Tokyo Tatemono (Price Discovery)

Overweight

Profile

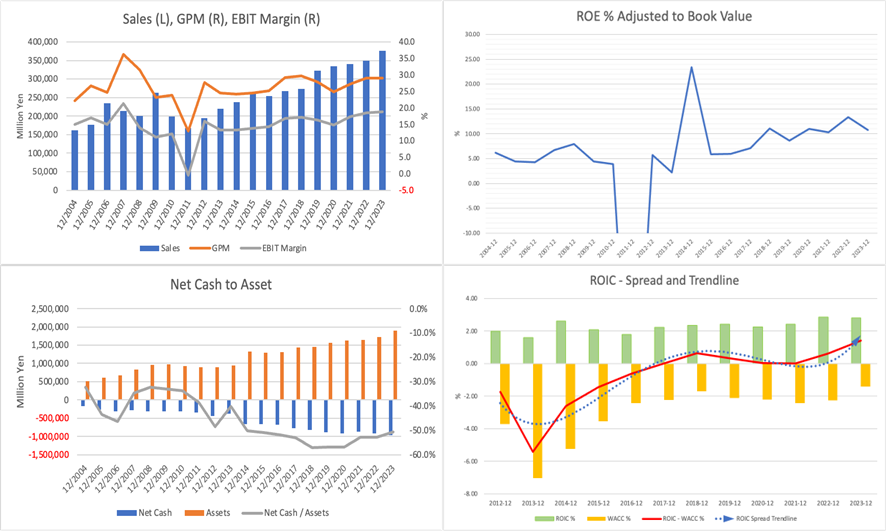

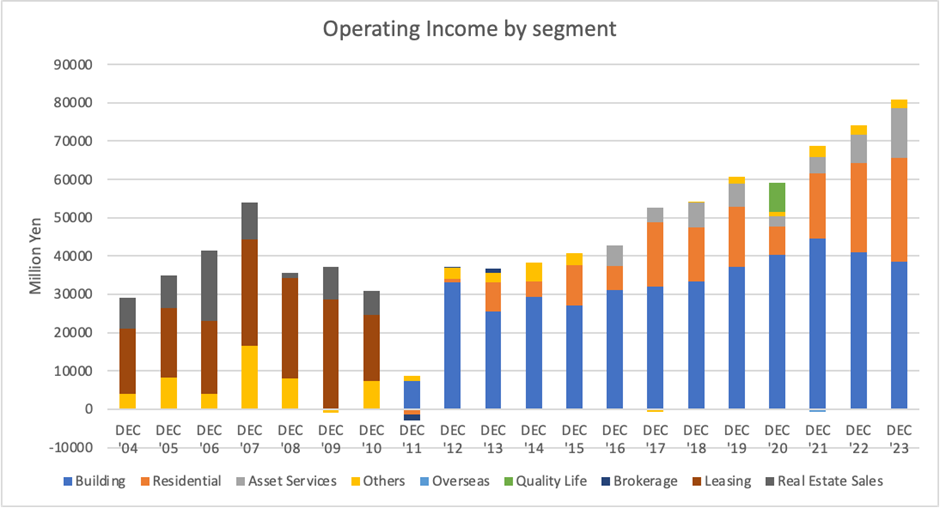

A comprehensive real estate company founded in 1896 by Zenjiro Yasuda, a pre-war business tycoon. It operates a building business, mainly leasing commercial properties and a residential business with ‘Brillia’ brand condominiums. Commercial properties are located in prime locations in Japan. Segment sales ratio % (OPM%): Buildings 41 (26), Residential 36 (20), Asset Services 17 (20), Others 6 (19) (FY12/2023)

| Securities Code |

| TYO:8804 |

| Market Capitalization |

| 559,314 million yen |

| Industry |

| Real Estate |

Stock Hunter’s View

Condominium sales drove the first half’s earnings. The company should comfortably achieve its targets in the medium-term management plan.

Tokyo Tatemono operates a building business that focuses on leasing and a residential business that is developing condominiums under the Brillia brand.

The focus area is the east side of Tokyo Station (Nihonbashi, Yaesu and Kyobashi), and a significant redevelopment project (Yaesu Project) is currently planned for completion in 2025 in the Yaesu 1-chome East District. In addition, the company is also undertaking a large-scale redevelopment project (Gofukubashi Project) in the Yaesu 1-chome North district to be completed in 2028 or later. The company’s leased floor space in office buildings is expected to increase from 540,000 m2 as of December 2011 to approximately 800,000 m2 by 2030.

For the current FY12/2024 results, the company plans sales of 495 billion (+31.7% YoY) and operating income of 75 billion (+6.4% YoY). Operating profit, including equity in earnings (losses) of affiliates, is expected to be 77 billion, exceeding the medium-term plan target of 75 billion. The number of condominiums for sale is expected to increase by 64% YoY, with 85% of the planned units under contract at the beginning of the year. Large, high-value properties in city centres are expected to drive performance in 1H, while a logistics REIT will be formed in 2H.

