Keikyu Corporation (Price Discovery)

| Securities Code |

| TYO:9006 |

| Market Capitalization |

| 370,898 million yen |

| Industry |

| Land transportation business |

Profile

A railway company that operates in the Keihin region and Miura Peninsula. It also manages real estate, hotels and leisure facilities, department stores and supermarkets along its railway lines.

Stock Hunter’s View

A major inbound tourism related stock. Shinagawa redevelopment is also a medium- to long-term share price incentive.

The number of visitors to Japan in December last year was 1.37 million, 54% of the same month in 2019 before the pandemic disease spread. Among many inbound tourism associated stocks, Keikyu Corporation, which operates access routes to Haneda and Narita airports, the “gateways to the skies”, is particularly expected to benefit from inbound travel.

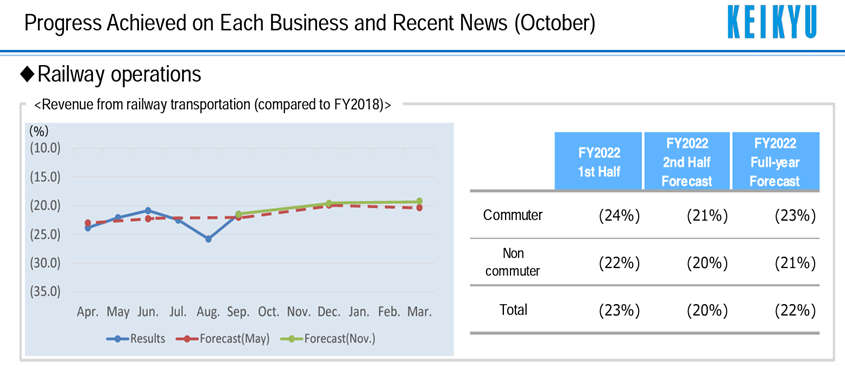

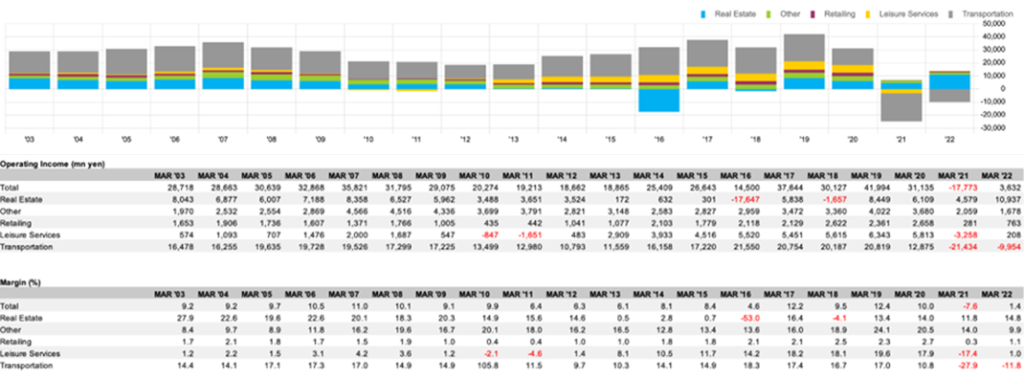

In the first half of FY3/2023, the company’s transportation business returned to profit as the number of passengers increased due to a recovery in people flow, while the recovery in demand for business hotels and the strong performance of Heiwajima leisure facilities resulted in an operating profit of ¥5.48 billion (operating loss of ¥2.92 billion in the same period last year), which is significantly higher than planned. The full-year forecast (2.2 times the previous year’s figure of ¥8 billion) was left unchanged, considering lower earnings in the supermarket business and higher power costs in the transport business.

In FY3/2024, the profitability of the transportation business is expected to improve due to inbound recovery and fare revisions. An average increase of around 10% is assumed for fares around autumn 2011. On the other hand, fares will be reduced for rides longer than 41 km to create demand in the Miura Peninsula and revitalise the railway lines.

In the medium to long term, attention should be paid to the underground concept between Shinagawa and Shirokane-Takanawa and redevelopment plans to coincide with the opening of the linear railway line. In collaboration with Toyota Motor Corporation (7203), the company will invest more than ¥100 billion in the redevelopment of the Shinagawa-Sengakuji area, aiming to complete the project by 2027.

