Sansei Landic (Company Note 1Q update)

| Share price (6/8) | ¥874 | Dividend Yield (22/12 CE) | 3.08 % |

| 52weeks high/low | ¥908/778 | ROE(TTM) | 6.44 % |

| Avg Vol (3 month) | 12.08 thou shrs | Operating margin (TTM) | 6.52 % |

| Market Cap | ¥7.40 bn | Beta (5Y Monthly) | 0.87 |

| Enterprise Value | ¥9.67 bn | Shares Outstanding | 8.476 mn shrs |

| PER (22/12 CE) | 6.81 X | Listed market | TSE Standard |

| PBR (21/12 act) | 0.69 X |

| Click here for the PDF version of this page |

| PDF Version |

The management revised up as the business is running ahead of forecasts. Sold off subsidiary One’s Life Home.

◇ The company has shifted its management resources to the well-performing core business. The management now expects a rise in 1H profits, though they had initially expected a fall.

Sansei Landic started FY12/2022 strongly, delivering 1Q sales and profits above projections thanks to a significant increase in sales of old unutilised buildings. Although it lowered the full-year sales target as it sold off a construction subsidiary, it raised the earnings forecasts for 1H and the full year amid a robust property market. Real estate purchases were also larger than the previous year, progressing as planned. The management announced a share buyback, which endorsed their confidence in the current year‘s performance. The shares have outperformed TOPIX year-to-date and have been solid since the result announcement. Trading on 0.66x book, they remain undervalued.

◇ 1Q Results: Sales and profits were down yoy, but exceeded the management’s forecasts

Thanks to a significant increase in old unutilised buildings, 1Q sales registered 4.44 billion yen (-17.2% yoy), and operating profit was 440 million yen (-15.4% yoy), beating the management’s estimate by a margin of 490 million yen and 150 million yen, respectively. (It should be noted that as the scale of each project is large, quarterly results would fluctuate significantly depending on the timing of booking. To grasp a more accurate business performance, one should compare the progress to company estimates).

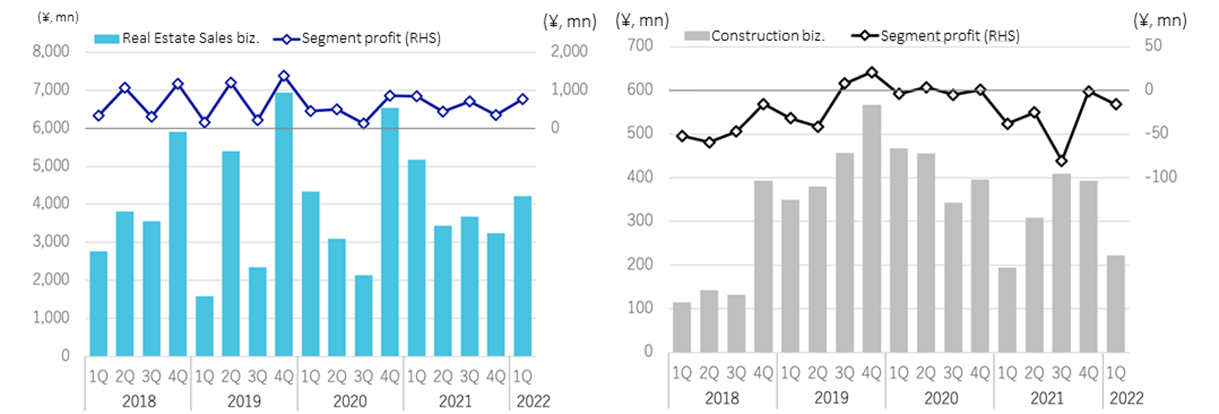

By segment, Real estate sales business recorded sales of 4,222 million yen, down 18.3% yoy but 13.3% above the company estimate. Profit dropped 8.1% to 774 million yen but exceeded the management’s forecast.

Leasehold land: 1,793 million yen (-48.2% yoy). The progress was in line with the forecast, mainly in the metropolitan area. Sales came in at 2.8% above the company forecast, and

profits exceeded its estimate. The yoy sales decline is attributable to the higher-than-usual sales of last year.

