of 0.63 billion yen. The current medium-term management plan aims to achieve sales of 3.60 billion yen and a recurring profit of 0.77 billion yen in FY12/2024.

◇Specialised in recruiting sports talents and leading the market with a distinctive sales style: Sportsfield’s primary business is placement-related services for newly graduating sports students, particularly those belonging to college athletic teams. The market is estimated to be around 50,000 people nationwide per academic year. The company has established a system of analogue support provided by sales employees, most of whom have sports experience. The number of registered job seekers has grown to over 20,000 every year. The company also operates a well-established business with companies that wish to recruit sports human capital and is believed to be securing a leading position in a specific market.

◇Main business: Sales comprise (FY12/2022) 39% of New Graduate Events for new graduates belonging to college athletic teams (fees are received from exhibiting companies), 30% of New Graduate Placement Support business for newly graduating athletic students and students with other sports experience (provides employment counselling to students, introduces them to employing companies and receives a recruitment consulting fee from companies after a job offer is accepted), and Graduate Placement Support business (provides employment counselling to sports graduates, introduces them to employers and receives a placement fee from companies as a performance reward).

1Q of FY2023 update

◇1Q results have endorsed high growth: FY12/2023 results confirmed the continuation of the business expansion trend that began in the previous year. Net sales were 920 million yen (+19% YoY), operating profit was 320 million yen (+36% YoY), ordinary profit was 310 million yen (+36% YoY). Net profit attributable to owners of the parent company was 210 million yen (+38% YoY). The results showed strong top-line growth and improved profit margins on sales. This is steady progress compared to the company’s full-year forecast.

◇Share price continues to reassess growth potential:The company’s share price began to rebound from May 2022 on the expectations of an earnings recovery and has since been keeping an upward momentum in line with the earnings progress. The share price is expected to be in a phase where it will rise if the company’s performance expands further.

◇Points of interest:

First, whether there is room for upside or upward revision to the company’s full-year forecasts. The recruitment market environment is seen as a tailwind for the company. Will the company’s performance continue to be strong, even after considering the increase in personnel and other costs planned from 2Q onwards?

Secondly, how athletics students graduating in March 2025, who will form the basis of next year’s company performance, stack up in the number of students registered for Sponavi.

Thirdly, will the company make progress in generating revenue from Spochalle, a job placement service for students with sports experience, the graduate recruitment business, and Spojoba, a recruitment website specialising in sports-related companies, and begin to play a new medium-term role in driving performance?

