Saint Marc Holdings (Price Discovery)

Worth a short-term position

Profile

The company operates a chain of restaurants and cafes. Its businesses are Restaurant (60% of sales) and Coffee (49%). The restaurant business operates bakeries, ramen shops, restaurants and sushi restaurants. The coffee division operates Saint Marc Cafe and Kurashiki Coffee Shop. Headquartered in Okayama.

| Securities Code |

| TYO:3395 |

| Market Capitalization |

| 49,586 million yen |

| Industry |

| Retail trade |

Stock Hunter’s View

Profitability has improved significantly due to the liquidation of unprofitable shops. Popular stock to be selected under the new NISA.

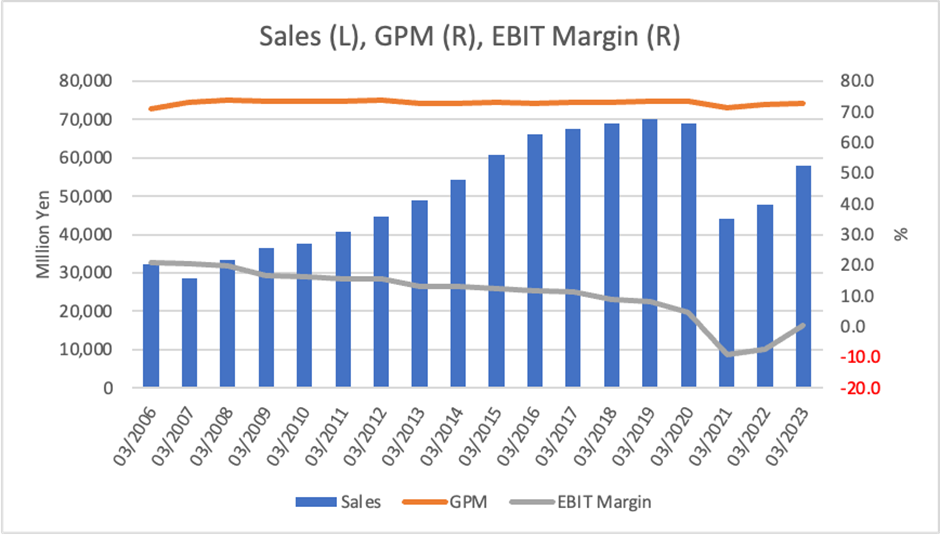

The restaurant industry continues to perform well due to a recovery in human flow and the effect of price increases. Saint Marc Holdings is one such company, which, in November last year, revised its full-year operating profit forecast for the year ending 31 March 2024 upward from 1.5 billion yen to 2 billion yen (8.3 times higher than the previous year).

Sales per shop in the period recovered to 98% of pre-COVID sales. The company achieved an operating profit for the first time in four years due to the closure of unprofitable shops. The company’s full-year forecasts are based on the assumption that existing shop sales and the COGS ratio will remain at the first-half level. However, the results of existing shops in October and November indicate that full-year sales are likely to exceed the plan. In line with this, the company is expected to beat its profit targets.

In recent years, the company has been keen to develop new brands and business categories through M&A, such as acquiring a popular Kyoto-based café, which inherited the taste of a long-established, famous restaurant, as a subsidiary in December 2020. The Japanese-style business model may also aim to capture inbound demand.

The company’s shareholder gifts are also popular among restaurant stocks. Going forward, the company can expect an inflow of investment funds through the new NISA (small-value investment tax exemption scheme).