Old unutilised properties: 2,024 million yen (+42.6% yoy). Both sales and profits were significantly higher than planned, partly because projects scheduled to be booked from 2Q were front-loaded in 1Q. Sales were 31.0% higher than planned, and profit margins were also better than expected.

Freehold: 315 million yen (+64.3% yoy). As sales were lower-than-usual in the previous year, 1Q sales grew significantly yoy but slightly undercut the estimate by 8.3%. Profit margins were largely in line with expectations.

Meanwhile, Construction business delivered sales of 222 million yen (+14.0% yoy), which was 3.0% below the plan. The segment lost 16 million yen, which contracted from the loss of 38 million yen in the same period of last fiscal year. As referred to later, the company sold off all the shares of construction subsidiary One’s Life Home on 31 March, so sales from Construction business will not be counted in from 2Q onwards.

| JPY, mn | Net sales | YoY % |

Oper. profit |

YoY % |

Ord. profit |

YoY % |

Profit ATOP |

YoY % |

EPS (¥) |

DPS (¥) |

| 2019/12 | 18,020 | 7.1 | 1,860 | 5.4 | 1,758 | 7.0 | 1,158 | 15.1 | 137.08 | 23.00 |

| 2020/12 | 17,774 | -1.4 | 847 | -54.5 | 709 | -59.7 | 357 | -69.1 | 42.34 | 25.00 |

| 2021/12 | 16,836 | -5.3 | 1,117 | 31.9 | 999 | 40.9 | 609 | 70.5 | 73.56 | 26.00 |

| 2022/12 (CE)* | 17,103 | 1.6 | 1,402 | 25.5 | 1,226 | 22.7 | 1,058 | 73.7 | 128.40 | 27.00 |

| 2021/12 1Q | 5,365 | 11.6 | 528 | 252.3 | 502 | 386.6 | 323 | 380.3 | 38.47 | – |

| 2022/12 1Q | 4,444 | -17.2 | 447 | -15.4 | 415 | -17.4 | 375 | 16.1 | 45.51 | – |

| 2021/12 2Q | 9,109 | 9.0 | 689 | 74.3 | 631 | 116.4 | 402 | 120.8 | 48.37 | – |

| 2022/12 2Q (CE)* | 8,290 | -9.0 | 839 | 21.9 | 761 | 20.7 | 669 | 62.2 | 81.14 | – |

* Revised company forecasts

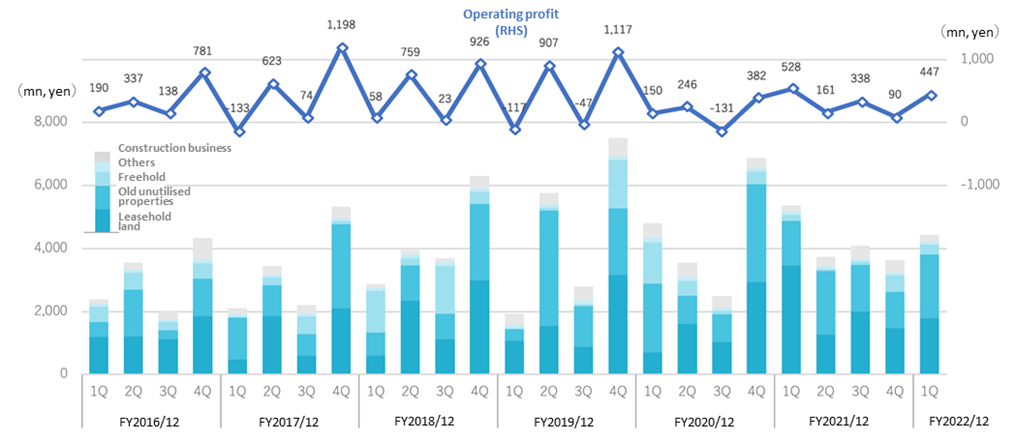

Quarterly sales and operating profit

Purchases and orders received for the Real estate sales business were 2,956 million yen (+14.5% yoy). This split into leasehold land of 1,289 million yen (+13.1% yoy), Old unutilised land business of 1,383 million yen (-1.5% yoy) and Freehold of 283 million yen (+672.7% yoy). The progress was in line with the annual purchase target of 13.4 billion yen. The number of projects exceeded the pre-COVID levels. The number of contracts is also on an upward trend.