Table of contents

| Summary | 1 |

| Key financial data | 2 |

| Financial results for 1Q of FY2023 | 3 |

| Share price trend | 7 |

| Points of interest | 8 |

| Financial results | 9 |

| Useful information | 11 |

Key financial data

Fiscal Year |

2017/12 |

2018/12 |

2019/12 |

2020/12 |

2021/12 |

2022/12 |

|

Net sales |

1,106,727 |

1,516,370 |

1,917,813 |

1,883,269 |

2,130,256 |

2,866,214 |

|

Ordinary profit |

60,171 |

113,916 |

192,045 |

32,016 |

-35,298 |

634,239 |

|

Net income |

41,031 |

72,809 |

132,965 |

17,055 |

-79,133 |

412,318 |

|

Capital stock |

10,300 |

10,300 |

92,680 |

92,712 |

92,869 |

93,079 |

|

Total number ofshares issued |

Ordinary shares (shares)Class A shares (shares) |

20,000400 |

20,400– |

881,600– |

882,560– |

897,400– |

1,808,080– |

Net asset |

59,396 |

132,205 |

429,932 |

446,826 |

368,007 |

780,524 |

|

Total asset |

418,961 |

735,377 |

1,106,275 |

1,488,182 |

1,540,544 |

2,127,327 |

|

Book value per share*1 (Yen) |

36.39 |

81.01 |

243.84 |

253.16 |

205.06 |

431.73 |

|

EPS*1 (Yen) |

18.20 |

40.50 |

121.92 |

126.58 |

102.53 |

215.87 |

|

Equity to asset (%) |

12.57 |

22.31 |

40.68 |

4.83 |

-22.21 |

114.44 |

|

ROE (%) |

100.6 |

76.0 |

47.3 |

3.9 |

-19.4 |

71.8 |

|

Cash flow from operating activities |

108,208 |

82,994 |

198,181 |

-88,974 |

53,789 |

609,537 |

|

Cash flow from investing activities |

-32,962 |

-75,085 |

-24,984 |

-32,077 |

-67,943 |

-7,100 |

|

Cash flow from financing activities |

-82,366 |

191,526 |

149,891 |

396,399 |

18,139 |

-120,077 |

|

Cash and cash equivalents at end of period |

163,792 |

363,227 |

686,315 |

961,663 |

965,648 |

1,448,007 |

|

Number of employees |

118 |

164 |

201 |

233 |

266 |

242 |

|

(Unit: Thousand yen)

*1: A 40-for-1 split of ordinary shares was carried out on 4 October 2019, a 2-for-1 split of ordinary shares on 1 July 2022 and a 2-for-1 split of ordinary shares on 1 April 2023. Book value per share and EPS in the table are calculated assuming such splits were carried out at the beginning of the year ended 31 December 2017.

Source: Omega Investment from company materials.

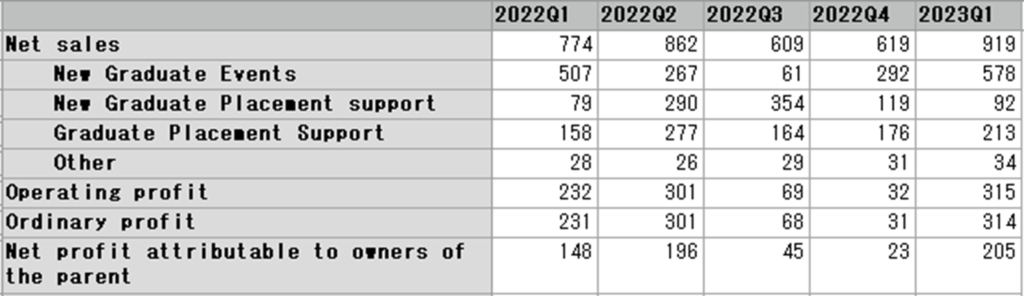

Financial results for 1Q of FY2023

Sportsfield Corporation announced its financial results for 1Q (Jan-Mar) FY2023 after the close of trading on 12 May 2023. The results showed a good start and better progress against the company‘s full-year plan than in the same period of the previous year, which is expected to lead to further growth in performance.

