Oisix ra daichi (Price Discovery)

| Securities Code |

| TYO:3182 |

| Market Capitalization |

| 92,712 million yen |

| Industry |

| Retail trade |

Profile

Oisix La daichi is a subscription-based food EC that delivers food to approximately 510,000 customers in Japan, selling organic vegetables, specially grown produce, additive-free processed foods and other foods and ingredients online and via catalogue.

Stock Hunter’s View

Out of the worst period and back on a growth track. The challenge of B2B subscription begins.

Oisix La Daichi, which manufactures and sells organic vegetables and meal kits for home delivery, saw its earnings deteriorate in FY3/2023 due to its efforts to recover from logistics problems in January last year and delays in counter-inflation measures. However, it made progress in reforming its earnings structure in the second half of FY2022. The TOB of Shidax (4837) was also completed and will contribute to earnings throughout this fiscal year.

Despite a lull in special demand under COVID-19, the number of actual members in the mainstay OisiX business reached 394,000 at the end of 4Q of the previous year, the highest quarterly growth ever recorded. The company intends to resume marketing in earnest this year and is expected to enter a phase of renewed growth in business performance on the back of the increase in membership.

While the growth potential is unknown, the challenge of B2B subscriptions, such as the meal service business, is also attracting attention. The domestic meal service market is worth approximately 4.5 trillion yen, even with the pandemic disaster taking its toll, and is expected to recover from this point onwards as the number of elderly care facilities increases. The company is currently conducting test marketing of a service for nursery schools. It has cut costs by about 20% using its meal kits to expand into new areas such as hospitals and elderly care facilities from FY3/2025 onwards.

Investor’s View

Modestly undervalued. The near-term share price should correct.

Profits to double this year

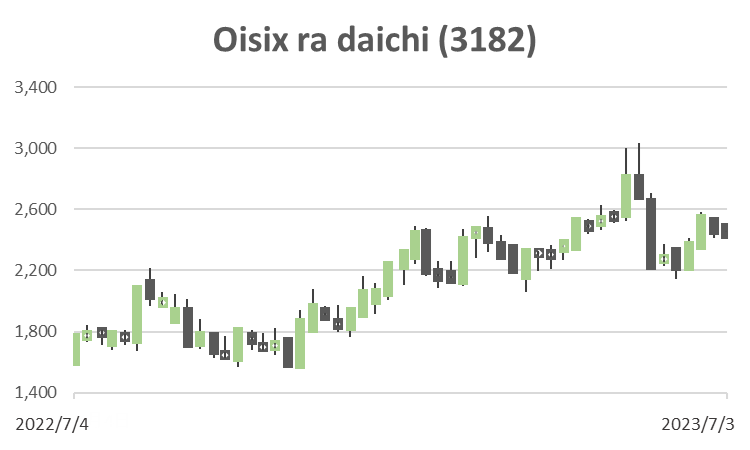

The company’s net profit for FY3/2021 was six times higher than the previous year, and the share price reached 5,120 yen in September 2021. Management explained this was due to a temporary increase in membership and ARPU due to the rapid rise in home delivery needs caused by COVID-19. The following year, in FY3/2022, profits almost halved, and the share price plummeted. Management cited ARPU heading towards normalisation and problems with the new distribution centre as reasons for this. Profits fell further in FY03/2023. However, during this period, the company rapidly grew its membership by strengthening PR, and profits will finally recover this year. Management expects to double net profit this year.

The shares are a laggard

The share price has risen by 50% in 12 months, and the prospect of a sharp profit recovery has been factored in to some extent. However, the share price performance since the beginning of the year has been +10%, which is inferior to the +22% rise in the TOPIX. The reasons for this can be attributed to the fact that the company’s shares, with a market capitalisation of less than 100 billion yen, were out of favour in a stock market led by large-cap, semiconductors and trading companies, and that investors were half-convinced by management’s forecast of a sharp increase in profits.

Modestly undervalued

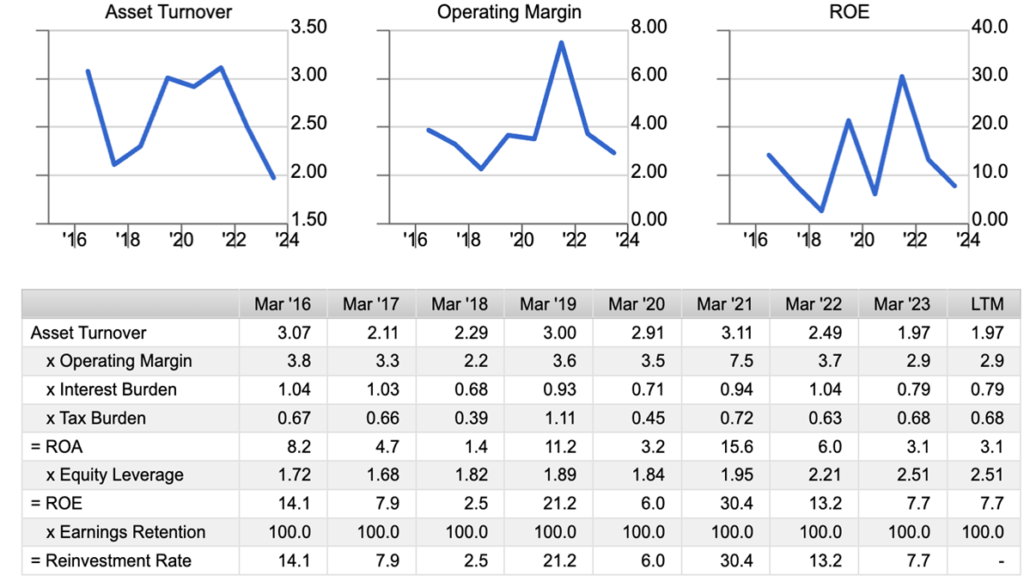

The company acquired 28.47% of Shidax, a food service company, for 8.5 billion yen and made it a consolidated equity-accounted affiliate from 4Q FY3/2023. The impact on net profit is reported to be negligible. On the other hand, the acquisition was funded by short-term borrowings, resulting in a 23% increase in assets in FY2022 compared to a 1% increase in sales. Although financial leverage improved, asset turnover declined markedly, which weighs on ROE. Although back-of-the-envelope, the secular ROE range is expected to be around 12%-15%, even though there will be a sharp recovery soon. Such that the current PBR of 3.6x is unlikely to have much upside. A prospective PER of 25x is not cheap. Earnings multiple could expand if evidence of better earnings momentum makes investors forecast the earnings stream more optimistically. Overall, we expect a short-term correction in the lagging share price but feel the share price is only modestly undervalued.

Dupont model