Investor’s View

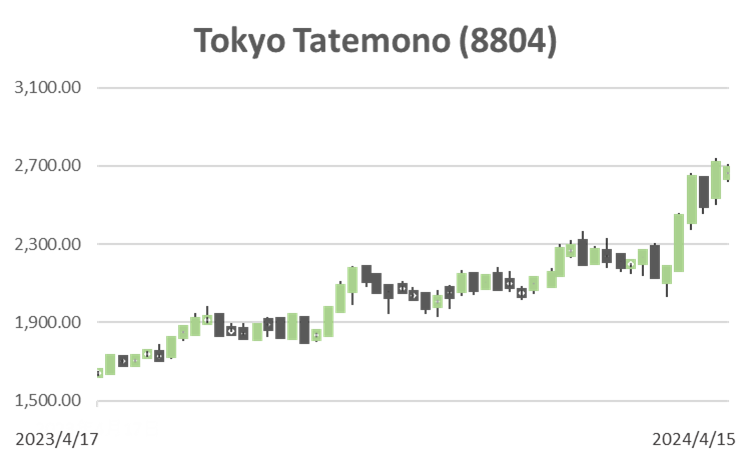

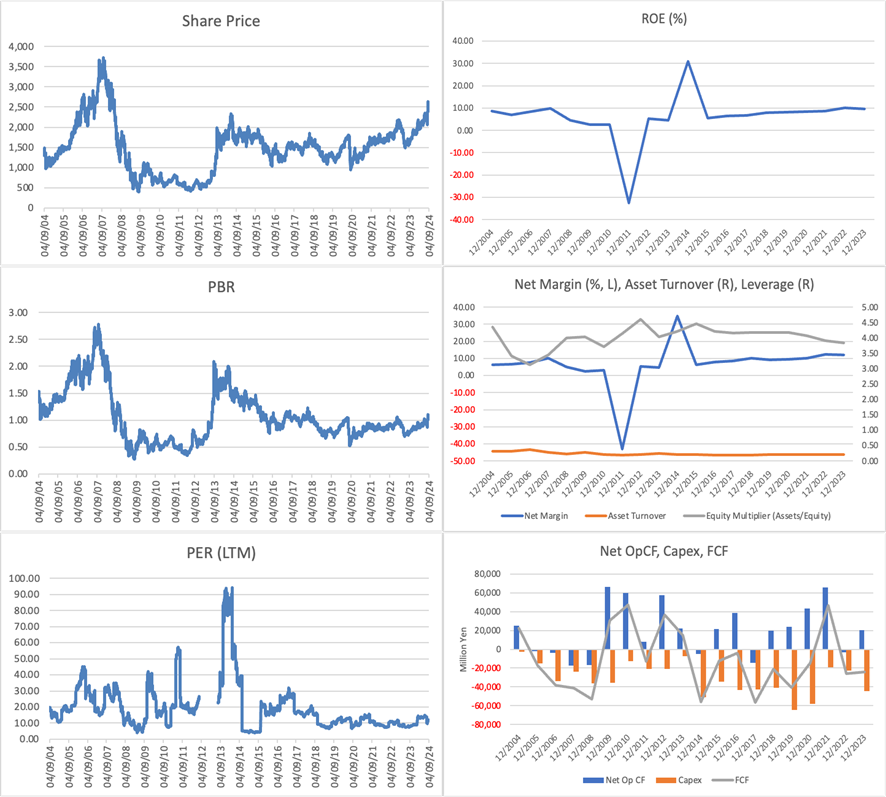

Overweight: Residential business drives profits. The operating environment is unlikely to change significantly in the near term. Equity yield and dividend yield are attractive.

The strong Residential business drives current earnings and should drive consolidated earnings further. The steady performance of the Residential business has exceeded management’s expectations. Despite the upward trend in construction costs and the outlook for higher loan rates, actual demand is strong in city centres and suburbs. Sales prices have exceeded management’s expectations, and profit margins have improved.

Meanwhile, in recent years, earnings of the Buildings business have been flattish and below management’s expectations, with factors such as the New Normal slowing the supply and demand for office buildings and the pace of rent fee growth. Market vacancy rates also remain high. However, the Buildings business remains solid, supported by the size and location advantages of the company’s properties. Management believes a significant deterioration in vacancy rates and rental fees is unlikely.

Although no catalyst could significantly boost share prices in the near term, the per-share indices should continue to rise on the back of low interest rates and strong housing demand. There are currently no factors that reduce the premium of the shares. The equity yield and dividend yield are reasonably attractive, at around 10% and 2.95%, respectively. Hence, we expect the share price to continue to outperform.