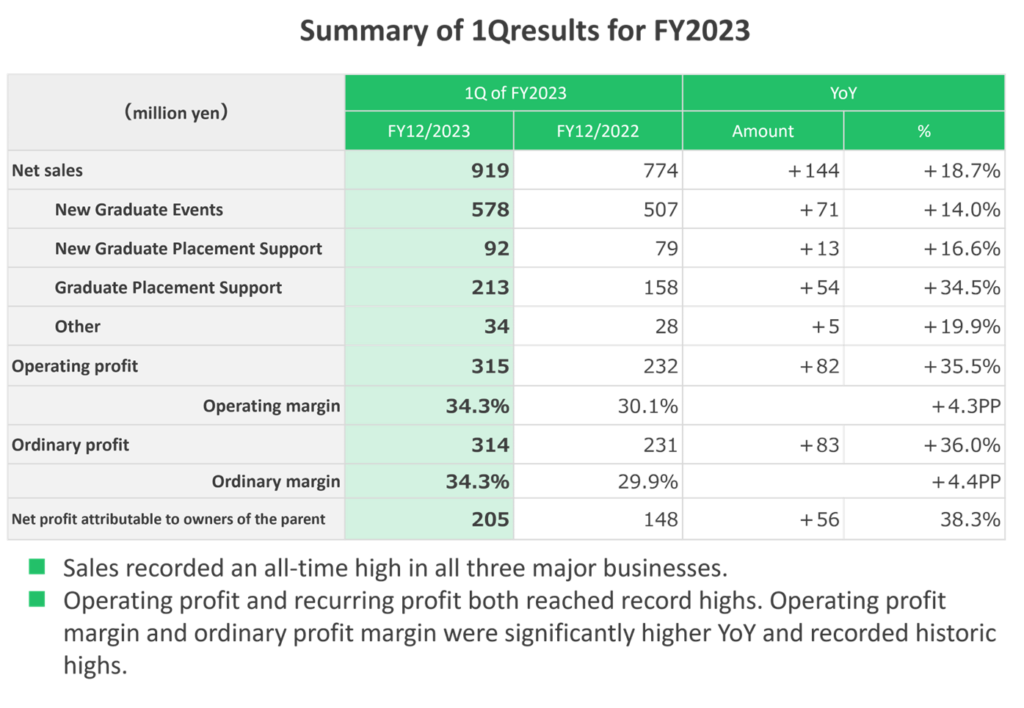

Strong financial results with record highs

Net sales were 920 million yen (+19% YoY), operating profit was 320 million yen (+36% YoY), ordinary profit was 310 million yen (+36% YoY), and net profit attributable to owner of parent was 210 million yen (+38% YoY). Sales, operating profit and ordinary profit registered record highs in 1Q, as did net profit attributable to owner of parent. The results are excellent, with a sales increase of approximately 20% and further expansion of operating profit margins.

In a nutshell, the strong performance directly reflects the recovery in demand for jobs since entering the post-COVID period, which the company has been able to translate into sales while holding down cost increases steadily.

Source: company materials

By sector, the three main businesses, i.e., New Graduate Events, New Graduate Placement Support, and Graduate Placement Support, all saw an increase in revenue.

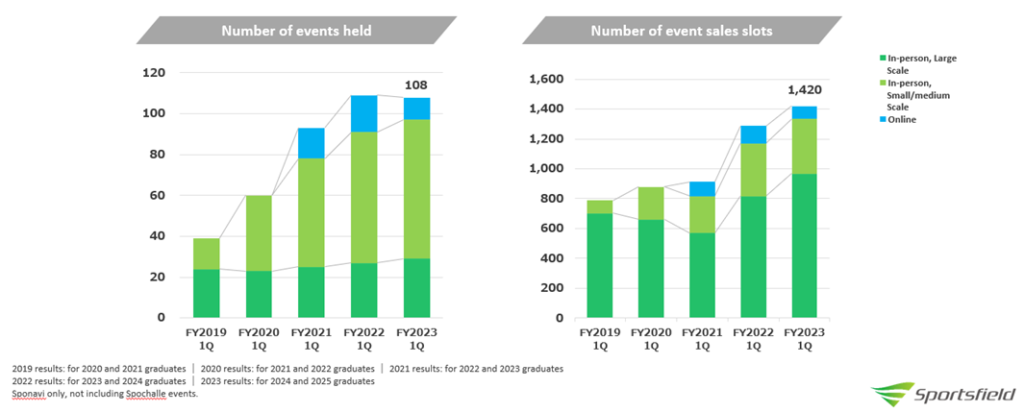

New Graduate Events

Although the number of events remained at the same level as in the same period of the previous year, the shift from online events to in-person and large-scale events was a driver of orders and sales. The demand from companies to exhibit at events for graduates of 2024 is strong and the progress of orders received has exceeded that for graduates of 2023, and will mainly be recorded as sales in 2Q to 3Q of the current financial year.