Investor’s View

Moderate Outperformer

Expectations of a steady recovery in the company’s earnings are mostly factored into the share price, though there appears to be some scope for PBR expansion to the tune of ca 20%. Near-term results should come in strong, but the share price is likely to move slowly as concerns about current cost increases, such as fuel costs, weigh on the shares. However, the fuel cost hike should eventually subside. If the government approves Keihin Electric Railways’ approximately 10% fare increase, the first hike in 28 years, from October this year, and if the hotel business recovers further while the benefits from the inbound recovery as noted by Stock Hunter takes place, the company’s earnings recovery in the railway sector next fiscal year could stand out amongst the rail sector. However, we see no reason to rush to purchase the shares. This is because, apart from the prospect of a return to pre-pandemic earnings and more robust earnings in the short term, we do not find any positive factors to raise the secular ROE and ROIC. If one is to generate alpha in the Japan railway sector, consider the shares of West Japan Railway (9021) and Central Japan Railway (9022), whose share prices have been slow to recover against their pre-pandemic levels. Therefore, we would grade the shares of Keikyu Corp a Moderate Outperformer. The reservation is that management will likely regain confidence in long-term cash flow generation and may increase leverage to the level of a decade ago through share buybacks and increased borrowing, thereby improving return on equity. It is essential to note that this is a significant potential upside to the share price. Also the recession-resilience of the railway companies may well come into investors’ favour as fears of economic recession mount.

Steady earnings recovery, but positive surprise is unlikely

The company’s railway transportation revenues have returned to around 80% of pre-pandemic levels and are in line with its forecasts. Hotel occupancy rates have exceeded the estimates in May, but there are unlikely to be any significant upward revisions. Against a background of rising power and fuel costs, the company applied to the Ministry of Land, Infrastructure, Transport and Tourism for a revision to Keihin Electric Railway fares to increase by an average of 10.8% in October, which, if approved, will contribute significantly to earnings in the second half of the current fiscal year and into next year. The hotel business in the leisure segment still has considerable room for earnings to recover to pre-pandemic levels.

20-year operating profit by segment and the margins

Scope for recovery in PBR

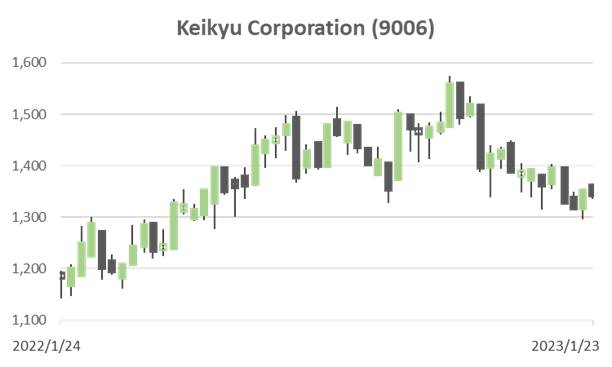

The share price rose 21% in CY2022, outperforming TOPIX by 26%, after falling 35% in CY2021, incorporating the rapid recovery in EPS and ROE. Current PBR is 1.4x, below the previous five-year average of 1.8x, suggesting scope for some more recovery.

20-year charts – Share Price, PBR, ROE, EPS, Price Relative

Upside to ROE and the share price

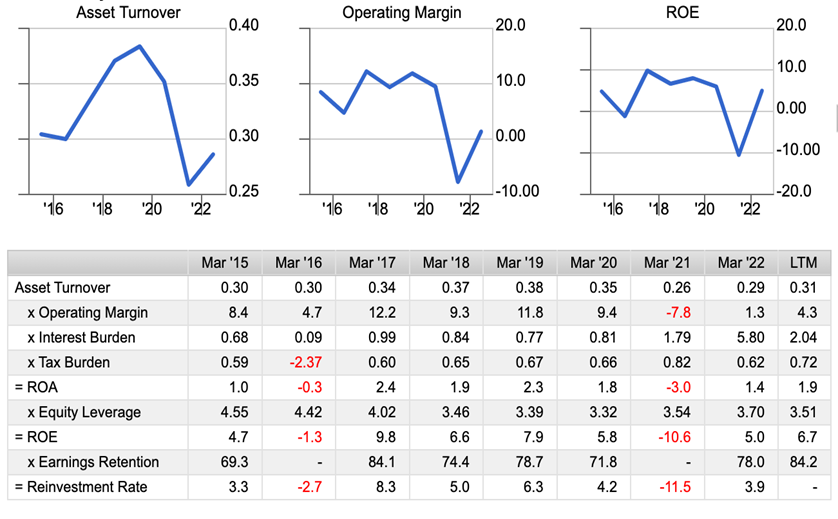

The asset turnover ratio of a railway business, which is equipped with considerable facilities to ensure service capacity during peak periods, is remarkably low and is comparable to that of utility companies. Keikyu Corp is no exception, although it is diversified beyond transportation, as it spends half its capex on the transportation business. The company’s secular ROE is around 7%, with depressed ROA multiplied by high equity leverage. An equity ratio of close to 30% is, perhaps, not necessary for a company with a strong CF generation capacity. If this is adjusted and leverage is increased to the level of 10 years ago, the share price valuation could increase through much higher ROE. However, management will not make drastic BS adjustments for shareholders, as they do not want a backlash from banks and other financial institutions.

Dupont Model