On the other hand, orders for Construction business fell sharply to 65 million yen (-83.0% yoy). This reflected the lengthening of the period between the application for construction and the signing of the contract.

(See graph on next page)

◇Forecasts for 2H and FY12/2022 were raised to reflect strong performance.

The company has revised up as follows.

2H:

| (million yen) | Initial estimate (YoY) | Revised estimate (YoY) | Revision (%) |

| Sales | 7,052 (-22.6% ) | 8,290 (-9.0% ) | +17.6% |

| Operating Profit | 395 (-42.7%) | 839 (+21.9%) | +112.4% |

| Recurring Profit | 317 (-49.7%) | 761 (+20.7%) | +140.1% |

| Net Income | 201 (-49.9%) | 669 (+66.2%) | +232.8% |

Sales and operating income by quarterly segment

Full-year to 12/2022:

| (million yen) | Initial estimate (YoY) | Revised estimate (YoY) | Revision (%) |

| Sales | 18,235 (+8.3% ) | 17,103 (+1.6% ) | -6.2% |

| Operating Profit | 1,301 (+16.4%) | 1,402 (+25.5%) | +7.8% |

| Recurring Profit | 1,142 (+14.3%) | 1,226 (+22.7%) | +7.4% |

| Net Income | 754 (+23.8%) | 1,058 (+73.7%) | +40.3% |

For the full year, sales will decline yoy due to the sell-off of the consolidated subsidiary One’s Life Home (the company estimates Construction business sales to be 1,134 million yen during Apr-Dec 2022). On the other hand, the 2Q sales estimate was raised as a project for Old unutilised properties, which is a segment under Real estate business, was brought forward to 1H earlier than the scheduled 2H. In addition, thanks to the recent strength of the real estate market, the sales prices of old unutilised properties have risen higher than expected. Furthermore, operating profit and recurring profit will likely be higher than forecast due to cost reduction efforts. Positive for the full-year net profit is a decrease in income taxes (about 230 million yen) resulting from the sales of One’s Life Home shares and the waiver of receivables.

◇ Sold off construction subsidiary One’s Life Home

Sansei Landic established One’s Life Home in March 2005 and advanced into the build-and-sell detached houses business to enter the construction business, which is an upstream process in the real estate business. The company collected know-how on detached house construction and expected synergies with its real estate business. One’s Life Home was involved in fully custom-built houses with excellent design and remodelling, but as a result, it proved not easy to turn this construction business into profitable. In recent years the company has experienced a sizeable gross cost overrun in RC properties. In addition, some inappropriate transactions were detected. The company considered restructuring One’s Life Home by incorporating it into its parent operation but ultimately decided to sell the shares to another company in the same business. The company will also waive its claims against One’s Life Home (730 million yen). As a provision for doubtful debts was already booked last year, there will be no impact on the current year’s results. One’s Home has been deconsolidated since April 2022.

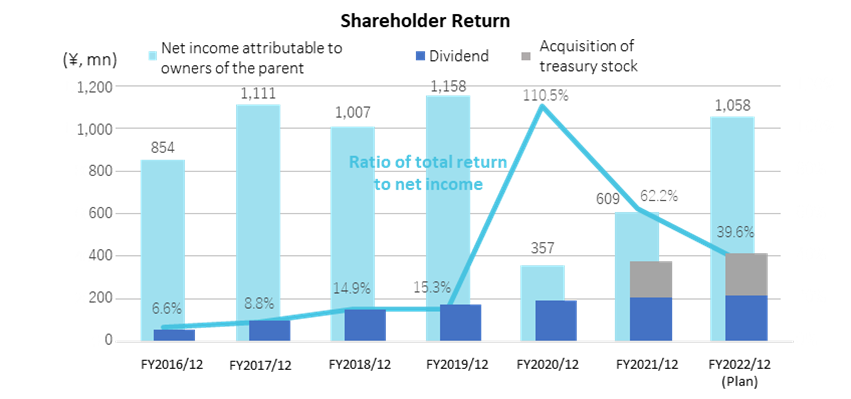

◇Announced a share buyback

On the same day as the results announcement, the company announced that it would buy back its shares, up to 150,000 shares for a maximum of 200 million yen, between 16 May and 29 July 2022. It also plans to increase dividend payment by 1 yen a share for the performance of FY12/2022. These will be 12-month total shareholder returns of around 420 million yen and translate into a total shareholder revert ratio of about 40% of net profit for the year.