Source: company materials

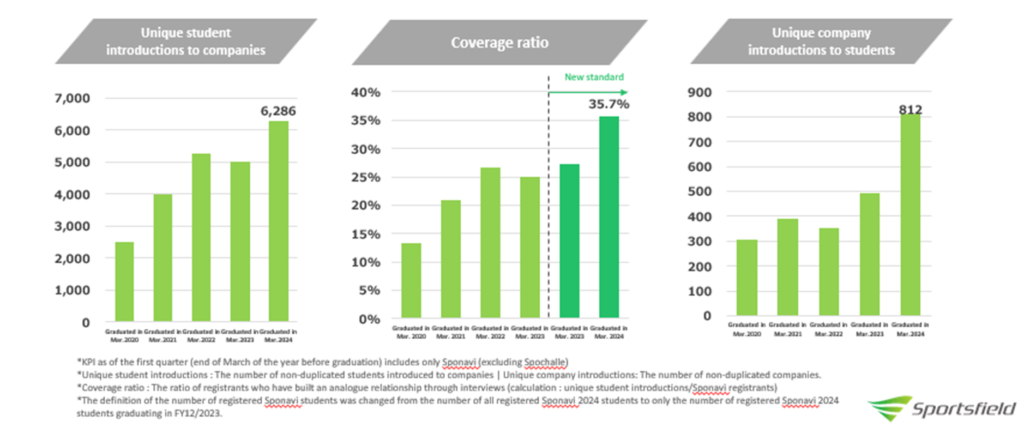

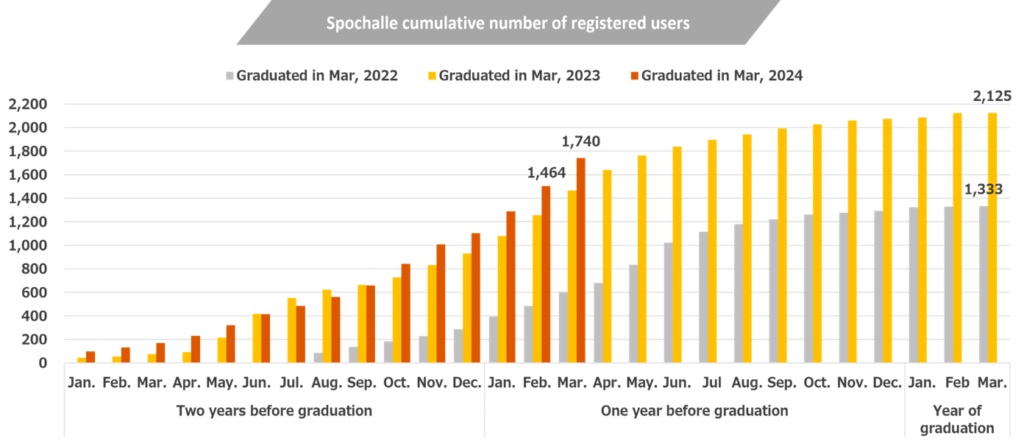

The number of students registered on Sponavi, which indicates the number of registered athletics students, was 17,631 at end-March 2023 in correspondence to students graduating in March 2024, a decrease from the number of registered students at end-March 2022 for students who graduated in March 2023. This is presumably due to a slight reduction in the company’s employees in FY2022.

However, the number of unique student introductions and the number of unique companies introductions have increased significantly, as the company provided support to registered students in response to earlier job searches and raised the coverage ratio, and as it captured the graduate recruitment needs of companies well. As a result, the sales for the quarter were solid.

Source: company materials

Furthermore, the number of registrants and unique student introductions on Spochalle, a placement support service for people with sports experience, grew significantly, with sales increasing by 89% YoY to 27 million yen. It is growing to become a new driving force for the new graduate placement business.