Investor’s View

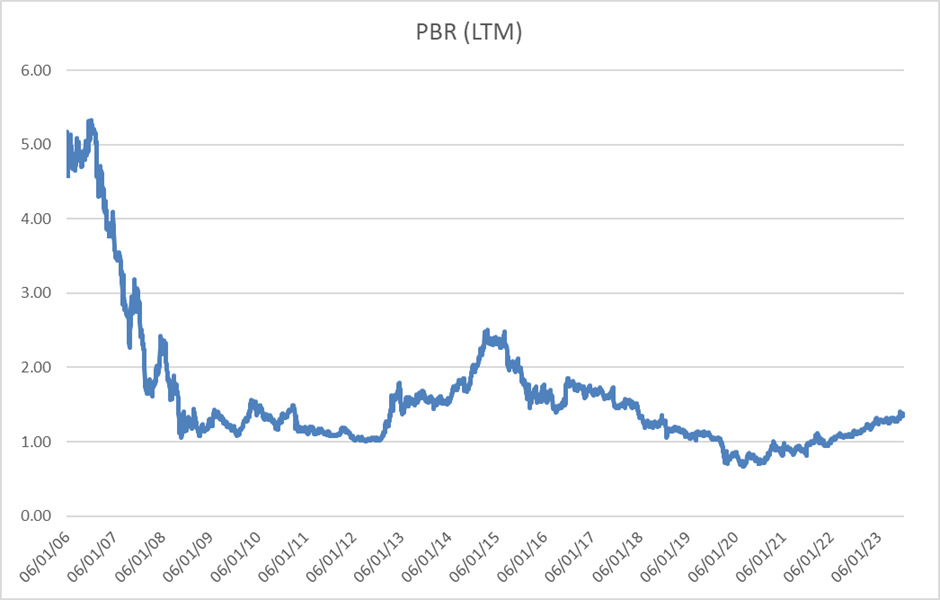

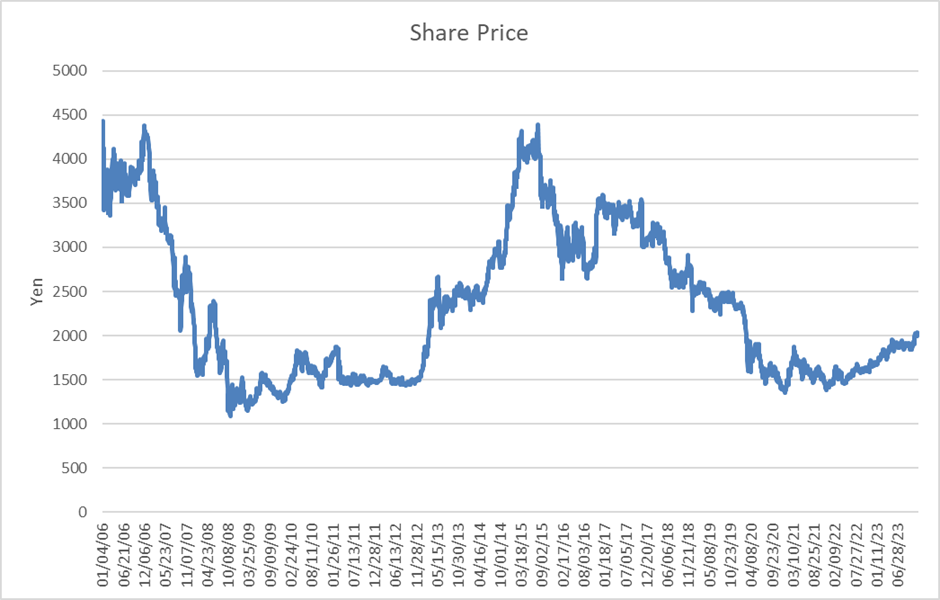

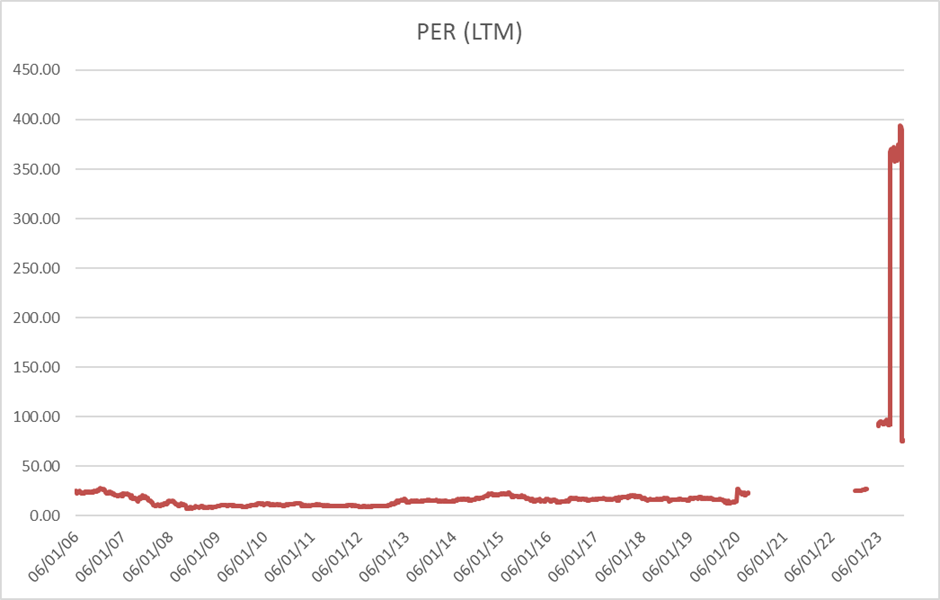

The share price has already factored in the recovery from COVID-19. However, given the positive earnings momentum and the potential for a relatively large share buyback, it may be worth buidling some positions. It is a good company that can regain its good pre-Corona fundamentals but is not expected to be any better than that. The post-recovery PBR is not very cheap, and valuations are not likely to expand materially.