◇ Share price: positive reaction to the result announcement, still the shares remain undervalued.

The company’s share price rose by 5.5% in one week following the announcement of a share buyback on top of the report of a favourable business outlook and the upward revision on 13 May. Real estate sales business, which runs on face-to-face sales, was severely affected by the coronavirus infection but had been recovering since FY12/2021. It has now almost recovered to the level before the infection spread. At the same time, the real estate market continues to be buoyant thanks to the monetary easing and other factors affecting the company’s earnings positively. Despite the favourable business environment, the company’s shares are trading at a PBR of 0.66x, which remains below the five-year historical trend of 0.87x. The shares outperformed TOPIX year-to-date, but they remain significantly undervalued. It will be interesting to see whether the company’s shares will be rerated further in the future.

5-year stock price move

Share price compared to TOPIX

Financial data

| FY (¥mn) | 2019/12 | 2020/12 | 2021/12 | 2022/12 | |||||||||

| 1Q | 2Q | 3Q | 4Q | 1Q | 2Q | 3Q | 4Q | 1Q | 2Q | 3Q | 4Q | 1Q | |

| [Sales by segment] | |||||||||||||

| Net sales | 1,925 | 5,775 | 2,811 | 7,507 | 4,807 | 3,546 | 2,481 | 6,938 | 5,365 | 3,744 | 4,089 | 3,637 | 4,444 |

| Year-on-year basis | -33.0% | 45.8% | -23.9% | 15.0% | 149.7% | -38.6% | -11.7% | -7.6% | 11.6% | 5.6% | 64.8% | -47.6% | -17.2% |

| Real estate sales business | 1,576 | 5,396 | 2,353 | 6,941 | 4,339 | 3,092 | 2,137 | 6,543 | 5,171 | 3,434 | 3,679 | 3,244 | 4,222 |

| Year-on-year basis | -42.8% | 41.3% | -33.9% | 17.5% | 175.3% | -42.7% | -9.2% | -5.7% | 19.2% | 11.1% | 72.1% | -50.4% | -18.3% |

| Sales composition ratio | 81.9% | 93.4% | 83.7% | 92.5% | 90.3% | 87.2% | 86.2% | 94.3% | 96.4% | 91.7% | 90.0% | 89.2% | 95.0% |

| Leasehold land | 1,086 | 1,546 | 889 | 3,176 | 719 | 1,613 | 1,044 | 2,950 | 3,464 | 1,267 | 2,003 | 1,474 | 1,793 |

| Year-on-year basis | 77.7% | -34.2% | -21.5% | 6.1% | -33.8% | 4.3% | 17.4% | -7.1% | 381.4% | -21.5% | 91.9% | -50.0% | -48.2% |

| Sales composition ratio | 56.4% | 26.8% | 31.6% | 42.3% | 15.0% | 45.5% | 42.1% | 42.5% | 64.6% | 33.8% | 49.0% | 40.5% | 40.3% |

| Old unutilised properties | 351 | 3,657 | 1,283 | 2,108 | 2,180 | 897 | 872 | 3,101 | 1,419 | 2,025 | 1,488 | 1,151 | 2,024 |

| Year-on-year basis | -51.6% | 225.4% | 62.0% | -12.9% | 520.6% | -75.5% | -32.0% | -47.1% | -34.9% | 125.8% | 70.6% | -62.9% | 42.6% |

| Sales composition ratio | 18.2% | 63.3% | 45.6% | 28.1% | 45.4% | 25.3% | 35.1% | 44.7% | 26.4% | 54.1% | 36.4% | 31.6% | 45.5% |