Source: company materials

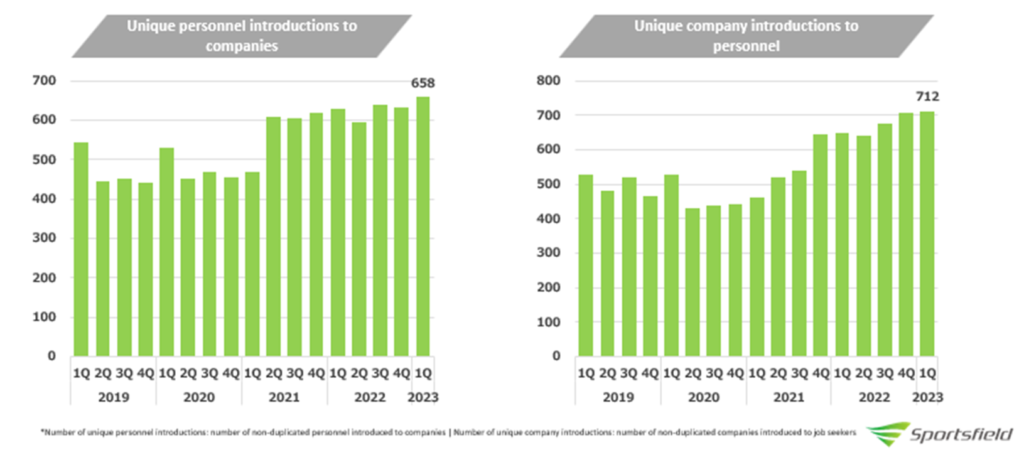

Graduate Placement Support

Against a backdrop of strong corporate demand for recruitment, the number of registered users of Sponavi Career and Spochalle Jobchange increased YoY, as did the number of unique personnel introductions and unique company introductions, resulting in high revenue growth.

In addition, the cumulative number of registered members and site PV of one of the new businesses, Spojoba (a recruitment website specialising in sports-related companies and mainly offering online matching), has also increased. Its contribution to sales of Graduate Support business was approximately 15% in 1Q.

Source: company materials

Progress against full-year forecasts

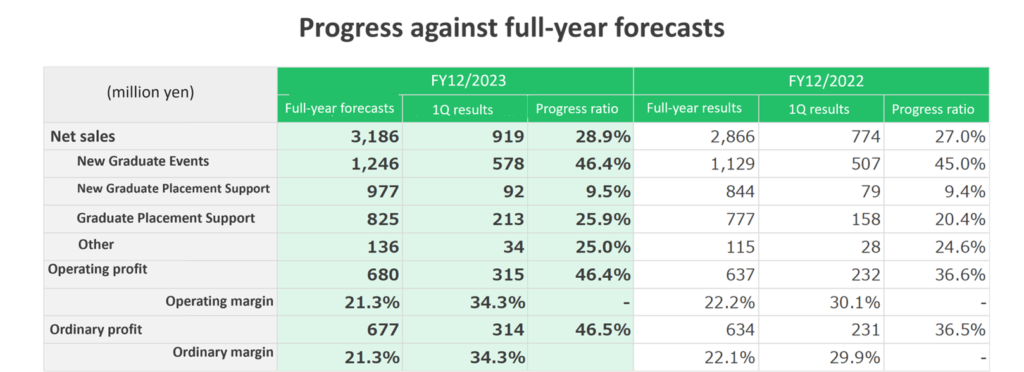

1Q result progress was fast compared to the full-year forecasts.

The progress ratios of sales, operating profit and ordinary profit were 28.9% (27.0% in 1H 2011), 46.4% (36.6% in 1H 2011) and 46.5% (36.5% in 1H 2011), respectively. There is no indication of whether progress to date against the company’s plan is above forecasts, but it is unlikely to be below.

Source: company materials

Healthy balance sheet

Although cash and cash equivalents have decreased since the end of FY2022, they remain high. Interest-bearing debt has decreased in line with the decrease in cash and cash equivalents, maintaining a net cash position.