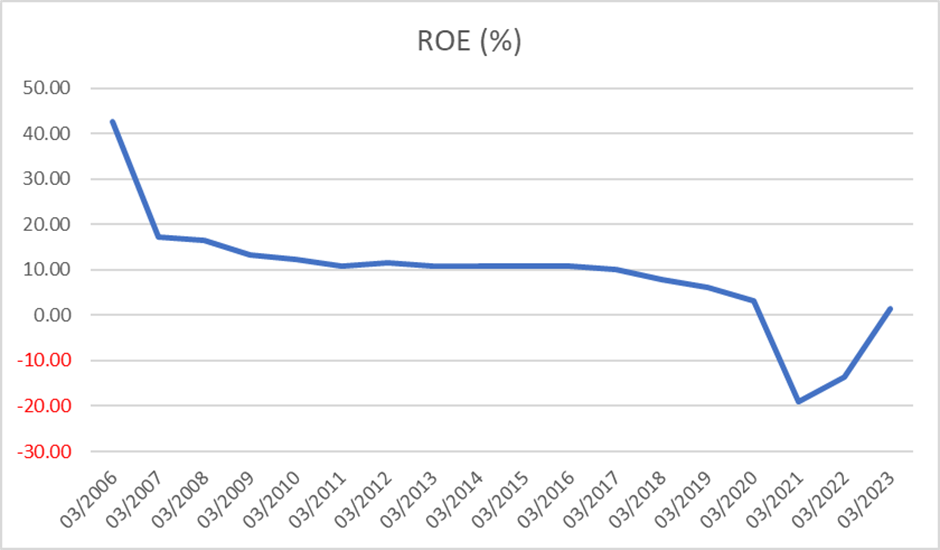

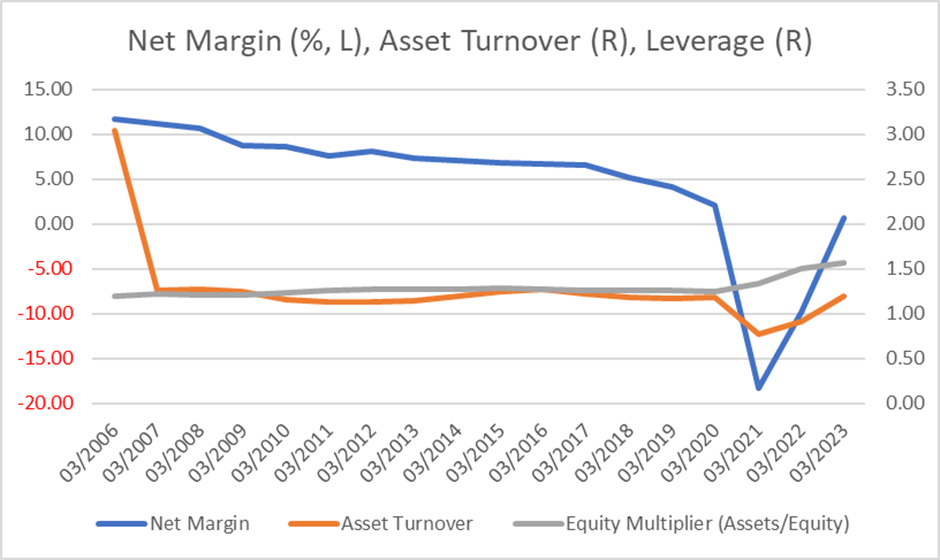

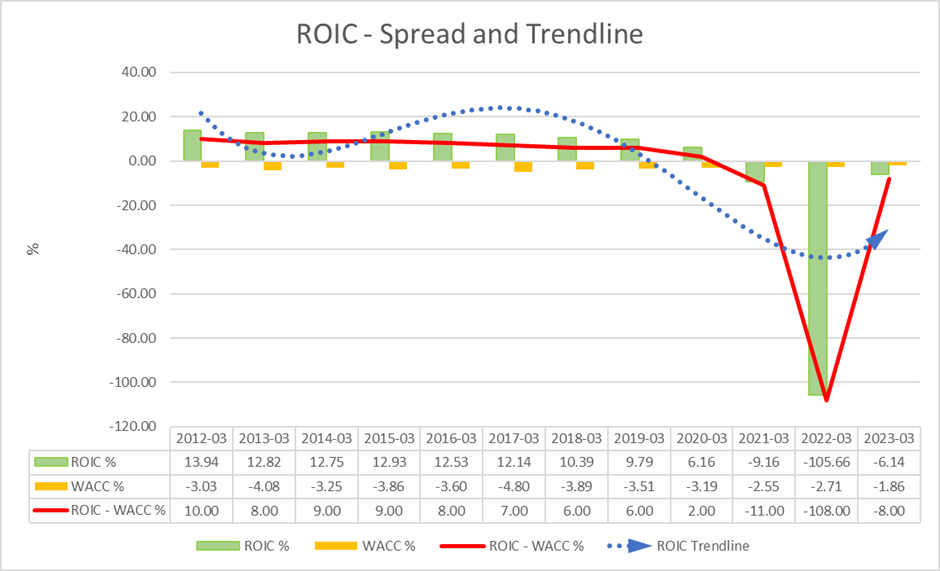

A good company

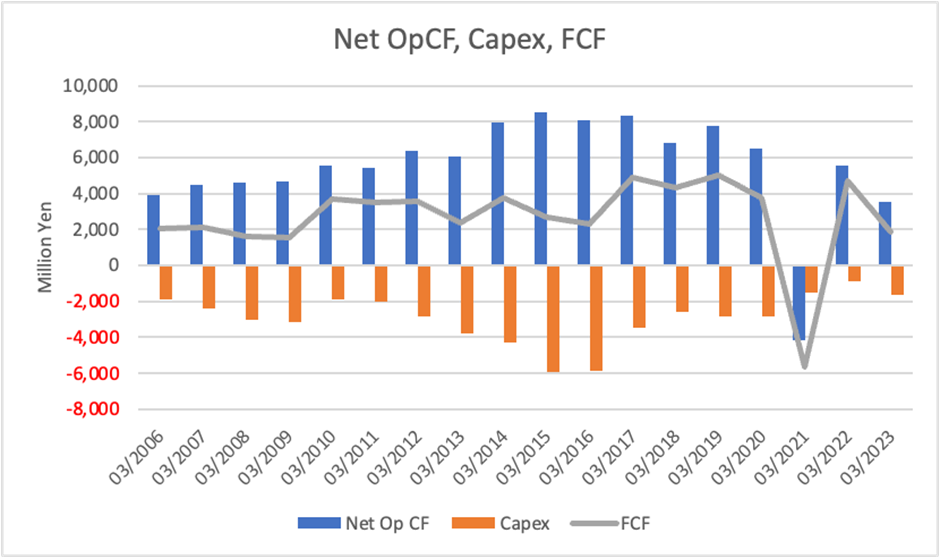

The recovery from the pandemic took some time, but the earnings are recovering well. Financials are well controlled; ROE and ROIC spreads will soon return to stable pre-pandemic levels. The business generates ample cash flow. Management is commercially astute, as evidenced by the clever development of Kamakura Pasta. All in all, Saint Marc is rated a good company.

Surplus cash suggests potential share buy-backs

Cash is excessive at 32% of assets. If management invests cash aggressively in investments that add to return on capital or in shareholder returns, this would be very positive for the share price. In a highly competitive industry, the former cannot be readily expected. On the other hand, the company could announce a reasonably large buyback within the next 12 months. Cash at the end of 2Q was 15bn yen; President Fujikawa said 10-11bn was appropriate. In the past, the company has continued share buybacks over a long time: 1 billion yen in 2014, 2.3 billion yen in 2019, 900 million yen in 2023 and 300 million yen in 2023.

Will the share price ever return to 4,000 yen?

The first thing that pops into mind when seeing the long-term share price chart is whether the share price will ever return to the level of over 4,000 yen again.

The top-line revenue expanded at a CAGR of +10% from FY03/2010 to FY03/2016, with significant CF generation. This is thought to be the reason for the share price rise, which reached over 4,000 yen, accompanied by valuation expansion. Although COVID-19 has made it difficult to see the underlying growth of revenue growth, presumably, growth has matured considerably over the last decade. If the company’s performance overturns this, share price multiples will expand again.

PER to date

PER before COVID