| Freehold | 28 | 88 | 55 | 1,532 | 1,305 | 465 | 106 | 395 | 191 | 46 | 101 | 526 | 315 |

| Year-on-year basis | -97.9% | -60.4% | -96.4% | 290.8% | 4560.7% | 428.4% | 92.7% | -74.2% | -85.3% | -90.1% | -4.7% | 33.2% | 64.9% |

| Sales composition ratio | 1.5% | 1.5% | 2.0% | 20.4% | 27.1% | 13.1% | 4.3% | 5.7% | 3.6% | 1.2% | 2.5% | 14.5% | 7.1% |

| Others | 110 | 104 | 126 | 126 | 133 | 117 | 116 | 97 | 96 | 95 | 88 | 94 | 89 |

| Year-on-year basis | 11.1% | -14.8% | 5.0% | 21.2% | 21.5% | 12.5% | -7.9% | -23.0% | -28.3% | -18.8% | -24.1% | -3.1% | -7.3% |

| Sales composition ratio | 5.7% | 1.8% | 4.5% | 1.7% | 2.8% | 3.3% | 4.7% | 1.4% | 1.8% | 2.5% | 2.2% | 2.6% | 2.0% |

| Construction business | 349 | 379 | 457 | 566 | 468 | 455 | 343 | 395 | 194 | 309 | 409 | 392 | 222 |

| Year-on-year basis | 202.6% | 166.5% | 246.1% | 44.0% | 34.1% | 19.8% | -24.9% | -30.1% | -58.4% | -32.1% | 19.3% | -0.8% | 14.0% |

| Sales composition ratio | 18.1% | 6.6% | 16.3% | 7.5% | 9.7% | 12.8% | 13.8% | 5.7% | 3.6% | 8.3% | 10.0% | 10.8% | 5.0% |

| [Statements of income] | |||||||||||||

| Net sales | 1,925 | 5,775 | 2,811 | 7,507 | 4,807 | 3,546 | 2,481 | 6,938 | 5,365 | 3,744 | 4,089 | 3,637 | 4,444 |

| Cost of sales | 1,346 | 4,014 | 2,076 | 5,466 | 3,865 | 2,557 | 1,934 | 5,431 | 4,020 | 2,756 | 2,945 | 2,745 | 3,146 |

| Gross profit | 579 | 1,762 | 736 | 2,042 | 942 | 989 | 548 | 1,507 | 1,344 | 986 | 1,143 | 892 | 1,297 |

| SG&A expenses | 696 | 855 | 783 | 924 | 792 | 744 | 678 | 925 | 816 | 826 | 805 | 802 | 850 |

| Operating income | -117 | 907 | -47 | 1,117 | 150 | 245 | -131 | 382 | 528 | 160 | 338 | 90 | 447 |

| Non-operating income | 4 | 28 | 5 | 5 | 9 | 5 | 51 | 5 | 12 | 8 | 8 | 6 | 7 |

| Non-operating expenses | 34 | 38 | 32 | 40 | 55 | 63 | 60 | 10 | 37 | 40 | 34 | 39 | 39 |

| Ordinary income | -147 | 898 | -75 | 1,083 | 103 | 188 | -140 | 298 | 502 | 128 | 311 | 56 | 415 |

| Extraordinary income | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 3 | 0 | 0 | 0 | 19 | |

| Extraordinary expenses | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | ||||

| Loss before income taxes | -147 | 898 | -75 | 1,083 | 103 | 188 | -140 | 298 | 506 | 128 | 311 | 56 | 435 |

| Total income taxes | -35 | 312 | -26 | 349 | 36 | 72 | -49 | 295 | 183 | 48 | 166 | -4 | 59 |

| Net income | -112 | 585 | -48 | 734 | 67 | 114 | -90 | 176 | 323 | 79 | 145 | 61 | 375 |

| [Balance Sheets] | |||||||||||||

| Current assets | 16,007 | 15,596 | 17,458 | 18,095 | 18,816 | 20,798 | 20,577 | 19,040 | 17,554 | 17,371 | 18,769 | 18,968 | 19.018 |

| Property for sale | 13,129 | 12,290 | 14,890 | 13,493 | 14,655 | 16,923 | 17,312 | 14,424 | 13,493 | 12,586 | 13,134 | 13,301 | 13,304 |