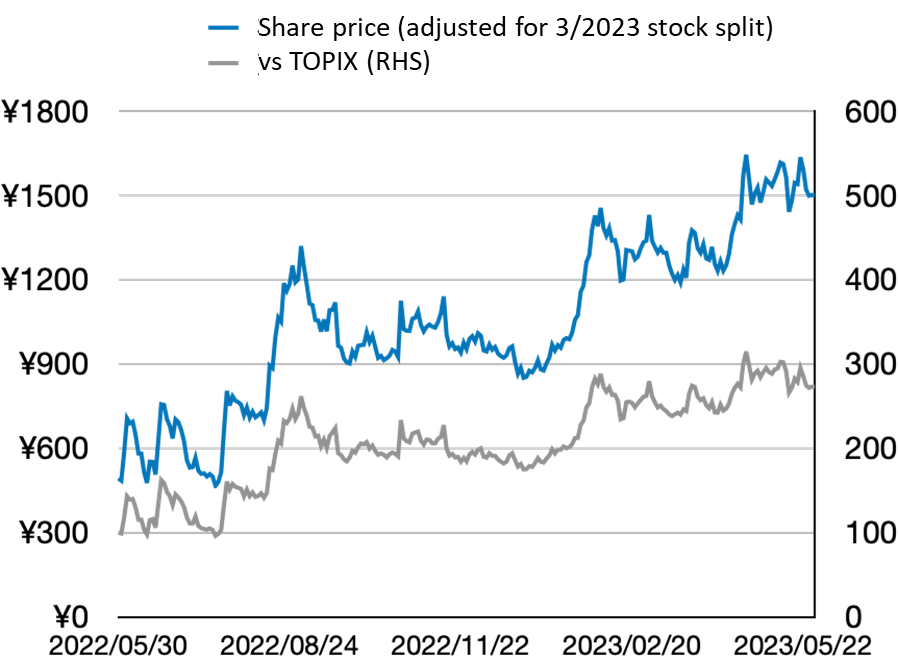

Share price trend

The company’s share price began to rebound in May 2022 on the expectations of business recovery and has since been keeping an upward momentum as the financial results progress.

However, the share price since the announcement of the 1Q results has generally remained flat. This is seen as a slow reaction to the recent strong quarterly results, as the share price over the past year had soared following the bottoming out of the earnings and the sharp recovery and the upward revision to the medium-term management plan. As mentioned above, investors may have been worried about the sluggish growth in the number of registered Sponavi students graduating in March 2024.

Regarding valuations, the shares are trading on 12.3x FY2023 EPS, and PBR is 7.0x. Considering the high ROE, the share price does not look overheated, and there should be a significant upside to the share price as the company’s business performance grows.

Points of interest

Three points of immediate interest are worth mentioning.

First, whether the earnings are likely to exceed the company’s full-year forecast or whether there is scope for the company to revise up its forecasts.

The current environment in the recruitment market is a tailwind for the company. It plans to increase its workforce from 2Q onwards and will likely spend aggressively developing new businesses. Still, the strong possibility is that the earnings will grow steadily, and the progress ratio vis-a-vis the full-year forecast will remain high. Investors are likely to be more interested in the scope for earnings to beat company forecasts or the likelihood of an upward revision by the company.

Needless to say, the possibility of headwinds in the recruitment market should always be borne in mind.

Second, how athletics students graduating in March 2025, who will form the basis of next year’s company performance, stack up in the number of students registered for Sponavi.

The number of Sponavi registrants is the foundation of New Graduate Events and New Graduate Placement Support, the company’s current primary sources of revenue. However, as pointed out, the number of registered students graduating in March 2024 was slightly lower than the apple-to-apple number of graduates in March 2023.

The build-up in the number of registered students graduating in March 2025 is a critical KPI for the company’s performance in the coming year, likely affecting the share price significantly. According to company data, it is currently above the comparable number of March 2024 graduates. It remains to be seen whether this improving trend will take hold.

Third, will the company make progress in generating revenue from Spochalle, a job placement service for students with sports experience, the graduate recruitment business, and Spojoba, a recruitment website specialising in sports-related companies, and begin to play a new medium-term role in driving performance?

