Menicon (Price Discovery)

| Securities Code |

| TYO:7780 |

| Market Capitalization |

| 217,418 million yen |

| Industry |

| Precision equipment |

Profile

Menicon manufactures and sells contact lenses and divides its business into Vision Care and Others segments. The majority of sales and profits are in the Vision Care segment. This segment includes contact lenses and contact lens care products. The Other segment deals with healthcare and life care operations. The company was founded in 1951 by Kyoichi Tanaka. The second and current president, Hidenari Tanaka, son of the founder and a former ophthalmologist, has been a strong driving force behind the company’s management since he was appointed president in CY2000.

Stock Hunter’s View

A boosting momentum in the resurging share price. Robust growth of myopia-suppressing lenses.

Menicon (7780) is on track to record its highest profits for the eighth consecutive year. The share price has been in a correction since the second half of October but has rebounded on the results announcement on 14 October.

The company’s subscription model for contact lenses, MELS Plan, is a stable revenue base. The company has also expanded its business in orthokeratology lenses, worn at bedtime, to control myopia progression.

The 2Q (Apr-Sep) results for the current FY2023/3 were 6.87 billion yen in operating profit (+35.8% yoy). This was a good result, with progress towards the full-year forecast reaching 66%. While the number of MELS Plan (domestic) members remained unchanged from 1Q at 1.34 million, sales of daily disposable contact lenses, which have a high average price per customer, increased steadily with a 2.4% increase in membership. Overseas sales grew by 34% yoy due to continued strong growth in orthokeratology lenses and lens care in China, where the government is making a concerted effort to curb myopia.

In China, a second orthokeratology product recently received medical device approval and is scheduled for launch in 2023.

Investor’s View

Short-term buy – caution for long-term investors

Still, an opportunity to accumulate the shares. Equity premium detachment could risk the long-term share price.

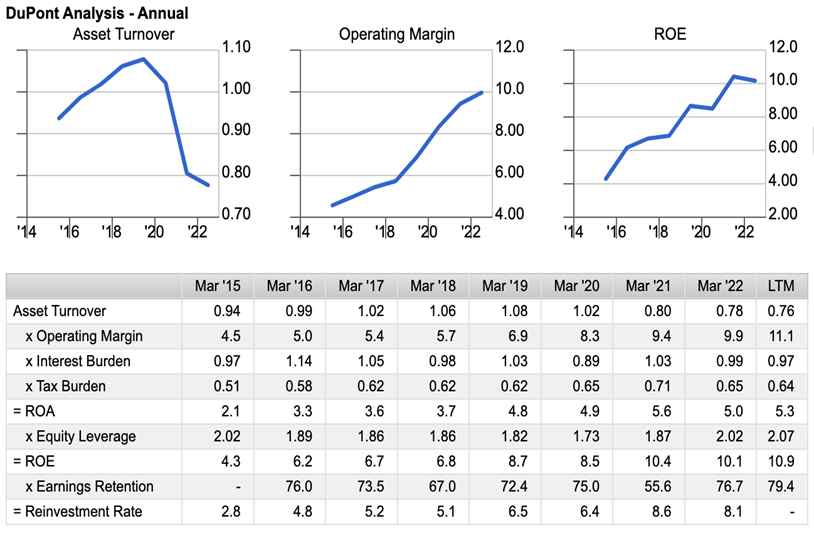

Strong earnings generation in a recessionary economy in the coming year will likely be a driver for Menicon’s share price. Hence, we consider it good timing to accumulate the shares given a time span of 6-8 months. In addition to the high volatility of the share price after the surge, the risk that ROE will not be sufficiently attractive in the long term and the shares could lose their premium should be noted: for an ROE of around 10%, current PBR is 3.1x, a high premium, albeit having adjusted from the peak of 5.5x in August last year.

Fine secular top-line growth

The 2Q results suggest that there is little concern about Menicon’s secular top-line growth, the company is proving resilience, and the Menicon brand is becoming more well-recognised overseas. The share price sensibly resurged. Cash flow has always been strong, and the management has spent most of it on capital expenditure over the past five years. In recent years, it has been keen to build new disposable lens factories. The aggressive strategy shows management’s firm conviction and makes us excited about the eventual return on the aggressive investment.

Significant risk to the value of the shares

On the flip side, we are increasingly concerned that the management’s chase for top-line growth is taking a back seat to return on shareholders’ equity – if an ROE of around 10% does not improve, the equity premium could strip away eventually. Management’s ROE forecast for FY2026/3 is 10%. What will the ROEs of listed Japanese companies, which are already just under 9% today, look like by then? Toyota (7203), for example, has successfully expanded in size over the past five years, with sales and EBIT growing by CAGR +3% and +8%, respectively, while ROE has remained flat at around 11%. With a current P/B ratio of 1.0x, the shares of Toyota have lost their premium and have only outperformed the TOPIX by 3% over five years. Turning to Menicon, it has an impressive five-year CAGR of +6.8% in sales and +20.6% in EBIT, but the five-year average RoE is 8.9%, and in recent years it has been struggling to rise above 10%. BPS grew at only +10.5% CAGR because the burden of a dividend payout ratio of just over 20% makes the reinvestment rate boring.

DCF estimate is negative

Assuming sales at +7% and EBIT at +20%, the fair value of Menicon shares, discounted at 5%, is around 1,600 yen a share if substantial capital expenditure and working capital expansion continue. The global market for contact lenses is highly competitive. Johnson & Johnson, the pioneer of disposable lenses, Alcon and CooperVision command 60% of the worldwide market, while Menicon’s share is only 7%. It is unlikely that anyone in Japan is unfamiliar with the name Menicon. However, the largest is Johnson & Johnson. To keep up with the competition, the company must keep capex, advertising, and promotional spending high domestically and internationally.

Engagement strategies can be crucial

The shareholders can encourage management, driven by the imperative to increase scale, to balance the growth speed between scale-up and the return on shareholders’ equity. President Tanaka, the son of the founder and second-generation president, is quite influential in management. Through patient engagement, shareholders can aim to increase the value of the shares by adjusting the management trajectory. If the management team only consistently strives for scale expansion, the shares’ value will eventually modulate.

Why the share price underperformed

The share price has fallen since October last year and has underperformed TOPIX. Fortunately, 2Q top-line growth of +12% was a solid performance. The share price has been positively driven by a 34% growth in overseas sales and a marked increase in the overseas sales ratio from 24% to 29%. Moreover, the management stated that the Chinese government’s ‘Buy China’ policy is not a concern. The share price has recovered quickly. Concerns that the company might be affected by the Chinese government’s policy are thought to have weighed on the share price since last summer.

Earnings run robust while the global market expands

2Q sales grew by 12%. The attribution is well balanced with 31% domestic, 24% yen depreciation and 45% overseas local currency sales. Domestic sales were +5%, and overseas sales were +34%. The company’s strong growth is mainly due to market growth and brand awareness gaining momentum overseas. The global contact lens market outlook is positive, with research indicating that the market will grow at a CAGR of more than 6.7% from 2021 to 2027. The source of demand is the growing myopic population. In Asia, government policies to curb the progression of myopia in children are the tailwind. This is why the market for orthokeratology lenses is growing in China. In Japan, the market for this product has grown 2.5 times in three years to around 500 million yen, but President Urakabe of Seed (7743) says the Chinese market is already at least ten times larger. Menicon’s orthokeratology lens sales grew by 13% yoy in 2Q, comprising only 4% of consolidated sales. However, the growth could become attractive long-term and provide speculative interest in the shares.