| Non-current assets | 1,230 | 1,206 | 1,229 | 1,199 | 1,188 | 1,164 | 1,197 | 1,030 | 951 | 1,054 | 1,081 | 1,082 | 1,124 |

| Tangible assets | 469 | 471 | 462 | 456 | 451 | 449 | 443 | 306 | 291 | 290 | 293 | 301 | 317 |

| Investments and other assets | 694 | 666 | 689 | 669 | 668 | 653 | 691 | 655 | 595 | 703 | 732 | 730 | 761 |

| Total assets | 17,236 | 16,802 | 18,686 | 19,294 | 20,004 | 21,962 | 21,774 | 20,071 | 18,505 | 18,425 | 19,849 | 20,051 | 20,134 |

| Current liabilities | 6,904 | 6,996 | 9,135 | 9,047 | 9,883 | 7,767 | 7,699 | 5,772 | 5,517 | 7,540 | 8,633 | 8,732 | 8,153 |

| Short-term borrowings | 5,645 | 5,360 | 7,702 | 7,203 | 7,729 | 6,352 | 6,676 | 4,463 | 4,272 | 6,105 | 7,171 | 7,368 | 5,025 |

| Non-current liabilities | 1,714 | 602 | 389 | 351 | 345 | 4,303 | 4,274 | 4,232 | 2,919 | 792 | 976 | 1,017 | 1,525 |

| Long-Term Borrowings | 1,347 | 222 | 3,958 | 3,929 | 3,879 | 2,570 | 483 | 683 | 740 | 1,260 | |||

| Total liabilities | 8,618 | 7,598 | 9,524 | 9,399 | 10,228 | 12,071 | 11,973 | 10,004 | 8,436 | 8,332 | 9,609 | 9,749 | 9.679 |

| Total net assets | 8,618 | 9,204 | 9,162 | 9,895 | 9,776 | 9,891 | 9,801 | 10,067 | 10,070 | 10,093 | 10,240 | 10,301 | 10,463 |

| Total shareholders’ equity | 8,618 | 9,204 | 9,162 | 9,895 | 9,776 | 9,891 | 9,801 | 10,067 | 10,070 | 10,093 | 10,240 | 10,297 | 10,459 |

| Capital stock | 811 | 811 | 814 | 814 | 818 | 818 | 818 | 818 | 818 | 820 | 820 | 820 | 821 |

| Legal capital reserve | 772 | 772 | 775 | 775 | 779 | 779 | 779 | 779 | 779 | 781 | 781 | 781 | 782 |

| Retained earnings | 7,031 | 7,616 | 7,568 | 8,302 | 8,174 | 8,289 | 8,200 | 8,465 | 8,577 | 8,656 | 8,802 | 8,863 | 9,023 |

| Stock acquisition right | 4 | 4 | 4 | 4 | 4 | 4 | 4 | 4 | 4 | 4 | 4 | 4 | 4 |

| Total liabilities and net assets | 17,236 | 16,802 | 18,686 | 19,294 | 20,004 | 21,962 | 21,774 | 20,071 | 18,505 | 18,425 | 19,849 | 20,051 | 20,134 |

| [Statements of cash flows] | |||||||||||||

| Cash flow from operating activities | -286 | -419 | -3,683 | -916 | 2,110 | 1,704 | |||||||

| Loss before income taxes | 750 | 1,758 | 291 | 712 | 635 | 1,003 | |||||||

| Cash flow from investing activities | -27 | -70 | -9 | -287 | -26 | -51 | |||||||

| Cash flow from financing activities | -446 | 984 | 3,021 | 952 | -2,129 | -608 | |||||||

| Net increase in cash and cash equiv. | -760 | 493 | -671 | -251 | -46 | 1,045 | |||||||

| Cash and cash equiv. at beginning of period | 3,465 | 3,465 | 3,958 | 3,958 | 3,707 | 3,707 | |||||||

| Cash and cash equiv. at end of period | 2,704 | 3,958 | 3,287 | 3,707 | 3,661 | 4,752 |

Source: Omega Investment from Company materials.