Financial results

Full-year financial results

Financial period |

FY12/2019 |

FY12/2020 |

FY12/2021 |

FY12/2022 |

FY12/2023 |

FY12/2024 |

Consolidated, Japanese GAAP |

(IPO) |

Company

|

Medium-term

|

|||

[Statements of income] |

||||||

Net sales |

1,918 |

1,883 |

2,130 |

2,866 |

3,186 |

3,600 |

Operating profit |

194 |

16 |

-32 |

637 |

680 |

768 |

Ordinary profit |

192 |

32 |

-35 |

634 |

677 |

767 |

Net profit before income taxes |

192 |

32 |

-81 |

634 |

||

Net profit attributable to owners of the parent |

133 |

17 |

-79 |

412 |

440 |

|

[Balance Sheets] |

||||||

Total assets |

1,106 |

1,488 |

1,541 |

2,127 |

||

Total liabilities |

676 |

1,041 |

1,173 |

1,347 |

||

Total net assets |

430 |

447 |

368 |

781 |

||

Total borrowings |

334 |

731 |

749 |

630 |

||

[Statements of cash flows] |

||||||

Cash flow from operating activities |

198 |

-89 |

54 |

610 |

||

Cash flow from investing activities |

-25 |

-32 |

-68 |

-7 |

||

Cash flow from financing activities |

150 |

396 |

18 |

-120 |

||

Free cash flow |

173 |

-121 |

-14 |

602 |

||

Cash and cash equivalents at end of period |

686 |

962 |

966 |

1,448 |

||

[Efficiency] |

||||||

Ratio of ordinary profit to sales |

10.0% |

1.7% |

-1.7% |

22.1% |

21.2% |

21.3% |

ROA |

14.4% |

1.3% |

-5.2% |

22.5% |

||

ROE |

47.3% |

3.9% |

-19.4% |

71.8% |

||

[Per-share] Unit : Yen |

||||||

EPS (Adjusted for stock splits, etc.) |

41 |

5 |

-22 |

114 |

122 |

|

BPS (Adjusted for stock splits, etc.) |

122 |

127 |

103 |

216 |

||

DPS (Adjusted for stock splits, etc.) |

0 |

0 |

0 |

0 |

0 |

|

[Number of employees] |

||||||

Number of consolidated employees |

201 |

233 |

266 |

242 |

(Unit: million yen)

Source: Omega Investment from company materials. The per-share indicators EPS and BPS are adjusted for the 1:2 share split carried out in April 2023.

Quarterly results

Source: Prepared by Omega Investment from the company’s IR material.

The per-share indicators EPS and BPS are calculated retrospectively, adjusting for the 1:2 share split implemented in April 2023.

Useful information

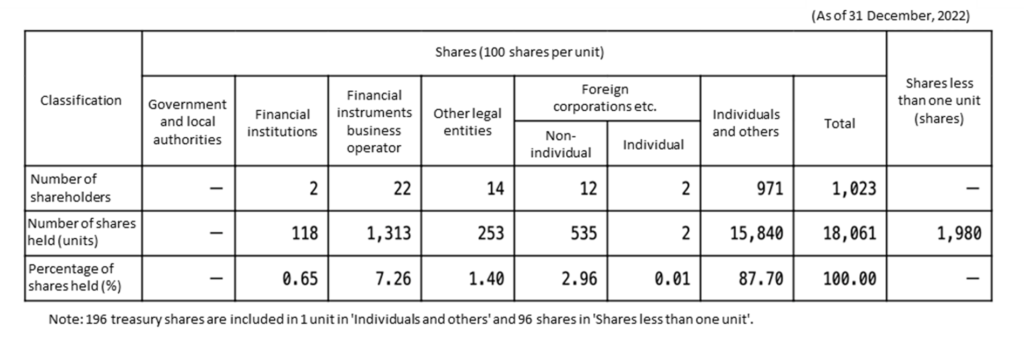

Principal shareholders

| Name | Number of shares owned |

Ratio of the number of shares owned to the total number of issued shares (%) |

| Katsushi Shinozaki | 409,000 | 22.62 |

| Kazuyoshi Ijichi | 209,600 | 11.59 |

| Tadashi Kaji | 209,600 | 11.59 |

| Shota Morimoto | 209,600 | 11.59 |

| Rakuten Securities, Inc. | 27,400 | 1.51 |

| Sportsfield Employee Stock Ownership Plan | 25,200 | 1.39 |

| Nomura Securities Co., Ltd. | 19,700 | 1.08 |

| Toyotaro Shigemori | 16,800 | 0.92 |

| NOMURA PB NOMINEES (Standing proxy: Nomura Securities Co., Ltd.) | 16,200 | 0.89 |

| Medical Corporation Takemura Medical Nephro Clinic | 16,000 | 0.88 |

| Katsumi Takemura | 16,000 | 0.88 |

| Total | 1,175,100 | 64.99 |

Shareholder composition